StateFarm Car Insurance Reviews: Insurance Offers, Features, Cost, Pros & Cons

By Vanessa Richards

January 10, 2024 • Fact checked by Dumb Little Man

Buying a car is not an easy decision because it costs a lot of money. You need to save a lot of money precisely in lacs to buy a car.

If you get into an accident and your car gets damaged. Then all of your money will get wasted. Also, you can even go into a crisis to have this much loss.

Therefore, it is important to have car insurance as it takes the responsibility for any of the damage. You can also have multiple insurance options to cover your damages especially life insurance.

But car insurance not only protects your car. It also protects from medical expenses and financial liability. Many companies provide the facility of auto insurance.

However, State farm car insurance is the best because it provides better car insurance quotes. For further information, read this state farm car insurance review here.

So without any further a due, shall we start the discussion?

StateFarm Car Insurance Review: What is a StateFarm Insurance?

State farm car insurance is founded in 1922, in Bloomington. It becomes famous among other car insurance companies due to better insurance coverage.

They provide a wide range of insurance products. Including auto insurance, life insurance, home insurance, and disability.

According to state farm insurance reviews, for 100 years. It has been providing the best insurance services in the United States.

Due to the efficient working of a state farm agent, it is included in the best auto insurers. Furthermore, they hold about 16% auto insurance market share that making state farm the best insurance company.

Just to back-up state farm claims, the company does not stop at a big amount of market share. Therefore, the company has impressive financial ratings.

A.M Rating: State farm car insurance has an A++ rating. This is the highest possible rating that a company can have. AM gives this rating because of its sound operational performance and financial strength. These are exactly the features that you need for auto insurance.

J.D Power Rating: State farm has the 5th rank according to the JD power 219 US Auto claim satisfaction study. This research is based on the customer's experience with the state farm claims.

State farm insurance also gets the rating from S&P global ratings and has quite a good impression. They also get an AA rating which shows that this company has strong creditworthiness.

Similarly when it comes to customer satisfaction with auto insurance claims. You will love to know that with higher-ranking, state farm reviews are also positive.

All these ratings show that the state farm car insurance company is legit and you can consult it to get your car insurance done. You can also use the state farm mobile app to do so.

How does State Farm Work?

State Farm is one of the best insurance commissioners because it provides all the basic insurance in one place. Therefore to protect yourself you do not have to search for different insurance commissioners.

So have a look at this insurance provider to know what kind of insurance you can have here.

1. Health Insurance

The state farm life insurance policy includes health insurance. Because in recent years healthy becomes more unpredictable. Therefore, it is important to do health insurance.

As with a single major medical accident can cause many financial issues. Sometimes the medical costs increase so much that people go bankrupt because they do not have money for the medical expenses.

So if you avoid the situation of bankruptcy you should consult the state farm agent to get health insurance.

2. Life Insurance

Like health, life is also very unpredictable. Therefore state farm insurance has multiple policies for life insurance. It provides the following life insurance policies

- Term Life Policy

- Whole Life Policy

- Universal Life Policy

In the Term life policy, the state farm insurance will give protection to policyholders for a specific period such as 10 to 20 years.

You can get the Term life insurance at both high or lower rates. It is suited to the people who have short goals like paying off a loan or providing protection to children.

While whole life insurance policy helps your loved ones to prepare for the unexpected. You can get the guaranteed death benefits in this policy.

The state farm insurance can help to replace the family's loss of income. Moreover, it helps with educational needs or mortgage costs.

The universal life policy, on the other hand, is a flexible way to protect your loved ones. This insurance policy is perfect for people who are seeking to adjust coverage and to meet changing needs.

State farm life insurance does not set any of the prices for these life insurance policies. You can get the quote from the licensed insurance agent when you select the specific life insurance policy.

You can also contact the local agent through the zip code and get the quote.

3. Disability Insurance

The third insurance that state farm insurance provides is disability insurance. The main purpose of this insurance is to replace your salary. If you were to become disabled temporarily or permanently.

According to state farm insurance reviews, it provides two types of disability insurance.

- Short term disability insurance

- Long term disability insurance

The short term disability insurance provides income protection. It means if you are unable to work due to disability, any injury, or illness you will receive the money.

So that you can pay your monthly expenses. On the other hand, long-term disability has different insurance policies. People do not realize that due to health issues they can become disabled permanently.

If they get disabled how they will fulfill their monthly expenses? Therefore, it is better to take long-term disability insurance.

In this policy, the company will pay the monthly income. If you are unable to work due to disability. You have to choose the time of your disability so that you can start getting benefits.

You can enjoy the benefits for 5 years or till the age of 67. Moreover, based on your job and salary you can receive the amount ranging from $500 to $20,000. In addition, you can customize the insurance coverage.

4. Long-Term Care Insurance

This type of insurance includes liability. The state farm provides two types of care insurance.

- Personal

- Business and Professional

If you experience major insurance claims. Then your underlying policies will not provide you with enough liability coverage.

These underlying policies can be

- Auto insurance

- Car insurance

- Renters insurance

- Homeowners insurance

- Comprehensive insurance

- Rideshare insurance

All of these insurance policies will not provide you with enough coverage. Therefore, you can go for the state farm personal liability umbrella policy.

It will provide you with enough coverage so that you can protect your financial future. On the other hand, business and professional liability insurance will help you and your business.

You can easily pay the judgments and the defense costs that come from the claims of professional negligence or liability claims, omission, or error. Therefore, it is considered a long-term liability.

5. Homeowners And Renters Insurance

State farm home insurance covers many property aspects. These properties can be

- Home

- Condominium

- Renters insurance

- Rental property

- Personal articles

- Manufactured home

- Farm and ranch

- Identity restoration

Here, homeowner insurance pays for the destruction or partial damage of your home. Moreover, it covers the damaged contents of the home.

In addition, state farm home insurance will provide the necessary funds to rent accommodations until your home is being repaired.

According to state farm homeowners, a home is the biggest purchase that you ever made and this is true. Therefore, homeowners insurance is important and you must have it.

Also, you should check all the details of the state farm homeowners policy before signing it. Just to make sure what the homeowner's insurance has to offer.

Moreover, you also need renters insurance if you are a renter. Because structural damage is the responsibility of the landlord.

Therefore, according to renters insurance policies, the company will give you enough funds to protect your possessions.

6. Small Business Insurance

According to state farm insurance reviews, the company provides insurance to small businesses. But the state farm make the insurance policies for different purposes including

- Business owners policy

- Commercial auto

- Contractors policy

- Liability umbrella

- Workers compensation

- Surety and fidelity bonds

In business bureau insurance, state farm, cover two important factors. One is property insurance and the second is general liability.

This insurance policy will help you in a better business bureau and protect you from unexpected risks. This type of saving program is suitable for small to medium range businesses.

On the other hand, commercial auto insurance is also important. Because businesses mainly depend on vehicles to supply things. So that they can stand first in every marketing competition.

Therefore, a driver safety course is important to protect your drivers from at-fault accidents. In this policy, auto insurance providers give an accident-free discount.

But as a save program the company's driver must have good driving habits. So that they have better roadside assistance and can manage to avoid accidents.

7. Automobile Insurance

State farm auto insurance policies are most famous. They have multiple auto insurance providers that give insurance for

- Car

- Motorcycle

- Boat

- Off-road vehicles

- Motorhome

- Roadside assistance

Due to all these policies state farm has become the largest auto insurer. According to the auto insurance policy, the company will pay you if your car gets damaged in an accident.

Moreover, it gives medical payments if you are in a serious condition due to an accident. Furthermore, if you have minor accidents then still company for the minor damages and repairs.

Therefore, it is important to have an auto insurance policy if you want to save your money. State farm does not have fixed auto insurance rates.

That's why you have to contact the agent to get a quote and set the auto insurance rates. So what are you waiting for?

Accidents are unexpected and you can not save your cars and motorcycles from damages. But what you can do is to take insurance for them.

So that you do not have to spend your money when they get damaged. The company will take care of all the auto damages and even your health. So contact the state farm as soon as possible to get insurance.

What are the Features of State Farm Insurance?

State Farm has been serving the people for more than 100 years. People also like it because of its multiple insurance options. State Farm provides insurance for the following fields.

- Automobiles

- Home and Property

- Life

- Health

- Pet Medical

- Disability

- Liability

These are just the main fields. State Farm provides benefits by dividing these fields into multiple categories.

Following are the types of coverage that you get in State Farm insurance policies. Have a look at them decide whether you want the State Farm insurance or not.

Rideshare Coverage

This is the unique feature of the State Farm auto insurance policy. Not all insurance companies provide this facility.

So you should take this opportunity if you have a side gig driving for others. If you utilize your car for a rideshare company like Careem or Uber. Then State Farm will protect your liability.

If you damage your car or the rental car while you are at work. Moreover, State Farm has the best rental car reimbursement options that you will love.

The car insurance rates are not specified. Therefore, you have to contact the agent to get the quote for your car insurance rates.

In addition, State Farm provides emergency roadside assistance if you need it you can take it from here.

Car rental coverage

Car rental coverage is the reason that State Farm is one of the top car insurance companies. This is an optional service but worth it.

You can take benefit from it if you mostly on your vehicle for transportation. In the car insurance policy, you will have access to the following feature.

- You can get reimbursed more than $400 per occurrence if you rent a car when you can not operate your car

Do you want to know the best part?

You and anyone who lives in your house. Both are eligible to receive this coverage. But only if you have selected it on your policy.

On the other hand, if you drive a rental car and you get involved in an accident. Then Farm car insurance will give you $500 towards your deductible.

In addition. State Farm will make all the necessary arrangements for you to get a rental car. If you find yourself in a qualifying event.

In short, state farm car insurance will protect you from every accidental situation in which you get involved.

Accessibility

State Farm provides more than 19,000 agents. Also, you can access them through multiple communication ways.

Therefore, if you have any questions about any insurance policy that you get. You can ask the company's agent. They provide 24/7 support so that you can get answers to your queries.

Moreover, if you do not like the phone calls you can file a claim. For filing a claim you need to follow the process digitally. You can either use the mobile app or use the online website to do so.

Lots of discounts

State Farm provides multiple discounts to all its users. Also, you can access several discounts, not just one or two.

By using the discount you can bring a huge difference in your quote. Moreover, you can exceed the coverage that you will receive.

Do not feel shy or confused to ask for a discount while communicating with the agent. This is your right and when the company is providing this facility you should take it.

So ask for all discount options confidently from the agent and see what discount you can take. Use all of them and enhance your benefits.

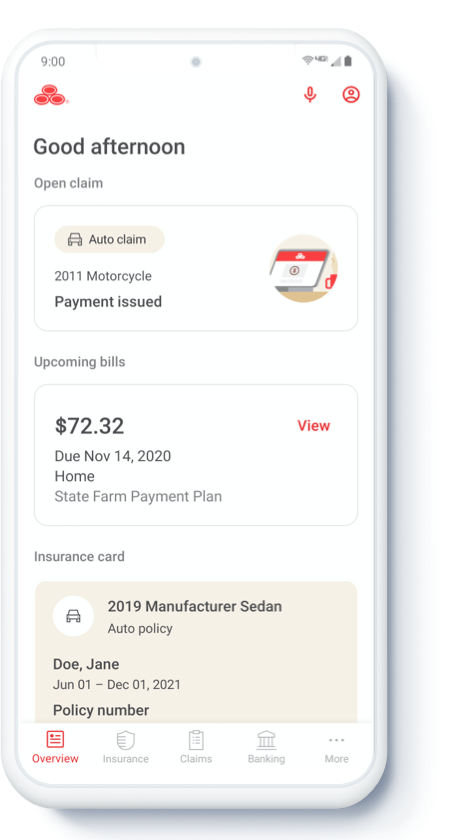

Mobile App

State Farm's mobile app is one of the features that I like. It is a simple and intuitive app that allows users to access all the features easily.

You can get the app on the play store and iPhone users can get it on the Apple Store. It means you do not have to pay any cost to get this app.

By using this app you can access all the facilities that you can do with the desktop version. The reason why I like the mobile app is that it is easy to access.

You can easily access any information that you want in less time through the app. While in the case of a desktop you need the laptop and PC to access the website.

This is not a suitable option. Therefore, you will also like the mobile app features when you select the State Farm insurance policies.

How much does State Farm Auto Insurance Cost?

To determine the cost of the State Farm auto insurance policy. It is important to enter your exact information for the quote

You are not obligated to purchase the insurance at any age. So write the exact numbers that you are financially facing.

Multiple factors affect the premium pricing of auto insurance according to insurance review. These factors are

- Age

- Vehicle

- Driving Record

- Location

- Your credit score

- Amount of your deductible

You can only control some of these factors like a safe driving record that's it. You can not control any other factors because they change with time.

So if we only talk about age, then see the difference below:

| Type | 25 Yeasr Old | 35 Years Old |

|---|---|---|

| Minimum Coverage | $942 | $832 |

| Maximum Coverage | $2216 | $1900 |

This is because, at a young age, you have more life to spend and have more requirements. While at the age of 35, you have spent 10 years more by living. Therefore, insurance costs get reduced.

Click Here to Open an Account with StateFarm (Official Page)

What Is The Solution?

The other thing except for the factors that you can control is the discounts. State Farm provides multiple discounts to all its users.

You can select the multiple discounts that are suitable for you. The discount is the best way to increase your premium cost and increase coverage.

So do talk about the discounts with your agent. As he can help you to select the right discounts for a better profit.

Moreover, the discount is the other important aspect that makes State Farm different and better from the other auto insurers.

State Farm provides multiple discounts to all its insurance policies and for all the users. So have a look at what kind of discounts you can have.

Drive Safe and Save™ discount

You can get this discount by downloading the Drive Safe and Save app on your mobile phone. Once you sign up for the app, you will automatically receive a discount.

Also, to take your State Farm discounts to the next level you should connect your phone to Bluetooth. So that the app can provide feedback while you drive the car or any vehicle.

The app will guide you in every step. Whether you accelerate the vehicle too fast or apply brakes too quickly. All this roadside assistance will provide personal injury protection.

Also, with personal injury protection, your vehicle will remain safe from damage. Furthermore, if by taking the feedback you improve your driving skills then the company will provide the deeper discount.

Amazing isn't it?

Many other insurance companies provide this safe driving program. But by using the State Farm app getting the deeper discount becomes easier.

And this is not something that you physically attach to the dashboard. If you do not like to use the mobile app. Then remember that through the app you can get a 30% discount on your premium.

Steer Clear® discount

This is the second insurance discount that State Farm provides. It is specially made for young drivers.

So if you are under 25 or 25 and have remained accident-free, no-fault, and drive without changing violations. Then you will get the Steer clear discount.

To begin the eligibility process, you need to download the mobile app first. Once you download the app you will have to complete 5 different training modules and several hours in doing driving practice.

However, once you complete all the requirements you will get a certificate. Do not showcase the certificate in your drawer or cabinet.

Immediately send the certificate to your State Farm agent and receive the Steer Clear discount. You might think it is a lot of work to do to get the discount.

But this is for your safety according to the national association. And once you complete all the stages you will get a discount of 15% on all insurance policies.

So if you are 25 years old avail this facility and save money.

Multiple policy discount

If you want to save money then a multiple policy discount is for you. If you have already selected the different State Farm insurances like

- Renters insurances

- Life insurance

- Homeowners insurance

- Life insurance and other types of insurances. You can lower the insurance rates by using the multiple policy discount.

By having this discount you can save money up to 17% on the policy that you select. Therefore, it is worth to talk your manager about the policy discount before you close the deal.

Other discounts available

For car insurance and other types of insurance, State Farm gives different discounts and better insurance coverage to the users.

To lower the rates of your premium following are the discounts that you can use

- Vehicle safety discount

- Good student discount

- Driver training discount

- Good driving discount

- Student away at school discount

- Accident-free

- Defense driving discount

- Anti-theft discount

- Passive restraint discount

- Multiple cars on a policy discount

As the national association says, all these discounts will allow people to get the insurance policies at lower terms. So you should get the maximum discounts that you can get.

Who is State Farm Best For?

From the above discussion, it is clear the State Farm is not for car insurance only. You can consult the state farm for

- Renters insurance

- Homeowners insurance

- Travel expense coverage

- Property damage liability

- Vehicle safety and many more.

Moreover, according to state farm reviews, it is better for the users who are looking for the best discounts. In addition, State Farm roadside assistance is worth using. Furthermore, two types of users can use the State Farm insurance services.

1. People Who Like Discounts

The people who like discounts must use consult this insurance company because it provides a huge variety of discounts.

But to get the discount you need to do some work. Some discounts require more effort to get them. But in the end, they are all worth it.

The reason why people like discounts is that they reduce the premium value and increase the coverage amount.

Also, State Farm rewards you for all the efforts that you make to win the discount. In the previous section, we have mentioned the main discount types and how you can get them.

So if you are willing to get the discount then read the previous section carefully and enjoy multiple benefits.

2. People Who Need A Variety Of Coverage Options

State Farm is best for the people who need huge coverage on insurance policies. The best thing about State Farm is that it tries to cover every aspect of the life fields in which you need the insurance.

Therefore, the following are the insurance options that you get from the State Farm. So have a look.

1. Automobiles

- Car

- Motorcycle

- Boat

- Off-road vehicles

- Motorhome

- Roadside assistance

2. Home and Property

- Home

- Condominium

- Renters insurance

- Rental property

- Personal articles

- Manufactured home

- Farm and ranch

- Identity restoration

3. Small Businesses

- Business owners policy

- Commercial auto

- Contractors policy

- Liability umbrella

- Workers compensation

- Surety and fidelity bonds

4. Life

- Term Life Policy

- Whole Life Policy

- Universal Life Policy

5. Health

6. Pet Medical

7. Disability

- Short term disability insurance

- Long term disability insurance

8. Liability

- Personal

- Business and Professional

Click Here to Open an Account with StateFarm (Official Page)

ُWho Can Not Use State Farm Auto Insurance?

Some people can use the State farm roadside assistance and the insurance policy. Similarly, some people can not use the State Farm services.

So have a look at these people and determine whether you are one of them or not.

People Who Do Not The Strong Customer Service

The better customer service is the quality feature of State Farm. They provide 24/7 better customer service.

Also, you can contact the agent anytime through any communication means. So that agents can reply to you easily.

But it does not mean that you always get the services that you expect. In some cases, you get better guidance over a single phone call.

Therefore people leave positive reviews on the main website. But sometimes you have to pay claims to get the right response from the agent.

Also, some people do not like to communicate with the agents over the phone calls. Therefore, State Farm is not a suitable solution for such people.

People Who Want The Cheapest Premiums Possible

After the customer service, people who are looking for the cheapest premiums can not use the State Farm. Because State Farm is not the cheap option to select for getting insurances.

But State Farm allows users to lessen the premium costs by using the discount. You can use as many discounts that you earn to reduce the premium amount.

But without the discount State Farm is not the cheap option. Therefore, you should avoid it if you do not want to work for the discounts.

State Farm Auto Insurance Pros and Cons

Before you consider the State Farm car insurance or any other insurance policy. It is important to review its pros and cons first. So that you will know what are its capabilities and limitations.

Let's have a look at them and decide whether you want to work with State Farm or not.

| PROS |

|---|

| 1. Strong Financial Rating: |

| Through the rating, you can decide whether the company provides positive results or not. And State Farm comes with the AA ratings. This means it is a legit company and you can use its insurance policies for a secure future. |

| 2. Digital Savvy: |

| State Farm comes with a mobile app. Because it knows that time has been changed and people know require better services and access to use any platform. Also, the app is fully customized and you can access all the features that you can have in the desktop version. |

| 3. Huge Range Of Coverage Options: |

| People love to consult State Farm because it provides a huge range of coverage. You can lower the amount of premium by using the discounts. On the other hand, the more you reduce the premium amount the more your coverage amount will increase. |

| CONS |

|---|

| 1. No-Gap Insurance Coverage: |

| This is an optional feature that only some insurance companies provide. And State Farm is not one of those companies. In this insurance, if you owe more than your vehicle value then the company will fill the gap and you get profit. But State Farm only pay you the money that you spend and does not fill any gap |

| 2. No Custom Equipment Coverage: |

| State Farm only pays for main equipment not for its particles. Therefore, if you want to modify your vehicle. The State Farm will not pay for it. Also, you have to spend all your money to do any kind of modification work. |

| 3. Premium Cost Is High: |

| As compared to other insurance companies, State Farm comes at high premium prices. But you can reduce the premium price by getting a discount. However, to get the discount you need to do some effort and works. Otherwise, you will not get a better discount and you have to pay a high premium amount. |

StateFarm Compared to other Insurance Company

| Insurer | J.D. Power Rating | A.M. Best Rating | Multiple Discounts | Gap Coverage |

|---|---|---|---|---|

| StateFarm | 3/5 | A ++ | Yes | No |

| Farmers | 10/15 | A- | Yes | No |

| Progressive | 3/5 | A+ | Yes | Yes |

StateFarm Auto Insurance

StateFarm Insurance is a famous insurance company and has been serving people for more than 100 years. In the ranking lists of big companies, it stood in the fifth position and have the AA rating.

Also, it has positive customer reviews that show this is a legit company and you should consult it to get multiple insurances.

The best thing about State Farm is that it provides better coverage on all aspects of life as compared to other companies. In addition, it has a huge list of discounts that helps you to lower the premium cost.

But to earn the discounts you have to work hard and fulfill all the conditions of that specific discount. Otherwise, you will not get the discount and pay the full premium payment to get the insurance.

StateFarm vs Progressive

It is another insurance company like State Farm and provides a huge variety of insurances. According to the insurance review, Progressive is considered the rival of State Farm.

Because they almost provide the same services to people who need to get insurance. Moreover, it provides multiple discounts to help people get more insurance policies.

In addition, progressive offers multiple options like

- Custom equipment coverage

- Gap Insurance

- Pet Policy for furbabies

Progressive has the lowest ranks in the ranking list of big companies like JD Power. But if customer services is an issue for you then you can contact the progressive company.

Final Verdict: State Farm Auto Insurance

That's all about the State Farm auto insurance. The first thing that you should remember is that it is not a costly premium company.

Because it provides a variety of discounts through which you can reduce the premium cost. All you have to do is to complete the tasks that each discount asks you to do.

All the takes are for your safety and if you achieve them. State Farm will give you deep rewards that no other insurance company provides.

So do the effort and reduce the premium amount. The other best thing is that the more you reduce the premium cost, the more your coverage will increase.

We all know that accidents are unpredictable. So why are you risking your life and your loved ones? Take multiple insurances as you can and save the future of your loved ones financially.

State Farm does all the efforts to provide you with better services. Therefore, it comes with flexible plans. You can select that plan according to your requirement.

Therefore contact State Farm now and secure your future or fulfill short-term plans.

State Farm Auto Insurance FAQs

Here are some questions that people frequently asked about State Farm. So have a look.

Is State Farm a bad insurance company?

No state farm is a good insurance company and takes care of all the users. It provides multiple discounts to help people to get insurance. Moreover, it provides better customer support so that people can ask anything related to the insurance policy.

What is the rating of State Farm Insurance?

A.M Rating: State farm car insurance has an A++ rating. This is the highest possible rating that a company can have. AM gives this rating because of its sound operational performance and financial strength. These are exactly the features that you need for auto insurance.

J.D Power Rating: State farm has the 5th rank according to the JD power 219 US Auto claim satisfaction study. This research is based on the customer's experience with the state farm claims.

What are the pros and cons of State Farm Insurance?

State Farm provides a wide range of coverage and to get that you need to pay the high premium cost. You can get a discount to lower the cost but discounts are difficult to achieve.

Who is cheaper Geico or State Farm?

Geico is cheaper than State Farm. Therefore, it is best for the people who are looking for cheaper premium rates.

Click Here to Open an Account with StateFarm (Official Page)

Vanessa Richards

Vanessa is a mom of 3 lovely children and a software geek. Outside of her career as a health and wellness instructor. She enjoys writing and researching on topics such as finance, software, health and culinary.