NAGA Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 125th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies NAGA as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

NAGA Review

In the world of investment and trading, Forex brokers play a crucial role by providing access to global currency markets. These platforms are the gateway for traders looking to buy and sell currencies, stocks, and other financial instruments. Among these brokers, NAGA stands out as a modern and innovative platform that offers more than 1000 trading tools. NAGA enables users to engage in the trading of stocks, forex, indices, and oil, setting itself apart with the use of cutting-edge technologies.

This review focuses on NAGA, a broker that aims to redefine the investment landscape by competing with traditional financial institutions like banks. By implementing modern technologies and innovative solutions, NAGA seeks to provide a unique and effective trading experience. Our detailed evaluation will cover NAGA's unique selling points, potential drawbacks, account options, deposit and withdrawal processes, commission structures, and more. By combining expert analysis with actual trader experiences, our goal is to offer essential insights that will help you decide whether NAGA is the right brokerage service for your trading needs.

What is NAGA?

NAGA is a company that lets people trade online, like buying and selling stocks or currencies. It started in 2015 and is based in Germany. This company is known because it's on the Frankfurt Stock Exchange, meaning it's big and trustworthy. They use new tech to make trading easier and compete with the big banks and older trading companies. A lot of people, over 1 million, use NAGA to trade because it offers something different from the usual banks and brokers.

Safety and Security of NAGA

After looking into Dumb Little Man for thorough research, we found out about the safety and security measures NAGA takes for its users. NAGA, part of The NAGA Group AG, shows its reliability through its listing on the Frankfurt Stock Exchange. This German FinTech company oversees various subsidiaries like NAGA GLOBAL LLC and NAGA MARKETS EUROPE LTD, ensuring a broad and secure foundation for its operations.

One key aspect of NAGA's commitment to client security is the separation of client funds from the company's assets. This means, if NAGA faces financial issues, client money stays safe. This segregation assures users that their investments are protected and managed with the highest standards of accountability.

NAGA also offers protection from negative balance, shielding users from owing money beyond their initial investment. In the trading world, this feature is crucial as it prevents clients from falling into debt due to unfavorable market moves. Furthermore, in case any disputes arise, clients have the right to file a complaint with the regulator, adding an extra layer of security and recourse for traders using NAGA's platform.

Pros and Cons of NAGA

Pros

- Diverse trading options

- Passive income through social trading

- Listed on Frankfurt Stock Exchange for reliability

- Advanced technology for trading

- Over 1 million active users

- Segregated client funds for added security

Cons

- Standard accounts have high spreads

- No trading bonuses like Welcome bonus

- Few payment methods for deposit and withdrawal

- No cent accounts available

Sign-Up Bonus of NAGA

When looking into NAGA for any sign-up bonuses, it's clear that, as of now, they don't offer one. This means new users won't get extra funds or benefits just for signing up. While this might be a drawback for those expecting a welcome perk, it's important to consider the other features and benefits NAGA provides.

Minimum Deposit of NAGA

The minimum deposit for starting with NAGA is $250. This amount is a bit higher than what many other brokers ask for to get started. This requirement might influence someone's decision on whether or not to choose NAGA, especially if they're looking to start with a smaller investment.

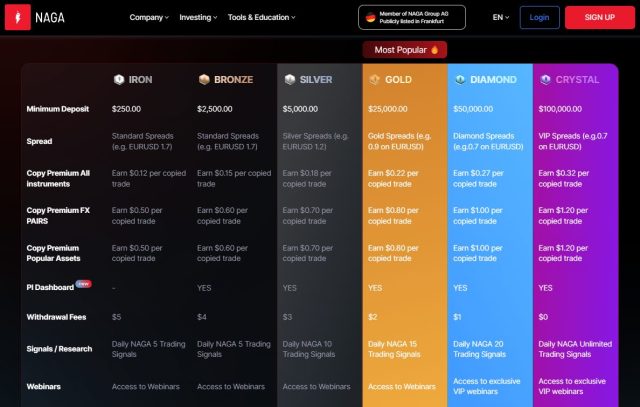

NAGA Account Types

After detailed testing and research by our experts at Dumb Little Man, we've outlined the trading accounts offered by NAGA. Each account is designed to cater to different levels of trading experience and investment capacities.

- Iron Trader

- Minimum deposit: $250

- Spreads: Floating from 1.7 pips

- Bronze Trader

- Minimum deposit: $2,500

- Spreads: Starting from 1.7 pips

- Benefits: Daily trading signals, access to webinars

- Silver Trader

- Minimum deposit: $5,000

- Spreads: Tighter, from 1.2 pips

- Gold Trader

- Minimum deposit: $25,000

- Spreads: From 0.9 pips

- Benefits: Instant withdrawals to NAGA CARD

- Diamond Trader

- Minimum deposit: $50,000

- Spreads: From 0.7 pips

- Benefits: Instant money transfer to NAGA card

- Crystal Trader

- Minimum deposit: $100,000

- Spreads: Precise, from 0.7 pips

- Benefits: Highest margin for trading, free NAGA CARD registration, participation in company webinars

Each account type offers a tailored experience to meet the needs of traders at various levels, from beginners to professionals.

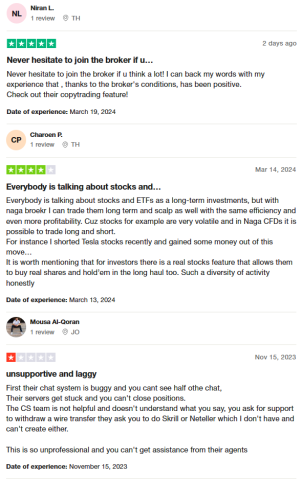

NAGA Customer Reviews

Customer feedback on NAGA highlights a mix of positive experiences and areas for improvement. Users praise the platform for its copytrading feature and the ability to trade both long and short positions on stocks and ETFs, pointing out the profitability and efficiency of trading with NAGA CFDs. The option to invest in real stocks for long-term holding is also appreciated, offering diversity in trading strategies. However, some customers have encountered issues with the chat system, reporting it as buggy and unresponsive at times. Additionally, there are complaints about the customer service (CS) team, mentioning unhelpful responses and difficulties in executing withdrawals, specifically concerning the preference for certain payment methods over others. These reviews indicate that while NAGA offers valuable trading opportunities, there is room for improvement in customer support and technical reliability.

NAGA Fees, Spreads, and Commissions

NAGA makes its money mainly through trading fees, which come in the form of floating spreads. This means the difference between the buying and selling price can change, depending on market conditions. Good news for traders: NAGA doesn't charge a commission per lot for any of its account types, making trading costs more predictable.

However, when it comes to non-trading activities, there's a withdrawal commission that can be anywhere from $0 to $5 per transaction. This fee applies when you want to take money out of your NAGA account. It's important to note that NAGA doesn't list the fees that payment systems like Visa or wire transfers might charge for withdrawals on their platform.

Additionally, there's a swap fee, which is a commission charged for holding a trading position overnight. This is standard practice in the industry, especially for trades that are not closed within the same trading day.

Deposit and Withdrawal

A trading professional at Dumb Little Man tested NAGA‘s deposit and withdrawal processes, providing insights into how they work. NAGA guarantees that all withdrawal requests are processed within 24 working hours, offering a quick turnaround time for traders wanting to access their funds. The minimum amount for any transaction is set at 50 EUR/USD/GBP and PLN, accommodating traders with varying budget sizes.

The withdrawal methods available with NAGA largely depend on the trader's country of residence. Options include withdrawing to a NAGA CARD, as well as using popular payment methods like VISA, VISA Electron, MasterCard, Maestro, Neteller, and Skrill. This flexibility ensures that traders can easily access their money in a way that suits them best.

Withdrawals can be made in EUR and USD, allowing for straightforward international transactions. However, it's important to note that NAGA charges a withdrawal fee of 0-5 EUR/USD (or the equivalent) for each transaction. This fee is relatively minimal but something traders should consider when planning their withdrawal strategy.

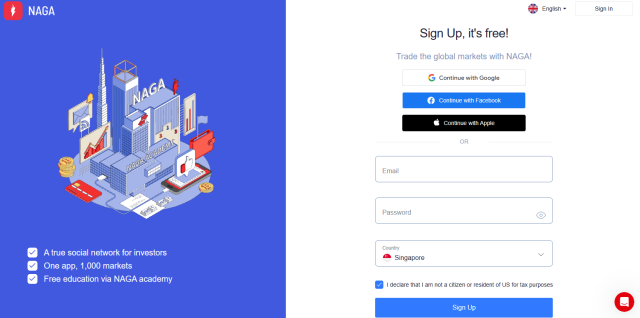

How to Open an NAGA Account

- Visit NAGA's official website and click “Sign Up” or “Start Trading”.

- Fill out the registration form with your full name, email, and phone number.

- Create a username and password for your account.

- Confirm your phone number and email to verify your account.

- You have the option to register using your Google or Facebook accounts.

- Complete any additional verification steps required by NAGA.

- Choose your account type based on your trading preferences and experience.

- Make your first deposit, keeping in mind the minimum amount required.

- Start trading with NAGA after your account is set up and funded.

NAGA Affiliate Program

One of the broker's services is their NAGA Pay Affiliate Program and you could earn up to 50€ for each new sign-up, with no cap on how much you can earn. This program offers high CPA (Cost Per Acquisition) payouts, making it an attractive option for those looking to benefit from competitive rewards.

You'll be able to track the performance of your referrals and see how much you've earned through a dedicated dashboard. This feature ensures transparency and helps you optimize your strategy.

Whether you're an Affiliate Partner, Influencer, or Media Promoter, NAGA Pay provides market-leading payouts. Influencers can monetize their social media followings on platforms like Instagram and YouTube, while media promoters can place pre-approved banners on their websites or other media platforms, all linked with their unique NAGA Pay referral link. This structured approach allows for scalable growth in your affiliate endeavors.

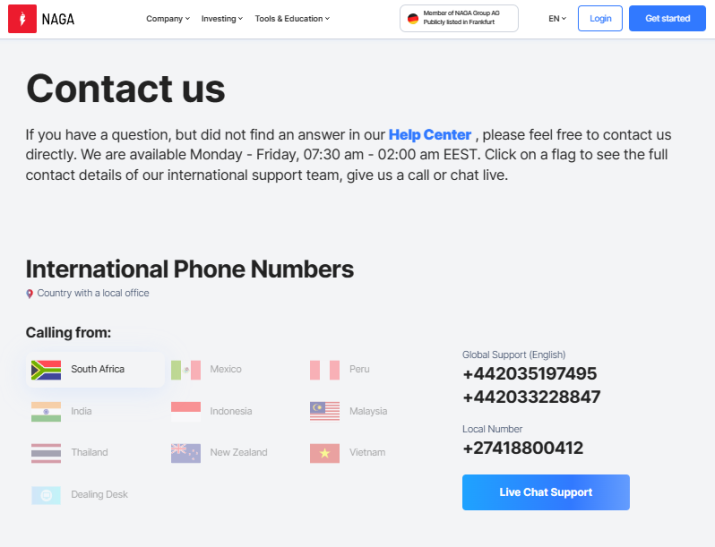

NAGA Customer Support

NAGA‘s Customer Support can be reached through several channels, based on Dumb Little Man's experience with their service. You can call international numbers found in the “Contact Us” section, send an email, or use the online chat feature on the website. This variety ensures that users can select the most convenient option for them.

Additionally, technical support is accessible both through your personal account and directly on the NAGA website. This flexibility is designed to provide assistance wherever you might be navigating, making it easier to get help when you need it.

Advantages and Disadvantages of NAGA Customer Support

| Advantages | Disadvantages |

|---|---|

NAGA vs Other Brokers

#1. NAGA vs AvaTrade

NAGA offers a broad range of trading tools and a unique social trading feature that allows for passive income, making it stand out for traders interested in community engagement and diverse trading strategies. On the other hand, AvaTrade has been in the market since 2006 and is known for its comprehensive trading experience, heavily regulated environment, and a wider global reach with a significant number of monthly transactions. While both provide excellent trading platforms, AvaTrade's extensive regulatory framework and global presence, combined with its long-standing reputation, might make it a better choice for traders prioritizing safety and a wide range of financial instruments.

Verdict: AvaTrade might be better for traders who value a well-regulated environment and extensive global reach. Its long-standing reputation and commitment to providing a full trading experience offer a compelling choice for traders at all levels.

#2. NAGA vs RoboForex

NAGA and RoboForex both focus on utilizing technology to enhance the trading experience. NAGA excels with its social trading platform and the ability to trade using a wide array of instruments. RoboForex, established in 2009, offers an impressive selection of over 12,000 trading options across eight asset classes and a variety of trading platforms. It also hosts contests on demo accounts, making it an attractive option for beginners and experienced traders looking for variety and competitive conditions. RoboForex may be better suited for traders looking for a vast array of trading instruments and platforms, as well as those who enjoy trading contests.

Verdict: For traders seeking variety in trading instruments and platforms, along with unique offerings like trading contests, RoboForex stands out as the superior option. Its vast array of trading options and accessibility for various trader levels makes it a versatile choice.

#3. NAGA vs FXChoice

NAGA provides a social trading platform where traders can engage with a community, alongside access to over 1000 trading tools. FXChoice, established in 2010 and regulated by the FSC of Belize, focuses on serving both active and passive traders with a commitment to business integrity and customer-focused services. It offers professional ECN accounts with tight market spreads but is primarily suitable for experienced traders due to its trading conditions and limitations on account types. Considering the focus on automated trading services and professional trading conditions, FXChoice may appeal more to experienced traders looking for specialized ECN accounts and those who prefer a brokerage committed to high standards of service and integrity. However, for those interested in social trading and a broader instrument range, NAGA could be the preferable option.

Verdict: FXChoice is likely the better choice for experienced traders focusing on ECN accounts and those who prioritize broker integrity and customer-focused services. However, for those looking for a community trading experience and a wide range of trading tools, NAGA offers distinct advantages.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For individuals passionate about forging a lucrative career in forex trading and aiming for significant financial returns and trading decisions, Asia Forex Mentor is the prime selection for the top forex, stock, and crypto trading course. The mastermind behind this initiative, Ezekiel Chew, known for his influence on trading institutions and banks, leads Asia Forex Mentor. Notably, Ezekiel consistently secures seven-figure trades, marking him as a standout educator in this arena. The following reasons solidify our endorsement:

Comprehensive Curriculum: Asia Forex Mentor delivers a thorough educational program encompassing stock, crypto, and forex trading. Its detailed curriculum prepares budding traders to thrive in these varied markets.

Proven Track Record: The reputation of Asia Forex Mentor is solidly built on its history of cultivating profitable traders across different markets. This success underscores the high efficacy of their teaching strategies and mentorship.

Expert Mentor: At Asia Forex Mentor, learners receive advice and insights from a mentor with a proven track record in stock, crypto, and forex trading. Ezekiel offers tailored support, helping students confidently tackle market complexities.

Supportive Community: Being part of Asia Forex Mentor means entering a global community of other traders focused on succeeding in the stock, crypto, and forex markets. This environment encourages sharing, collaboration, and mutual learning, enriching the learning journey.

Emphasis on Discipline and Psychology: Achieving trading success requires a disciplined mindset. Asia Forex Mentor emphasizes psychological training to aid traders in emotion management, stress coping, and making sound decisions under pressure.

Constant Updates and Resources: Recognizing the ever-evolving nature of financial markets, Asia Forex Mentor keeps its students informed with the latest trends, strategies, and market analyses. Ongoing access to essential resources ensures traders stay competitive.

Success Stories: Asia Forex Mentor is proud of its many success tales where learners have dramatically changed their trading careers and attained financial freedom through its all-inclusive forex, stock, and crypto trading education.

Asia Forex Mentor stands as the definitive pick for individuals desiring the finest forex, stock, and crypto trading course to embark on a profitable career and secure financial success. With its all-around curriculum, skilled mentors, practical approach, and nurturing community, Asia Forex Mentor equips aspiring traders with the tools and guidance needed to transform into successful professionals in various financial domains.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: NAGA Review

In conclusion, the team of trading experts at Dumb Little Man has thoroughly reviewed NAGA and found it to be a platform with several strong points. NAGA excels in offering a wide range of trading instruments, including stocks, forex, indices, and more, with over 1000 tools available. Its social trading feature stands out, providing users the chance to earn passive income by copying successful trades. Additionally, the platform's innovative technology and the fact that it's listed on the Frankfurt Stock Exchange add layers of reliability and sophistication.

However, potential users should be aware of the downsides. The high spreads on standard accounts and limited payment options for deposits and withdrawals might deter some traders. Furthermore, the absence of trading bonuses and cent accounts could be seen as drawbacks compared to other brokers. The customer support system, while generally reliable, has areas that could be improved, such as availability on weekends and responsiveness during peak times.

>> Also Read: IFX Brokers Review 2024 with Rankings By Dumb Little Man

NAGA Review FAQs

What trading platforms does NAGA offer?

NAGA provides traders with access to a user-friendly, proprietary trading platform that integrates seamlessly with MetaTrader 4 and MetaTrader 5, two of the industry's most acclaimed trading platforms. This combination allows traders to benefit from NAGA's unique features, such as social trading, while also utilizing the advanced analytical tools and functionalities of MT4 and MT5.

Can I start trading on NAGA with a small investment?

Yes, you can start trading on NAGA with a minimum deposit of $250. This entry-level deposit is designed to make trading accessible to beginners without requiring a significant initial investment. However, it's worth noting that this minimum deposit is relatively higher than some other brokers, which might offer lower entry points for new traders.

Is NAGA regulated?

NAGA is a trademark of The NAGA Group AG, a German-based FinTech company that is publicly listed on the Frankfurt Stock Exchange. The NAGA Group AG oversees various subsidiaries that are regulated in their respective jurisdictions, ensuring a secure and transparent trading environment for its clients. This regulatory framework highlights NAGA's commitment to providing a trustworthy and reliable trading platform.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.