Kot4x Review 2024 with Rankings By Dumb Little Man

By Wilbert S

February 25, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 119th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

Kot4x Review

Forex brokers play a crucial role in providing access to the global currency markets. They serve as intermediaries between retail traders and the broader financial markets. Kot4x Broker emerges as a notable player in this space, offering advanced technologies for trading in Forex, cryptocurrencies, and CFDs (Contracts for Difference). This introduction aims to shed light on the services and capabilities of Kot4x, distinguishing it as a potential choice for traders seeking reliable market access.

In our detailed review of Kot4x, we aim to deliver a comprehensive analysis of what this broker has to offer. By highlighting its unique selling propositions and potential drawbacks, our goal is to provide readers with critical insights. We cover various account options, deposit and withdrawal processes, commission structures, and other essential details. Combining expert analysis with actual trader experiences, this review is designed to equip potential users with the knowledge needed to make an informed decision about Kot4x as their brokerage service provider.

What is Kot4x?

Kot4x Broker stands as a dynamic online platform catering to Forex, cryptocurrency, and CFD trading. Utilizing advanced technologies, it facilitates access to the financial markets for traders worldwide. The broker is designed to support a secure ECN (Electronic Communication Network) trading environment, ensuring efficient execution and competitive pricing for its users.

Offering an extensive range of trading instruments, Kot4x provides traders with over 250 options, including a variety of cryptocurrencies. This diversity enables traders to explore multiple markets and asset classes, enhancing the potential for portfolio diversification. Kot4x distinguishes itself by not restricting trading strategies, allowing traders the flexibility to apply their preferred techniques and methodologies.

In terms of cost efficiency, Kot4x is known for its low trading fees, making it an attractive option for traders seeking to maximize their returns. Additionally, the platform supports payments in bitcoins, offering an added convenience for those who prefer to use cryptocurrency for financial transactions. This approach underscores Kot4x’s commitment to embracing modern payment methods and catering to the needs of the contemporary trader.

Safety and Security of Kot4x

Based on thorough research from Dumb Little Man, it’s noted that Kot4x prioritizes the safety and security of its clients, especially given its lack of a formal regulatory license. The broker implements two-factor authentication (2FA) as a key measure to safeguard user identities and prevent unauthorized account access. This system allows users to opt between the Authy application or SMS verification, adding an extra layer of security to the login process.

The separation of clients’ funds from the company’s operational capital is another critical aspect of Kot4x’s approach to security. By holding these funds in special bank accounts, the broker ensures that client investments are protected and managed with the utmost integrity. This practice is essential for maintaining trust and confidence among its user base.

However, it’s important to acknowledge certain limitations in Kot4x’s protective measures. The absence of negative balance protection means that traders could potentially lose more money than they have in their accounts, exposing them to higher financial risks. Additionally, without the option to file formal complaints with international regulators, clients have limited recourse in the event of disputes or issues with the broker. These factors are crucial considerations for anyone looking to trade with Kot4x.

Pros and Cons of Kot4x

Pros

- Tight spreads, high leverage for $250+ deposits

- Variety in asset classes – currencies, cryptos, stocks, more

- MT4 platform availability – mobile, desktop, web

Cons

- No micro (Cent) accounts

- Passive income limited to affiliate program

- Islamic accounts missing

Sign-Up Bonus of Kot4x

Kot4x offers a sign-up bonus designed to enhance the trading experience for new clients. Traders can take advantage of a 20% deposit bonus, capped at $€£ 5000 per trader. This bonus is aimed at giving traders a financial boost right from the start, enabling them to increase their trading volume and potential profitability.

The bonus is credited directly to the accounts of eligible Kot4x traders as a form of credit. To unlock this credit for withdrawal or further trading, traders must reach a specified level of trading activity. This requirement ensures that the bonus serves its purpose of encouraging trading activity on the platform.

Minimum Deposit of Kot4x

Kot4x sets a low entry barrier for new traders with its minimum deposit amount of just $25. This accessible threshold allows individuals from various financial backgrounds to start trading without a significant initial investment.

Kot4x Account Types

Our team at Dumb Little Man conducted thorough research and testing to present a clear overview of Kot4x account types. Here’s what traders can expect:

- Mini Pairs Account: Designed as a standard account for those interested in currency trading, it offers access to 29 currency pairs. With a minimum deposit of $25, traders experience floating spreads starting from 1.0 pips and a low broker’s commission of $1 per lot.

- Standard Pairs Account: This account type broadens trading opportunities, requiring a minimum deposit of $50. Traders gain access to a wide range of assets including currency pairs, stocks, indices, commodities, metals, and cryptocurrencies. Spreads begin at 0.8 pips, with a commission of $7 per lot for all assets.

- VAR Pairs Account: Catering to traders looking for an ECN (Electronic Communication Network) experience, the VAR account demands a minimum deposit of $250. Unique for its no commission per lot structure, it offers slightly higher spreads starting from 1.2 pips on average.

- Kot4x Professional Account: Tailored for the seasoned trader, this account type provides precise spreads starting from 0.4 pips. A minimum deposit of $500 is required, with a $7 commission per lot traded, reflecting its professional status.

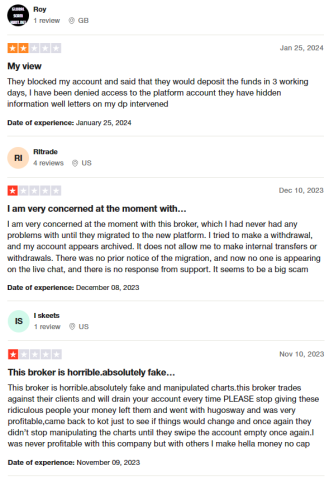

Kot4x Customer Reviews

Kot4x customer reviews reveal a mix of concerns and dissatisfaction among users. Issues range from blocked accounts with promises of funds being deposited within three working days, to difficulties encountered during the broker’s platform migration. Customers report archived accounts, inability to make withdrawals or internal transfers, and a lack of communication from customer support. Furthermore, allegations of manipulated charts and trading against clients have been made, suggesting a loss of trust in the broker’s operations. These reviews indicate significant challenges in customer service and platform reliability, leading some traders to seek other brokers where they experience better profitability and transparency.

Kot4x Fees, Spreads, and Commissions

Kot4x implements a dual fee structure to accommodate its range of trading accounts. Trading fees are incurred through spreads applicable to all account types, alongside commissions per lot for specific accounts. Specifically, the Standard Pairs and Pro Pairs accounts carry a $7 commission per lot, while the Mini Pairs account is subject to a lower $1 commission per lot. This system ensures that traders are aware of the costs associated with their chosen trading activities.

For non-trading transactions, Kot4x imposes a 5% fee on deposits made through debit and credit cards via eCommerce Pay. This fee is directly related to the transaction amount, affecting the net amount deposited into the trading account. Conversely, the broker offers an advantage by allowing free withdrawals, alleviating some of the cost concerns for traders looking to access their profits. This fee structure is crucial for traders to consider when evaluating Kot4x as their broker of choice, balancing trading costs against potential returns.

Deposit and Withdrawal

A trading professional at Dumb Little Man tested Kot4x’s deposit and withdrawal processes, providing valuable insights into their efficiency and user-friendliness. Kot4x does not levy a commission on withdrawals, positioning it as a cost-effective option for traders. Withdrawal requests are typically processed within 24 hours, highlighting the broker’s commitment to prompt service.

For withdrawing funds, Kot4x supports multiple methods, including Bitcoin crypto wallets, VISA debit and credit cards, MasterCard, Discover Card, and third-party providers. This variety ensures flexibility for traders in accessing their funds. The minimum withdrawal amount is set at $10, making it accessible for traders with smaller balances to retrieve their money. Additionally, if a deposit was made using a card, the amount withdrawn can only match the deposited amount; profits must be withdrawn via alternative methods.

Withdrawal and deposit currencies are limited to BTC (Bitcoin), aligning with the growing trend of using cryptocurrencies for financial transactions. Crediting terms vary by method: Bitcoin wallet transfers take 1-3 hours, while credit card transactions may take 1-5 business days, depending on the card used for the initial deposit. This detailed breakdown provides a clear overview of Kot4x’s deposit and withdrawal mechanisms, essential for traders considering this broker for their trading activities.

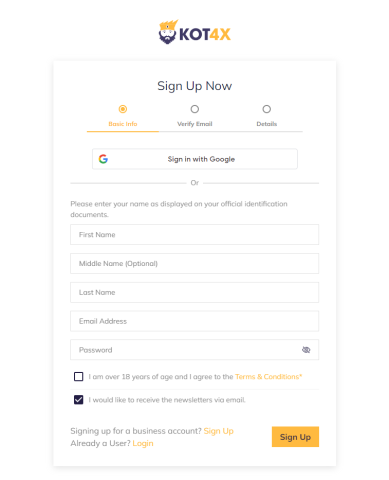

How to Open an Kot4x Account

- Visit Kot4x‘s official website and click SIGN UP located at the top right.

- Fill in your personal details including last name, first name, and email, then set a password.

- Confirm your email address by clicking the link sent to your email.

- Provide additional information such as phone number, date of birth, gender, and address including zip code.

- Choose the currency for your account.

- Enable two-factor authentication for added security.

- Create a new account, choosing between a demo or a real account.

- Complete any required verification processes as instructed.

- Fund your account to start trading.

Kot4x Affiliate Program

Kot4x’s affiliate program is structured to reward its partners through two main channels: the Introducing Broker (IB) and the Affiliate Broker programs. In the IB program, partners earn a 28.6% commission from the broker’s fees for each new trader they bring to the platform who actively trades. This remuneration model incentivizes the recruitment of active, depositing traders.

Alternatively, the Affiliate Broker program offers a different compensation structure, paying partners $2 for every lot traded by their referrals. This scheme directly ties the partner’s earnings to the trading volume of the clients they introduce to Kot4x.

Kot4x Customer Support

Based on the experience of Dumb Little Man with Kot4x Customer Support, traders have multiple avenues for assistance. They can initiate a conversation through the chatbot feature on the website for immediate queries. For more detailed inquiries, sending an email request is another option available to both prospective and existing clients.

Registered customers gain additional support options, including the ability to fill out a contact form directly on the Kot4x website. This method is tailored for more specific or complex issues. Moreover, traders with active accounts have the privilege of requesting a callback, providing a direct line to the support team for personalized assistance. This multi-channel approach ensures that traders at all levels of engagement can find the help they need when navigating the Kot4x platform.

Advantages and Disadvantages of Kot4x Customer Support

| Advantages | Disadvantages |

|---|---|

Kot4x vs Other Brokers

#1. Kot4x vs AvaTrade

Kot4x and AvaTrade cater to different segments of the trading community. Kot4x offers a more cryptocurrency and CFD-centric platform with flexible trading strategies and low entry barriers, suitable for traders interested in these markets. On the other hand, AvaTrade has established itself as a leading Forex and CFD broker since 2006, providing a broad spectrum of over 1,250 financial instruments to a global clientele. AvaTrade stands out for its heavy regulation, licensing across several jurisdictions, and commitment to trading efficiency and security.

Verdict: AvaTrade is better for traders looking for a more regulated, secure, and comprehensive trading experience with a wide range of financial instruments. Its long-standing reputation and global presence offer a robust platform for serious traders.

#2. Kot4x vs RoboForex

Kot4x provides a platform focused on Forex, cryptocurrencies, and CFDs with advanced technologies. In contrast, RoboForex emphasizes cutting-edge technologies and diverse trading conditions since 2009. With more than 12,000 trading options across eight asset classes, RoboForex offers a broader range of trading platforms, including MetaTrader, cTrader, and RTrader, catering to various trading preferences and styles.

Verdict: RoboForex emerges as the better option for traders seeking a wide selection of trading platforms and instruments. Its extensive range of services and personalized terms accommodate traders of all experience levels and investment sizes, making it a more versatile choice.

#3. Kot4x vs FXChoice

Comparing Kot4x and FXChoice, both brokers offer services tailored to different trader needs. FXChoice, established in 2010, is recognized for its integrity, customer focus, and a wide range of trading instruments and services, particularly for automated trading. Licensed by the FSC of Belize, FXChoice positions itself towards experienced traders, offering ECN accounts with tight market spreads but not catering to beginners with cent accounts or zero spreads.

Verdict: FXChoice is preferable for experienced traders seeking a broker committed to quality services and a focus on automated trading. While Kot4x provides a broad entry point for cryptocurrency and CFD trading, FXChoice offers a more specialized service for seasoned traders with a preference for ECN accounts and automated trading solutions.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

Asia Forex Mentor is the premier destination for individuals eager to forge a lucrative career in forex trading and attain significant financial success. The foundation of this top-rated course in forex, stock, and crypto trading is attributed to Ezekiel Chew, a distinguished figure in the trading community known for his advisory role to trading institutions and banks. Notably, Ezekiel’s consistent delivery of seven-figure trades distinguishes him from his peers, underscoring his expertise in the trading domain. The key factors endorsing our recommendation include:

Comprehensive Curriculum: The educational offering at Asia Forex Mentor spans forex, stock, and crypto trading, presenting a curriculum that thoroughly prepares traders for success in these varied markets.

Proven Track Record: Asia Forex Mentor’s legitimacy is bolstered by its history of nurturing traders who achieve profitability in various market environments, validating the impact of their educational and mentorship approaches.

Expert Mentor: Students at Asia Forex Mentor receive instruction from Ezekiel Chew, whose trading acumen spans stocks, cryptocurrencies, and forex. His tailored support empowers students to confidently tackle market challenges.

Supportive Community: Enrollment at Asia Forex Mentor includes entry into a community where traders share goals of market success, promoting an environment of mutual learning and idea exchange.

Emphasis on Discipline and Psychology: The program highlights the importance of mental fortitude and a disciplined strategy in trading, offering psychological tools to enhance decision-making and stress management.

Constant Updates and Resources: Keeping pace with the evolving nature of financial markets, Asia Forex Mentor ensures students have ongoing access to the latest market trends, strategies, and insights.

Success Stories: The numerous testimonials of students achieving financial independence through their education at Asia Forex Mentor speak volumes of the program’s effectiveness in forex, stock, and crypto trading.

For individuals determined to excel in forex, stock, and crypto trading, Asia Forex Mentor stands out as the optimal educational platform. It combines a robust curriculum, mentorship from experienced traders, a practical learning approach, and a community-driven environment to equip traders with the skills needed for professional success in diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Kot4x Review

Concluding our Kot4x review, the team of trading experts at Dumb Little Man has meticulously evaluated the broker’s offerings, weighing both its advantages and drawbacks. Kot4x stands out for its competitive trading conditions, variety of account types, and accessibility to a wide range of financial instruments, including cryptocurrencies, Forex, and CFDs. These features make it an appealing choice for traders looking for flexibility and diversity in their trading strategies.

However, potential users should be mindful of the broker’s limitations, such as the lack of regulatory oversight, absence of negative balance protection, and limited customer support options. These factors could pose concerns for traders prioritizing security and comprehensive support.

>> Also Read: Land-Fx Review 2024 with Rankings By Dumb Little Man

Kot4x Review FAQs

Is Kot4x Regulated?

Kot4x operates without formal regulatory oversight, which may concern traders used to the security provided by licensed brokers. While it offers advanced trading technologies and a range of financial instruments, the lack of regulation means traders should exercise caution and consider the implications on the security of their funds and trading experience.

What Types of Accounts Does Kot4x Offer?

Kot4x caters to a diverse trading community with several account types, including Mini Pairs, Standard Pairs, VAR Pairs, and Professional Accounts. These accounts are designed to suit various trading strategies and levels of experience, with differences in minimum deposits, spreads, and commission structures. This flexibility allows traders to select the account that best matches their trading style and financial goals.

How Can I Withdraw Funds From Kot4x?

Withdrawals at Kot4x can be made through Bitcoin crypto wallets, VISA, MasterCard, Discover Card, and third-party providers, with a minimum withdrawal amount set at $10. The process is commission-free, with withdrawals typically processed within 24 hours. However, traders should note that if their account was funded via a credit or debit card, the withdrawal amount cannot exceed the deposited amount, and profits must be withdrawn through an alternative method.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.