LonghornFX Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 105th  |  |

| Evaluation Criteria |

|---|

The team at Dumb Little Man, comprising financial specialists, seasoned traders, and private investors, employs a specialized algorithm for thorough evaluations of brokerage services. Their analysis focuses on key areas such as:

|

LonghornFX Review

Forex brokers play a pivotal role in the global financial markets, offering a platform for traders to buy and sell foreign currencies. LonghornFX, an STP (Straight-Through Processing) and ECN (Electronic Communication Network) broker, steps into this arena, providing access to the Forex and CFD markets. This broker stands out for its diverse offerings, allowing clients to trade over 180 financial instruments. Notably, it extends significant leverage, up to 1:500, and offers tight spreads. LonghornFX caters to a variety of trading styles, including scalping and hedging, and presents a unique opportunity for clients to earn by copying trades of experienced market participants through MetaTrader 4 (MT4).

Our LonghornFX review aims to deliver a comprehensive evaluation of the broker. We focus on its unique selling propositions and potential limitations, providing a transparent view for prospective traders. This review delves into the various account options, deposit and withdrawal processes, and commission structures offered by LonghornFX. By integrating expert analysis with real trader experiences, we endeavor to furnish you with critical insights. Our goal is to empower you with the knowledge necessary to decide if LonghornFX aligns with your trading needs and preferences, positioning it as a potential preferred brokerage service provider.

What is LonghornFX?

LonghornFX is a True ECN STP Broker catering to traders across various experience levels. This broker distinguishes itself by offering excellent trading conditions, designed to accommodate both novice and seasoned traders. LonghornFX's commitment to providing a robust trading environment makes it a significant player in the online trading industry.

The platform offered by LonghornFX grants access to an extensive array of 160+ assets, appealing to a diverse range of trading interests and strategies. This selection includes over 55+ Currency Pairs, covering Major, Minor, and Exotic Pairs, enabling traders to engage in dynamic forex trading. Additionally, LonghornFX specializes in 35+ Crypto Pairs, including popular options like BTC/USD and ETH/USD, catering to the growing demand for cryptocurrency trading.

For those interested in equity markets, LonghornFX provides opportunities to trade 64+ Stocks, including high-profile companies like Apple, Tesla, and Goldman Sachs Group. The broker also offers access to 11 Indices, such as NAS100, AUS200, and SPX500, along with trading in precious Metals including Gold, Silver, and Platinum. Furthermore, LonghornFX facilitates trading in essential Commodities like Gas and Oil, broadening its appeal to commodity traders.

Safety and Security of LonghornFX

LonghornFX is operated by Longhorn LLC and is registered in Saint Vincent and the Grenadines. This registration with the Financial Services Authority of St. Vincent and the Grenadines (SVGFSA) is crucial in understanding its regulatory framework. While SVGFSA oversees the financial sector, it's important to note that it does not issue licenses to Forex brokers but only registers them in the company registry. This information, gathered from thorough research by Dumb Little Man, highlights a key aspect of LonghornFX's operational structure.

In terms of safety and security, LonghornFX employs progressive methods to safeguard its clients' funds and personal data. Notably, the broker stores traders’ cryptocurrencies in cold storage, an entirely offline wallet system, enhancing the security of assets like BTC. Additionally, account security is fortified with 2FA (Two-Factor Authentication), adding an extra layer of protection against unauthorized access.

However, there are certain aspects to consider regarding LonghornFX's approach to security and client protection. The broker's clients do not have access to any compensation funds, which is a potential concern for some traders. Also, in case of disputes, resolutions are managed internally, without the involvement of third parties. Furthermore, LonghornFX’s financial statements are not available to the public, limiting transparency about the broker's financial health and operations. These points, critical for informed decision-making, are essential considerations for anyone evaluating LonghornFX as a potential trading platform.

Pros and Cons of LonghornFX

Pros

- Automated trading allowed

- Access to MT4 versions

- Favorable partnership program

- Multiple trader accounts

- High leverage up to 1:500

- Tight spreads from 0.1 pips

- Low $10 minimum deposit

Cons

- No cent accounts

- Cryptocurrency-only transactions

- Unlicensed broker

Sign-Up Bonus of LonghornFX

LonghornFX currently does not offer a sign-up bonus for new clients. As of the latest information available, the broker has opted not to include a welcome bonus as part of its account opening incentives. This approach may change in the future, but for now, traders considering LonghornFX should note the absence of a new account promotional offer.

Minimum Deposit of LonghornFX

LonghornFX sets a remarkably low minimum deposit at just $10. This requirement applies to its sole account type, the MT4 ECN account. This low deposit threshold makes LonghornFX accessible to a wide range of traders, from beginners to those looking to test the platform without a significant financial commitment. It's an attractive feature for traders seeking entry into Forex trading with minimal initial investment.

LonghornFX Account Types

Our team at Dumb Little Man conducted extensive research and testing to provide detailed insights into the account types offered by LonghornFX. Here's a concise breakdown:

MT4 ECN Account

- This is the only live account type offered by LonghornFX.

- Designed for trading directly with liquidity providers.

- Features tightest possible spreads with a fee per lot.

- Adjustable leverage settings and choice of base currency.

- Unlimited live accounts per trader, offering flexibility in trading strategy.

Swap-Free/Islamic Account

- Available for Muslim clients.

- Exempt from swaps, but subject to an administrative fee.

Demo Account

- Can be opened in any version of the trading platform.

- No limit on the number of demo accounts.

- Offers the same trading conditions as live accounts, useful for practice and strategy testing.

LonghornFX ensures that all clients, regardless of their experience level or the amount of equity, have access to uniform trading conditions. This approach demo

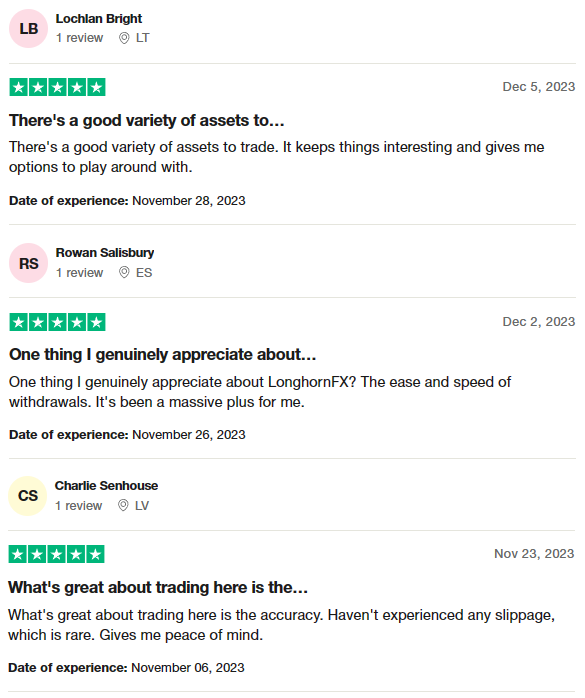

LonghornFX Customer Reviews

Customer reviews of LonghornFX highlight several key strengths of the broker. Users appreciate the good variety of assets available for trading, which offers them flexibility and numerous options to explore different market strategies. A notable aspect frequently mentioned is the ease and speed of withdrawals, a critical factor for traders prioritizing quick access to their funds. Additionally, the accuracy in trade execution and a lack of slippage are highly valued, contributing to a sense of reliability and peace of mind for the traders. These aspects collectively reflect a positive user experience with LonghornFX, emphasizing its effectiveness in meeting various trading needs.

LonghornFX Fees, Spreads, and Commissions

LonghornFX, as an ECN broker, implements two primary types of trading fees. The first is a $6 fee per lot, applicable to all assets and trades across the platform. This fee structure is a common aspect of ECN brokers, reflecting the cost of accessing direct market liquidity.

The second type of fee involves floating spreads, which vary depending on the trading instrument and current market conditions. For example, the minimum spread for EUR/USD is notably low at just 0.1 pips. This competitive spread is attractive to traders looking for cost-effective trading opportunities.

While LonghornFX does not impose fees for depositing or withdrawing funds, it is important to note that all cryptocurrency transactions incur costs related to blockchain network and miner fees. Consequently, trading and transferring Bitcoin and other cryptocurrencies will inevitably involve some level of fund expenditure due to these external fees. This factor is an essential consideration for traders using cryptocurrencies on the LonghornFX platform.

Deposit and Withdrawal

LonghornFX‘s deposit and withdrawal processes have been thoroughly tested by a trading professional at Dumb Little Man, revealing key insights. For deposits, the minimum amount is $10, which can be transferred directly from a crypto wallet.

Alternatively, funds can be credited from a card or bank account using Instacoins, a third-party service that facilitates Bitcoin purchases. However, the minimum transaction through Instacoins is $50, and each transaction incurs a blockchain network fee of 0.0005 BTC. Deposited funds are credited to the account within 6 hours after the transaction is confirmed.

When it comes to withdrawals, LonghornFX exclusively deals in Bitcoin. Clients have the choice to transfer cryptocurrency to their own wallets or to withdraw profits to a card or bank account via Instacoins. Opting for Instacoins incurs additional fees for converting BTC into fiat currency, plus service fees from the Instacoins platform.

LonghornFX processes withdrawal requests on the same day, with the time for crediting funds depending on blockchain speeds, typically taking up to 6 hours. The minimum withdrawal is $10, and there's no cap on the maximum amount. While LonghornFX itself does not charge for withdrawals, Bitcoin transactions are subject to a network fee of 0.0005 BTC, with the fee amount fluctuating based on Bitcoin's current market price.

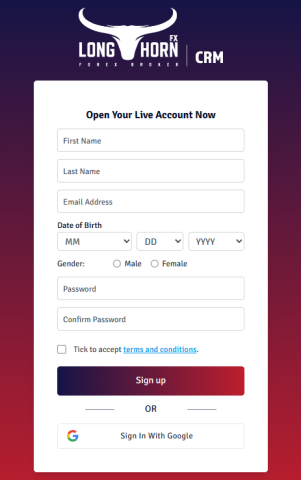

How to Open a LonghornFX Account

- Visit the LonghornFX website and locate the account creation form on the main page.

- Fill in your first and last names, email address, date of birth, and gender.

- Create a password and enter it twice in the form for verification.

- Submit the completed registration form.

- Check your email for a confirmation link from LonghornFX.

- Click the link to confirm your email address.

- Access your user account on the LonghornFX platform.

- Use your email address and password for account login.

- Complete any additional verification steps required by LonghornFX.

LonghornFX Affiliate Program

LonghornFX‘s Affiliate Program offers a lucrative opportunity for its partners. Participants in the program earn a $3 fee per lot traded by their referrals. This system does not impose any limits on the number of traders one can invite, nor does it restrict the duration for earning bonuses. As a result, partners continue to receive fees as long as their referrals remain active traders.

Regarding the payout of these partner fees, LonghornFX credits them to the MT4 trading account at the end of each month. However, partners have the flexibility to request an earlier payout through their account manager if needed. The minimum withdrawal amount for these fees is set at $10, making it accessible for partners to access their earnings. This affiliate program is designed to be both rewarding and flexible, catering to the needs of LonghornFX's partners.

LonghornFX Customer Support

Based on the experience of Dumb Little Man, LonghornFX‘s Customer Support is accessible through multiple channels. Clients have the option to use live chat for instant assistance, ideal for urgent queries or immediate guidance. This feature ensures real-time communication and quick resolution of issues.

Additionally, for those preferring a more personal touch, LonghornFX offers a callback service. This option allows clients to schedule a call at their convenience, providing a direct line to support staff. Lastly, for more detailed inquiries or non-urgent matters, customers can reach out via email. This channel is suitable for comprehensive support or when documentation needs to be shared. LonghornFX's multi-channel customer support system ensures that clients' needs are met efficiently and effectively.

Advantages and Disadvantages of LonghornFX Customer Support

| Advantages | Disadvantages |

|---|---|

LonghornFX vs Other Brokers

#1. LonghornFX vs AvaTrade

LonghornFX offers a low minimum deposit and focuses on cryptocurrency transactions, while AvaTrade boasts a wider range of financial instruments and strong regulatory compliance. AvaTrade caters to a global audience (except US traders) with a strong presence in multiple countries.

Verdict: Given its comprehensive regulatory framework and diverse offerings, AvaTrade may be better suited for traders seeking a highly regulated environment and a broad selection of trading options.

#2. LonghornFX vs RoboForex

RoboForex stands out with its extensive range of over 12,000 trading options and multiple platform choices, appealing to various trading styles. In contrast, LonghornFX offers streamlined trading options with a focus on cryptocurrency.

Verdict: For traders seeking technological diversity and a vast array of trading instruments, RoboForex might be the more appealing choice, especially for those with specific platform preferences or diverse trading needs.

#3. LonghornFX vs FXChoice

FXChoice is known for its commitment to experienced traders, offering professional ECN accounts with tight market spreads, whereas LonghornFX has a simpler account structure and a focus on crypto transactions.

Verdict: FXChoice's approach, including a loyalty program for high-volume traders, makes it more suitable for seasoned traders looking for advanced trading conditions. In comparison, LonghornFX could be more appealing for those prioritizing cryptocurrency trading and a more straightforward account setup.

>> Also Read: AvaTrade Review 2025 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you're passionate about establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor is the ideal choice for top-notch forex, stock, and crypto trading courses. Renowned visionary Ezekiel Chew, known for his contributions to trading institutions and banks, leads Asia Forex Mentor. Personally achieving seven-figure trades, Ezekiel sets himself apart from other educators. Here are the compelling reasons supporting our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers a well-rounded educational program covering stock, crypto, and forex trading. This structured curriculum equips aspiring traders with the knowledge and skills needed to excel in these diverse markets.

Proven Track Record: Asia Forex Mentor's credibility is solidified by its track record of consistently producing profitable traders in various market sectors. This achievement attests to the effectiveness of their training methods and mentorship.

Expert Mentor: Students benefit from the guidance of an experienced mentor at Asia Forex Mentor, with a remarkable track record in stock, crypto, and forex trading. Ezekiel provides personalized support, enabling students to navigate each market confidently.

Supportive Community: Joining Asia Forex Mentor grants access to a supportive community of like-minded traders pursuing success in stock, crypto, and forex markets. This community encourages collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Trading success requires a strong mindset and disciplined approach. Asia Forex Mentor offers essential psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: Financial markets are dynamic, and Asia Forex Mentor ensures students stay updated with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in numerous success stories where students have transformed their trading careers and achieved financial independence through comprehensive forex, stock, and crypto trading education.

Asia Forex Mentor is the top choice for those seeking the best forex, stock, and crypto trading courses to shape a rewarding career and attain financial prosperity. With its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor equips aspiring traders with the tools and guidance to excel in diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: LonghornFX Review

Concluding our review by the team of trading experts at Dumb Little Man, LonghornFX presents a mixed yet compelling proposition in the Forex and CFD trading world. The broker stands out for its low minimum deposit and the flexibility of cryptocurrency transactions, appealing to a broad spectrum of traders. Its high leverage of up to 1:500 and the availability of multiple accounts for a single trader are noteworthy features that enhance its attractiveness.

However, it's important to approach LonghornFX with caution due to certain limitations. The absence of a regulatory license and the limitation to cryptocurrency-only transactions for deposits and withdrawals might be concerning for some traders. Additionally, the lack of a diverse range of account types could be a drawback for those seeking more tailored trading experiences.

>> Also Read: FXORO Review with Rankings 2025 By Dumb Little Man

LonghornFX Review FAQs

What types of trading does LonghornFX support?

LonghornFX caters to various trading styles, including forex, CFDs, and cryptocurrency trading. It supports scalping and hedging and provides access to over 180 financial instruments, making it suitable for diverse trading strategies.

Is LonghornFX regulated, and how safe is it to trade with them?

LonghornFX operates without a regulatory license, as it is registered in Saint Vincent and the Grenadines, where the Financial Services Authority does not issue licenses but registers Forex brokers. While it employs security measures like cold storage for cryptocurrencies and two-factor authentication for account security, the lack of regulatory oversight might be a concern for some traders.

Can I start trading with a small investment at LonghornFX?

Yes, LonghornFX is accessible to traders with small investments, with a minimum deposit requirement of just $10. This low entry barrier makes it an attractive option for beginners or those wishing to test the platform with minimal financial risk.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.