IronFX Review 2024 with Rankings By Dumb Little Man

By John V

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors:

Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved. |

IronFX Review

Since its establishment in January 2010, IronFX has emerged as a prominent player in the global online trading platform industry. Founded by a team of finance and software development experts, IronFX has earned a reputation for its comprehensive range of trading services. In this review, we will explore the key strengths and features that make IronFX a preferred choice for traders worldwide.

IronFX has successfully expanded its services to clients in over 180 countries. The broker’s commitment to serving a global clientele is further exemplified by its compliance with multiple regulatory authorities.

IronFX operates under the supervision of reputable regulatory bodies such as the Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). This regulatory oversight ensures that IronFX adheres to stringent financial and ethical standards, offering clients a secure trading environment.

This IronFX review aims to give an in-depth look at the company as a whole, including all of its pros and cons. Also, you can find out everything else you need to know about this broker, such as account types, withdrawal and deposit procedures, commissions, and more, so you can make an informed choice before investing with this firm. In addition to our experts’ reviews, we’ve also added customer reviews to give you real information about the broker from a trader’s point of view.

Let’s dive in.

What is IronFX?

IronFX is a global online forex and CFD (Contract for Difference) broker that provides trading services to retail and institutional clients. Founded in 2010, IronFX has established itself as a prominent player in the financial industry, offering a wide range of trading instruments across multiple asset classes. The broker operates through various entities globally, serving clients from over 180 countries.

IronFX offers access to a comprehensive selection of financial instruments, including major and minor currency pairs, commodities, indices, stocks, and cryptocurrencies. Clients can trade these instruments through the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, renowned for their advanced charting tools, order execution capabilities, and technical analysis features.

Regulation and security are key priorities for IronFX. The broker operates under the supervision of reputable regulatory bodies, such as the Financial Conduct Authority (FCA) in the United Kingdom, the Australian Securities and Investments Commission (ASIC), and the Cyprus Securities and Exchange Commission (CySEC). Compliance with these regulators ensures that IronFX adheres to strict financial and operational standards, providing clients with a secure trading environment.

In addition to its diverse range of trading services, IronFX offers educational resources and tools to assist traders in enhancing their knowledge and skills. These resources include video tutorials, webinars, e-books, and market analysis reports, designed to empower traders of all experience levels.

IronFX caters to both individual and corporate clients, providing tailored solutions to meet their specific trading needs. The broker aims to deliver cutting-edge technological innovation, responsive customer support, and competitive trading conditions to enhance the trading experience for its clients.

It is important to note that trading Forex and CFDs involves significant risks, and individuals should thoroughly educate themselves and consider their risk tolerance before engaging in such activities.

Safety and Security of IronFX?

IronFX prioritizes the safety and security of its clients’ funds and operates under the supervision of reputable regulatory bodies worldwide. The broker maintains regulatory compliance through its various entities:

Notesco Financial Services Limited: Regulated by the Cyprus Securities and Exchange Commission (CySEC) with license number: 125/10. This regulation ensures that IronFX operates in accordance with strict financial and operational standards set by CySEC.

Notesco (SA) Pty Ltd: Regulated by the Financial Sector Conduct Authority (FSCA) with license number: 45276. This regulatory oversight ensures that IronFX complies with the regulatory framework established by the FSCA, ensuring the protection of client funds and fair trading practices.

Notesco UK Limited: Authorized by the Financial Conduct Authority (FCA) with reference number: 585561. The FCA is one of the most respected regulatory authorities in the financial industry, and IronFX’s authorization by the FCA demonstrates its commitment to transparency and client protection in the United Kingdom.

These regulatory licenses and authorizations highlight IronFX’s adherence to stringent financial and ethical standards. The oversight provided by these regulatory bodies ensures that client funds are held in segregated accounts, separate from the broker’s operational funds, enhancing the safety of client funds.

Furthermore, IronFX employs advanced security measures to protect clients’ personal and financial information. These measures include encryption protocols and secure socket layer (SSL) technology, which helps safeguard sensitive data from unauthorized access.

By maintaining regulatory compliance and employing robust security measures, IronFX demonstrates its commitment to providing a safe and secure trading environment for its clients. Traders can have confidence in the integrity and reliability of IronFX as a trusted broker in the forex and CFD industry.

Sign Up Bonus of IronFX

IronFX provides attractive sign-up and welcome bonus offers to enhance the trading experience for new clients. The broker offers three bonus programs with varying percentages and minimum deposit requirements:

+100% Bonus Program

With a minimum deposit of $100 USD, clients can qualify for a 100% bonus on their initial deposit. This bonus effectively doubles the trading capital, providing traders with increased potential for profits.

+40% Bonus Program

To qualify for the 40% bonus, a minimum deposit of $200 USD is required. This bonus adds an extra 40% to the deposited amount, further boosting the trading account’s buying power.

+20% Bonus Program

The +20% bonus program requires a minimum deposit of $500 USD. Traders who meet this requirement are eligible to receive a 20% bonus, providing additional funds to their trading accounts.

These bonus programs serve as a welcoming gesture from IronFX and can be beneficial in amplifying trading opportunities. However, it is important to note that bonus offers often come with specific terms and conditions that traders must carefully review. These conditions may include trading volume requirements or limitations on bonus withdrawal until certain criteria are met.

Traders should also consider their individual trading strategies and preferences before opting for bonus offers. While bonuses can provide additional trading capital, they may come with certain restrictions that could affect trading flexibility. It is essential to thoroughly understand the terms and conditions associated with bonus offers before making a decision.

Minimum Deposit of IronFX

IronFX offers a minimum deposit requirement of $100 USD for opening a trading account. This minimum deposit allows traders to start their journey with IronFX and gain access to the broker’s trading services and features. With a $100 USD deposit, traders can begin trading a wide range of financial instruments, including currency pairs, commodities, indices, stocks, and cryptocurrencies.

It’s important to note that while the minimum deposit requirement is set at $100 USD, traders have the flexibility to deposit higher amounts if they wish to increase their trading capital or take advantage of specific account types or promotions offered by IronFX.

Additionally, it’s advisable for traders to consider their risk tolerance, trading strategy, and financial circumstances when determining the amount they should deposit. It’s always recommended to start with an amount that you are comfortable with and that aligns with your trading goals and risk management strategies – trading involves risk.

By offering a relatively low minimum deposit requirement, IronFX aims to make Forex and CFD trading accessible to a wider range of traders, including those who may be starting with a smaller capital base.

Account Types

IronFX offers a range of live trading accounts to cater to the diverse needs and preferences of traders. Let’s explore the various account types provided by IronFX:

Standard Account

The Standard Account is designed for traders who prefer a straightforward trading experience. It offers competitive spreads, access to a wide range of trading instruments, and various trading platforms.

Premium Account

The Premium Account is suitable for traders who seek enhanced trading conditions and additional features. With a higher minimum deposit requirement, this account offers lower spreads, dedicated account managers, and access to exclusive research and analysis.

VIP Account

The VIP Account is tailored for high-volume or professional traders. It offers the most favorable trading conditions, including tighter spreads, priority customer support, advanced trading tools, and exclusive VIP events and promotions.

Live Zero Fixed Spread Account

This account type is designed for traders who prefer fixed spreads. It offers zero spreads on major currency pairs and fixed spreads on other instruments, allowing traders to have more predictable trading costs.

No Commission Account

The No Commission Account is specifically suited for traders who prefer not to pay commissions on trades. Instead, this account type incorporates the trading costs within the spreads, providing a commission-free trading experience.

Zero Spread Account

The Zero Spread Account is ideal for traders who prioritize tight spreads. It offers near-zero spreads on major currency pairs, providing traders with competitive pricing and potential cost savings.

Absolute Zero Account

The Absolute Zero Account is a unique offering from IronFX, combining zero spreads with zero commissions. This account type provides traders with the tightest possible spreads and eliminates commissions, aiming to deliver cost-effective trading conditions.

It’s important to note that each account type may have specific requirements, benefits, and trading conditions. Traders can choose the account type that aligns with their trading style, preferences, and objectives.

The minimum deposit required to open an IronFX account is $100 USD, allowing traders to get started with a relatively low initial investment. However, depending on the chosen account type, higher deposits may be required to access certain features and benefits.

It’s advisable to review the details of each account type, including trading conditions, spreads, leverage, and other relevant factors, to determine which account suits your trading needs best.

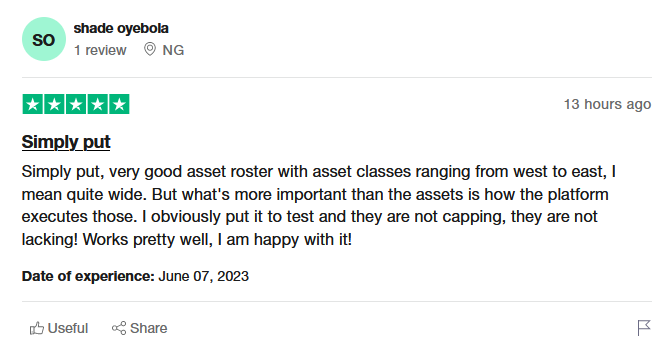

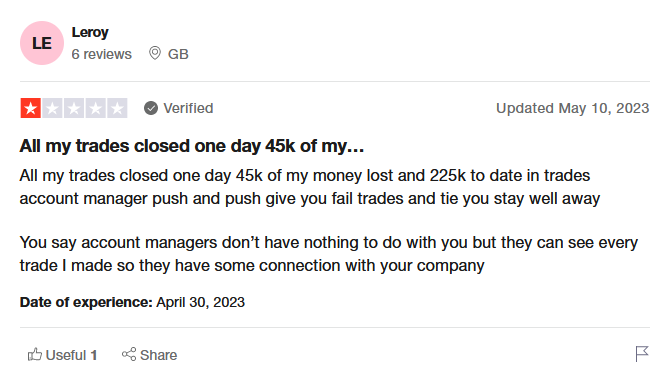

IronFX Customer Reviews

|

|

|

In the end, it’s crucial to remember that everyone’s trading experience is unique, and what works well for one trader may not necessarily work for another. It’s always a good idea to try out a demo account first, if available, to see if the broker’s platform, services, and support meet your individual trading needs.

IronFX Spreads, Fees, and Commissions

When trading with IronFX, traders can expect various fees and trading conditions depending on the selected account type. Here’s an improved version of the section:

IronFX offers competitive fees and trading conditions to cater to different trading preferences. Here are the key details:

Minimum Deposit

To start trading with IronFX, the minimum deposit requirement is $100 USD. This allows traders to open an account with a relatively low initial investment.

Spreads from 1.6 Pips

IronFX provides competitive spreads on various financial instruments. The starting spreads can be as low as 1.6 pips, enabling traders to access cost-effective trading opportunities.

Commission

The commission structure at IronFX is variable, meaning it may vary depending on the specific account type and trading instrument. Some account types offer commission-free trading, while others may have associated commissions. It’s essential to review the account types and trading conditions to understand the applicable commissions.

Leverage

IronFX offers leverage up to 1:1000, allowing traders to amplify their trading positions. However, it’s important to note that higher leverage involves increased risk, and traders should use it judiciously and consider their risk management strategies.

It’s worth noting that trading costs and conditions can vary based on factors such as the trading instrument, account type, and market conditions. Traders are advised to refer to IronFX’s official website or consult with their customer support to get the most up-to-date and accurate information regarding fees, spreads, commissions, and leverage.

Remember, trading in forex and trading CFDs carries risks, and it’s crucial to have a solid understanding of the associated costs, leverage implications, and risk management strategies before engaging in any trading activities.

Deposit and Withdrawal

IronFX offers a range of live trading accounts, ensuring that traders can find an account type that suits their individual needs and preferences. These account types include Standard, Premium, VIP, Live Zero Fixed Spread, No Commission, Zero Spread, and Absolute Zero.

To cater to the diverse needs of its clients, IronFX provides a wide variety of trusted deposit options and withdrawal methods. Traders can choose from multiple payment methods, including Debit/Credit Cards, Neteller, FasaPay, Perfect Money, and more. These options offer convenience and flexibility when it comes to funding their trading accounts.

When it comes to withdrawals from IronFX, it’s important to note that the broker currently supports withdrawals via Bank Wire. This method ensures secure and reliable transfer of funds from the trading account to the trader’s bank account.

It’s worth mentioning that while IronFX offers a range of deposit options, the availability of specific methods may vary based on factors such as the trader’s location and regulatory requirements.

How To Open an IronFX Account?

Opening an IronFX account is a straightforward process. It involves an online registration where you provide personal details, verify your identity, and deposit the minimum required funds. Once these steps are completed, you can start trading.

Step 1: Start the Account Registration

To begin the IronFX account registration, visit the IronFX webpage and click on the green “Register” button located at the top of the page.

Step 2: Complete the Account Registration

To complete the account application, you will need to fill out a simple online registration form. The form will require you to provide essential information such as your name, email address, and contact details. Additionally, you may be asked to provide certain identification documents to comply with regulatory requirements.

Step 3: Account Verification and Account Approval

Once you have submitted the registration form, IronFX will initiate the verification process. This process is essential for account security and regulatory compliance. You may be required to provide additional documents for identity verification. Once your account is approved, you will receive confirmation via email.

Step 4: Fund Your Account

After your account has been approved, you can proceed to fund your IronFX trading account. IronFX offers a variety of secure deposit methods, including Debit/Credit Cards, e-wallets, and bank transfer options. Choose the method that suits you best and follow the instructions provided by IronFX.

Step 5: Start Trading

With your IronFX account funded, you are now ready to start trading. You can access the trading platforms provided by IronFX, such as MetaTrader 4 (MT4) or MetaTrader 5 (MT5), and explore the range of available financial instruments. It’s important to familiarize yourself with the platform’s features and trading tools to make informed trading decisions.

IronFX Affiliate Program

The IronFX Affiliate Program presents a lucrative opportunity for individuals seeking to generate additional income. By referring qualified traders to IronFX, affiliates can earn up to $1,500 CPA per referral, with the added bonus of a $1,000 Cash Bonus for the first 10 qualified accounts. Payments are made on a weekly basis, providing affiliates with regular earnings.

IronFX equips affiliates with a comprehensive set of marketing and trading resources, including high-converting landing pages, professionally designed banners in multiple languages, and a user-friendly affiliates portal for live tracking and reporting. With a 60-day cookie life, affiliates have ample time to convert their referred clicks into qualified traders. Ongoing promotions, such as trading competitions and bonuses, further enhance the program’s appeal and enable affiliates to attract high traffic.

IronFX Customer Support

IronFX is dedicated to providing extensive customer support to both prospective and existing clients. They offer 24/5 support, catering to customers in over 180 countries and supporting 30 different languages. This ensures that clients from diverse backgrounds can communicate effectively with the support team. The availability of email and live chat options allows for convenient and real-time assistance.

During multiple contact attempts, IronFX’s live chat feature was found to be responsive, indicating their commitment to prompt customer service. The company also maintains active Twitter and Meta portals, which can serve as additional channels for communication and updates.

IronFX recognizes the importance of providing comprehensive resources for clients. They have a detailed FAQ section that addresses many common inquiries, helping users find answers without the need for direct assistance. Moreover, tutorials on trading platforms are available to assist clients in navigating the platforms efficiently, reducing the learning curve associated with trading.

Contact information, including email addresses and phone numbers, is provided for satellite offices located in Cyprus, South Africa, and Australia. This enables local contact for clients in these regions. However, it is worth noting that there is no dedicated U.K. or international phone number, which may result in potential charges for clients making calls to Cyprus or other satellite offices.

Advantages and Disadvantages of IronFX Customer Support

| Advantages | Disadvantages |

|---|---|

|

|

IronFX Vs Other Brokers

Therefore, it is important for clients to understand the highlight of each broker and comparisons with other brokers so that the traders are in the position to make an informed decision about which trader would best suit their trading style.

#1. IronFX vs. Avatrade

IronFX is known for its wide range of account types and diverse asset classes, including forex, stocks, commodities, and indices. They provide 24/5 customer support in multiple languages, offer competitive spreads, and have a strong global presence with clients in over 180 countries. IronFX also offers a comprehensive affiliate program for those interested in earning additional income through referrals. However, one potential drawback is the absence of a dedicated U.K. or international phone number, which may result in potential charges for clients needing phone support.

AvaTrade, on the other hand, is recognized for its user-friendly platforms and extensive educational resources. They provide a range of account types, including a demo account for beginners, and offer a wide selection of trading instruments such as forex, cryptocurrencies, stocks, and commodities. AvaTrade is regulated by multiple authorities, providing an added layer of security for traders. Their customer support is available 24/5 and can be contacted through various channels. However, some traders may find the spreads to be relatively higher compared to other brokers.

Verdict: IronFX excels in its diverse account types, asset classes, and global presence, while AvaTrade stands out with its user-friendly platforms and extensive educational resources. Ultimately, the better broker depends on individual trading needs and preferences. Traders who prioritize a wide range of account options and global presence may find IronFX more suitable, while those seeking user-friendly platforms and comprehensive educational resources may lean towards AvaTrade.

#2. IronFX vs. RoboForex

IronFX offers a wide range of trading accounts, including Standard, Premium, VIP, and specialized accounts like Zero Spread and Absolute Zero. They provide access to over 300 trading instruments across various asset classes, and their platforms are known for their cutting-edge technology and innovative tools. IronFX has a global presence, serving clients from over 180 countries, and offers multilingual customer support. However, it’s worth noting that IronFX lacks a dedicated U.K. or international phone number, which may inconvenience some traders.

RoboForex, on the other hand, is known for its diverse account options, including Pro-Standard, Pro-Cent, ECN, and Prime accounts. They offer a wide range of trading instruments, including forex, cryptocurrencies, stocks, and commodities. RoboForex provides access to multiple trading platforms, including the popular MetaTrader 4 and MetaTrader 5. They also offer competitive spreads and leverage options. However, their customer support may not be as extensive as IronFX, and their range of educational resources may be more limited.

Verdict: IronFX stands out with its wide range of account options, innovative trading platforms, and global presence. On the other hand, RoboForex offers diverse account types and a selection of trading instruments, particularly for those interested in cryptocurrencies. Traders who prioritize extensive customer support and a global presence may find IronFX more suitable, while those looking for a variety of account options and trading instruments may lean toward RoboForex.

#3. IronFX vs FXChoice

IronFX is a globally recognized broker with a wide range of account types, including Standard, Premium, VIP, and specialized accounts like Zero Spread and Absolute Zero. They offer access to a diverse range of trading instruments across multiple asset classes. IronFX is known for its innovative trading platforms and cutting-edge technology. They have a strong global presence, serving clients from over 180 countries, and provide multilingual customer support. However, one potential drawback is the absence of a dedicated U.K. or international phone number, which may result in potential charges for clients requiring phone support.

FXChoice, on the other hand, is an ECN/STP broker that focuses on providing competitive pricing and deep liquidity. They offer a selection of trading accounts, including Classic, Pro, and VIP accounts. FXChoice provides access to various trading instruments, including forex, cryptocurrencies, and precious metals. They are known for their reliable execution and transparency. FXChoice also offers the popular MetaTrader platforms, which are highly regarded by many traders. However, their customer support may not be as extensive as IronFX.

Verdict: IronFX appeals to traders who value a wide range of account types, a diverse selection of trading instruments, and a global presence. On the other hand, FXChoice is suitable for traders who prioritize competitive pricing, deep liquidity, and reliable execution.

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: IronFX Review

IronFX is a well-established and reliable broker in the online Forex trading platform industry. With its extensive range of account types, including Standard, Premium, VIP, and specialized accounts, traders have options to suit their individual needs. The broker offers access to a wide variety of trading instruments across different asset classes, providing ample opportunities for diversification.

IronFX is recognized for its cutting-edge technological innovation, offering advanced trading platforms and tools to enhance the trading experience. The availability of multiple languages for customer support team reflects their commitment to serving clients from over 180 countries. Additionally, IronFX provides a comprehensive affiliate program for those interested in earning additional income through referrals.

IronFX Review FAQs

Can I trade cryptocurrencies on IronFX?

Yes, IronFX offers the opportunity to trade cryptocurrencies as part of their diverse range of trading instruments. Traders can access popular cryptocurrencies such as Bitcoin, Ethereum, and Litecoin, allowing them to participate in the growing cryptocurrency market.

Does IronFX charge any fees for deposits and withdrawals?

IronFX does not charge any fees for deposits made into trading accounts. However, it’s important to note that fees may be applicable for certain withdrawal methods. Traders should review the withdrawal options and associated fees outlined on the IronFX website or contact customer support for specific details.

What educational resources does IronFX provide for beginners?

IronFX is committed to supporting traders of all experience levels, including beginners. They offer a variety of educational resources, including tutorials on trading platforms, comprehensive FAQs, and a range of educational articles and videos. These resources aim to help beginners understand the basics of trading, develop trading strategies, and navigate the financial markets effectively.

Dumb Little Man Recommends - Top 3 Best Forex Brokers in 2023 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.