Everything You Need To Know About Margin in Forex

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

Margin in forex trading is among the many terms in the industry. While knowing the definition of margin trading has no significant effect on trading results, in-depth knowledge plus how best to work with it helps you to garner the odds towards your ultimate benefits as forex traders.

In a nutshell, the knowledge of how to calculate forex margin helps you tweak your strategy to minimize risks. True, money management is a key strategic component that will see your trading forex account grow over time.

In this post, under the guidance of Ezekiel Chew, we’ll dive deeper into what margin is in forex and how best to ride on it towards becoming excellent forex traders. Ezekiel Chew is the lead trainer from Asia Forex Mentor. A website he established to offer individuals and corporates opportunities to fast track their trading experience and earn six figures trading.

By the end of this post, you will be able to know how best to work with margin to your advantage. And that narrows down to trading with minimal risks by avoiding instances where brokers close your trades that are running into excessive losses or margin deficits.

What is Margin in Forex

In the simplest form, a margin is an amount you have to put in a trading account for the broker to allow you to open a position. Therefore, forex margin is not a commission, nor is it a transaction cost in forex. Margin also allows you through the broker to hold a trade before it hits stop loss. Else it moves towards your profit target direction.

In better words, forex margin is the capital commitment that a trader puts in the market to hold positions for a currency pair on the forex market. Therefore, while it’s part of the equity in your trading account, forex margin (used margin) is a portion already committed to holding a trade.

Every trade requires a set minimum amount (margin requirement) for you to open positions in a trader's account. And the minimal amount varies with every forex pair or commodity you open trades for. For instance, very volatile commodities like Silver and Gold have relatively higher requirements for margin. The same applies to major currencies and their counterparts in the forex market: GBP, USD, EUR, and YEN.

Entirely, brokers offer a fair playing ground. Requirements for margin in forex positions are not too strict across the brokers' industry. The huge onus remains with the trader to control their appetites for greed. If a trader messes with greed, they inherently mess with the margin requirements.

What is Margin Percentage in Forex

Earlier on, we mentioned the need to get into the nitty-gritty with margin in forex. That helps you balance your stake in light of the risky environments with trading forex.

You can express forex margin as a percentage of the equity you hold in an account. You can also convert it to a specific figure of unit currency.

Assuming you want to work in percentages, the forex margin applicable will amount to a set percentage of the value you target to hold as a position in the market. The margin varies from one broker and the applicable assets. For instance, you can find brokers allowing margins of 2.5% and all the way upwards to 10%.

Also, if the forex margin is set in amounts, then brokers will only allow you to trade if you meet the set amount and upwards.

Let's use a practical scenario. Assume you hold equity amounting to $2,000 in a trading account. And your target is to buy or go long on the pair EURUSD, holding a mini lot or 10,000 units.

How much margin is needed for the transaction?

- First, locate the price line for the EURUSD pair and say it’s exchanging at 1.12000. Check your base or first currency – the EUR.

- Next, see how many mini-lots of 10,000 you can hold at the current price (1.12000). In this case, it’s 10,000 mini lots X 1.12000 units to get the value of $11,200 (as the notional value of holding the trade/position)

- Assuming that the broker requires a 3% margin, then you require $336 to open that position. ( i.e. $11,200 X3%)

- Once the position is open, your capital reduces by the margin requirement of $336. The brokerage platform freezes that amount and only releases it when you’ll close the transaction.

Note: In the above scenario, assuming prices dive or fall. The broker expects you to have slightly more than $336 in your account as maintenance margin.

Tip: MT4s have an inbuilt forex margin calculator. Many forex markets online sites also run the forex margin calculator to facilitate your projections with forex margin requirements as you trade forex.

How is Margin Calculated in Forex

The calculations for forex margin level are not complex.

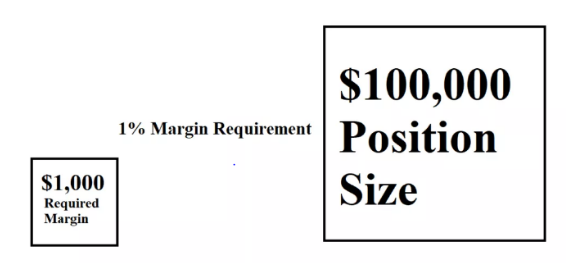

An initial margin requirement to open and hold a trade is a given percentage of the notional value or the size of the position.

At all times, base your margin calculations with the base or first currency or the currency to the left of a pair.

If you refer to our example above, the base currency is the EUR, which is different from the capital accounts currency with the broker (USD). Therefore, you should concert margin requirement into the denomination of the brokerage account.

Consider the two scenarios here:

If the account’s currency is similar to the base currency:

The Required Margin = Notional Position Value X Margin Requirement

Else, if the account’s currency differs from your base currency, multiply the result from the above formula by the currency pair's exchange rate.

The Required Margin = [Notional Value X Margin Requirement] X Exchange Rate

What is Free Margin for Forex Trading

The best scenario here will be to talk about free margin but within the context of used margin.

The reason is that your forex margin can either be used or free.

Let’s look at that with an example.

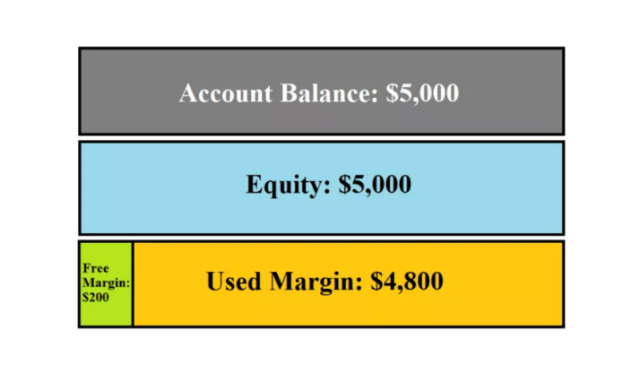

Assume that the equity on your forex account amounts to $5,000 without any active trade. If you open a trade/position whose margin requirement is $300 and still add another requiring a margin is $500.

So, your overall margin amounts to $800. And your free forex margin is $4,200 (Equity of $5,000 less $800 margin).

Further, let's assume that your free margin is only a total of$200. The broker cannot allow you to float or open a new position requiring a margin of $201 upwards.

In other trading circles, trading forex professionals use the term “Equity” which is simply your initial investment.

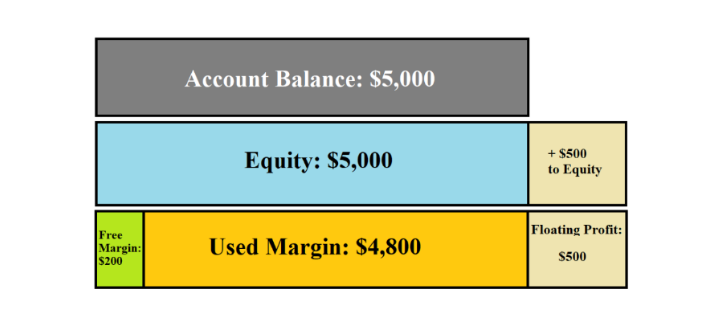

The idea is to think of equity as the unused portion, the initial investment or sum of two components: the used and the free margin. Also, traders can refer to equity as the sum of an account balance, including floating profits and losses.

In better words, the term floating profit or losses (P&L) includes both profits/losses that your current trades hold.

Floating P and L are amounts not yet deducted or added to your account, and they keep fluctuating every minute the exchange prices shift in the market.

Bear in mind that the shift affects the amount of equity in your account and, by extension, influences the value of subsequent trades you can open.

As you can see, grasping the total figure of equity you have in an account is simple.

But once you open positions, that begins to fluctuate with respect to your floating profit/loss. Logically, an open position holds or freezes the forex margin, and you then hold an account balance that is less than the margin requirement to hold the position or trade.

Note also that forex margin trading value is a constant figure that you can only realize when the transaction ends or closes. Also, it's after the closure of trades that you can realize your full value, and at then forex margin level is zero.

What is Margin Call in Forex

A margin call is a safety mechanism for margin levels. Each time a trade hits the thresholds of a margin deficit/call, it’s risky as two things can happen in leveraged trading:

- One, you can add more capital into the forex or account for trading CFDs to hold a trade that's running into losses. Yes, you can provide the margin required and avoid margin calls and retain the trading position.

- Secondly, the trades or positions can be closed or liquidated by the forex broker – with the trade bearing the losses.

Margin level or margin rate varies from brokers and assets on any forex trade platform. They shift from the percentage of 0% all the way to 200%. A forex broker with MT4 platforms for trading CFDs mostly auto-calculates the margin level as a percentage of your used margin over the total equity available.

However, the level where the margin deficit/call level activates also varies with different brokers out there.

The bottom line is that it’s a percentage of the margin against your equity. A forex broker may drop an email when positions oscillate towards the margin call thresholds.

If we look at margin deficit levels in more straightforward scenarios, view it as taking an exam.

The pass mark set for passing the exam is set at 50% out of a possible total of 100%. Therefore, a margin level is only a score, which can be any mark like 12, 27, 87, etc. However, the margin call level mark is 50, so it’s a specific value. Therefore, a margin deficit/call as an event can only occur when you hit the 50% mark and above.

When traders receive notifications of margin calls, they have two options to adjust for the margin required.

- Add more money/funds into your account. Bear in mind that funds are a scarce resource, and already you run a significant risk of losing money rapidly due to excessive leverage limits.

- Secondly, you can close some of the trades to increase your free margins. Closed transactions release account equity or trader's funds to cater for the required margin deficit.

When traders receive a margin deficit/call, it’s usually a scary position. You cannot open more positions since your free margin is almost nil. You may be lucky to hold some trades that are deed into profit territory, and closing those can help free the margin required. But a worst-case scenario is where you have running trades that are deep into losses, and your required margin is almost nil.

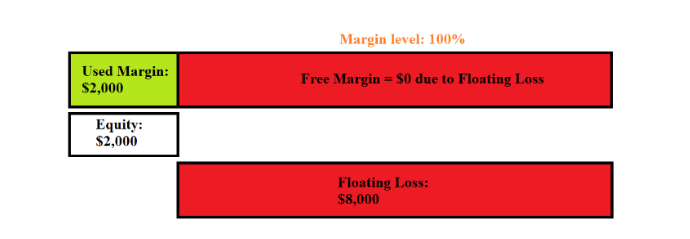

Here’s a more exemplified scenario for the required margin. Assume you have a trading account holding $10,000. You want to open a position for the USD/EUR pair, which targets 1 mini lot (10,000 units), requiring a 20% margin or 20% of $10,000, which amounts to $2,000.

Once you open the position, your have already committed margin is $2,000. That leaves you with a 500% free margin or $10,000 less than $ 2,000.

From the above scene, if the trade moves fast into the wrong territory, you’ll be in the red. A bad trade there, and let’s say it holds you at a losing point with 8000 pips (1 pip is a Dollar, quite a high lot size but helps for the illustrative purpose here)

Your equity has now made a dive, plummeting from $10,000 to only $2,000. Your margin is now at a delicate position at 100% only. You are losing money rapidly. In this case, you are unable to open any more positions.

Two options remain for you here:

#1. First will be, wait hopefully for the markets to swing back towards your favorable positions. This will free you from the excessive burden of the required margin.

#2. The second will require you to pump in more equity to boost the levels of your margin to at least be higher than the already used margin.

In an unfortunate case where the prices may be reacting to market news and do not shift in your favor, you only have to go for the second option, which is often too hectic.

Adding funds to accounts to hold positions is not often an easily available option. The next option will be either you take the loss or close your positions out. In our example above, if you take a loss of $8,000, you end up with a remainder of $2,000. That will be your final equity or account balance – without any floating P&L.

In reality, who wants to take losses? Many traders fail to admit defeat and bank on the hope that the market may reverse in their favor. But, hope is a terrible trading strategy with leveraged forex trading.

If eventually the market never reverses, the trader keeps losing money rapidly and lastly dives into a deeper loss. Deeper dives into losses trigger a position known as the stop-out level. While the stop-out levels also vary with brokers, it’s often a worse situation.

At stop-out levels, brokers have no options but to force close your positions. It means that at the point the broker forcibly closes the trade, your margin level falls way below the 100% you may have recovered earlier. Under some circumstances, the account may even close with a negative figure!

And that is practically what traders refer to as blowing an account – where investor accounts lose money.

What is Safe Margin Level Forex

Having grasped the concepts of how margin works, now come the question of a safe margin in leveraged forex trading.

A good margin that is safe depends on the size of your account plus your levels of risk tolerance.

Every time you approach a trade, ask yourself one question: how much can you willingly lose if the trade turns out bad?

The truth is, no one ever wants to lose money out there. But trading is also a risky affair as it is with any other business. You are not alone here; even the best professional retail investor accounts lose some trades while trading margin.

Here is a good scenario that you can take for a start as a forex trader. Start with risking only 2% of your account funds or balance for a single position or on the total forex trades at any given point in time.

Therefore, if your trading account balance has total equity or the initial margin of $1,000, working with 2% risk allows you to take a maximum of only$200 and no more. It's a reasonable margin required for the margin account trading CFDs.

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Best Forex Trading Course

If you want to learn candlestick patterns and trade forex successfully, then you need the Asia Forex Mentor. This amazing course was developed by the legendary Ezekiel Chew.

He has been in the forex market and trained many successful forex traders from different backgrounds from individual retail traders to banks and financial institutions. So you know you are dealing with a proven course that has credible results.

The Asia Forex Mentor One Core Program is divided into 5 sections. Each section seamlessly progresses into the next to turn you into a competent and capable trader. It is suitable for any level trader from beginner to advanced. With the Asia Forex Mentor One core Program, you also get access to Ezekiel Chew's live trading so you can see firsthand how he executes trades.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion on Forex Margin

Margin refers to an amount or portion of margin requirements that a trader has to allow the broker to freeze while a transaction is ongoing. You cannot open trades where you do not meet minimum margin requirements. Of course, the higher your equity or account value, the more chances you have at committing to more positions.

In the professional realm, traders start by risking only 2% or less of an account for a single trade. For those who do not know, increasing your margin is equal to increasing your exposure. Since all trading decisions majorly depend on a trader, it’s for the trader to discipline themselves- and not leave that to the market.

If a trade runs into losses, it decreases the free margin. At an extreme level, the broker lets you know that you are exceeding margin levels by giving a notice or a margin call. A margin deficit/call is like a road sign telling you there’s danger ahead. It requires you to add more funds to increase the free margin to hold the current positions.

Another way to react to a margin deficit/call is by closing some of your trades. Lucky if they are into profits or unfortunate if they are into losses. The last and most extreme level past the margin call is the stop-out position. It's a position when a broker has a resolution to forcibly close trades. In most cases, this is where traders end up with blown accounts.

Margin in Forex FAQs

What is a good margin level in forex?

A good margin trading level in forex varies. Needless to say, it depends on two factors: the amount of equity in the account and the limits of your risk tolerance.

The ideal is to commit not more than 2% of the equity for any single trade.

Therefore, by way of exemplification:

If your account holds $ 1,000, your maximum allowable limit is 2% of the $1,000, which amounts to $200. And because margin goes hand in hand with the amount of equity, an account with equity amounting to $ 2,000 would see an upwards margin limit of $ 400 (=2% 0f the $2,000).

The theory behind limiting the margin to 2% aligns with the risks in foreign exchange markets trading and the strategy a trader deploys. If you risk only 2%, you are able to protect 98% of your capital to trade another time.

The beauty with forex is that there are many opportunities if a trader leverages a good strategy, cutting losing trades at the earliest opportunities and riding winning trades to the best exit positions.

What is a 5% margin in forex?

A 5% margin converts to committing 5% of your equity to hold a trade. While professionals advise on a 2% risk, 5% is way too high. However, traders out there have varying risk tolerance levels. And the margin one is best able to commit is a derivative of your capital and risk tolerance.

In practical terms, committing 5% of the margin for an account with equity totaling $1,000 amounts to $500(=5% of 1000). The other way to view margin is to look at how many times you can trade consecutively to end up with a nil account.

Therefore, with a 5% margin on an account with $1,000, you will trade for 20 trades, each losing $500 to hit zero.

If we switch to lower risk and tune the margin down to 2%, the situation changes. To arrive at a nil account, you must make 50 trades, each losing $200.

Therefore, if we remove the greed factor in foreign exchange, it’s best to work with a 2% margin for accounts as per professional guidance.

Note that the rule is not cast in stone. If odds favor your case, go for the 5%, and make sure you always win the trades!

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.