Dip and Rip – A Complete Expert’s Guide 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

There are many strategies on which traders can rely and emerge as profitable traders. And the general approach places focus on buying assets at low prices, plus selling when prices are high.

One strategy fitting within the above is the Dip and Rip strategy. However, making profits is not as easy as it sounds above. Market analysts require more in-depth exposure to what will enable them to avoid many pitfalls in the financial markets.

The main purpose of this post is to guide traders from the point of view of an expert who trades and trains for a living. In that order, we have the pleasure of inviting Ezekiel Chew from Asia Forex Mentor.

Ezekiel trains traders and offers them mentorship. Besides, he’s highly sought regarding his opinions on price action across financial markets. Plus, his trading education helps trainees tap from his 20-plus years of successfully trading.

Further ahead, this post will enlighten you with a summary of what the Dip and Rip strategy is. We’ll go over how this strategy builds from the Dip and Rip pattern formation in the markets. To enrich your insights, the post will expound on the ways to approach markets – the advantages of the strategy.

Towards the end, there’s an FAQ section – providing feedback on probable questions you may have regarding the strategy.

What is Dip and Rip Strategy?

The dip and Rip strategy is a two-fold approach where the investor decides to pick the opportunities from the price levels and risks involved in a target stock.

Buy transactions fit stocks with high opening prices, which eventually fall or dip. Next, the traders allow the prices to rise, and they exit the buy transactions.

Still, while prices are high, most traders locate entry opportunities or sell high – and target to exit when the prices later move to lower zones on day trading.

Buying dips is a common investment approach – where traders find stocks or securities at very low prices after a recent dip -anticipating a bullish trend. And the reason why we mention stocks with high opening prices before the dip is a clear indication that buyer interest exists at those levels. It’s the demand zone.

Pullbacks from prices happen for many reasons, and it’s the target for buyers looking for opportunities to join the markets. It’s in tandem with high or low prices with respective changes to selling and buying pressure.

For the seller, to spot opportunities to sell the rip. Simply it’s joining into a market with high selling pressure or markets with high prices. And the prospective course of action is to leave the markets when prices dive to lower levels.

As part of the analysis, sellers approach markets with prior price action. A good example applies where markets are struggling to maintain a dominant bullish trend, and it combines best with signals of trends changing toward bearish.

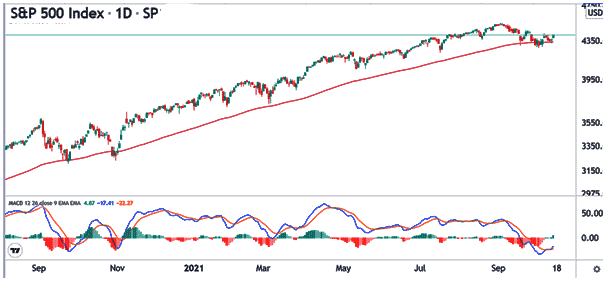

The dip and Rip strategy work very well within markets with high market volatility. It allows speculators to open positions and consistently accumulate profits as the markets shift.

Experts guide that it requires some level of precise timing at entry, plus reasonable patience. Volatile markets favor traders with the ability to trend and erase the gains with massive pullbacks in stock prices.

However, in the broader sense of a volatile market, the guarantee of making a profit gets lower. The reason is that in case a pullback takes place while you are on the wrong side, you stand to lose huge amounts of capital. It’d be even worse if your trading involves only a small amount of capital.

From other points of view, the Dip and Rip strategy suits day traders and also scalpers – who aim for small portions of profits and close trades.

The strategy is not suitable for swing traders – whose aim is to hold traders for relatively longer periods or timeframes.

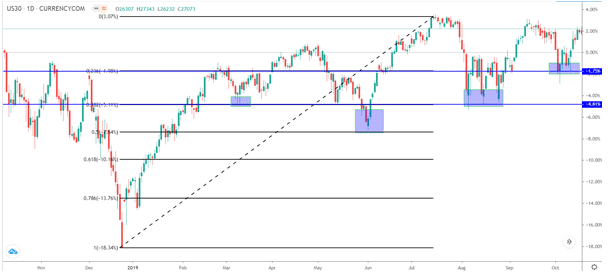

Dip and Rip Pattern Explained on Stock prices

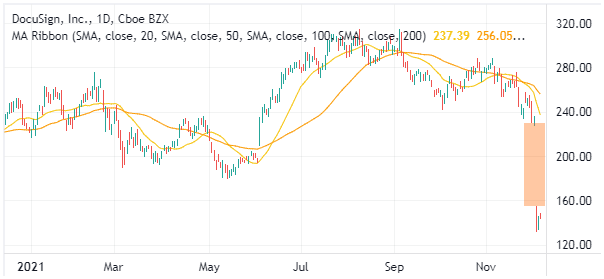

Dip and rip patterns are common on many charts. Observers note that prices fall rapidly for the dips. Next, markets make pullbacks to recover the gains from the dip. Essentially, the dips happen faster than the bullish recovery phases.

At the onset, prices open with a strong bullish trend, only to be hit by a huge dip in prices. One other peculiar note with the bullish recovery is the nature of prices forming successively higher highs. Eventually, the prices rise adobe the former peak price hit via the opening impulse.

In normal circumstances, the bullish trends face resistance higher up – where supply zones encourage sellers to consider stepping in. At this level, prices go choppy or consolidate before sellers garner enough support to turn the market into bearish trends.

If you look at the behavior of price movements after the dip, buyers step in with confidence. However, at higher levels, traders panic for various reasons.

Therefore, at consolidation phases, some exit while others lock profits. So, at consolidation, buyers keep losing control of sellers – who eventually take control of the prices.

With sellers in control, prices keep falling as the sellers keep locking their profits and exiting the markets. Concurrently, at the lower price levels, buyers keep stepping in, and the eventual demand increases as the prices pull back against the bears.

As you can see, a good trader is able to jump in and out of the markets – gathering small yet consistent profits. And as highlighted earlier on, the strategy builds heavily on points with timing plus patience as a trader.

Over time, traders gather adequate experience to add to their technical analysis. So, they are able to project current stock prices and news reclaiming premarket highs.

However, one big drawback is being impatient, panicking, or having poor risk management practices, where traders exit markets after the dips, only for favorable pullbacks to happen.

How to Trade using Dip and Rip Pattern

Traders aiming for the dip and rip pattern have one thing – it appears they are playing a very simple game. However, in real markets, it’s not so. In case a trader makes the wrong move, it can push them into huge losses.

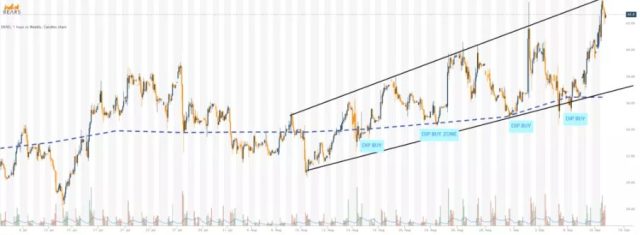

The best way to trade requires a little patience. Allow the prices to fall into support zones. Of course, the overall plan is to enter at the right spot while prices make the pullback – toward the bullish scenario.

Next, we’ll share helpful tips for premarket trading the Dip and Rip pattern:

#1. Sharp Stock Price Timing on Position Entry

Successful trading of the dip and rip pattern on the charts requires insightful knowledge of entry and exit price points. Other than the appealing visual insights from a chart, it’s recommended to check the price action with other indicators.

The right timing of the entry allows traders to capture the best results with the impending pullback in the prices. Therefore, the aim is not to open positions out of personal will but out of confidence after analyzing and confirming with market indicators.

To add more emphasis, the dip and rip pattern is a favorite for short-term traders- scalpers and day traders, to be specific. So, long-term traders have to explore other patterns that favor long-term and specific strategy trading setups.

#2. Discipline of Traders

Usually, prices in the stocks and currencies make dips into price zones far lower than the normal support points. And whenever this unusually takes place, it falls upon the traders to escape the markets by cutting losses via a stop loss position.

Therefore, the discipline among traders here calls for capital protection whenever plans go out of projections with stop losses.

The other way also involves realistic take profit levels or positions. Taking profit should work to the advantage of traders by locking profits as far as price lines may allow.

Failure to take profit in expectation of more is a risky move – a good position faces risks of price reversals, ending in little profit or even losses at the extreme.

#3. Selecting the Right Stocks to Trade

Stock and Forex currency take place with varying skills and results in terms of profitability. Not all are subject to price dips and rips. Therefore, it’s important to pick a few stocks or currencies that one is able to analyze and trade best for profitability.

And the best way to approach the selected currencies or stocks is with technical analysis. It helps to establish the limits of dips into the support regions, as well as the extent of the pullbacks into the zones of resistance within a trading day.

However, market experts say that morning dips for many stocks can hit the range of 30 to 35% in dips before making recoveries.

Of course, traders should not put fundamentals out of the picture. Pay attention to the releases of news and align the trading positions appropriately for a big gainer.

Benefits of the Dip and Rip Pattern

The Dip and Rip pattern has three key benefits.

First, the pattern is very simple to analyze and trade – and it’s a helpful one for new traders learning their ropes in trading.

Secondly, Drip and Rip patterns helps form great trading habits that traders build on and put to use trading other strategies. And one good trading trait the pattern helps build is patience.

Thirdly, the pattern shows up in many charts and timeframes, and therefore, traders can be sure of pretty many opportunities to trade with real news and a potential dip. It works well within many markets, like bull markets, and it still holds during a pandemic market. So, it’s a pattern that does not go obsolete.

The dip and rip pattern applies to highly volatile markets too. But, traders must be keen to tweak the strategies to fit what works for them.

The best outcomes align with mastering the timing of position entry with a re-break of prices.

Best Forex Trading Course

Ezekiel Chew is a professional forex trader and trainer. He is the founder of Asia Forex Mentor, one of the largest forex education companies in the world. He has 2 decades of experience in the forex market and is respected for his knowledge and expertise.

Ezekiel's core program, ‘AFM PROPRIETARY ONE CORE PROGRAM,' is the Complete Program, which covers everything from beginner to advanced. The program is designed to give you the best possible chance of success in the forex industry. It is backed by mathematical probability and has been used by banks and trading institutions for years.

Ezekiel is a highly credible figure in the forex industry. So, if you are trying to make money in forex trading, you should check out his program to start your forex career.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Broker

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Dip and Rip

The Dip and Rip pattern forms across many currencies, assets, and timeframes.

Traders, especially newbies, can easily grasp the way to trade successfully by taking keen note of the general order of price movements on a chart pattern:

- A strong opening break in the morning

- A morning dip in prices into a region of price support

- Final recovery with higher highs that peak higher in price than the initial false break

It’s key to state that the pattern works best for scalpers and day traders.

And the setup is prone to disruptions like news – where prices move very fast in line with the perception released into the market.

The approach with a dip and rip pattern – allowing prices to settle into support before considering the entry of position, is a great habit for both analysis and trading.

New traders can gain much from it and use it to build other strategies.

Lastly, investors can make good profits within volatile markets, plus they should always use stop loss positions and reasonable rate of risk-to-reward ratios to take profits.

Dip and Rip FAQs

Should you buy the Dip?

Not always. To buy, avoid hot stocks, plus check with other indicators or built-in scans to see if there’s potential for prices to make a pullback or a bullish break.

What does Dip and Rip mean in stocks?

A dip is where the price of a stock makes a false bullish break. Traders join in at high prices and exit with profits at lower levels. A rip is the recovery price. Traders buy low and exit at higher prices with profits.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.