Funding Traders Review with Rankings 2024 By Dumb Little Man

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Dumb Little Man's expert team, comprising financial specialists and experienced traders, is renowned for conducting in-depth reviews of prop trading firms. They utilize a precise algorithm and strict evaluation techniques to assess brokers on essential aspects, ensuring comprehensive reviews. These aspects cover:

Their analysis of Funding Traders reveals that the firm not only meets but surpasses these key criteria. Funding Traders offers an abundance of brokerage expertise and robust support for its traders, elevating it as a standout prop trading firm in the industry. |

A “prop firm” or a proprietary trading firm is a specialized company that allows traders to use their trading capital in exchange for a split in the profit. Prop trading firms benefit by not only getting a share of the profit from successful traders but also by replicating their strategies. Prop trading firms are essential so traders can practice their trading skills while minimizing risk.

Funding Traders is a company founded in 2023. This prop trading firm emerged as a key participant in the industry with robust international connections in prop trading firms in different countries. Their main objective is to identify and provide traders with exceptional trading skills, giving them the essential trading instruments and funding to be successful in the competitive trading industry.

This Funding Traders review aims to examine this prop trading firm comprehensively, based on the thorough research of experts from Dumb Little Man. This aims to provide an honest assessment and analysis of the prop firm's features and offerings designed to cater to prospective traders.

What is Funding Traders

Created in 2023, Funding Traders is a prop trading firm that conducts their operations on a global level. Their connections with key prop firms in Miami, Dubai, and the United Kingdom enable them to have a significant presence in the global financial markets.

This proprietary trading firm is created by Stan G., a highly seasoned professional with an extensive experience in Wall Street trading. Funding Traders distinguishes itself by its commitment to empowering new traders. The prop firm not only offers funding but also risk management education and resources, tools, and a strong support network to prospective traders.

This way that Funding Traders operates allows traders to have all of the materials and resources that they need in order to succeed.

In selecting traders, prop firms, especially Funding Traders use a very selective approach with emphasis on quality and not quantity. They intentionally select individuals with innate trading ability in order to develop them from “diamonds in the rough” to successful and profitable traders.

The company believes that it is better to allocate the fund to smaller but exceptional traders, than to a huge of ordinary ones. This is their way of ensuring that the business will reach greater heights.

Pros and Cons of Funding Traders

Pros

- Competitive terms

- No trading time limits

- News trading permitted

- Weekend position holding allowed

- Favorable pricing

- Variety of plans and prices

- Refundable one-time fee

- Extensive knowledge resources

- Excellent customer service

Cons

- Strict trading rules

- Limited to two payment options

Safety and Security of Funding Traders

Funding Traders places a high priority on ensuring a secure and sustainable trading environment for its users. This commitment is evident in their strict guidelines on trading strategies. According to research by Dumb Little Man, certain high-risk strategies are explicitly prohibited to maintain this environment.

The use of the Martingale System is not permitted. While it may show potential for profitability, this strategy is associated with significant risks, particularly in larger sample sizes. Manual application of the Martingale system increases the risk of substantial account damage due to human error.

Funding Traders, therefore, encourages strategies that involve effective risk management and adherence to trading rules, fostering a stable and disciplined trading approach. They clearly state that a trader can only add one position to a losing trade, and it must not exceed the size of the initial trade.

Arbitrage Trading, which involves exploiting minor price differences across markets, is also not allowed on the platform. By restricting Martingale and Arbitrage trading, Funding Traders aims to support traders who utilize more sustainable and long-term strategies.

This approach ensures a fair and competitive trading ecosystem, steering clear of the risks these strategies pose.

Funding Traders Bonuses and Contests

Funding Traders currently does not offer any incentives or contests to its traders. Individuals with a deep interest in such prospects, however, should stay up to date on any new developments. Because the corporation has the ability to establish bonus programs and contests, traders should keep an eye on their announcements in order to capitalize on potential incentives.

Funding Traders Customer Reviews

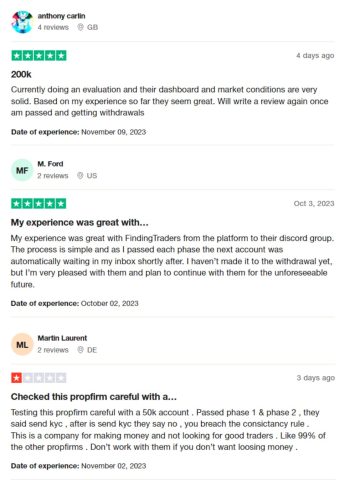

Funding Traders‘ client feedback indicates a mixed bag of experiences, culminating in a 4.8-star rating on Trustpilot, indicating room for improvement. Customers like Anthony and Ford have praised the company's great user interface, straightforward approach, and quick setup of new accounts after completing each level.

Martin's experience, on the other hand, underlines concerns with stringent standards, particularly consistency, which leads to dissatisfaction. These mixed reviews suggest that, while Funding Traders may provide a good platform and community, there are certain aspects that may be improved, most notably rule clarity and fairness.

Funding Traders Commissions and Fees

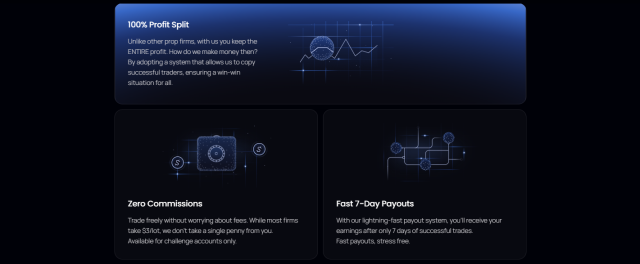

Funding Traders, a Forex proprietary trading service, provides traders with a profit share agreement that is both appealing and adaptable. Traders initially receive 80% of profits, with the remaining 20% going to the business. Funding Traders provides the option to increase the profit share in order to honor trader dedication and talent.

This upgrade, which is available at the time of purchase, allows traders to increase their profit share to 90% or even 100%, enhancing their potential earnings.

This adaptability accommodates traders with various objectives and risk tolerances, allowing for a more tailored approach to profit sharing. Traders are eligible for this increased compensation as long as they meet the minimum trading period and adhere to the firm's trading objectives.

Additionally, the minimum payout requirement is set at a $50 profit on any account size. This framework at Funding Traders not only incentivizes traders but also aligns with their results, providing a gratifying journey in the Forex trading market.

Funding Traders Account Types

Following extensive study by our team of specialists at Dumb Little Man, we have developed a full list of account kinds available by Funding Traders.

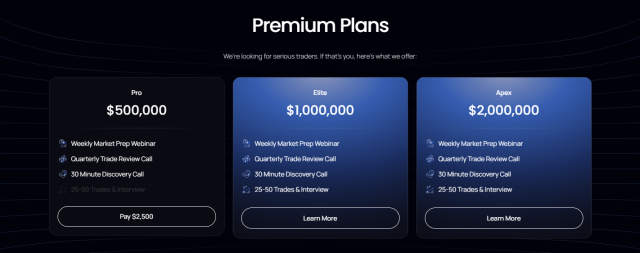

Pro Account

- Entrance Fee: $1,500

- Funding: $500,000

- Additional Features: Weekly Market Prep Webinar, Quarterly Trade Review Call, 30 Minute Discovery Call

Elite Account

- Entrance Fee: Variable

- Funding: $1,000,000

- Additional Features: Weekly Market Prep Webinar, Quarterly Trade Review Call, 30 Minute Discovery Call,25-50 Trades & Interview

Apex Account

- Entrance Fee: $10,000

- Funding: $2,000,000

- Phase 1 Requirements: 10% profit target, 5% daily loss cap, 10% overall loss cap, 2-6 months trading period

- Phase 2 Requirements: 5% profit target, similar loss caps and trading period as Phase 1

- Additional Features: Weekly Market Prep Webinar, Quarterly Trade Review Call, 30 Minute Discovery Call,25-50 Trades & Interview

Opening a Funding Traders Account

Starting your journey with Funding Traders is a systematic process, from easy online registration to trading on a funded account. Follow this eight-step guide to seamlessly navigate from initial sign-up to potentially earning profits with Funding Traders.

- Visit the Funding Traders website to begin your trading journey.

- Complete the registration process by providing the necessary personal and financial details.

- Choose your preferred account type from the various options available to suit your trading level and investment capacity.

- Wait for the verification email.

- Finish the challenge which is to achieve a 10% profit without dropping your account below 5-10% of its value.

- Maintain your profit aim while staying within your loss boundaries.

- After completing the challenge for your account, you will be able to receive a live-funded account.

- Begin trading with your funded account, which is now live and completely configured for you.

Funding Traders Customer Support

Funding Traders offers a number of ways to reach them. They have live chat, a contact form, Twitter, Discord, or email at [email protected]. These options make it easier to ask for assistance, and for quick response.

Also, Funding Traders has an available FAQs sectionon the website for common questions. Dumb Little Man's experience has proved that their live chat team is extremely attentive and responsive, offering users with prompt and useful service. This is an important factor in considering whether a trading platform can be trusted.

Advantages and Disadvantages of Funding Traders Customer Support

| Advantages | Disadvantages |

|---|---|

|

Funding Traders Withdrawal Options

Funding Traders accepts two types of withdrawals: bank transfers and cryptocurrencies.

Traders must create a Deel account and link it to their bank in order to make bank transfers. The transfer usually takes 1-5 business days to complete using this technique. It is a dependable choice for those who live in nations where Deel operates.

For traders outside of Deel's operational nations, cryptocurrency withdrawal offers the benefit of instant fund transfer. This strategy meets the needs of worldwide traders by offering flexibility and quick access to funds.

Funding Traders guarantees that rewards are processed within 7 days of completing your first live deal. Furthermore, they provide a refund bonus on top of your gains, allowing you to take money while still growing your account.

This method makes Funding Traders an appealing alternative for budding forex traders, as it provides an effective way to earn while building trading abilities and pursuing a professional trading career.

Funding Traders Challenges and Difficulties

Your first goal when you join Funding Traders is to accomplish one of their challenges. This is a critical stage in showcasing your trading expertise and strategy effectiveness.

The goal for individuals who select a standard challenge account is to achieve a 10% profit while retaining the account balance between 5 and 10% during the evaluation. Funding Traders offers two types of challenges: one-step and two-step.

Navigating the 1-Step Regular Challenge:

Traders in the 1-step regular challenge must achieve a profit of 10%. They must adhere to tight risk management standards, such as a daily drawdown restriction of 4% and a cumulative drawdown limit of 5% determined on the greatest amount received. This assignment tests a trader's capacity to produce money while managing risks.

How to Pass Funding Traders Evaluation Process

The Funding Traders evaluation process is a huge difficulty because to its stringent standards. It is critical to be properly prepared with the required knowledge and methods to maximize the likelihood of success.

Participating in a comprehensive training program is critical in this preparation, as it provides the tools and understanding required to navigate and effectively complete the Funding Traders exam.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Asia Forex Mentor, named Investopedia's best complete course, is strongly recommended for individuals preparing for the Funding Traders examination. It has been recommended by Dumb Little Man professionals for assisting thousands of people in navigating and passing evaluations in real estate businesses.

Ezekiel Chew, a respected forex trading specialist with over two decades of experience and a track record of six-figure deals, created the platform. His One Core Program, a key component of Asia Forex Mentor, focuses on teaching profitable forex trading strategies. Ezekiel launched Asia Forex Mentor by educating friends and has now extended online, supporting ambitious traders in their professional development.

How Could Asia Forex Mentor Help You Pass Funding Traders Challenge?

The proven success of Asia Forex Mentor in forex trading education makes it a wonderful resource for anyone taking up the Funding Traders challenge. Its credibility is proved by a number of noteworthy awards below.

Most Comprehensive Course Offering: Investopedia, a well-known financial content website, has named Forex Mentor's One Core Program as the greatest comprehensive Forex education available. This certification highlights the breadth and depth of its forex instruction.

Best Forex Trading Training: The One Core Program was named the best forex trading training for beginners by Benzinga, a well-known source of financial, economic, and stock market news. Benzinga's endorsement of the software underlines its usefulness for traders of all skill levels, from novice to advanced.

Best Forex Coach: The BestOnlineForexBroker website recognized Asia Forex teachers the top Forex tutor in 2021. Their appreciation emphasizes the program's potential to help traders make large gains in FX trading.

Asia's Best Forex Trading Course: In a comprehensive analysis conducted by renowned forex traders and platforms, Forex Mentor was recognized for its exceptional trading methods and systems.

These awards and recognitions attest to the One Core Program's ability to meet and exceed the expectations of both novice and seasoned traders. Traders preparing for Funding Traders' tasks should enroll in Asia Forex Mentor to prepare themselves with great ways and insights.

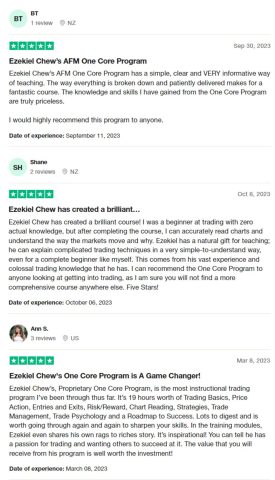

Asia Forex Mentor Members' Testimonials

Ezekiel Chew‘s Asia Forex Mentor‘s One Core Program has been praised for being a thorough program. Participants have commended the program for its clarity and coverage increasing their understanding of the market dynamics and different approaches.

The program covers a broad range of topics from the basics and the fundamentals to advanced concepts. It is also lauded for having a transformative effect on participants' trading abilities.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Funding Traders Review

Experts at Dumb Little Man assessed Funding Traders as a notable prop firm with its 100% profit split and free commission offering for the challenge account. This is a significant incentive for traders and is also an attractive opportunity to increase their earnings.

However, Funding Traders is also committed to ensuring a secure and sustainable environment with their stringent criteria, and their restriction of certain high-risk approaches like the Martingale System and Arbitrage Trading. This idea might not fit the style of some traders.

While prop firms line Funding Traders present a lot of challenges in rider to secure a funded account, enrolling in programs such as Asia Forex Mentor‘s One Core Program can increase the likelihood of success. These programs offer extensive training, providing a competitive edge for traders beginning their trading journey.

Funding Traders Review FAQs

What is a Prop Trading Firm?

A proprietary trading firm, sometimes known as a prop firm, is a company that invests its own money in financial markets rather than depending on client money. These firms generally hire traders to trade this capital, paying them a percentage of the profits gained.

How can I increase my profit share with Funding Traders?

By purchasing an add-on during the checkout process, you can increase your profit share from the default 80% to up to 90% or 100%. This change allows traders to maximize their returns in proportion to their trading investment.

Are there any specific trading strategies prohibited by Funding Traders?

Yes, certain high-risk methods, such as the Martingale System and Arbitrage Trading, are prohibited by Funding Traders. These limits are in place to promote a more stable and sustainable trading environment, as well as to encourage traders to use more disciplined and long-term trading strategies.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.