Weltrade Review 2025 with Rankings by Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.3 1.5/5 | 146th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Weltrade as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Weltrade Review

Forex brokers are vital for gaining access to the global currency markets, where consumers can buy and sell currencies. These systems offer a range of tools and resources to improve trading activity, therefore catering to both rookie and experienced traders.

Weltrade, an international brokerage company that stands out by stressing the importance of good customer service. This forex broker always aims to enhance its offerings and gives feedback top priority so that traders' demands are satisfactorily addressed. This evaluation provides an insightful analysis of Weltrade's service quality and performance by combining professional opinions and experiences.

What is Weltrade?

Established in 2006 by a group of multinational financial and IT professionals, Weltrade is an internet broker that offers services in the financial field, and online trading. with a worldwide presence Their goal is to offer a worldwide clientele clear, safe Forex trading. Weltrade's significant influence and reach in the forex market is demonstrated over the years by the over 60,000 active traders it has accumulated across more than 20 countries.

Weltrade sets a high benchmark in the sector with features like 30-minute money withdrawals and 24/7 assistance; she stresses direct contact and provides exceptional customer service. This method increases user experience as well as dependability and confidence. The broker's dedication to security is clear from strict safety policies like two-factor authentication (2FA) and strong account verification procedures meant to protect trader capital.

Weltrade is also known as a consistent and controlled broker that provides negative balance protection, therefore shielding traders from losing more than their account value. Together with fast account verification, this function helps new users start trading boldly and safely more easily. Weltrade guarantees all of its customers a safe, quick, and easy trading environment by use of these solutions.

Weltrade also sets itself apart with competitive demos and generous incentives, which appeal to its customers for their openness and large benefits. Along with providing excellent analytical tools and advertising options, the platform offers a vibrant partnership program with over 40,000 associates globally. Weltrade's mobile app offers traders on demand a flawless trading experience with real-time market data and a built-in trading terminal, therefore improving general trading accessibility and efficiency.

>> Also Read: 9 BEST Forex Brokers For 2023: Reviewed By Dumb Little Man

Safety and Security of Weltrade

As an online forex broker, Weltrade has developed a strong basis for security and safety in its activities. Officially recognized as a trademark of Systemgates Ltd, Weltrade runs under Saint Vincent and the Grenadines under company number 24513 BC. This material has been extensively investigated and confirmed—including using tools like Dumb Little Man.

Under two main conglomerations, Systemgates LTD in Saint Vincent and the Grenadines for CFD services and an IBC in Saint Lucia for forex and currency exchange services, the company provides a wide range of financial services including currency conversion, Forex market operations, and CFD trading on metals, commodities, stocks, and indexes. This double incorporation offers a safe basis for client investments and helps guarantee adherence to worldwide rules.

Further guaranteeing the dependability and security of the material sent to customers, Sofiante LP, a Dublin, Ireland-based partner firm, handles content and runs Weltrade's website. Weltrade guarantees a trustworthy and safe trading environment using its rigorous operating structure and open, transparent contact with its clients, therefore reflecting its dedication to safety and security.

Pros and Cons of Weltrade

Pros

- Direct communication with clients

- Quick withdrawal process

- Broad range of financial instruments

- Attractive sign-up bonuses

- Competitive spreads and leverage

- Robust affiliate program

- Comprehensive customer support is available 24/7

Cons

- Inactivity fee charged

- Withdrawal issues reported by some users

- Commission on certain payment methods for deposits and withdrawals

- Limited regulatory information

Sign-Up Bonus of Weltrade

Weltrade gives new traders a pleasing sign-up incentive and a substantial 100% deposit bonus to boost their first outlay. Clients are advised to fill out their accounts using the promo code EXTRA100 in order to benefit from this promotion. Starting their trading activity, this benefit essentially doubles the trading capability of new customers, therefore providing a great advantage.

This advertising approach not only increases the first deposit but also motivates fresh traders to investigate the several trading possibilities on Weltrade. Weltrade wants to draw a larger audience and provide them more tools to begin their trading path on a good basis by running such campaigns.

Minimum Deposit of Weltrade

Aimed at motivating new traders to join the market, Weltrade has set a minimum deposit requirement that is easily available and reasonably priced. New users of Weltrade's 100% deposit bonus campaign must make at least $25 deposits into their accounts. This low criterion is meant to enable a broad spectrum of investors—from beginners to more seasoned traders seeking fresh prospects—to engage in trading.

Clients must activate the incentive in the Financial area of their Personal Area using the promo code EXTRA100 upon depositing. This promo code should be used only once and while the cash rewards increase trading capacity using drawdown; it cannot be withdrawn and will be subtracted upon any money withdrawal or transfer from the trading account. With low initial investment, this arrangement essentially doubles the trading potential of rookie traders, therefore giving them a great boost to their efforts.

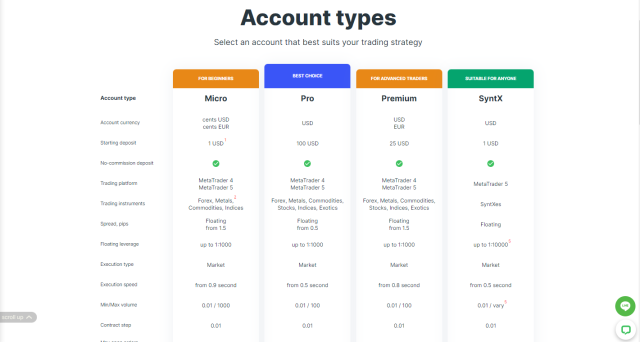

Weltrade Account Types

From beginners to expert traders, Weltrade provides a range of account kinds meant to suit various degrees of trading knowledge and trading strategy. Every account type is customized with certain characteristics to maximize trading circumstances in line with customer requirements.

Our knowledgeable staff from Dumb Little Man has carefully investigated and tested to guarantee correct and valuable data for every account choice. The information about the several account kinds is below:

Micro Account

- Currency: cents USD, cents EUR

- Starting Deposit: 1 USD

- Platform: MetaTrader 4, MetaTrader 5

- Instruments: Forex, Metals, Commodities, Indices

- Spread: from 2 pips, Floating

- Leverage: up to 1:1000

- Execution Type: Market

- Execution Speed: from 0.9 second

- Trading Features: One-click trading, Hedging, Copy Trading, Swap free

- Maximum Equity: 1000 USD

Pro Account

- Currency: USD

- Starting Deposit: 100 USD

- Platform: MetaTrader 4, MetaTrader 5

- Instruments: Forex, Metals, Commodities, Stocks, Indices, Exotics

- Spread: from 0.5 pips, Floating

- Leverage: up to 1:1000

- Execution Type: Market

- Execution Speed: from 0.5 second

- Trading Features: One-click trading, Hedging, Copy Trading, Swap free

- Maximum Equity: Unlimited

Premium Account

- Currency: USD, EUR

- Starting Deposit: 25 USD

- Platform: MetaTrader 4, MetaTrader 5

- Instruments: Forex, Metals, Commodities, Stocks, Indices, Exotics

- Spread: from 1.5 pips, Floating

- Leverage: up to 1:1000

- Execution Type: Market

- Execution Speed: from 0.8 second

- Trading Features: One-click trading, Hedging, Copy Trading, Swap free

- Maximum Equity: Unlimited

SyntX Account

- Currency: USD

- Starting Deposit: 1 USD

- Platform: MetaTrader 5

- Instruments: SyntXes

- Spread: Floating

- Leverage: up to 1:10000

- Execution Type: Market

- Execution Speed: from 0.5 second

- Trading Features: One-click trading, Hedging, Copy Trading, Swap free

- Maximum Equity: Unlimited

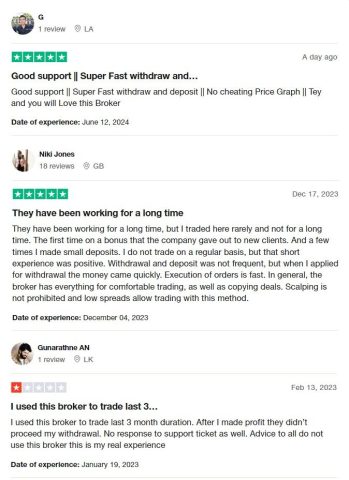

Weltrade Customer Reviews

Weltrade has had a mixed set of client comments. Many customers praise the broker for its efficient procedures for withdrawals and deposits as well as for assistance. Both novice and seasoned traders find it a preferred option as they value the fair pricing of the price graph and the overall dependability. Good experiences usually show the broker's fast order execution and the adaptability to participate in scalping with minimal spreads, thereby improving the trading experience.

Some assessments, meantime, point up difficulties, especially with regard to withdrawal problems following profit-making and a dearth of support services during such periods. This disparity in user experiences implies that although many traders have had good encounters with Weltrade, some have had major problems; thus, advise prospective new customers to be careful.

Weltrade Fees, Spreads, and Commissions

Weltrade is known for its competitive attitude to commissions, spreads, and trading fees, therefore accommodating a spectrum of trading preferences. Traders Union experts have carefully screened this broker to ensure its dedication to keeping affordable trading and non-trading expenses. Though the ZuluTrade account does contain an extra markup of 1.4 pips on the market spread, Weltrade operates mostly on a zero-commission basis for most accounts, hence trading expenses are quite minimal.

Trading several financial assets like Forex, oil, precious metals, and cryptocurrencies allows traders to interact with the market under flexible conditions since the spread for them is floating and spans 0 to 2.9 pip. For individuals who can control the related dangers, the leverage presented can reach 1:1000, therefore giving them notable trading capability.

Potential traders should be aware of the non-trading costs, though as well. Weltrade charges a commission fee depending on the deposit method between 0.5% and 2.5%. Less active traders may also be discouraged by a £12 monthly inactivity fee if accounts kept inactive for more than three months. Variable per asset, overnight swap costs also apply and may be viewed using the MetaTrader or Terminal systems. This system guarantees that although inactive accounts may pay extra fees, active traders may profit from low-cost trading.

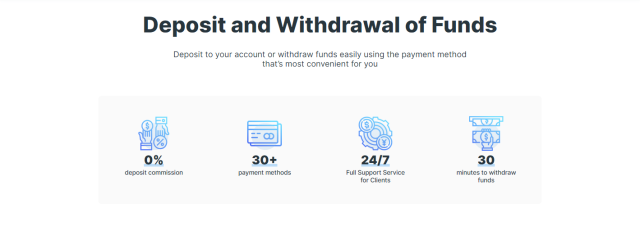

Deposit and Withdrawal

Designed to meet the various demands of its worldwide customers, Weltrade provides a simplified approach for fund depositing and withdrawal. To guarantee accuracy and dependability, a trade specialist at dumb little man has carefully examined and validated this material.

Weltrade accepts several payment options for deposits: VISA/MASTERCARD, SKRILL, NETELLER, PERFECT MONEY, IDLB, FASAPAY, and Pakistan Local Bank, among others. Except for IDLB and Pakistan Local Bank, which process within 24 hours and may contain costs depending on the sender's bank rates, all these choices provide immediate deposits with a 0% deposit commission. This diversity guarantees traders may fill their accounts effectively and without more expenses.

Though they vary in nature, withdrawal procedures also involve service costs. For example, whilst NETELLER costs 2% with a minimum fee, withdrawals using VISA/MASTERCARD pay a fee of 1.2% plus a predetermined amount depending on the currency. Lower costs of 0.5% for PERFECT MONEY and FASAPAY; withdrawals from IDLB are free of cost. Available 24/7, these withdrawals take 30 minutes to handle and provide traders quick access to their money. This effective technique emphasizes Weltrade's dedication to giving its customers quick and trustworthy financial transactions.

How to Open a Weltrade Account

Starting an account with Weltrade is simple and meant to be quick and user-friendly. Whether you have experience trading or are brand-new to the forex market, opening your trading account requires just a few steps. From accessing their website to providing your email, this part describes the required actions to create and activate your Weltrade account.

Starting trading with one of the most easily available online forex brokers, follow these basic rules.

- Visit the Weltrade website.

- Click “Registration” located in the upper right corner of the homepage.

- Register using your Facebook, Google, or Line account.

- Alternatively, enter your email address manually.

- Create a strong password for your account.

- Select your country from the dropdown list.

- Enter a referral code if you have one. You can also use the code 61108.

- Confirm that you are at least 18 years old.

- Click on “Create an Account” to finalize registration and then check your email to verify the account.

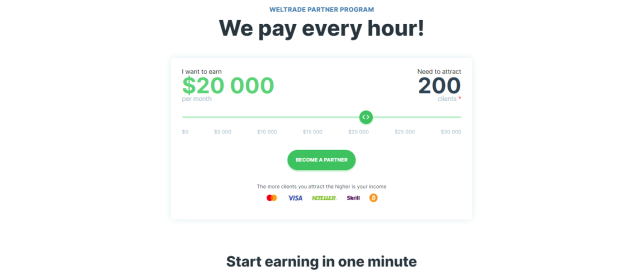

Weltrade Affiliate Program

The Weltrade Affiliate Program provides a simple and effective means for people to begin making money via recommendations. Designed to be easily available and user-friendly, the service lets partners start making money within one minute after registration. With three easy stages, the approach appeals to both new and experienced professionals.

Less than a minute is needed to register and activate the partner program in the first step. Once enrolled, associates may go to step two, sharing their referral link and drawing customers using Weltrade's ready-made advertising solutions. Along with choices for personal branding and banner design, they comprise a range of advertising campaigns, banner sizes, and promotional texts.

In step three, affiliates get rewards every hour and may withdraw money at any time, 24/7, from their selected payment method. Together with thorough assistance and tools, our continuous payout method guarantees that associates have all they need to effectively market Weltrade and get regular earnings.

Weltrade Customer Support

Renowned for its thorough and easily available services, Weltrade Customer Support is open around the world to suit merchants anywhere. Experiences told by Dumb Little Man confirm this material, which emphasizes the broker's commitment to providing outstanding help.

Customers have several ways to get in touch with Weltrade's support staff so they may do so most conveniently for them, provided that it's in the Weltrade Trading Hours (GMT +3). These choices cover messaging, LiveChat, and callback requests utilizing LiveChat. Customers may directly email the pertinent departments for more customized service; general inquiries may be directed to [email protected], financial difficulties to [email protected], technical support questions to [email protected], and partnership-related questions to [email protected].

Whether the client has technical problems or trade-related inquiries, this degree of committed customer care guarantees that all demands are quickly and effectively met. Weltrade's dedication to keep such flexible and responsive support systems emphasizes their emphasis on operational excellence and customer pleasure.

Advantages and Disadvantages of Weltrade Customer Support

| Advantages | Disadvantages |

|---|---|

Weltrade vs Other Brokers

#1 Weltrade vs AvaTrade

Although both Weltrade and AvaTrade are well-known participants in the online FX and CFD trading scene, their service offerings and geographical reach allow them to appeal to somewhat diverse trader profiles. Weltrade has a strong affiliate program, appealing sign-up incentives, and fast withdrawal policies. It lacks regulatory clarity compared to certain brokers, meanwhile, and does not benefit U.S. traders. Emphasizing trader education and protection with tools like AvaProtect and accounts including negative balance protection, AvaTrade, registered in many countries and based in Dublin, Ireland, It offers a larger spectrum of tradable tools and platform choices fit for both manual and automated trading.

Verdict: While Weltrade may appeal to those stressing incentives and affiliate opportunities, AvaTrade might be ideal for traders seeking a more regulated broker environment and comprehensive teaching tools.

#2 Weltrade vs RoboForex

Though they provide different trading services, Weltrade and RoboForex vary in their target markets and platform offers. Weltrade emphasizes customer assistance strongly and provides competitive trading terms with an eye toward direct client communication. Operating since 2009, RoboForex is well-known for its extensive range of trading platforms, which include MT4, MT5, cTrader, and R Stock Trader, so satisfying different trading tastes and approaches. Traders seeking flexibility in trading platforms may find RoboForex's approach to customized trading circumstances and good selection of software alternatives more enticing.

Verdict: RoboForex is probably the superior alternative for traders who appreciate a range of trading platform options and customized trading circumstances; Weltrade is perfect for people who want strong customer service and simple trading incentives.

#3 Weltrade vs FXChoice

With an eye on forex and CFD trading, Weltrade and FXChoice both service overseas markets. With its fast withdrawal times, thorough customer service, and user-friendly tools including a mobile app and other promotional offers, Weltrade distinguishes itself. FXChoice concentrates on providing access to a wide selection of currency pairs, including developing market currencies, and commodities CFDs like crude oil and precious metals, which can be especially appealing to traders wishing to diversify their trading across several asset classes and emerging economies.

Verdict: FXChoice offers particular benefits in emerging markets and commodities, hence it could be better for traders in these fields. For traders seeking quick transaction capacity and efficient service, Weltrade may appeal more.

Choose Asia Forex Mentor for Your Forex Trading Success

Asia Forex Mentor is the perfect tool to help you towards major financial success if you are resolved to follow a successful career in forex trading. Trade professionals at Dumb Little Man, who understand the platform's strong features, provide this advice. Ezekiel Chew, a seasoned trader well-known for his innovative contributions to trading institutions and banks, leads Asia Forex Mentor. Especially, Ezekiel has always managed to make seven-figure transactions, setting him apart as a top-notional teacher in the area.

Asia Forex Mentor offers a complete learning course covering forex, stock, and cryptocurrency trading. This carefully crafted curriculum is meant to provide students the necessary information and abilities so they may flourish in many financial markets.

The platform's success is demonstrated by its past of producing regularly successful traders. This achievement emphasizes the caliber and influence of their mentoring and teaching materials.

Students at Asia Forex Mentor gain from Ezekiel Chew's knowledge. His direction boosts students' trading confidence by allowing them to gently negotiate the complexity of every market.

Participating in Asia Forex Mentor also means joining a community of aspirational traders. This network greatly enhances the educational process using ideas, cooperative learning, and mutual encouragement—all of which are vital.

Emphasizing discipline and psychology, the program teaches traders to keep control, control emotions, and make wise under duress judgments.

Asia Forex Mentor routinely changes its products and gives students the most recent market insights and tactics to stay up with the ever-changing financial markets.

Many Asian Forex Mentor graduates have had amazing success in their trading professions and became financially independent using the whole instructional resources of the site.

All things considered, Asia Forex Mentor is the top pick for anyone hoping to be outstanding in forex, stock, and cryptocurrency trading. Its comprehensive program, professional mentoring, active community, and emphasis on psychological training offers all the tools required to produce accomplished, competent traders.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Weltrade Review

To end this Weltrade review, it offers features like fast withdrawal procedures, a wide selection of financial and trading instruments, and more. For individuals trying to optimize their trading prospects, the competitive spreads and leverage up to 1:1000 also appeal.

Potential users should exercise caution, nevertheless, about several observed drawbacks. Problems with withdrawal and inactivity fees might affect the whole trading experience. Furthermore, commissions on some payment systems might compromise its appeal, especially for traders who want low transaction fees. Prospective customers should give these elements great thought against their trading needs and risk tolerance.

>> Also Read: TMS Brokers Review 2024 with Rankings By Dumb Little Man

Weltrade Review FAQs

What types of trading accounts does Weltrade offer?

Micro, Pro, Premium, and SyntX accounts are among Weltrade's several account options to fit varying trader requirements. With features like varied spreads, leverage options up to 1:10000, and access to several trading products, each account type, including a demo account fits different degrees of trading expertise and investment quantities. This range guarantees that both novice and seasoned traders may locate an account suitable for their trading strategies and financial objectives.

What trading strategies are supported by Weltrade?

Weltrade provides several trading techniques to fit traders who employ expert advisers, hedging, and scalping. Thanks to its strong technology and competitive trading conditions, the platform offers the freedom required to properly apply these ideas. For traders depending on real-time data and needing quick execution speeds to maximize their trading techniques, this makes it a good option.

Which trading platforms are available with Weltrade?

Along with access to its own SyntX trading platforms, Weltrade provides the well-known MetaTrader 4 and MetaTrader 5 trading systems. These systems are highly appreciated for their automated features, thorough analytical tools, trading signals, and easy-to-use interfaces. By selecting the platform that best fit their technical needs and trading style, traders can guarantee they have the greatest tools available to engage the markets.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.