AximTrade Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 131st  |  |

| Advantages | Disadvantages |

|---|---|

AximTrade Review

Forex brokers play a crucial role in the global financial markets, acting as intermediaries that allow traders and investors to buy and sell currencies. AximTrade stands out as a notable player in this field, distinguished by its regulatory compliance and exceptional offerings. Duly regulated by the ASIC and SVGFSA, AximTrade has cemented its reputation on the global stage by delivering unparalleled services, cutting-edge solutions, and highly competitive trading conditions.

Our review dives deep into AximTrade, spotlighting its standout features and areas that may need improvement. We aim to furnish a comprehensive evaluation, focusing on the broker's unique selling propositions. This analysis is geared towards providing readers with vital information about AximTrade's various account options, deposit and withdrawal processes, commission structures, and more, blending expert analysis with real trader feedback.

The goal of this review is to offer a balanced view of AximTrade, empowering you with the insights needed to decide if it aligns with your trading requirements. By examining both the advantages and potential drawbacks, our objective is to assist you in making an informed decision regarding choosing AximTrade as your go-to brokerage service provider.

What is AximTrade?

AximTrade is recognized as a prominent forex broker in the financial markets, catering to a wide range of trading needs. The broker is acclaimed for its use of the MT4 forex trading platform, which is considered the industry standard for forex and CFD trading. Offering a diverse portfolio, AximTrade.com provides access to over 30 forex currency pairs, equity, gold, and silver, presenting a variety of options for personal investment and trading.

Operating under stringent regulatory frameworks, AximTrade is fully regulated in Australia and New Zealand, jurisdictions known for their robust financial regulations and dependable government agencies. These provide a safety net for traders in case of disputes with the broker. Moreover, AximTrade maintains an offshore entity in Saint Vincent and the Grenadines, noted for its more lenient regulatory environment for forex brokers.

The regulatory environment significantly affects trading conditions such as leverage. AximTrade offers different leverage caps depending on the entity a trader is registered with. For instance, Australian regulations restrict leverage to a maximum of 1:30, whereas its entities in New Zealand and Saint Vincent and the Grenadines offer much higher leverage, up to an astonishing 1:3,000. Unique to AximTrade is the “Infinite Leverage Account,” enabling traders to essentially borrow an unlimited amount of trading capital, highlighting the broker’s commitment to providing flexible trading conditions.

Safety and Security of AximTrade

The safety and security of AximTrade have been thoroughly vetted, with insights gathered from extensive research by Dumb Little Man. As a multifaceted forex broker, AximTrade Group encompasses various entities, each regulated in different jurisdictions to ensure trader safety. AximTrade Pty Limited falls under the oversight of the Australian Securities and Investments Commission (ASIC), establishing a strong regulatory foundation. Additionally, Huntington Services Limited, a New Zealand-based IBC, is authorized as a Financial Service Provider (FSP), while AximTrade LLC is regulated by the Financial Services Authority of Saint Vincent and the Grenadines and the National Futures Association.

To further safeguard client funds, AximTrade implements crucial financial security measures. Each client's funds are segregated, transferred to separate bank accounts, ensuring protection from unforeseen company risks. The broker also offers negative balance protection, a critical feature that prevents clients from losing more money than they have deposited. This mechanism is pivotal in maintaining the financial well-being of traders.

Moreover, the broker's parent company, Thara Heights Owner's Corporation, has a longstanding operational history since 2010, reinforcing its stability and reliability in the financial sector. AximTrade also accommodates modern financial practices by accepting electronic wallets and cryptocurrency for fund deposits and withdrawals, catering to the diverse preferences of its global clientele. These measures collectively underscore AximTrade's commitment to providing a secure and reliable trading environment.

Pros and Cons of AximTrade

Pros

- Globally recognized and regulated

- $1 minimum for cent/standard accounts

- ECNs start at $50

- Competitive spreads and commissions

- Leverage up to 1:Infinite

- Cryptocurrency and electronic payments

- Social trading for extra income

- Free access to MT4

Cons

- No access for US, UK, Canada traders

- Lacks web terminal

Sign-Up Bonus of AximTrade

In the ever-competitive world of forex trading, brokers often offer incentives to attract new clients. However, as of the latest update, AximTrade does not offer a sign-up bonus. This decision reflects the broker's focus on other aspects of their service, such as competitive trading conditions and access to advanced trading platforms.

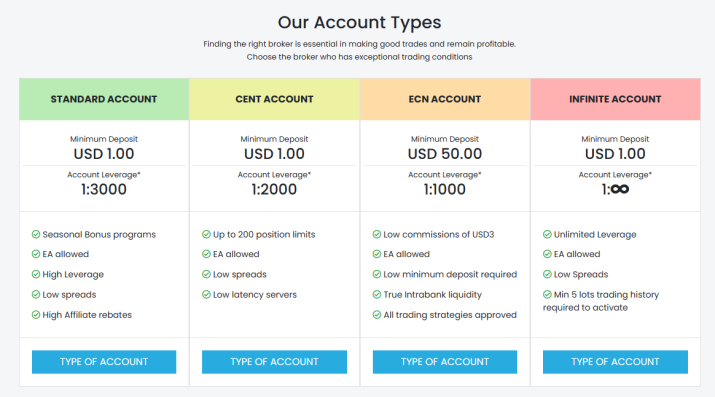

Minimum Deposit of AximTrade

When trading, the minimum deposit is a crucial factor for many investors, especially those new to the market or with limited capital. AximTrade stands out by offering a highly accessible entry point. For cent and standard accounts, the minimum deposit begins at just $1, making it an attractive option for beginners or those wishing to test the broker's services with minimal financial commitment.

For traders interested in more specialized trading conditions, such as tighter spreads and more direct market access, AximTrade offers ECN accounts with a minimum deposit starting from $50. This tier is tailored for more experienced traders or those looking to engage with larger volumes. This stratification in deposit requirements ensures that AximTrade caters to a wide spectrum of traders, from novices to seasoned investors, by providing flexible financial entry points.

AximTrade Account Types

After thorough research and testing by our team of experts at Dumb Little Man, we've compiled a detailed overview of AximTrade‘s account types, designed to cater to both Forex beginners and professional traders. All accounts feature support for currency pair trades, negative balance protection, and position hedging. Margin calls and Stop out levels are set at 60%/30%, respectively.

Cent

- Micro account with a $1 minimum deposit.

- Contract size of 1,000 units.

- Leverage up to 1:2,000.

- Spreads start at 1 pip for major currency pairs.

- Indices and cryptocurrencies trading unavailable.

Standard

- Basic account with floating spreads from 1 pip for major pairs.

- $1 minimum deposit.

- Trades currencies, cryptocurrencies, CFDs on indices, metals, and energy with up to 1:3,000 leverage.

ECN

- Professional account with the tightest spreads from 0.0 pips on major currency pairs.

- $3 commission per lot each way.

- Leverage up to 1:100.

- $50 minimum deposit.

- Trading assets selection similar to the standard account.

INFINITE

- Basic account with spreads as low as 3 Pip.

- Unlimited leverage.

- $1 minimum deposit.

- Margin call/Stop out level: 60% / 0%.

PRO

- Professional account with spreads as low as 5 pips.

- High minimum deposit of $300.

- Leverage up to 1:1,000.

AximTrade Customer Reviews

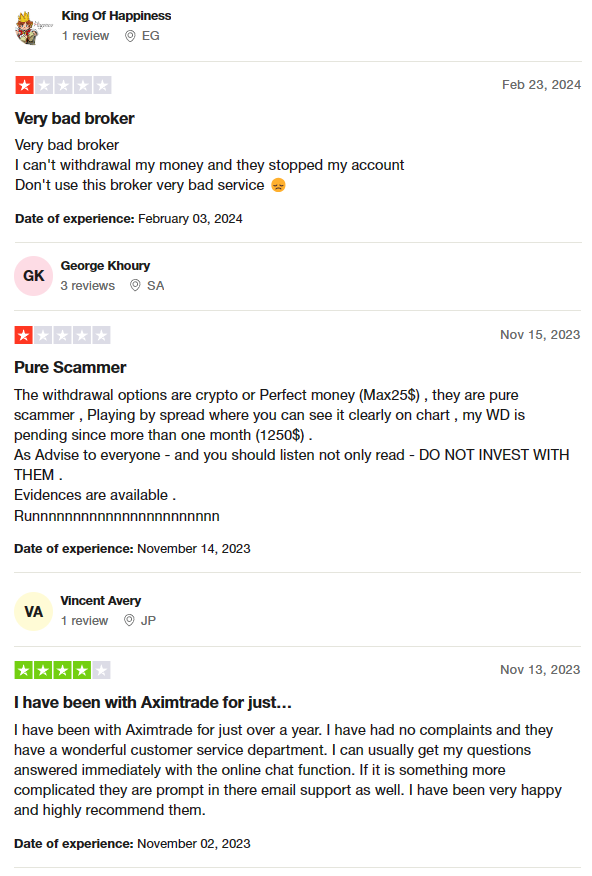

Customer reviews of AximTrade reveal a mixed reception among its users. Some customers have expressed significant dissatisfaction, highlighting issues with withdrawals and account management. Complaints include difficulties in withdrawing funds, with options limited to cryptocurrency or Perfect Money, and instances of accounts being unexpectedly frozen.

Accusations of the broker being a “scam” due to problematic spread practices and prolonged pending withdrawals have been voiced, urging potential clients to steer clear of investing. Contrarily, another segment of users reports a positive experience, praising the broker's customer service.

These customers highlight an efficient online chat function for immediate query resolution and commend the prompt email support for more complex issues. This group of users has recommended AximTrade, satisfied with over a year of service. This divergence in feedback suggests that while AximTrade may offer commendable customer support to some, it faces serious allegations of service inconsistencies and operational issues from others, reflecting a broad spectrum of trader experiences.

AximTrade Fees, Spreads, and Commissions

When navigating the financial landscape of AximTrade, understanding its fees, spreads, and commissions is essential for traders. Notably, AximTrade does not impose commissions on deposits and withdrawals, although charges from certain payment systems may apply. For instance, Skrill and Neteller deduct a 4% fee from the transaction amount for withdrawals. Furthermore, the broker ensures that account maintenance comes without any cost.

In terms of trading costs, AximTrade adopts a floating spread model. Spreads start from 1 pip for both cent and standard accounts, offering competitive rates for traders. For those utilizing ECN accounts, spreads can be as low as 0.0 pips, accompanied by an additional commission of USD 3 per lot for the opening and closing of positions. Another fee to consider is the swap fee, which is a commission charged for transferring a position to the next trading day.

These financial structures underscore AximTrade's commitment to transparency and cost-efficiency in trading operations. By providing a clear breakdown of applicable fees and the conditions under which they are charged, AximTrade caters to a wide range of traders, from those seeking minimal initial investments to experienced traders looking for advanced trading conditions.

Deposit and Withdrawal

The deposit and withdrawal processes at AximTrade have been closely examined and tested by a trading professional at Dumb Little Man, ensuring a thorough evaluation. The findings reveal that AximTrade processes all withdrawal requests within 24 working hours, contingent upon the trader's verification status. It's noteworthy that funds are instantly credited through all available channels once deposited.

For withdrawals, AximTrade supports a variety of methods tailored to its international clientele. Neteller, Skrill, and USDT (ERC20) are universally available, while FasaPay is exclusive to Indonesian traders. Bank transfers cater to clients from Malaysia, Indonesia, Thailand, Vietnam, China, and India. AximTrade is also in the process of expanding its withdrawal options to include Bitcoin, MomoPay, Zalopay, Visa, and Mastercard, enhancing accessibility for its users.

Remarkably, AximTrade does not impose a withdrawal fee, although payment systems such as Skrill and Neteller levy a 4% charge on the transaction amount. For other systems, the fee is 0%. The minimum withdrawal amounts vary by currency and method, ensuring flexibility for traders across different regions. This comprehensive approach to managing financial transactions underscores AximTrade's commitment to providing a seamless and efficient banking experience for its users.

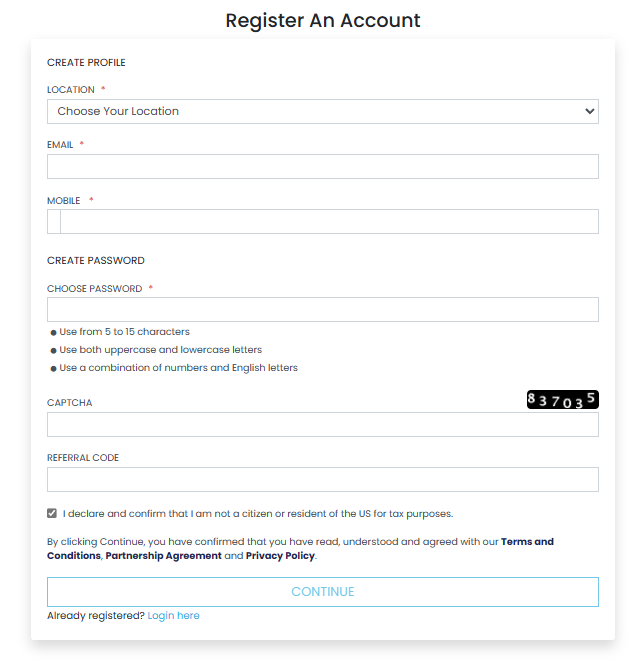

How to Open an AximTrade Account

- Visit AximTrade's website and select New Account on the right side.

- Input your country of residence, email address, and phone number.

- Create a password for your account and enter a referral code if available.

- Confirm you're not a US tax resident and submit the form.

- Look for a registration confirmation on your screen.

- Check your mobile for an OTP code from AximTrade and enter it.

- Verify your account through the confirmation link sent to your email.

- Navigate back to the main page of the AximTrade website.

- Click Member Login and enter your email, password, and CAPTCHA code.

AximTrade Affiliate Program

The AximTrade Affiliate Program caters to both private traders and companies, offering lucrative opportunities to earn additional income. Participants can enjoy a maximum reward of up to $20 per lot traded by their direct referrals, plus up to 10% earnings from second-level referrals. This tiered system enhances the earning potential for affiliates, making the program particularly attractive.

Furthermore, the program includes a Loyalty Program, which rewards active affiliates with the chance to win valuable prizes such as smartphones, watches, cars, and luxury vacations. Eligibility for these draws requires affiliates to achieve a total referral trading volume of 3,000 lots within a three-month period, incentivizing both recruitment and trading activity among referred clients.

AximTrade supports its affiliates with daily remuneration, ensuring consistent and timely rewards for their efforts. Additionally, the program boasts around-the-clock support and assigns a personal manager to each affiliate, addressing any queries or concerns that may arise. Importantly, there are no restrictions on withdrawals, allowing affiliates to access their earnings freely and whenever they choose, highlighting AximTrade's commitment to a transparent and rewarding affiliate partnership.

AximTrade Customer Support

Based on the experiences of Dumb Little Man with AximTrade‘s Customer Support, it's evident that the broker prioritizes accessible and versatile communication channels for its clients. AximTrade offers multiple ways for traders to reach out, including live chat, a dedicated form for queries, email at [email protected], and through social media platforms like Instagram, Facebook, Twitter, and LinkedIn. This multi-channel approach ensures that clients can choose the most convenient method for them, enhancing the overall support experience.

The availability of the online chat feature is particularly noteworthy, as it extends beyond the website to include the user's personal account area. This ensures that assistance is readily available at every stage of the client's journey with AximTrade, from general inquiries on the website to specific questions within the trading environment. This level of support accessibility underscores AximTrade's commitment to providing a supportive and responsive service to its clients, thereby enhancing trader satisfaction and confidence in the platform.

Advantages and Disadvantages of AximTrade Customer Support

| Advantages | Disadvantages |

|---|---|

AximTrade vs Other Brokers

#1. AximTrade vs AvaTrade

AximTrade, known for its low entry threshold and high leverage options, caters especially well to traders seeking flexibility in trading conditions. Its ability to offer infinite leverage and a $1 minimum deposit for certain account types stands in contrast to AvaTrade‘s approach, which emphasizes a broad range of financial instruments and a strong regulatory framework across multiple jurisdictions. With over 300,000 registered customers and a focus on providing a full online trading experience, AvaTrade appeals to traders looking for a diversified portfolio and stringent regulatory protection.

Verdict: AvaTrade might be better for traders valuing a wide selection of financial instruments and regulatory security. In contrast, AximTrade is more suited for those prioritizing flexible trading conditions and high leverage.

#2. AximTrade vs RoboForex

RoboForex offers an impressive array of over 12,000 trading options across eight asset classes, supported by a variety of trading platforms like MetaTrader, cTrader, and RTrader. Its strong emphasis on cutting-edge technology and tailored trading conditions makes it a strong competitor. AximTrade, with its focus on high leverage and low minimum deposits, provides a straightforward entry point for new and experienced traders alike but might lack the breadth of trading options and platform variety that RoboForex boasts.

Verdict: RoboForex edges out for traders who value diversity in trading platforms and a wide array of trading instruments. However, for those looking for simplicity and high leverage, AximTrade remains a compelling choice.

#3. AximTrade vs FXChoice

FXChoice, with its commitment to serving both active and passive traders since 2010, emphasizes quality brokerage services and a suite of trading instruments and services for automated trading. The focus here is on experienced traders, given the absence of cent accounts, zero spreads, and the limited validity of demo accounts. In contrast, AximTrade appeals to a broader audience with its low minimum deposits and high leverage options, offering a more accessible entry point for newcomers and flexibility for seasoned traders.

Verdict: For experienced traders focused on automated trading and professional ECN accounts, FXChoice may be the preferable option, given its tailored services and strict regulatory environment. AximTrade, however, offers broader appeal to those new to forex trading or those seeking high leverage and low entry barriers.

Choose Asia Forex Mentor for Your Forex Trading Success

For individuals passionate about forging a lucrative career in forex trading and aiming for significant financial success, Asia Forex Mentor is the prime destination for top-notch forex, stock, and crypto trading education. The founder, Ezekiel Chew, a celebrated figure among trading institutions and banks, is the cornerstone of Asia Forex Mentor. Notably, Ezekiel's regular seven-figure trades set him a cut above other educators, showcasing his exceptional prowess in the field. The reasons for our endorsement are compelling:

Comprehensive Curriculum: Asia Forex Mentor delivers a thorough educational package spanning stock, crypto, and forex trading. The curriculum is meticulously designed to arm budding traders with the requisite skills and knowledge to thrive in these varied markets.

Proven Track Record: The reputation of Asia Forex Mentor is solidified by its track record of consistently grooming profitable traders in different market segments. This success underscores the efficacy of their educational strategies and mentorship.

Expert Mentor: Learners at Asia Forex Mentor benefit from the expertise of a mentor with a proven track record in stock, crypto, and forex trading. Ezekiel offers personalized assistance, guiding students through the complexities of each market confidently.

Supportive Community: Enrolling in Asia Forex Mentor grants access to a welcoming community of ambitious traders focused on success in the stock, crypto, and forex arenas. This environment encourages mutual support, exchange of ideas, and collaborative learning, enriching the educational journey.

Emphasis on Discipline and Psychology: Mastery in trading requires a disciplined mindset and psychological resilience. Asia Forex Mentor emphasizes psychological training to aid traders in managing emotions, coping with stress, and making informed decisions during trading activities.

Constant Updates and Resources: Given the ever-changing nature of financial markets, Asia Forex Mentor ensures learners stay informed on the latest trends, strategies, and market insights. Ongoing access to essential resources positions traders to stay competitive.

Success Stories: Asia Forex Mentor is proud of its numerous success stories, with many students significantly transforming their trading endeavors and achieving financial autonomy through its extensive education in forex, stock, and crypto trading.

Asia Forex Mentor stands out as the foremost option for those desiring the finest forex, stock, and crypto trading education, aiming to cultivate a profitable career and attain financial growth. With its all-inclusive curriculum, skilled mentors, practical learning approach, and supportive community, Asia Forex Mentor equips aspiring traders with the tools and mentorship necessary to become successful professionals in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: AximTrade Review

In conclusion, the team of trading experts at Dumb Little Man has provided a comprehensive review of AximTrade, highlighting its strengths and areas of concern. AximTrade emerges as a formidable player in the forex brokerage industry, celebrated for its low entry barriers and high leverage options. These features make it particularly appealing to new traders and those looking to maximize their trading potential with minimal initial investment.

However, it's crucial for potential users to weigh the broker's advantages against its shortcomings. While AximTrade offers competitive spreads and a range of account types to suit various trading styles, concerns regarding customer support limitations and regional restrictions should not be overlooked. The absence of a sign-up bonus might also deter some traders, accustomed to such incentives from other brokers.

>> Also Read: NAGA Review 2024 with Rankings By Dumb Little Man

AximTrade Review FAQs

What minimum deposit is required to start trading with AximTrade?

To begin trading with AximTrade, the minimum deposit requirement varies depending on the account type chosen. For cent and standard accounts, a minimum deposit of $1 is required, making it highly accessible for beginners. For those interested in ECN accounts, which offer tighter spreads and more direct market access, the minimum deposit starts from $50. This flexibility ensures that traders of all levels can find an account that suits their financial capacity and trading strategy.

Does AximTrade offer a sign-up bonus for new traders?

As of the latest information available, AximTrade does not offer a sign-up bonus for new traders. The focus of AximTrade is more on providing competitive trading conditions, such as low entry requirements and high leverage, rather than upfront financial incentives. Traders looking for value-added features might find the broker's competitive spreads and leverage options to be compelling reasons to join, even in the absence of a sign-up bonus.

How does AximTrade ensure the safety and security of trader funds?

AximTrade prioritizes the safety and security of its traders' funds through several mechanisms. Firstly, it operates under the regulation of reputable bodies such as the ASIC and SVGFSA, ensuring compliance with strict financial standards. Additionally, AximTrade employs the practice of segregating client funds from company funds, which means that traders' money is kept in separate bank accounts. This segregation helps protect clients' funds in the unlikely event of financial instability or insolvency of the broker. Furthermore, AximTrade provides negative balance protection, safeguarding traders from losing more than their account balance during volatile market conditions.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.