US Dollar Awaits Job Data; Forex Setups for GBP/USD, EUR/USD

By Daniel M.

January 5, 2025 • Fact checked by Dumb Little Man

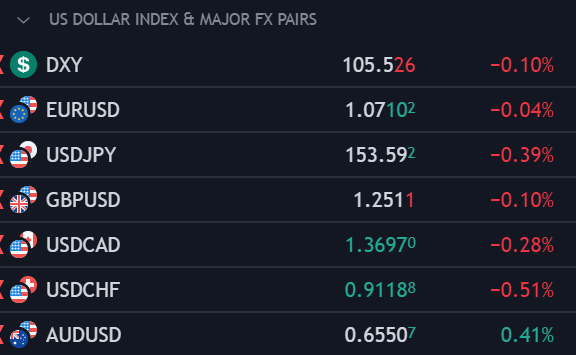

US Dollar Dynamics Post-Fed Decision

The U.S. dollar (DXY) saw a modest decline on Thursday, continuing to retract after the Federal Reserve's decision to maintain interest rates between 5.25%-5.50%. Notably, the Fed also adjusted its quantitative tightening approach, reducing the roll-off of maturing Treasuries from $60 billion to $25 billion starting in June—a move that surprised many in the bond market.

While the Fed's inflation warnings suggest persistent price pressures, Chair Powell provided a nuanced view in his press conference, indicating a high threshold for rate cuts and an even stricter one for potential hikes. This mixed messaging leaves yields struggling for direction, potentially undermining the dollar's strength, especially if upcoming data underperforms.

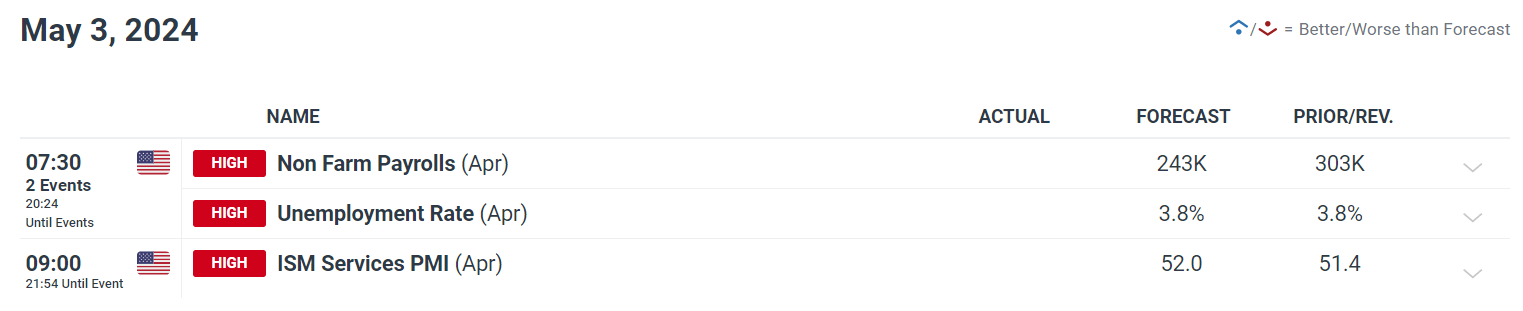

Key Employment Data Ahead

The focal point now shifts to Friday's jobs report, with projections centered around 243,000 new jobs for April. A disappointing nonfarm payrolls outcome might tilt expectations towards further monetary easing in 2024, weakening the dollar. Conversely, stronger job growth could lead to higher prolonged interest rates, buoying the dollar.

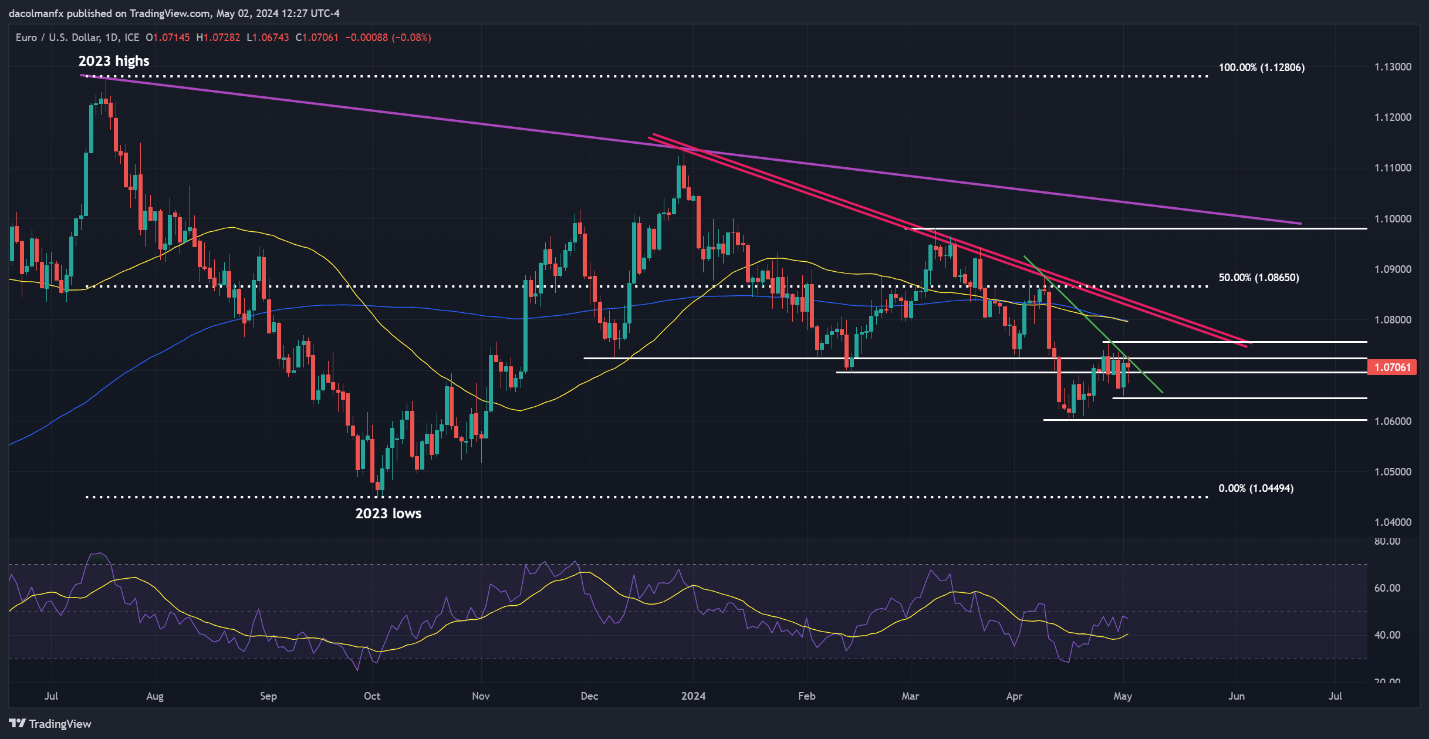

EUR/USD Technical Outlook

EUR/USD dipped after failing to breach the 1.0725 resistance, retracting towards the 1.0700 mark. A break below this level could push prices to 1.0645 or even 1.0600.

However, a rebound from these levels could see the currency test resistance at 1.0725 and potentially 1.0755, with an upward move possibly extending to the 1.0800 zone marked by key moving averages.

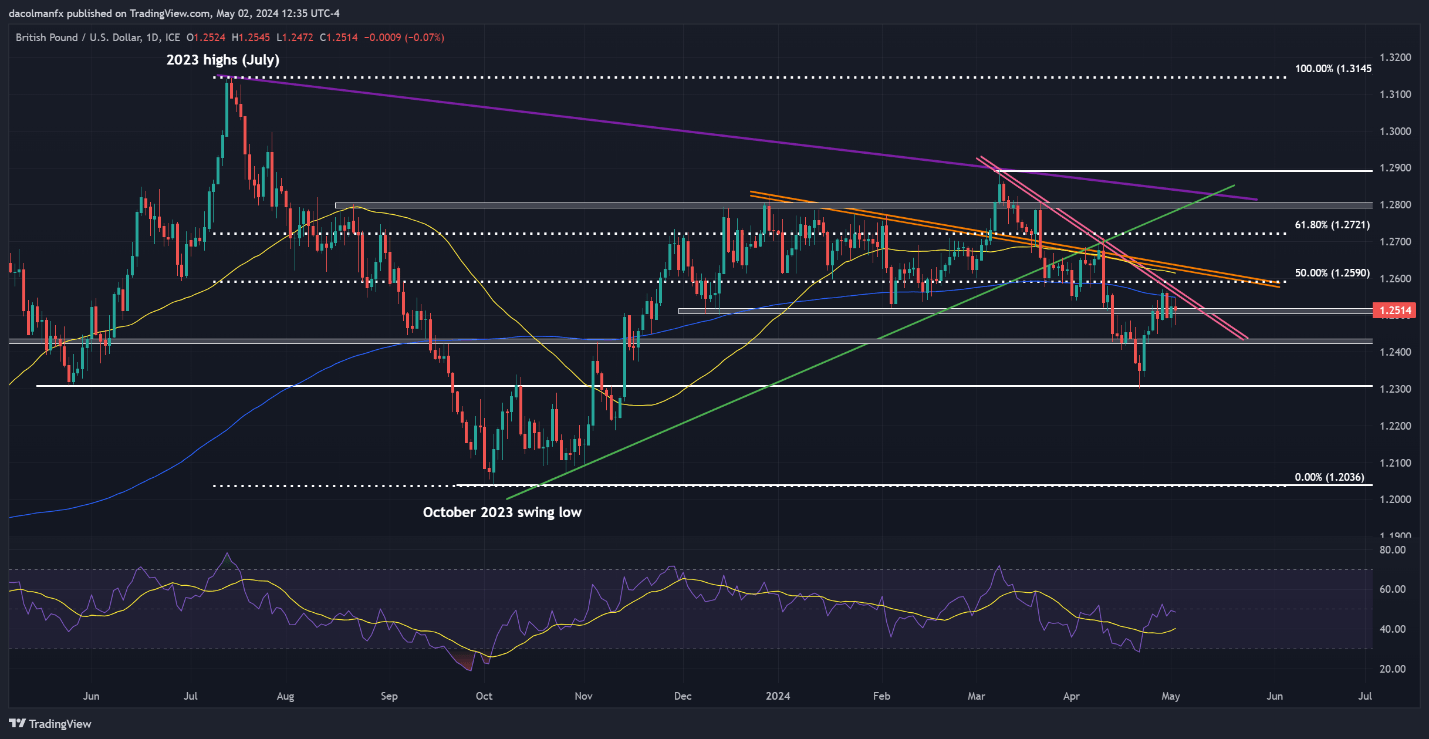

GBP/USD Technical Outlook

GBP/USD slightly declined but found some stability around 1.2515/1.2500. The pound needs to stay above this support to prevent a bearish outlook; a drop below this could lead to a test of 1.2430.

If the bulls return, resistance at 1.2550—where a descending trendline and the 200-day SMA meet—will be key, followed by Fibonacci levels at 1.2590 and 1.2620.

Daniel M.

Daniel Moore is a seasoned trading analyst with over 20 years of experience navigating the ever-evolving financial landscape. Renowned for his unconventional yet effective approach, Daniel utilizes a blend of technical and fundamental analysis to identify hidden gems and craft winning trade strategies. He is a master at demystifying complex market data and translating it into actionable insights for traders of all experience levels.