Scandinavian Capital Markets Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.6 1.5/5 | 100th  |   |

| Evaluation Criteria |

|---|

The team at Dumb Little Man, comprising financial specialists, seasoned traders, and personal investors, employs a specialized algorithm for an in-depth review of brokerage services. Their evaluation encompasses key areas such as:

|

Scandinavian Capital Markets Review

Forex brokers are pivotal in the currency trading landscape, providing platforms for traders to engage in buying and selling currencies, cryptocurrencies, and other financial assets. A prominent figure in this sector is Scandinavian Capital Markets. Established in 2011, this broker specializes in a variety of trading options, including currency pairs, cryptocurrencies, and precious metals.

Based in Sweden, Scandinavian Capital Markets is renowned for its adherence to regulatory standards and transparency. The firm operates under the vigilant oversight of Finansinspektionen (Swedish Financial Supervisory Authority), ensuring a secure and trustworthy trading environment for its clientele.

In our detailed review, we aim to offer an exhaustive evaluation of Scandinavian Capital Markets. This encompasses an in-depth look into its account options, deposit and withdrawal processes, and commission structures. Merging expert analysis with actual trader experiences, we provide a balanced perspective, equipping potential clients with the necessary information to make well-informed decisions regarding their brokerage services.

What is Scandinavian Capital Markets?

Scandinavian Capital Markets is a Swedish-based financial services provider, specializing in Forex trading and investment solutions. Catering to a global clientele, it offers a diverse range of services in various financial markets, including Forex, commodities, indices, cryptocurrencies, and more.

As an ECN broker, Scandinavian Capital Markets employs the STP (Straight Through Processing) execution model. This approach ensures that clients have direct access to liquidity providers, enabling fast and transparent order execution, a key advantage in the dynamic world of Forex trading.

Safety and Security of Scandinavian Capital Markets

The safety and security of Scandinavian Capital Markets, as researched by Dumb Little Man, are paramount in its operation. The broker maintains a representative office in Sweden and adheres to the strict regulations of the Swedish Financial Supervisory Authority. This compliance ensures a high level of trustworthiness and reliability for its clients.

Client funds at Scandinavian Capital Markets are treated with utmost care. They are segregated from the company's capital and held in major international banks. This separation is a critical aspect of their commitment to financial security, providing an additional layer of safety for client investments.

Legal and regulatory compliance is a cornerstone of Scandinavian Capital Markets' operation. All client agreements are subject to the constitution, legal acts, rules, and regulations of Sweden. Furthermore, the broker is not only registered with the Swedish Financial Supervisory Authority (Finansinspektionen), but also fully complies with the European ESMA regulation and the MiFID directive. These measures ensure that Scandinavian Capital Markets operates within a robust legal and regulatory framework, offering peace of mind to its clients.

Pros and Cons of Scandinavian Capital Markets

Pros

- Flexible account settings for optimal trading conditions

- MetaTrader 4 and cTrader platforms, with FIX API connectivity

- Supports automated and copy trading

- Demo account available

- Partnership programs for passive income

- Catering to both retail and professional traders

- Low minimum deposit

Cons

- No cent accounts

- Limited payment options for deposits and withdrawals

- Lacks trading in stocks, futures, indices, and options

- Absence of a top-tier license

Sign-Up Bonus of Scandinavian Capital Markets

As of the writing of this review, Scandinavian Capital Markets does not offer a sign-up bonus for new clients. This is an important consideration for traders who might be looking for initial trading incentives. The absence of a sign-up bonus reflects the broker's focus on other features and services.

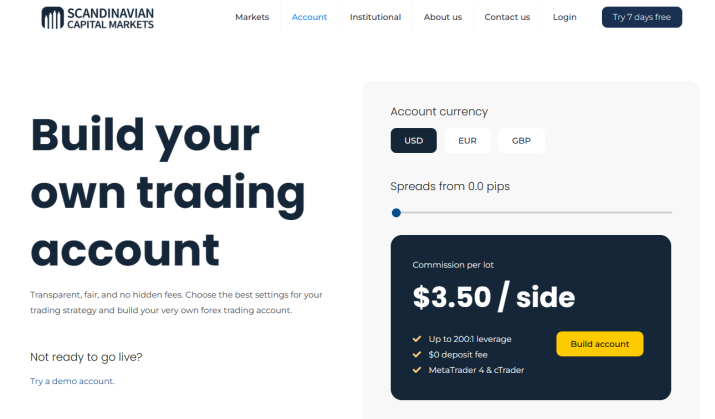

Minimum Deposit of Scandinavian Capital Markets

Scandinavian Capital Markets sets its minimum deposit amount at $250. This entry threshold is designed to be accessible for a broad range of traders, balancing affordability with a commitment to serious trading. This minimum deposit is a crucial factor for potential clients considering this broker for their trading needs.

Scandinavian Capital Markets Account Types

Scandinavian Capital Markets offers different account types, each catering to varied trader needs. After thorough testing and research by our team of experts at Dumb Little Man, we present a clear and organized summary of these accounts:

Live Account

- Customizable to fit individual trader needs.

- Basic settings include leverage of 1:200.

- Access to MT4 and cTrader platforms.

- No deposit fees.

- Options to choose account currency and spread, influencing trading fees.

Demo Account

- Ideal for novice traders and risk-free trading.

- Operates with virtual currency.

- Helps in testing different trading strategies.

- Standard configuration, but conditions and quotes may vary.

- Aimed at testing trading platforms and applying theoretical knowledge.

These account types reflect Scandinavian Capital Markets' commitment to providing flexible and suitable trading conditions for both experienced and beginner traders.

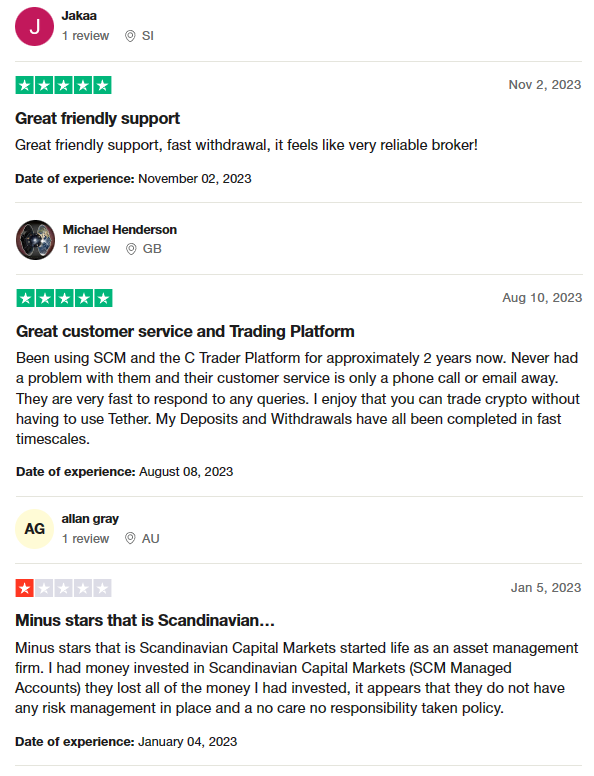

Scandinavian Capital Markets Customer Reviews

Customer reviews of Scandinavian Capital Markets reveal a mixed but generally positive sentiment. Many users commend the broker for its great, friendly support and fast withdrawal process, reflecting a sense of reliability. The C Trader Platform is highlighted for its ease of use, and the customer service is praised for being responsive and accessible. The ability to trade cryptocurrencies without Tether is also appreciated, along with the prompt handling of deposits and withdrawals. These factors contribute to Scandinavian Capital Markets being regarded as one of the better brokers in the industry.

However, there are notable criticisms, particularly from clients who experienced significant losses in managed accounts. These negative reviews point to a perceived lack of effective risk management and a sense of irresponsibility in handling client investments. This feedback underscores the importance of careful consideration and risk assessment when engaging with any financial service provider.

Scandinavian Capital Markets Fees, Spreads, and Commissions

Scandinavian Capital Markets adopts a fee structure that is contingent on the type of account a trader uses. The spreads can vary, with the Standard account offering spreads starting from 0.0 pips for popular pairs like the EUR/USD in the Forex market. For those opting for the Premium account, the broker provides a raw interbank spread with a distinct commission structure: $10 per lot on the MT4 platform and $100 per million traded through cTrader.

The brokerage fees are either spread-based or commission-based, depending on the account selected by the trader. Importantly, deposits are free of charge. However, Scandinavian Capital Markets does apply a $25 discretionary fee for withdrawals via bank transfer. Additionally, an inactivity fee of $20 (or its equivalent in the account currency) is levied on accounts that remain inactive for more than six months. This tiered fee structure is an essential aspect for traders to consider when selecting an account type that best fits their trading style and frequency.

Deposit and Withdrawal

Scandinavian Capital Markets offers a versatile range of payment options for deposits and withdrawals, as tested and verified by a trading professional at Dumb Little Man. Clients can utilize Bank Wire transfers, Credit/Debit cards, and e-wallets like Skrill, as well as make deposits using popular cryptocurrencies such as BTC, ETH, and USDT. This diversity in payment methods caters to the varied preferences of traders globally.

The broker is efficient in processing withdrawal requests, typically completing them within one day. For withdrawals, options include bank cards, bank transfers, and Skrill. Notably, Scandinavian Capital Markets does not impose fees for withdrawing money to a bank card or through Skrill. However, for withdrawals via wire transfers, a $25 discretionary fee may be charged.

An important security measure in place is the requirement for verification to withdraw funds. To initiate a withdrawal, clients need to log into their user account and navigate to the “Withdraw funds” tab, where they can complete and submit their withdrawal request. This process underscores the broker's commitment to ensuring a secure and streamlined transaction experience for its users.

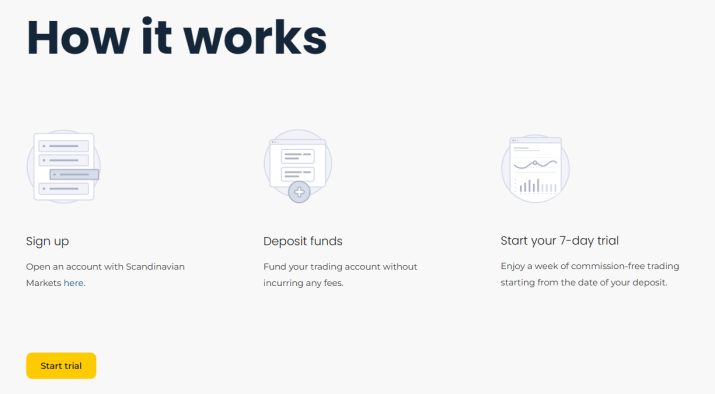

How to Open a Scandinavian Capital Markets Account

- Visit the official Scandinavian Capital Markets website and select the “Open an account” option.

- Start the registration process by providing your personal details like name, date of birth, phone number, country, and email address.

- Choose between a personal or corporate user account, and select either a trading or managed account type.

- Fill in the detailed questionnaire with your address, jurisdiction, identification number, and profession.

- Provide information regarding your income, account currency preference, and make an initial deposit.

- Set your preferred leverage, trading volume per trade, and select your trading platform.

- Enter details about your marital status, and social, legal, and political status.

- Review and agree to the rules and privacy policy of Scandinavian Capital Markets.

- Finalize the process by clicking on the “Complete and verify account” button to complete the registration.

Scandinavian Capital Markets Affiliate Program

Scandinavian Capital Markets offers a comprehensive Affiliate Program, tailored to different types of partners and their needs.

- Introducing Broker (IB): This program is designed for those who wish to earn rewards based on the trading volume of their referrals. Participants are provided with software to track referrals and accrue rewards, ensuring a transparent and efficient process.

- White Labels: This option is ideal for both small and large companies looking to monetize through the broker's infrastructure. Scandinavian Capital Markets offers assistance in setting up a brokerage company, along with guidance on using cTrader and other operational specifics.

- Institutional and Financial Managers: The program for these professionals includes collaboration with the broker's team to offer flexible terms and individual pricing structures. This is tailored to meet the unique needs of institutional clients and financial managers, providing a bespoke partnership experience.

Each component of the Affiliate Program highlights Scandinavian Capital Markets' commitment to offering diverse and adaptable earning opportunities for its partners.

Scandinavian Capital Markets Customer Support

Scandinavian Capital Markets‘ Customer Support has been evaluated by Dumb Little Man, revealing a comprehensive and accessible service. The support is available 24/5 and can be reached through various channels including Email, Phone, Live Chat, and WhatsApp. This range of options ensures that clients can choose the most convenient way to get in touch.

The broker's support team is skilled in handling a wide array of inquiries. They adeptly address technical questions, provide analysis recommendations, answer general queries, and assist with operational issues. This proficiency highlights their commitment to delivering efficient and effective customer service, catering to the diverse needs of their clients.

Advantages and Disadvantages of Scandinavian Capital Markets Customer Support

| Advantages | Disadvantages |

|---|---|

Scandinavian Capital Markets vs Other Brokers

#1. Scandinavian Capital Markets vs AvaTrade

Scandinavian Capital Markets, established in 2011, specializes in Forex and a range of other financial instruments. It stands out for its customizable trading conditions and platforms like MetaTrader 4 and cTrader. Based in Sweden, it adheres strictly to the regulations of the Swedish Financial Supervisory Authority. On the other hand, AvaTrade, operational since 2006, has garnered a significant global presence with over 300,000 customers and offers more than 1,250 financial instruments. This broker is known for its heavy regulation and presence in multiple global jurisdictions, including Ireland and Australia.

Verdict: AvaTrade is better for traders seeking a wider range of financial instruments and global market access. Its long-standing reputation and extensive regulation make it a more robust choice for diverse trading needs.

#2. Scandinavian Capital Markets vs RoboForex

When comparing Scandinavian Capital Markets to RoboForex, the latter, operating since 2009, offers an extensive range of trading options and asset classes, along with cutting-edge technology. RoboForex is renowned for its personalized trading terms and a variety of platforms such as MetaTrader, cTrader, and RTrader. Scandinavian Capital Markets, while focused on Forex trading, emphasizes security and customized trading conditions.

Verdict: RoboForex edges out for traders who value technological sophistication and a wider variety of trading platforms. Its tailored trading conditions and diverse asset classes make it more versatile for different trading styles.

#3. Scandinavian Capital Markets vs FXChoice

In contrast, FXChoice, established in 2010 and licensed by the International Financial Services Commission of Belize, is popular among Western traders. It is committed to business integrity and customer focus, offering classic and professional ECN accounts with tight market spreads. FXChoice is particularly suitable for experienced traders, given its trading conditions, and it does not cater extensively to beginners.

Verdict: FXChoice is more suitable for experienced traders due to its tight spreads and professional account options. Scandinavian Capital Markets, with its strong regulatory backing and customizable trading environment, may be more appealing to traders prioritizing security and personalized trading conditions.

Choose Asia Forex Mentor for Your Forex Trading Success

For individuals eager to build a successful career in forex trading and attain significant financial rewards, Asia Forex Mentor is the top selection for the finest forex, stock, and crypto trading course. Ezekiel Chew, the mastermind behind numerous trading institutions and banks, spearheads Asia Forex Mentor. Notably, Ezekiel consistently secures seven-figure trades, distinguishing him as a unique educator in this domain. The reasons we endorse Asia Forex Mentor are compelling:

Comprehensive Curriculum: Asia Forex Mentor delivers an extensive educational program, encompassing stock, crypto, and forex trading. This curriculum is designed to provide learners with the essential knowledge and skills to thrive in these varied markets.

Proven Track Record: The effectiveness and credibility of Asia Forex Mentor are evidenced by its history of cultivating consistently profitable traders in multiple market areas. This record reflects the potency of their training and mentorship approaches.

Expert Mentor: Students at Asia Forex Mentor receive mentoring from an expert who has achieved notable success in stock, crypto, and forex trading. Ezekiel's guidance helps students confidently tackle each market's complexities.

Supportive Community: Enrollment in Asia Forex Mentor grants access to a community of fellow traders who share a common goal of excelling in the stock, crypto, and forex markets. This network promotes collaborative learning, idea exchange, and mutual support, enriching the educational journey.

Emphasis on Discipline and Psychology: Mastery in trading demands a disciplined mindset. Asia Forex Mentor imparts essential psychological training to aid traders in emotion management, stress handling, and making informed decisions.

Constant Updates and Resources: Recognizing the ever-evolving nature of financial markets, Asia Forex Mentor ensures that learners stay abreast of the latest trends, strategies, and insights, providing continuous access to critical resources.

Success Stories: The numerous success narratives of students achieving financial autonomy through their education in forex, stock, and crypto trading at Asia Forex Mentor are a source of pride for the institution.

Asia Forex Mentor stands out as the foremost option for those aiming for the best education in forex, stock, and crypto trading, seeking both a lucrative career and financial success. Its well-rounded curriculum, proficient mentors, practical approach, and nurturing community equip aspiring traders with the tools and guidance needed to evolve into successful professionals in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Scandinavian Capital Markets Review

In conclusion, the Scandinavian Capital Markets review, as conducted by the team of trading experts at Dumb Little Man, presents a broker that stands out in several key areas, but also has certain limitations. Notably, the broker excels in offering customizable trading conditions, a range of financial instruments, and comprehensive customer support. These strengths make it a viable choice for traders looking for flexibility and reliable service.

However, potential clients should be aware of the drawbacks. The absence of a 24/7 customer support service and the lack of certain trading instruments like stocks and indices may limit its appeal to some traders. Additionally, the broker's limited payment options for deposits and withdrawals could be a constraint for those seeking more variety.

>> Also Read: Capitalcore Review with Rankings 2024 By Dumb Little Man

Scandinavian Capital Markets Review FAQs

What trading platforms does Scandinavian Capital Markets offer?

Scandinavian Capital Markets provides access to popular trading platforms like MetaTrader 4 (MT4) and cTrader. These platforms are known for their user-friendly interfaces, advanced charting tools, and automated trading capabilities. The availability of these platforms makes it suitable for both novice and experienced traders.

Is Scandinavian Capital Markets regulated?

Yes, Scandinavian Capital Markets operates under the regulation of the Swedish Financial Supervisory Authority (Finansinspektionen). This regulatory oversight ensures that the broker adheres to strict financial standards and offers a secure trading environment, which is crucial for trader confidence and security.

What types of accounts can I open with Scandinavian Capital Markets?

The broker offers a variety of account types, including Live and Demo accounts. The Live account can be customized to suit individual trading needs, with options to choose the account currency and spread. The Demo account is ideal for beginners or those looking to test strategies without financial risk, as it allows for trading with virtual currency under real market conditions.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.