ATFX Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 117th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

ATFX Review

Forex brokers play a pivotal role in the global trading landscape, offering platforms for trading currencies and other financial instruments. ATFX, a distinguished member of this community, stands out as a Forex and CFD broker within the framework of AT Global Markets, an expansive international investment holding company. This broker prides itself on delivering beneficial trading conditions not only for active traders but also for passive investors, making it a versatile choice for a wide array of trading needs.

In our comprehensive review of ATFX, we delve into the broker's offerings, spotlighting its unique selling propositions and acknowledging its potential drawbacks. Our mission is to furnish you with critical insights regarding ATFX's account options, deposit and withdrawal processes, commission structures, and more. By weaving together expert analysis and real trader experiences, we aim to provide a balanced view. This will empower you with the knowledge necessary to determine if ATFX aligns with your trading goals, positioning it as a potential brokerage service provider of choice.

What is ATFX?

ATFX, a regulated broker in the UK, has seen rapid growth by prioritizing customer service and low trading costs. This focus on the client experience has set ATFX apart in the competitive world of online trading, establishing it as a go-to choice for those seeking reliability and affordability in their trading activities.

The broker excels in providing professional clients with opportunities to invest in a diverse range of assets through a user-friendly platform. This platform is compatible with MetaTrader 4 software, offering competitive pricing and access to a state-of-the-art client portal. The portal’s security is ensured by leading encryption security systems, emphasizing the broker’s commitment to client data protection.

Safety and Security of ATFX

After thorough research by Dumb Little Man, the safety and security of ATFX have been closely examined. ATFX, operating under the umbrella of AT Global Markets holding, benefits from a robust regulatory framework. Its operations are licensed by FCA (UK), CySEC (Cyprus), FSC (Mauritius), and FSA (Saint Vincent and the Grenadines). Moreover, ATFX adheres to the strict standards set by ESMA (European Securities and Markets Authority), a testament to its commitment to regulatory compliance and fund protection for retail traders.

A key aspect of ATFX's approach to safety is the segregation of customer funds. This practice ensures that client money is held in separate bank accounts, providing an added layer of security. Furthermore, ATFX offers negative balance protection, a critical feature that shields clients from owing more than they have deposited, thus safeguarding traders from market volatility.

In the event of disputes, there is a clear mechanism in place, as the regulator steps in to settle disagreements between ATFX and its customers. This not only underscores the broker's transparency but also reinforces the level of trust clients can place in ATFX. Such measures, diligently overseen by independent authorities and regulators, underscore ATFX’s dedication to maintaining a secure and trustworthy trading environment.

Pros and Cons of ATFX

Pros

- Tailored liquidity for pros

- Strong FCA, CySEC regulation

- Unrestricted MT4 trading

- Competitive spreads, no commissions

- Fast deposit processing

- Expert-led trading education

- Access to Trading Central for Premium

Cons

- No retail client support

- Single platform option

- Fewer assets available

- Selective bonuses

Sign-Up Bonus of ATFX

Currently, ATFX does not offer a sign-up bonus for new clients. This policy aligns with the broker's focus on providing value through competitive spreads, high-quality educational resources, and advanced trading tools rather than promotional incentives. While the absence of a sign-up bonus might seem like a drawback, ATFX compensates by ensuring a trading environment that prioritizes long-term benefits over short-term gains.

Minimum Deposit of ATFX

ATFX sets a minimum deposit amount of $500 for opening a trading account. This requirement is designed to make financial markets accessible to a broad range of traders, balancing the need for accessibility with the offering of professional-grade trading conditions.

ATFX Account Types

After comprehensive testing and analysis by our team of experts at Dumb Little Man, ATFX's account types have been thoroughly reviewed. Here's a clean and organized summary of the account options available, showcasing the broker's commitment to catering to a diverse clientele:

Standard Account

- Minimum balance: £$€500

- Benchmark spread for currency pairs: 1.0 pips

Edge Account

- Minimum balance: £$€5,000

- Benchmark spread for currency pairs: 0.6 pips

Premium Account

- Minimum balance: £$€10,000

- Benchmark spread for currency pairs: 0.0 pips

- Designed for professional traders, offering higher leverage on all instruments. Proof of professional status required upon application.

This categorization enables traders to select an account that best matches their trading style, financial goals, and level of experience. ATFX thus provides a platform that supports traders from various backgrounds, offering tailored trading conditions to meet the needs of both novice and professional traders.

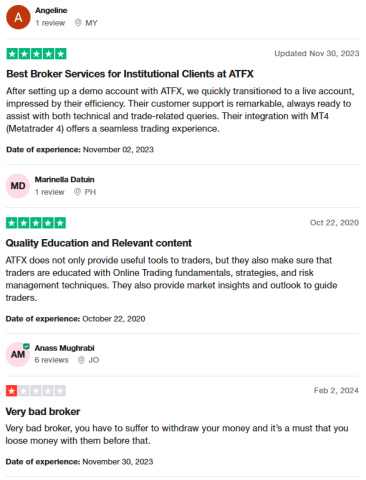

ATFX Customer Reviews

Customer feedback on ATFX presents a mixed view, highlighting both the strengths and areas for improvement of the broker. Many users praise ATFX for its efficient transition from demo to live accounts, remarkable customer support, and seamless integration with MT4, facilitating a user-friendly trading experience. The broker is also commended for providing valuable educational resources on trading fundamentals, strategies, and risk management, alongside market insights to guide traders in their decisions. However, there are criticisms as well, with some customers expressing dissatisfaction over difficulties experienced during withdrawal processes and voicing concerns over financial losses. These reviews reflect a broad spectrum of user experiences, underscoring the importance of ATFX addressing these concerns to enhance service quality and maintain trader trust.

ATFX Fees, Spreads, and Commissions

ATFX stands out in the financial trading market for its cost-effective trading conditions. Notably, spread betting with ATFX is exempt from UK stamp duty and capital gains tax, presenting a significant advantage for traders based in the UK. The broker ensures no commissions are charged, and boasts competitive spreads starting at just 0.6 pips. This allows traders to speculate on both rising and falling markets efficiently, with a maximum margin of 1:30, utilizing MT4's stop-loss limit orders and balance protection features for risk management.

The minimum deposit for a spread betting account is set at £100, paired with a low stop-out level of 0.5. ATFX also guarantees no rejections or requotes, and both EAs and hedging strategies are permitted, further enhancing its appeal to professional investors seeking a competitive edge.

Order execution with ATFX is designed to be seamless, with market orders promptly forwarded for execution at the best available market price. This process benefits from the liquidity provided by banks, ensuring efficient transaction execution. The platform supports a variety of order types, including Sell Stop, Sell Limit, Buy Stop, and Buy Limit, all executed based on preset instructions within the server.

ATFX does not impose commission fees on its traders, further reducing the cost of trading. The broker's commitment to offering highly competitive spreads significantly lowers the financial barrier for opening and maintaining positions, making ATFX a compelling choice for traders prioritizing cost efficiency alongside robust trading capabilities.

Deposit and Withdrawal

After thorough testing by a trading professional at Dumb Little Man, the deposit and withdrawal processes at ATFX have been closely evaluated. ATFX stands out for not charging fees on deposits, offering flexibility with methods including debit or credit cards, e-wallets, and bank transfers. The broker accepts EUR, GBP, and USD, ensuring accessibility for a broad base of traders. While bank transfers may take up to one working day, other deposit methods are impressively processed within 30 minutes.

It's important to note that clients using non-UK debit or credit cards might face fees from their card providers. However, ATFX offers a reimbursement for such charges upon submission of charge evidence, further showcasing its commitment to maintaining cost-effective trading conditions for its clients.

Regarding withdrawals, ATFX ensures a smooth and fee-free process, with funds payable back to debit or credit cards, e-wallets, or bank accounts. Withdrawal requests are promptly processed within one working day, although bank wire transfers may require two to five working days to complete. The importance of having a fully verified bank account prior to withdrawal cannot be overstated, as ATFX mandates that all funds be returned to the original source of deposit. Moreover, ATFX UK adheres strictly to anti-money laundering regulations by disallowing any third-party payments, with deposits required to be made from the client’s personal account, ensuring both security and regulatory compliance.

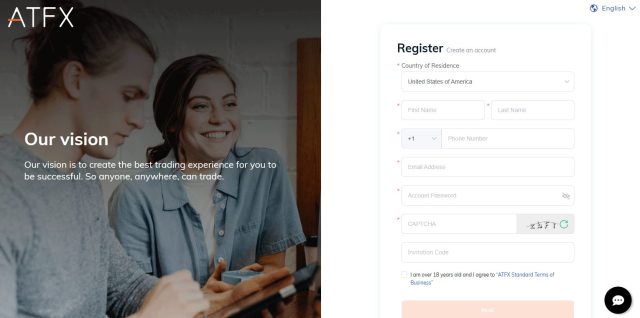

How to Open an ATFX Account

- Go to ATFX‘s official website and click Create Live Account on the home page.

- Complete the registration form with your first and last name, country of residence, phone number, and email.

- Create a secure password, enter the captcha code, and agree to the terms and conditions.

- Verify your email and phone number by inputting the verification codes sent to you.

- Submit the form for initial review by ATFX.

- Provide additional required documents for identity and residence verification.

- Wait for approval of your submitted documents by ATFX.

- Once approved, fund your account with the minimum deposit or more.

- Start trading with your new ATFX account.

ATFX Affiliate Program

ATFX runs an Introducing Broker (IB) program, offering a partnership reward of up to $19 per lot for each connected customer. This program represents ATFX's sole partnership type, highlighting its focused approach towards collaboration. Through this initiative, ATFX shares a portion of its commission with the introducing broker as a token of appreciation for referring new traders to the platform and motivating them to engage actively. This streamlined affiliate program underlines ATFX's commitment to fostering strong partnerships and supporting the growth of its affiliate network.

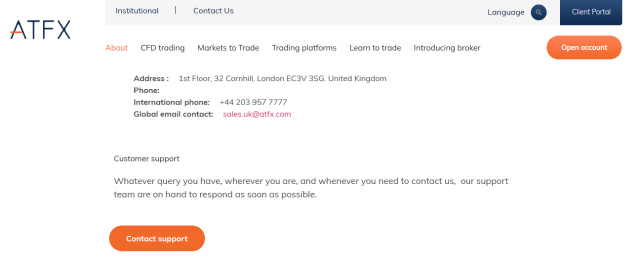

ATFX Customer Support

Based on the experience of Dumb Little Man with ATFX Customer Support, it's clear that the company prioritizes a customer-centric approach. ATFX provides multilingual service, ensuring that traders from various backgrounds can receive assistance in their preferred language. The availability of a live chatbot, conveniently located in the bottom right corner of their website, allows for immediate responses to queries.

Furthermore, ATFX maintains international phone lines, open from Monday to Friday, 9 am to 5 pm, accommodating traders across different time zones. Additionally, a dedicated support email offers an alternative channel for detailed inquiries. This comprehensive support framework demonstrates ATFX’s commitment to delivering exceptional service and maintaining high levels of customer satisfaction.

Advantages and Disadvantages of ATFX Customer Support

| Advantages | Disadvantages |

|---|---|

ATFX vs Other Brokers

#1. ATFX vs AvaTrade

ATFX focuses on providing competitive spreads, strong regulatory oversight, and specialized account types catering to professional traders. It prides itself on no deposit fees, fast processing, and a user-friendly platform integrated with MT4. AvaTrade, on the other hand, has a broader customer base with over 300,000 registered users, offering a wide range of over 1,250 financial instruments. AvaTrade stands out with its global reach, extensive regulatory framework, and commitment to trading education.

Verdict: For traders prioritizing a diverse range of financial instruments and global trading opportunities, AvaTrade may be the better choice due to its comprehensive offerings and strong regulatory environment. However, ATFX might be preferred by those valuing competitive conditions specifically tailored for Forex and CFD trading.

#2. ATFX vs RoboForex

ATFX offers a straightforward, competitive trading environment with a focus on Forex and CFDs, enhanced by strong regulatory backing and efficient customer support. RoboForex, distinguished by its vast array of trading options (over 12,000) across eight asset classes, caters to a wide spectrum of traders through a variety of platforms including MetaTrader, cTrader, and RTrader. RoboForex’s diverse offerings and commitment to cutting-edge technology make it appealing for traders looking for flexibility and innovation in their trading experience.

Verdict: RoboForex is potentially the superior option for traders seeking technological diversity and a wide range of trading instruments. Its versatility and breadth of options cater well to various trading preferences. Meanwhile, ATFX remains a solid choice for those focused on Forex and CFDs with an emphasis on customer service and regulatory assurance.

#3. ATFX vs FXChoice

ATFX and FXChoice both cater to active and passive traders with strong regulatory frameworks and commitment to service quality. FXChoice differentiates itself with its focus on a niche market, offering specialized ECN accounts and a range of automated trading options, suited for experienced traders. Its services are tailored towards traders looking for tight market spreads and a loyalty program designed for high-volume trading. ATFX, with its competitive spreads and no commission structure, appeals to traders looking for efficient and straightforward trading conditions.

Verdict: FXChoice may be the better choice for experienced traders who benefit from ECN accounts and automated trading services, offering a tailored experience for those with specific trading strategies and high volumes. ATFX, with its focus on simplicity and efficiency, is well-suited for traders who prioritize competitive pricing and regulatory security.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For those eager to excel in forex trading and secure significant financial rewards, Asia Forex Mentor is the go-to source for top-tier education in forex, stock, and crypto trading. The mastermind behind this comprehensive program, Ezekiel Chew, is recognized for his exceptional contributions to the trading world. Notably, Ezekiel's consistent seven-figure trades distinguish him as a leader in trading education. The following points highlight why Asia Forex Mentor is our top recommendation:

Comprehensive Curriculum:Asia Forex Mentor presents a thorough educational package, spanning forex, stock, and crypto trading. The curriculum is meticulously designed to prepare traders for success in these varied markets.

Proven Track Record: The effectiveness of Asia Forex Mentor is evidenced by its history of cultivating profitable traders across different market segments. Such success underscores the value of their teaching methods and mentorship.

Expert Mentor: Enrollment in Asia Forex Mentor means learning from Ezekiel Chew, a seasoned trader with notable achievements in forex, stock, and crypto markets. His hands-on support guides students through market complexities with assurance.

Supportive Community: Being part of Asia Forex Mentor offers entry into a collaborative community of ambitious traders. This network is invaluable for sharing ideas, learning from peers, and enriching the educational journey.

Emphasis on Discipline and Psychology: Mastery in trading requires mental strength and discipline. Asia Forex Mentor emphasizes psychological training to aid traders in maintaining composure, managing stress, and making informed decisions.

Constant Updates and Resources: With the ever-changing nature of financial markets, Asia Forex Mentor keeps students informed with the latest trends and strategies, providing ongoing access to essential trading resources.

Success Stories: The legacy of Asia Forex Mentor includes numerous success stories of individuals who achieved financial independence through their comprehensive education in forex, stock, and crypto trading.

Asia Forex Mentor stands out as the definitive selection for ambitious individuals aiming for a lucrative career in trading. With its in-depth curriculum, expertise of mentors like Ezekiel Chew, practical learning approach, and supportive community, Asia Forex Mentor equips traders with the skills and knowledge to succeed in the competitive world of financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: ATFX Review

In conclusion, after an extensive review by the team of trading experts at Dumb Little Man, ATFX stands out as a reputable broker in the Forex and CFD trading industry. The broker's commitment to providing beneficial trading conditions for both active traders and passive investors sets it apart. With a solid regulatory foundation under FCA and CySEC, ATFX assures a high level of safety and security for its clients' funds.

However, potential traders should be aware of the limitations, such as the absence of retail client support and a limited platform choice. While these cons may not detract from the overall quality of ATFX's offerings, they could influence the decision-making process for some traders.

>> Also Read: AVFX Capital Review 2024 with Rankings By Dumb Little Man

ATFX Review FAQs

What regulatory bodies oversee ATFX?

ATFX is rigorously regulated by reputable authorities, including the Financial Conduct Authority (FCA) in the UK and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies ensure that ATFX adheres to strict financial standards and practices, offering a secure trading environment for its clients.

Does ATFX offer a demo account for beginners?

Yes, ATFX provides a free demo account, allowing beginners to practice trading strategies and get familiar with the platform without any financial risk. This feature is part of ATFX's commitment to supporting traders at all levels of experience, facilitating a smoother transition to live trading.

Are there any fees for depositing or withdrawing funds with ATFX?

ATFX prides itself on transparency and cost-efficiency, charging no fees for both depositing and withdrawing funds. This approach enhances the trading experience by minimizing the costs associated with managing a trading account, making ATFX an attractive option for traders seeking to maximize their financial gains.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.