Andrews Pitchfork Trading Strategy Explained By An Expert

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

Want to jump straight to the answer? The best forex broker for traders is Avatrade

The #1 Forex Trading Course is Asia Forex Mentor

If you have been trading for some time, you may already know the importance of technical indicators. Some of the indicators are lagging while some are leading. Some are simple, while some are complex. Among all these, one indicator which is easy to understand and interpret is the Andrews Pitchfork trading strategy. However, it is not well-known or used by beginner traders.

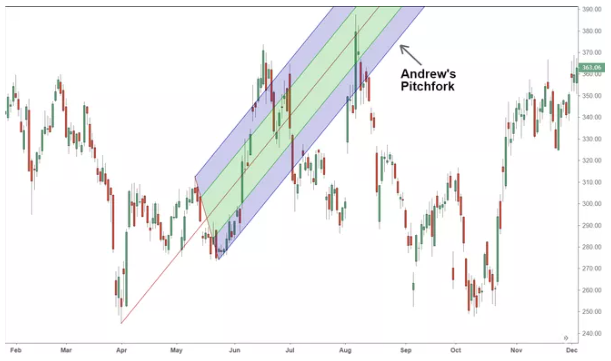

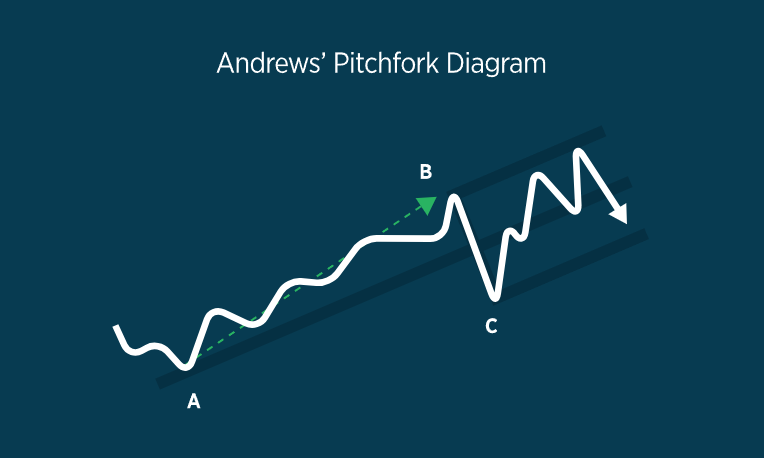

The basic idea behind this indicator is to identify potential reversal points in the market. It is based on the theory that the market moves in cycles, and these cycles can be identified by using this indicator. In addition, you can use it to determine your asset price's possible level of support and resistance in the market. This indicator is called ‘pitchfork' because it looks like a pitchfork when drawn on the chart.

Andrew pitchforks indicator offers some of the best and most advanced options to recognize upper and lower trend lines. To understand this trading strategy, we have got Ezekiel Chew, the founder, and CEO of Asia Forex Mentor. Ezekiel is a professional trader and has been trading for the past ten years. Also, he is a highly sought-after forex trading coach and has trained hundreds of students worldwide.

In this guide, we will discuss Andrews Pitchfork Indicator reveal, breakouts, Middle line Support and Resistance levels, how to draw Andrews Pitchfork, and more. Let's hear what he has to say.

What is Andrews Pitchfork in Forex

The Andrews Pitchfork is a technical indicator that is used to recognize potential reversals in the market. It is developed by Dr. Alan Andrews, a trader, and statistician. The indicator is based on the theory that the market moves in cycles, and these cycles can be identified by using this indicator. In addition, you can use it to determine your asset price's possible level of support and resistance in the market.

Andrews Pitchfork forms around the recent price action created by the two parallel and one median line. You can use this indicator to estimate the pricing behavior in the rising trends. The Andrews pitchfork is used to draw the lines on the chart and is most often utilized to depict highs and low reactions. This tool is basically for drawing price channels and helps to determine the medium and long-term trend, breakout and breakdown levels, and market reversals.

The best thing about this technical indicator is that it works well in a downtrend or strong uptrend. Unfortunately, Andrew's is not useful in sideways trading markets. However, some of Andrews' PITCHFORK variants are better suited for sideways purchases.

What does Andrews Pitchfork Indicator reveal?

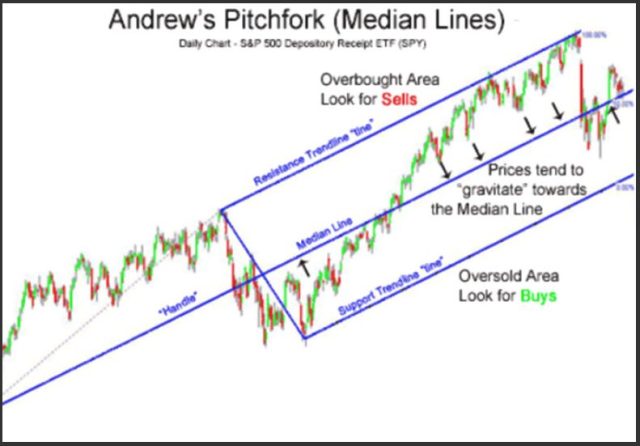

Traders use the Andrews Pitchfork indicator to recognize potential reversals in the market. The basic idea behind this indicator is that it uses three lines to form a pitchfork pattern on the chart. The three lines are the median line, upper line, and lower line.

The median line is the main line used to identify the market trend. The upper and lower lines identify potential support and resistance areas. When the price action breaks out of the upper or lower line, it clearly indicates that the market trend is about to reverse.

As a trader, you need to identify the levels that make it pretty useful to recognize stop-loss orders.

Breakouts in the Upper Trend Line

A version of the Andrews pitchfork tool may be used when trading breakouts over the upper trigger line and breakdowns under the lower trend line. However, the technique requires investors to be vigilant about fraudulent indicators, and they should use indicators to determine whether or not a breakout is viable on the trend lines.

Middle line Support and Resistance levels

Investors may begin a position as soon as the cost of an asset reaches the lower trend line. A short position may be established if the price reaches the top line.

When an asset's price falls below the pitchfork, investors may consider booking some or all of their profits. However, before starting a position, investors must verify that support and resistance are at these levels.

When an asset is trending, the price may follow the center trend line, indicating that the trend is picking up speed.

Creating Andrews Pitchfork in a Chart

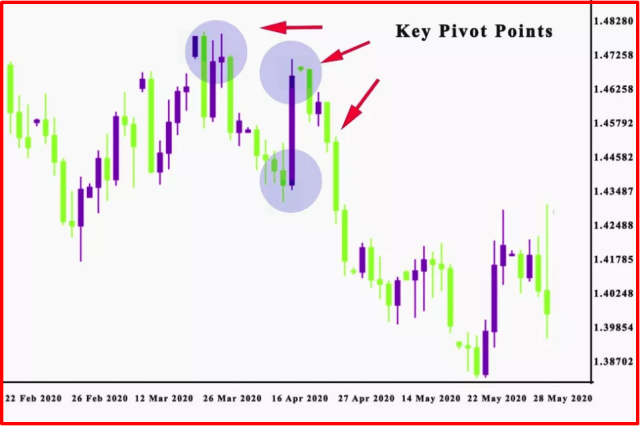

To draw Andrews pitchfork in a chart, you need to locate three consecutive big lows or highs in the stock's price. After that, indicate turning points on the chart and draw a straight line that starts at the initial point and goes through the middle of the next two pivots. Now you need to locate the central median trend line from the upper and lower lines.

Draw the remaining lines that begin from the second and third pivot points and run parallel with the median line, forming the prongs of the pitchfork. The Andrews Pitchfork indicator isn't simple to create, partly because of the subjectivity involved in determining what constitutes crucial highs and lows in an asset's price.

When the lines are plotted, however, the indicator is simple to use, and trading platforms execute the process automatically, with the trader's subjective bias clouding their judgment.

Trading with Andrews Pitchfork Median Line

People make money by developing ideas, but how ideas are put into action in the real world matters more.

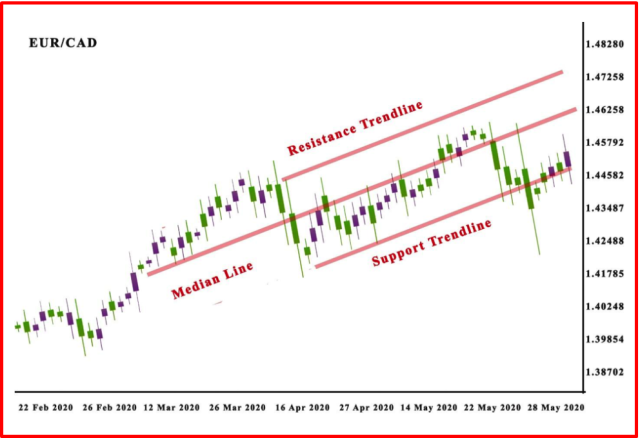

A trader's indicators must be effective in the market where he intends to profit. For example, consider a EUR/USD currency pairing. It has rebounded off the median line and climbed to the maximum resistance of the pitchfork, as shown by the red arrow.

When buying momentum begins to wane, the upper prong forms a cross-like pattern beneath it. Using a stochastic oscillator, you can identify the cross under the signal line, which validates downside momentum.

Ezekiel advises traders to implement an entry near the 3rd candle while using this indicator, with a stop-loss order placed below the most recent low.

At this point, the price is likely to either bounce or fall below the entry signal. A buyer will be triggered when the price approaches or reaches the median line. A sell might be triggered if the price drops below the support level or bounces from it.

Confirming the Effectiveness of Andrew Pitchfork

When you've finished your chart with the Andrews Pitchfork indicator, you'll need to be sure it's authentic. By completing this step, you can be confident that the trade is valid and potentially lucrative if you stick to the program. Also, remember that the Pitchfork indicator is only valid if the price action shows the reactive movements.

When the price comes into touch with the pitchfork lines, it responds swiftly by bouncing in the opposite direction. Moreover, there are situations where the price action may not touch the median line. In such cases, the price action is called a “rejection.”

If the price action contacts the support trendline, it quickly rises upward. When the price action reaches the resistance trendline, it bounces downward. Most trading platforms can determine whether a trend is bullish or bearish.

Limitations of using Andrews Pitchfork

The most difficult part of utilizing the indicator is learning to pick the reliable three points on the chart that will form the channels.

These factors determine the indicator's effectiveness. Traders test out various highs and lows to determine the most successful price points.

The art of nimble trading is not about simply looking at technical indicators or utilizing a drawing tool. To be successful in price action trading, traders must understand market principles and devise a strategy for analyzing the market. On the other hand, Pitchfork-based trading methods may be useful if utilized correctly.

Moreover, you can use pending orders when implementing this indicator. For example, traders may use a buy stop order to protect the first support and set a stop loss at the median line. The stop trade will be activated if the price reaches the support level. When the price touches the median point, it will be stopped.

Best Forex Training Course

Thousands of people from the United States, the United Kingdom, Hong Kong, India, Indonesia, Japan, Malaysia, Vietnam, and other nations have been trained in Singapore, and other locations across the world have been trained and mentored by The Asia Forex Mentor.

They have the greatest forex trading education in Asia. Their course is designed to allow you to make money while learning. With the assistance of a skilled trader, you will be able to trade forex profitably.

They've advised not only individual students but also corporations and financial institutions on foreign exchange, including the DBP, the Philippines' second-largest state-owned bank with assets of more than $13 billion.

The course is reasonably priced, and it is backed by a money-back guarantee. You can begin the course by registering for a free trial. You can decide whether or not to continue with the course after the free trial period.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

|

| securely through Avatrade website |

Conclusion: Andrew Pitchfork

Andrews' Pitchfork is a unique trading technique that uses price action to identify high-probability, high-reward trade setups in the market. In addition, the indicator is designed to help traders identify potential support and resistance levels. When used correctly, the Pitchfork indicator can be valuable to any trader's toolkit.

Investors must know what Andrews' Pitchfork is and how it may help them. It's not difficult to figure out what Andrews' Pitchfork is; all you have to do is adhere to a few simple rules and keep an eye on the trigger lines. For example, the price typically follows the median line. When the price passes beyond the median line, there's a good probability it will retreat and test the median line again.

The tool that drives this work is the same as that used by established traders: fundamental and technical analysis. It's crucial to understand how it works, what attracts funds into the market in general, and where those funds go once they've arrived.

However, as with all technical indicators, it is important to remember that the indicator is not perfect. Several factors can affect its accuracy, and it is important to test the indicator on historical data before using it in live trading.

When the pitchfork is utilized correctly with sound money management and textbook technical analysis, a trader may isolate outstanding options while filtering choppier price action in the forex momentum markets.

Andrew Pitchfork FAQs

Is Andrew Pitchfork Pattern Profitable?

The answer to this question is a resounding YES! The Andrew Pitchfork pattern can be extremely profitable to any trader's toolkit. However, it is important to remember that no indicator is perfect, and several factors can affect its accuracy. Therefore, as with all technical indicators, it is important to test the indicator on historical data before using it in live trading.

How do you plot Andrews Pitchfork?

There are several ways to plot Andrews Pitchfork. Some charting platforms have the indicator built in, while others require the use of a third-party indicator. Moreover, to draw the Andrews Pitchfork chart, the three points are placed by the end of the previous trend. After that, a line is drawn from the first point to the second point, and a median line is drawn from the second to the third point.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.