ACY Securities Review 2024 with Rankings by Dumb Little Man

By John V

January 10, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.8 1.5/5 | 88th  |  |

| Evaluation Criteria |

|---|

The financial experts, experienced traders, and private investors at Dumb Little Man use a unique algorithm to thoroughly assess brokerage services. Their review emphasizes important aspects such as:

|

Forex brokers play a vital role in the realm of online trading by serving as entry points to the international currency markets. These brokers provide venues for buying and selling currencies, serving as middlemen between traders and the huge forex market. Founded in 2013, ACY Securities is a well-known player in this market, renowned for its creative solutions and extensive product line.

ACY Securities distinguishes itself by emphasizing advanced technologies and improving the trading experience. The business links traders with premier liquidity providers using the ECN trading paradigm, enabling quick and effective trade executions.

This evaluation emphasizes the influence of ACY Securities in the trading community, based on expert observations and experiences. Numerous international Forex communities, institutions, and media outlets have honored the company for its client success and trading services.

>> Also Read: 9 BEST Forex Brokers For 2024: Reviewed By Dumb Little Man

What is ACY Securities?

Originally established in Melbourne as ACY Capital Australia Limited, ACY Securities has grown into a well-known international provider of financial services. At first, the company concentrated on developing state-of-the-art technologies to traders navigate the world’s financial markets.

Moving its headquarters to Sydney was a big step in its evolution, indicating a move towards worldwide expansion.

Strategic alliances, such as the one with OANDA, the fifth-largest forex company in the world, contributed to the company’s expansion. Through this partnership, ACY Securities was able to provide more services, such as expert forex market lessons, current currency analysis, and one-on-one forex trading tools and instruction.

ACY Securities has also taken the lead in educational endeavors, introducing cutting-edge courses and working with leading Australian universities to organize summits on economic development.

By establishing an office in Asia and purchasing Sydney-based Synergy Financial Markets (Synergy FX), ACY Securities broadened its reach internationally. ACY Securities benefited greatly from the addition of Synergy FX, which was named the 2015 Australian Best Forex Broker by the Global Financial Market Review (GFMR).

Following the merger, ACY Capital changed its name to ACY Securities and expanded the range of products it offered to include commodities, FX, indices, and cryptocurrencies.

ACY Securities has been recognized as the “Best Investor Education Broker” and the “Influential Forex Broker,” and their customer assistance system, ACY.Cloud, is proof of their dedication to innovation. The company has received recognition for its collaboration initiatives and extensive multi-asset services, including being chosen by Technology Era as the “Best Multi-Asset Broker in Australia in 2020.”

With honors like the ‘Best Overall Broker’ at the Fazzaco Expo Dubai 2022 and the ‘Business Excellence Award 2022’ from the Hong Kong Australia Business Association, ACY Securities’ recent accomplishments demonstrate a growing global presence.

The company’s dedication to openness was further acknowledged when it won the title of “Best Transparent Trading Broker” at the Smart Vision Investment Expo Egypt 2022.

ACY Securities PTY is a company that keeps growing, offering over 2200 instruments on the MT4 and MT5 trading platforms. It has also significantly increased the number of cryptocurrencies it offers.

In the field of online trading and financial services, ACY Securities is positioned differently thanks to its unique blend of technological focus and broad financial services, similar to being half Wall Street and half Silicon Valley.

Safety and Security of ACY Securities

The safety and security of clients are paramount for ACY Securities, a trading name for ACY AU and ACY LLC. ACY Securities Pty Ltd (ACY AU) is licensed and regulated by the Australian Securities and Investments Commission (AFSL 403863), and the Vanuatu Financial Services Commission (VFSC) ensuring a high standard of financial integrity and operational reliability.

For international operations, ACY Capital Australia LLC (ACY LLC) is incorporated in St Vincent and the Grenadines, accommodating non-Australian clients under local laws and regulations.

Financial complaints are taken seriously at ACY Securities. They have established internal dispute resolution procedures to address client grievances effectively. Clients can contact the Compliance Team through various channels to raise complaints, which are initially handled and investigated internally.

If a client is dissatisfied with the internal resolution by ACY Securities, there is a provision to escalate the issue to an external body for further resolution.

In compliance with anti-money laundering regulations, ACY Securities mandates thorough identity and address verification for all clients opening a live trading account. This ensures that all transactions are transparent and legitimate, with deposits and withdrawals being strictly conducted between the trading account and the account holder, prohibiting any third-party payments.

Regarding privacy, ACY Securities adheres strictly to its Privacy Policy Statement. This policy underlines ACY Securities’ commitment to protecting personal information, detailing how they collect, use, disclose, and safeguard the personal data of individuals who avail of their services.

This comprehensive approach to safety and security, as researched and compiled by Dumb Little Man, highlights ACY Securities’ dedication to maintaining a secure and trustworthy trading environment.

Pros and Cons of ACY Securities

Pros of ACY Securities

- Offers a range of account types.

- Provides low or zero spreads.

- Focuses on advanced trading tools and technology.

- Supports multiple global currencies.

- Regulated by the ASIC

- Offers comprehensive educational resources.

- Variety of trading instruments available.

- Multiple customer support channels.

Cons of ACY Securities

- Does not accept U.S. traders.

- Limited promotional offers.

- Potential delays in withdrawals.

- Requires online forms for support.

- Commission charges on some accounts.

- Possible regional limitations in services.

Sign-Up Bonus of ACY Securities

Regarding the Sign-Up Bonus for new clients, ACY Securities currently does not offer any such incentive. This means that when traders open an account with ACY Securities, they should not expect a sign-up bonus as part of the initial registration process.

This approach aligns with the company’s focus on providing comprehensive trading services and advanced technology rather than promotional incentives.

Minimum Deposit of ACY Securities

For those interested in trading with ACY Securities, the minimum deposit varies depending on the type of account chosen. To open a Standard account, a minimum deposit of $50 is required. This option is often suitable for newcomers or those who prefer to start with a smaller investment.

A $200 minimum deposit is needed for the ProZero account, which is intended for more seasoned traders or those looking for more sophisticated features. For professional traders, this account category provides more features and services.

ACY Securities caters to institutional traders and high-net-worth individuals with its Premium Bespoke account. A sizeable $10,000 minimum deposit is required to start this kind of account, which is indicative of its specialized services and unique trading tools and terms.

ACY Securities Account Types

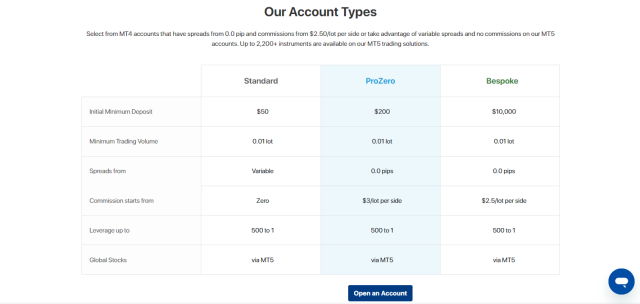

ACY Securities trading account is tailored to different trading preferences and trading strategies. According to thorough research and testing by the team of experts at Dumb Little Man, the account types are Standard, ProZero account, and Premium Bespoke account.

The minimum trading volume is the same for all account types at 0.01 lot. However, the spread is variable at the Standard account, and 0.0 pips for both ProZero and Bespoke accounts. There is no commission for Standard, while ProZero account has $3/lot per slide and $2.5/lot per slide for Bespoke.

Meanwhile, the leverage is the same at 500 to 1, and the Global stocks are via MT5 for all account types at ACY Securities.

ACY Securities Customer Reviews

Customer reviews of ACY Securities present a mixed picture. On the positive side, clients appreciate the great service provided by ACY’s account managers, noting the onboarding process and the variety of payment and withdrawal methods.

Many find the customer support of ACY Securities satisfactory, with specific mentions of helpful account managers like Nathan Yin who provide personalized training and assistance. However, there are also negative experiences, with some customers reporting issues such as delayed withdrawal processes, although they are generally completed within five business days.

A more concerning claim involves an account closure with a significant amount of funds, suggesting potential dissatisfaction and challenges in certain cases. These varied experiences highlight the importance of considering individual needs and circumstances when evaluating a Forex broker like ACY Securities PTY LTD.

ACY Securities Fees, Spreads, and Commissions

ACY Securities trading fees are a transparent model with fees, spreads, and commissions tailored to different account types. For clients with a Standard account, there are no fees or commissions charged, unlike ProZero and Bespoke accounts, making it an attractive option for those who prefer a straightforward trading cost structure.

The ProZero Account charges a commission of $3 per lot per side, combined with a competitive spread of 0.0 pips. This setup is ideal for most traders who prioritize tight spreads along with a reasonable commission rate.

On the other hand, the Bespoke Account has a slightly lower commission rate of $2.5 per lot per side, also with a 0.0 pip spread.

For those holding a ProZero account, charges vary based on the account’s currency denomination. The commission structure is as follows:

For International Clients

- USD account: $6 USD per trade

- AUD account: $8.5 AUD per trade

- EUR account: €5.5 EUR per trade

- GBP account: £5 GBP per trade

- NZD account: $9 NZD per trade

- CAD account: $8 CAD per trade

- JPY account: 700 JPY per trade

For Australian Clients Only

- USD account: $3 USD per trade

- AUD account: $3 AUD per trade

- EUR account: €3 EUR per trade

- GBP account: £3 GBP per trade

- NZD account: $3 NZD per trade

- CAD account: $3 CAD per trade

- JPY account: 350 JPY per trade

Deposit and Withdrawal

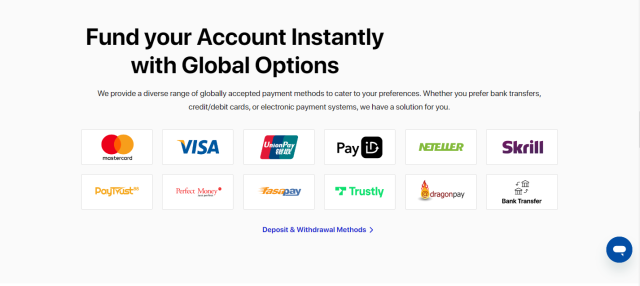

With a large range of currencies available for deposits and withdrawals, including EUR, GBP, USD, AUD, USDT, PHP, VND, and JPY, among others, ACY Securities takes pleasure in its international customer support. This range guarantees that customers from different areas may handle their money in the currency of their choice with ease.

ACY Securities stresses the significance of timeliness and convenience of withdrawal procedures. Customers can withdraw money easily with a variety of alternatives, such as bank transfers, e-wallets, and other practical ways. Because of the platform’s straightforward design, users can withdraw money in a matter of minutes.

To accommodate traders from all around the world, ACY Securities provides a range of deposit and withdrawal options. Even if some approaches could be region-specific, the business makes an effort to offer a wide range of options, guaranteeing increased accessibility and convenience for every customer.

ACY Securities places a high value on fee transparency. The organization maintains an open and honest relationship with customers by clearly disclosing all connected charges, even though rates may differ depending on the options selected. Using this method ensures that clients are fully informed about any fees related to account maintenance.

Bank transfers, credit/debit cards, and electronic payment methods are just a few of the deposit options that ACY Securities provides to accommodate a variety of preferences. Customers can choose and use the deposit option that best suits their needs thanks to the user-friendly interface, which makes funding trading accounts easier.

This data demonstrates how dedicated ACY Securities is to offering its clients quick and easy financial transactions; it was obtained and examined by a Dumb Little Man trading specialist.

How to Open an ACY Securities Account

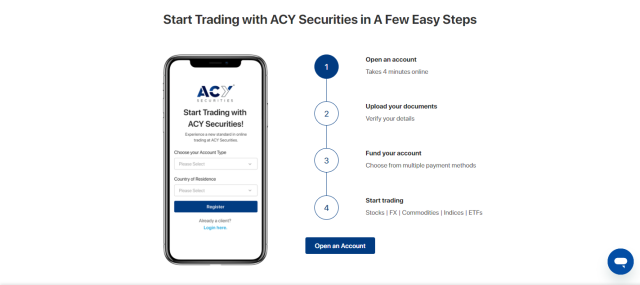

The procedure of opening an account with ACY Securities is simple, rapid, and easy to use. This is a brief tutorial that lists the nine necessary steps to begin trading on their trading platforms:

- To start the account opening process, go to the ACY Securities website.

- Fill out the online application; this should take about four minutes.

- Upload the required paperwork to prove your identity and place of residence.

- Wait for an email stating you are finally verified.

- Use one of the numerous available payment options to fund your account.

- You can begin trading as soon as your account is funded.

- Select from a variety of trading alternatives, such as indices, ETFs, stocks, currency, and commodities.

- To configure your trading preferences, log in to your trading platforms.

- Start your trading career by investigating various financial markets with ACY Securities.

ACY Securities Affiliate Program

The ACY Securities Affiliate Program presents a profitable prospect for affiliates, with a revenue share of more than 50% on spread refunds and fees. This program is intended to help people who want to get paid for introducing new customers to ACY Securities.

Key features of the program include:

- An embedded affiliate portal within ACY Cloud, complete with a unique affiliate link for client referrals.

- Affiliates receive exclusive access to full statistics and details of all referred clients, enhancing tracking and management capabilities.

- Instant commission rebates are displayed on the affiliate portal and are available for withdrawal at any time, offering immediate financial rewards.

- The program provides free marketing tools and materials, including educational resources and daily market analysis from ACY’s team of economists.

- A senior ACY representative is assigned as a personal contact for Introducing Brokers (IBs), ensuring dedicated support and assistance.

- Affiliates can promote over 2200 products, including FX, commodities, indices, cryptocurrencies, and equities, broadening the scope for client referrals.

- There’s an opportunity for exclusive promotion through the Trading Cup Trading competition, adding an extra competitive edge to the affiliate experience.

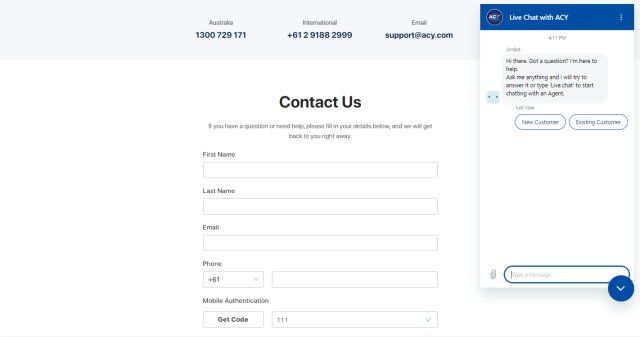

ACY Securities Customer Support

Customer service is very important to ACY Securities, and they make sure that customers can readily access help when they need it. This pledge of assistance is predicated on the experiences that Dumb Little Man has shared.

Customers are invited to submit their questions on the form available on the ACY Securities website, where they will receive a fast response from the customer support team if they have any questions or need any help. This strategy shows a commitment to promptly resolving client problems.

ACY Securities’ dedicated local phone number, 1300 729 171, allows Australian clients to contact the company directly and effectively. To serve its global clientele, the organization offers a dedicated number for overseas customers at (+61 2 9188 2999).

In addition, clients can reach their support staff by email at [email protected], which provides a convenient and alternate means of communication. The availability of this multi-channel support system demonstrates ACY Securities’ dedication to providing thorough and easily accessible client care.

Advantages and Disadvantages of ACY Securities Customer Support

| Advantages | Disadvantages |

|---|---|

ACY Securities vs Other Brokers

#1 ACY Securities vs. AvaTrade

ACY Securities, regulated by the Australian Securities and Investments Commission, focuses on technology-driven trading with a variety of account types and competitive spreads. AvaTrade offers a broad spectrum of tradable instruments across various trading platforms, including negative balance protection and AvaProtect insurance. However, AvaTrade doesn’t accept U.S. traders and lacks regulation by the FCA.

Verdict: The better alternative for traders looking for a tech-focused and trustworthy broker with a wide range of account and trading options is ACY Securities. But AvaTrade is better suited for people who want more trade protection features and a large selection of trading instruments.

#2 ACY Securities vs. RoboForex

The technology-focused approach of ACY Securities‘ ECN idea, which offers direct access to liquidity sources, makes it appealing. MT4, MT5, cTrader, and R Stock Trader are just a few of the trading platforms that RoboForex is renowned for offering to accommodate different trading volumes and preferences. The business opened for business in 2009.

Verdict: Traders who enjoy using cutting-edge technology and an ECN trading approach ought to give ACY Securities some thought. On the other hand, RoboForex would be a better option for traders looking for more individualized trading circumstances and a larger selection of trading platforms.

#3 ACY Securities vs. FXChoice

ACY Securities offers a broad variety of trading instruments to meet the needs of all types of traders by fusing cutting-edge technology and innovation. CFD and forex trading are among FXChoice’s specialties. They offer distinctive potential in emerging economies with a broad range of commodity and currency pairings.

Verdict: Traders seeking cutting-edge technology and a wide range of trading possibilities can consider ACY Securities. However, people who want to trade in expanding markets and have access to a greater range of Forex pairings and commodities might want to check into FXChoice.

Choose Asia Forex Mentor for Your Forex Trading Success

Trading professionals at Dumb Little Man strongly recommend Asia Forex Mentor for anyone looking to launch a profitable career in trading and make substantial financial advantages. Asia Forex Mentor, run by prominent trader Ezekiel Chew, who is well-known for his seven-figure deals, provides a plethora of advantages:

Comprehensive Curriculum: The site offers a comprehensive course covering forex for forex traders, cryptocurrencies, and stock trading. This curriculum aims to transmit the knowledge and skills necessary for success in these sectors.

Proven Track Record: Real-world success is what matters here, not theory. Asia Forex Mentor has a strong track record of developing traders who consistently make money in the markets. This record demonstrates the worth and efficacy of the instruction you will get.

Expert Mentor: You can become the best by studying under the greatest. The exceptional chance to receive mentoring from Ezekiel Chew, a mentor with a successful track record in the markets, is provided by Asia Forex Mentor. His individualized assistance gives pupils the confidence to comprehend and maneuver the complexity of the market.

Friendly Community: Connect with other traders, learn together, be accountability partners, and more. All of this is made possible using the friendly community that is built in Asia Forex Mentor.

Emphasis on Psychology and Discipline: Trading is not only about strategies, in Asia Forex Mentor, your discipline and mindset will also be trained. The psychology and discipline behind trading will help you regulate your emotions, and your stress, leading you to better decision-making.

Updates and Resources Every Day: Asia Forex Mentor and the markets are always moving. You’ll always be one step ahead because of your constant access to the newest tactics, trends, and market knowledge.

Success Stories: Be inspired by the number of success stories and the number of traders who have achieved financial independence and success in their trading careers, that stemmed from Asia Forex Mentor.

All these make Asia Forex Mentor a premier learning resource for traders who want to participate in more extensive training, not only in trading platforms like Fusion Markets but also in stocks and cryptocurrency. Being part of the program will guarantee traders the assistance that they in order to succeed in today’s ever-changing market.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: ACY Securities Review

Dumb Little Man’s team of trading specialists has carefully examined ACY Securities, pointing out both its advantages and disadvantages. The broker appeals to a variety of traders with a wide choice of account types and competitive spreads. Significant benefits include the emphasis on cutting-edge technology and its status as an organization governed by the Australian Securities and Investments Commission.

All things considered, ACY Securities is a great alternative for many traders because of its technologically advanced trading environment and wide range of trading possibilities. Notwithstanding its advantages, people should consider their unique trading requirements and preferences in addition to the broker’s limits before deciding.

>> Also Read: AAAFx Review 2024 with Rankings by Dumb Little Man

ACY Securities Review FAQs

Can I trade cryptocurrencies with ACY Securities?

ACY Securities offers a bitcoin trading platform. They offer a range of choices, including well-known cryptocurrencies, enabling traders to diversify their holdings outside of conventional FX and commodities.

Is ACY Securities suitable for beginner traders?

Indeed. Beginner traders as well as experienced ones are catered to by ACY Securities. They provide a variety of account kinds and extensive training materials to meet the requirements of inexperienced traders who want to learn and advance in the trading industry.

Are there any account maintenance or inactivity fees with ACY Securities?

Usually, ACY Securities doesn’t impose fees for account maintenance or inactivity. However, for the most recent information on any prospective costs, traders should always check the terms and conditions or get in touch with customer service.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.