W7 Broker Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating Overall Ranking Trading Terminals 1.4 130th

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies W7 Broker as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

W7 Broker Review

Forex brokers play a pivotal role in enabling individual and institutional traders to access the global currency markets. They act as intermediaries, facilitating the buying and selling of currencies. Among these, W7 Broker and Trading (W7BT) stands out as a reputable ECN (Electronic Communication Network) broker, established in 2019. This broker offers traders the opportunity to engage in markets across six classes of assets, including cryptocurrencies and indices, marking a significant presence in the diverse world of online trading.

In our comprehensive review, we delve into the specifics of W7 Broker, highlighting both its advantages and areas for improvement. Our analysis is geared toward furnishing you with a deep understanding of what sets W7 Broker apart, focusing on account options, deposit and withdrawal processes, commission structures, and more. By integrating expert opinions with real user feedback, we aim to present a balanced view that aids in your decision-making process. Whether you're contemplating W7 Broker as your go-to platform for trading or simply exploring your options, our review seeks to provide the critical insights needed for a well-informed choice.

What is W7 Broker?

W7 Broker (W7BT) is a distinguished ECN (Electronic Communication Network) broker that began its operations in 2019. It offers a platform for trading in a variety of markets, enabling access to six classes of assets, including cryptocurrencies and indices. This range provides traders with a broad spectrum of investment opportunities, catering to different interests and strategies in the global financial markets.

The broker is strategically based in an offshore economic zone in Kingstown, Saint Vincent and the Grenadines. This location is significant for traders seeking opportunities in markets with potentially different regulatory landscapes. W7BT prioritizes legal compliance and works directly with clients' legal departments. This collaboration ensures adherence to the regulatory requirements of the offshore zone, highlighting the broker's commitment to operating within legal boundaries while offering its services to global traders.

Safety and Security of W7 Broker

After an exhaustive investigation by Dumb Little Man, the safety and security measures of W7 Broker have been meticulously analyzed to provide potential and current traders with essential information. W7 Broker, with its representative offices nestled in the offshore economic zone of Kingstown, Saint Vincent, and the Grenadines, is registered under the number 25512 BC 2019. This indicates a formal recognition and adherence to the legislative framework of the offshore zone, aiming to ensure a regulated trading environment for its clients.

The broker takes significant measures to safeguard its clients' investments. Clients' funds are stored separately from the broker’s own capital, a practice that enhances financial security and integrity. Moreover, W7 Broker provides negative balance protection for all user accounts, which is automated. This feature is critical in ensuring that traders do not lose more money than what is available in their trading accounts, thereby offering an additional layer of financial safety.

Technical support is another cornerstone of W7 Broker’s commitment to its users' security and overall trading experience. Traders can reach out to technical support at any time, addressing issues related to financial instruments or any other trading challenges they encounter. This 24/7 availability underscores the broker’s dedication to offering a responsive and supportive trading environment, making W7 Broker a considerate choice for those prioritizing safety, security, and support in their trading ventures.

Pros and Cons of W7 Broker

| Pros | Cons |

|---|---|

|

|

Sign-Up Bonus of W7 Broker

W7 Broker currently does not offer a sign-up bonus to new clients. This policy is in effect as of the latest information available. Without such incentives, the focus shifts to the broker's core offerings and performance as the primary factors for new traders considering their services.

Minimum Deposit of W7 Broker

W7 Broker sets its minimum deposit amount at $100. This entry threshold is designed to make the platform accessible to a broad range of traders, from beginners to more experienced individuals. By setting this amount, W7 Broker aims to balance accessibility with a commitment to a serious trading environment.

W7 Broker Account Types

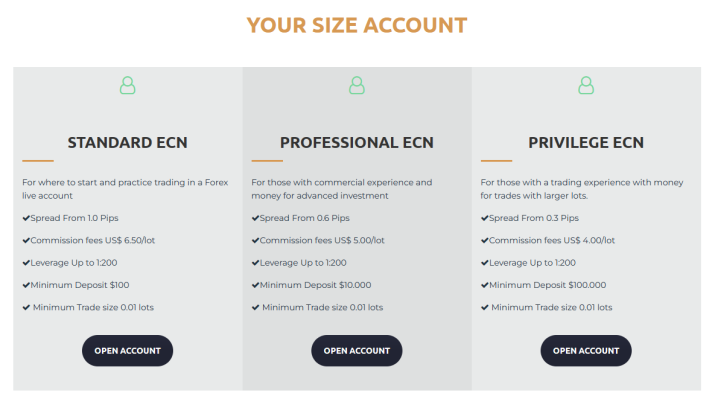

Our team of experts at Dumb Little Man conducted thorough research and testing on the account types offered by W7 Broker. They discovered that W7 Broker provides three distinct ECN account types, all featuring a maximum leverage of 1:200. However, traders can only set this leverage after completing account verification. Here’s a concise overview of each account type:

Standard ECN Account

- Spread: From 1.5 pips

- Fee: $7.5 per lot

- Leverage: Up to 1:200

- Minimum Deposit: $100

- Minimum Trade Size: 0.01 lots

Professional ECN Account

- Spread: From 1 pips

- Fee: $6 per lot

- Leverage: Up to 1:200

- Minimum Deposit: $10,000

- Minimum Trade Size: 0.01 lots

Privilege ECN Account

- Spread: Starts from 0.7 pips

- Fee: $5 per lot

- Leverage: Up to 1:200

- Minimum Deposit: $100,000

- Minimum Trade Size: 0.01 lots

W7 Broker Customer Reviews

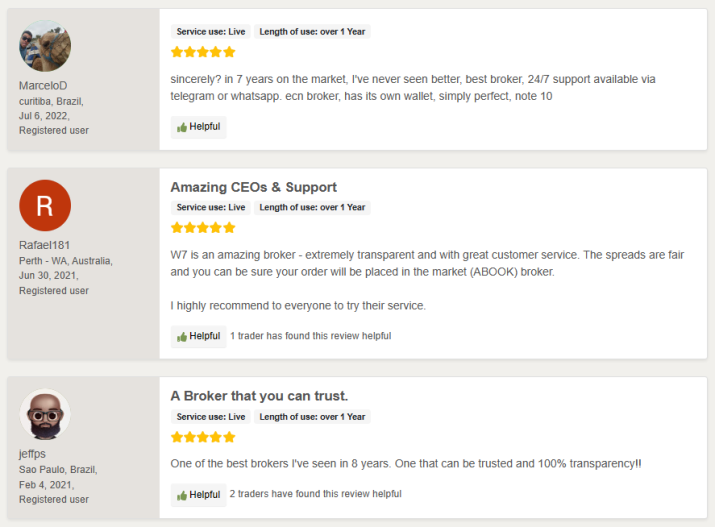

Customer reviews highlight W7 Broker as an outstanding player in the brokerage industry, celebrated for its exemplary service and 24/7 support availability through channels like Telegram and WhatsApp. Clients with years of market experience—spanning over seven to eight years—commend W7 for being the best broker they've encountered, emphasizing its transparency, excellent customer service, and fair spreads. The broker's commitment to placing orders directly into the market (A-Book) and its proprietary wallet system for transactions are particularly praised. This accumulation of positive feedback underlines W7 Broker's reputation as a trustworthy and transparent ECN broker, making it a preferred choice among experienced traders.

W7 Broker Fees, Spreads, and Commissions

W7 Broker adopts a straightforward approach to fees, spreads, and commissions, ensuring clarity for its traders. Those utilizing a Standard account are subject to a fee of $7.5 per lot, which applies uniformly across all asset types. In contrast, Professional and Privilege accounts benefit from lower fees, set at $6 and $5 per lot respectively. This tiered fee structure reflects the broker’s intent to cater to varying levels of trading activity and investment.

Significantly, W7 Broker imposes no deposit fees, making it efficient for traders to fund their accounts. However, it's important to note that swaps are charged, a common practice in the forex trading industry that accounts for holding positions overnight. This fee structure is designed to accommodate a broad spectrum of trading strategies and budgets, underlining W7 Broker's commitment to providing a flexible and transparent trading environment.

Deposit and Withdrawal

A trading professional at Dumb Little Man conducted thorough tests on W7 Broker‘s deposit and withdrawal processes to provide accurate insights. They found that the brokerage company processes withdrawal applications within 48 hours, though it commonly completes these requests within 24 hours. This efficiency underscores the broker's commitment to quick and reliable financial transactions.

For withdrawals, clients have the flexibility to transfer funds to bank cards, utilize cryptocurrency, or opt for Sepa-Transfer. The withdrawal fees are variable, depending on the chosen method or payment system, indicating the importance of selecting the most cost-effective option. Prior to making deposits or withdrawals, traders are required to pass verification, a step that can be completed in their user account. It's notable that standard bank transfers are not available for withdrawals, guiding clients towards alternative withdrawal methods that might better suit their needs.

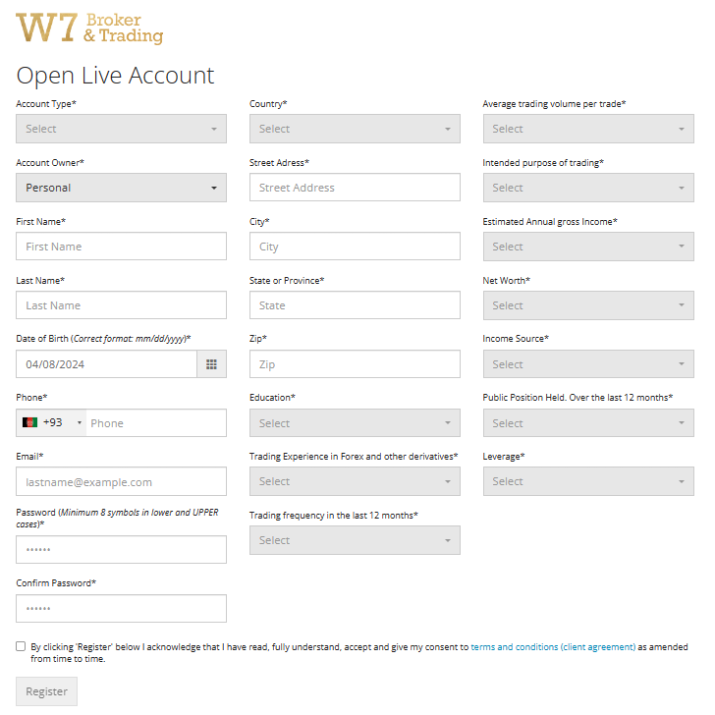

How to Open a W7 Broker Account

- Visit the W7 Broker & Trading website.

- Choose your preferred account type on the homepage.

- Check your email for an account creation confirmation.

- Log in using your email and password.

- Complete your profile with contact details, trading experience, and initial capital.

- Link Google Authenticator to your account for access.

- Begin account verification by navigating to Personal Info.

- Upload scanned documents for verification.

- Await verification approval to start trading.

W7 Broker Affiliate Program

W7 Broker offers a unique Introducing Broker (IB) program for individuals interested in partnering with the firm. By registering as an IB, partners gain the advantage of reduced spreads, enhancing the attractiveness of their offers to potential clients. The clients they bring on board benefit from the opportunity to trade with a leading brokerage entity.

The IB program grants partners the flexibility to set their markup independently, allowing for tailored financial arrangements. Compensation within this program can be structured as either fixed income or a percentage of the trading volume generated by the IB's referred clients on the platform. This dual compensation model provides a versatile approach to earning through the affiliate program, catering to different preferences and business strategies.

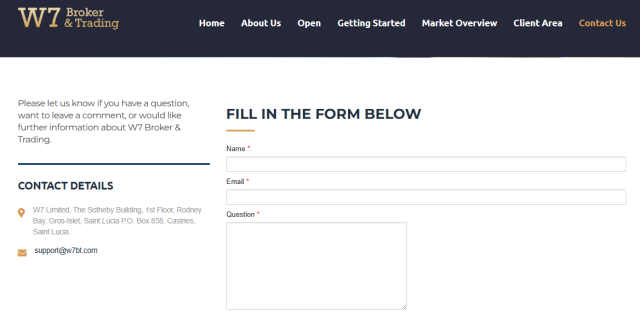

W7 Broker Customer Support

Based on the experience of Dumb Little Man with W7 Broker‘s Customer Support, it's clear that the brokerage prioritizes accessible and versatile support channels. Traders have multiple options for contacting technical support: through email, via live chat directly from their user account, or through W7BT's Telegram channel. This variety ensures that traders can choose the communication method that best suits their preferences and needs.

The availability of technical support services to all traders emphasizes W7 Broker's commitment to providing comprehensive support. Regardless of the issue at hand, be it account-related queries or questions about trading instruments, traders can expect prompt and helpful assistance. This level of customer care not only enhances the trading experience but also instills confidence in the broker's reliability and dedication to its clients' success.

Advantages and Disadvantages of W7 Broker Customer Support

| Advantages | Disadvantages |

|---|---|

W7 Broker vs Other Brokers

#1. W7 Broker vs AvaTrade

W7 Broker offers an ECN model with a focus on tight spreads and high leverage up to 1:200, catering to traders looking for direct market access and flexibility in trading strategies. It supports cryptocurrencies and indices among other assets. AvaTrade, established in 2006, boasts a broader asset range with over 1,250 financial instruments and a strong regulatory framework, serving over 300,000 customers globally. While AvaTrade's extensive regulation and wide instrument range are compelling for traders seeking diversity and security, W7 Broker's ECN model and asset variety might appeal more to those prioritizing direct market access and specific asset classes.

Verdict: AvaTrade is better for traders looking for a broad range of instruments and regulatory security. W7 Broker is suited for those valuing ECN access and specific markets like cryptocurrencies.

#2. W7 Broker vs RoboForex

RoboForex is known for its technological edge, offering a vast selection of trading platforms and tools since 2009. With over 12,000 trading options across eight asset classes and a flexible approach catering to various trading styles and volumes, RoboForex presents a robust trading environment. W7 Broker, with its ECN accounts and competitive leverage, caters to traders favoring direct market access and efficiency in execution. While RoboForex stands out for its technology and platform diversity, W7 Broker's streamlined ECN offering may attract those looking for simplicity and effectiveness in trading execution.

Verdict: RoboForex wins for traders valuing technological options and diversity in trading instruments. W7 Broker is preferred for ECN market access and straightforward trading conditions.

#3. W7 Broker vs FXChoice

FXChoice, established in 2010, is celebrated for its dedication to service quality and a strong regulatory stance under the FSC. Specializing in Forex with a focus on experienced traders, FXChoice offers ECN accounts with tight spreads but does not cater to beginners, lacking cent accounts or beginner-friendly leverage. W7 Broker, on the other hand, provides an accessible platform with a $100 minimum deposit and up to 1:200 leverage, suited to both new and experienced traders. While FXChoice emphasizes service for the experienced trader with higher requirements, W7 Broker’s inclusive approach and broader accessibility make it appealing to a wide range of traders.

Verdict: W7 Broker is the better choice for traders seeking inclusivity and flexibility in trading conditions. FXChoice remains a solid option for seasoned traders focused on Forex.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For those passionate about forging a lucrative career in forex trading and aiming for significant financial success, Asia Forex Mentor is the premier option for top-notch forex, stock, and crypto trading courses. Ezekiel Chew, the mastermind behind this initiative, known for his advisory role to trading institutions and banks, stands out as a remarkable figure in the educational arena. Ezekiel's consistent delivery of seven-figure trades marks him as a unique presence among trading educators. The key factors endorsing our recommendation include:

Comprehensive Curriculum: Asia Forex Mentor provides a thorough educational experience, spanning forex, stock, and crypto trading. Its structured program is designed to arm traders with the necessary expertise to thrive in varied market environments.

Proven Track Record: The reliability of Asia Forex Mentor is underscored by its history of nurturing traders who consistently profit in different markets. This success underscores the quality of their teaching approach and mentorship.

Expert Mentor: Learning at Asia Forex Mentor comes with the privilege of insights from Ezekiel, a mentor with an impressive track record in trading. His direct support empowers students to master market complexities confidently.

Supportive Community: Membership in Asia Forex Mentor includes joining a community that promotes mutual success in forex, stock, and crypto trading. This network encourages sharing, collaboration, and collective growth, enriching the learning journey.

Emphasis on Discipline and Psychology: Achieving trading success requires discipline and a resilient mindset. Asia Forex Mentor emphasizes psychological resilience, teaching traders to manage emotions and stress effectively for better decision-making.

Constant Updates and Resources: With the ever-evolving nature of financial markets, Asia Forex Mentor ensures students stay informed on the latest trends and strategies. Ongoing access to resources keeps traders competitive.

Success Stories: The legacy of Asia Forex Mentor is illustrated through numerous success stories of individuals who have drastically improved their trading skills and achieved financial freedom through their education in forex, stock, and crypto trading.

Asia Forex Mentor stands as the definitive choice for aspiring traders seeking an exemplary forex, stock, and crypto trading course to achieve both career success and financial well-being. With its all-inclusive curriculum, experienced mentorship, actionable strategies, and a supportive trading community, Asia Forex Mentor lays down the pathway for transforming ambitious traders into proficient market participants across a spectrum of financial disciplines.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: W7 Broker Review

The team of trading experts at Dumb Little Man has thoroughly reviewed W7 Broker, taking into account its diverse offerings and operational features. This broker distinguishes itself with a competitive ECN model, offering direct market access and a broad selection of assets, including cryptocurrencies and indices. Its low minimum deposit and high leverage options make it an attractive choice for traders of varying experience levels and financial capacities.

However, it's important for potential clients to weigh the W7 Broker's advantages against its limitations. The broker's mandatory verification process, absence of cent accounts, and limited deposit methods may pose challenges for some traders. Moreover, its customer support—while accessible—operates in English only, which could be a limitation for non-English speaking traders.

>> Also Read: Fibo Group Review 2024 with Rankings By Dumb Little Man

W7 Broker Review FAQs

What types of accounts does W7 Broker offer?

As an established ECN Forex broker provides three main types of ECN accounts: Standard, Professional, and Privilege. Each account type is tailored to different trader needs, offering variations in spreads, fees, and minimum deposit requirements. The Standard account is accessible with a minimum deposit of $100, suitable for newcomers, while Professional and Privilege accounts cater to more experienced traders with higher minimum deposits and reduced trading costs.

Is W7 Broker suitable for beginner traders?

Yes, W7 Broker is considered suitable for beginners, primarily due to its low minimum deposit requirement of $100 for a Standard account, which makes it accessible to those new to trading. Furthermore, the broker provides negative balance protection and a range of educational resources to support novice traders. However, beginners should also be aware of the mandatory verification process and the limited range of deposit methods when choosing W7 Broker.

How does W7 Broker ensure the safety and security of client funds?

W7 Broker prioritizes the safety and security of client funds through several measures. Firstly, it operates as an ECN broker, offering a transparent trading environment. Client funds are kept separate from the broker's operational funds, ensuring that traders' money is not used for any other purposes. Additionally, the broker provides negative balance protection, safeguarding clients from losing more money than what is in their trading account. These precautions are part of W7 Broker's commitment to providing a secure and reliable trading platform.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.