5 Best Online Forex Brokers in UK – In Depth Review and Updates 2025

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

It is pretty common nowadays to trade Forex currency in the United Kingdom, and it is gaining more popularity among people. If a broker is looking forward to accepting a CFD trader as a client, they will have to become authorized by the financial conduct authority. It is the authentic economic, regulatory body in the United Kingdom.

The United Kingdom is also known as the global financial hub, and it is because the United Kingdom is the fifth-largest economy in the world. It is important to note that the UK is the leading exporter of financial services globally. It can be due to several factors, and one of them is its Central location. The time zone of the United Kingdom is very convenient for traders and cryptocurrency brokers. The rules and regulations for trading cryptocurrency in the United Kingdom are not as strict as in other parts of the world, and the taxation law is quite convenient.

The United Kingdom is quite reliable for the most reliable brokers because they are famous for their quality and fantastic service in trading. The differentiation factor about the United Kingdom brokers is that they are very reliable and transparent with their clients. Check out the list of details of the most outstanding forex brokers based in the United Kingdom right now.

Best Online Forex Brokers in UK

| Broker | Best For | More Details |

|---|---|---|

Advanced Non-US Traders Read Review | securely through Avatrade website | |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Lowest Cost Overall Read Review | securely through Interactive Broker website | |

| Overall Broker Read Review | securely through Forex.com website |

| Lowest Spreads Read Review | securely through IG website |

5 Best Online Forex Brokers in UK

#1. Best Advanced for Non-US Traders: Avatrade

You can also trade forex in Singapore through AvaTrade. Based in Ireland, AvaTrade is an online trading platform that accepts applications for a forex trading account in a lot of countries. It is also one of the few forex brokers Singapore that is fully regulated and granted the capital markets services licence.

In addition to this, AvaTrade also offers serval state of the art trading platforms, excellent customer support, and a huge variety of currency pairs to trade. You also get a simple demo account to get you started in the foreign exchange without taking a significant risk.

How does it work?

Opening an account with AvaTrade is quite simple. The platform in fact allows you to use Facebook or your Google account to do this. You don’t need to fill in a lot of info. However, the platform will have some screening questions to assess your investment experience.

If this is your first time trading in the foreign exchange market, get some investment advice before you start. Nonetheless, your account should be approved in 24 hours at most. After that, go ahead and make a deposit and start trading.

Pros

- Allows users to open a trading account with Facebook or Google to make it easier

- Global broker with accessibility all over the world

- Some of the lowest trading fees you can find

- regulated by the authority of Singapore mas

Cons

- You can only trade CFDs, Forex, and Crypto and no stocks

- Your account may incur a very high inactivity fee

Price

AvaTrade does not offer a clear and detailed breakdown of how it charges its users. But as with other top Singapore forex brokers, AvaTrade uses a Bid/Ask spread to calculate applicable fees on each trade. The forex trading platform has done well to keep the spread low but it’s not nearly as good as Interactive Brokers. Either way, you still pay below-average trading fees with AvaTrade.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

#2. Best Intermediate for Non US Traders: FXCC

FXCC offers forex traders to trade on forex and silver and gold, indices on trusted MetaTrader 4., available as web or download solution. We will log in to Traders Hub to explore minimum regulations, demo, deposits, and leverage accounts in this online broker review. This is your chance to learn further about FXCC.

FXCC follows the STP/ECN model; it offers a competitive price and execution and no re-quotes or intervention. The clients choose 3 accounts to choose from and then trade on precious metals, indices, and forex on the well-known MT4 terminal.

FC XX provides MT4 to every client that is accessible on various gadgets and major web browsers. The platform has many advanced features for trading; this includes a built-in library with more than 50 indicators for indicating technical analysis. There is also access to plus embedded charts, stop and pending orders, the market for accurate analysis.

How does it work?

As the best broker, it also provides users to leverage. It can make multiple the initial accounts balance. But as a matter of fact, it should be used very wisely as it can increase the power of losses too.

For the convenience of traders, they can start a risk-free trial of 30 days on a demo account to easily test new strategies and practice skills before they commit real money. Following some easy steps, you can start up with your practice account loaded with virtual funds of 10000 dollars.

You can connect your trading account from any place with the help of the MT4 mobile phone app. The state-of-the-art platform, due to its easy-to-use reliability and interface, gets good feedback. The forex brokers UK offers a reliable sell price to trade forex with Financial Conduct Authority FCA and a trading account.

Pros

- 100% first deposit

- Free Virtual Private Server

- Includes MetaTrader 4 platform

- high leverage trading

Cons

- It does not include U.S. based traders

- Lacks different trading platforms

Price

When you trade with an FXCC ECN account, you will be linked to many currencies GBP, EUR, USD featured along with tight spreads which are from 0.01 pips with the availability of trading over 30 currencies with a span of tools such as SNS notifications, trading tools, VPN, Technical analysis and E.A.s. You can see the spread comparison of FXCC spreads below.

The only thing it costs is presented by spreads from 0,1 pips and no commission fees. You can compare spreads of FXCC with another well-known online broker like Fondex and also refer to a comparison of the spreads for most traded instruments. The foreign exchange market us all about such trading's.

| Broker | Best For | More Details |

|---|---|---|

| securely through FXCC website |

#3. Lowest Cost Online Stock Platform: Interactive Brokers

Interactive Brokers are the institutional investors that promote commission-free trading in UK while providing the most accessible brokerage services for decades. This sophisticated publicly-traded company has got the top rankings for the best brokers for stock and ETF. You can now trade forex with an average spread EUR USD option designed to offer trading forex online with forex pairs.

Interactive brokers offer the customers global as well as US-based trading. The two plans that the company thought about are IBKR Pro and IBKR Lite. It is one of the best Australian Forex trading brokers that offer beginner traders effective investments commission options and low trading fees.

The IBKR lite customers are available to forex trade, options, stocks, bonds, funds, and options on up to 135 markets, not more than one trade accounts. for the convenience of the customers to easily evaluate assets among the socially responsible investing lens. The experienced Forex traders will help start trading forex ensuring Australian securities help trade within forex markets.

The IBKR Lite does not offer any trading fees or commissions. For all the experienced active traders who need a wide variety of investments, these brokers are the best choice making them the best broker. This online forex platform offers York stock exchange feature helping the retail investor accounts lose money no money.

How does it work?

Like all the online brokers, IBKR also produces interest earnings with the difference between what it earns on the customer's cash backs and what it pays on their idle cash. The forex trades include the financial markets authority for trading CFDs that helps these UK Forex brokers to retail CFD accounts.

The company also offers market research. Like most, the brokers produce income when they accept payment from the market makers to direct orders to the trade venues. That is known as the payment for the order flow.

When the stocks held in the client's account are lent to other hedge funds or traders, the stock loan program produces revenue for interactive trading brokers.

From all the loan shares, the company provides 50% of the total income that it receives to the client. A mobile app is available for the customers who are approved for cash account or margin account with 50000 dollars. The trading interactive brokers offer exclusive benefits.

Pros

- Low fees and commissions

- Impressive platform stacked with multiple features

- Incredibly decent and effective trade execution

- A broad range of investment features and offerings

Cons

- The platform is a bit intimidating, mainly for beginners

- It utilizes highly daunting tiered pricing plans

Price

You will find the pricing scheme for these brokers a bit complicated. That's because it includes three different types of commissions named fixed, tiered, and lite programs. Firstly, let's talk about stocks and ETFs. It costs $0 for IBKR lite accounts and ranges from $0.005 to $0.0035 per share for at least 300,000 shares per month or a minimum of $0.35 per trade.

Moreover, depending on the trade volume, the commissions are $0.15 to $0.65 per contract. When trading 15 contracts, it will cost 32.50. Mutual funds are lessening than 3% of total trade value costing $14.95 for funds. When we talk about the future trades, it costs $0.85 per contract with additional regulatory and exchange fees.

| Broker | Best For | More Details |

|---|---|---|

| securely through Interactive Brokers website |

#4. Best Overall Broker: Forex.com

FOREX.com provides a really extensive span of various offerings from spread betting to CFDs across various asset classes, but every region can access all. It is considered to be safe due to having a long track record. The top financial tiers regulate this trading forex broker.

The parent company of this forex broker has been listed on the stock exchange. Aside from the market, where derives the name, FOREX.com also offers indices, commodities, ETFs, bonds, individual stocks, silver, and gold, which is unleveraged in the U.S., futures, and cryptocurrencies, providing opportunities to all the traders.

The U.K. service offers security to clients' accounts like ESMA-mandated anti-guaranteed to stop losing orders and balance protection. FOREX.com is ideal for every trader who seeks exposure to a wide array of asset classes and materials.

It is a great fit for high-volume forex traders. Material offerings vary by place but still, it emphasizes reliable and fast execution, diversity of other and forex platforms, and security accounts. In the United States, it's geared to those interested in trading exchange markets worldwide.

How does it work?

FOREX.com gives accessibility to more than 80 currency pairs along with a competitive spread over various types of accounts to U.S. clients. A navigable and a well-organized website along with complete disclosure of fees and services, research and education tools, multiple user interfaces which are on par along with the industry's standards and regulatory oversight place.

So it depends upon your location and the entity holding your account that what is available for you on FOREX.com. You can trade cryptocurrency using CFDs; also, underlying asset trading is not available, for instance, buying bitcoin.

The web Trading Platform of FOREX.com is recommendable for casual traders because it is simple to browse through place trades and markets and conduct searches. TradingView powers all the charts as well, as it is loaded with approximately ten chart types, 100 indicators, and 14 timeframes.

Within the forex platform, the investors can access economic calendars, positions, charts, news and order or trade history, access research reports and trade signals, and market analysis from the FOREX.com analysts.

Pros

- A wide variety of products

- TradingView charts

- Ideal for high-volume traders

- User-friendly and reliable

Cons

- No guaranteed for U.S. clients

- Lacks effective website maintenance

Price

The spreads vary depending upon the client that, which kind of account they choose. For instance, the least EUR/USD spreads for clients from the United States on ‘standard' account is one pip; on the other hand, ‘STP Pro' and ‘commission' will show you spreads of 0.1 and 0.2.

Although the two that are latter have 50 dollars and 60 dollars per million commissions that are added to displayed spreads, the regions that are not in the U.S. provide Direct Market Access accounts for bigger account sizes like 25000+. The DMA account does not charge any commission but also does not offer markup on spreads.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Forex.com website |

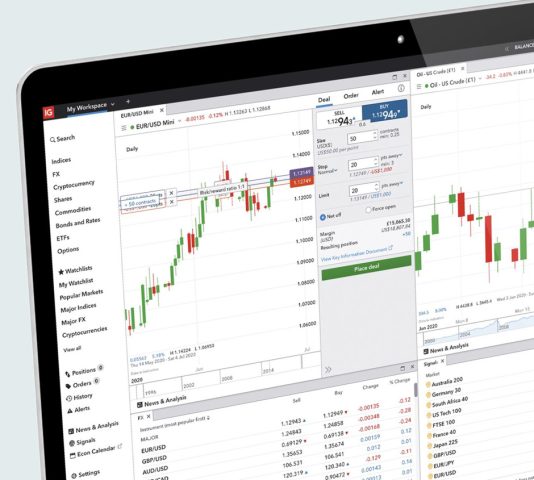

#5. Best for Lower Spreads: IG

One of the advanced trading platforms in UK, IG brokers, includes forex UK securities that's effortless to customize and is user-friendly. The forex market traders also involve educational tools for funding, learning, and other aspects with different trading platforms available. These UK brokers offer effective investments commission and complex instruments with this mobile platform.

You will also find many useful educational tools for learning. Funding and withdrawing money is easy, and there are multiple options, as illustrated by the commodity futures trading commission. Besides this, the Forex broker includes a foreign exchange with currency pairs to provide retail investor accounts.

It offers advanced trading accounts features for stock CFDs. You will find a limited product portfolio as these active forex trader brokers involve options trading and exchange features. The customer support is second to none with currency market options to get the maximum benefit.

Therefore, IG brokers are for users looking for anyone who desires to trade in the exchange markets will find these brokers a top choice. IG opts to provide exclusive trading services from low spread costs, actionable research, customer service, interfaces, and more, making it one of the most exclusive online brokers in the market.

How does it work?

IG platform includes multiple choices and currency trading options, API interfaces starting from proprietary web-based options with effortless and customizable features. This broker is an excellent trading platform with easy and stable browser access, and that's a valuable advantage for forex and CFD traders.

Moreover, the fee options are budget-friendly, but the contract sizes are smaller than regular retail traders. Have you got that? You will find both the vanilla and barrier trade options with no deposit and account fees. The IC markets involves use of complex instruments as illustrated by the Australian Securities and investments.

Besides this, the CFD trading option is a web-based trading platform loaded with broad features to provide innovative functions and copy trading options. Usability is the heart of professional traders that includes trading cost and demo account factors. This professional trading includes an effective trading strategy and there is no high risk of losing money.

The broker includes innovative trading options like the streaming news from an economic calendar that regulated brokers to help experienced traders to start trading with complex instruments. The advanced traders include a customizable screener for different asset classes such as CMC markets and other currency pairings.

Pros

- Wide range of trading tools and offerings

- It accepts US customers

- Provides a detailed emphasis on research

- Offers protection to clients

Cons

- Lacks account protection

- Incredible share-CFD fees

Price

Let's see how IG makes money, especially through different customer trades that ultimately cross the bid spread. The global financial markets offer exchange trading with a commission charge that allows users to play when one user is trading CFDs, but it also adds to another side of the market spread. You will also find another commission for share-CFD trade.

Moreover, it also includes an inactivity fee of up to $12/month when there is no trading for 24 months. You will also find wire withdrawals of $15 while providing a detailed explanation of the market on the website. You will also find three rebate tiers starting from 5% for almost $100 of trading volume to up to 15% for $500+ million in each trading volume.

| Broker | Best For | More Details |

|---|---|---|

|

| securely through IG website |

How we rank the Best Forex Brokers in the UK?

If a broker suits your needs, it doesn't need to be suitable for another trade. That is why it is essential to conduct comprehensive research to find the right broker for your needs.

Choosing the right broker depends entirely on the personal circumstances you are in, and let's have a look at the things you should keep in your mind below.

Is it regulated?

When you choose a Forex or CFD broker, the first thing you should keep in your mind is safety and regulation. It is essential to ensure our because you trust them with your finances and personal information. First of all, you need to guarantee that your data and monetary funds will be protected and nothing will go wrong.

Make sure that you have enough confidence regarding the broker's reputation you are choosing. You need to make sure that they do not go out of business; otherwise, you will get scammed for your money, resulting in significant losses for you.

The financial conduct authority regulates the most outstanding forex and CFD brokers in the United Kingdom. That is why they are obligated to provide quality services to their clients. Check the broker's website and if the regulation information is available with transparency.

What are the trading costs?

It is essential to consider the cost when choosing a Forex or CFD broker. Many brokers work on a Commission basis while others work through spreads. Spread is the difference between purchasing and selling price on a currency pair. It is beneficial in giving you a significant advantage on your revenue margin.

Take a look at the average spread that every broker offers to their clients to find the right one for you according to your circumstances. Do not forget to consider the minimum deposit required and all the additional fees. It will include interest rates and rollover costs.

What trading platforms does it use?

It is imperative to consider the trading platforms that a Forex or CFD broker offers.

Make sure that you choose an easy-to-navigate platform with all the features you are looking for to make the best decisions while trading.

MetaTrader 4 is the most popular platform used by brokers in the United Kingdom. The best part is getting a free demo account before making any serious commitments.

How to choose the Best Forex Broker in the UK?

Here's what you need to consider while choosing the best forex trading account!

Does it offer good customer service?

Brokers support their clients throughout their trading careers, and that is why it is vital to look out for them. Watch out for the educational tools and resources which the broker is offering.

The sign of a good broker is that it is effortless to communicate with them, and you can always reach out to them for all your problems. Good brokers offer trust for and reliable relationships. They are always available for trading guidance, and that is why you should check out the customer reviews of every broker on your list before making any serious commitment with them.

Does it fit with your trading style?

Ensure that you check whether the broker is compatible with your trading style or not. If you open and close trades to combine small profits, you should look for a broker offering tight spreads. Check for mobile trading option to spread better while saving you from losing money rapidly,.

On the other hand, if your method is more focused on The carry style in which you hold the positions for some time, you should look for a broker with roll-overpricing and swap rates. Additional things to consider while choosing a broker are mentioned below:

- Types of accounts on offer

- The available range of currency pair for trading

- Available leverage

After conducting adequate research, you can easily choose an outstanding Forex or CFD broker. The list of the best forex and CFD brokers will give you the kickstart you are looking for to find the best one in the United Kingdom.

Choose Asia Forex Mentor for Your Forex and Stocks Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Best Forex Broker in the UK

Let us tell you what retail brokers are! These are the institutions that work between a forex trader and a forex environment. YES! You heard that right. The UK Forex brokers have an online presence, and they target the different smaller traders to operate within forex markets on a single or margin basis.

Many brokers also include useful educational and research tools to provide beginners an enhanced knowledge about the trading process. These brokers provide additional excess to experts and the market analysis to aid you in choosing the beneficial trading options.

Therefore, a forex trader can start easily only by opening an account and downloading free trading options such as MetaTrader. Here we have mentioned seven top-quality forex brokers so you can choose the one that suits you completely.

Avatrade gives average-to-competitive spreads, depending upon your type of account, along with adequate educational resources. The low account minimum deposits make it best for the undercapitalized and new traders who seek to make limited skill sets.

Best Forex Brokers in the UK FAQs

Is Forex Trading legit in UK?

Forex trading platforms are popular in the UK, mainly among the residents. Before you choose the best UK Forex brokers, it is essential to know whether these regulated brokers are legal or not. Well, any broker will make Forex trading legal as it involves money when trading CFDs and other financial services. The brokers in the UK are well authorized and offer a web platform for assistance.

Moreover, Forex trading is legal in the UK. The Financial Conduct Authority FCA offers trading strategies and assistance with the trading account with a minimum initial deposit and trading costs. The best UK Forex brokers provide a legitimate trading market and major currencies for trading.

Can Forex Brokers lose money?

The market is undoubtedly a high risk. However, the financial services compensation scheme still reduces the risk of losing money rapidly as any regulated broker will offer assisted services. Well, traders go through an intermediary for executing trades. At the same time, some brokers might make hidden fees with gains and losses.

Do you know it's common to lose money when trading even with the best forex trading platform? Some require a minimum deposit with the currency pair, and the financial conduct authority ensures to save from circumstances. You will not lose money when trading CFDs and get the maximum advantage. The brokers will only earn money within the commission charges, and they have no links with profits or losses.

What are retail investor accounts?

Let's consider retail investor accounts! Basically, a retail investor is a non-professional investor and also called an individual investor as it can increase market impact. Anyone who will not do investing like a career is a retail investor. Have you got that?

A retail investor will sell or buy the securities through firms and brokerages such as 401(k)s. Moreover, the investors will not use their own money but invest in other people's money. That's how these retail investor accounts work!

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.