XM Review 2024 with Rankings By Dumb Little Man

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the dumblittleman platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors:

Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved. After evaluating XM global on the above-mentioned criteria, we discovered that XM international is a reliable platform for traders and investors searching forsearching for a credible financial broker. Moreover, with its fast order executions and minimal slippage, XM global limited is not only a good choice for professional traders, but novice traders can also benefit from the low minimum deposit and demo or cent accounts. |

XM Review

For any trader, the first challenge in successful trading is looking for the right broker as a trading partner. This task becomes more complicated with so many brokerage companies offering their services in the financial market. Each broker claims to be providing the best trading tools and services; however, usually, every firm has a unique feature making it different from others. Among these, XM broker is one company that is highlighted for its fast order executions and technical advantages.

XM broker has been providing services in the financial market since 2009 and the firm has seen exponential growth ever since. As three leading financial commissions regulate the company, XM broker has improved consistently and is now offering trading services to more than 5 million people worldwide. Moreover, the firm's credibility can also be seen through the numerous awards it has received from multiple financial platforms.

There are many advantages to choosing XM as your brokerage partner such as multiple account types, advance trading platforms, tightest spreads, fast market executions, minimal slippage, commission free trading, free deposit and withdrawal of funds, and much more. However, it should be noted that the perks come with a price,

This XM review aims to present a complete analysis of XM as a brokerage firm with all its pros and cons. Moreover, every other relevant information regarding this broker, such as account types, withdrawal and deposit procedures, commissions, and more, are also provided so that you can make an informed decision before investing with this firm. Lastly, other than our expert analysis, we have also added customer reviews to provide authentic information about the broker from a trader's perspective.

What is XM?

XM global limited is a brokerage platform founded in the year 2009. It started as a small firm; however, it became among the best trading service provider in the financial market. The best part about XM is that it is a safe and reliable firm as it is regulated by not only one but three financial regulators ASIC (Australian Securities), FCS (Belize), and CySEC (Cyprus). Moreover, the XM group has also received numerous prestigious awards from various financial institutions including the “Best CFDs Broker in MENA Region award”‘ by the Dubai financial services authority in the year 2021.

The XM group is also known for its range of financial instruments exceeding over 1000, including Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, Energies, and Shares. Moreover, XM global is among the very few brokers that provide trading facility in rare commodities such as cocoa, cotton, grain, and metals, including palladium and platinum. Even when XM offers a wide range of trading instruments it still is less than many of the top range brokers where the number count of assets is more than 20000.

Moreover, there are multiple trading features of XM that are appreciated by both the financial experts as well the customers, such as minimal slippage, tight spreads from 0.6 pips, fast speed market executions, and no requotes. In addition to this, the broker also offers the most advanced trading platforms, MT4 and MT5, to its customers. All in all, XM has the complete package of trading assistance for traders and investors for successful trading.

On the downside, it should be noted that XM global is towards the high end when it comes to the overall trading cost compared to its competitors. Therefore, traders who prefer a cost-effective broker would favor other brokers than XM global as their trading partner. Moreover, beginners who need support through educational resources and tools may also find XM fall short in these factors when set side by side to other brokerage firms.

Safety and Security of XM?

The assurance of safety and security of traders' investments comes with regulated online brokers. The regulatory bodies serve as surveillance entities for the brokers, which keep an eye on all the monetary transactions and financial services of the broker. Therefore, brokers regulated by international commissions are deemed safe and secure.

XM global is not only regulated by one but three financial regulators, with one being the top-tier financial regulator ASIC The Australian Securities and Investments Commission (Trading Point of Financial Instruments Pty Ltd), and the other two are considered average financial regulators. In the Singapore market, XM Broker operates under the regulation of the Belize license issued by the Financial Services Commission (FSC-Belize).

FSC The Financial Services Commission (XM Global Limited), CySEC Cyprus Securities and Exchange Commission (Trading Point of Financial Instruments Ltd) and the DFSA (Trading Point MENA Limited). Moreover, XM also comes under the Markets in Financial Instruments Directives (MiFID) that ensure transparency funds across the financial markets.

Along with these regulators, the XM broker also ensures the protection of funds through segregated accounts. This means that the funds are kept in separate accounts in European banks and are protected from any misuse. Furthermore, XM also provides negative balance protection, which protects clients from market volatility and uncertain market conditions.

Sign Up Bonus of XM

XM provides many promotions and rewards to entice customers to sign up on their platform. This includes a 20% deposit bonus of up to $5000. This amount is instantly deposited into the user's account as soon as they sign in. Moreover, this sign-up bonus is available to all MT4 and MT5 account-holding customers regardless of their deposit amount.

In addition to this, there are different rewards and gifts for international customers, including lucky draws and special rewards through the XM Loyalty Program. Moreover, there is also a $35 credit bonus for each referral to a friend which has regional specifications. The exact guidelines can be referred through the official website of XM global.

Minimum Deposit of XM

Some brokers have high initial deposit fees, making it difficult for low-budgeted and inexperienced traders to open accounts. However, at XM, the deposit fee is very low$ 5 for all account types, except the share account. Such a low minimum deposit requirement encourages novice traders to be able to enter the financial market with minimal risks.

Furthermore, another feature that adds value to this low minimum deposit is the XM broker's zero deposit fee policy. This feature makes it more cost-efficient for traders to invest a minimal amount and earn maximum profits through this broker. As beginners and inexperienced traders always look for the lowest risk investments, such traders would be encouraged to open an account with the XM platform.

Account Types

XM Global offers the following account types where each account type is customized keeping in mind the trading needs of the customers. . However, XM claims to provide the same trading features to all customers giving exceptional trading services to each trading account type with minimal trading costs.

#1. Micro Account

Micro accounts have the base currency option of all major currencies with high leverage of up to 1:1000. At a minimum deposit fee of $5, users can have multiple trading features such as swaps, overnight holding, hedging, and negative balance protection. Moreover, the users can also enjoy fast order executions for spreads as low as 1 pip.

The contract size per lot in the micro accounts is 1000 with a 0.1 minimum trading volume. The best part of this account is that, like all other account types, the Micro account provides commission-free trading to gain maximum profits. This account type is ideal for novice and inexperienced traders to test the waters of the financial markets.

#2. Standard Account

The standard account has all the same trading features as the micro account with the same initial deposit requirement of $5 and zero commission trading. Other features such as swaps (on selected instruments), hedging, and negative balance protection are also available in this account. However, this account is a step forward, allowing contract sizes of up to 1000 000 and 50 lot restrictions per ticket at a 0.01 minimum trade volume.

The standard account is one step further than the micro account as far as the trading conditions are involved. Day traders and retail traders can go for the standard account as it provides all the required trading options of a profitable trading account without any commission fees and bigger contract sizes.

#3. XM Ultra Low Account

The XM clients also have the option to open an XM ultra-low account which allows traders to have the freedom to choose customized trading features that suit their trading styles. The ultra-low accounts are not available in all countries therefore users are requested to check their region-specific official XM website for account confirmation.

In this account, the type of trader can either go for the standard contract size or the micro contract sizes with a trading volume of 0.1 or 0.01. Such narrow spreads can result in massive profits for the traders as the ask and bid price difference is very low at fast order executions with zero commission.

#4. Shares Account

The XM shares account is different from all the other three account types. XM is among the very few brokers which provides customized account type for trading shares. This account has the base currency of USD with a contract size of 1 share per lot. Moreover, there is no leverage given to traders in this account and the spreads also varies according to the underlying exchange.

Moreover, the commission free policy also does not apply on this account type and neither does the trader can the swap and hedging options. However, user can still avail the negative balance protection feature in this account type. In addition to this, users also have a pay whooping $10, 000 as initial deposit to open this shares account.

#5. Demo Account

The XM brokerage platform also has the facility of opening a demo account with initial virtual balance of $100, 000. This account is presenting a great opportunity for inexperienced and new traders who can test their trading skills without risking any money. Once the trader is comfortable with the platform then the demo account can be switched to alive trading account by just paying the initial deposit money.

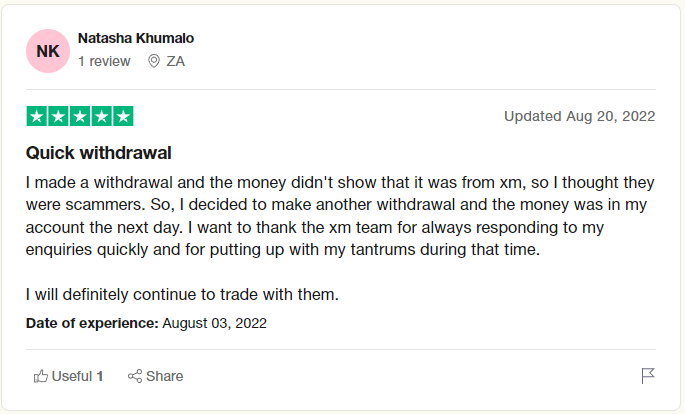

XM Customer Reviews

|

|

|

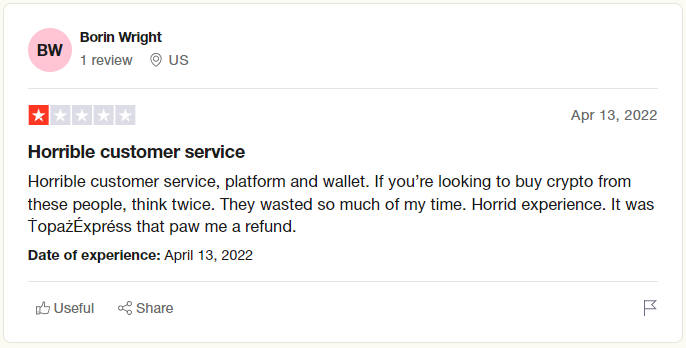

The customer reviews of XM are balanced. Some customers have highly appreciated their trading experiences with this broker. These customers specifically mentioned the easy withdrawal procedures and prompt technical assistance from the firm. Moreover, others praised the excellent customer support team who solved their issues and were readily available whenever needed.

In contrast, many negative reviews were also observed regarding XM which included comments like slow customer service, complicated platform and prolonged withdrawals. However, these customers still managed to get a refund. All in all, the XM customer reviews were at two extremes of good and bad where no conclusive opinion can be made about the firm.

XM Spreads, Fees, and Commissions

One of the strong points of XM as a brokerage firm is that it offers tight spreads to its clients. The micro and standard account holders get the spreads starting from 1 pip. On the other hand, the ultra-low account holders get the benefit of receiving the narrowest pips starting from 0.6.

There is no commission fee in micro, standard and ultra-low accounts. However, the share account holders also have to pay the commission which varies according to the underlying asset.

Other than the ones mentioned clearly on the website we found no other hidden charges of fees on the XM brokerage platform.

Deposit and Withdrawal

The initial deposit requirement for all account types n the XM platform is as low as $5. However, the initial deposit limit for the share account is high starting from $10, 000. Other than this there are no extra charges or fees on deposits made by the customers.

As far as withdrawals are concerned, XM claims to provide instant withdrawals with ease. Moreover, there are multiple withdrawal methods available for client's convenience on the XM platform. Customers can withdraw money through e-wallets, online payment options, credit or debit cards and also from standard wire transfers.

In addition to this, XM also promotes its platform for providing zero fees on deposits and withdrawals. All e-wallets and credit cards are 100% free of transfer fees and wire transfer above $200 are also covered by zero fee on the platform.

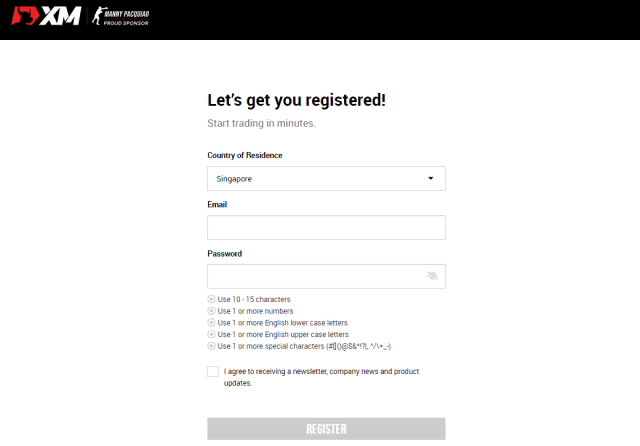

How To Open an XM Account

Keeping the convenience of the customers in mind, opening an account on the XM platform is quick and easy. The first step is to simply open the official website of XM platform. The XM global website opens with specifications of different regions. The website also has all the relevant information regarding the trading services offered by XM and answers all the questions in the FAQs section. Users can get access to all the information that they require on the website.

Next step is to click on either the “Open a Demo Account” button if they want to open a demo account or can click on the “Open an Account” button for a live account. These tabs are located on the homepage of the website.

Procedure for Demo Account

The demo account will be opened for users after filling a very simple form providing the personal information like name, location, email address and phone number of the client. However, for the live account there is a two-step registration process.

In the first step the user will have to fill a registration form with personal details like name, last name, residence, preferred language, phone, email address, trading platform type, preferred account type. After confirming to the information, the users can proceed to the verification link that is sent by the firm and can start trading using the account details.

Procedure for Live Trading Account

The first step of the live trading account is same as the demo account. In second step of the registration form requires more specific information including date of birth, complete address, citizenship, trading account details, investor information, trading experience information, and account password.

Once the user confirms to the given information and clicks on “open real account” the user will receive a verification link and by clicking on that link the user will b able to login to the account dashboard with the email id and their selected password. Users will have to pay initial deposit of at least $ 5 or more to start live trading.

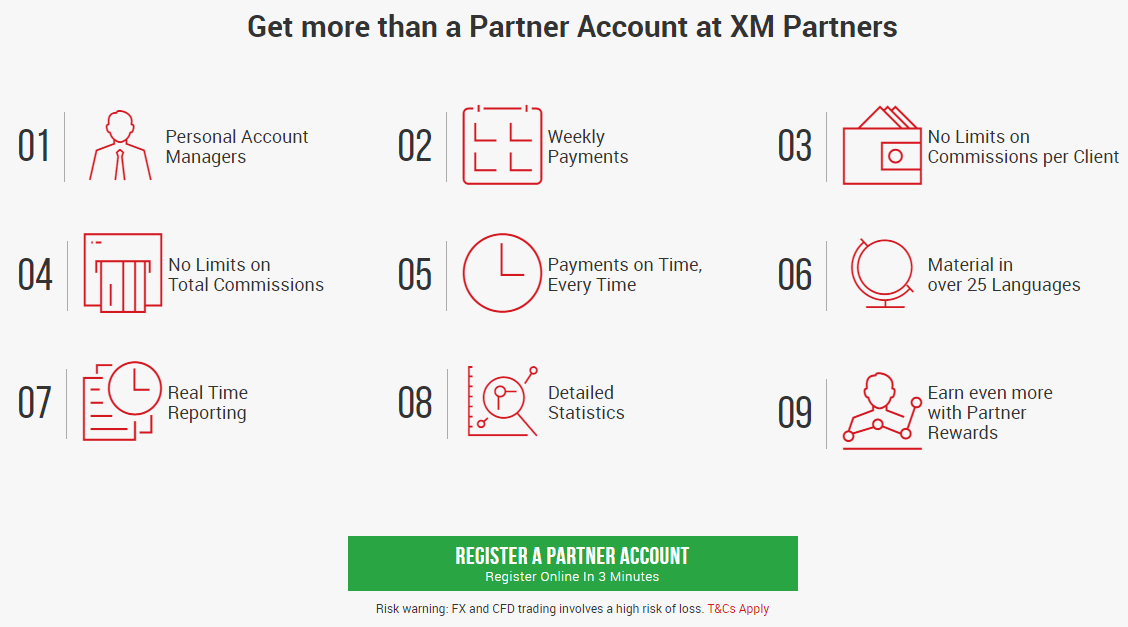

XM Affiliate Program

The XM Broker only provides one type of an affiliate program. The customers with a trading account on XM can view the profitability stats of their affiliate program on their personal account dashboard. However, there are some general guidelines for this affiliate program which has the following conditions.

- There is a fixed rate of $ 25 for each standard lot.

- Customes who make second or more referrals have the opportunity to make a multi-level affiliate program. In such a scenario, the customers will also earn 10% on the second referral and an allotted percentage on the rest of the referral levels.

- There is also a CPA plan in which referred clients belonging to countries such as UK, EU and Australia would get payments up to $ 650. However, this plan is region specific and referral clients from countries such as Spain and Portugal are exclusive of this plan.

XM Customer Support

For any brokerage company, a reliable and superior customer service is an integral part of their success. Since many traders are into forex trading it takes place even on weekends as the forex market is operative 24 hours a day and give days a week. In such a situation when some brokers do not provide customer service on weekends believing it to be non-essential however, it leads to much hassle for the traders who need urgent assistance.

At the XM brokerage platform, the biggest pro is that their support team is available 24/7 for both the existing customers and potential customers. Along with this, the customer reviews also suggests that the customer services are prompt and reliable and tackles with the issues of the clients proficiently. However, not all the reviews are positive and some also suggest that customer service is not up to the mark.

The medium of communication that are offered by the XM customer service also speaks for its credibility. There are multiple ways to contact support including live chat box and toll-free call service for quick and urgent matters and email and call back service for other general queries. Moreover, there is also a strong presence of XM on multiple social media platforms, such as twitter, Linkedin, Facebook, etc, to keep the customers updated with latest news and trends.

Advantages and Disadvantages of XM Customer Support

| Advantages | Disadvantages |

|---|---|

|

|

XM Vs Other Brokers

With such a tough competition between brokers in the financial market, almost all brokerage platforms use customer-centric approaches to entice more and more clients. However, no matter how much these firms try to copy each other in providing the best trading services, each broker has a unique trading feature which makes it different from other brokers.

Therefore, it is important for clients to understand the highlight of each broker and comparisons with other brokers so that the traders in the position to make an informed decision about which trader would best suit their trading style.

#1. XM vs. Avatrade

Avatrade is considered to be among the best online brokerage platform that provides top-notch trading services to customers globally. Avatrade is known for its educational content and providing appropriate tools and resources for the novice traders. Moreover, Avatrade is also popular among traders due to its low trading cost and easy to use interface.

There are a lot of similarities between Avatrade and XM brokerage services. First, both are regulated platforms with license from authentic financial authorities. Moreover, both these firms provides free of charge withdrawal and deposit of funds to the customers. Additionally, Avatrade and XM both have advanced trading platform of MT4 and MT5.

The only way Avatrade excels from XM is through its provision of wide range of useful resources, tools and strategies for the traders to make the trading experience more profitable. Avatrade makes sure that the customers have all the facilities to maximize their profits and do successful trading. This approach is not so visible on the XM brokerage platform.

#2. XM vs. RoboForex

RoboForex is rated as the top broker by many financial experts and broker evaluating platforms. Moreover, this firm has also been awarded many prestigious financial awards for recognition of its trading services in the industry. RoboForex is a favorite platform of millions of traders as it provides trading services for new and experienced traders both with the highest leverage of 1:2000.

The common features of RoboForex and XM are that each of the platform has the lowest minimum deposit requirement. RoboForex has a $ 10 requirement and XM has only $ 5. Furthermore, both RoboForex and XM offers cost efficient trading solutions with tightest spreads starting from 0.6 pips. Similarly, the trading platforms of T4 and MT5 are also a common trading feature of both the platforms.

Regardless of these similarities, RoboForex certainly has an edge over XM as it provides a huge number of trading instruments up to 12 000 with more than eight asset types. Whereas XM has a range of 1000 trading instruments on its platform. Additionally, the educational resources available on the RoboForex platform is also more facilitative compared to XM.

#3. XM vs FXChoice

FXChoice is also a licensed platform that provides reliable trading services to all type of traders and investors. FXChoice offers a complete range of trading instruments including forex, indices, commodities and cryptocurrencies. Moreover, the firm ensures protection of funds through segregated accounts and provides transparent pricing regarding its fee structures FXChoice and XM are two firm which are similar in many ways.

In fact, both of these platforms offer identical trading features making it difficult for customers to make a choice between the two firms. Both the firms have similar options of trading in assets, an account with low spreads, MT and MT5 trading platform, and same payment methods for fund deposit and withdrawals.

However, in some ways XM is a better choice for traders than as FX choice has high commission rate unlike the zero commission of XM. Moreover, the initial deposit requirement of FXChoice is $100 which is a comparatively bigger amount than $5 on XM. Therefore, FXChoice is more costly for traders than XM which is more of a cost-friendly option.

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up to date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: XM Review

In the recent time, the world has seen a great hype towards the finance industry particularly online trading. As a result, More and more people are investing in online trading considering it to be an opportunity for making profits. Consequently, the demand for reliable and competent brokerage firm is ever increasing in the financial market. The never-ending demand of brokers across the globe brought many brokerage companies to emerge giving tough competition to the monopoly of brokers.

The best part about having so many brokers in the market is that every firm has to put their best foot forward to allure more customers towards them. In the race of the of the best brokerage companies, XM is one of the trading service providers which has made its place securely in the financial market.

XM global has more than 500 k registered traders and is constantly expanding its clientage network across the world. The success of XM is due to a balance approach of the firm in providing complete trading solutions to its customers. From a varied range of account types and trading instruments to high leverage up to 1:1000, XM provide the ideal trading conditions for any type of trader.

Moreover, XM is also not behind in providing the most advanced trading technology through the high-performance Meta trader platforms MT4 and MT5. In addition to this, XM also presents itself as a great broker for the budget conscious and novice traders who do not want to invest huge amount on a platform and want to trade with minimal risk involved. Therefore, XM has an option of ultra-low account which has lowest minimal deposit and zero commission policy with tightest spreads for optimal profits.

All in all, we can say that XM has all the right things going in its favor and is a good option for almost any type of trader. However, it still lacks in some respects to reach the highest position in the brokerage firm rankings. The reason behind XM's scarcity is that top brokers like RoboForex provides multitudinous range of trading instruments and highest leverage in the market. By working on some of its drawbacks, XM surely has the potential to lead the financial market by replacing other firms.

XM Review FAQs

Is XM a trustworthy broker choice?

Yes XM is a trustworthy platform as it has many benefits. The first feature that makes XM a reliable firm is that it is regulated by not one but three reputable financial regulatory authorities from different countries including ASIC, FCA, CySEC AND DFSA. Being under these regulatory bodies ensures and conditions the broker to provide the best trading services and provide safety of user data and funds.

Another reason for considering XM as a reliable broker is that it has a transparent fee structure and also provides segregated accounts to its customers.. These accounts in the European banks provides protection oof funds to the traders and promises against any misuse of customer's funds.

Do I get a reward for signing up with XM?

XM provides many rewards and promotional bonuses to traders for encouraging them into signing up with the platform. After signing up with XM users get a deposit bonus of 20% or up to $ 5000, which is instantly deposited to the user account. This promotional bonus applies to all initial deposits starting from the minimum deposit of $ 5. Moreover, there is also no restriction of account type to avail this reward, all accounts of MT4 and MT5 receive the signup bonus.

Other than this sign-up bonus, othered are other rewards which includes lucky draws with amazing prizes, bonus for referral accounts, and seasonal bonuses and rewards through the XM loyalty program.

What is the minimum deposit amount I need to trade with XM?

XM is a cost-efficient trading platform therefore the in minimum deposit amount on this firm is the lowest in the industry. Traders can sign up to all account types other than the shares account by just depositing a small amount of $5. In contrast, for the share account users have to pay a big amount of $ 10 000 as initial deposit.

Dumb Little Man Recommends - Top 3 Best Forex Brokers in 2023 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.