InterTrader Review 2025 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors: Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved. |

InterTrader Review

InterTrader has cemented its place in the trading world as a leading Straight Through Processing (STP) and Electronic Communication Network (ECN) broker since its inception in 2009. Its expansive offerings encompass Forex trading services alongside Contracts for Difference (CFD) instruments. Coming under the large and reputable umbrella of Entain Plc, a formidable name in the sports betting arena with operations spanning across five continents, InterTrader operates with both legitimacy and reliability. Its operations are meticulously monitored by the Gibraltar Financial Services Commission (GFSC) and are registered with the esteemed UK Financial Conduct Authority (FCA).

Leveraging the power of modern technology, InterTrader presents its traders with seamless, direct access to international financial markets. In this comprehensive review, our aim is to present an all-inclusive assessment of InterTrader, underscoring its standout features and potential limitations. Our goal is to offer essential insights about the broker that spans a variety of aspects: account types available, the process of deposits and withdrawals, the structure of commissions, and other pivotal details.

This review offers a balanced viewpoint, consolidating professional analysis and actual trader experiences to provide necessary information aiding your decision-making process when considering InterTrader as your potential brokerage service provider.

What is InterTrader?

InterTrader is an established brokerage service offering clients access to spread betting and Contracts for Difference (CFDs) trading across a broad spectrum of financial instruments. The assortment includes, but is not limited to, shares, stock indices, Forex, commodities, and more. Over the course of its existence since 2009, the company has carved out a significant niche by delivering flexible and transparent trading services.

What sets InterTrader apart is its steadfast commitment to a market-neutral trading model. Essentially, the broker mirrors every position taken by a client in the underlying market, thereby creating a balanced trading environment free from conflicts of interest. This means the broker doesn't stand to gain from client losses or vice versa.

InterTrader's business approach ensures a healthy balance between covering its own risks and offering traders the chance to profit from market fluctuations. By reflecting each client's position in the actual market, it provides a trading environment where potential gains are not constrained by the broker's risk capacity.

>> Also Read: How To Trade Forex For Beginners – An Important Know How For Traders

Safety and Security of InterTrader

InterTrader is a highly regulated broker that is authorized and licensed by the top-tier FCA (UK) enabling low-risk trading. The parent company, InterTrader Limited, is a subsidiary of Entain Plc (formerly GVC Holdings), boasting a staggering capital exceeding £10 billion (as of June 2021), and is a respected name on the London Stock Exchange.

The security of client funds is a top priority for InterTrader. All transactions are handled responsibly and securely. Client funds transferred to InterTrader are held safely in segregated accounts, aligning with the strict rules laid down by the regulator.

InterTrader's retail clients are further protected by the Gibraltar Investor Compensation Scheme (GICS). In the unlikely event that the broker is unable to meet its financial obligations, GICS safeguards each client with a compensation claim of up to €20,000.

>> Also Read: Top Forex Scams: How to Spot and Avoid Them

Sign-Up Bonus of InterTrader

As of the time of our review, InterTrader does not extend any sign-up bonuses to its new clients. It focuses more on providing quality services, cutting-edge technology, and ensuring a safe trading environment.

Minimum Deposit of InterTrader

When opening an account with InterTrader, clients are required to make a minimum initial deposit amounting to 500 units of their chosen base currency. This could be in US dollars, euros, or British pounds. This minimum deposit requirement serves to maintain the quality of the service provided and ensure clients have sufficient funds to engage in meaningful trading activities. It also establishes a baseline for the risk management strategies that the trading platform adopts to protect both itself and its clients.

InterTrader Account Types

InterTrader trading account types put forth a variety of spread betting and CFD accounts for traders, each of which showcases competitive trading conditions paired with comprehensive solutions and services.

Spread Betting Account

The Spread Betting Account offers quick, flexible ingress to global markets. Instead of buying or selling an actual stock or futures contract, traders place bets on price movements. Starting from as low as £1 per point movement, traders can engage with thousands of markets across regions such as the United States, Asia, the United Kingdom, and Europe. This range of markets encompasses commodities, forex, shares, and indices.

CFDs Account

The Contract for Difference (CFD) account allows traders to speculate on price fluctuations in markets without the necessity of physical buying or selling. It empowers traders with the freedom to decide when to close their positions and ascertain their profit or loss. A deposit or a margin is required to open a position, which could potentially enhance the risk return on the invested capital. Intertrader facilitates trading of CFDs starting from 10p per point on indices, or from 0.01 of a lot on forex.

InterTrader Customer Reviews

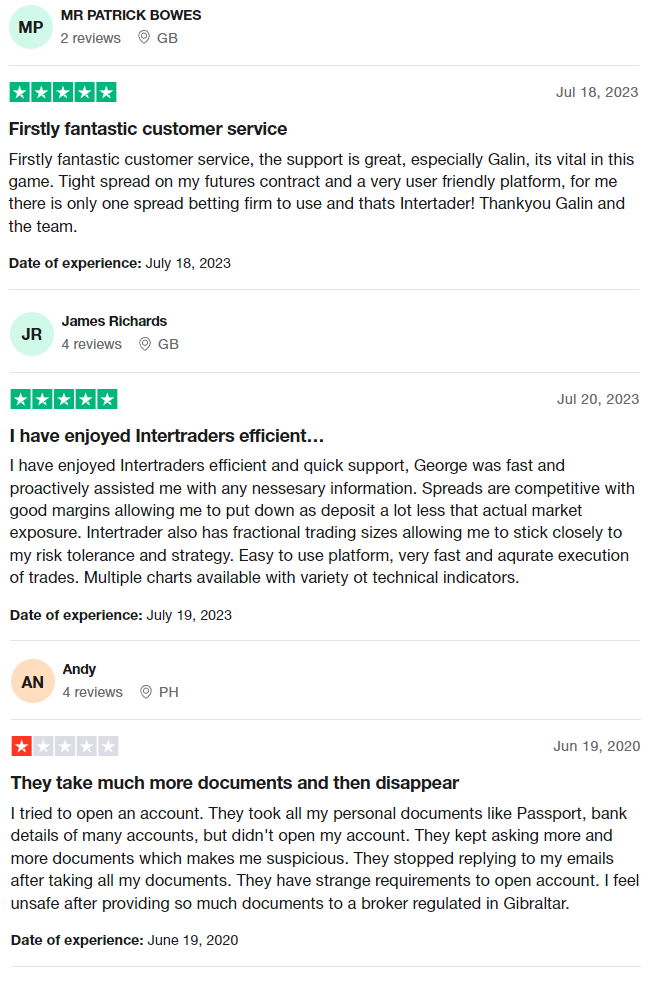

In general, customer reviews about InterTrader indicate largely positive sentiments about the platform. Many users praised the platform for its excellent customer service, particularly highlighting support team members for their exceptional assistance.

The platform's user-friendliness, quick and accurate trade execution, and the availability of multiple charts and technical indicators were lauded by users. They also appreciated the competitive spreads, good margins, and the option of fractional trading sizes, allowing for better adherence to individual risk tolerance and strategy.

However, a contrasting view was expressed by a customer who encountered issues with account opening. This individual found the process cumbersome, requiring numerous personal documents, and was left feeling uneasy about their information security after the support team stopped responding to their emails.

It is important to note that these reviews reflect varied user experiences and InterTrader, as a Gibraltar-regulated broker, may have specific account opening requirements to comply with regulatory standards.

InterTrader Fees, Spreads, and Commissions

InterTrader‘s mission is to offer a clear, competitive pricing structure for its client base. The costs associated with trading and spreads fluctuate depending on the specific instrument being traded. For instance, the spread for the frequently traded EUR/USD forex pair is typically around 0.6 pips, presenting an appealing proposition in the forex market. In the case of UK 100 shares, the commission stands at 0.1% per side.

InterTrader presents a unique loyalty rebate initiative, dubbed as TradeBack. Traders who have incurred a combined spread cost exceeding £500 within a month are entitled to an automatic rebate, irrespective of the outcomes of their trades. This feature can effectively reduce overall trading costs for active InterTrader traders.

The trading cost with InterTrader is primarily incorporated in the spread, the gap between the buying and selling price of an instrument. For spread betting and non-Forex CFDs, the dealing charge is included in the spread that is wrapped around the base market price.

For Forex CFDs, traders engage at the base market price, and a commission is levied. The commission amounts to 3 units of the quoted currency per standard lot, per side. For instance, for a USD/EUR trade, a commission of $6 would be levied per $200,000 lot upon opening and another $6 upon closing.

Deposit and Withdrawal

InterTrader offers a streamlined process for depositing and withdrawing funds. Clients can transact using Bank transfers and Credit/Debit cards. Beyond this, clients can request withdrawals via the web platform and gain access to their full trade and transaction histories.

When it comes to funding methods, InterTrader provides a variety of options for the convenience of its clients. These include credit/debit cards, bank wire transfers, and Skrill.

InterTrader ensures prompt processing of withdrawal requests, typically within 24 hours of receipt. Clients can withdraw their funds via bank transfer, debit and credit cards, or Skrill. However, the withdrawal must be made to the same account used for depositing funds.

Once the withdrawal application is approved, the funds are credited to the receiving account within 3-5 days. The minimum withdrawal limit is set at 100 USD/€/£, and there is no limit on the number of withdrawals that can be made.

InterTrader provides the first withdrawal within 24 hours (from 12:00 of the current day to 12:00 of the next day, UK time) free of charge. Each subsequent withdrawal of less than 1,000 USD/€/£ will incur a fee of 5 USD/€/£. Any subsequent withdrawals of an amount exceeding 1,000 USD/€/£ will not attract any commission.

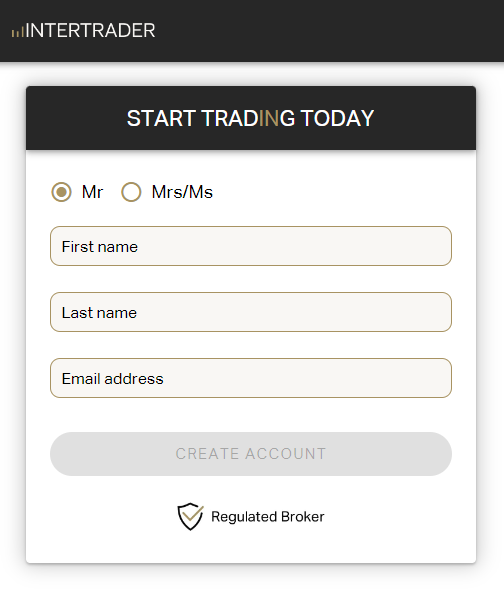

How to Open an InterTrader Account

Setting up a trading account with InterTrader is a straightforward procedure.

- Navigate to the InterTrader website and locate the prominent “Create Account” button adjacent to the “Log In” button on the homepage. Click on it to start the account setup process.

- You will be asked to complete a form with your personal details. Make sure to provide accurate information as this will be crucial for the later stages of account verification.

- After submitting the form, an account verification email will be dispatched to your registered email address. This email will contain detailed instructions on how to verify your account.

- As part of the verification process, you may be asked to provide additional documents like a valid ID and proof of address. This is a standard process to comply with anti-money laundering regulations and ensure the security of your account.

Once all these steps are completed and your account is verified, you can start trading with InterTrader.

InterTrader Affiliate Program

InterTrader extends the opportunity to individuals and businesses to participate in their robust affiliate program. If you have an online presence or audience, you can capitalize on this by redirecting traffic to the InterTrader platform, creating a continuous revenue stream. InterTrader offers bountiful rebates for their affiliates, all the while providing support through their dedicated Partner Portal.

Introducing Broker

For Introducing Brokers, InterTrader's program provides the opportunity to introduce clients directly to their platform, securing ongoing revenue from their trading activity. The broker ensures real-time rebates and offers a variety of deal structures including Cost Per Acquisition (CPA), revenue share, mark-up, or hybrid deals. Moreover, they extend marketing support and take care of back-office functions, facilitating a seamless business relationship.

Asset Managers, Professional Traders, and Money Managers

For Asset Managers, Professional Traders, and Money Managers, InterTrader provides a high-speed trading environment with multiple execution venues and the convenience of Multiple Account Management (MAM) software.

Single Flow API

For those with custom trading platforms, InterTrader allows direct connection to their server via a Single Flow API. This allows affiliates to merge InterTrader's liquidity and execution facilities with their own back-office operations, Customer Relationship Management (CRM), and compliance functions. This flexibility is a testament to InterTrader's commitment to offering diverse partnership opportunities.

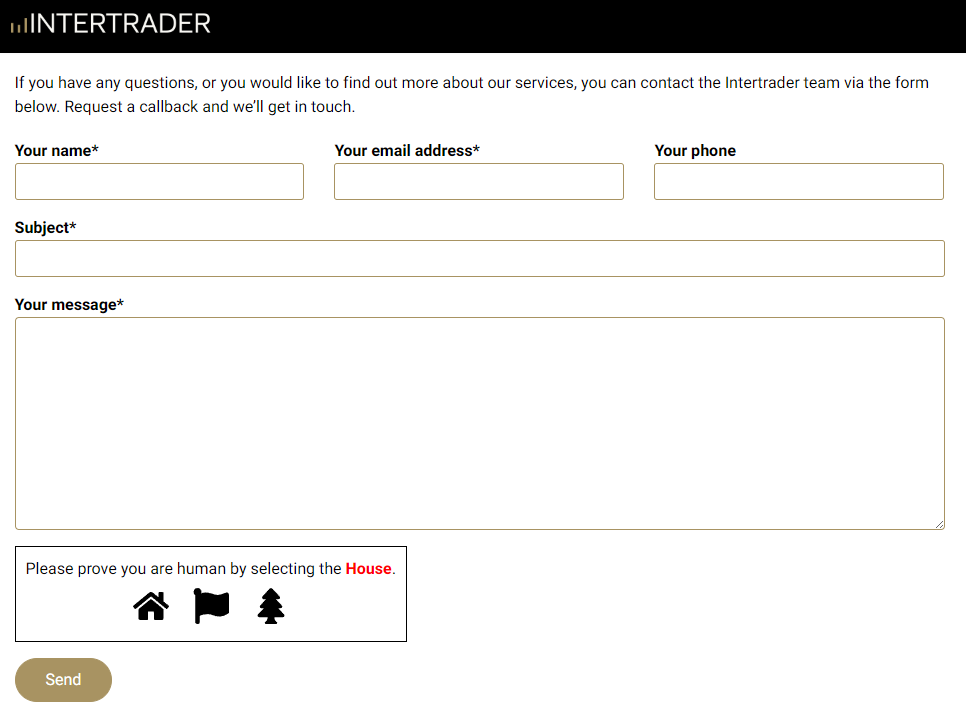

InterTrader Customer Support

InterTrader prioritizes delivering exceptional customer support, aiming to ensure a seamless trading experience for all its clients. They offer support five days a week (24/5), corresponding to standard trading hours.

Clients can reach out to InterTrader's customer support team through multiple communication channels. Direct phone lines and email support are available for comprehensive inquiries or concerns requiring extensive assistance. Noteworthy is InterTrader's prompt response time coupled with their customer service representatives' professionalism and knowledgeable assistance.

In addition to these traditional channels, InterTrader is abreast of modern trends by offering support through various social media platforms. Clients can send their queries via Facebook, Twitter, or LinkedIn messenger services. This added layer of convenience is particularly beneficial for tech-savvy traders who prefer these platforms for communication, demonstrating InterTrader's commitment to adapting to their client's evolving needs.

Advantages and Disadvantages of InterTrader Customer Support

| Advantages | Disadvantages |

|---|---|

InterTrader vs Other Brokers

#1. InterTrader vs AvaTrade

InterTrader offers spread betting, a type of trading not available with AvaTrade. This can be a key consideration for traders based in the UK or Ireland, where spread betting profits are tax-free. InterTrader also has a unique TradeBack loyalty program that rewards active traders with rebates on their spread costs, which can be advantageous for high-volume traders.

On the other hand, AvaTrade has a broader global reach with offices in several countries and a client base spread across 150 countries. They also offer a wider range of financial instruments to trade than InterTrader, boasting over 1250 assets.

Verdict: While both brokers have their strengths, AvaTrade seems to offer a slightly more comprehensive trading experience due to its larger range of financial instruments and wider global reach.

#2. InterTrader vs RoboForex

RoboForex stands out for its range of trading platforms and a massive selection of over 12,000 trading options, far surpassing InterTrader's offering. RoboForex also conducts regular trading contests, offering an avenue for traders to potentially augment their trading capital.

However, InterTrader excels with its TradeBack loyalty program and spread betting offering, neither of which RoboForex provides. InterTrader's transparent pricing structure, with costs primarily built into the spread, can also make it a more attractive choice for traders who prefer clarity in their trading costs.

Verdict: If you value a wide range of trading options and platform diversity, RoboForex could be the better option. However, if you prefer a transparent pricing structure and a rewarding loyalty program, InterTrader comes out on top.

#3. InterTrader vs FXChoice

FXChoice offers services for both active and passive trading, and they place a strong emphasis on expanding their trading instruments and services for automated trading. FXChoice's ECN accounts with tight market spreads can be attractive for experienced traders. Their commitment to customer service and strict regulatory oversight are also strong points.

However, FXChoice does not offer spread betting, which InterTrader does. InterTrader also stands out with its TradeBack loyalty program, which rewards active traders with rebates, something not offered by FXChoice. The wide variety of CFDs and spread betting options offered by InterTrader provides flexibility for both new and seasoned traders.

Verdict: While FXChoice offers a commendable service with tight spreads and a commitment to customer service, the unique offerings from InterTrader, such as the TradeBack program and spread betting, make it a better choice for a wider range of traders.

Conclusion: InterTrader Review

InterTrader proves to be a robust and reliable platform for both spread betting and CFD trading. Catering to a diverse array of traders, it distinguishes itself with its transparent pricing structure and the unique TradeBack loyalty program. Its commitment to competitive spreads and low costs makes it an attractive choice for cost-conscious traders.

While it may not offer the vast number of trading options some of its competitors do, its service is comprehensive and of high quality, focusing on providing a wide range of major, minor, and exotic pairs, as well as commodities, indices, and shares.

InterTrader excels in its customer service, offering support through multiple channels five days a week. The ease of use, straightforward account setup, and range of payment options further enhance its appeal to traders of all experience levels.

In conclusion, while there is always room for improvement, InterTrader, with its unique offerings and client-centered approach, provides a well-rounded trading environment that many traders will find beneficial and rewarding.

> Also Read: 9 BEST Forex Brokers For 2025: Reviewed By Dumb Little Man

InterTrader Review FAQs

What types of trading does InterTrader offer?

InterTrader offers spread betting and Contract for Difference (CFD) trading. These allow you to speculate on the price movement of a range of financial instruments including forex, indices, commodities, and shares.

How competitive are InterTrader's fees and costs?

InterTrader aims to provide a transparent and competitive pricing structure. The main trading cost is built into the spread, which is the difference between the buying and selling price of an instrument. They also offer a unique TradeBack loyalty program which rewards active traders with rebates, helping to lower overall trading costs.

How can I deposit or withdraw funds from my InterTrader account?

You can deposit or withdraw funds from your InterTrader account through several methods including bank transfer, credit/debit card, and Skrill. Withdrawal requests are typically processed within 24 hours and funds are credited to your account within 3-5 days following approval.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.