ATC Brokers Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 106th  |  |

| Evaluation Criteria |

|---|

Dumb Little Man's team, which includes financial experts, experienced traders, and private investors, utilizes a unique algorithm to conduct in-depth reviews of brokerage services. Their evaluations concentrate on critical aspects such as:

|

ATC Brokers Review

Forex brokers play a pivotal role in the global financial markets, acting as intermediaries between retail traders and the vast world of foreign exchange. Among these, ATC Brokers stands out as a distinguished ECN (Electronic Communication Network) and STP (Straight Through Processing) broker.

This review aims to dissect ATC Brokers comprehensively, shedding light on its competitive edges and potential limitations. By delving into the broker's array of account options, deposit and withdrawal mechanisms, commission structures, and more, we intend to offer a well-rounded perspective.

Our analysis is enriched with expert insights and real-user experiences, ensuring that you receive a thorough understanding necessary for making an informed decision. Whether considering ATC Brokers as your go-to for forex trading or simply exploring your options, our evaluation seeks to equip you with crucial insights into its service offerings.

What is ATC Brokers?

ATC Brokers is a prominent ECN (Electronic Communication Network) and STP (Straight Through Processing) broker, established in 2005. Catering to a diverse clientele, the company offers specialized services for individual traders and institutional investors alike. With its headquarters in the United States, ATC Brokers is recognized for its robust regulatory framework, operating under licenses from FCA (Financial Conduct Authority) in the UK and CIMA (Cayman Islands Monetary Authority) in the Cayman Islands.

This dual ECN and STP brokerage model ensures that ATC Brokers provides its clients with direct access to interbank trading prices, which can lead to tighter spreads and more transparent pricing. By serving both individual and institutional clients, ATC Brokers demonstrates a commitment to offering flexible trading solutions that meet the diverse needs of traders worldwide. The firm’s adherence to regulations set by FCA and CIMA underscores its dedication to upholding high standards of financial integrity and client security.

Safety and Security of ATC Brokers

ATC Brokers stands out as a secure and regulated broker, ensuring the safety of its clients' investments. This information, derived from a comprehensive analysis by Dumb Little Man, highlights ATC Brokers' adherence to stringent regulatory standards. The broker is duly authorized and regulated by the Financial Conduct Authority (FCA) in Great Britain and the Cayman Islands Monetary Authority (CIMA), showcasing its commitment to upholding high levels of financial security and regulatory compliance.

The safety measures implemented by ATC Brokers include the segregation of client funds from the company’s capital, with these funds held in segregated bank accounts. This critical feature ensures that clients' money is kept separate from the firm's funds, providing an additional layer of financial security. Moreover, the broker offers negative balance protection, which safeguards clients from losing more money than they have deposited, thus preventing debt to the broker.

In the event of any disputes or violations of the contractual obligations by ATC Brokers, clients are empowered to file a complaint with the regulating authority. This measure offers an extra level of accountability and protection for traders, reinforcing the broker's dedication to transparent and fair trading practices. The regulatory framework provided by FCA and CIMA ensures that ATC Brokers operates within strict guidelines, maintaining the trust and security of its clients’ investments.

Pros and Cons of ATC Brokers

Pros

- Offers Trade Copier and PAMM accounts for investment

- Tight spreads for EUR/USD starting at 0.3 pips

- Licensed by reputable regulators in the USA and Great Britain

- Supports 38 Forex currency pairs

- Direct access to liquidity providers via ECN and STP technologies

- Negative balance protection is in place

Cons

- Limited to two groups of trading instruments

- Commissions on account replenishment, fund withdrawals, and inactivity fee

- No bonuses offered

Sign-Up Bonus of ATC Brokers

ATC Brokers currently does not offer a sign-up bonus for new clients. This policy is in place as of the latest update, highlighting the company's focus on providing value through tight spreads, advanced trading technologies, and strong regulatory compliance rather than promotional incentives. The absence of a sign-up bonus may influence potential clients' decision-making process, as bonuses are often considered an attractive incentive for new traders. However, ATC Brokers compensates for this with its competitive trading conditions and secure trading environment, aiming to attract traders who prioritize long-term trading benefits over initial perks.

Minimum Deposit of ATC Brokers

The minimum deposit required by ATC Brokers stands at $5,000, positioning it on the higher end of the spectrum in comparison to other forex brokers. This significant initial deposit may be a barrier for novice traders or those looking to test the waters with a smaller financial commitment.

ATC Brokers Account Types

Our team of experts at Dumb Little Man conducted thorough research to test the trading accounts offered by ATC Brokers. They discovered the following options:

- Individual Account: Tailored for private traders using their own funds, with an average spread of 0.3 pips for EUR/USD and 0.4 pips for XAU/USD. Offers leverage up to 1:200 and market execution.

- Joint Account: Designed for use by multiple persons, it shares similar terms with the Individual account.

- Corporate Account: Intended for legal entities, with specific trading conditions not publicly disclosed.

All account types provide similar trading conditions, focusing on flexibility and tailored solutions for different types of traders and investment entities.

ATC Brokers Customer Reviews

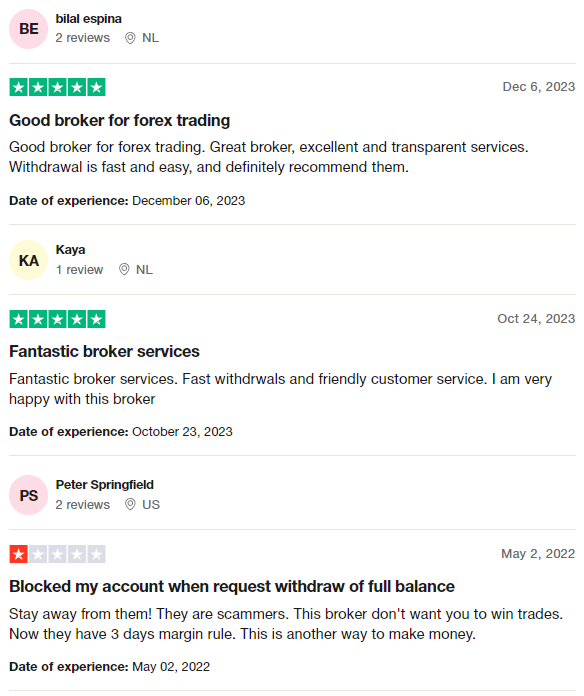

Customer reviews of ATC Brokers offer a mixed view, highlighting both strengths and concerns. Many traders praise the broker for its excellent forex trading services, noting fast and easy withdrawal processes, transparent operations, and friendly customer service. These positive reviews often recommend ATC Brokers for their efficiency and reliability in the trading experience.

On the other hand, there are critical voices raising alarms about the broker, with some labeling it as untrustworthy and accusing it of creating policies such as a 3-day margin rule to disadvantage traders. This divide in customer feedback suggests that while ATC Brokers has many satisfied clients, potential users should approach with caution and consider both the commendations and criticisms before deciding to engage with their services.

ATC Brokers Fees, Spreads, and Commissions

ATC Brokers employs a dual structure for trading commissions, encompassing both spread and fixed commission charges. The average spread for EUR/USD is notably low at 0.3 pips, appealing to traders looking for tight spreads. Additionally, a fixed commission is levied at USD 30 per USD 1,000,000 of traded volume, aligning with the broker's competitive pricing strategy for high-volume traders. However, ATC Brokers also imposes fees beyond trading activities, including a commission for account inactivity.

After six months without trading activity, an inactivity fee of 50 units of the base currency is charged, leading to account blocking if insufficient funds are available. Furthermore, the broker mandates payments for account replenishments and withdrawals, which constitutes an additional cost consideration for traders. These fees, spreads, and commissions reflect ATC Brokers' comprehensive approach to financial operations, necessitating a thorough understanding by potential clients.

Deposit and Withdrawal

ATC Brokers ensures a swift processing time for withdrawal requests, taking up to 48 hours to process applications. This was confirmed through testing by a trading professional at Dumb Little Man, highlighting the broker's commitment to efficient service. Clients can withdraw funds via bank transfer, Visa and Mastercard bank cards, and Skrill wallets, offering a range of options to suit different preferences.

However, the broker imposes commission fees on withdrawals, with bank transfers incurring charges of GBP 20, EUR 30, or USD 40, depending on the account's base currency, and Skrill withdrawals attracting a 1% commission. Notably, transactions using bank cards are exempt from commission fees.

For both deposit and withdrawal transactions, ATC Brokers requires clients to complete a verification process, ensuring a layer of security and compliance with regulatory standards. This mandatory verification underscores the broker's dedication to maintaining a secure trading environment, aligning with industry best practices for financial security and anti-money laundering measures.

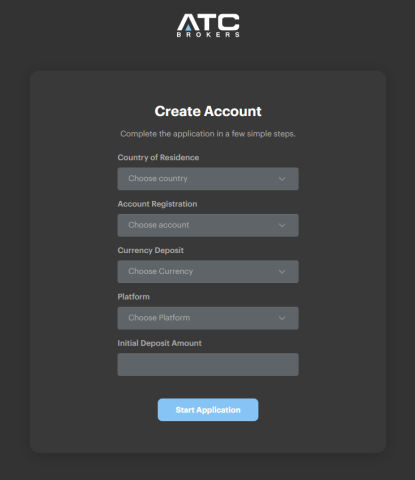

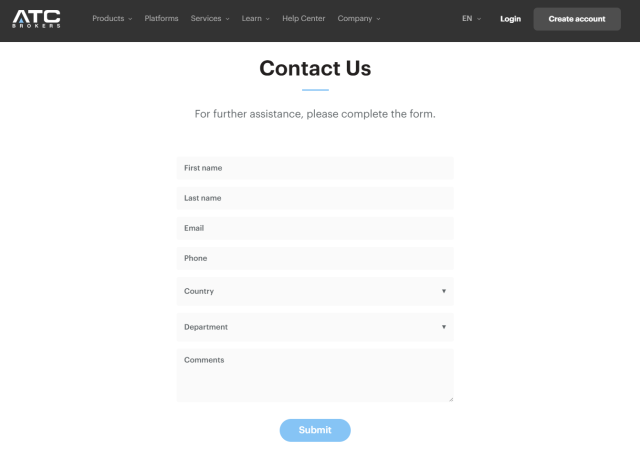

How to Open an ATC Brokers Account

- Visit the ATC Brokers website and access the account creation form directly from the homepage.

- Start by filling out the initial form with details like your country of residence, desired account type, account currency, and type of trading platform you prefer.

- Provide your personal information, including your name, surname, date of birth, residential address, email, and phone number.

- Set a secure password for your account along with a four-digit PIN code for added security and support interactions.

- Acknowledge the commission fees associated with trading by reading and confirming the fee structure.

- Complete a detailed identification form requiring your personal data, including address verification.

- Indicate your U.S. citizenship status, place of birth, and tax information, including your country of tax residence and tax identification number.

- Confirm the accuracy of all provided information in the form to ensure its correctness and truthfulness.

- Proceed to the verification stage by uploading your ID and proof of residential address to verify your identity and complete the account setup.

ATC Brokers Affiliate Program

ATC Brokers features an Introducing Brokers (IB) affiliate program, designed to empower institutional investors, account managers, and Forex schools to promote their services effectively. Participants can monitor their affiliate program results through a dedicated application and receive comprehensive reports via email from ATC Brokers, ensuring transparency and ease of tracking their success.

To join the ATC Brokers IB program, interested parties are required to submit an application through the form available on the company's official website. This streamlined process facilitates the engagement of partners looking to expand their offerings and leverage ATC Brokers' platform for mutual benefits.

ATC Brokers Customer Support

ATC Brokers provides a robust customer support system, as evaluated by the team at Dumb Little Man. Clients have multiple communication channels at their disposal to reach out for assistance. These include a phone number listed in the Contact section of their website, email support, a feedback form, and an online chat feature directly on the site.

These varied options ensure that users can choose the most convenient way to get in touch with customer support specialists. Whether it's for quick inquiries via online chat or more detailed communication through email, ATC Brokers aims to provide timely and effective support to its clients. This commitment to accessible and responsive customer service underpins the company's dedication to fostering positive user experiences and trust.

Advantages and Disadvantages of GKFXATC Brokers Customer Support

| Advantages | Disadvantages |

|---|---|

ATC Brokers vs Other Brokers

#1. ATC Brokers vs AvaTrade

ATC Brokers and AvaTrade both cater to a wide range of traders, yet their offerings have distinct differences. ATC Brokers, with its ECN and STP brokerage model, appeals to traders looking for direct market access and low spreads, especially beneficial for high-volume traders. AvaTrade, on the other hand, is a Forex broker that stands out for its broad range of financial instruments—over 1,250 compared to ATC's focus mainly on Forex. AvaTrade's global reach and diversified regulatory framework across multiple jurisdictions provide a robust trading environment, especially for those seeking a variety of trading platforms.

Verdict: AvaTrade may be better for traders seeking a wide range of trading instruments and those in jurisdictions outside the U.S. ATC Brokers, however, offers a more streamlined Forex trading experience with the potential for tighter spreads through its ECN/STP model.

#2. ATC Brokers vs RoboForex

Comparing ATC Brokers with RoboForex, the latter offers a vast array of trading options—over 12,000, and a selection of trading platforms, including MetaTrader, cTrader, and RTrader. This makes RoboForex a versatile choice for traders with various preferences and trading styles. RoboForex also prides itself on offering customized trading terms, making it suitable for a wide range of traders, from novices to experienced professionals. ATC Brokers, with its focus on ECN and STP trading, might appeal more to those looking for direct market access and low spreads.

Verdict: RoboForex could be seen as the better option for traders looking for variety in trading instruments and platform choices, as well as customized trading conditions. ATC Brokers is ideal for those prioritizing ECN/STP trading in Forex.

#3. ATC Brokers vs FXChoice

FXChoice and ATC Brokers both target a segment of the market that values brokerage service quality and trading conditions. FXChoice, established in 2010 and regulated by the FSC of Belize, focuses on providing services suited for active and passive trading, with a particular appeal to experienced traders. They offer ECN accounts with tight market spreads, which can be very attractive to professional traders. ATC Brokers, with its ECN/STP model, offers similar advantages in terms of market access but is more narrowly focused on Forex trading.

Verdict: For traders specifically interested in Forex and looking for direct market access, ATC Brokers could be the preferred choice due to its specialized approach. FXChoice stands out for traders seeking a broader range of services and tools for automated trading, making it a potentially better fit for those with a focus on technology and a wider instrument selection beyond just Forex.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For individuals passionate about forging a successful career in forex trading and aiming for significant financial returns, Asia Forex Mentor is the premier selection for top-tier forex, stock, and crypto trading courses. Ezekiel Chew, distinguished for his contributions to trading institutions and banks, is the cornerstone of Asia Forex Mentor. Notably, Ezekiel's consistent delivery of seven-figure trades underscores his expertise and distinguishes him from other educators in this arena. The reasons for our endorsement are compelling:

Comprehensive Curriculum: Asia Forex Mentor delivers a holistic educational program encompassing forex, stock, and crypto trading. This curriculum is meticulously designed to furnish traders with the necessary acumen and trading strategies to thrive in these varied financial markets.

Proven Track Record: The legitimacy of Asia Forex Mentor is solidified by its track record of nurturing traders who consistently achieve profitability across different markets. This success is a clear indication of the efficacy of their educational and mentoring approaches.

Expert Mentor: Enrollees at Asia Forex Mentor receive mentorship from an adept mentor with a proven record of success in forex, stock, and crypto trading. Ezekiel's personalized support empowers students to confidently tackle the complexities of the financial markets.

Supportive Community: Becoming a part of Asia Forex Mentor grants access to a nurturing community of traders who share a common goal of market success. This environment encourages cooperation, exchange of ideas, and mutual learning, thus enriching the educational journey.

Emphasis on Discipline and Psychology: Mastery in trading requires not only skill but also a disciplined mindset. Asia Forex Mentor places a strong emphasis on psychological training, equipping traders to manage their emotions, deal with stress, and make informed decisions under pressure.

Constant Updates and Resources: With the ever-evolving nature of the financial markets, Asia Forex Mentor ensures that its students stay informed on the latest trends, strategies, and market insights. Ongoing access to essential resources positions traders to remain competitive.

Success Stories: Asia Forex Mentor boasts numerous testimonials from students who have dramatically improved their trading performance and achieved financial autonomy through their robust education in forex, stock, and crypto trading.

Asia Forex Mentor is the definitive choice for aspirants seeking an exceptional forex, stock, and crypto trading education. Offering a comprehensive curriculum, guidance from seasoned mentors, a practical learning approach, and a supportive community, Asia Forex Mentor equips budding traders with all the tools and knowledge needed to succeed in the dynamic world of financial trading.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: ATC Brokers Review

In conclusion, the team of trading experts at Dumb Little Man has provided a comprehensive review of ATC Brokers, highlighting the broker's strengths and areas of concern. ATC Brokers stands out for its tight spreads, robust regulatory framework, and access to direct liquidity providers, making it a reliable choice for serious traders. With spreads for EUR/USD starting from 0.3 pips and the support of ECN and STP technologies, traders are offered a transparent and efficient trading environment.

However, potential clients should be mindful of the higher minimum deposit requirement of $5,000, which may be prohibitive for newcomers to the forex market. Additionally, the presence of commissions on account replenishment, withdrawals, and an inactivity fee are important considerations. The lack of 24/7 customer support and bonuses may also be seen as drawbacks when compared to other brokers in the market.

>> Also Read: LonghornFX Review 2024 with Rankings By Dumb Little Man

ATC Brokers Review FAQs

What types of accounts does ATC Brokers offer?

ATC Brokers caters to various traders by offering three main types of accounts: Individual, Joint, and Corporate. These accounts are designed to meet the specific needs of private traders, groups of traders, and legal entities, respectively, without differentiating in trading conditions.

Is ATC Brokers regulated?

Yes, ATC Brokers is a regulated broker, operating under stringent oversight from reputable authorities. It holds licenses from the Financial Conduct Authority (FCA) in the UK and the Cayman Islands Monetary Authority (CIMA), ensuring a secure and trustworthy trading environment for its clients.

What are the fees and commissions at ATC Brokers?

ATC Brokers charges two main types of trading commissions: spreads and fixed commissions. The average spread for EUR/USD is 0.3 pips, and a fixed commission is applied at USD 30 per USD 1,000,000 of trading volume. Additionally, there are commissions for account inactivity and non-trading activities such as deposits and withdrawals.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.