Liberty Market Investment Review with Rankings 2025 By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

The team at Dumb Little Man, known for their financial expertise and trading experience, specializes in detailed evaluations of proprietary trading firms. They employ a detailed algorithm and rigorous assessment methods to review brokers on critical factors, ensuring thorough evaluations. These factors include:

Their review of Liberty Market Investment shows that the firm excels in meeting these important criteria. Liberty Market Investment is recognized for its extensive expertise in brokerage and strong trader support, making it a prominent player in the prop trading sector. |

Proprietary trading businesses, or “prop firms”, are specialized financial entities. They differ from regular brokerages in that they trade their own capital. This technique allows them to profit immediately from successful deals, making them a one-of-a-kind force in the financial markets.

A well-known example of a prop firm is Liberty Market Investments (LMI). LMI, based in London and founded in 2018, focuses on providing transparent recruitment programs for both novice and experienced futures traders. Their goal is to develop and improve trading skills, preparing people to navigate and flourish in global financial markets.

This Liberty Market Investment review provides a detailed analysis of this prop firm, integrating insights from Dumb Little Man trading experts and genuine customer feedback. The evaluation tries to provide a fair and useful perspective by incorporating expert analysis as well as real-world user experiences. This method ensures a thorough understanding of LMI's offers and performance in the volatile realm of proprietary trading.

What is Liberty Market Investment?

Liberty Market Investment Ltd, or LMI, is a competitive prop trading service that is based in London, England. This company serves futures traders all around the world by providing a transparent and competitive proprietary trading solution. LMI differentiates itself by offering substantial profit splits and complete support to traders of all skill levels.

Their goal is to support growth and success in the sector by creating a welcoming atmosphere for traders.

Despite its claims to be situated in the United Kingdom, LMI is not formally registered in any country, raising concerns about its validity. For individuals considering the firm, this needs a more thorough research. As part of this analysis, we dive deeper into Liberty Market Investment's operations and dependability.

LMI specializes in program evaluation for CME and EUREX futures traders. These programs are developed in two stages, with successful completion resulting in a funded account.

Pros and Cons of Liberty Market Investment

Pros

- 90% profit share

- LMI Trade Report for stats analysis

- Free access to VolFix platform

- 14-day free trial

- Built-in risk management

- Variety in futures trading

- Minimum 7 days to qualify

- Range of products including CME Group and EUREX

- End-of-day drawdown in all plans

- 100% payout of first $30,000 profits

- 24/5 SEPA transfer payout

Cons

- Only Futures trading

- No MetaTrader platforms

- More suitable for professional traders

- Limited user feedback

- Partnered with unregulated broker

- Only VolFix platform available

Safety and Security of Liberty Market Investment

In Liberty Market Investment's case, their association with an unregulated brokerage, the Volfix platform, signals potential risks in trading activities.

Additionally, a significant portion of LMI's clientele is based in the United States, a region where regulatory oversight by the Commodity Futures Trading Commission (CFTC) is mandatory. Despite this, both LMI and Volfix boast 4-star ratings on Trustpilot, which, after thorough research by Dumb Little Man, appear to be possibly fabricated. This raises further concerns about their reliability.

Investors are advised to be cautious and preferably avoid unregulated brokers like Eukrypto to mitigate potential security issues.

Liberty Market Investment Bonuses and Contests

Currently, Liberty Market Investment does not offer any active contests or bonuses. However, this doesn't mean such opportunities won't arise in the future. Traders interested in Liberty Market Investment should stay alert for future announcements.

Liberty Market Investment Customer Reviews

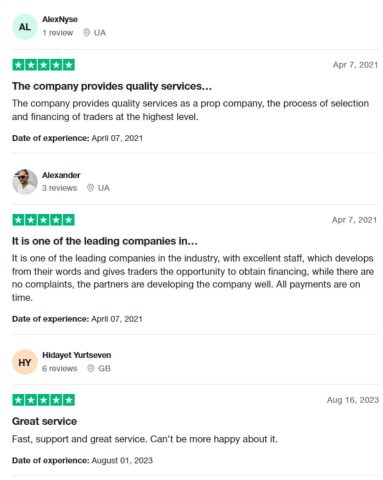

Liberty Market Investment, holding a 4-star rating on Trustpilot, garners positive reviews from its users. Customers like Alexander describe it as a leading entity in the industry, praising its excellent staff and the opportunity for traders to obtain financing.

Alex highlights the quality of services in trader selection and financing as particularly high-level. Hidayet speaks highly of the fast support and great service offered. These reviews collectively paint Liberty Market Investment as a reputable and efficient choice in the proprietary trading world.

Liberty Market Investment Commissions and Fees

Liberty Market Investment has a structured approach to commissions and fees, particularly after traders advance to the Funded Session. This stage signifies that a trader has the skills to manage investors' capital responsibly.

Once a trader completes the Qualifying Session, they are transitioned to the Funded Stage, a process facilitated by the LMI team, involving a contract and account details arrangement, typically within a few working days.

In terms of commissions, traders are entitled to 100% of all withdrawals up to a total of $30,000 earned per account. This can be withdrawn to any bank, giving the trader flexibility independent of the location. When gains exceed $30,000, the profit share changes to 90/10, with the trader receiving the majority, 90%.

Furthermore, if traders run into problems, they can return to the Qualifying Session for free if no regulations are broken, a procedure known as Re-Qualifying. This policy demonstrates Liberty Market Investment's dedication to assisting its traders while maintaining a transparent and equitable commission system.

Liberty Market Investment Account Types

Liberty Market Investment provides a variety of account kinds, each tailored to different degrees of trading skill and capital management. Dumb Little Man's team of professionals has investigated and researched these accounts.

The account kinds available at Liberty Market Investment are listed and arranged below:

Small (30,000)

- Profit Target: $2,000

- Daily Loss Limit: No Daily Loss Limit

- Max. Trailing Drawdown: $1,500

- Max. Position Size: 3

- Restart Cost: $50

- Subscription Cost: $140

Medium (50,000)

- Profit Target: $3,000

- Daily Loss Limit: No Daily Loss Limit

- Max. Trailing Drawdown: $2,000

- Max. Position Size: 5

- Restart Cost: $50

- Subscription Cost: $155

Large (100,000)

- Profit Target: $6,000

- Daily Loss Limit: No Daily Loss Limit

- Max. Trailing Drawdown: $3,000

- Max. Position Size: 10

- Restart Cost: $80

- Subscription Cost: $300

Max (150,000)

- Profit Target: $9,000

- Daily Loss Limit: No Daily Loss Limit

- Max. Trailing Drawdown: $4,500

- Max. Position Size: 15

- Restart Cost: $90

- Subscription Cost: $350

Evaluation Program Stages

- First Stage: Practice Session: Traders choose an account, demonstrate their trading skills, and meet profit targets. Performance is tracked via LMI Trade’s VolFix terminal.

- Second Stage: Qualifying Session: Traders prove their stability and consistency. Successful participants in this stage are granted funded accounts.

- Third Stage: Funded Session: Traders operate globally with LMI Trade’s investor capital. This stage offers mobility, convenience, and risk-free trading, allowing traders to earn while leveraging the firm's

Opening a Liberty Market Investment Account

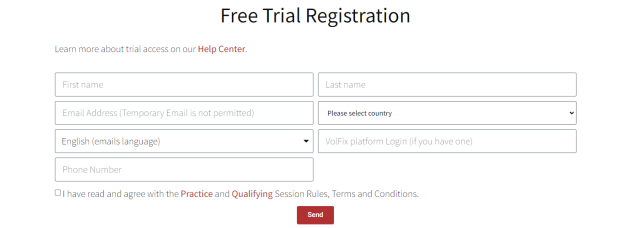

In order to guarantee a smooth and user-friendly experience, registering on LMI is made to be a simple process that only consists of eight easy steps.

- To begin, navigate to the LMI website and look for the sign-up option.

- Select the ‘Get Funded' option.

- Fill in your personal information, such as your name, email address, and contact details.

- Create a username and password for your new account.

- Accept the terms and conditions after carefully reading them.

- Follow the link in your inbox to verify your email address.

- Complete any remaining profile settings, such as uploading a profile photo or entering payment information.

- Log in to your new account with your username and password to begin using the website's features.

Liberty Market Investment Customer Support

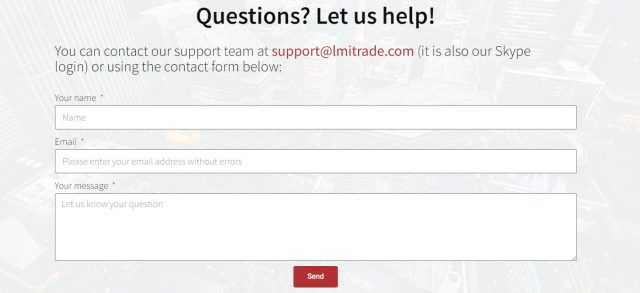

Dumb Little Man experienced and remarked that Liberty Market Investment has a responsive customer care system. Customers who require assistance can contact the support team via email at [email protected], which also serves as their Skype login, or via the contact form offered on their platform.

In addition to direct assistance, LMI's platform has a wealth of instructional and useful content. This feature is especially beneficial for users who prefer self-help alternatives since it makes it simple to obtain answers to varied problems.

LMI's internet reputation reflects the effectiveness of its customer care, with a 4-star rating on TrustPilot and a 5-star rating on Facebook, showing a high degree of consumer satisfaction with the service they receive.

Advantages and Disadvantages of Liberty Market Investment Customer Support

| Advantages | Disadvantages |

|---|---|

|

Liberty Market Investment Withdrawal Options

Liberty Market Investment, according to trading experts at Dumb Little Man, provides its traders with a choice of withdrawal options. Deel handles all withdrawal transactions on the site, providing a safe and quick process. It also offers traders a variety of withdrawal options based on their region.

Profits can be withdrawn using bank transfers, PayPal, Payoneer, Binance, Revolut, Coinbase, and Wise, among other methods. There are additional solutions that cater to a wide range of interests and desires, such as the Deel Card and Deel Instant Card Transfer.

The adaptability of Liberty Market Investment's withdrawal methods demonstrates its commitment to serving the financial needs of its global user base.

Liberty Market Investment Challenges and Difficulties

The trading market will always be volatile, and because of this, traders will also always risk both the profit and the loss. In this case, knowledge of risk management will be useful. Furthermore, despite the LMI‘s platform being extensive, it has a steep learning curve for new traders.

Another challenge is the regulatory compliance. Since LMI's broker is unregulated and lacking of regulatory authority in some regions, security and compliance issues may arise. This factor may affect the trader's confidence in the platform's reliability and stability.

How to Pass Liberty Market Investment Evaluation Process

Passing the Liberty Market Investment screening procedure is a critical step for traders seeking investment. Given the firm's high criteria, this is no easy task. Traders must be adequately prepared to maximize their chances of success.

This preparation entails more than simply comprehending the market; it needs precise tactics and in-depth information. Participating in a comprehensive training program is very critical. A curriculum like this can provide traders with the knowledge and abilities they need to overcome the demands of Liberty Market Investment's evaluation process.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Asia Forex Mentor, named Investopedia's best complete course, is highly recommended for individuals preparing for the Liberty Market Investment evaluation process. It is great for traders who are serious about achieving the difficult challenge of Liberty Market Investment, as recommended by the professionals at Dumb Little Man.

Thousands of people have used this site to help them pass various prop firm evaluations. Asia Forex Mentor is more than just a course. It was founded by Ezekiel Chew, a well-known forex trading expert with over two decades of experience. It features Chew's One Core Program, which is aimed at teaching efficient Forex trading tactics and highlights his expertise in producing large profits from Forex trading.

Ezekiel's journey into trading instruction began with private lessons for friends before it expanded online. This expansion demonstrates his commitment to share his trading knowledge and approaches. Asia Forex Mentor is a testimonial to his successful trading career and his desire to help others achieve similar success in the forex market.

How Could Asia Forex Mentor Help You Pass Liberty Market Investment Challenge?

For traders attempting to succeed in the Liberty Market Investment challenge, Asia Forex Mentor (AFM) is a very trustworthy and useful resource. Numerous prominent honors and these accolades below serve as the foundation for this legitimacy:

Best Comprehensive Course Offering Award: AFM's One Core Program has been recognized by Investopedia, a leader in financial education, as the best comprehensive Forex course offered. This award acknowledges the program's breadth and depth in satisfying a variety of learning demands.

Best Forex Trading School: Benzinga, a reputable source of financial and business information, named the AFM One Core Program the best forex trading instruction for beginners. This award recognizes the program's success in guiding traders from beginner to advanced levels, making it suited for newcomers to FX trading.

Best Forex Mentor: Asia Forex Mentor was designated the best forex mentor by BestOnlineForexBroker in 2021, acknowledging its capacity to assist traders in achieving large gains in forex trading.

Top Forex Trading Courses: Asia Forex Mentor was ranked first in a comprehensive analysis conducted by prominent forex traders and platforms for its effective trading strategies and systems.

Asia Forex Mentor's One Core Program has consistently outperformed the expectations of its students, which include both new and experienced traders. Its wide and successful curriculum equips traders with the information and skills they need to tackle and succeed in the Liberty Market Investment challenge with confidence.

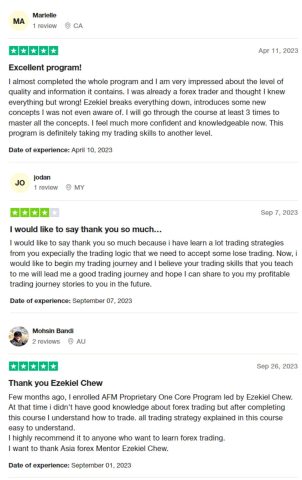

Asia Forex Mentor Members' Testimonials

Members of Asia Forex Mentor‘s One Core Program by Ezekiel Chew express deep gratitude in their testimonials. Moshin, a forex novice, likes the software for its straightforward and profitable trading strategies. Jodan understands the importance of trading logic and loss acceptance and believes he is well-prepared for a lucrative trading future.

Marielle, an experienced trader, found the program to be a big skill enhancer, providing new concepts that enhanced her trading knowledge. These testimonials show how the training has changed traders' trading knowledge and confidence for a wide range of traders.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Liberty Market Investment Review

Liberty Market Investment (LMI), according to the Dumb Little Man team of trading specialists, is a strong alternative for prop traders, particularly those with some trading background and industry understanding. LMI distinguishes itself in the market by providing one of the best profit split options, making it an interesting option for traders who can fully utilize what LMI has to offer.

However, there are several drawbacks to LMI. Its reliance on the VolFix trading platform may turn off traders used to more common platforms like MetaTrader5. Furthermore, LMI's single focus on futures trading limits the options available to people interested in indices, foreign exchange, or other assets.

For those looking to maximize their chances of success in LMI's evaluation process, enrolling in top-tier courses like Asia Forex Mentor can significantly enhance trading skills and knowledge, potentially increasing the likelihood of passing the evaluation.

Liberty Market Investment Review FAQs

Is LMI limited to only futures trading?

Liberty Market Investment specializes solely in futures trading. This means that it does not offer trading alternatives in other markets such as FX, indices, or commodities. LMI especially caters to those who specialize in or are interested in futures trading.

What is the process for withdrawing profits from LMI?

LMI provides a variety of withdrawal ways via Deel, including bank transfers, PayPal, Payoneer, and multiple cryptocurrency choices. Traders can withdraw gains in accordance with the rules of their profit split, with different choices available according on their location.

Can beginners participate in LMI's trading programs?

Yes, beginners can engage in LMI's trading programs; however, the platform is generally better suited to traders with some prior industry expertise and trading experience. LMI provides instructional resources and tools to help traders of varying levels of expertise.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.