Capital Index Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 123rd  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

Capital Index Review

Forex brokers play a crucial role in the global financial markets, offering platforms for trading in foreign exchange (FX), commodities, indices, and more. These brokers act as intermediaries, facilitating trades between buyers and sellers, which makes understanding their services vital for traders. Capital Index, founded in 2014, stands out as a prominent player in this field, specializing in CFDs, Financial Spread Betting, and Spread Trading across various financial instruments.

In our Capital Index review, we aim to deliver a comprehensive analysis of the broker's offerings. This includes a deep dive into Capital Index's unique selling propositions and any potential drawbacks. By focusing on account options, deposit and withdrawal processes, commission structures, and more, we provide a balanced overview. Our goal is to furnish traders with critical insights, combining expert analysis and actual trader experiences, empowering you to make an informed decision on whether Capital Index suits your trading needs.

What is Capital Index?

Capital Index is recognized in the forex trading community for leveraging MetaTrader 4 (MT4), the industry's leading trading platform. This choice highlights the broker's commitment to providing high-quality, user-friendly tools for traders. MT4 is renowned for its advanced features, including automated trading, which caters to both novice and experienced traders seeking a competitive edge in the market.

With a diverse offering of over 50 forex currency pairs, indices, CFDs, commodities, and precious metals, Capital Index positions itself as a versatile broker for personal investment and trading. This range ensures that traders have access to a wide array of markets, enhancing their ability to diversify their investment portfolios and explore various trading strategies.

Safety and Security of Capital Index

The safety and security of Capital Index are foundational to its operation, ensuring that traders' investments are protected. Registered in the UK, Capital Index UK operates under the strict oversight of the Financial Conduct Authority (FCA, UK). This regulatory framework mandates compliance with rigorous rules and obligations, underscoring the broker's commitment to maintaining high standards of operation and customer protection.

Furthermore, Capital Index (Global) Limited is authorized and regulated by the Securities Commission of the Bahamas (SCB), allowing it to extend its services on an international scale. This dual regulation reinforces the broker's dedication to upholding security measures and ethical trading practices across global markets.

A crucial aspect of Capital Index's approach to protecting customer funds is the use of separate, segregated accounts. This measure ensures that clients' money is kept distinct from the company's funds, prohibiting any unauthorized use. In the event of insolvency, Capital Index guarantees the return of all customers’ funds in full, minus any fees charged by the payment system. This information, gathered through thorough research from Dumb Little Man, highlights the broker's stringent adherence to safety and security measures, providing traders with peace of mind.

Pros and Cons of Capital Index

Pros

- Intuitive website design

- Micro-lot trading available

- Options for both novice and expert traders

Cons

- Absence of cent accounts for beginners

- Scarce educational resources

Sign-Up Bonus of Capital Index

Currently, Capital Index does not offer a sign-up bonus for new clients. This information is crucial for potential traders who might be looking for initial trading incentives. Despite the absence of a sign-up bonus, it's important for traders to consider the broker's overall offerings and features when making a decision.

Minimum Deposit of Capital Index

The minimum deposit required to open an account with Capital Index is $100. This relatively low entry barrier makes it accessible for a wide range of traders, from beginners to those with more experience. It enables traders to start trading without a significant initial investment, aligning with the broker's commitment to providing flexible trading options for its clients.

Capital Index Account Types

Capital Index offers a variety of account types to cater to different levels of traders. Our team of experts at Dumb Little Man conducted extensive research and testing to provide a clear overview of these accounts:

- Advanced Account: Ideal for novice traders, with a minimum deposit of 100 units of the base currency. Spreads start from 1.4 pips, and no commission is charged for order execution.

- Pro Account: Designed for more advanced users, requiring a minimum deposit of 5,000 units of the base currency. Offers more competitive spreads from 1 pip, with no commission on order execution.

- Black Account: Tailored for professional traders, this account demands a minimum deposit of 50,000 euros (or equivalent in dollars or pounds). It features the lowest spreads starting from 0.4 pips and includes a commission for order execution.

This structured account system ensures that traders at all levels can find an option that best suits their trading style and experience level.

Capital Index Customer Reviews

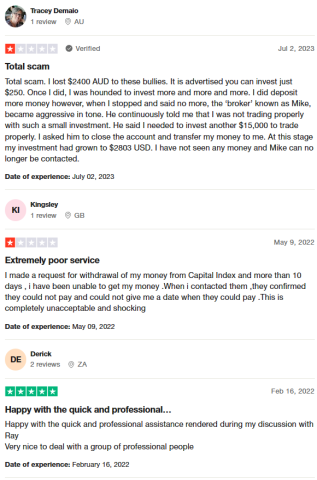

Customer reviews of Capital Index present a mixed picture, with experiences ranging from dissatisfaction to satisfaction. Some customers have expressed concerns over practices perceived as aggressive, particularly regarding the pressure to increase investments beyond the advertised minimum of $250. These reports include instances where communication with brokers became difficult after refusing to invest more, leading to issues in withdrawing funds. Conversely, there are testimonials praising the quick and professional assistance provided by the Capital Index team, highlighting positive interactions with staff members. This variance in experiences suggests potential areas for improvement in customer service and transparency, while also acknowledging the presence of commendable customer support within the company.

Capital Index Fees, Spreads, and Commissions

Capital Index is noted for its transparent fee structure, with no hidden commissions. This straightforward approach ensures traders can manage their finances effectively without unexpected costs. Notably, Capital Index does not impose a deposit fee, making it more accessible for traders to fund their accounts. However, a withdrawal fee applies exclusively when traders opt for an instant wire transfer service, highlighting a specific scenario where additional charges are incurred.

For those trading on the Black Account, a trading commission for order execution is applicable, distinguishing it from other account types where such fees are not charged. Additionally, swaps, or fees for rolling a trader's position over to the next day, are a part of the cost structure, affecting traders who hold positions overnight. This comprehensive fee overview is essential for traders considering Capital Index as their broker, enabling informed decision-making based on potential trading costs.

Deposit and Withdrawal

Capital Index provides a straightforward process for deposit and withdrawal, as confirmed by a trading professional at Dumb Little Man through thorough testing. To withdraw personal funds, traders must submit a request to the financial department via their personal account, with the advantage of no restrictions on the number of withdrawals. A withdrawal fee is applicable exclusively for instant wire transfers, catering to those in need of rapid transactions.

For deposits, Capital Index offers two primary methods: debit/credit cards and wire transfer. Transactions via debit or credit cards are processed within one business day, while wire transfers may take up to one week. An instant wire transfer service is also available for those requiring faster processing. Importantly, transactions can be conducted in three major fiat currencies: USD, EUR, and GBP, providing flexibility for international traders.

A crucial requirement for performing financial transactions is that the user’s account must be verified. This step ensures the security and integrity of financial operations, aligning with Capital Index's commitment to safe and secure trading practices.

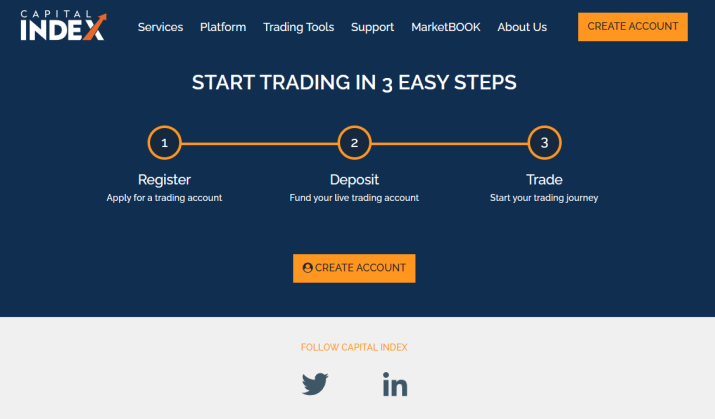

How to Open a Capital Index Account

- Visit the Capital Index home page and select Create Account for a live account setup.

- Complete the questionnaire with your details like name, nationality, and contact information, then click Next.

- Enter your address details, including country, city, and postal code.

- Detail your trading experience and financial education.

- Take a short test to assess your trading knowledge.

- Provide information about your financial status, including income and investment capacity.

- Set up your personal trading account with the chosen specifications.

- Capital Index will email you regarding required documents for account verification.

- Account access is granted post-verification of the submitted documents.

Capital Index Affiliate Program

Capital Index does not currently offer an affiliate program or passive income partnership program. The broker's focus is squarely on delivering Forex trading access to active traders. This means that there are no available programs for partners that provide bonuses for referring new customers. This approach underscores Capital Index's commitment to its core trading services, prioritizing direct trading activities over the expansion of its user base through referral incentives.

Capital Index Customer Support

Capital Index offers a variety of channels for contacting customer support, ensuring that traders can easily seek assistance when needed. Based on the experience of Dumb Little Man, the available methods include phone calls, email, a feedback form, and an online chat feature on the website. These options provide flexibility for users to choose the most convenient way to get in touch.

Traders have the convenience of reaching out to customer support either through their personal account or directly via the Capital Index website. This accessibility highlights the broker's commitment to offering comprehensive support, aiming to address queries and resolve issues efficiently for a seamless trading experience.

Advantages and Disadvantages of Capital Index Customer Support

| Advantages | Disadvantages |

|---|---|

Capital Index vs Other Brokers

#1. Capital Index vs AvaTrade

Capital Index specializes in CFDs, Financial Spread Betting, and Spread Trading, offering a tailored approach for traders interested in these specific markets. With a focus on Forex trading and a straightforward fee structure, it caters well to both novice and seasoned traders. AvaTrade, on the other hand, boasts a wider array of over 1,250 financial instruments and a larger global presence with a strong regulatory framework, making it a robust option for traders seeking diversity and security in their investments.

Verdict: AvaTrade may be better for traders looking for a broad range of trading instruments and who value a broker with extensive regulatory oversight. Its global footprint and commitment to offering a comprehensive trading experience give it an edge for traders seeking versatility and security.

#2. Capital Index vs RoboForex

Capital Index offers a more traditional trading environment with a focus on Forex and CFDs, appealing to traders who prefer straightforward trading options without the need for advanced technologies. RoboForex, in contrast, emphasizes cutting-edge technology and diversity in trading platforms, including MetaTrader, cTrader, and RTrader, alongside a vast selection of over 12,000 trading options. This makes RoboForex ideal for tech-savvy traders and those looking for variety in their trading platforms and instruments.

Verdict: RoboForex stands out as the better choice for traders who prioritize technological innovation and a wide range of trading instruments. Its comprehensive platform options and extensive asset classes cater to a broader spectrum of trading styles and preferences.

#3. Capital Index vs FXChoice

Capital Index provides a focused trading platform for those interested in Forex, CFDs, and Spread Betting, offering a straightforward and user-friendly approach to trading. FXChoice, however, is known for its strong focus on customer service and advanced trading options, including ECN accounts with tight market spreads, catering especially to experienced traders. FXChoice's commitment to expanding its trading instruments and services for automated trading also highlights its adaptability and forward-thinking approach.

Verdict: FXChoice might be more appealing to experienced traders looking for tight spreads and advanced trading options, including ECN accounts. Its focus on professional trading conditions and automated trading services provides a more specialized platform for seasoned traders, making it a preferable option for those with specific trading needs and higher volumes.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For individuals eager to build a successful career in forex trading and attain significant financial rewards, Asia Forex Mentor is the top selection for the finest forex, stock, and crypto trading course. Ezekiel Chew, the mastermind behind numerous trading institutions and banks, spearheads Asia Forex Mentor. Notably, Ezekiel consistently secures seven-figure trades, distinguishing him as a unique educator in this domain. The reasons we endorse Asia Forex Mentor are compelling:

Comprehensive Curriculum: Asia Forex Mentor delivers an extensive educational program, encompassing stock, crypto, and forex trading. This curriculum is designed to provide learners with the essential knowledge and skills to thrive in these varied markets.

Proven Track Record: The effectiveness and credibility of Asia Forex Mentor are evidenced by its history of cultivating consistently profitable traders in multiple market areas. This record reflects the potency of their training and mentorship approaches.

Expert Mentor: Students at Asia Forex Mentor receive mentoring from an expert who has achieved notable success in stock, crypto, and forex trading. Ezekiel's guidance helps students confidently tackle each market's complexities.

Supportive Community: Enrollment in Asia Forex Mentor grants access to a community of fellow traders who share a common goal of excelling in the stock, crypto, and forex markets. This network promotes collaborative learning, idea exchange, and mutual support, enriching the educational journey.

Emphasis on Discipline and Psychology: Mastery in trading demands a disciplined mindset. Asia Forex Mentor imparts essential psychological training to aid traders in emotion management, stress handling, and making informed decisions.

Constant Updates and Resources: Recognizing the ever-evolving nature of financial markets, Asia Forex Mentor ensures that learners stay abreast of the latest trends, strategies, and insights, providing continuous access to critical resources.

Success Stories: The numerous success narratives of students achieving financial autonomy through their education in forex, stock, and crypto trading at Asia Forex Mentor are a source of pride for the institution.

Asia Forex Mentor stands out as the foremost option for those aiming for the best education in forex, stock, and crypto trading, seeking both a lucrative career and financial success. Its well-rounded curriculum, proficient mentors, practical approach, and nurturing community equip aspiring traders with the tools and guidance needed to evolve into successful professionals in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Capital Index Review

In conclusion, the team of trading experts at Dumb Little Man has provided a comprehensive review of Capital Index, highlighting its strengths and areas for improvement. Capital Index excels in offering a user-friendly trading environment, transparent fee structure, and a variety of account types to cater to different trader levels, from novices to professionals. Its commitment to safety and security, through strict regulatory compliance and the use of segregated accounts, ensures that traders' investments are protected.

However, potential traders should also be aware of the limitations associated with Capital Index. The absence of a sign-up bonus, limited educational resources, and the lack of an affiliate program may deter some traders looking for these specific features. Additionally, the mixed customer reviews suggest that while many are satisfied with the platform's offerings, others have faced challenges, particularly regarding customer support and withdrawal processes.

>> Also Read: Skilling Review 2024 with Rankings By Dumb Little Man

Capital Index Review FAQs

Is Capital Index regulated?

Yes, Capital Index is regulated by reputable financial authorities, including the Financial Conduct Authority (FCA) in the UK and the Securities Commission of the Bahamas (SCB). This regulatory oversight ensures that Capital Index adheres to strict financial standards and practices, offering a secure trading environment for its clients.

What types of accounts does Capital Index offer?

Capital Index offers a range of account types to suit various trader needs and experience levels. These include the Advanced Account for novice traders, the Pro Account for more experienced users, and the Black Account for professional traders. Each account type comes with different minimum deposit requirements, spreads, and commission structures to accommodate different trading strategies and preferences.

How can I deposit and withdraw funds with Capital Index?

Deposits and withdrawals with Capital Index can be made using debit/credit cards and wire transfers, including an option for instant wire transfers for quicker transactions. While there is no deposit fee, a withdrawal fee is applied only for instant wire transfer services. It's important to note that all financial transactions require the trader's account to be verified, ensuring security and compliance with financial regulations.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.