BadCreditLoans.com Reviews • Personal Loan For Low-Credit

By Peter Vanderbuild

January 12, 2024 • Fact checked by Dumb Little Man

You've come to the right place in case you need a modest personal loan despite a bad credit score. Bad Credit Loans is an online loan market that focuses on connecting people with bad credit with helpful online lenders.

According to consumer reviews on badcreditloans.com, this platform may be the ideal option if you need quick cash to deal with a financial emergency. This sort of financial assistance is not only preferable to a payday loan, but it also allows you the opportunity to enhance your credit score.

BadCreditLoans.com is a lending platform, which means it won't provide you any money. Instead, it collaborates with various lenders that are willing to connect with clients in need of funds. The organization understands that financial emergencies might strike at any time. It is difficult for people to obtain finance from banks or other financial organizations in such a circumstance.

BadCreditLoans.com is a lending platform, which means it won't provide you any money. Instead, it gathers and collaborates with various lenders that are willing to connect with clients in need of funds. The organization understands that financial emergencies might strike at any time. It is difficult for people to obtain finance from banks or other financial organizations in such a circumstance.

What is BadCreditLoans.com?

Badcreditloans.com is an online lending marketplace owned and administered by Chief LLC that caters to consumers looking for personal loans of $5,000 or less. We are not a direct lender at Bad Credit Loans. It connects potential borrowers with various online lenders around the United States to provide loan comparison services.

Borrowers looking for a business loan will be pleased to find that the Bad Credit Loans network includes lenders who ]provide funding for small businesses and startups.

They are accessible all the time, seven days a week. Therefore a request can be submitted by people with poor credit anytime they need it or want it. The company uses the highest line of data for keeping personal information safe. On top of that, people with all types of credit ratings can submit a loan request.

It runs through all the information provided by you for finding a lender who is suited to work with you. This means a few lenders work with those with outstanding credit scores while others offer certain kinds of loans. You've come to the correct place if you need a modest personal loan despite a bad credit score. Bad Credit Loans is a digital loan marketplace that focuses on connecting people with bad credit with helpful online lenders.

How does BadCreditLoans.com Personal Loan work?

Bad Credit Loans, by the name, you can tell that they provide different loan amounts for people with bad credit. They offer personal loans, auto loans, debt consolidation loans, business loans, student loans, and mortgages. There are best personal loan amounts, topping at 5000 dollars. The loan term is also relatively little, at less than three years.

Many personal loan lenders find it easier to get a personal loan as the technology is getting advanced, giving the lenders healthy competition. Being approved for most personal loans doesn't mean that it is important to guarantee the best personal loan interest rates. It is hard finding reasonable interest rates with a bad credit score.

This is one of the best bad credit loans, which helps people with bad credit personal loans to find loans online. This includes personal and other loans like consolidation loans, student loans, mortgages, business loans, and car loans.

They can help you find a loan that starts from 500 to 5000 dollars; also, the loan term differs by three months up to thirty-six months along with the diverging interest rates by 5.99-35.99 percent APR. Interest payments and other details depend upon the lender with whom you are connected according to your monthly payments.

According to consumer reviews on badcreditloans.com, this platform may be the ideal option if you need quick cash to deal with a financial emergency. This sort of financial assistance is not only preferable to a payday loan, but it also allows you the opportunity to enhance your credit score.

Click Here to Get Started With BadCredit Loans.

What are the Features of BadCreditLoans.com?

Personal Loans

They might cover unexpected expenditures with the aid of a personal loan. A personal loan may be useful if your car breaks down or you run out of money one month. Personal loans do not demand collateral and are easy to disburse.

Student Loans

Paying for school might be difficult, but Badcreditloans.com can help make it more reasonable. With a variety of financing alternatives for those with bad credit, you can get approved in as little as a few minutes and have your financing completed in a matter of days.

Business Loans

For many small firms, having quick access to cash is critical. Many businesses would fail if it weren't for it. Badcreditloans.com's business loan makes it simple to acquire the funding you want quickly.

This Nevada-based organization focuses on assisting customers with bad credit, as its name implies. The organization accepts applications from clients with credit ratings as low as 500 and matches each applicant with multiple lenders. If you don't succeed with a personal loan, Bad Credit Loans can help you find other ways to meet your financial obligations.

Terrible Credit Loans offers clients extensive comparison shopping services in addition to personal loans for individuals with really bad credit. Customers may browse for mortgages, vehicle loans, credit cards, student loans, and other financial products on the website.

The approval takes only a few minutes, and if you pick a lender, you might get the payment you need in as little as a day or two.

100% Free to Use

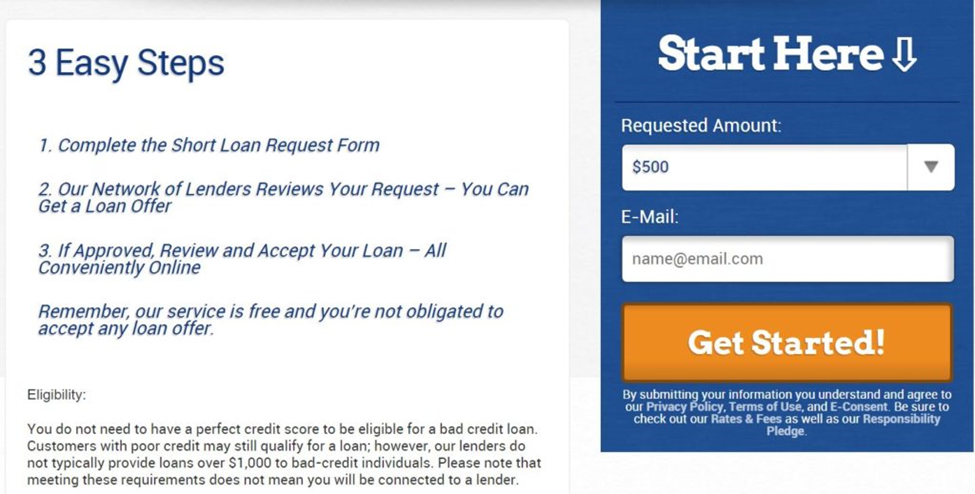

Most firms need a fee from customers to continue in operation. However, Badcreditloans.com does not. You are not required to spend anything to acquire and compare as many offers delivered to you. The lender pays Badcreditloans.com a modest fee if you pick a loan and finalize it.

Get Connected to a Lender and Compare Options

Badcreditloans.com's application is only an internet form. When you pick a partner lender's offer, you'll be dealing with that lender from then on.

Badcreditloans.com just serves as an intermediary, pairing you with the appropriate lender. You can compare offers from as many lenders as Badcreditloans.com can discover for you.

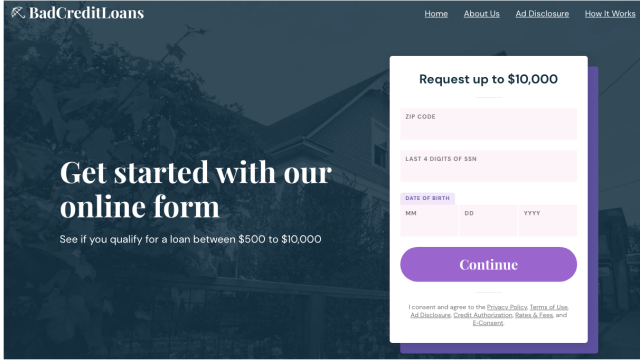

Simple Online Form

The online application is the most straightforward of the three. It just takes a few minutes to complete and a few minutes longer to receive your response. It's the pinnacle of quick satisfaction.

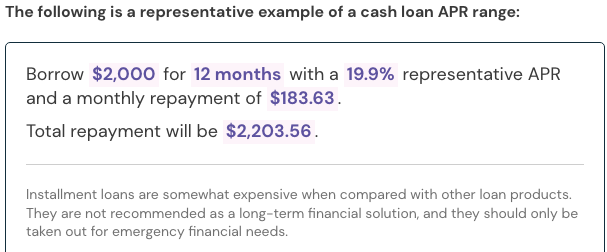

Badcreditloans.com Interest Rates and Fees

Each lender determines its rates and fees, just like they would if you shopped around independently. While interest rates and costs vary depending on your qualifying conditions, they typically range from 5.99 percent to 35.99 percent. The greater the interest rate you'll pay, the worse your credit score is.

Another expense that lenders commonly charge people with weak credit is origination fees. Lenders may charge between 1% and 8% of the loan amount as fees.

Read the fine print and make sure you're aware of the overall charges. Even on a $2,000 loan, an 8% origination cost of $160 is deducted from your loan profits, leaving you with less cash.

BadCreditLoans Credit Score Requirement

Let's do a credit check! Does it offer unsecured loans? Or is bad credit loans legit? The better business bureau illustrates that the leading lender networks and loan agreement offers increased credit rating even on poor credit means.

Moreover, the application process is easy and requires an online request form even with a poor credit score. You can lend money on different repayment terms and pay taxes for personal finance. There is no need for third parties as loan products vary depending on tribal lenders.

It offers on of the best personal loans regarding lender loan terms and credit check options for multiple lenders. The easy application process and credit rating make it reliable for self-employment.

The minimum requirement is 620 and the debt consolidation with effective debt-to-income ratio and credit history. You should be a US citizen if you want to qualify for loans. Moreover, the credit bureaus will also require bank account information.

What are the BadCreditLoans.com Fees?

Participating lenders in the BadCreditLoans.com lender network set the interest rates and costs for these loans, not the site.

However, as of 3/5/21, our test applications revealed interest rates ranging from 5.99 percent to 35.99 percent APR. As you might anticipate, applying with bad credit will put you at the top of the APR spectrum.

To put things in perspective, credit card lenders can charge up to 35.99 percent annual percentage rate (APR). However, most cards have rates between 15 and 27 percent. However, because credit card balances have no set payments, you may wind up paying more interest over time.

The BadCreditLoans.com website is entirely free to use, and none of the participating lenders appear to require the application charges. Lenders pay the area for your business, but there is little evidence that these fees are costly to customers.

Click Here to Get Started With BadCredit Loans.

Who is BadCreditLoans.com Best For?

Aside from making work easy for you, like submitting a request and approving a loan, other things that make it the best are millions of articles and tips accessible on its website.

These can be used to answer necessary financing questions such as budget, which may keep you from falling into a financial issue in the future, spending the borrowed money wisely, paying off loans quickly, or whether to consider a loan or not.

Bad credit loans are for people who have no credit history, and their credit report is less than spotless. Typically these loans offer high-interest rates and have too many restrictions compared to other loans as it assures the lender by reducing the risk of you not repaying them.

BadCreditLoans.com Bank Pros and Cons

| ✅ PROS |

|---|

▶ Online platform BadCreditLoans.com is a personal loan marketplace that connects you with a huge number of lenders. This will maximize your chances of getting a loan approved and receiving the best rates and conditions. The use of the web platform is free. Its location and contact details are available on its website, which isn't usually the case with negative credit lenders. Loan periods span from three to 36 months, giving you plenty of options for payments. For individuals with superior credit, the lender network provides larger loan amounts and cheaper interest rates. |

| 🚫 CONS |

|---|

✖ Not a directly working lender. Because BadCreditLoans.com is not a borrower, then you'll be dealing with the loan company you select from the credit options on this website. With a higher loan sum of $10,000, the loan balances are rather minimal. Personal loans for $100,000 are available from different providers. The credit limit for lower credit scores (less than 500) is $1,000. |

BadCreditLoans.com Compare to other Lenders

| Lender | APR Range | Min. Credit Score | Loan Term | Loan Amount |

|---|---|---|---|---|

| BadCreditLoans | 5.99% - 35.99% | Not Specified | 3 mnths - 7 yrs | $500 - $10,000 |

| LightStream | 2.49% – 19.99% | 660 | 24 - 36 months | $5,000 - $100,000 |

| Avant | 9.95% - 35.99% | 580 | 2 - 5 years | $2,000 - $35,000 |

Click Here to Get Started With BadCredit Loans.

Bad Credit Loans vs Avant Personal Loans

Bad credit loans offer personal loan, auto loans, debt consolidation loans, business loan, student loans, and mortgages. However, Avant provides secured as well as unsecured personal loan choices.

Bad Credit Loans, by the name, you can tell that they provide different loan amounts for people with bad credit. In contrast, Avant provides personal loans online to many borrowers with a fair or bad credit score of 689 or maybe lower FICO.

BadCreditLoans vs. LightStream

Bad Credit Loans is a reputable loan provider. However, Lightstream offers the customers highly valuable credit history and min credit score with monthly payments to offer customers excellent benefits.

Badcreditloans.com is an online lending marketplace owned and administered by Chief LLC that caters to consumers looking for personal loans of $5,000 or less. In contrast, Lightstream offers increased debt to income ratio with increased reliability making it an accessible option for excellent credit.

Final Verdict

Customers may choose from a variety of deals from BadCreditLoans.com's network of banks and lenders. While BadCreditLoans.com is not a lender, it does provide a platform for lenders and consumers to network and find the best rates.

Individuals and corporations can fund traditional personal loans, personal installment loans, and peer-to-peer loans. They have a strong track record of connecting clients with several lenders who compete for your business by giving the greatest APR rates.

In several ways, Bad Credit Loans exceed expectations. For example, borrowers who have utilized the company's services have written badcreditloans.com reviews praising the company's customer-service employees' friendliness and expertise.

Bad Credit Loans assist people with bad credit in obtaining modest personal loans rapidly. Its 10-minute application procedure makes requesting cash a breeze. If used appropriately, a personal loan may be a sensible move, or it might only get you deeper into debt. If you're having financial difficulties and can't get the money you need, this might be the place for you.

>> Related Topic: Best Personal Loans for Bad Credit of 2024

Frequently Asked Questions

Is BadCreditLoans com legit?

Yes, Bad Credit Loans and the services they provide are legal. Customers like the company's large lender network, low loans, and speedy funding for borrowers with blemished credit records, according to multiple badcreditloans.com testimonials from delighted consumers.

Bad Credit Loans is a reputable loan provider. Although the online loan application procedure is quick and simple, it does need a little more information than conventional forms. The fact that anyone, including those with terrible credit, may apply for a loan makes it accessible to individuals who have never had a loan authorized before.

Which loan company is best for bad credit?

Bad credit loans offer the most exclusive loan terms at low credit score. This financial institution offers installment loans, loan products, low origination fees, and online loans on bad credit scores. The application process is simple and poor credit loan applicants can get benefit. But wait! It's not a direct lender as illustrated by the better business bureau.

Therefore, in this badcreditloans.com review we have explained how you can get effective credit report. The loan request process is easy with the bad credit loan. It allows you to fill the loan request form as it's not a lender only. The loan offer exclusive options on poor credit scores to help borrowers get the maximum advantage.

What are the BadCreditLoans alternatives?

Although, bad credit loans is our top choice but in this bad credit loans review we will explain the alternatives. Anyone who desires to get credit score between 600 and 700 FICO will find AVANT credit union as their top choice. Moreover, it suits people applying for managing loans online. The options fulfills the need for personalization of loan funds in 1 or 2 business day.

Upgrade personal loans are available the rates starting from just $1,000 to $50,000, which gives it a lead to be known as small loan providers. They also want to invest their money in small businesses. Upgrade is an excellent choice for people looking for loan with bad credit options.

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.