3 Ways to Reduce Customer Acquisition Costs

By Tess Bemporat Paiewonsky

November 14, 2019 • Fact checked by Dumb Little Man

Have you ever stopped to think how much it costs to get a person to buy one of your products?

Then you’re in the right place.

Customers come with a price tag called customer acquisition cost (CAC), and it’s one of the most important pieces of information for business owners who want to get more customers without breaking their marketing budget.

So, how do you get more customers without breaking the bank? We’ve broken things down into three categories:

- Streamline your customer’s shopping process

- Optimize your marketing tactics

- Embrace customer relationship management

Let’s dive right in!

What is customer acquisition cost?

Your customer acquisition cost is defined as how much it costs your business to attract a new customer.

How to calculate customer acquisition cost

CAC is calculated by adding up all your marketing and sales costs and dividing them by the number of new customers acquired for a certain period of time. Here’s the formula:

For example:

Let’s say you spent $5,000 on marketing and sales expenses this October. That same month, you got 1,000 new customers (meaning only customers that have never previously visited or made a transaction at your store).

Sum of all marketing and sales expenses = $5,000.00

Total newly acquired customers = 1,000

CAC = $5

In this example, it costs you $5 to acquire a new customer.

The next question you should ask is “what is my average transaction value?” If your point of sale system’s sales reports tell you that your average transaction value (ATV) for October is under $5, that means you’re effectively spending more than you’re making per sale. Not good. Your ATV should ideally be higher than your CAC.

How to reduce customer acquisition cost

Let’s say you fall into the above category: Your CAC is higher than your ATV. How do you lower your CAC?

Streamline your customer’s shopping experience

A great way to lower your acquisition cost? Remove as many barriers to purchase as possible.

Make it easy for customers to find and buy what they’re looking for either in your store or on your website. The easier it is for them to find and complete a purchase, the more transactions your store stands to make (that’s why online vendors are developing one-click to purchase technology).

The same can be said for brick-and-mortar transactions: Every retailer’s goal should be to remove as many friction points from their purchasing process as possible.

Imagine being a customer ready to buy something, only to find yourself in a lengthy lineup to pay. Most customers will abandon their purchase entirely if the wait time is too long. Research from Irisys found that Americans will leave a checkout line after waiting just six minutes.

The best way to stop losing sales from long checkout lineups? Eliminate them altogether.

Barbara Thau, a contributing writer for Forbes, suggests that brick-and-mortar retailers “banish the wait in line, once and for all” to avoid losing sales.

A cloud-based point of sale effectively removes the need for lineups and traditional cash registers. Sales associates can ring up sales from anywhere in the store and accept any type of payment. Only If the transaction is in cash do you need to move the transaction to your cash register, but consumers are using cash less and less these days.

If you want to increase your average transaction value, we suggest refreshing your store merchandising and point of purchase displays to cross-sell more items. For a deeper look into how you can increase in-store sales, check out a list that Lightspeed curated with other retail experts, How to Increase Retail Sales – 11 Tips.

Make your business easy to find online by local customers

The next step is to get more customers to find your store or website for free. To do this, we suggest doing the following:

- Create a Google My Business (GMB) profile

- Include your store’s contact information on its Facebook and Instagram Business Profile

- Use the right keywords to describe your business on your Facebook and Instagram Business Profile

The concept here is simple: focus your marketing on people that live close to your business. If they can find you online, see your inventory and get directions fast, the likelihood of them paying you a visit increases substantially.

That’s why we created a step-by-step guide to creating a GMB profile and optimizing your business’s Facebook and Instagram profiles so that you get found online by more local customers entirely for free. With a little work, you can attract customers for $0.

Embrace customer relationship management

If you consistently have what customers are looking for in stock and your customer service is personalized, friendly and helpful, customers are likely to come back to your store again and again.

The more they come, the more they buy. Commonly known as customer lifetime value (CLV), the metric looks at the estimated revenue you make from a customer over the duration of their relationship with the company.

We mentioned ATV earlier, you can think of this as a micro view of your sales. CLV, on the other hand, is the macro view—the big picture.

In an ideal world, you want a 3:1 CLV to CAC ratio. In a nutshell, this means that you generate three times more revenue from a customer than what it cost you to acquire them.

But how do you achieve that ratio? In part, by leveraging loyalty programs, referral programs and customer retention.

Loyalty programs

A loyalty rewards program incentivizes members to make more purchases, eventually getting points they can exchange for exclusive rewards. In a nutshell, it motivates repeat visits and purchases. The more purchases they make, the more points they get to exchange for exclusive offers, promotions and gifts.

For the retailer, the loyalty program helps grow their CLV. It’s a win-win scenario.

See Also: Will Your Customers Buy From You Tomorrow?

Referral Programs

Your existing customers are your store’s biggest brand ambassadors. If they’re happy, they’re more likely to recommend your store to friends.

Believe it or not, brand ambassadors and referrals are one of the most effective ways to bring in new customers. 77% of customers are likely to buy from a business that they’re introduced to by friends.

Rather than sinking tons of cash into marketing to acquire customers, the most cost-effective (and financially sustainable) way to acquire new customers is for your happy customers to spread the word and recommend your business for you.

It’s an authentic trust signal that marketing alone simply can’t replicate.

Consider incentivizing your customers to refer your business to friends and family. For every customer they refer, they get more points they can use as part of your rewards program.

Customer retention

Did you know that it’s up to 25 times more expensive to acquire a new customer than to retain an existing one?

This means one thing: If you focus on keeping your existing customers happy (happy enough to recommend your store to friends), you can get them to find new customers for you. It’s cheaper and more effective.

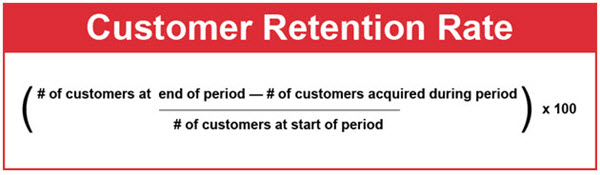

Want to know what your business’s current customer retention rate is? Just use this formula:

Retaining customers brings in a ton of ROI:

- Affordable: It’s five to 25 times more expensive to acquire a new customer than it is to retain an existing customer. (HBR)

- ROI: Just a 5% increase in customer retention can increase a company’s revenue by 25-95%. (HBR)

- Loyalty: Retained customers buy more often and spend more than newer customers (maybe in part to the loyalty and rewards programs they offer). (American Express)

- Referrals: Satisfied, loyal customers are more likely to refer their friends and family—bringing in new customers, without having to spend anything on marketing. (American Express)

See Also: 12 Tips That Build Customer Loyalty And Boost Sales

Improve your customer acquisition cost

Improving your customer acquisition cost is a process that should start from the inside out.

Before you focus on finding new customers and launching fancy marketing campaigns, you need to make your existing customers happy. When your customers are happy, they’ll voluntarily recommend your business to friends and family. Your customers turn into brand evangelists; walking trust signals that find new customers for you, free of charge.

The next step is increasing your customer’s lifetime value. With Loyalty and referral programs, you can increase how much your customers spend in store and achieve that coveted 3:1 CLV to CAC ratio we mentioned earlier in the post.

But it all starts with customer happiness. When customers are happy, businesses don’t need to spend as much on marketing to convince people that their shop is worth going to and spending their hard earned money.

Tess Bemporat Paiewonsky

Tess is a Content Marketing Specialist at Lightspeed, a leading POS for retailers, restaurateurs and eCommerce merchants. With 5 years of combined experience in international relations, marketing & technology, Tess enjoys writing content that’s both entertaining and educational. Find her on LinkedIn.