Best Forex Currency Pairs to Trade

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

There are lots of currencies in different parts of the world and some of these currencies can be traded in the forex market. To facilitate this, currencies are traded in pairs known as currency pairs. A Forex currency pair is made up of 2 currencies. The first currency in a currency pair is the base currency while the second is the counter currency. Pairing the currencies in the forex market makes it possible to trade many forex pairs all day round since different countries and economies exist in different time zones. There are 3 types of forex pairs;

- Major Forex Pairs

- Minor Forex Pairs

- Exotic Forex Pairs

The major currency pairs are the most traded currency pairs in the Forex market. They are currency pairs that contain the United States dollar(USD) as the base or quote currency. They are the best currency pairs to trade and account for a significant portion of currency exchange transactions worldwide. They include; EURUSD, GBPUSD, AUDUSD, NZDUSD, USDJPY, USDCHF.

The minor currency pairs are currency pairs that exclude the USD. They are also known as cross currency pairs. Modern world forex brokers offer both major and minor currency pairs on their trading platforms. Examples of minor Forex pairs are; AUDJPY, EURGBP, GBPCHF. Exotic currency pairs are currency pairs that contain a currency from a major economy and another currency from an emerging economy. Examples include; USDNOK, EURSEK, USDSGD, USDMXN.

The primary goal of a forex trader is to make profits by buying and selling these currency pairs. Traders employ tools of technical and fundamental analysis to speculate about the potential strength or weakness of a currency and trade Forex pairs in line with this speculation. Technical analysis involves the use of various trading strategies, indicators, and systems to forecast the movement of forex pairs. Fundamental analysis involves the analysis of economic data, news reports, and the currency exchange rate, to forecast the potential strength or weakness of a currency.

Keep reading to learn about the different currency pairs in the forex market, and the best currency pairs to trade.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Forex Terms that you need to understand?

-

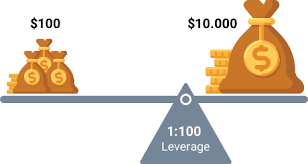

Leverage

Leverage, in forex trading, is the use of borrowed funds to control a greater amount of money than what the original capital would have allowed. It is a component of forex trading that allows traders to trade with larger positions or lot sizes than their capital would have allowed. The additional positions made possible by high leverage are funded by the forex broker.

Traders trade with leverages that suit their risk management parameters and account sizes. Conservative traders prefer to use lower leverages (such as 1:10) because they are best suited for low-risk forex traders who do not enter a lot of trades at once. A 1:10 leverage means that every dollar of your capital has a power equivalent to $10. Aggressive traders and traders who trade with smaller accounts usually trade with higher leverages (such as 1:500, 1:1000) because this allows them to enter a greater number of trades, and open trades with bigger lot sizes and high risk percentages.

-

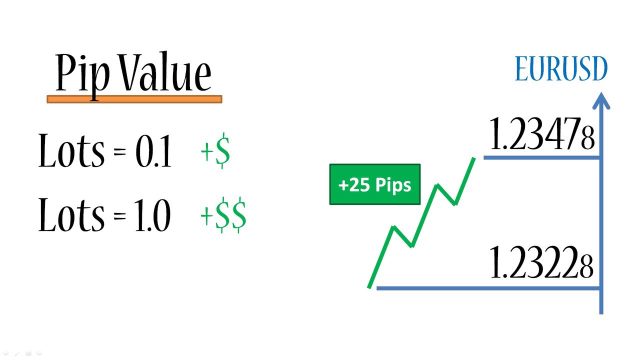

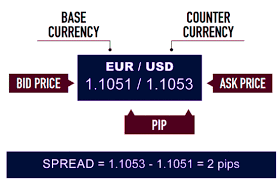

Pip

In Forex trading, the word pip simply means percentage in point. It represents the change in the value of two currencies in a forex currency pair. The number of pips moved by a currency pair can be obtained by finding the difference between two price points.

For instance, if EURUSD moves from 1.2030 to 1.2031 this is a 1 pip move. Essentially, traders profit from the foreign exchange market as a result of price movements and price fluctuations, the extent of which can be measured in pips.

A volatile market environment usually produces more pips and provides greater opportunities to make profits from the forex market. However, volatility could result in irrational price movements which is a risky trading environment.

-

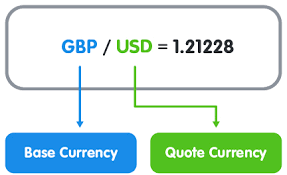

Base Currency

Trading Forex pairs involves buying one currency in the pair and selling the other based on speculation of their strengths and weaknesses. In forex trading, the first currency in a currency pair is the base currency.

In the forex pair GBPUSD, the British pound(GBP) is the base currency while the USD(US dollar) is the quote currency. While trading forex pairs, traders buy a currency pair if the base currency is stronger than the quote currency and vice versa.

-

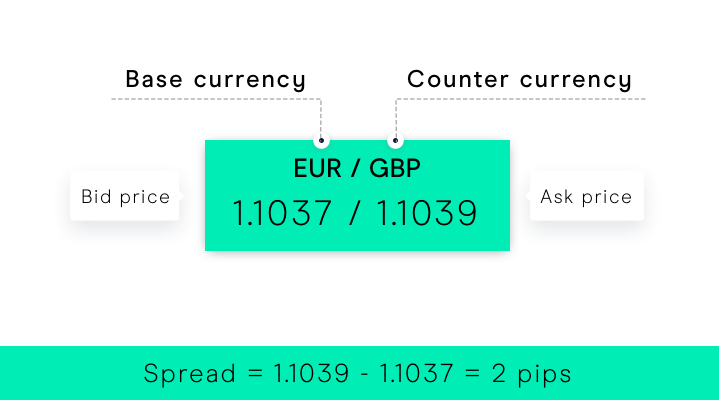

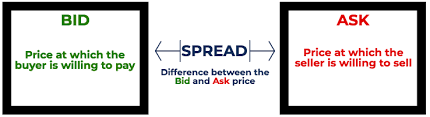

Spread

Currency pairs are traded on forex broker platforms. Forex brokers provide a data feed that shows the fluctuations in the price of currencies and currency pairs. For currency pairs to be traded, there has to be a bid price and an asking price. The difference between the bid and ask price is the spread.

Spreads vary across forex brokers and depend on factors such as the level of volatility in the forex market at that point in time. This means that in less volatile market conditions such as session classes or public holidays, spreads are bound to be higher and there is an increased likelihood of random fluctuations in price.

Why Should You Care About Spread?

Spreads affect a lot of crucial parameters while trading CFDs and forex currency pairs. Variations in real-time spreads can influence whether or not an order (limit order) gets triggered, or a stop loss or take profit is reached.

-

Ask

Since forex trading involves buying and selling currency pairs, forex traders have to buy the currencies at a specific price. This price is set by the forex broker and is known as the asking price.

The asking price is the price a forex trader is willing to buy a currency pair at, and the price the broker is willing to sell at.

-

Bid

The bid price is the price a forex broker is willing to buy a currency pair at. Since forex traders need to trade on a broker's platform, the bid price can also be defined as the price a forex trader is willing to sell a currency pair at.

The difference between the ask and bid price in forex trading is the spread. The bid price for trading currencies can be seen on a broker's platform and is highlighted with a bid price line.

Best Forex Pairs to Trade

#1. USD to CAD

USDCAD is one of the major currency pairs in the forex markets. The quote currency is the Canadian dollar while the base currency is the US dollar. The strength of the Canadian dollar is strongly correlated with oil prices. this is because Canada exports oil to several countries around the world, including the United States. Therefore, an increase in the price of oil can strengthen the Canadian dollar.

The US and Canadian economies are in close proximity and are closely linked. An increase in the oil exports from Canada to the US would increase the influx of the US dollar into the Canadian economy and this can strengthen the CAD. If the Canadian dollar (the quote currency) is stronger than the US dollar(the base currency) then the USDCAD would move in a downtrend.

Trading CFDs and forex markets generally require fundamental analysis. Since the CAD is correlated with oil, it is crucial to monitor oil prices, news reports, and economic data while trading this pair. Like other major pairs, the USDCAD is a widely traded currency pair.

#2. USD to EUR

The USD to EUR is also referred to as EURUSD. In EURUSD, the Euro is the base currency while the US dollar is the quote currency. EURUSD is the most traded currency pair in the forex market. The Euro is a currency used by countries in the European Union. Therefore, while trading ERUSD, it is important to be on the lookout for news reports concerning the European market and European economies. Also, news reports from the European Central Bank such as monetary policies, greatly impact the strength of the Euro and should be analyzed by traders, regardless of the trading strategy or system of technical analysis they adopt.

Forex traders prefer to forecast the strength or weakness of the US dollar using the US dollar index. The stronger the dollar index, the stronger the dollar. If the strength of the dollar increases, then EURUSD would move in a downtrend and vice versa.

The EURUSD is one of the most liquid currency pairs and this makes it easy for most traders to trade. It typically has lower spreads and high volatility which provides a favorable trading environment for all kinds of traders.

#3. USD to JPY

The USD to JPY is commonly referred to as USDJPY. It is one of the most popular forex pairs in the forex market. In relation to the risk appetite of traders and investors, the forex market has ‘risk on' and ‘risk off' environments. The ‘risk on' environment is one in which the investors and traders in the financial market are ready and willing to take on a significant degree of risk. These trading environments are characterized by an increase in stock prices and a decrease in the value of ‘safe havens' like the Japanese Yen.

In ‘risk-on environments, investors and traders are unwilling to take on risks. This causes the price of stocks to fall, and the value of the Japanese Yen to increase. Therefore, during periods of uncertainty such as the spread of diseases, investors are in a ‘risk off' environment and do not want to invest in risky assets and currencies. therefore, the value of safe havens like the Japanese Yen increases.

Therefore, before trading the USDJPY, it is important to determine if the forex market and investors are in a ‘risk on' or ‘risk off' environment, in order to forecast the valuation of the Japanese Yen.

#4. USD to CHF

The US dollar to Swiss Franc, also known as USDCHF, is one of the major forex pairs. The Swiss Franc is a legal tender of Switzerland and is seen as a safe haven just like the JPY.

Before trading the USDCHF, it is important to take note of the news releases and economic data of the eurozone and Switzerland. This is due to strong economic ties between Switzerland and the eurozone. The Swiss Franc was pegged to the Euro in 2011 but this peg was removed in 2015. Since then, the Swiss Franc has been a strong and volatile currency and still remains a safe haven for investors.

#5. GBP to USD

The GBP to USD is one of the most-traded forex pairs in the currency market. This is due to its high volatility and liquidity compared to other popular currency pairs. The strength of the US dollar is greatly impacted by news reports and economic data such as the non-farm payroll and monetary policy reports. The GBPUSD is often impacted by these news data and shows high volatility and price fluctuations upon their release.

Similarly, the British pound is affected by the economic data and news reports relating to the British economy. During Brexit, the UK withdrew from the European Union and this caused a significant devaluation of the British Pound. This was because investors lost confidence in the British pound as it became unstable due to the economic instability caused by Brexit.

Therefore, traders who start trading forex while unaware of these news reports are at substantial risk of losing money rapidly. Trading CFDs and forex pairs require traders to monitor and evaluate the economic situation in various countries.

#6. AUD to USD

The Australian dollar like other major currency pairs is one of the most heavily traded currencies. The Australian dollar to US dollar is one of the most popular forex pairs in foreign exchange trading. The AUD is a commodity currency because its strength is correlated with some commodities. These commodities include precious metals like gold, silver, and iron ore. An increase in the price or strength of gold can strengthen the AUD. This is because a significant portion of the world's gold is produced by Australia. This means that an increase in the price of gold is favourable for the Australian economy.

Since the AUDUSD is one of the most traded currency pairs, it is quite volatile compared to other currency pairs. Trading this pair also requires fundamental analysis of news data and economic reports of the Australian and US economies. These include interest rate news, monetary policy statements, unemployment data, and so on. These news data can be found on several platforms before a trading week begins. This allows traders to anticipate their release and prepare accordingly. Since the Australian dollar is a commodity currency, it is important to evaluate news data relating to precious metals such as gold. The supply and demand of these precious metals can give us insight into the potential strength or weakness of the Australian dollar.

Choose your Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

| Intermediate Non-US Traders Read Review | securely through FXCC website |

Overall Broker | securely through Forex.com website | |

| Professional Forex Traders Read Review | securely through Interactive Brokers website |

Best Forex Course

If I had to recommend one course that would help you grow as a Forex trader, it would be: Asia Forex Mentor by: Ezekiel Chew

The Asia Forex Mentor by Ezekiel Chew is undoubtedly the best beginning course you can pursue if you want to know the ins and outs of the Forex market.

There are multiple blogs that would help you in understanding the program better. You can also sign up for the One Core Program that is a foreign exchange market course that teaches many forex traders how to improve their trading style and improve their trading account.

If you pursue this course with all your heart, you would learn the basics of making money on the Forex platform. Your knowledge of analyzing the market would boost tremendously, and you can seize the next opportunity to make huge profits on the market. With the right forex trading tools and this course, you will be able to prioritize return on investment over anything else.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Conclusion: Best Forex Pairs to Trade

There are lots of forex pairs that can be traded in the foreign exchange market. These pairs can be traded all day round due to the different time zones of the world's economies.

However, the best forex pairs to trade are stable currency pairs which are volatile and highly liquid. This allows traders to make profits and avoid the random fluctuations in price, caused by lack of liquidity. These pairs are usually major currencies as discussed above but may include some cross currencies.

Before trading any currency pair, it is important to carry out adequate technical and fundamental analysis to forecast price movement. Technical analysis involves the use of tools of technical analysis to forecast price movement. Fundamental analysis involves the evaluation of economic data and news reports to come up with speculation about the future movement of price.

Best Forex Pairs to Trade FAQs

Which currency pair is most profitable in forex?

There is no profitable forex pair. There can only be profitable traders. A trader's profitability depends on their approach to forex trading from a technical, fundamental, and psychological perspective. Traders have to develop a profitable system of fundamental and technical analysis to become profitable. However, there are certain pairs that most traders prefer to trade. This is because these pairs are liquid and volatile and this makes them move in a systematic and fairly predictable fashion. They are the major pairs discussed above and some cross pairs also.

Since most traders make a profit by trading these pairs, they are regarded as the most ‘profitable' pairs.

What is the easiest forex pair to trade?

The easiest forex pair to trade is any pair that is liquid and at least moderately volatile. These are the major pairs discussed above such as EURUSD, GBPUSD, AUDUSD, and so on. These pairs are easy to trade because their high liquidity prevents the random price fluctuations that make less liquid pairs difficult to trade.

This makes them the preferred forex pairs by neophytes and expert traders and they are now traded in the foreign exchange market extensively.

What currency pairs move the most?

Traders like to trade forex pairs that are moderately or highly volatile and these can be major pairs(GBPUSD, EURUSD) or cross pairs (GBPJPY, EURJPY). The movement of these pairs also depends on factors like the trading session. The JPY crosses tend to be more volatile in the Asian session compared to the other currencies. Major pairs are highly volatile in the New York session since they contain the US dollar.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.