Elite Trader Funding Review with Rankings 2024 By Dumb Little Man

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

3.0 3.5/5 | 33rd  |  |

| Evaluation Criteria |

|---|

The specialized team at Dumb Little Man, known for their expertise in finance and trading, excels in comprehensive evaluations of proprietary trading firms. They use a detailed algorithm and strict evaluation criteria, focusing on crucial areas for in-depth analysis. These include:

|

A “Prop trading firm”, also known as a prop firm, gives people a way to trade the company's capital and divide gains while reducing their own financial risk. These businesses boost the potential for profit by providing traders with access to more capital than they do.

Elite Trader Funding stands apart in this sector. Three seasoned professionals started this company to empower individual traders and promote successful discipline. Because they understand the challenges of starting from scratch, Elite Trader Funding offers traders a unique opportunity to grow and prove their skills without having to risk their personal funds.

This Elite Trader Funding review will offer a detailed evaluation based on comments from users and trading guidance from Dumb Little Man's experts. Giving readers a well-informed perspective on the company's offerings and performance in the prop trading world is the aim.

What is Elite Trader Funding?

A new one-stop shop for traders looking for financial opportunities is called Elite Trader Funding. The company is committed to finding and developing such talent since it understands how important it is to collaborate with experienced traders.

They take a supportive stance and don't burden traders with undue fees because they recognize that trading entails risks and mistakes.

An important perk for novice traders is that this cutting-edge platform lets them keep all of their first $12,500 in profit. Elite Trader money allows traders to demonstrate their skills in virtual trading settings and win live money. This method provides a useful and risk-free technique to exhibit trading intelligence.

The guiding principles of Elite Trader Funding are simplicity and flexibility. Their lowest needs are to manage drawdowns, demonstrate profitability, and trade for a minimum of five days, in contrast to many other businesses that have stringent regulations. Because of its simplicity, traders may concentrate on improving their skills without getting sidetracked by complex regulations.

This prop trading firm does not set trading schedules since it values trader autonomy. Even on holidays, on special occasions, or when the market is impacted by noteworthy news events, traders are free to trade whenever it is most convenient for them.

This flexibility, along with futures trading's benefit of leverage, presents traders with a rare chance to maximize earnings while lowering personal financial risk. Elite Trader Funding allows novice and experienced traders to leverage the capital of the company, greatly easing the anxiety that comes with potential personal financial loss.

Pros and Cons of Elite Trader Funding

Pros:

- Different assessment schemes

- Unambiguous withdrawal guidelines

- Adaptable assessments

- Structure focused on growth

- Daily rewards

- Several avenues for support

Cons:

- Stringent guidelines for drawdown

- Not trading during the night

- Rule compliance is required

- Intricate support structure

- The necessity of methodical approaches

Safety and Security of Elite Trader Funding

Elite Trader Funding as a prop firm has shown how seriously it takes security and safety by putting in place several safeguards against dishonest behavior and unwelcoming services. Dumb Little Man conducted extensive research to obtain this data, indicating the company's dedication to upholding a safe trading journey and environment.

For these reasons, the company has a stringent address verification process in place. By lowering address mismatches—which are typically connected to fraudulent activity—it seeks to stop fraud. Strict inspection is also required to comply with regulations and uphold moral and legal standards.

It is significant because it shields the Elite Trader Funding community from the dangers presented by dishonest behavior.

On this platform, providing multiple addresses or ones that don't match can have dire effects. A user's account will be immediately closed and banned if this is found out. To maintain the security and integrity of Elite Trader Funding's services, a stringent methodology is required.

Another key component of Elite Trader Funding's security plan is prohibiting risky services. The company is fiercely opposed to any services that compromise its review process or allow unapproved payments, including paid services meant to pass assessments or fast payout scams.

This restriction is required to safeguard the platform's integrity and guarantee that all activities adhere to moral and legal requirements.

Elite Trader Funding's dedication to safeguarding legitimate users is evidenced by its zero-tolerance stance regarding accounts associated with fraudulent services. Multiple accounts linked to these types of activity are immediately prohibited and closed in order to protect the public and create an atmosphere that promotes ethical trading.

Elite Trader Funding Bonuses and Contests

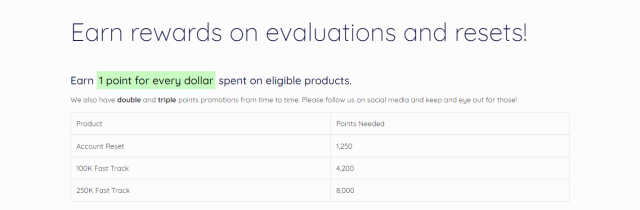

Clients of Elite Trader Funding can take advantage of an exciting rewards program that emphasizes evaluations and account resets. Trades give traders one point for every dollar spent on qualified products. Redeeming these points entitles you to a variety of trade rewards. This strategy promotes platform investment and active engagement.

Elite Trader Funding occasionally offers double and triple-point bonuses to increase interest. These promos give traders a great chance to increase the rate at which they accrue points. It's simple for traders to stay informed about these deals; all they have to do is follow Elite Trader Funding on social media and keep an eye out for updates.

Points can be redeemed easily and customized to meet various trading requirements. For example, resetting an account costs 1,250 points, whereas major goods like the 100K and 250K Fast Track cost 4,200 and 8,000 points, respectively.

Traders can carefully spend their points for services that best fit their trading experience thanks to this tiered approach.

Elite Trader Funding Customer Reviews

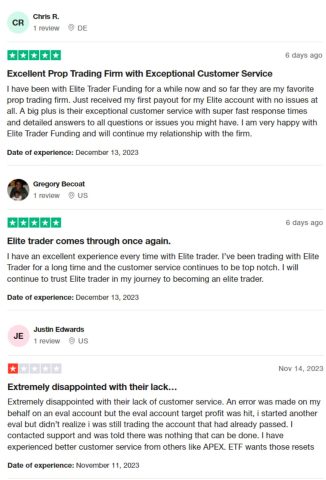

As of right now, Elite Trader Funding, a prop trading company, has a 4-star rating on Trustpilot, which suggests a variety of customer experiences. Some clients give the business high marks for its attentive customer care, prompt response times, and thorough support.

These traders are happy with their continued partnership with the company and report having had trouble-free transactions, including payouts. However, some consumers have had difficulties, especially when attempting to resolve account-related errors through customer service.

There has been some disillusionment as a result of these events, with parallels to other companies like APEX. A wide variety of user experiences with Elite Trader Funding are reflected in this mixed feedback.

Elite Trader Funding Commissions and Fees

A comprehensive overview of commissions and costs related to trading futures products is provided by Elite Trader Funding. Exchanges including CBOT, CME, COMEX, NYMEX, and SMFE are supported by them. It is easy to find comprehensive information about instruments and the commissions associated with them.

After the first $12,500, ETF traders pocket an amazing 90% of all earnings. Furthermore, there's a $75 optional assessment reset cost. The payout policy aims to cultivate enduring bonds with dealers. Traders must fulfill certain trading day conditions and make gains that match or surpass a predetermined threshold in order to be eligible for rewards. Payouts are done every day, with a $100 minimum withdrawal amount.

In terms of the payout procedure, traders who seek a payout are unable to make more transactions until the payoff has been verified, which normally takes less than a day. Crucially, Elite Trader Funding pays all payout fees and maintains the authority to allocate money in unusual situations.

There are also detailed tax duties for dealers. For US individuals working as independent contractors, the 1099-NEC form based on total payouts can only be obtained by filling out a W-9 form and keeping a current postal address. For any additional tax-related questions, it is recommended that you speak with a licensed tax professional.

Elite Trader Funding Account Types

Elite Trader Funding offers a variety of evaluation programs for traders with different strategies and risk tolerances.

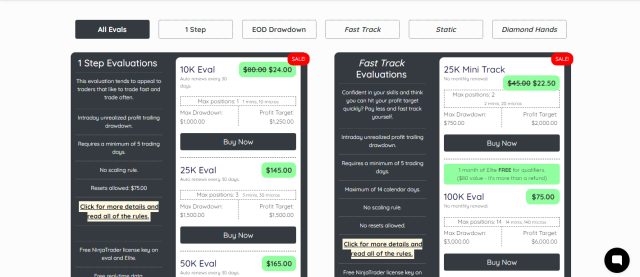

The 1 Step Evaluations, which have an intraday unrealized profit trailing drawdown, a minimum of 5 trading days, no scaling rule, and resets for $75.00, are perfect for traders who love to trade quickly and frequently. A 10K equity is valued at $24.00, while a 300K equity is valued at $655.00. All options have distinct maximum positions, drawdown limits, and profit objectives.

The Static Drawdown Evaluations feature no trailing drawdown, a minimum of 5 trading days, no scaling criteria, and a $75 reset. They also have a static maximum loss. For instance, the cost of the 150K Static Eval is $300.00, whereas the 100K Static Eval is $135.00.

The Fast Track Evaluations are designed with confident traders seeking immediate profit targets in mind. There is no scaling rule, no monthly renewal, a 14-day limit, and no resets permitted for these evaluations. The 250K Eval costs $150.00, while the 25K Mini Track starts at $22.50.

The End of Day Drawdown Evaluations include a daily loss cap and end-of-day trailing drawdown. These evaluations come with set maximum holdings, drawdown, and profit targets. They range in price from a 25K assessment at $275.00 to a 250K evaluation at $745.00.

Designed for traders who hold positions overnight and over weekends are the Diamond Hands Evaluations. The 100K Eval in this category is priced at $365.00.

All evaluations come with a free NinjaTrader license key, real-time data, and an $80.00 monthly fee upon qualification or a one-time activation. These diverse options cater to a wide range of trading styles and preferences.

Opening an Elite Trader Funding Account

The procedure of opening an account with Elite Trader Funding is simple and only requires a few important steps. Here's a quick start guide to get you going:

- From the available options, select the evaluation kind and amount that best suit your needs.

- Provide accurate personal information.

- To set up your account, enter your billing details.

- Agree to the no-refund policy, billing terms, and privacy policy.

- You accept the platform, technology, and data disclaimer.

- Choose a trading platform based on what you require.

- Finish the payment procedure for the evaluation you have chosen.

- Apply any promo codes that are available before completing the setup of your account and starting the assessment procedure.

Elite Trader Funding Customer Support

The customer service system at Elite Trader Funding is made to be easily reachable and effective, providing multiple avenues for support. Dumb Little Man's experiences indicate that their Contact Us area provides a clear and direct avenue for consumers to contact them with questions or concerns, guaranteeing an easy-to-follow communication path.

Furthermore, they offer a thorough Help Center that is furnished with tools and FAQs to tackle typical questions and difficulties. With this self-service option, traders can get the answers they need to their inquiries fast.

Additionally, Elite Trader Funding prop firm is always present on their Discord channel, allowing for instant communication and assistance. This platform provides a dynamic and cooperative support environment by allowing traders to interact with the support staff as well as the trading world.

Advantages and Disadvantages of Elite Trader Funding Customer Support

| Advantages | Disadvantages |

|---|---|

|

Elite Trader Funding Withdrawal Options

Elite Trader Funding offers structured withdrawal options for different account sizes and payout cycles. This information, tested by a trading professional at Dumb Little Man, outlines the payout structure and requirements.

The payout structure varies based on the funding amount and the number of payout cycles. For instance, if $10,000 is funded, the first payout cycle can be between $100 and $1,000. This amount can then increase in succeeding cycles, and after the fourth cycle, there is no minimum or limit. Higher funding levels result in an escalation of this system.

Each payout cycle requires traders to fulfill certain requirements to be eligible. A safety net that requires traders to make profits equal to the drawdown plus $100, a predetermined number of trade days, and adherence to the 40% consistency rule—which guarantees that the best trade day profit does not surpass 40% of the total balance—are some of these.

Once the trader satisfies the safety net, trading day, and consistency conditions, the payout procedure starts. A trader's daily withdrawal limit is as low as $100. Payouts are now processed daily, with requests received by 10 AM EST included in the day's payouts. This is a huge update. But before the money is issued, the KYC procedure must be finished.

If a trader does not withdraw the entire maximum amount during a cycle, the remaining amount does not carry over to the next cycle. For instance, if a trader withdraws less than the maximum limit in the first cycle, the remaining amount stays in the account but doesn't increase the maximum limit for the next cycle.

Elite Trader Funding Challenges and Difficulties

In Elite Trader Funding's EOD evaluations, the drawdown mechanism is based on the highest end-of-day balance, accompanied by an intraday loss limit calculated from the previous day's close. Exceeding this limit at any time during the trading day results in evaluation failure.

The same principle applies to Elite accounts, where once profits equal to drawdown plus $100 are earned, the account's minimum allowable balance becomes static, eliminating the daily loss limit. In both scenarios, strict adherence to these drawdown and balance rules is crucial to avoid account failure.

Traders are prohibited from holding trades overnight, with all positions required to be closed one minute before market closing time, which varies for different instruments. Failure to comply results in account failure and potential profit forfeiture.

Additionally, traders are required to operate within the maximum account positions that have been set, and infractions will result in comparable penalties.

Finally, trading low liquidity and volume contracts is prohibited, so only the highest volume and most current contracts should be exchanged. This ensures that only viable and active contracts are engaged.

How to Pass the Elite Trader Funding Evaluation Process

Because of its strict requirements, passing the Elite Trader Funding prop firm evaluation process necessitates careful navigation. You must equip yourself with the necessary information and strategies to improve your chances of success.

A crucial first step in this preparation is to enroll in an extensive training program, which provides the skills and knowledge required to successfully meet and navigate the evaluation's challenges. Using this method guarantees that you have all you need to pass the test.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Trading gurus at Dumb Little Man heartily propose Asia Forex Mentor for people sincerely hoping to pass the Elite Trader Funding evaluation. Thousands of successful traders have used this tool to navigate the assessment programs offered by their firms with success.

A well-known trading specialist with over 20 years of expertise, Ezekiel Chew founded Asia Forex Mentor, which is well-known in the trading community.

Ezekiel, who also serves as the leader of the Golden Eye Group, created the One Core Program with the express purpose of teaching forex traders effective trading techniques and profitable trading styles. He wanted to make his wealth of information, abilities, and trading experiences more widely available, thus he created Asia Forex Mentor.

Ezekiel began Asia Forex Mentor by teaching friends, and since then, he has expanded online to assist aspirational traders in their career advancement.

How Could Asia Forex Mentor Help You Pass Elite Trader Funding Challenge?

A reliable and helpful resource for traders trying to succeed in the Elite Trader Funding challenge is Asia Forex Mentor (AFM). The following honors and several illustrious distinctions provide as the basis for its legitimacy:

Best Comprehensive Course Offering Award: AFM’s One Core Program has been recognized by Investopedia, a leader in financial education, as the best comprehensive Forex course offered. This award acknowledges the program’s breadth and depth in satisfying a variety of learning demands.

Best Forex Trading Training: Benzinga, a reputable source of news on the financial, economic, and stock markets, named the One Core Program the best forex trading training for novices. Benzinga's support of the program highlights how beneficial it is for traders of all experience levels.

Best Forex Coach: The BestOnlineForexBroker website recognized Asia's Forex instructors the top tutors for Forex in 2021. Their gratitude shows how the strategy might assist traders in making big profits from FX trading.

Best Forex Trading Course Available: Renowned forex traders and platforms gave Forex Mentor great marks for its trading strategies and excellent trading system. This enhances its standing as a leader in the field of forex trading education.

These honors demonstrate how traders of all skill levels continuously receive more than they anticipate from Asia Forex Mentor's One Core Program. Because of its vast training programs and well-thought-out techniques, it is an invaluable resource for anyone trying to get past the Elite Trader Funding obstacle.

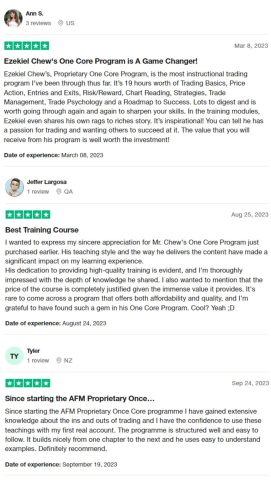

Asia Forex Mentor Members' Testimonials

Asia Forex Mentor program participants have expressed positive feedback on Ezekiel Chew's One Core Program, citing the curriculum's substantial impact on their trading skills. They highlight the course's extensive coverage of subjects including advanced trading strategies, trade psychology, and risk management in addition to its clear and well-organized structure.

With 19 hours of comprehensive instruction, the curriculum is highly praised for its exceptional training quality. Ezekiel's personal trading story is very beneficial to participants since it shows how excited he is about trading and helping others, and it is seen as inspirational.

Thanks to the knowledge and confidence the training has given them to handle an actual funded trading account, participants frequently remark that it was well worth the cost.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Elite Trader Funding Review

According to Dumb Little Man's trading experts, Elite Trader Funding is a suitable platform for seasoned traders since it provides a variety of assessment programs and clear withdrawal methods. Its strict rules, which forbid drawdown and overnight trading, should be known by traders.

All things considered, traders who are prepared to follow its strict rules and take advantage of the growth chances it offers should consider Elite Trader Funding. Getting the right advice, such as that provided by Asia Forex Mentor, may be essential to success on this platform.

>> Also Read: Glow Node Review with Rankings 2024 By Dumb Little Man

Elite Trader Funding Review FAQs

What are the key offers of Elite Trader Funding?

Through Elite Trader Funding, traders can take advantage of a range of programs, including distinct evaluation procedures, well-structured withdrawal choices, and clear instructions for trading plans. These offers help it stand out from other prop trading companies.

How does Elite Trader Funding compare to other prop trading firms?

Recall that the ability to offer personalized performance reports, transparent incentive programs, and stringent trading standards is how Elite Trader Funding distinguishes itself from other prop trading companies.

Can beginners succeed with Elite Trader Funding?

Inexperienced Elite Trader Funding users can be disciplined and open to learning new things. It is suggested that candidates consider enrolling in in-depth trading courses like Asia Forex Mentor in order to hone their skills prior to passing the exams.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.