FBS Review 2024 with Rankings By Dumb Little Man

By Wilbert S

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

With numerous brokerage platforms available in the financial market, it is challenging to pick the right firm compatible with the customers' trading needs. Therefore, traders have to do a lot of research to select a reliable broker, and still, fraudulent companies sometimes deceive them. For this reason, it is very important to trust those platforms that provide the most authentic and unbiased information regarding various brokerage firms. In this regard, Dumblittleman has been providing relevant information to traders, which is based on not just expert opinions but is also accredited with a rigorous evaluation process. Each broker is analyzed on standardized criteria, and then it is classified based on its performance. Therefore, traders and investors can rely on this information to make an informed decision regarding any broker. The evaluation criteria are based on the following factors.

After evaluating FBS on the aforementioned criteria, it was concluded that it is a genuine broker providing safe and profitable trading services. Moreover, as FBS is a regulated broker, it protects its customers' data and funds. Similarly, FBS has all the trading features needed for a successful trading experience. However, the platform is behind many other top-rated firms in terms of its options for trading instruments and advanced trading tools. |

No matter which profession you belong to, everyone is looking for ways to increase their income. One popular way to earn additional income these days is trading in the stock market. However, successful trading is not as easy as it sounds; there are many prerequisites before reaching the profitable trading landmark. Among them, the most important is having an efficient broker. FBS is also one brokerage firm you can consider in your search for a reliable trading partner.

FBS is a regulated platform that provides all the basic trading conditions required for a profitable trading experience. Moreover, FBS is not restricted to professional traders; the platform also enables new traders to enter the market conveniently.

Regardless of all the benefits, some loopholes in the broker’s performance make it a mediocre platform compared to the top-rated brokers. Nevertheless, it is not a bad option for traders looking for low-cost primary trading conditions. Moreover, FBS is also improving its services day by day, and new trading features are often added to compete in the financial markets.

This FBS review is intended for individuals, traders, and investors looking for a reliable brokerage firm with suitable trading conditions. Therefore, this review presents all the relevant information that a trader requires before investing with a broker, such as the benefits and drawbacks, trading features, account opening procedures, and various other features.

What is FBS?

FBS is a brokerage company that has been offering trading services to clients worldwide. Moreover, it has been in the financial market for more than 12 years and can be accounted for being an experienced broker. FBS is known for providing a straightforward trading platform with all the basic trading features and services. Additionally, it is also a regulated firm making it a safe and reliable broker for traders and investors.

The trading conditions at FBS are encouraging, with multiple varieties of trading instruments and trading accounts. Clients of FBS can trade in forex trading, indices, and commodities, and now the firm has recently added cryptocurrencies. Similarly, there are also many options for trading account types where users can choose the account type which suits their trading style.

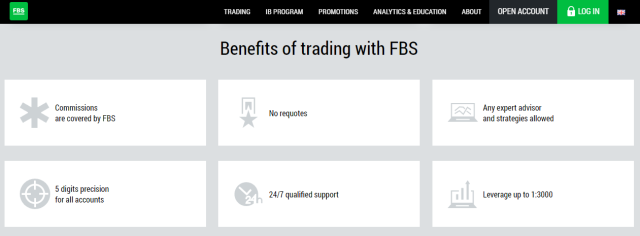

Other than this, there are also many other features that provide trading opportunities to traders on the FBS platform, such as high leverage, tight spreads, and fast market executions. All this comes with not a high commission rate, so we can say that FBS is cost-efficient. Moreover, there are also trading features such as ECN accounts for automated trading and copy trading for novice traders.

All in all, FBS has a complete package for traders with all the basic tools, strategies, and characteristics required for successful trading. However, we cannot call FBS a top contender in the brokerage industry as there are many other competent brokers that offer many more amenities on their platform at a better price.

Safety and Security of FBS

As far as safety is concerned, FBS can be categorized as a secured firm as it provides multiple apparatus to protect the data and funds of the customers. For one, the firm is regulated by the International Financial Services Commission (IFSC) and got licensed by ASIC in Australia and Financial Sector Conduct Authority (FSCA) in South Africa in the year 2020. This shows that FBS is a genuine firm providing trading services under the supervision of multiple regulators, ensuring that the user’s funds transactions are safe and secured.

Along with this, FBS also protects from losses through its Negative balance protection options, where in case of huge losses, the FBS client’s trading balance goes to zero from minus so that the trader is not liable to pay anything to the broker and can take a fresh start. Moreover, FBS is also a member of the Investor Compensation Fund, where traders are refunded in case the broker does not pay its liabilities.

In addition, FBS also has segregated accounts for clients’ funds, which means that the broker can not use the client’s funds for their use. These accounts ensure that the client’s fund is safe and available to withdraw whenever they want. All these provisions establish that FBS is a safe and secure brokerage platform for all types of traders and investors.

Sign Up Bonus of FBS

FBS offers various promotions and bonuses to allure new clients to their platform. The first offer is the 100% deposit bonus. This is a welcome bonus for new traders who join the platform. Traders can double their deposits by requesting this bonus which the broker will pay into the trader’s FBS account.

Next is the level-up bonus account, which the broker introduced for customers on mobile applications only. After opening this account, users will be rewarded a free $140 account balance for trading. Traders can use this bonus amount for 20 days of trading and can earn profits without any investments.

Another signup bonus for traders is the cashback offer. Traders can claim cashback of up to $15 per lot by activating the cashback option on their account dashboard. Other than these bonus offers, there are also many seasonal promotions available on the FBS platform, and users can get information regarding them on the official website of the firm.

Minimum Deposit of FBS

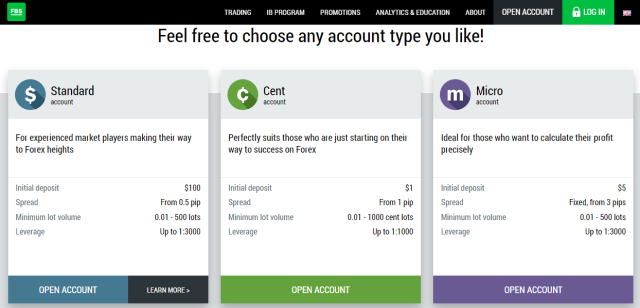

The minimum deposit on FBS varies according to the account type. For each account, there is a different requirement. For the cent account, the initial deposit requirement is $1; for the micro account, $5; and for the standard account, $100.

For the exclusive account types, the minimum deposit is higher for zero spread accounts from $500 and for ECN account types, $1000. FBS has also introduced a crypto account, and the minimum deposit requirement is very low, starting from $1. Traders who are reluctant to start trading with big or small investments can also choose a demo account for their initial trading experience.

Account Types

FBS offers a wide range of account types to customize the trading experience for its clients. Each specification of an account type is tailor-made, keeping in mind the various kinds of traders and their trading needs. The account types are as follows:

#1. Cent Accounts

Cents accounts are specially created for low-budgeted and inexperienced traders who are uncertain of their future in trading and are reluctant to invest money. Therefore cent accounts are low-cost trading opportunities for such people to do trading with minimal or no investment.

The cent accounts come with a minimum deposit of $1 and no commission fee. Even with the low price, the cent account offers the same trading features as other accounts, such as fast market executions, maximum opening position, and order volume from 0.01 to 1000 cents. The leverage is a little low up to 1:1000, and the spreads are floating 1 pip compared to other account types.

#2. Micro Accounts

The micro accounts are one step higher than the cent accounts on the trading ladder. It starts with an initial deposit of $5, with high leverage of up to 1:3000, and there is no commission fee in this account type. Besides this, the order volume, fast market execution, and maximum opening positions are the same as the cent account.

The only drawback of this account is that it offers fixed spreads from 3 pops which would not work in favor of professional traders or big investors who are looking for the tightest spreads in the market to gain maximum profits.

#3. Standard Accounts

The standard account can be opened by depositing $100 and provides floating tight spreads starting from 0.5 pips. Moreover, there is no commission on this account, and users can avail high leverage of 1:3000. The order volume and speed of order execution are the same as the micro account.

The standard account is ideal for day and retail traders looking for a tight spread with fast executions at a zero commission rate. Such trading condition is ideal for making profits in the forex market when the ask and bid difference is meager, and the trading cost is minimal.

#4. Zero Spread Accounts

FBS ensures that all types of traders and investors are catered to through their platform; therefore, for professional and experienced traders, there is a zero-spread account. Investors with massive trading investments seek narrow spreads from 0 pips with ultra-speed order executions. These features enable the traders to be in a position to earn huge profits. Therefore the zero spread accounts are customized for such traders.

However, this advantage of zero spreads comes with a price. Unlike other accounts, the zero spread account also has a commission fee starting from $20 per lot and a minimum deposit of $500. Besides this, all the other features, such as lot size and order speed, are similar to other account types.

#5. ECN Accounts

FBS is among the few brokers offering ECN accounts for seasoned traders and investors. ECN accounts enable traders to reach the liquidity providers directly without any intervention of a middleman. For this reason, more than any other account, ECN account holders need the narrowest spreads and super fast executions to make the most of this automated trading system.

The minimum deposit amount for ECN accounts is a whooping $ 1000, and the commission rate is a fixed $ 6 per lot. Moreover, this account has no trading limit, and traders can trade at floating spreads of 1 pip. The leverage is lowest in this account type which is 1:500.

#6. Crypto Accounts

FBS recently added a crypto account to its list of account types. This makes FBS a complete trading service provider with a popular range of trading assets. For crypto accounts, the minimum deposit is $ 1 with a floating spread from 1 pip. Moreover, the commission rate is 0.5% for opening and 0.5% for closing positions. The leverage is up to 1:5 with fast market execution from 0.3 seconds. Crypto accounts are available on the FBS trader app.

FBS Customer Reviews

|

|

|

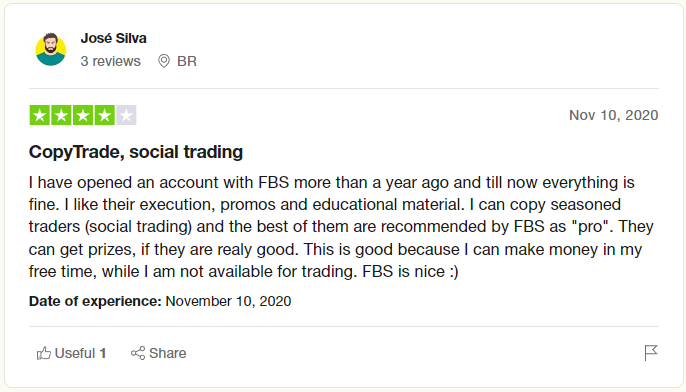

The majority of customer reviews about FBS that we came across were positive. The customers liked the overall trading experience with FBS. Most customers judge brokers through their withdrawal methods. For this reason, clients praised FBS for its easy cashback procedures. Some also highlighted that the tight spreads offered by FBS led to profitable trading, and the customer service of FBS was very responsive and solved their issues immediately.

Moreover, the copy trading feature offered by FBS is appreciated by existing customers as it makes trading more convenient and accessible due to its copy trading options. Similarly, copy trading and social trading also allow traders to earn passive income.

In contrast, some negative remarks, including the slow or delayed withdrawal procedure, were also observed. The reviews also suggested that traders complained that customer support turned a deaf ear and was not processing the withdrawal payments.

FBS Spreads, Fees, and Commissions

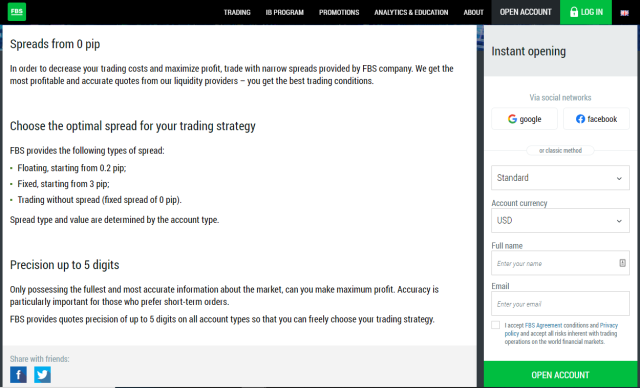

FBS offers different spreads for its multiple account types. Nonetheless, most of the account types have to offer tight spreads to provide maximum benefits to the traders. The spreads for the cent account have a floating 1 pip and a floating 0.5 pip for the standard account.

Then there are the ECN and zero spread accounts, which offer the narrowest pips in the financial market. As the name suggests, the zero-spread account has the narrowest spreads starting from 0 pips, whereas, for the ECN accounts, there is a floating 1 pip.

There are no additional fees other than the commission charges and withdrawal charges. The cent, micro and standard accounts are commission free, whereas the ECN and Zero spread accounts have a commission rate of $6 and $ 20 per lot, respectively.

Deposit and Withdrawal

All widely used payment methods are available to deposit and withdraw money at FBS. These include traditional bank transfers, master and visa cards, modern e-wallets, and other online payment options, including Neteller, Skrill, Sticpay, etc. Bank transfer usually take 4 to 5 business days to complete transactions; however, other payment methods take up to 48 hours.

The information given on the official website of FBS states the following commission fees on withdrawals. For Visa cards, a commission of $1; for bank transfers, there is no commission by the brokerage firm, but third-party charges may apply. There are different commission rates for each payment company in online payment methods. More information can be found on the FBS website.

How To Open a FBS Account – Step by Step Guide

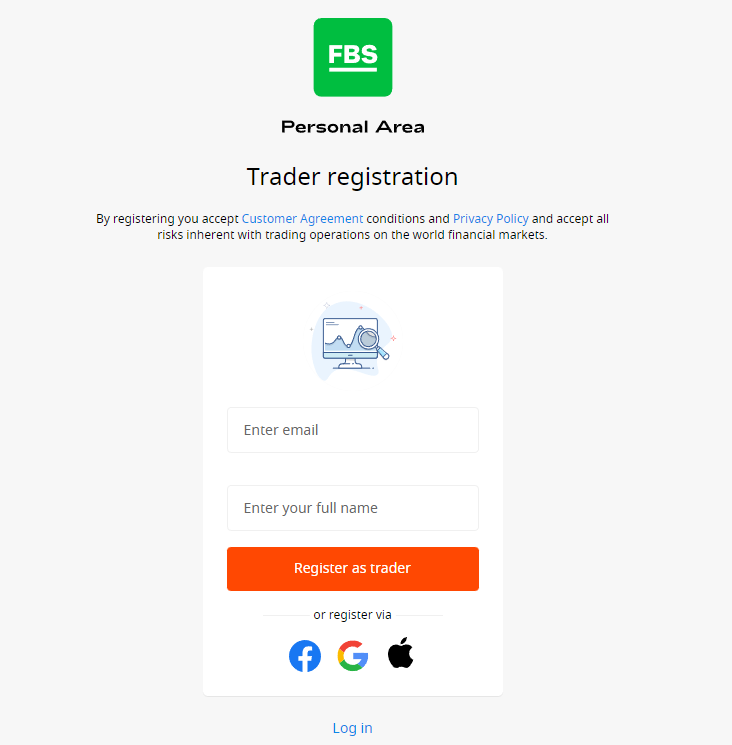

Opening a trading account on FBS is pretty simple. The first step is to visit the official website of the firm. Here users can find more information about what they are specifically looking for in the firm. After exploring the website, the user can decide whether the firm fits their trading needs.

The second step is to click on the top-right tab, which says “open account.” Once the user clicks on that tab, they will be taken to the account registration page. Once all the required information is filled in on the form, the user can click on the “Open account” tab at the bottom. The next page will ask for more specific information for the final registration step, such as passport number, etc. After this, a verification link will be sent to the user’s email, where the login details of the ID password will be shared.

The Last step is to go again to the landing page of the FBS website and, this time, click on the ” log in” tab. Enter the ID and password on the website and click log in. Now the personal trading account will be signed in where users can replenish, download or launch a trade according to their will.

FBS Affiliate Program

There are a few affiliate programs available for customers on the FBS platform. The first one is the corporation program. This is a standard affiliate program where each new client is rewarded with a 100% deposit bonus. Moreover, clients can also choose to take a percentage of trades rather than a bonus.

CPA is another program promoted by FBS. However, this one is specifically intended for social media markets and related personnel who would advertise FBS as a reputable brokerage firm on their platforms. Each partner would review earnings from FBS based on certain terms and conditions.

There is also an FBS IB program which is quite promoted even on the FBS website. This program is introduced for business promotions where individuals can open a franchise of FBS and can generate income of up to $ 80 per lot traded by their clients. FBS would financially support and promote the developmental stages of the business of this new partner.

FBS Customer Support

Customer support is an integral part of the success of any online brokerage firm. As customers are not physically linked up with the broker, strong virtual customer service is of utmost importance. Therefore, many brokers lose clients not because of their poor trading services but due to inadequate customer support.

FBS provides multiple communication methods for its customers to contact the broker whenever they want. Customer service is available 24/7 through various communication methods. These methods include Live chat, Call back service, and numerous social media platforms, including news and updates on Facebook, Twitter, LinkedIn, Youtube, etc. Additionally, multiple social media platforms for communication, such as WhatsApp, Telegram, WeChat, and others, are also available to get linked with FBS.

Besides this, FBS claims to provide customer support in multiple languages to facilitate customers from around the globe. Similarly, the broker claims to have a customer support team of financial experts and professionals to solve technical issues instantly. Despite all these facilities, the customer review indicated that the customer support team of FBS is not responsive.

Advantages and Disadvantages of FBS Customer Support

| Advantages | Disadvantages |

|---|---|

|

|

FBS Vs Other Brokers

As numerous brokerage platforms are available in the financial markets, it becomes very difficult to choose one. However, each broker has something different from other firms. Some specialize in ECN accounts; others are best for forex traders. Similarly, there are brokers who are ideal for professional traders, while other brokers provide the best trading conditions for a novice trader.

For this reason, to understand FBS better, it is important to make comparisons of FBS traders with other top brokers in the market. This would give a clear understanding to the reader about where FBS stands and what position it holds compared to its business rivals.

#1. FBS vs Avatrade

AvaTrade is an all-rounder trading platform that is also considered to be the best place for forex trading. The top financial authorities regulate the company, and it is a safe and secure trading partner. With a user-friendly interface and transparent fee structure, AvaTrade has been able to shift millions of customers worldwide in its domain.

When we compare FBS with AvaTrade, it is obvious that there are a lot of differences between the two firms. First, the range of trading instruments at Avatrade is far more than FBS. Therefore, customers would prefer a trader who could offer them a diversified portfolio.

Another difference is that Avatrade provides an overall low-cost trading experience, including commission-free trading and covering the cost of withdrawal and deposit charges. For these reasons and others, AvaTrade is a better option for traders than FBS.

#2. FBS vs RoboForex

Roboforex is yet another online brokerage firm that has taken place in the top rate brokers in the forex market. Roboforex is mostly popular for being the best platform for beginners. The simple and easy-to-use platform is ideal for novice traders who do not have the know-how of trading platforms. Moreover, the broker also focuses on integrated education resources, advanced tools, and prompt customer service to encourage inexperienced traders.

FBS and Roboforex are two brokers who have completely different trading approaches. Even when FBS provides all types of trading features, the broker is more beneficial for professional traders and investors than new and inexperienced ones. There are few educational resources or training programs on FBS, and the platform requires some trading knowledge before subscription.

#3. FBS vs Alpari

Alpari is among the few traders with a long history of over 2 decades in the financial industry. Alpari started off as a traditional broker and transformed into an online brokerage firm providing the best trading conditions through its immense experience in the financial markets. Alpari is an online and competitive broker offering the most advanced features, such as copy trading and binary options trading.

In many ways, FBS and Alpari offer the same trading features and services. So both firms are identical in their multiple account types, advanced MT4 and MT5 platforms, automated features, ECN accounts, multi-tier regulation, and copy trading. However, traders who are specifically looking to trade in binary options will have to choose Alpari over FBS, as binary options trading is not available on the FBS platform.

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: FBS Review

The best brokers in the financial market are the ones that provide complete trading solutions for traders. Therefore, some brokers have made their mark among the customers and are getting more and more clients due to their performance. However, as new technologies kick in, new trading features are introduced, and some new companies would take the place of the old monopolized ones.

In such a scenario, online brokerage firms that keep their services updated with time are the only ones that would survive the test of time and stay at the top of their field. Among many such brokers struggling to be at the top of the industry, FBS is one such name. FBS started as a small firm with limited trading features; however, FBS integrated all the advanced features with time. For this reason, FBS has been successful in making its place in the most competitive market.

In the current scenario, FBS offers all major trading assets, including the popular cryptocurrencies that are also added, which were unavailable before. So it is obvious that FBS is constantly updating its services to compete with other competent brokers. Moreover, in 2021, FBS was also licensed and regulated by top-tier financial authorities, including AISC Australia and IFSA (South Africa), to add FBS to the most reliable and secure brokers list.

Other than this, FBS also has many other advantages, such as the provision of ECN accounts, Zero spread accounts, fast speed market executions, tight spreads, zero commission in major accounts, low minimum deposits, and most importantly, a regulated platform. Additionally, FBS also provides freedom to traders by allowing all kinds of trading strategies, including EAs and Hedging.

To sum up, we can say that FBS is a reliable platform that offers effective trading conditions and is still pursuing being the best trading platform in the industry. However, if you are someone who is looking for the best services and most advanced features, then there are many other options in the market.

FBS Review FAQs

Can FBS be trusted?

FBS can be trusted as it offers multiple layers of protection. Firstly it is regulated by not one but three financial regulators that assure the firm’s reliability. Additionally, FBS provides investor insurance funds to customers as compensation for any financial crisis. Then there is also the feature of negative balance protection available, which safeguards traders from massive losses. Finally, the FBS segregated funds account also give the clients added security.

How long does FBS withdrawal take?

The withdrawal procedure varies according to the payment methods. For bank transfers, the standard duration is 3 to 5 business days. However, for other payment methods such as Visa and Master cards and e-wallets, the procedure time given by the broker is 48 hours. However, it should be noted that the time duration may vary and should not be expected to be precise, as indicated by the broker.

How much is FBS withdrawal fee?

The withdrawal fee for bank transfers is not mentioned on the website; however, it is indicated that the third-party standard bank charges will be applied to bank withdrawals. For Visa and Master cards, the withdrawal fee charged by the broker is $ 1 per transaction. Other online payment options have different charges; for instance, Neteller has a 30$ commission per transaction, whereas, for SticPay, no commission fee is given, Skrill has a 1% commission rate, and Perfect money has a 0.5% commission rate.

Traders can choose any one option which works best for them and would cost the least commission charges. However, it should also be noted that there are multiple brokerage firms that do not charge any commission and cover all the payment charges.

Dumb Little Man Recommends - Top 3 Best Forex Brokers in 2023 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.