What Is Gamma Squeeze: In Depth Guide For Beginners

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex brokers for traders are Avatrade and FXCC

The #1 Forex Trading Course is Asia Forex Mentor

When it comes to trading and investments, several things come into play. Due to many unforeseen factors, no one can predict a 100% accurate market outcome. One of such factors is a squeeze. Depending on who is trading and other market price actions taking place, a squeeze may occur and force stock prices to go higher. There are different types of squeezes, but the gamma squeeze is the riskiest. In this article, we’ll be going into full detail about what it is and what happens when it occurs.

To aid us in helping you understand better, we have Ezekiel Chew, a renowned and well-known forex mentor. Thousands of people from countries worldwide have studied under Ezekiel. His teaching style is founded on the return-on-investment theory. It's not about outlandish strategies or elaborate procedures. Without further ado, let’s get started.

What is Gamma Squeeze

The culmination of significant stock price rises due to various purchasers in the underlying stock is known as a gamma squeeze. While buying leads stock prices to climb, panic buying can produce a situation where spikes are forcibly ripped higher. The buying pressure on the stock rises to absurd levels as the stock rises.

The conditions for a squeeze may be ideal when stock prices encounter rapid swings. In this case, investors may find themselves purchasing or selling stock outside their typical trading patterns to limit their losses. A gamma squeeze, in which investor buying activity pressures a stock's price higher, is an extreme example.

A gamma squeeze can last from a few hours to several weeks. As the stock rises, the cycle repeats itself. The upward price explosion can be exacerbated if the company is widely shorted. A gamma squeeze occurs when a stock's price rises quickly due to the underlying calls spiking on extremely high volume. The call volume might soar more than usual, catching investors by surprise and compelling them to hedge the calls by buying stock in the open market.

What is Squeeze in Investing

The term “squeeze” is used to describe a variety of financial and economic scenarios, most of which involve market pressure. The word is used in investing to describe scenarios where short-sellers buy shares to cover losses or investors sell long positions to realize capital gains. You may have heard the term “squeeze plays,” which refers to attempting to earn large profits by borrowing money or investing in assets about to lose value. These squeezes can yield huge rewards, but they also carry enormous hazards. Margin borrowing and short selling are two riskier investments, with potential losses exceeding initial investment amounts.

There are 3 main types of squeezes apart from the gamma squeeze linked to investing; short, long, and bear squeeze.

A short squeeze is a regular occurrence in the stock market, in which the price of a stock rises, and purchase volume rises as short-sellers exit their positions and cut their losses.

When there's a sudden price drop in a strong financial market, investors who are long a company sell a portion of their position, forcing more long holders of the stock to sell their shares to safeguard against a spectacular loss.

A bear squeeze occurs when traders are obliged to repurchase underlying assets at a greater price than they sold them for when they entered the trade due to rising prices.

Short Squeeze vs. Gamma Squeeze

A short squeeze can cause stock prices to rise dramatically, albeit this upward trend may not be sustainable in the long run. A short squeeze occurs when stock prices rise, and people who have shorted the stock are forced to buy back their shares. It occurs when the market price of an item is pushed up to the point where those who are short on that asset start complaining.

A gamma squeeze can occur when there is widespread buying activity of short-dated call options for a particular stock. This can successfully generate an upward spiral in which call buying leads to higher stock prices, which leads to even more call buying and higher stock prices.

Certain conditions must be met for a gamma squeeze to occur in the market. It begins with investors forming assumptions about the price of a certain stock. They specifically anticipate a price increase in the stock.

How Gamma Squeeze works with Stock Price

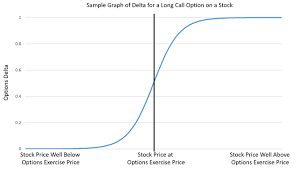

To begin a gamma squeeze, a group of small retail traders or a single large trader betting on a stock's increase purchases short-dated call options in the underlying stock. The investment banks and intuitional investors who sell these call options effectively become short of the underlying stock once they buy them.

Market makers and institutional brokers will be obliged to acquire additional shares of the underlying stock to hedge their short position if traders buy more call options. As the price of a stock rises and traders raise their call bets, market makers are pushed to buy the underlying stock, driving the price higher, similar to a short squeeze.

Investors selling or writing the call expect a price drop. Still, the downside, like going short, is theoretically unlimited because the stock can continue to rise rather than plummet to zero. If a stock has little liquidity, it can drive the share price to rise, even more, requiring brokerages to buy more shares as the value of their exposure rises as the share price approaches the strike price of call options. This link causes a “gamma squeeze,” a phenomenon that can result in large losses for some investors.

Gamma Squeeze Examples

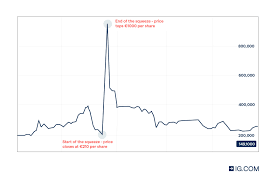

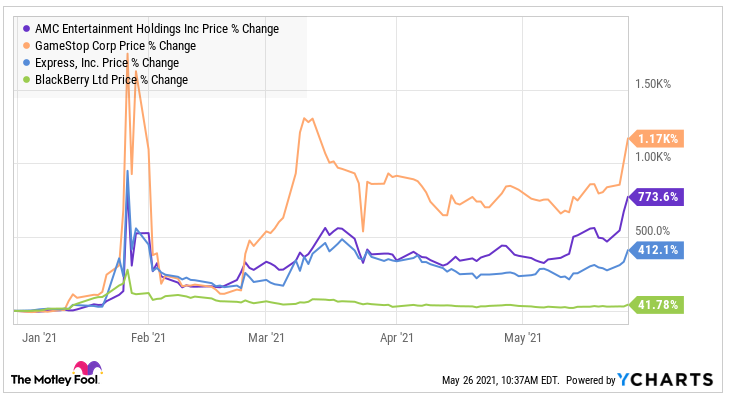

There are many times when a gamma squeeze has occurred, but one of the most popular ones is the AMC gamma squeeze. AMC Entertainment, founded in Leawood, Kansas, is an American movie theater chain. After their short squeeze sent markets into a tailspin in June 2021, the corporation became well-known worldwide.

Many traders began speculating and bought call options at different prices when the group showed a good trajectory on its way to positive cash flows. A group of retail traders orchestrated a bid to boost the company's stock price. As a result, market makers were forced to take out massive short positions to mitigate the risks. When the price unexpectedly jumped, the market makers were gamma pressed, leading the price to skyrocket.

There's also the GameStop gamma squeeze in 2021. Many traders were shorting stocks and hedge funds after hearing rumors of poor outcomes in late 2020. The price was raised due to the r/WallStreetBets Reddit group's aggressive call option purchase, forcing these traders to be short-squeezed. This resulted in a gamma squeeze due to the massive number of call options purchased, as well as a short squeeze, leading the price to skyrocket.

Tesla and Beyond Meat are two such companies that have experienced gamma squeezes.

What Triggers a Gamma Squeeze

When many people buy call options from a market maker, the market maker effectively becomes a large short position in the stock. They stand to lose a lot of money if the stock price rises.

They begin purchasing stock to hedge their short options position to counteract this. Ironically, this has the effect of increasing the stock price. This is when gamma enters the picture. When a stock with a large short position is expected to climb by a sufficient amount, it is triggered.

This prediction, however, is the polar opposite of the present short holdings. As a result, rather than purchasing shares, bullish investors should acquire short-dated call options as the call ratio continues to rise.

What Gamma Squeeze means for Investors

Gamma squeeze could mean different things for each trader or investor depending on which side of the market they find themselves.

It could be a lucrative investment opportunity while also being a high-risk position. It relies on the conditions that cause a brief squeeze and then a longer squeeze that might last days or weeks. As a result, timing plays a key role in determining whether it will be successful or result in large losses.

When a Gamma squeeze reaches its climax, price reversals are likely to occur quickly, and you may see a significant drop in share price. As a result, trading options may not be appropriate for investors who cannot accept risk.

Best Forex Trading Course

Asia Forex Mentor offers the best forex trading education in Asia. The course is set up so that you can earn money while learning. You'll be able to trade forex profitably with a skilled trader's help. In Singapore and other sites worldwide, tens of thousands of people from the United States, the United Kingdom, and other Asian countries have been taught.

Ezekiel Chew's teaching method is founded on the principle of return on investment, which states that if you invest $1, you will gain $3. It's not about zany strategies or elaborate procedures. Professional traders and financial organizations use his authorized system. He is the driving force behind the growth of various companies, including DBP, the Philippines' second-largest state-owned corporation.

Due to his strategy's effectiveness, many full-time traders have joined the program with little to no prior trading experience and emerged successful.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

Conclusion: Gamma Squeeze

Shorting stocks, shorting options, and buying a stock in the middle of a gamma squeeze after a tremendous run upward are the easiest ways to prevent getting caught in a gamma squeeze and the accompanying slump. Because many companies now carry weekly options, the possibility for gamma squeezes is likely to persist in this market for some time.

Market makers will eventually price out the ease with which these techniques can be performed by boosting the premium on far out-of-the-money call options more quickly. As a result, the risk of buying those options will be too high for speculators to aggressively attempt to gamma squeeze a stock.

Until then, stay away from small-cap or low-float stocks.

Gamma Squeeze FAQs

Is Gamma Squeeze good?

Gamma squeezes are dangerous. A price drop can occur without warning, and a squeeze might linger for days. Investors have no way of knowing when this will happen.

Gamma squeezing may be for you if you have a lot of money to burn. Gamma squeezing might not be for you if you're more of a low-to-medium risk person.

How long does a Gamma Squeeze last?

A Gamma squeeze can continue for days, weeks, or even months, so timing your investments is crucial. You shouldn't be caught in a Gamma squeeze, where you're forced to purchase high and sell low.

Essentially, it will last until the gamma is flattened down, either through call selling and unwinding the open positions or upon the expiration of the options. Short squeezes and gamma squeezes can linger for days or weeks, or they can fade away rapidly depending on what's causing them.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.