Oil Prices Rally Amid Strategic Reserve Talks, Upcoming US Data

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

Strategic Petroleum Reserve Replenishment

Crude oil prices experienced a boost on Thursday, driven by speculations that the U.S. may soon purchase oil to refill its Strategic Petroleum Reserve. After a substantial drawdown in 2022, the U.S. aims to replenish at prices no higher than $79 per barrel—a level close to current market prices. This development offered much-needed support to a market lacking positive drivers.

Market Dynamics and Economic Indicators

The oil market's recent downturn was exacerbated by reports of rising U.S. oil stockpiles and the potential for a ceasefire between Israel and Hamas. Furthermore, the Federal Reserve's decision on Wednesday to maintain interest rates, despite ongoing inflation concerns, has dimmed hopes for early rate cuts, with optimists now hoping for easing by year's end.

While the U.S. economy's resilience is a good sign for oil demand, the tight correlation between borrowing costs and market dynamics led to price declines. Now, all eyes are on Friday's U.S. jobs report for April, with expectations set for a significant payroll increase. A strong report could further complicate the rate cut outlook.

Upcoming Oil Market Indicators

This week's oil trading will also be influenced by the Baker Hughes oil-rig count, providing further insights into production dynamics.

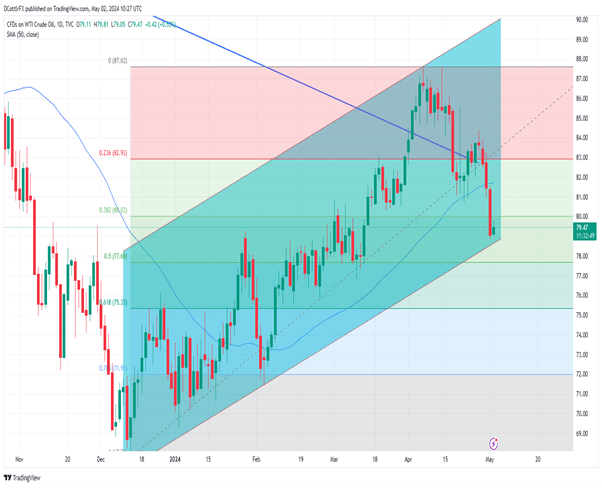

West Texas Intermediate crude is currently testing the lower bounds of its uptrend channel established since early December. Although this support level at $78.55, with further support at $77.68, has not been seriously challenged since February, recent price movements suggest it is still a key marker.

Bulls are aiming to breach the resistance at $80.21 to mitigate recent losses and face another significant hurdle at $83.00. Meanwhile, resistance at $82.45, stemming from a downtrend line since December 2022, continues to play a pivotal role in capping gains.

This complex interplay of market forces and economic indicators will likely shape the short-term trajectory of oil prices, making the upcoming U.S. economic data crucial for market sentiment.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.