Errante Review 2024 with Rankings By Dumb Little Man

By Wilbert S

April 7, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 129th  |   |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Errante as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Errante Review

Forex brokers play a crucial role in the global financial markets, acting as intermediaries that allow traders and investors to buy and sell foreign currencies. Errante, an international broker, established its operations in 2019 and gained regulatory status from the Cyprus Securities and Exchange Commission in March 2020. This underscores Errante’s commitment to providing a secure and regulated trading environment.

This review aims to offer a comprehensive examination of Errante, highlighting its unique selling propositions and identifying any potential shortcomings. We intend to furnish readers with vital details, including account options, deposit and withdrawal processes, commission structures, and more. By merging expert analysis with feedback from actual users, our goal is to deliver a balanced view that aids in making an informed decision about choosing Errante as your brokerage service provider.

What is Errante?

Errante is a Forex broker that holds registration in both Cyprus and the Seychelles, showcasing its global footprint and adherence to regulatory standards. It facilitates the trading of widely traded assets, employing the popular MT4 and MT5 platforms. This broker stands out for its inclusive approach, welcoming clients from across the globe, except from countries like the USA, Canada, Belgium, and a few others where restrictions are in place.

The broker offers a variety of account types, catering to a broad spectrum of traders. Errante features three retail trading platforms: the well-known MetaTrader 4 and MetaTrader 5, along with cTrader. Its competitive fees, particularly on share CFDs and some indices, position it as an attractive option for traders looking to minimize costs.

Errante sets itself apart with an advanced copy trading feature and informative educational webinars, making it an appealing choice for those keen on learning while trading. The services provided by Errante are deemed highly suitable for day traders and support automated trading, offering flexibility for various trading strategies and preferences.

Safety and Security of Errante

After a thorough analysis conducted by Dumb Little Man, the safety and security of Errante have been closely examined. Errante, a trademark of the Errante Group, operates through two distinct entities. Notely Trading Ltd, catering to European clients, is rigorously regulated by the Cyprus Securities and Exchange Commission (CySEC). This regulation ensures that all client investments from the EU are safeguarded, with protection up to a sum of €20,000 by the Investors Compensation Fund.

Outside of Europe, Errante Securities (Seychelles) Ltd serves traders from various other regions, operating under the supervision of the Seychelles Financial Services Authority (FSA). This dual regulatory framework highlights Errante’s commitment to maintaining a transparent and secure trading environment. Furthermore, Errante’s financial performance is publicly available, offering an additional layer of transparency to clients.

It is noteworthy that the regulatory bodies overseeing Errante do not impose restrictions on the use of electronic payment systems for depositing and withdrawing funds. This flexibility in financial transactions contributes to the overall convenience and accessibility of Errante’s services, making it a secure and user-friendly option for traders globally.

Pros and Cons of Errante

Pros

- Regulated by CySEC

- Multiple trading platforms available

- Support for copy and algorithmic trading

- Educational webinars offered

- Variety of currency pairs

- Flexible leverage options

- Diverse account types

Cons

- Limited range of trading instruments

- Limited research tools

- CopyTrade service restricted to non-EU residents

- No cent accounts available

Sign-Up Bonus of Errante

Errante offers a sign-up bonus to attract new clients, scaling the bonus percentage with the amount of the initial deposit. For first-time deposits ranging from $50 to $500, clients receive a 15% bonus. The bonus percentage increases to 20% for deposits between $501 and $1,500, 25% for amounts between $1,501 and $3,000, and peaks at 30% for deposits ranging from $3,001 to $7,000. This tiered bonus structure is designed to accommodate a wide range of traders, from those making modest initial investments to more substantial depositors.

To qualify for this deposit bonus, individuals must be new clients with a minimum deposit of $50. It’s imperative that the account is fully verified before the bonus is credited, ensuring compliance with regulatory standards and the broker’s internal policies. Importantly, Errante allows traders to withdraw profits from their trading activities at any time, without any restrictions. This policy underscores the broker’s commitment to providing flexible and trader-friendly conditions, enhancing the overall attractiveness of their bonus offer.

Minimum Deposit of Errante

The minimum deposit requirement for opening an account with Errante is set at €50/$50. This accessible entry point is designed to lower the barrier for new traders, making it easier for individuals from various financial backgrounds to start trading

Errante Account Types

Following a detailed investigation by our team of experts at Dumb Little Man, we have compiled a concise overview of the trading account types offered by Errante. This information is gleaned from thorough research, designed to aid potential traders in making informed decisions.

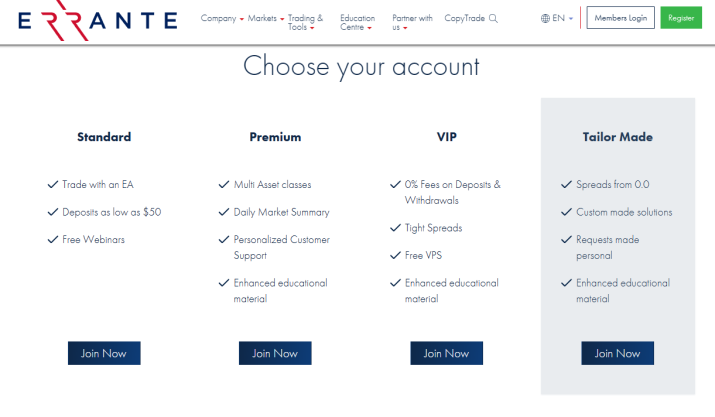

- Standard Account: This account features spreads beginning at 1.8 pips and requires a minimum deposit of €50. Notably, it carries no commission per lot, making it an appealing option for those new to Forex trading or looking for straightforward cost structures.

- Premium Account: With a minimum deposit of €100, this account eliminates additional trading commissions. Spreads start at a lower benchmark of 1 pip, catering to traders seeking tighter spreads without the burden of extra fees.

- VIP Account: Tailored for more experienced traders or those with higher capital, the VIP account sets its first deposit requirement at €5,000. It boasts the more competitive minimum spread value of 0.8 pips and exempts users from other transaction fees, aligning with the needs of serious traders looking for premium trading conditions.

- Tailor Made Account: This is an ECN account, distinguished by its spreads starting from 0 pips and the inclusion of a commission per lot. It is designed for high-volume traders, requiring a minimum deposit of €15,000. This account type offers the most direct access to market prices and is suited for sophisticated investors seeking an edge through lower spreads.

Errante Customer Reviews

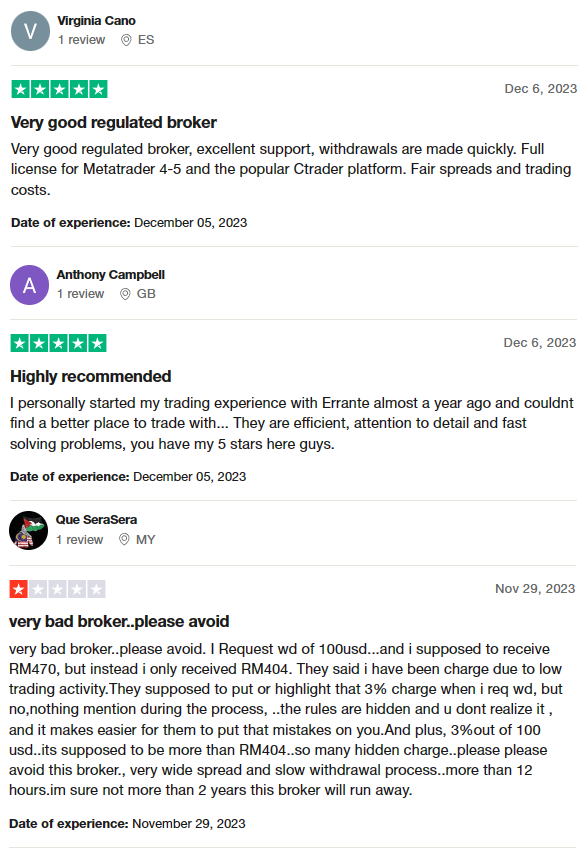

Customer reviews of Errante present a mixed picture, highlighting both the strengths and areas for improvement. Many users praise the broker for being a well-regulated entity, offering excellent support, and ensuring quick withdrawals. Its full license for Metatrader 4-5 and the popular Ctrader platform, along with fair spreads and trading costs, are frequently commended attributes. Several traders have expressed satisfaction with Errante’s efficiency, attention to detail, and prompt problem-solving capabilities, earning high marks from those individuals.

However, not all feedback is positive. Some customers have experienced dissatisfaction, citing issues such as hidden charges and slow withdrawal processes. One particular grievance involved a withdrawal request where the received amount was significantly less than expected, attributed to charges for low trading activity not clearly communicated upfront. Complaints about wide spreads and concerns over the transparency of fees have also been noted, suggesting that while Errante has many satisfied clients, there are areas where the broker could enhance its services to better meet trader expectations.

Errante Fees, Spreads, and Commissions

Errante structures its trading fees, spreads, and commissions to accommodate a range of trading strategies and account types. The broker primarily uses spread as the mandatory type of trading commission. For Standard accounts, spreads begin at 1.8 pips, which narrows to 1 pip for Premium accounts and further to 0.8 pips for VIP accounts. The Tailor Made accounts offer spreads starting from 0 pips, with an additional commission per lot, which varies based on the client’s country and trading volume.

Withdrawal commissions are also part of Errante’s fee structure. For e-wallet withdrawals, a 1% commission of the payment amount is charged. Cryptocurrency withdrawals incur a fee of $1, $2, or $5, depending on specific conditions at the time of the transaction. While bank fees may be applicable, Errante absorbs the costs for depositing funds. An inactivity fee of €5/$5 is levied on accounts that remain dormant for 12 months. Additionally, for positions that are held overnight, a swap commission is applied, except for swap-free (Islamic) accounts, which can be requested by the trader.

Deposit and Withdrawal

A trading professional at Dumb Little Man tested the deposit and withdrawal processes of Errante, providing insights into their efficiency and range of options. Errante clients have the flexibility to withdraw funds through a variety of channels, including bank account, credit or debit card, Skrill, or Neteller. For traders outside the EU, there’s the added option to withdraw in cryptocurrencies via SticPay, Perfect Money, Advcash, and local e-wallets, broadening accessibility for international clients.

The minimum withdrawal amount varies by method: €100 or $100 for bank transfers, €20 or $20 for cards and e-wallets, and $50 (XRP, USDT-TRC20) or $100 (USDT-ERC20, BTC, ETH) for cryptocurrencies. This tiered structure ensures a degree of flexibility in managing funds. Withdrawal requests are processed Monday through Friday, from 9:00 to 18:00 (GMT+2), with funds typically credited within 1 business day for cards, e-wallets, and crypto wallets, and 2-4 days for bank accounts, highlighting Errante’s commitment to prompt service.

A notable policy applies when a client seeks to withdraw more than 80% of their deposit within 48 hours of the transaction, with less than two lots traded. In such cases, Errante withholds 5% of the requested amount as a commission. This commission decreases to 3% if more than 48 hours have passed, a measure designed to encourage trading activity and maintain a balance between accessibility and the broker’s operational needs.

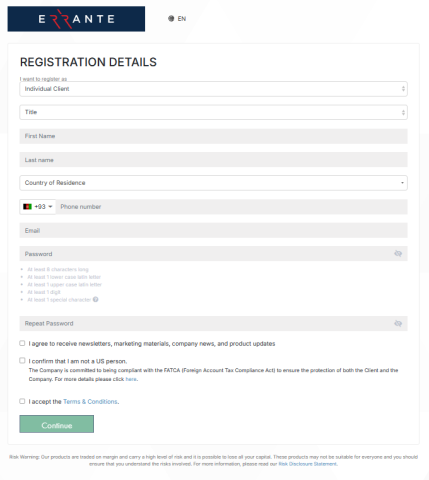

How to Open an Errante Account

- Click Register or Join Now to initiate the account opening process with Errante.

- Complete the form with details such as last name, first name, phone number, and email.

- Specify your country of residence and create a password for account access.

- Check your email for a PIN code sent by Errante for first-time account authorization.

- Enter the PIN code in the registration form as directed.

- Log in to your user account using your email address and password.

- Follow any additional instructions provided by Errante to finalize your account setup.

- Verify your identity and address by submitting the required documentation as requested by Errante.

- Once verified, you are ready to start trading with your new Errante account.

Errante Affiliate Program

Errante offers an affiliate program designed for traders outside the European Union through its Introducing Broker (IB) system. Participants in this program can earn a referral fee by directing new clients to Errante. The broker compensates IBs with a portion of the commission from trades executed by the individuals they refer. However, it’s important to note that this affiliate opportunity is not available to clients residing in the European Union, reflecting regulatory compliance and geographic limitations on the program’s availability.

Errante Customer Support

Based on the experience of Dumb Little Man, Errante Customer Support offers multiple channels for clients to reach out for assistance. Customers can call the numbers provided in the contact section, send an email directly to the company, engage through LiveChat, or fill out a contact form via email. These diverse options ensure that clients have various ways to communicate with Errante, catering to different preferences and needs.

Additionally, Errante allows clients to create a ticket within their user accounts, providing a detailed description of any issue they encounter. This system is designed to streamline the resolution process, making it easier for the customer support team to address and solve problems efficiently. The availability of multiple contact methods and the ticketing system underscores Errante’s commitment to delivering robust and responsive customer support.

Advantages and Disadvantages of Errante Customer Support

| Advantages | Disadvantages |

|---|---|

Errante vs Other Brokers

#1. Errante vs AvaTrade

Errante and AvaTrade differ significantly in their offerings and global reach. While Errante is known for its varied account types and focus on providing competitive spreads and a range of platforms like MT4, MT5, and cTrader, AvaTrade distinguishes itself with a broad array of over 1,250 financial instruments and a strong regulatory framework across multiple jurisdictions. AvaTrade’s long-standing presence since 2006 and commitment to client education and support cater to both novice and experienced traders globally, except in the US. On the other hand, Errante’s newer entry into the market focuses on leveraging technology to offer tailored trading experiences.

Verdict: For traders seeking a broad selection of instruments and robust regulatory security, AvaTrade might be the better choice. However, for those prioritizing a variety of platform choices and competitive trading conditions, Errante offers compelling features.

#2. Errante vs RoboForex

Errante and RoboForex offer distinct advantages depending on a trader’s needs. RoboForex shines with its extensive range of over 12,000 trading options across eight asset classes and a variety of platforms including MetaTrader, cTrader, and RTrader. Its focus on technology and flexible trading conditions cater well to traders with diverse strategies and experience levels. Errante, while offering a more focused range of platforms and instruments, emphasizes competitive spreads and customer support.

Verdict: For traders who value a wide selection of assets and platform options, RoboForex stands out. However, for individuals looking for tailored account types and competitive spreads, Errante may be more appealing.

#3. Errante vs FXChoice

Comparing Errante with FXChoice reveals differences primarily in market experience, regulatory environment, and trading conditions. FXChoice, established in 2010 and regulated by the International Financial Services Commission of Belize, focuses on serving active and passive traders with a preference for classic and ECN accounts. Its offerings are well-suited for experienced traders, given its emphasis on tight spreads and professional trading conditions. Errante, on the other hand, provides a broader range of account types and access to popular trading platforms, catering to a wide spectrum of traders.

Verdict: For seasoned traders seeking ECN accounts and a focus on automated trading, FXChoice presents a compelling option. However, traders looking for flexibility in account types and platform options might find Errante to be a better fit, especially those newer to the Forex market.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For those deeply interested in forging a rewarding career in forex trading and aiming for significant financial achievements, Asia Forex Mentor is the premier destination for top-tier forex, stock, and crypto trading courses. Ezekiel Chew, celebrated for his contributions to trading institutions and banks, leads Asia Forex Mentor with his exceptional trading record, notably securing seven-figure trades. This level of success distinctly elevates him above his peers in trading education. The reasons we advocate for Asia Forex Mentor are compelling:

Comprehensive Curriculum: Asia Forex Mentor delivers a thorough educational program encompassing stock, crypto, and forex trading. The curriculum is designed to arm budding traders with the essential skills and knowledge to thrive in these varied markets.

Proven Track Record: The reputation of Asia Forex Mentor is solidly backed by its history of cultivating consistently profitable traders in different market segments. This record attests to the efficacy of their educational and mentoring approaches.

Expert Mentor: Students at Asia Forex Mentor receive mentorship from an accomplished mentor, Ezekiel, who has achieved significant success in the realms of stock, crypto, and forex trading. His tailored guidance helps students confidently tackle the complexities of the markets.

Supportive Community: Membership in Asia Forex Mentor grants access to a community of ambitious traders seeking success in stock, crypto, and forex markets. This community encourages sharing of ideas and collaborative learning, enriching the educational journey.

Emphasis on Discipline and Psychology: A disciplined mindset is crucial for trading success. Asia Forex Mentor emphasizes psychological training to aid traders in managing emotions, coping with stress, and making sound decisions under pressure.

Constant Updates and Resources: Recognizing the dynamic nature of financial markets, Asia Forex Mentor keeps students informed with the latest trends, strategies, and insights. Ongoing access to resources ensures traders remain competitive.

Success Stories: Numerous success stories from Asia Forex Mentor underscore the transformative impact of their comprehensive education in forex, stock, and crypto trading, leading many to financial independence.

Asia Forex Mentor stands out as the ideal choice for individuals desiring the finest education in forex, stock, and crypto trading, aiming for a prosperous career and financial success. With its broad curriculum, experienced mentoring, practical training approach, and a supportive community, Asia Forex Mentor equips aspiring traders for success in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Errante Review

In conclusion, the team of trading experts at Dumb Little Man has conducted a comprehensive review of Errante, revealing a brokerage that offers a compelling mix of services for forex traders. With a strong regulatory foundation and a variety of account types, Errante caters to traders at different levels of experience and with varying trading strategies. The availability of popular trading platforms like MT4, MT5, and cTrader, alongside competitive spreads and no commission on certain accounts, positions Errante as an attractive option for those seeking to engage in the forex market.

However, it’s important for potential clients to consider the limitations noted in our review. The narrow selection of instruments and restricted research tools may limit some traders. Additionally, the CopyTrade service’s unavailability to EU nationals and the absence of cent accounts could be significant drawbacks for certain investors.

>> Also Read: Admiral Markets Review 2024 with Rankings By Dumb Little Man

Errante Review FAQs

Is Errante a regulated broker?

Yes, Errante is a regulated broker, providing a secure trading environment for its clients. It operates under the supervision of the Cyprus Securities and Exchange Commission (CySEC) for services offered to European clients and is also regulated by the Financial Services Authority (FSA) in the Seychelles for international clients. This dual regulation ensures that Errante adheres to strict financial standards and practices, offering traders peace of mind regarding the safety of their investments.

What types of accounts does Errante offer?

Errante offers a range of account types to suit various trader needs, including Standard, Premium, VIP, and Tailor Made accounts. The Standard account is ideal for beginners with no commission and spreads starting at 1.8 pips. The Premium and VIP accounts offer tighter spreads for more experienced traders, and the Tailor Made account is designed for high-volume traders with spreads starting from 0 pips and a commission per lot. This variety allows traders to choose an account that best fits their trading style and financial goals.

Can I trade cryptocurrencies with Errante?

Yes, traders can engage in cryptocurrency trading with Errante, along with forex, stocks, and other instruments. Cryptocurrency trading is available through the same trading platforms as other assets, including MT4, MT5, and cTrader. This offers traders the flexibility to diversify their portfolios by including cryptocurrencies, a market known for its volatility and potential for significant returns. However, traders should be aware of the risks involved in trading cryptocurrencies and proceed with caution.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.