Citrus Loans Reviews: Compare Top Lenders of 2024

By John V

January 12, 2024 • Fact checked by Dumb Little Man

The Citrus Loans provides a smooth user experience to hundreds of customers worldwide. It is one of the best third-party loan aggregators that you can find online nowadays.

The best part about getting a loan using this platform is that you don’t have to worry about bad credit. Do you have a bad credit score, and you don’t know what to do?

In that case, you don’t have to worry anymore at all. It is because Citrus Loans has got you covered. You can rely on this service if you have a bad credit rating because it will not affect your application process in any way. Have you read consumer reviews? This article will provide you with a complete review of Citrus Loans and compare the top lenders of 2024.

Overview: Citrus Loans Review

| Lender | Best For | Fee & Credit | More Details |

|---|---|---|---|

| Best For Bad Credit Quick Loan Process | Loan Amount: $100 - $2,500 • Loan Term: up to 5 years |  |

What are Citrus Loans?

Citrus Loans is a loan aggregator service available online for users going through an emergency. Anybody can be going through a tough time in their life, and they might be looking for an emergency cash advance loan service.

This platform will provide you with precisely that, and the best part is that you will not have to indulge yourself in multiple applications. This platform empowers you and enables you to apply to as many lenders as possible by using just a single application.

All you need to do is fill out a single application form, and then you are good to go. The lenders will compete for your business, and you will not have to do all the work by yourself.

What are the Types of Loans Offered by Citrus Loans?

The Citrus Loans company is the best option available for you online if you want to get a Home Mortgage Loan and live in Florida. It should be your top choice without giving it a second thought.

If you want a manufactured home loan, you should not look for another place and just come to Citrus Loans. This platform is helping the residents of Florida to get financing for their new home from the year 2005. You can try out this option if you are getting a house for the first time or looking for an investment type of property.

This platform will work out for you and make sure that all your real estate dreams come true and you don’t have to worry about anything at all anymore. Citrus Loans are offering the following loan options with multiple vendors right now.

Let’s have a look at them below.

- Hard money loan

- Mobile Home financing

- New construction loan

- Jumbo loans

- 1% Down Conventional loan

Unsecured Loans

The Citrus Loans is providing a typical loan to their customers. The Manor Park funding has a complete network of multiple lenders. The unique aspect of these givers is that they offer loans to their customers. The range of these loans is between $100 and $2,500.

These loans range from 14 days to 24 months. It depends upon your requirements which loan you are looking for, and which one you want to apply for, depending upon your emergency loan requirement and cash. It is the right loan for people looking for emergency cash borrowing from different companies with effective credit reports and interest rates.

How do Citrus Loans work?

Citrus Loans work so that they are providing an option for payday loans. The best part about this loan is that it can be approved online in less than 2 minutes. If you search for emergency cash instantly, it will be the only option for your available.

You can quickly get your hands on quick cash when you need it or if there is an emergency in your life. You will get the loan in your account the next day, and you will receive it in your checking account. However, there is one crucial thing that you need to keep in your mind if you decide to choose this platform for getting loans.

Citrus Loans work so that it is not the actual lender. The Citrus Loans is going to connect your application with multiple different blenders. It will keep happening until your application gets accepted by one of the lenders, and the process will keep happening until then in the background.

It is a straightforward option for you if you need quick cash, and there is no other institution that can provide you alone. Most of the people who use this service have a bad credit score, and that is why they use this service to get quick cash.

Click Here to Get Started With Citrus Loans.

What are the Features of Citrus Loans?

Citrus Loans are offering different types of loans and a credit card service to their customers online. If you have a bad credit score and are in trouble, you can quickly get a loan by using this platform. The best part is that it is a quick cash loan, and the amount will be made available in your account the very next day. Let’s have a look at the features of Citrus Loans below.

Great customer support

The best feature of Citrus Loans is that they provide excellent customer service to their users online. You can get in touch with them anytime you want, and they will answer all the questions you have in your mind. The best part is that they also have a phone number and an email.

You can contact them whenever you have any questions about applying for a loan online. You will get your loan quickly, and your questions will be answered by their great customer support agents. However, an online chat support option is not available, which can be a bummer sometimes.

Secure

The next feature of Citrus Loans is a safe and secure platform if you are looking for an instant cash loan online. Many people make use of this platform to get an online loan.

That is why you can completely trust it because it is a reliable platform to get instant cash loans if you have bad credit. You can easily borrow money through its secure site and use it for your business.

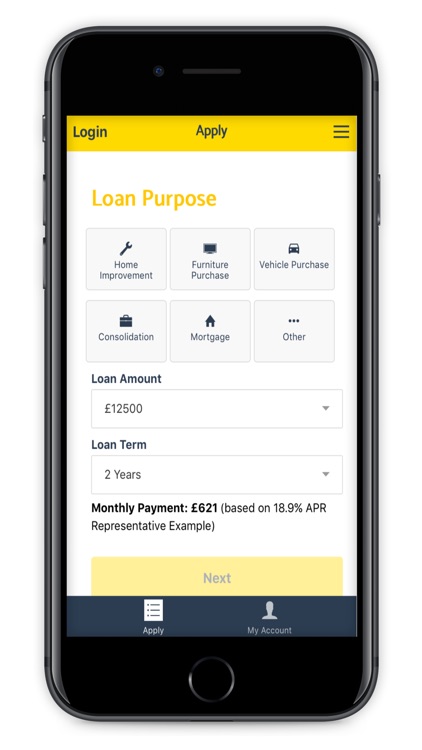

Fast application process

The next best feature of this platform is that the application process is speedy and does not take long. If you apply for a payday loan online, it will take only 3 minutes to process it.

The best part about this platform is that it makes things happen instantly, and the money will be available in your current account the very next day!

Citrus Loans Requirement?

Let’s look at the requirements you need to fulfill if you need to apply for Citrus Loans.

If you want to apply for a loan from Citrus Loans, you need to make sure you have a regular income or a job. Some lenders might ask you for further proof of employment during the last month. After providing this information, you will be good to go.

The following requirement is that you need to have a bank account if you want to apply for a loan and get the amount by using the services of Citrus Loans.

- Otherwise, you will not receive the payment in your current account after applying for the loan if you do not have a bank account.

- You need to be a United States citizen and have a valid social security number.

How to Apply for Citrus Loans?

The application process is straightforward because you need to fill out an online form. After that, this form will be sent to multiple lenders by the platform. These lenders will evaluate all the information about you, and then they will get in touch with you.

They will send you an offer that will contain all the details about the loan offer and what you need to do. Ensure that you read all the details correctly and do not keep anything because it can cause you trouble later. In the end, you have to give your electronic signature, and you are good to go!

How much does Citrus Loans Cost?

So far, the citrus loans has not published any set of schedules for free. A citrus loans is a third party, and it is only a broker. The rate and APR will depend upon the lender that will accept your loan application. The paying back term will also be discussed with the lender but most of the time and can be two weeks for a payday loan.

Click Here to Get Started With Citrus Loans.

Who is Citrus Loan Best For?

Citrus Loans is the best option for people going through bad credit. If you have a bad credit score and you need emergency cash, then there are very few options available for you out there.

Most financial institutions will not trust you enough to provide you with a loan. After all, you do not have any bank balance left. Or, if you are going through bankruptcy, then no financial institution or bank will provide you with the loan.

But you can still need emergency cash in any situation in your life, and it can be a troubling situation for you at that time. If you are going through a circumstance like this in your life, then Citrus Loans will be your lifesaver and provide you with a loan. So it is the perfect loan option for people who have a bad credit score. Pay doe the right loan and note all the specific features of approval and access.

Citrus Loans Pros and Cons

| 👍 PROS |

|---|

► Fast application process An advantage of Citrus Loans is that the application process is speedy, and it does not take much time. ► Quick cash loan The next advantage is that it is an instant cash loan, and the amount will be made available in your account the next day. ► Multiple lenders The next benefit is that Citrus Loans are not the actual Lender, but a third party connects you with multiple lenders out there. |

| 👎 CONS |

|---|

► Not the actual Lender This is not the right option if you are looking for an actual lender and not a third party. ► The website is not comprehensive The official website is not comprehensive enough and does not contain much information. The website could have been made better. |

Citrus Loans Compare to other Lenders

| Lender | Est. APR | Loan Amount | Loan Term | Min. Credit Score |

|---|---|---|---|---|

| Citrus Loans | Depends on Lender | $100 - $2,500 | up to 5 years | Not Specified |

| BadCreditLoans.com | 5.99% - 35.99% | $500 - $10,000 | 3 months to 7 yrs | Not specified |

| 100Lenders | 5.99% - 35.99% | $100 to $40,000 | Depends on the Lenders | Not Specified |

| ZocaLoans | 7.95% | $200 - $1500 | 6 - 12 months | Not specified |

Click Here to Get Started With Citrus Loans.

Citrus Loans vs. Bad Credit Loans.com

Bad Credit Loans give tough competition to Citrus loans because you can request up to $10,000 by using the bad credit loan option.

As it is clear from its name, you can apply for this loan if you have bad credit, and their service is 100% free. A considerable difference between them is that citrus loans are a third party on the other hand that suitable loans are not a third party.

>> Full Article Review: BadCreditLoans.com Reviews • Personal Loan For Low-Credit

Citrus Loans vs. 100Lenders

The citrus loan is the perfect option for those people who not only have bad credit but are also looking for emergency cash. However, 100Lenders is an easy and fast option to get a loan. You can quickly get a loan of up to 40000 dollars by using this loan option. This is giving out of the competition to citrus launch because they are not providing a loan of up to 40000 dollars!

Citrus Loans vs. ZocaLoans

ZocaLoans is a popular loan option that is very expensive and is a short-term financial solution. It is not better than the citrus loan option. Whereas, Citrus Loans is a better option in this regard because it is not expensive and provides you with a solution instantly.

>> Full Article Review: ZocaLoans Review: Compare Top Lenders of 2024

Final Verdict

The Citrus Loans is the perfect option for those people who not only have bad credit but are also looking for emergency cash. Anyone can be going through such a situation in their life, and such platforms are a blessing in disguise.

The same is the case with Citrus Loans, and you can take advantage of them by using them in emergency cases. Overall it is a safe and secure platform, and it is prevalent nowadays as well. You will not find any better option online with an easy application process.

If you are looking for something straightforward, then this will be the perfect option for you in this regard!

Citrus Loans FAQs

Does a Citrus Loans offer a quick cash option?

Yes. Citrus Loans is perfect for people who need emergency cash. The funds are made available the next day in the customer’s checking account.

Is the Citrus Loans a safe and reliable platform?

Yes. The Citrus Loan is a safe and reliable platform because it is pretty popular.

Who is a Citrus loan best for?

The Citrus Loans platform is best for people with bad credit and does not have other options. If you need emergency cash, you should check it out as early as possible to fulfil your needs.

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.