4XC Review 2025 with Rankings by Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.8 1.5/5 | 86th  |  |

| Evaluation Criteria |

|---|

Dumb Little Man's team, comprising financial experts, experienced traders, and private investors, employs a unique algorithm to thoroughly assess brokerage services. Their evaluation focuses on key aspects such as

Client feedback is also integrated into their reviews for a well-rounded and impartial perspective. Following an in-depth review, they determined that 4XC stands out as a dependable broker for individuals seeking a consistent financial ally. Nonetheless, Dumb Little Man recommends that prospective clients meticulously review their detailed article to grasp any potential drawbacks of the broker completely. |

“Forex brokers” play a crucial role in the Forex industry for two main reasons. Aside from the fact that they facilitate currency trading, they also help traders by offering traders a variety of tools, suggesting data-driven trading strategies, and vital market trends. 4XC stands out in this market with its commitment to empowering traders of all skills.

4XC is centered around its core values: transparency, innovation, and customer satisfaction. Their goal is to make a safe and secure trading environment while supporting traders with the necessary tools for their success.

This 4XC review highlights the findings of trading experts at Dumb Little Man mixed with real user experiences aimed at finding out what sets it apart in the Forex trading market.

>> Also Read: 9 BEST Forex Brokers For 2024: Reviewed By Dumb Little Man

What is 4XC?

In 2018, 4XC, a financial brokerage firm, was founded and is headquartered in the Cook Islands. It is well-known for its worldwide reach, accepting traders with a range of account types and providing leverage up to 1:500.

4XC offers a wide range of over 400 tradable assets in financial markets such as Forex, equities, indices, commodities, and cryptocurrencies, in spite of certain worries regarding platform-related fees.

4XC, a brand of Geomatrix Limited, places a high priority on customer security by separating funds and joining The Financial Commissions to resolve disputes. 4XC offers 400 financial products that is available via MT4 and MT5 trading platform.

With account kinds like Standard, VIP, and Pro—which include commission-free and commission-based options—this reliable broker caters to a variety of trading instruments and tastes.

Bank wire transfers, credit cards, e-wallets, and other conventional and digital deposit and withdrawal methods are all supported by 4XC. With the help of automated services like PAMM accounts, flexible trading techniques, and educational materials, it enhances the trading experience.

4XC is well-known for its dependability and commitment to making trading easy for each and every one of its customers.

Safety and Security of 4XC

There have been some questions about the security and safety of 4XC, a financial broker operating under the Geomatrix Ltd. trademark. Under the auspices of the Cook Islands Financial Supervisory Commission license, this broker is based in an area renowned for its weak regulations. This, together with 4XC's peculiar pricing strategy, has raised concerns about the broker's legitimacy and made it dangerous for traders to deposit money.

4XC keeps several safety precautions in place in spite of these worries. Although not as well-known as organizations like the Financial Conduct Authority in the UK, it is a licensed broker in the Cook Islands and adheres to certain established procedures. For example, 4XC segregates client cash from business funds and maintains a Professional Indemnity insurance coverage.

Retail investors can also benefit from negative balance protection provided by the broker, which guarantees they won't lose more than their initial investment. McMillan Woods regularly audits 4XC, which provides an additional level of responsibility.

Comparing the FSC's regulatory structure to those of other well-known regulatory bodies, it is thought to be less strict. 4XC's dependability is called into question due to the ease of doing business under FSC regulations and the lack of strict regulatory control, which allows for potentially dishonest practices.

This implies that 4XC might not be subject to strict regulations, which could put traders at risk.

Dumb Little Man conducted extensive research before compiling this data, which highlights the advantages and disadvantages of 4XC's security and safety protocols.

Pros and Cons of 4XC

Pros

- Conditions for trading that are beginner-friendly

- Minimum of USD 50 deposit with leverage of 1:500

- Spreads on a Standard ECN account start at one pip.

- Extensive instruction

Cons

- One withdrawal transaction limit per day

- Insufficient FAQs section

Sign-Up Bonus of 4XC

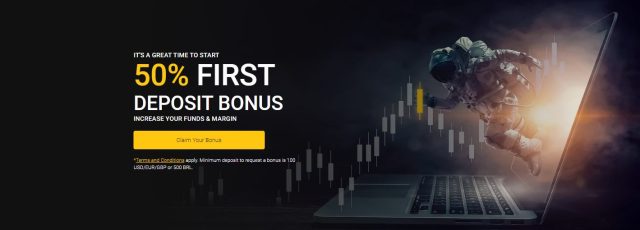

Starting to trade with 4XC is profitable because they provide new traders with an enticing 50% initial deposit bonus. A minimum initial deposit of $100 USD, EUR, GBP, or 500 BRL is needed to qualify for this offer.

The deposit bonus cannot exceed 5000 BRL or 1000 USD, EUR, or GBP and is only worth 50% of the initial investment. This allows for a more stable entry into the trading market and significantly increases a trader's beginning capital.

By offering them a significant deposit bonus when they begin trading, 4XC is attracting new clients with this strategic sign-up bonus.

Minimum Deposit of 4XC

At 4XC, traders have the flexibility to select an option that aligns with their investment strategy and risk tolerance, as the minimum deposit required varies depending on the account type they select.

The Standard account is perfect for those who want to start with a small investment because it just requires a minimum of $50 USD deposit. For those who are new to it or are unwilling to make significant initial commitments, this makes it inexpensive.

Aiming for more experienced or high-volume traders, the VIP account has a substantially higher minimum deposit requirement of $10,000 USD. This account is meant for those who are comfortable making larger amounts and are searching for more serious trading opportunities.

Meanwhile, traders looking for a middle ground between the features of the Standard and VIP accounts can find it with the $100 USD deposit required for the Pro account.

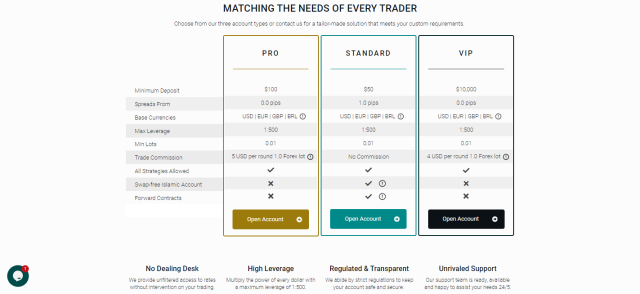

4XC Account Types

To accommodate the various demands and approaches of traders, 4XC provides three different trading account types: Standard, Pro, and VIP Accounts.

Each account type has its own features and specifications, so traders may select the one that best suits their trading objectives and available funds.

Standard Account

- Minimum Deposit: $50

- Spreads From: 1.0 pips

- Base Currencies: USD, EUR, GBP, BRL

- Max Leverage: 1:500

- Min Lots: 0.1

- Trade Commission: No commission

- All Trading Strategies Allowed: Yes

- Swap-free Islamic Account: Yes

- Forward Contacts: Yes

Pro Account

- Minimum Deposit: $100

- Spreads From: 0.0 pips

- Base Currencies: USD, EUR, GBP, BRL

- Max Leverage: 1:500

- Min Lots: 0.1

- Trade Commission: 5 USD per round 1.0 Forex lot

- All Trading Strategies Allowed: Yes

- Swap-free Islamic Account: No

- Forward Contacts: No

VIP Account

- Minimum Deposit: $10,000

- Spreads From: 0.0 pips

- Base Currencies: USD, EUR, GBP, BRL

- Max Leverage: 1:500

- Min Lots: 0.01

- Trade Commission: 4 USD per round 1.0 Forex lot

- All Trading Strategies Allowed: Yes

- Swap-free Islamic Account: No

- Forward Contacts: No

4XC Customer Reviews

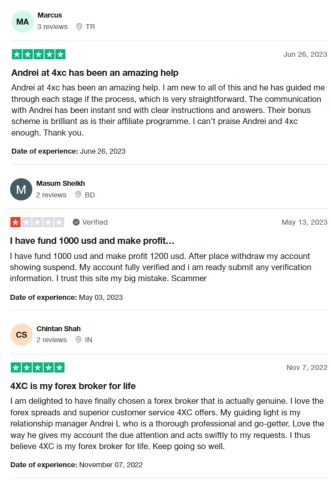

Reviews from customers of 4XC show a range of experiences. Numerous customers commend the outstanding customer service, emphasizing the direction and lucid communication given by agents such as Andrei and the enticing bonus and affiliate schemes.

The customer support team's professionalism and response are frequently highlighted in these excellent reviews, which has led some customers to choose 4XC as their long-term forex broker.

On the other hand, there are also accounts of bad experiences, such as difficulties with withdrawals and account suspension, which have caused some consumers to express regret and call the business unreliable.

4XC Fees, Spreads, and Commissions

Standard, Pro, and VIP are the three primary account categories that 4XC offers, and each has different fees, spreads, and commissions. Every account is customized to accommodate its capital capacity and trading strategy.

The Standard Account offers spreads starting at 1.0 pips and has a $50 minimum deposit requirement. It has a maximum leverage of 1:500 and doesn't charge a trade commission. This account allows a minimum lot size of 0.1 and supports a number of base currencies, including USD, EUR, GBP, and BRL.

On the other hand, the Pro Account has narrower spreads starting at 0.0 pips, and requires a $100 minimum deposit. The trade commission for this account is $5 for each round 1.0 Forex lot.

The VIP Account is designed for high-volume traders, requiring a minimum deposit of $10,000 and offering spreads from 0.0 pips. The trade commission here is slightly lower at $4 per round 1.0 Forex lot, and the account allows a finer minimum lot size of 0.01.

Deposit and Withdrawal

4XC enforces specific deposit and withdrawal rules, as reviewed by a trading expert from Dumb Little Man. The policy limits them to only withdraw money and earnings once daily per account to reduce fees, except for VIP accounts. Withdrawals made within 48 hours of deposit or by inactive traders post-deposit charges equivalent to the deposit fees.

Withdrawals must be to the client’s own account, reinforcing financial security and anti-money laundering measures. Deposits and withdrawals are available 24/7, and typically processed within 24 hours, but may face delays during weekends or due to payment system issues. Internal transfers between same-type accounts are executed on the same day.

For clients using multiple payment methods, withdrawals must align with the proportions of deposits. 4XC may change processing times and available payment methods without notice and may impose limits based on the client’s country. VIP account holders and traders benefit from waived deposit and withdrawal fees.

How to Open a 4XC Account

Opening an account that 4XC offers is a straightforward process, designed to be user-friendly for both novice and experienced traders. The steps for registering either a live or demo account involve simple online procedures, ensuring a smooth and efficient setup.

- Visit the broker's website and select the Live account option in the top-right corner.

- Provide your full name, email address, and phone number, and set a password.

- Receive and enter the PIN or verification code sent to your phone or email for verification.

- Fill out a questionnaire detailing your trading experience and goals.

- Submit the necessary documentation requested by the broker.

- Choose whether your account will be used for individual or corporate purposes.

- Indicate your country of residence in the registration form.

- For a demo account, specify your desired account type and demo balance, excluding the need for a phone number.

- Fund your account to start trading.

4XC Affiliate Program

The 4XC's initiative, which seeks to foster productive partnerships, provides IBs with the knowledge and resources they require and requires no upfront capital, making it a cost-effective and potentially lucrative choice for those looking to trade Forex.

They also offer a competitive edge with a 50/50 split of spreads and trade commissions. This is 4XC's way of fostering partnerships while providing partners with knowledge and resources in order to succeed.

4XC Customer Support

According to the research of experts at Dumb Little Man, 4XC offers various communication channels. They have customer service available via phone, chat, and email that is available 24/7.

4XC is committed to providing satisfactory customer support and is encouraging their clients to contact them right away. This approach is in line with their vision which is client satisfaction.

Advantages and Disadvantages of 4XC Customer Support

| Advantages | Disadvantages |

|---|---|

4XC vs Other Brokers

#1 4XC vs AvaTrade

4XC is well-known for providing trading conditions that are perfect for novices, thanks to its low minimum deposit and big leverage option. Conversely, 4XC is subject to the less stringent standards of the Financial Supervisory Commission. AvaTrade offers a wide range of trading platforms and trading instruments that may be traded by humans or automatically. It has a global reach, a wealth of educational resources, negative balance protection, and exclusive trade insurance—all without being governed by the FCA.

Verdict: For traders seeking a large selection of tradable instruments and educational resources, AvaTrade may be a preferable choice. However, 4XC can be a better choice for those who prefer settings that are easy for beginners to use and have more leverage.

#2 4XC vs RoboForex

High leverage and a range of account types are prioritized, making 4XC an approachable platform for traders of all experience levels. It operates according to the Financial Supervisory Commission of the Cook Islands. RoboForex is renowned for providing advanced trading conditions and a range of trading platforms, including MT5, MT4, and cTrader. It supports any trading strategy and offers an extensive toolkit.

Verdict: RoboForex is a superior choice for traders looking for a good trading platform and advanced trading tools. If good leverage and easy-to-use trading conditions are your primary goals, 4XC might be a better choice.

#3. 4XC vs FXChoice

4XC is geared toward traders seeking high leverage and a variety of account options, operating under the Cook Islands’ regulatory framework. FXChoice focuses on providing access to emerging financial markets with a variety of Forex pairs and commodity CFDs, including in energy and precious metals.

Verdict: For traders interested in emerging market currencies and commodity CFDs, FXChoice offers a more specialized platform. 4XC, on the other hand, is more suited for those seeking big leverage and a range of account types.

Choose Asia Forex Mentor for Your Forex Trading Success

Experts at Dumb Little Man recommend Asia Forex Mentor for those who want to make a successful career in Forex trading. This platform is popular for its courses on stock, Forex, and crypto trading because of the following:

Extensive Curriculum: It provides an in-depth and intensive curriculum about the important aspects regarding stock, cryptocurrency, and Forex market.

Proven Track Record: Real-world success is what matters here, not theory. Asia Forex Mentor has a strong track record of developing traders who consistently make money in the markets. This record demonstrates the worth and efficacy of the instruction you will get.

Expert Mentor: You can become the best by studying under the greatest. The exceptional chance to receive mentoring from Ezekiel Chew, a mentor with a successful track record in the markets, is provided by Asia Forex Mentor. His individualized assistance gives pupils the confidence to comprehend and maneuver the complexity of the market.

Friendly Community: A community of traders that assist and educate one another is also housed on the platform. By promoting the exchange of concepts and tactics, this network improves learning.

Stress on Psychology and Discipline: In addition to teaching trading tactics, Asia Forex Mentor also emphasizes the psychological and emotional components of trading. The goal of the psychological training is to assist traders in making deliberate, well-informed decisions.

Updates and Resources Every Day: Asia Forex Mentor and the markets are always moving. You’ll always be one step ahead because of your constant access to the newest tactics, trends, and market knowledge.

Success Stories: Be inspired by the number of success stories and the number of traders who have achieved financial independence and success in their trading careers, that stemmed from Asia Forex Mentor.

In conclusion, Asia Forex Mentor is a great resource for everyone who wants to learn all about trading stocks, cryptocurrencies, forex, and especially Global Prime. The supportive community behind it, the holistic approach to trading, and the comprehensive curriculum it offers provide traders with the knowledge and guidance they need in order to be successful in the trading industry.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: 4XC Review

After a thorough assessment by trading experts at Dumb Little Man, 4XC appears to be a viable option in the Forex market with its high leverage and negative balance protection, and its NDD environment which is very suitable for every trader. Their features like copy trading, PAMM accounts, and excellent customer support also add to its appeal.

On the other hand, 4XC also has some issues regarding its regulatory oversight, specifically in relation to its prices and trading conditions. While 4XC offers competitive trading options and training tools, potential traders should carefully consider these limitations.

>> Also Read: Fusion Markets Review 2024 with Rankings by Dumb Little Man

4XC Review FAQs

What trading platforms does 4XC support?

4XC supports MT4 and MT5, aside from its Acuity plugin capabilities. These platforms suit both novice and experienced traders because they offer a wide range of tools for technical analysis and trade execution.

Can traders use various trading strategies with 4XC?

4XC allows different trading strategies, may it be manual or automated trading. The broker provides services including copy trading and PAMM accounts to suit a range of trading preferences and styles. Due to its versatility, 4XC is an excellent choice for traders who wish to employ their own trading strategy.

How does 4XC compare to other forex brokers in terms of fees and leverage?

As a forex broker, 4XC offers advantageous trading conditions, including multiple account types with varying fee schedules and high leverage up to 1:500. While its spreads and commissions are competitive, traders should be aware of the regulatory framework and transparency concerns, since these may not match those of other top-tier forex brokers.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.