AVFX Capital Review 2024 with Rankings By Dumb Little Man

By Wilbert S

February 26, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 121st  |   |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

AVFX Capital Review

Forex brokers play a critical role in the global financial ecosystem, providing platforms for trading currencies and other financial instruments. These brokers are the bridge between retail and institutional traders and the dynamic markets. AVFX Capital has been part of this landscape since 2018, offering its services internationally and distinguishing itself in the competitive world of online trading.

In our comprehensive review, we delve into AVFX Capital to highlight what sets it apart and where it faces challenges. Our goal is to present an unbiased overview of its account options, financial transactions, and commission structures, among other aspects. This review is grounded in both expert analysis and feedback from actual users, aiming to give you a well-rounded view of AVFX Capital as a potential brokerage service provider for your trading needs.

What is AVFX Capital?

AVFX Capital is a notable international broker that has been active in the financial markets since 2018. Specializing in a wide range of financial instruments, the company facilitates trading in currencies and cryptocurrencies, stocks, indices, energies, metals, and commodities. This broad spectrum of trading options highlights AVFX Capital’s commitment to catering to diverse investor needs.

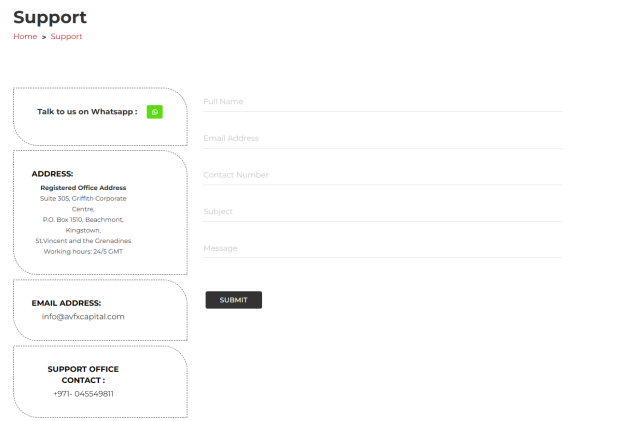

The broker is registered in Kingstown (Saint Vincent and the Grenadines) and boasts a strategic presence in Dubai (United Arab Emirates). This geographical footprint underscores AVFX Capital’s international reach and its ambition to serve traders across various regions. The company’s global operations and comprehensive offering make it a competitive player in the world of online trading.

Safety and Security of AVFX Capital

AVFX Capital, based on thorough research by Dumb Little Man, operates from its registered location in Kingstown (St. Vincent and the Grenadines), with a registration number of 24760 IBC. The company extends its reach with a support office located in Dubai (U.A.E.). Despite its established presence, AVFX Capital operates without the oversight of a regulatory body, which may raise concerns about the trading environment’s safety and the protection of trader rights.

To enhance trader confidence, AVFX Capital ensures that client funds are segregated from the company’s capital, held in accounts with major banks. This measure is crucial for safeguarding client assets. Additionally, the broker allows account opening and trading without a mandatory verification process, offering ease of access to its services. However, it’s important to note that unverified clients are restricted from making withdrawals, a policy likely aimed at enhancing security measures.

Furthermore, AVFX Capital provides protection against negative balance, a feature that prevents clients from losing more than their deposited funds. Despite these safety features, the lack of regulatory oversight remains a critical point for potential traders to consider. The broker’s approach to safety and security reflects a mix of protective measures for client assets, albeit within an unregulated framework.

Pros and Cons of AVFX Capital

Pros

- Broad selection of financial instruments

- Six account types offering varied trading conditions

- Customizable leverage options

- Client funds segregated in major international banks

- Demo accounts for risk-free learning

Cons

- No licensing from SVG FSA or other regulators

- Lack of educational and analytical resources on website

Sign-Up Bonus of AVFX Capital

AVFX Capital offers an enticing WELCOME BONUS to new clients, featuring a No Deposit Bonus scheme. By simply signing up, clients are credited with Free $50 in their account, enabling them to start trading immediately without the need to deposit any funds. This bonus is designed to give new traders a head start in exploring financial markets, allowing them to experience trading with real money under live market conditions without any initial investment.

Minimum Deposit of AVFX Capital

AVFX Capital sets a high minimum deposit requirement for its Standard account at USD 100, indicating a threshold aimed at traders ready to commit a moderate amount of capital from the start. For other account types, the minimum deposit increases significantly, starting from USD 1,000, catering to more experienced traders or those with a higher investment capacity.

Contrastingly, the broker also offers an option with a much lower entry point, setting the minimum deposit amount at $10 for certain conditions. This low minimum deposit option provides an accessible entry for beginners or those looking to test the AVFX Capital trading environment with minimal financial commitment.

AVFX Capital Account Types

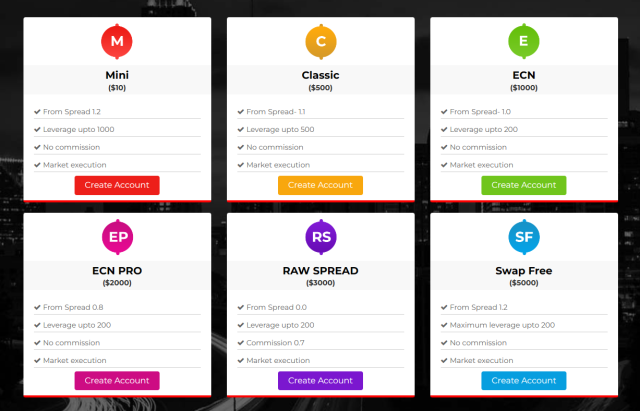

Based on thorough testing and research by our team of experts at Dumb Little Man, AVFX Capital offers a variety of account types tailored to meet the needs of different traders:

- Mini: Ideal for beginners with a minimum deposit of $10. Offers leverage up to 1:1000 and spreads starting from 1.2 pips.

- Classic: Designed for traders with some experience. Requires a minimum balance of $500, with leverage up to 1:500 and spreads from 1.1 pips.

- ECN: Allows trading directly with liquidity providers, with a minimum deposit of $1,000, spreads from 1 pip, and leverage up to 1:200.

- ECN PRO: Features leverage up to 1:200 and spreads starting from 0.8 pips. The minimum deposit required is $2,000.

- Raw Spreads: Suitable for professional traders, offering spreads from 0 pips, $7 per lot commission, leverage up to 1:200, and a minimum deposit of $3,000.

- Swap Free: Best for traders who hold positions for a long term, providing leverage of 1:200, spreads from 1.2 pips, and a minimum deposit of $5,000.

AVFX Capital Customer Reviews

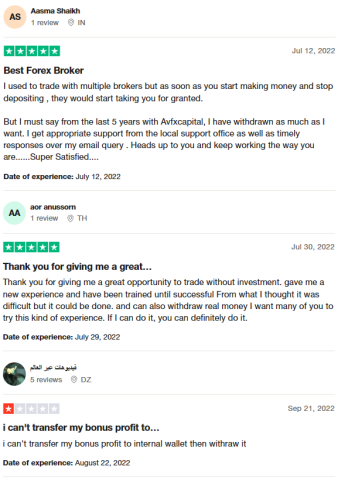

AVFX Capital customer reviews reveal a generally positive sentiment towards the broker’s services. Traders appreciate the flexibility in withdrawals and the high level of support received from both local offices and via email, marking a departure from experiences with other brokers where support might dwindle once trading becomes profitable. Particularly, the WELCOME BONUS has been highlighted as a valuable opportunity for traders to engage with the market without initial investment, offering a practical learning and earning experience. However, some users have noted issues with transferring bonus profits, indicating areas where AVFX Capital could enhance its service. Overall, the feedback underscores a satisfactory trading environment at AVFX Capital, underscored by effective customer support and realistic trading opportunities, albeit with some room for improvement in terms of bonus fund accessibility.

AVFX Capital Fees, Spreads, and Commissions

AVFX Capital prides itself on offering a commission-free structure for deposits and withdrawals, enhancing the appeal of trading with them. It’s important for traders to note, though, that banks and payment services might apply their own fees, which are out of the broker’s control. This aspect underscores the importance of reviewing the terms of your chosen payment method.

Trading with AVFX Capital involves spreads on all accounts, with the Raw Spread account featuring spreads that are nearly zero. This competitive offer is particularly attractive for traders looking for minimal trading costs. However, it’s accompanied by a broker commission of $7 per lot, a factor to consider when calculating potential trading costs. Additionally, swap fees are applied across all account types except for the swap-free account, catering to traders who wish to avoid these fees for holding positions overnight. This fee structure is designed to accommodate a range of trading strategies and preferences, offering both cost-efficiency and flexibility.

Deposit and Withdrawal

Based on rigorous testing by a trading professional at Dumb Little Man, AVFX Capital has specific protocols in place for deposit and withdrawal processes. It’s important to note that withdrawals are accessible exclusively to clients who have completed the verification process, emphasizing the broker’s commitment to security and regulatory compliance.

Clients have a variety of withdrawal methods at their disposal, including bank transfers, major credit cards (Visa, Mastercard, Diners Club), cryptocurrency wallets, and electronic payment systems like PayPal, Perfect Money, and WebMoney. This range ensures flexibility and convenience for traders in managing their funds. The processing time for withdrawal requests is capped at three business days, providing a reasonable timeframe for accessing funds.

Furthermore, AVFX Capital stands out by offering zero withdrawal fees, making it more cost-effective for traders to move their money. Additionally, for those who deposit funds via bank transfer, the broker requires that the first withdrawal be executed through the same method, a measure likely in place to further secure financial transactions. This approach underscores AVFX Capital’s dedication to providing a secure and user-friendly financial transaction experience.

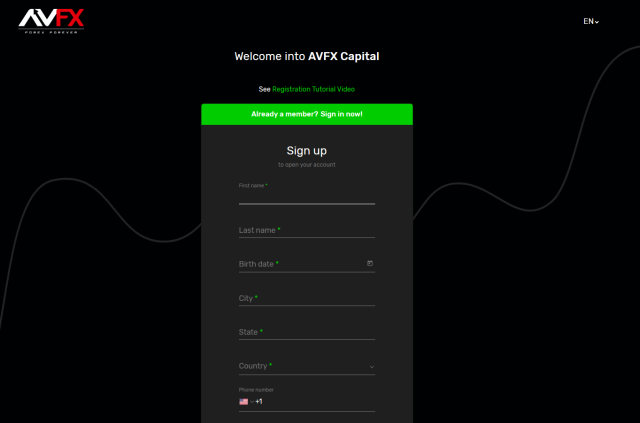

How to Open an AVFX Capital Account

- Navigate to the AVFX Capital website and select “Create Account.”

- Begin your registration by entering personal details such as name, surname, date of birth, city, state, country, phone number, and email.

- Set up a secure password, agree to the terms and conditions, and proceed by clicking “Continue.”

- Complete any additional required fields in the follow-up sections of the registration process.

- Verify your email address by clicking on the link sent to your email.

- Submit documentation for identity and address verification as per the broker’s requirements.

- Once verified, log in to your new AVFX Capital account using your credentials.

- Deposit funds into your account using one of the approved methods to meet the minimum deposit requirement.

- Start trading by selecting financial instruments and making your first trade on the platform.

AVFX Capital Affiliate Program

AVFX Capital offers a comprehensive Affiliate Program designed to cater to various types of partners with attractive commission structures and bonuses. The program is divided into several key components:

- Introducing Broker (IB): This is a multi-tiered program where partners can earn commissions across 10 levels for trades executed by clients they refer. Commission rates increase significantly at higher levels, starting from 10% for the initial five levels, 25% for the sixth and seventh, 50% for the eighth and ninth, and culminating in 100% at the tenth level.

- FX White Label: Tailored for broker representatives, this partnership option includes access to essential trading infrastructure such as a server, dedicated hosting, IP addresses, a database, and a control panel. The terms of this partnership are customized and discussed after an application is submitted.

- Refer a Friend: This segment of the affiliate program rewards partners for each new active trader they bring to the platform. The incentive structure is based on the referred trader’s volume, with bonuses scaling up from $100 to $500 depending on the trading turnover of the new client. This scheme not only benefits the referring partner but also provides bonus funds to the newly invited client, fostering a mutually beneficial relationship.

AVFX Capital Customer Support

Based on the experience of Dumb Little Man with AVFX Capital’s Customer Support, reaching out to the support team is facilitated through a variety of channels. Clients can contact support via feedback form, phone, email, and online chat, ensuring multiple avenues for assistance depending on their preference or urgency of the query.

Additionally, AVFX Capital extends its customer service reach through modern communication platforms, including messengers like Telegram and WhatsApp, as well as social media accounts such as Instagram, Facebook, and Twitter. This broad spectrum of contact methods highlights the broker’s commitment to accessibility and responsiveness, aiming to provide timely and effective support to its clients across different digital environments.

Advantages and Disadvantages of AVFX Capital Customer Support

| Advantages | Disadvantages |

|---|---|

AVFX Capital vs Other Brokers

#1. AVFX Capital vs AvaTrade

AVFX Capital and AvaTrade both cater to a global audience but differ significantly in their regulatory frameworks and service offerings. AvaTrade, established in 2006, boasts a strong regulatory foundation with multiple licenses, offering over 1,250 financial instruments. Its global presence and regulatory compliance make it a trusted choice for traders worldwide. AVFX Capital, while offering a diverse range of financial products and a flexible trading environment, lacks the extensive regulatory oversight present in AvaTrade.

Verdict: AvaTrade is better for traders prioritizing regulatory security and a wide range of trading instruments.

#2. AVFX Capital vs RoboForex

Comparing AVFX Capital with RoboForex, the latter offers a more technologically advanced trading environment with over 12,000 trading options across eight asset classes and a variety of trading platforms like MetaTrader, cTrader, and RTrader. RoboForex also has a strong regulatory status with FSC regulation and a history of innovation in trading solutions. AVFX Capital provides a competitive trading environment with customizable account features but lacks the regulatory clarity and technological breadth that RoboForex offers.

Verdict: RoboForex is better for traders seeking advanced trading tools and a strong regulatory framework.

#3. AVFX Capital vs FXChoice

FXChoice, known for its integrity and customer-focused approach, has established a strong foothold among Western traders since its inception in 2010. Licensed by the FSC of Belize, FXChoice specializes in offering services suited for experienced traders, including professional ECN accounts with tight market spreads. AVFX Capital offers a range of account types and a no-commission structure, appealing to traders looking for flexible trading options. However, its regulatory status does not match the stringent oversight of FXChoice.

Verdict: FXChoice is better for experienced traders looking for a regulated broker with professional trading conditions and a focus on customer satisfaction.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you’re passionate about building a lucrative career in forex trading and aim for significant financial success, Asia Forex Mentor is the premier choice for the foremost forex, stock, and crypto trading course. Ezekiel Chew is celebrated for his pivotal role in shaping trading institutions and banks and is the cornerstone of Asia Forex Mentor. Notably, Ezekiel’s ability to consistently secure seven-figure trades distinguishes him from his peers in the educational arena. The following points highlight why we highly recommend this program:

Comprehensive Curriculum:Asia Forex Mentor presents a holistic educational program that spans stock, crypto, and forex trading. This meticulously crafted curriculum is designed to furnish traders with the requisite knowledge and skills to succeed in these varied markets.

Proven Track Record: The reputation of Asia Forex Mentor is solidified by its history of nurturing traders who consistently achieve profitability in various market environments. This success attests to the high efficacy of their educational content and mentorship.

Expert Mentor: Participants of Asia Forex Mentor receive mentorship from Ezekiel Chew, an expert with a proven track record in stock, crypto, and forex trading. Ezekiel’s personalized guidance helps students adeptly maneuver through market complexities.

Supportive Community: Enrollment in Asia Forex Mentor grants access to a community of traders with similar aspirations, promoting an environment rich in collaboration, knowledge exchange, and peer learning.

Emphasis on Discipline and Psychology: Recognizing the importance of mindset and discipline, Asia Forex Mentor emphasizes psychological training to equip traders to manage their emotions, cope with stress, and make informed decisions.

Constant Updates and Resources: Acknowledging the ever-changing nature of financial markets, Asia Forex Mentor ensures that learners stay informed about the latest market trends and strategies, providing them with continuous access to essential resources.

Success Stories:Asia Forex Mentor is proud of its many success stories, showcasing students who have significantly advanced their trading careers and achieved financial independence through their comprehensive education in forex, stock, and crypto trading.

For those seeking unparalleled education in forex, stock, and crypto trading, Asia Forex Mentor stands out as the definitive choice. With its all-inclusive curriculum, expert mentorship, hands-on approach, and supportive network, Asia Forex Mentor equips budding traders with everything needed to become successful professionals in the diverse world of financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: AVFX Capital Review

In summary, the team of trading experts at Dumb Little Man has conducted a thorough review of AVFX Capital, identifying key strengths and areas of concern. AVFX Capital is praised for its diverse range of financial instruments and multiple account types, catering to a wide spectrum of traders. The ability to customize leverage and the provision of demo accounts are particularly beneficial for both novice and experienced traders, enhancing the trading experience.

However, potential clients should be aware of the lack of regulatory oversight and the absence of educational resources on the broker’s website. These factors could impact the decision-making process for those prioritizing security and learning resources in their trading journey.

Despite these drawbacks, AVFX Capital offers competitive features, such as commission-free deposits and withdrawals and innovative affiliate programs, which may appeal to many traders. When considering AVFX Capital as a brokerage option, it’s crucial to weigh these pros and cons carefully to ensure it aligns with your trading goals and risk tolerance.

AVFX Capital FAQs

What financial instruments can I trade with AVFX Capital?

At AVFX Capital, traders have access to a wide variety of financial instruments, including currencies, cryptocurrencies, stocks, indices, energies, metals, and commodities. This extensive selection ensures that traders of all preferences and strategies can find suitable options for their investment goals.

Is AVFX Capital regulated?

AVFX Capital operates from its registered location in Kingstown, Saint Vincent and the Grenadines, and has a support office in Dubai, U.A.E. However, it’s important to note that the broker does not currently hold a license from SVG FSA or any other financial regulatory authority, which may be a consideration for traders prioritizing regulatory oversight.

Can I open an account at AVFX Capital with a low minimum deposit?

Yes, AVFX Capital offers the possibility to open an account with a relatively low minimum deposit. For a Mini account, the minimum deposit is $10, making it accessible for beginners or those looking to start trading with a lower financial commitment. Other account types may require higher minimum deposits, catering to more experienced traders or those with specific trading needs.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.