What is Grid Trading – An Expert’s Take 2025

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

For successful trading, investors and traders use different strategies. Some are long-term investors, while some take a more short-term view. There are many different trading strategies, but one method that is gaining popularity is the grid trading strategy. But why?

Well, grid trading incorporates the buy and sell sequence at preordained levels. This trading can be done manually or automatically at the established market price. The trading approach works best in markets with a competitive environment and typically price changes.

When the selling price is higher than the buying price throughout an oblique movement, the successful grid trading strategy helps to gain more profits by automatically completing modest purchasing orders resulting in large selling orders, thereby reducing the need for market forecasts.

To better understand the concept of grid trading and how it works, we have got Ezekiel Chew. He is a professional forex trader and founder of Asia’s largest forex education company – Asia Forex Mentor. Ezekiel has been trading forex for the last ten years and is a self-made millionaire.

In this guide, we will explore Grid Trading, its benefits, strategies, advantages, and every other relevant detail regarding the topic. So without further ado, let’s get started.

What is Grid Trading

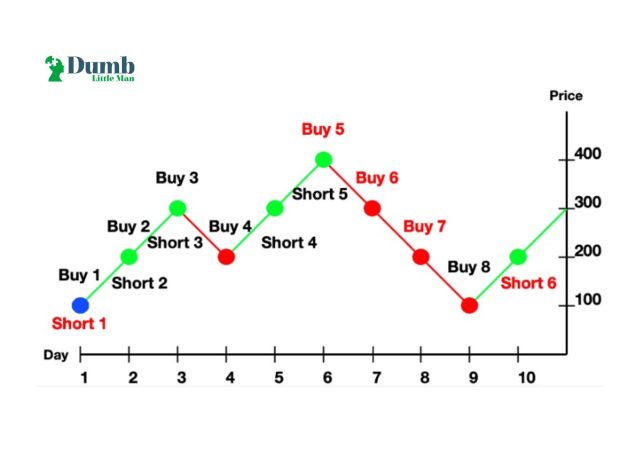

Grid trading is a type of trading strategy that seeks to profit from the market's inefficiency by simultaneously placing buy and sell orders at different prices. The goal of grid trading is to take advantage of the flow of the market by buying low and selling high or selling high and buying low.

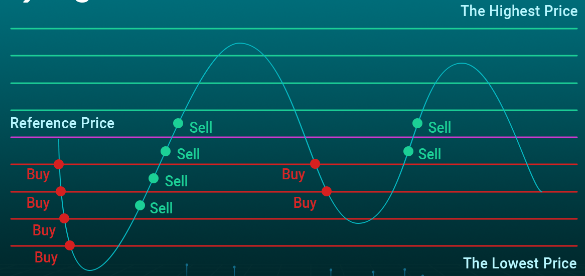

Grid trading is a bot or software that automates futures contract purchases and sales. It was developed to enable market orders within a designated price range at predetermined time scales. When orders are created at or above or below a set price, the market generates an orders grid as prices fluctuate. This strategy is most successful when prices bounce in a narrow range on both sides of the equilibrium.

Grid trading strategy is a popular strategy among day traders and scalpers, as it can be used to capture small profits multiple times throughout the day. Moreover, several elements are considered to improve the profits of grid trading. The good news is that there is a method to profit from the volatility. The majority of traders would love to be able to automate their trades, allowing them to unwind and enjoy consistent profits.

Grid Trading Strategies Explained

The best thing about a grid trading strategy is that you don't have to predict the market course. Everything can get automated according to your rules. You can set your take-profit and stop-loss orders at the levels you want, and the grid trading system will do the rest.

However, the most significant disadvantage is the potential for substantial losses if stop-loss restrictions are not maintained and the complexity of managing several positions in a large Grid.

Grid trading implies that the price stays in a consistent direction, and as the position grows, so does the profit potential. More purchase orders are triggered when the price rises, resulting in a great position. The profit potential rises as the position grows larger, and the price continues to move in that direction.

Most investors are stuck between two options after this: should they sell their investments and take the profits? Because the price can potentially reverse, the profits may evaporate. The losses are controlled by sold orders that are also properly spaced, and until those orders have been filled, the position can move from earning potential to a loss-making situation.

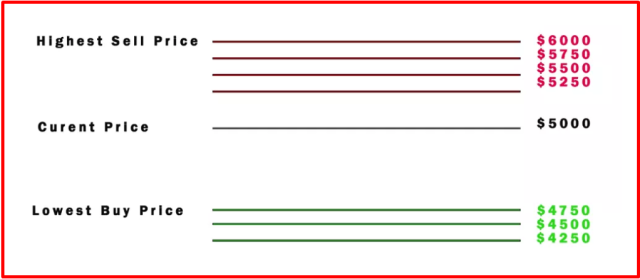

Investors often reduce the number of orders they place to a certain amount. For example, they might put four buy orders above a set price point. If the price drops below that point and meets all their purchase orders, they can exit the trade with some earnings. This is done either all at once or using a cell grid.

When the price is volatile, it may activate purchase orders above and below the specified price, resulting in losses. It is a successful method if the price moves in a constant direction. However, when prices rise and fall regularly, they are typically ineffective.

The biggest disadvantage of the against-the-trend Grid is that you cannot control the risk. The investor may gain a large position when the price moves one way and doesn't range. Finally, many traders will set a stop loss level to protect themselves from losses.

Grid trading investors place both buy and sell orders at standard intervals. This strategy is most successful in markets where prices ebb and flow regularly.

When the price drops, investors go long. It may be shorted when the price rises and sell orders are activated to reduce the long position. The trader makes money when the price fluctuates horizontally, allowing them to activate the sell order.

Grid Trading Bot Benefits

If you're looking to automate your investments, grid trading is a great option with many benefits. It can be used in most markets and adjusted to different time frames. Below are a few of the benefits of a grid trading bot.

#1- Easy To Use And Adaptable

The combination of fundamental trading and technical analysis is known as basic trading. It may be used in any market because of its simple trading principles. For example, investors may select the strategy's duration by selecting a price range.

You can use grids for short-term trades to make small earnings or choose a larger range and let it run for months to get profits from bigger changes in the market.

#2- Trustworthy Strategy

Grid trading is nothing new; it's a notion that has been tested and shown its potential. Over the decades, investors have utilized it in many markets, and the crypto sector has been a good testing ground for Grid trading because of the substantial volatility.

Grid trading is a tried and tested strategy that many successful traders have used.

#3- Fewer Emotional Decisions

One of the main advantages of automation is that it helps you take the emotion out of your trading. When you have a plan and follow it, you're less likely to make rash decisions based on fear or greed. This can help you hold onto your profits and avoid making costly mistakes.

Using a bot can help you take the emotion out of your trading and manage your investments more efficiently.

#4- Better Risk Management

When manually managing your investments, it's easy to make impulsive decisions that can lead to big losses. With a grid trading strategy, you can pre-determine your risk tolerance and set up your bot accordingly. This will help you avoid making trades that are too risky and protect your capital.

Moreover, you can also use a bot to set stop-loss orders, which will help you limit your losses if the market turns for the worse.

Risk Management in Grid Trading

Grid trading is a great way to manage risk because it allows you to set clear trade boundaries. However, traders who don't have a risk tolerance want to know if their bets are secure.

The good news is that Grid trading is inherently hedged because it includes numerous trades, and solid trades can outnumber low-performing ones. In addition, investors may mitigate the danger by watching bots trade and implementing stop-losses and take-profits.

Besides that, investors must be in step with the latest news and trends about the market in which they are trading. Breaking news can majorly influence certain markets, such as the Forex and cryptocurrency markets, resulting in quick price drops.

Below are a few key points that investors can use to minimize risk in their trading Grid strategy:

- When trading in an unstable or low liquidity market, it's possible that trades will not be executed at the desired levels indicated in the Grid, increasing the risk for investors

- Many investors choose to place wide-stop losses on every trade to protect against potential losses from non-opposing trade pairs

- Do not multiply your order volume and exposure to levels over the risk limits you can afford as a trader when implementing a Grid strategy

- Be sure to keep an eye on your lot sizes and grid settings so that you don't get overexposed and end up with a margin call

- To ensure that the exit levels are correct, have a clear view of the market range

- The greatest advantage of a Grid structure is that it averages exit and entrance fees

Popular Grid Bots

Several Grid bots are accessible to investors, and most trading platforms provide at least one type, allowing you to construct price, grid quantity, and upper and lower limits. However, fees are an important consideration because they influence trading outcomes. Therefore, working with exchanges that have lower costs may have a significant impact on Grid trading.

Use the data from your examination to find the greatest matches and market conditions, then learn how to read the market and develop a feel for what you should focus on when trading. Look at charts with sideways movement and seek out pairs with big swings but still within the same price range.

Moreover, the bot has several grid trading parameters, like take profit, stop loss, lower limit, grid number, and upper limit. You can also use a bot to set stop-loss orders, which will help you limit losses if the market worsens. Below are the most common grid trading bots you can consider:

#1. Pionex

Pionex offers five free options that are each great for different situations. If you're just starting, Bits Gap is also a fantastic option with extra features like take profit and stop-loss.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Pionex website |

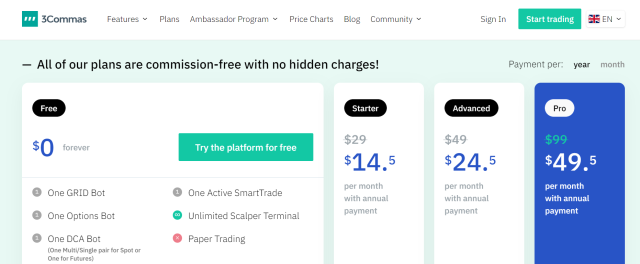

#2. 3Commas

The 3Commas Grid trading bot uses an AI system that allows investors to not worry about picking limits. 3Commas Grid bots come in several combinations and are free for investors who actively use the trading platform.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through 3Commas website |

Best Forex Trading Course

Instead of relying on an odd article here and there, you may want to get a full detailed course to take you through all these situations.

Here is where the idea of the Asia Forex Mentor by Ezekiel Chew comes in. The course is a robust introductory guide that will give you the knowledge you need to trade forex. It's a beginner-friendly guide as well that works for folks who want to trade forex and any other financial asset.

The Asia Forex Mentor will not just teach you how to predict price shifts, daily volume, and other technical indicators. It will also teach you how to manage capital and explore some of the most advanced risk control measures in the world. After all, as long as you are managing your capital correctly, identifying overbought and oversold pairs will be the easier part.

Also, if you are an advanced trader looking to learn some of the tricks used by leading banks, this course is ideal. The Asia Forex Mentor is developed by Ezekiel Chew who has taught some of the leading investment bankers how to trade forex. You will be able to identify a losing trade, gauge price movement under immense trading pressure, and maintain a level head even when the markets are volatile.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Grid Trading

The major benefit of Grid trading is that emotions are excluded from the trading strategy; everything is automated and guided by computer code. The bot creates orders at progressively increasing and decreasing prices, generating money off market volatility. Traders profit from the disparity in pricing in the market.

Grid trading is an automated process where investors set upper and lower limits. When the price hits these limits, the order to buy or sell is automatically executed. This strategy benefits from short-term chart volatility.

Automated trading has some inherent dangers that might result in losses. Traders must study the bot they want to use and decide if the risk is one they are willing to take. The strategy works best during a sideways market where prices don't change much. Investors who watch the latest news and regularly readjust the grid can make money using this method.

Grid Trading FAQs

Is Crypto Grid Trading Profitable?

Without the need for complex algorithms, investors can make fair profits if they buy low and sell high, as long as they follow the system's grid parameters. On the other hand, the use of Grid trading isn't always a lucrative tactic.

How do you use Grid Trading Bots?

Most of these bots are used similarly. After you have deposited money into your account, you will need to set some basic parameters like the amount you want to trade, the price you are willing to buy and sell, etc.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.