CAPEX Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 120th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

CAPEX Review

Forex brokers play a pivotal role in the world of online trading, acting as intermediaries between retail traders and the vast global financial markets. These platforms enable individuals to trade currencies, commodities, stocks, and more, offering a gateway to potentially lucrative investments. CAPEX, launched in 2016, stands out in this crowded marketplace with its commitment to transforming how trading is done through advanced technology and a customer-first approach.

This review aims to deliver a comprehensive evaluation of CAPEX, highlighting its unique selling points and areas where it may fall short. By delving into the various account types, deposit and withdrawal methods, commission structures, and more, we seek to offer a balanced view that marries expert analysis with real-world user feedback. Our goal is to arm you with the essential information needed to decide if CAPEX aligns with your trading objectives, making it a potentially preferred brokerage service provider for your investment journey.

What is CAPEX?

CAPEX is a recognized online forex and CFD broker that was established in 2016, based in Cyprus. This broker has broadened its reach beyond its initial locale, offering services globally, with its main office remaining in Cyprus. This expansion reflects CAPEX's commitment to providing accessible trading opportunities to a worldwide audience.

Operating under Key Way Investments Limited, CAPEX Europe (www.capex.com) adheres to stringent regulatory standards. It is regulated by the Cyprus Securities and Exchange Commission (CySEC), holding a regulatory license with the number 292/16. This regulation underscores CAPEX's dedication to maintaining a secure and transparent trading environment, ensuring traders can invest with confidence.

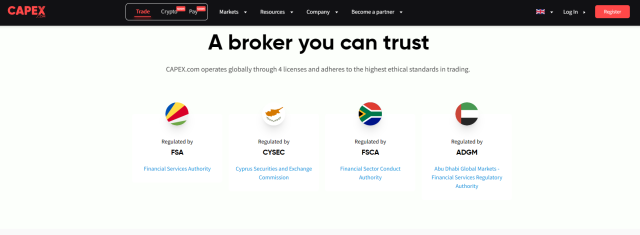

Safety and Security of CAPEX

CAPEX‘s commitment to safety and security is evident through its extensive regulation by several top-tier financial regulatory bodies globally, as thoroughly researched by Dumb Little Man. This includes oversight by the FSCA, CySEC, ADGM, and FSA. Such widespread regulation not only enhances the broker's credibility but also provides a robust framework for the protection of trader interests and investments.

A key aspect of CAPEX‘s approach to security involves the safeguarding of client funds in segregated accounts. This measure ensures that traders' funds are kept separate from the company’s operating funds, providing an additional layer of security. Furthermore, the provision of negative balance protection is a significant safety feature. It protects traders from losing more money than they have deposited, preventing them from falling into debt due to trading activities. These measures reflect CAPEX‘s dedication to offering a secure trading environment.

Pros and Cons of CAPEX

Pros

- Extensive selection of trading assets

- Client funds in separate accounts

- Trading Central insights and updates

- Choice between fixed and variable spreads

- Exclusive web and mobile trading platforms

Cons

- Limited accessibility for certain clients

- Absence of social trading features

- Inadequate educational resources

Sign-Up Bonus of CAPEX

CAPEX offers enticing incentives for both new and existing traders through its sign-up bonus scheme. Upon activating an account and making an initial deposit, traders are eligible to receive a bonus of up to 40%. This substantial offer aims to boost the trading capabilities of users from the get-go, enhancing their investment potential.

Moreover, CAPEX extends its generosity beyond the first deposit, offering an additional deposit bonus. Traders can benefit from a 40% bonus on all subsequent deposits, providing a continuous incentive to fund their trading accounts. This strategy not only rewards loyalty but also encourages active trading by increasing the capital traders have at their disposal.

Minimum Deposit of CAPEX

CAPEX sets a high minimum deposit requirement, aiming to cater to a diverse clientele with varying investment capacities. For all types of accounts, the threshold is set at USD 100, making it accessible for beginners or those looking to test the platform with a lower financial commitment. This initial deposit is designed to open the door to the financial markets for a wide range of traders.

CAPEX Account Types

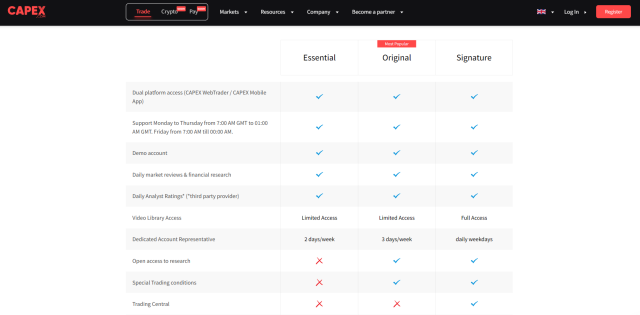

After thorough research conducted by our team of experts at Dumb Little Man, the following CAPEX account types have been identified, each catering to different levels of trading expertise and preferences:

- Essential Account: Targeted at beginner traders, this account type offers access to a broad spectrum of financial instruments, such as currencies, commodities, stocks, indices, and cryptocurrencies. It features competitive spreads and a user-friendly platform, making it an excellent choice for those new to trading.

- Original Account: Designed for intermediate traders, the Original Account builds upon the Essential Account by adding advanced features and tools. It provides enhanced trading conditions, more comprehensive market analysis, and trading signals, catering to traders looking to elevate their trading strategies.

- Signature Account: The Signature Account is aimed at experienced and professional traders, offering premium features and benefits. This account includes access to all instruments and features of the lower-tier accounts, plus personalized support, priority customer service, and exclusive research, addressing the needs of seasoned traders.

- Islamic Account: CAPEX.com accommodates traders who follow Islamic finance principles by offering an Islamic Account version for all the above account types. This account eliminates swap fees and interest-based charges, adhering to Shariah law, making it a viable option for traders who must comply with Islamic financial guidelines.

These account types reflect CAPEX's commitment to providing a tailored trading experience for individuals at various stages of their trading journey, ensuring that every trader finds an account that suits their specific needs and trading style.

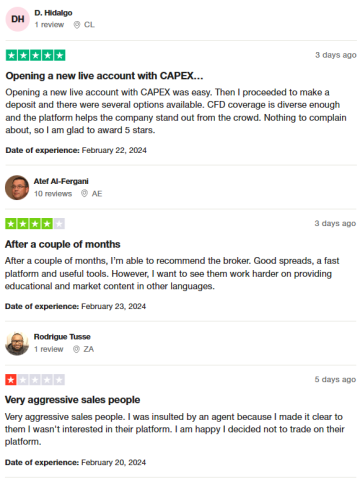

CAPEX Customer Reviews

Customer feedback on CAPEX reveals a mixed but generally positive outlook on the broker's services. Users commend the ease of opening a new account and the variety of deposit options available, alongside the diverse CFD coverage and the platform's distinctiveness. The fast, efficient platform with good spreads and useful tools has garnered recommendations from users, though there is a call for more educational and market content in multiple languages. However, a notable concern arises from reports of aggressive sales tactics, with one customer experiencing unpleasant interactions with a sales agent. Despite this, the overall sentiment leans positively towards CAPEX's trading environment, with specific areas highlighted for improvement.

CAPEX Fees, Spreads, and Commissions

CAPEX stands out in the forex and CFD trading landscape with its competitive fee structure, primarily featuring floating spreads, while also providing options for fixed spreads. This approach ensures traders can engage with the markets under favorable conditions. Particularly for major currency pairs such as GBPUSD and EURUSD, spreads can be as low as 0.01 pips, showcasing CAPEX.com‘s commitment to offering tight spreads. Indices trading also benefits from competitive spreads, with 1.2 on FTSE100 and 0.65 on S&P 500, further enhancing the appeal for traders interested in these markets.

A significant advantage of trading with CAPEX.com is the absence of commissions, allowing for commission-free trading. This feature, combined with the broker's competitive spreads, positions CAPEX.com as an attractive option for traders looking to minimize their trading costs. The amalgamation of low spreads and commission-free trading ultimately contributes to a more cost-effective trading environment, improving the overall trading experience for CAPEX.com users.

Deposit and Withdrawal

A trading professional at Dumb Little Man tested the deposit and withdrawal processes at CAPEX, finding a range of options available for traders to manage their funds. It's crucial to recognize that while the information provided is accurate, specific withdrawal options and associated fees might have evolved.

For withdrawals, CAPEX offers several convenient methods:

- Bank Card withdrawals provide a direct route to access funds, offering simplicity and ease of use.

- Wire Transfer is supported for those preferring traditional banking methods, though it's worth noting potential fees and longer processing times.

- E-wallet services like Neteller and Skrill are also available, offering fast and secure online transactions for both deposits and withdrawals.

CAPEX's commitment to user convenience is evident in offering zero withdrawal fees, enhancing the trading experience. However, traders should be aware that external charges from banks or payment providers (such as Neteller or Skrill) may apply. The availability of these withdrawal options and any associated costs can vary based on the trader's location and the specific terms set by CAPEX.com, underscoring the importance of reviewing the broker's current policies and conditions.

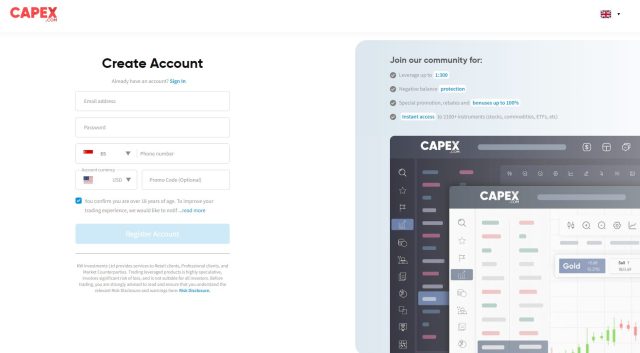

How to Open a CAPEX Account

- Navigate to the CAPEX.com website by entering its URL in your browser.

- Click on the “Register” or “Open Live Account” button, typically found at the website's top right corner.

- Fill out the registration form with required details like your name, email, phone number, and country.

- Select your preferred account type from the options available – Essential, Original, Signature, or Islamic Account.

- Upload documents for identity verification, including a passport or ID for identity and a utility bill or bank statement for residence.

- Deposit funds into your account using one of the provided methods such as bank transfer or credit/debit card.

- Begin trading by downloading the trading platform, logging in, and initiating your first trade.

CAPEX Affiliate Program

The CAPEX Affiliate Program is designed to cater to a wide range of partners through its diverse partnership opportunities. It offers a classic partnership program with three distinct types: individual partnership, franchise, and White Label. Participants in this program can select from three different reward models, allowing for flexibility and customization based on their specific needs and goals.

Additionally, the program includes an Affiliates option, which is particularly appealing to website and online business owners. Affiliates can earn payouts up to USD 1,200 per conversion, with the actual amount depending on the referral's geographic region. This tier of the affiliate program is designed to maximize earnings for those with a strong online presence and the ability to drive high-quality traffic to CAPEX.

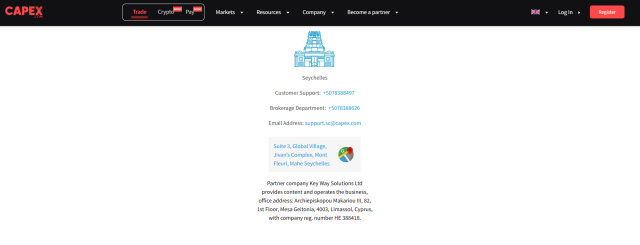

CAPEX Customer Support

Based on the experience of Dumb Little Man with their customer support, CAPEX excels in delivering reliable and efficient customer support to its traders. The broker has established multiple channels to ensure that users have access to help whenever it's needed.

One of the key features is the Live Chat option on the CAPEX.com website, which facilitates real-time conversations with customer support representatives. This channel is particularly effective for obtaining quick responses and immediate assistance, making it a convenient option for traders.

In addition to live chat, CAPEX.com also provides Email Support, allowing traders to send detailed inquiries and maintain a written record of their communications. This method is suitable for addressing more complex issues that may require thorough explanations.

Phone Support is another valuable service offered by CAPEX.com, enabling traders to have direct conversations with customer support representatives. This option is ideal for urgent matters or when immediate attention is required, ensuring that traders can receive prompt and effective assistance.

Advantages and Disadvantages of CAPEX Customer Support

| Advantages | Disadvantages |

|---|---|

CAPEX vs Other Brokers

#1. CAPEX vs AvaTrade

CAPEX and AvaTrade are both reputable brokers in the online trading community. CAPEX shines with its customer-oriented approach, offering a broad array of financial tools and a user-friendly trading environment. It's particularly noted for its innovative technology and educational resources, making it suitable for traders at all levels. AvaTrade, on the other hand, stands out for its global presence and hefty regulation, offering over 1,250 financial instruments.

Verdict: With its foundation in 2006 and a strong regulatory framework, AvaTrade is a solid choice for traders looking for a diverse trading experience. However, CAPEX might be the better choice for traders valuing cutting-edge technology and a wide range of educational materials to support their trading decisions.

#2. CAPEX vs RoboForex

When comparing CAPEX to RoboForex, the distinction lies in their core offerings and technological prowess. RoboForex emphasizes superb trading conditions and a wide selection of trading platforms, catering to a broad spectrum of traders with its advanced technologies. With a license from FSC and a vast range of trading options, RoboForex is geared towards traders looking for customizable trading conditions and platform diversity.

Verdict: CAPEX, with its focus on innovative trading solutions and accessibility for traders of all levels, might be preferable for those who prioritize ease of use and educational support. Given the technological edge and user-friendly focus of CAPEX, it could be deemed more suitable for traders prioritizing a modern trading experience.

#3. CAPEX vs FXChoice

CAPEX and FXChoice cater to different segments of the trading community. FXChoice is recognized for its strong commitment to business integrity and offering conditions that are more tailored to experienced traders. With its inception in 2010 and regulation by the FSC, FXChoice offers a more niche experience with ECN accounts and a focus on professional trading services. CAPEX, with its broad range of financial tools and emphasis on a customer-friendly environment, appeals to a wider audience, including both novice and seasoned traders.

Verdict: While FXChoice offers a specialized service for those with specific trading preferences, CAPEX stands out as a more versatile broker with its comprehensive educational resources and state-of-the-art technology. For traders seeking a broad-based platform that caters to various trading needs with advanced tools and educational support, CAPEX emerges as the preferable option.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you're deeply interested in building a prosperous career in forex trading and aim for significant financial success, Asia Forex Mentor is the prime selection for top-notch forex, stock, and crypto trading education. Ezekiel Chew stands at the forefront of this initiative, celebrated for his contributions to trading institutions and banks. Notably, Ezekiel's consistent performance in securing seven-figure trades distinguishes him from others in the educational sphere. The reasons for our recommendation are compelling:

Comprehensive Curriculum:Asia Forex Mentor delivers a thorough educational program spanning forex, stock, and crypto trading. This curriculum is designed to arm traders with the essential knowledge and skills to thrive in these varied markets.

Proven Track Record: The reputation of Asia Forex Mentor is solidified by its history of nurturing consistently profitable traders across different market segments, showcasing the efficacy of their educational and mentoring approaches.

Expert Mentor: Students at Asia Forex Mentor gain from Ezekiel's extensive experience and success in trading. His personalized mentorship helps students confidently tackle the complexities of the markets.

Supportive Community: Enrolling in Asia Forex Mentor grants access to a community of ambitious traders. This network encourages sharing, collaboration, and mutual learning, enriching the educational journey.

Emphasis on Discipline and Psychology: Understanding the psychological aspects and maintaining discipline are crucial for trading success. Asia Forex Mentor emphasizes mental training to aid traders in emotion management, stress handling, and making informed decisions.

Constant Updates and Resources: With the ever-evolving nature of financial markets, Asia Forex Mentor keeps its students updated with the latest trends and strategies, providing ongoing access to vital resources.

Success Stories: The numerous success stories from Asia Forex Mentor highlight the transformative impact of its education on students' trading careers and financial independence.

For those eager to pursue excellence in forex, stock, and crypto trading, Asia Forex Mentor stands out as the definitive choice. It offers a robust curriculum, expert mentorship, a practical approach, and a supportive network, equipping aspiring traders with all necessary to succeed in the financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: CAPEX Review

In conclusion, the team of trading experts at Dumb Little Man has provided a comprehensive review of CAPEX, highlighting both its strengths and areas where caution is advised. CAPEX stands out for its innovative technology, wide range of financial instruments, and commitment to customer education. These attributes make it an appealing choice for traders looking for a modern and supportive trading environment.

However, potential users should be aware of the high minimum deposit requirements and the limited availability of multilingual customer support. While these drawbacks may not deter every trader, they are important considerations to keep in mind when choosing a broker.

>> Also Read: ATC Brokers Review 2024 with Rankings By Dumb Little Man

CAPEX Review FAQs

What financial instruments can I trade with CAPEX?

CAPEX provides traders access to a vast array of financial instruments, including currencies, commodities, stocks, indices, and cryptocurrencies. This wide selection ensures that traders of all interests and strategies can find opportunities that align with their trading goals.

Is CAPEX a regulated broker?

Yes, CAPEX is a regulated broker, overseen by several leading financial regulatory bodies such as the Cyprus Securities and Exchange Commission (CySEC), among others. This regulation provides traders with a level of security and trust in their trading platform, knowing that CAPEX adheres to strict financial standards and practices.

Are there any fees for depositing or withdrawing funds from CAPEX?

CAPEX offers zero withdrawal fees, enhancing the trading experience by allowing traders to manage their funds without worrying about extra costs. However, traders should note that while CAPEX does not charge for deposits or withdrawals, third-party fees from banks or payment processors may apply, depending on the method used.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.