Hantec Markets Review 2025 with Rankings by Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.3 1.5/5 | 146th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Hantec Markets as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Hantec Markets Review

Forex brokers play an important role in the financial markets by facilitating access to currency trading. Hantec Markets, part of the Hantec Group, stands out as a seasoned broker, having been established in 1990. It aims to guide clients through their trading journey with advanced trading platforms, educational resources, and dedicated support.

Founded in Hong Kong, Hantec Markets has expanded its influence as a multinational financial broker over three decades. With a footprint in twelve countries, Hantec has garnered numerous awards, highlighting its commitment to excellence and a broad service spectrum, embodying the visionary goals of its founders.

What is Hantec Markets?

Hantec Markets, established as part of the Hantec Group in 1990, is renowned for providing comprehensive trading platforms and resources. This firm supports traders with a broad array of asset classes including forex, CFDs, commodities, and indices. Over the years, Hantec has evolved beyond its initial focus, expanding into various sectors such as real estate and cultural innovation.

In 2008, the brand ‘Hantec Markets’ was officially launched in Sydney, Australia, followed by the opening of its flagship office in London in 2010. This expansion marked the beginning of significant growth, spreading across seven regulated entities and eighteen offices worldwide.

By 2020, Hantec Markets had strategically divided into Eastern and Western divisions, with headquarters in Hong Kong and London, respectively. This structure allows the firm to focus on local expertise and regulatory frameworks to ensure security, confidence, and competitive offerings for its global clientele.

Hantec Markets is dedicated to delivering transparent and fair trading conditions and fostering a secure and stable environment for clients. The focus remains on providing fast execution and tailored services in currency, commodity, and indices trading like market analysis.

Safety and Security of Hantec Markets

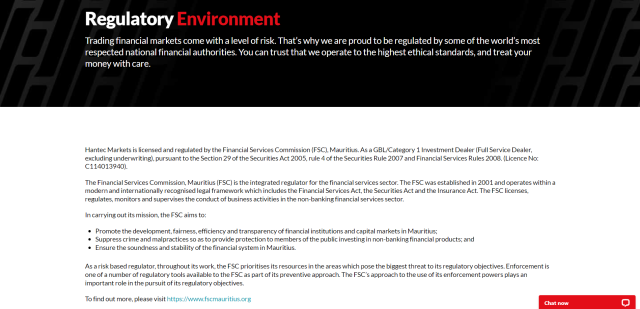

Hantec Markets underscores its commitment to safety and security by maintaining a strong regulatory framework. Licensed and regulated by the Financial Services Commission (FSC) of Mauritius, Hantec Markets operates as a GBL/Category 1 Investment Dealer.

This classification ensures compliance with multiple regulatory standards including the Securities Act 2005 and Financial Services Rules 2008, signaling a high level of operational integrity. The FSC of Mauritius, established in 2001, acts as an integrated regulator for the island’s financial services sector outside of banking.

It is recognized for promoting the development, fairness, efficiency, and transparency of financial institutions. By focusing on preventing crime and malpractice, the FSC provides substantial protection to investors in non-banking financial products. Through a risk-based approach, the FSC prioritizes its resources effectively to maintain the soundness and stability of Mauritius's financial system.

This information was thoroughly researched and gathered from Dumb Little Man, confirming the rigorous standards Hantec Markets adheres to, ensuring they operate within a secure and reliable trading environment.

Pros and Cons of Hantec Markets

Pros

- Low spreads

- Cent account suitable for beginners

- Demo account available

- Regulated by top-tier authorities (FCA, ASIC, FSA)

- Copy trading feature

- Traders' deposits insured up to £85,000

- Entry threshold for trading as low as $0

- Floating spread starting at 0.2 pips

- Competitive trading conditions

Cons

- Inactivity fee of $5 per month after six months inactive

- Withdrawal commission varies with the activity

- No CFDs on cryptocurrencies or ETFs

- No option for bank wire transfer deposits

- A high minimum deposit of $1,000 for currency trading

- No proprietary technologies or passive investment services

- Insufficient details on trading terms

- No trading bonuses for loyal customers

Sign-Up Bonus of Hantec Markets

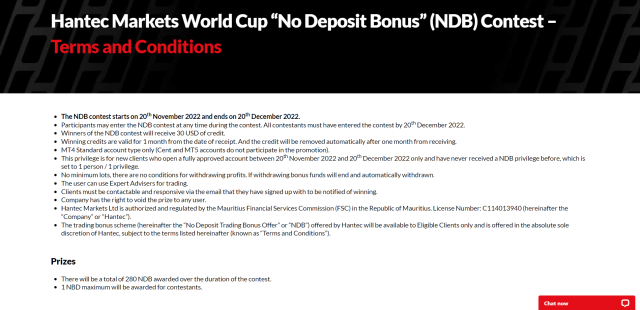

Signing up with Hantec Markets is straightforward and offers a beneficial start with their “No Deposit Bonus” (NDB) promotion. New clients can easily register a trading profile during the promotion period to qualify for this offer. Once the registration and bonus criteria are met, a 50 USD bonus is automatically credited to the client's account.

This initial bonus allows traders to commence financial trading and potentially grow their profits. To apply for the bonus, new clients must first complete the registration process by setting up an account. This involves verifying their identity and address, ensuring compliance with regulatory requirements.

Once verified, the bonus is issued and can be used for trading with a maximum leverage of 1:500. While profits can be withdrawn without restrictions, it’s important to note that the bonus itself will be voided upon any withdrawal request. The bonus remains active for 30 days, providing a substantial period to use the trading benefits.

Minimum Deposit of Hantec Markets

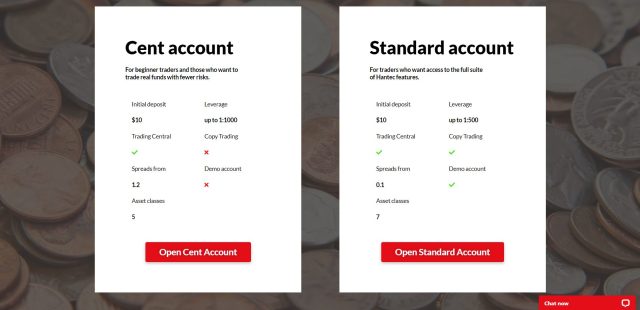

Hantec Markets offers flexible options for traders through its No Deposit Bonus, effectively setting the minimum deposit requirement to $0 for initial account activation. However, for those looking to establish a more traditional trading setup, Hantec Markets provides two account types, each tailored to different trader needs and experience levels.

For novice traders and those looking to reduce risk when using real money to trade, the Cent account is specially made for them. This account has a $10 minimum deposit and up to 1:1000 leverage, but it doesn't allow copy trading or offer a demo account.

Conversely, the Standard account caters to more experienced traders who require access to Hantec Markets’ full suite of features. This account also has a low barrier to entry with a $10 minimum deposit and provides enhanced trading conditions, including leverage up to 1:500, access to Trading Central, and the option for copy trading.

Hantec Markets Account Types

We've gathered comprehensive insights into the account types that Hantec Markets offers following extensive testing and investigation by our team of experts at Dumb Little Man. With a $10 initial investment, both of these trading accounts, aside from Hantec Markets demo account and live account, accommodate varying degrees of trading experience and offer a range of trading conditions.

Here’s a streamlined breakdown of the account types available:

Cent Account

- Target Audience: Beginner traders and those looking to trade with lower risk

- Leverage: Up to 1:1000

- Trading Central: Available

- Copy Trading: Not available

- Demo Account: Not available

- Spreads From: 1.2

- Asset Classes Available: 5

Standard Account

- Target Audience: Traders seeking full access to Hantec's features

- Leverage: Up to 1:500

- Trading Central: Available

- Copy Trading: Available

- Demo Account: Available

- Spreads From: 0.1

- Asset Classes Available: 7

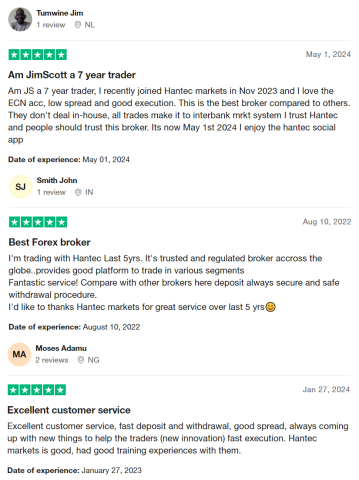

Hantec Markets Customer Reviews

Hantec Markets has high broker ratings, owing to the broker's reliable ECN accounts, low spreads, and efficient execution. They value direct access to the interbank market system, enhancing trust. The secure and straightforward funding processes, strong global regulation, innovative tools, and excellent customer service, including effective training programs, contribute significantly to a positive trading experience.

Hantec Markets Fees, Spreads, and Commissions

Hantec Markets structures its fees, spreads, and commissions to be straightforward and transparent, allowing traders to manage their costs effectively. Opening an account with Hantec Markets is free, and there are no fees for holding money in an account. The primary costs for traders come from spreads and, in some cases, commissions, particularly when trading CFDs.

The spread—the difference between the bid and ask price—varies depending on market conditions and is how Hantec Markets primarily earns from trades. For CFD trading, costs may involve a combination of spreads and commissions, which vary by the specific CFD.

Additionally, Swap rates, or overnight funding costs, are charged when positions are held overnight, influenced by the interest rates of the traded products or currency pairs.

Currency conversion fees also apply when a trade involves multiple currencies. This fee is calculated at 0.6% of the trade value and is added to the settlement exchange rate. For instance, if converting from GBP to USD, the rate is adjusted by multiplying the market exchange rate by 1.006 to include the conversion fee. This fee is automatically included in any profit or loss realized from currency differences.

Hantec Markets provides an annual ‘costs and charges' statement to clients, detailing all currency conversion fees paid over the fiscal year from July 1st to June 30th. These statements are accessible via email and the Hantec Markets Client Portal. To estimate the currency conversion fee for any given transaction, clients can multiply the amount converted by 0.6%.

Deposit and Withdrawal

Hantec Markets offers a streamlined and secure deposit and withdrawal process, as tested by a professional at Dumb Little Man. Deposits can be made using credit/debit cards like Visa, Maestro, and UK Debit Cards, starting at a minimum of $25, with immediate fund transfers to the trading account.

Additional deposit options include Skrill and NETELLER, both set at a minimum of $100 with no deposit fees, as well as China UnionPay, which supports fee-free deposits from cards issued in Mainland China.

Withdrawals are facilitated through the Client Portal and must be executed using the same payment method as the deposit to comply with anti-fraud regulations. Withdrawal requests are processed on the same day if submitted before 15:00 GMT, but funds may take 2 to 5 business days to reflect in the account.

How to Open a Hantec Markets Account

Opening an account with Hantec Markets is straightforward. Here are the essential steps to get you started, whether you choose a demo or a real account:

- Navigate to the Hantec Markets website where you can start the process to open either a demo or a real account directly from any page.

- Upon creating a demo account, you gain entry to the MT4 trading platform and a connection to the broker’s server. This setup allows you to explore the platform’s features; however, a real account is necessary for full personal account access.

- A real account requires you to submit accurate information during registration to ensure a smooth verification process later on.

- Complete the application in five steps, which include uploading the necessary verification documents. This part can be postponed if needed.

- Your personal account features a management and trading panel that simplifies trading operations.

- The account provides answers to basic questions, helping you navigate through common concerns.

- After your account is verified, features for depositing and withdrawing funds will be activated.

- You can apply for professional client status which offers additional trading benefits.

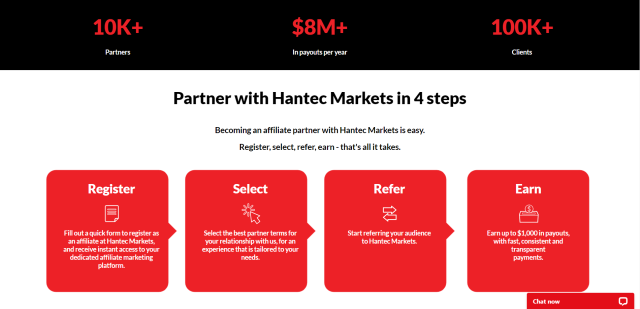

Hantec Markets Affiliate Program

The Hantec Markets affiliate program offers a lucrative opportunity to earn up to $1,000 per referral by partnering with a globally regulated, award-winning broker. The sign-up process is straightforward: affiliates register online to access a dedicated marketing platform, select personalized partnership terms, refer their audience, and earn competitive payouts promptly.

The program benefits include a partner portal for tracking success, flexible terms to suit various needs, access to global markets, and dedicated multi-lingual support. With over 10,000 partners and more than $8 million in annual payouts, the Hantec Markets affiliate program is an attractive option for those looking to enhance their earning potential in the financial markets.

Hantec Markets Customer Support

According to Dumb Little Man's experience and reporting, Hantec Markets provides extensive customer service that is customized to match the needs of its international clients. Every local office throughout the world—from London to Santiago, Lagos to Dubai—offers clients easy access to their closest support team by providing direct contact information, including phone numbers and email addresses.

During market hours, which are open twenty-four hours a day, five days a week, clients can get in touch with Hantec Markets' support services at any time. The support staff can be reached via phone, email, or live chat, and they can assist with a variety of questions, including those about accounts and technical assistance.

Hantec Markets also provides a detailed contact form on their website for anybody who would like to get in touch. In order to guarantee that the support they receive is as beneficial and complete as possible, clients can indicate their chosen language, contact day and time, and the nature of their request.

Advantages and Disadvantages of Hantec Markets Customer Support

| Advantages | Disadvantages |

|---|---|

Hantec Markets vs Other Brokers

#1 Hantec Markets vs AvaTrade

Hantec Markets is known for its solid regulatory framework and local office presence in numerous countries, which provide specialist support and direct communication. Its primary concentration is on forex and CFD trading, with a heavy emphasis on client assistance and service customization. AvaTrade, on the other hand, was founded as AvaFX and has significantly expanded its offerings to cover equities, commodities, cryptocurrencies, and indices, with a lower entrance threshold for novice traders. AvaTrade's competitive advantage stems from its numerous trading platforms and the extra feature of AvaProtect, which provides trade insurance.

Verdict: AvaTrade may be better for traders looking for a wider range of trading instruments and platforms, as well as those interested in trade protection features. Hantec Markets could be more suited for those who value localized support and a secure regulatory environment.

#2 Hantec Markets vs RoboForex

With an emphasis on FX and CFDs, Hantec Markets provides a simple trading environment backed by dependable client support. Since its founding in 2009, RoboForex has specialized in providing customized trading circumstances and software choices. It serves a wide range of customers with platforms like MT5, MT4, cTrader, and R Stock Trader, which are suitable for novice and expert traders alike. RoboForex's versatility is reflected in the customization and large selection of trading platforms.

Verdict: RoboForex might be preferable for traders seeking a variety of trading platforms and tailored trading conditions. For traders who prioritize strong regulatory oversight and customer support, Hantec Markets could be the better option.

#3 Hantec Markets vs FXChoice

Hantec Markets and FXChoice both offer forex and CFD trading, but they cater to different segments of the market. FXChoice stands out with its offering of exotic forex pairs and commodity CFDs, like crude oil and precious metals, providing traders with opportunities in emerging markets and large energy sectors. This could be appealing for those looking to diversify into less traditional currencies and commodities. Hantec Markets, with its strong regulatory structure and localized customer service, emphasizes a secure and supported trading environment.

Verdict: FXChoice is potentially more attractive for traders interested in a broader range of forex pairs and commodities. Hantec Markets is likely to appeal more to those who value regulatory security and localized support services.

Choose Asia Forex Mentor for Your Forex Trading Success

Asia Forex Mentor is highly recommended by trading experts at Dumb Little Man for anyone looking to succeed in forex, stock, and crypto trading. Led by Ezekiel Chew, a trader known for his consistent seven-figure trades, Asia Forex Mentor offers an exceptional educational platform

- Comprehensive Curriculum: The program provides an extensive range of topics covering forex, stock, and crypto trading, equipping traders with the necessary skills and knowledge to excel in these markets.

- Proven Track Record: Asia Forex Mentor has a solid history of nurturing traders who consistently achieve profitability, showcasing the effectiveness of their teaching methods and mentorship.

- Expert Mentor: Ezekiel Chew himself offers personalized guidance, sharing his deep understanding and successful trading strategies, which significantly benefits the students.

- Supportive Community: The platform includes access to a community of traders who support each other through idea-sharing and collaboration, which is vital for learning and growth.

- Emphasis on Discipline and Psychology: Understanding the psychological aspects of trading and maintaining discipline are key focuses of the course, helping traders manage stress and make informed decisions.

- Constant Updates and Resources: The dynamic nature of financial markets is addressed with ongoing updates and resources that keep traders informed about the latest trends and strategies.

- Success Stories: The numerous success stories of students who have achieved financial independence through the course stand as a testament to its impact and effectiveness.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: SuperForex Review 2024 with Rankings By Dumb Little Man

Conclusion: Hantec Markets Review

Based on insights from Dumb Little Man, Hantec Markets is recognized for its competitive trading conditions and low spreads, with a starting point of just 0.2 pips. It appeals to a broad audience by offering features like copy trading and a cent account, ideal for beginners. The brokerage upholds a high standard of security and trust, regulated by top-tier authorities such as the FCA, ASIC, and FSA.

However, prospective clients should consider some drawbacks, such as an inactivity fee of $5 per month after six months and a lack of CFDs on cryptocurrencies or ETFs. Despite these limitations, Hantec Markets remains a solid choice for those not requiring extensive educational resources or trading in cryptocurrencies and ETFs, offering a secure and well-regulated trading environment.

>> Also Read: 8 BEST Forex Trading Courses in 2024 – Reviewed By Dumb Little Man

Hantec Markets Review FAQs

Is Hantec Markets legit?

Hantec Markets is generally considered a good broker, especially for traders looking for a reliable and regulated environment and tradable assets. It offers access to forex and CFD trading with a focus on providing active customer support and a secure trading platform.

Is Hantec Markets regulated?

Yes, Hantec Markets Limited Jordan is a regulated broker. It operates under the oversight of several regulatory bodies across different jurisdictions, which helps ensure that it adheres to strict standards of operational integrity and client protection.

How long does Hantec Markets' withdrawal take?

The withdrawal process at Hantec Markets Limited typically takes between 2 to 5 business days, depending on the method of withdrawal and the specifics of the bank account or payment service involved. It's important for clients to ensure that all their documentation is in order to avoid any delays.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.