USAA Auto Insurance Reviews: Insurance Offers, Features, Cost, Pros & Cons

By Vanessa Richards

January 10, 2024 • Fact checked by Dumb Little Man

United Services Automobile Association (USAA) is a reputable insurance company that operates in the United States. It was established in 1922 by 25 Army officers from Fort Bliss who got together to insure one another's vehicles. In the ’70s, USAA partnered with an online technology company which led to more growth and expansion of its business. Currently, it offers a plethora of services for both private and commercial clients, including life insurance, banking, financial planning usaa home insurance, and personal property coverage among others.

USAA is one of the leading insurers in America and it has been providing coverage for over 60 years. The company currently serves about 11 million USAA members across the country, with more than 22 million family members benefiting from financial planning services offered by USAA. As a member-owned association, USAA uses its revenue to support military families and their individual insurance needs.

USAA provides a wide range of auto insurances that are tailored to meet the specific requirements of their USAA members and drivers, regardless of where they live or what type of vehicle(s) they drive. USAA's services include classic car coverage, multiple driver discounts, usaa home insurance, gap coverages for new vehicles as well as used ones, and a car replacement service.

USAA Quick Facts

-Headquarters: San Antonio, Texas

-Founded in 1922 with just $1 million in assets

-Today handles over $150 billion in total assets

-Offers auto, banking, home, and life insurance services to members of the military and their families (which may include veterans)

– USAA coverage offers insurance for classic cars and vehicles with the model year of 1986 or older

– The insurance company provides multiple driver discounts as well as an auto rental reimbursement plan to its customers

– Gap coverages are offered for new and used vehicles to protect customers against losses that may occur due to depreciation

– USAA offers car replacement assistance with roadside assistance that covers the full value of an insured vehicle, regardless of how much it costs on the market.

Still today, USAA is one of only two companies in Texas authorized by The National Association of Insurance Commissioners (NAIC) to sell auto policies directly to customers without the use of an agent, according to the state Department of Insurance, National association of insurance and Association of Insurance Commissioners.

USAA Auto Insurance Review: What is USAA Insurance?

USAA car insurance is the perfect choice for military members, veterans, and their families who are looking to save money on auto coverage.

Military personnel typically have unique needs when it comes to saving money on existing policies or finding new carriers after being transferred from station to station. With a long history that makes them an industry leader with over 90 years of experience serving in active duty servicemen and women, they also help deliver peace of mind through excellent customer support available 24/365 at no extra cost to you!

According to USAA auto insurance reviews, because the company's primary focus is on those who serve or have served their country as members of the armed forces, they currently only operate in a handful of states. California, Texas Florida, Kansas, New Mexico, Oklahoma, Virginia, Missouri, and Utah all allow residents with military ties to join USSA for full access to its many insurance plans and investments offerings.

The insurance company was awarded the J.D. Power award for car insurance in 2013, 2014, and 2015.

USAA also received an AM Best rating of A++ (Superior) which is only given to car insurance companies that have exceeded insurance industry standards for financial stability.

How does USAA Car Insurance Work?

There are many types of insurance provided by USAA, including automobile insurance, homeowners insurance, and life insurance. Their auto coverage consists of 6 different options; Standard, Classic, Preferred Enhanced, Deluxe Specialty, Premier Specialty, and Premier Elite.

Each option has a few different deductible rates that you can choose from when it comes time to be insured under one of their auto insurance policies. On top of the deductibles offered with each plan, there is also a standard rate class that applies to every vehicle insured by USAA. You have the ability to add more than one car or motorcycle under your USAA insurance policy so long as they meet certain requirements such as being on the same Household and Tenure plan with USAA.

USAA takes care of getting you insured as quickly as possible, even if you have a less than perfect good driving record by its approved defensive driving course. They can help those who have had previous incidents such as accidents, speeding tickets, or DUI's by making the process easier and helping provide some forgiveness for those willing to accept responsibility for their actions.

Those who own high-end vehicles may find it more difficult to get insurance through USAA due to the fact that most high-end cars depreciate in value rapidly which could make them difficult to insure under coverage plans offered by USAA since they want their customers to be able to safely drive and retain their vehicles over time.

If this is your case, however, do not fear, since USAA Automobile Insurance offers an option for those who need to insure a high-end vehicle. That policy is called Premier Specialty and it has all the benefits of their standard plans but also adds coverage options such as guaranteed replacement, which will pay you what your vehicle was worth in the case that it can not be restored to its former glory before getting into an accident.

USAA Auto Insurance provides protection for many different types of vehicles from pop-up campers to motorcycles, boats, and RVs so there should be something on their list that will fit your needs. They even have a discount program, where if you keep everything up to date on your credit score report they will give you discounts off of your premiums so long as all the information they have on you is accurate.

You can also receive discounts if your house has a security system, smoke detectors, or a burglar alarm installed on it as well as access to round-the-clock customer service and online resources to help make filing a claim quicker and more efficient if an unfortunate event should arise.

USAA Auto Insurance does not allow for coverage of any vehicle that has been declared salvage either by their insurance company or by another entity in this case graders, dismantlers, or junking certifying agencies.

If there are any outstanding liens on the vehicle at the time you make your purchase they will not cover that car either. Also, USAA Insurance does not cover vehicles that are specifically used for commercial purposes like ice cream trucks, food trucks, or delivery vehicles for companies such as UPS and FedEx.

What are the Features of USAA Auto Insurance?

Auto insurance can be an exceptionally difficult financial decision, as well as a complicated legal one. However, USAA offers some of the best auto insurance features to make their policies easier for you to understand and manage.

1. Coverage Options:

The USAA Auto Insurance offers different types of coverage so that people can choose the type they are interested in. The following are the options available:

Bodily Injury Liability Coverage

This type of coverage pays bills for injuries to others due to an accident caused by the insured party. If you cause an accident, this part of your insurance will take care of expenses related to any damages or injuries to other parties involved.

It is possible that you may still have to pay bills out-of-pocket for damage done to other vehicles.

Property Damage Liability Coverage

Just like bodily injury coverage, property damage coverage also takes care of any damage done during an accident you are responsible for. This portion will help repair or replace things such as street signs, fences, windshield or window repairs, and buildings.

Uninsured/Underinsured Motorist Coverage

This coverage is meant to protect you against drivers who do not have insurance or those who don’t carry enough coverage. If an uninsured driver causes a wreck and injures someone with USAA auto insurance, this type of liability will cover some expenses for the injured party.

Medical payments coverage

This part of your policy pays for medical costs directly related to injuries from an accident that were caused by an insured person. This includes treatment provided at the scene as well as follow-up care such as physical therapy or medical appointments.

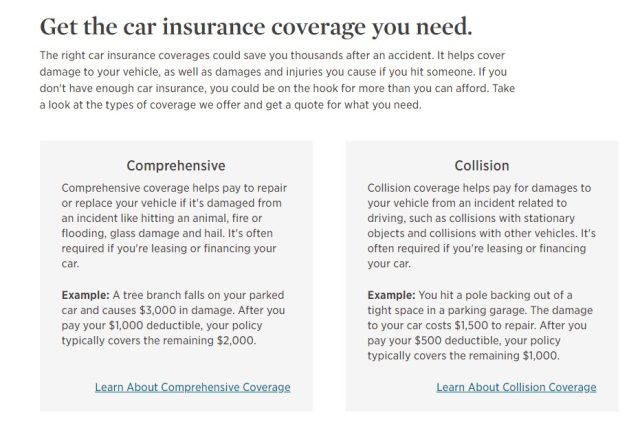

USAA also offers Collision Insurance, Comprehensive Coverage Insurance, Towing & Labor Costs, Rental Car Reimbursement, and Emergency Road Service.

Bodily Injury Protection – If you or a family member is injured in an accident, this part of your policy will pay medical expenses and lost wages. This also covers passengers in other vehicles who are hurt during the same incident.

Disability Insurance – Disability insurance can help take care of living expenses if a covered person cannot work due to a medically determined disability.

Life Insurance – The death benefit from life insurance can protect an insured person's loved ones from financial hardship due to his/her passing.

Income Replacement Coverage – If you lose your job because of illness or injury, this type of coverage can help replace some income until you’re ready to return to work without having to worry about paying for necessities like food and rent.

Inflation Guard – This will help to keep your policy's coverage limits current as the cost of living increases.

2. Payment Options:

USAA offers a variety of payment options that customers can choose from, including one-time payments, monthly payments, annual payments, or bi-annual.

Customers can also opt to pay for their auto insurance premiums through automatic debits from an account at another financial institution.

3. Claims Process:

There is no need for customers with USAA auto insurance to file claims themselves because this is done by experts on their behalf. When filing a claim under USAA Auto Insurance, you should speak with a representative and provide about your policy, such as your name, policy number, and the details about your car. You should also describe what happened during the accident in order to speed up the accident forgiveness claim process.

4. Discounts:

USAA Auto Insurance is offered in all fifty states, Washington D.C., Puerto Rico, and outside of the USA. It’s available for people who are interested in ensuring their vehicles or who want to add on additional insurance coverage when they already have an existing insurance plan with them.

The USAA offers discounts for things like bundling policies together, multiple cars insured under one policy, paying through automatic payment plans, and receiving grades for a good driving record. There might be additional ways to save if you meet certain membership qualifications like joining the military or being a relative of a current USAA member.

5. Online Services:

USAA Auto Insurance offers online tools through its website that can help simplify the claim process for customers who are filing an accident forgiveness claim after an at-fault accident. There are also several other ways that USAA members can save money on their vehicles, including by checking if they qualify for discounts and finding out what the current auto insurance rates are in their area.

A USAA customer can also find helpful articles about car insurance, check out different policy options and even speak with someone directly via chat or phone.

USAA mobile app plays a key role in USAA's approach to service, with its ability to provide members with 24-hour access to their accounts. Another feature that makes USAA mobile app stand out among the competition is its Safe Driver IQ test, which tells you what you could be doing right and wrong behind the wheel.

How much does USAA Auto Insurance Cost?

The USAA car insurance cost varies depending on factors like age and location, but there are other variables that can affect this auto insurance rate as well. For instance, if you're adding someone who already has their own auto policy with USAA, they'll have a multi-vehicle family discount applied to their new car from the very beginning.

In addition, if multiple people drive your car regularly ( is true regardless of how many people actually own the car ), you'll save even more on USAA insurance this way, as these drivers can have their rates adjusted accordingly.

There's a good chance that you'll save even more on car insurance by raising your deductible. This can have an effect on how much USAA Auto Insurance accident forgiveness Costs as well, since the higher it is, the less money will be spent to replace or repair your vehicle after an at-fault accident.

In general, 25-year-olds will pay around $500 per year for minimum liability insurance coverage with USAA insurance. This number increases to about $800 each year if added full-coverage – comprehensive insurance coverage and collision – covers damages from theft and vandalism. The cost of insuring a luxury car like a Mercedes Benz S550 Coupe also varies depending on many different factors such as location, age of the driver(s), etc., but most luxury vehicles will cost a little more to insure.

Lastly, it's important for all drivers – especially those who are paying off student loans – to take advantage of USAA car insurance discounts that could save them hundreds or even thousands of dollars each year! Some examples include having good grades and being part of the military.

In conclusion, there's no one-size-fits-all rule regarding how much does USAA Insurance Cost, since every person has different needs based on their situation. However, rates can be as low as $500 per year with minimum coverage in some areas.

For example, in Kentucky, USAA offers full coverage with a $500 deductible for someone who's 25 years old. The price is slightly higher for others in that state.

Thus, it follows that your average annual premium for minimum coverage would cost around $1,000 to $1,100 if you're 25 years old; around $820 if you're 10 years older; and around $768 if you’re 60 years old.

The average annual premium for full coverage with a $1,000 deductible would cost around $2,100 to $2,400 if you're 25 years old; around $1,820 if you’re 10 years older; and around $1,728 if you’re 60 years old.

The best way to find out how much USAA Insurance Costs is by getting an online quote or calling them at 1-800-531-USAA (8272).

Click Here to Open an Account with USAA (Official Page)

Who is USAA Best For?

Anyone who is eligible for USAA can join USAA as long as they have been associated with the military at some point in their lives. This includes active, retired, reserve members, and those who have received an honorary discharge due to a service-related injury. If you meet these criteria, you will be able to enjoy the benefits of USAA membership and all the deals and offers that come with it.

USAA car Insurance can serve as a solid option for active duty service members who do not wish to carry two car insurance policies. It can also serve as an excellent way for retired military personnel to get more coverage options at discounted rates.

New recruits, on the other hand, may find that USAA is limiting because they don't offer full coverage or adequate discounts in every state, especially when compared to other carriers.

If you are uncertain about what type of USAA auto insurance policy or coverage you need, USAA customer service team is available around the clock to provide advice and guidance in your time of need. They can help you understand the basics and show you the different types of policies that are available like USAA homeowners insurance, renters insurance, USAA roadside assistance, rideshare insurance.

USAA can also assist you with things like towing and labor costs, renting a vehicle, USAA roadside assistance vehicle storage, buying a new one, and filing for an auto claim online. If you're unsatisfied with your experience or the service that is provided, USAA's financial advisors can be reached through email or over the phone. You should have no problem getting in touch with them if you need to discuss any pressing matters.

In short, USAA car insurance is a popular choice for military members who want access to discounts and all the benefits associated with USAA membership. Rates may not be as competitive when compared to other car insurance companies but they can still offer affordable rates in certain states when compared to other military-affiliated companies.

Though USAA is not available everywhere, they are considered one of the top car insurance companies for military retirees who need more insurance options at discounted rates.

USAA Auto Insurance Pros and Cons

| PROS |

|---|

| 1. No Telephone Required for Service: |

| With so many insurance companies requiring lengthy questionnaires over the phone before they'll offer an estimate, it's refreshing to know that USAA doesn't require this for any of its policies. If you want to get an auto insurance quote or set up your policy online, you can do so in just minutes without speaking to anyone on the phone. |

| 2. No Uninsured/Underinsured Motorist Coverage Required: |

| The majority of USAA's competitors require uninsured and underinsured motorist coverage for at least a portion of state minimums. In contrast, USAA doesn't make this a requirement for any of its policies, which can help you to potentially save hundreds or even thousands of dollars per year. |

| 3. No Down Payment: |

| Many USAA customers rave about the fact that they don't need to make a down payment for their insurance as long as they make timely payments, which is something most other companies continue to require. |

| CONS |

|---|

| 1. No Low Mile Discounts Available: |

| USAA doesn't offer any type of discount for drivers who drive fewer than 8,000 miles per year. Many other companies provide low annual mileage discounts that can lower your insurance premiums by up to 25 percent in some cases based on annual mileage. |

| 2. Difficult Claims Processes for Certain Policies: |

| According to many USAA customers, the claims process can be very difficult if you're making a claim on certain types of policies like comprehensive coverage and/or collision. You'll need to follow certain protocols and ask for help from USAA representatives if you get stuck along the way, which can be viewed as a hassle by some customers. |

| 3. USAA Insurance is only available in 24 States: |

| Although USAA has tried to expand its car insurance coverage into more states, it's still unable to offer policies in all 50 states like many of its competitors. If you live somewhere that doesn't yet offer USAA insurance, you may want to consider other alternatives. |

Click Here to Open an Account with USAA (Official Page)

State Farm Compared to other Insurance Company

| Insurer | J.D. Power Rating | A.M. Best Rating | Multiple Discounts | Gap Coverage |

|---|---|---|---|---|

| USAA | 5/5 | A ++ | Yes | No |

| Farmers | 3/5 | B++ | Yes | Yes |

| Progressive | 3/5 | A+ | Yes | Yes |

| StateFarm | 3/5 | A+ | Yes | No |

>>Read More About StateFarm Car Insurance Reviews: Insurance Offers, Features, Cost, Pros & Cons

USAA Auto Insurance

It is the most affordable car insurance option for military personnel and their families. USAA groups its car insurance rates into three types of coverage-collision, liability, and comprehensive coverage. These are valid for homeowners insurance.

USAA Insurance offers lower premiums than other auto insurance providers because they are able to leverage their superior financial stability through their use of an in-house claims department that performs all operations from first notice of loss to final settlement.

In addition, USAA also invests a portion of every premium dollar back into the organization rather than paying dividends to shareholders as dividends which can then be used to keep costs down for policyholders.

This model not only allows USAA to better serve its members and eligible family members but also reduces costs for policyholders.

USAA Insurance offers even more savings through their discounts which include a multi-vehicle, anti-theft device, military affiliation, or a good student. It is important to note that most of these discounts are no longer available if the insured has any lapse in coverage. For example, a customer with a good student (a discount that covers drivers under 25 years old) will lose this benefit if there is more than one month during the last six months without insurance.

USAA vs Progressive

Progressive insurance is one of the nation's leading providers of car insurance. It was founded in 1937 and has always been headquartered in Ohio. Progressive offers several financial services, including home insurance review, life insurance, motorcycle insurance, boat insurance, and commercial auto insurance.

Progressive is a direct writer, meaning that it does not use independent agents to sell its insurance products. Progressive provides online car insurance quotes and has been rated the best auto insurer by J.D. Power and Associates for eight consecutive years from 2008 through 2015. In 2013, TheStreet Ratings gave the company a C+ rating based on a sentiment score of 2 out of 5 stars.

However, USSA has proven to be more beneficial as USAA can keep operating costs low while still providing quality insurance products at competitive prices based on the credit score and credit report. Also, USAA is national while Progressive only conducts business in certain states. This means that Progressive can provide better service to customers who live near its branch locations, but USAA has more locations nationwide and can provide better customer service, auto insurance premiums to all of its members.

Progressive has some good points, however, it is not the best option for military families.

Final Verdict: USAA Auto Insurance

Ultimately, you will have to decide if this company can provide you with the type of coverage you need at a decent price. It may depend if you need USAA homeowners insurance review, renters insurance policy, valuable personal property insurance, military installation discount, family discount, bundling auto insurance, optional coverage limits, or something else. If you've only been associated with the military for a short period of time and do not yet qualify for USAA membership, USAA Auto Insurance may not be an option for you. For those looking to switch from their current provider or make a change in policy, USAA should be your first stop as they allow discounts to military members and offer flexible payment plans. They also provide adequate coverage at competitive rates in certain states. If you don't need full coverage or feel that USAA's discounts are probably not going to be enough to offset the cost of a policy, then you should consider other alternatives before buying an auto insurance policy from them.

USAA Insurance rates can be lower when compared to other insurance review companies but they may still charge more compared to regular insurance carriers. According to USAA auto insurance reviews, rates also tend to vary depending on which state you reside in so if you're looking for a military discount, it might be a good idea to check with USAA first before applying elsewhere.

Is USAA Insurance worth it? It's really up to personal preference and ultimately what type of coverage you are looking for like USAA homeowners insurance, renters insurance, request roadside assistance online, rideshare insurance, etc. According to our USAA auto insurance review, if you need more coverage options when it comes to coverage, USAA is a good choice since they offer discounts and benefits exclusive to military members. Simply put, USAA Insurance is worth the investment if you qualify for membership in the organization.

USAA insurance reviews suggest that if you're an active military member stationed within an approved zip code, USAA Insurance is definitely worth considering.

USAA Auto Insurance FAQs

How often can I change my deductible without affecting my premium?

You can change your deductible as often as you'd like; however, it is recommended that you not make changes more than once every 6 months to avoid paying too much or too little for your policy. You can take a look at USAA insurance reviews on your quotes from the USAA website for this purpose

Is there a fee for using insurance commissioners with USAA?

Yes, but it is a very small amount and well worth the peace of mind that comes with knowing that your insurance policy is being represented by insurance commissioners authorized by the National Association of Insurance Commissioners who have your best interests at heart. The insurance commissioners will work to ensure that you have the lowest possible price on the insurance coverage you need as well as ensure that you have the right coverage and limits on your policy.

What kinds of insurance does USAA offer?

USAA offers insurance policies for members and their families cars and other personal items; life insurance; investment plans; homeowners insurance; bank accounts; business insurance; renters insurance; boat insurance; motorcycle insurance; ATVs or snowmobiles roadside assistance.

Vanessa Richards

Vanessa is a mom of 3 lovely children and a software geek. Outside of her career as a health and wellness instructor. She enjoys writing and researching on topics such as finance, software, health and culinary.