TeleTrade Review 2024 with Rankings by Dumb Little Man

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.7 1.5/5 | 79th  |  |

| Evaluation Criteria |

|---|

The team at Dumb Little Man includes financial advisors, seasoned traders, and retail investors who apply a proprietary algorithm to conduct detailed reviews of brokerage services. Their evaluation uses consistent criteria, which are:

Customer feedback is also a crucial part of their analysis, ensuring a comprehensive and unbiased review. The result of their in-depth evaluation is that TeleTrade stands out as a reliable broker for those seeking a credible financial partner. However, it's crucial for potential users to recognize its shortcomings. Dumb Little Man advises a thorough read of their article to understand these aspects fully. |

TeleTrade Review

Forex brokers are crucial middlemen who enable trading access to the currency markets. They play a crucial role in making it easier for institutional and retail dealers to buy and sell foreign currencies.

Having been established in 1994 and having won the 2018 Traders Union Awards for Best Broker in Europe, TeleTrade is a unique player in this competitive market and it has already established a solid reputation for itself.

A wide range of trading interests may find its varied portfolio, which includes currency pairs, commodities, equities, cryptocurrencies, indices, and energy, appealing. Using MetaTrader 4 and MetaTrader 5 platforms, TeleTrader aims to give traders the modern tools and agility they need to trade on the Forex market and other markets.

This review blends professional insights with real trader testimonials to present an unbiased view, aiding traders in making educated choices about using TeleTrader for their brokerage needs.

>> Also Read: 9 BEST Forex Brokers For 2024: Reviewed By Dumb Little Man

What is TeleTrade?

Since its founding in 1994, TeleTrade—which has its headquarters in Cyprus—has held a dominant market position by offering superior services and state-of-the-art technology. The Cyprus Securities and Exchange Commission (CySEC, 158/11), which has been closely monitoring it for a while, assures both new and experienced traders of its dependability and adherence to regulations.

TeleTrade, a leader in Forex and CFDs trading, has expanded its product offering to include more than 200 instruments from many asset classes. The fact that MetaTrader 4 and MetaTrader 5 are now available further demonstrates TeleTrade's dedication to serving a wide range of customers.

With 19 distinct coins available for trading, the broker does not let cryptocurrency aficionados down.

After 25 years in the business, TeleTrade has shown its mettle and is now regarded as a trustworthy broker. TeleTrade was recognized as the Best Broker in Europe in 2018 by the Traders Union Awards.

As evidence of its commitment to trust and trader security, TeleTrade is a member of the Association of Forex Dealers and conforms with MiFID in the European market, despite the fact that some conservative and experienced traders may prefer that it be regulated by the FCA in the UK.

Safety and Security of TeleTrade

It's evident from Dumb Little Man's thorough investigation that TeleTrade maintains a secure trading environment. A reputable body in the sector, the Cyprus Securities and Exchange Commission (CySEC), is firmly in charge of the broker's regulatory control.

This rule guarantees the segregation of client funds, the support of traders with a negative balance protection fund, and investor compensation.

It's crucial to remember, nevertheless, that although TeleTrade's compliance with the ESMA regulatory framework and MiFID II strengthens security, it also makes it less competitive in the worldwide market.

Since 2018, these rules have imposed strict limits that have an impact on TeleTrade's leverage and product offerings. Extensive research confirms that TeleTrade is committed to providing a reliable trading experience even with these constraints.

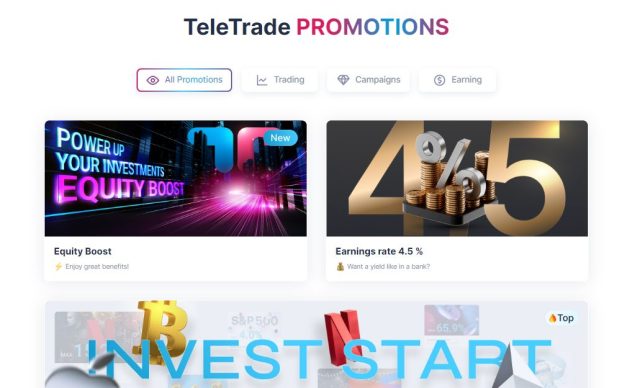

Sign-Up Bonus of TeleTrade

In the world of Forex trading, TeleTrade stands out by welcoming new traders with a 100% funded sign-up bonus. This Welcome Bonus serves as a generous incentive for new account registration, giving them a big boost right away.

To provide even more excitement for its clients, the broker occasionally hosts regular events and tournaments to spice up the trading experience.

Minimum Deposit of TeleTrade

With a $100 USD minimum investment needed for a Professional live trading account, opening an account with TeleTrade is easy. The brokerage's extensive trading tools and services are accessible with this initial investment.

The minimum deposit for a Standard Account is flexible and will change according to the trader's chosen payment method.

Traders are able to select the trading account funding option that best suits their trading style and financial circumstances thanks to this tiered approach. TeleTrade's deposit options provide flexible entry for both committed and novice traders into professional or standard accounts.

TeleTrade Account Types

To provide you with an understandable summary of TeleTrade's account kinds, our Dumb Little Man experts have done extensive study and testing.

It's important to remember that, despite TeleTrade's promotion of maximum leverage of 1:500, ESMA restrictions limit this offer to professional clients exclusively. Leverage for retail trades is limited to 1:30.

Our analysts have found two areas of concern: the regulatory organizations' restrictions and the inconsistency in the labeling of accounts on TeleTrade's website.

MT4 Standard Account

One of the account types, The MT4 platform provides access to a large selection of forex trading instruments with this commission-based trading account. It is intended for traders of all skill levels who desire market orders without order confirmation prompts or requotes. It is positioned as a viable choice for anyone who wants to do forex trading, with a $100 minimum deposit.

MT4 NDD Account

It offers direct access to the interbank market and is sometimes referred to as the No Dealing Desk (NDD) Account. Because this account offers instant transaction orders without requotes, it happens without the need for a dealing desk. It's a great option for people looking for continuous and quick trading.

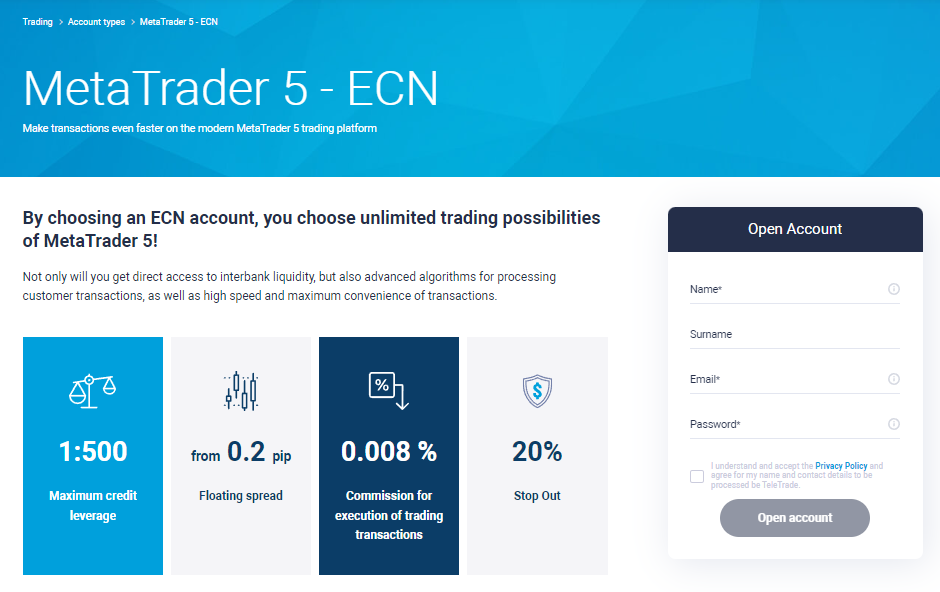

MT5 Real ECN Account

Operating outside of conventional stock exchanges, the Electronic Communication Network (ECN) Account serves as a way for smaller market players and liquidity providers. It is perfect for people who want to trade outside of regular business hours in order to avoid bigger spreads, as well as ensure quick trading and live-streaming prices.

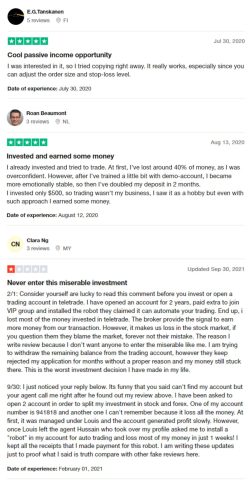

TeleTrade Customer Reviews

Reviews left by customers on TeleTrade show a variety of trade experiences. By practicing with a demo account, Roan overcame his initial losses and achieved success; Tanskanen compliments the trading platform's copy trading tools.

On the other hand, Clara warns others about her bad experience by reporting large losses, problems with customer care, and challenges with cash withdrawal. These accounts emphasize the value of investing cautiously and draw attention to the inconsistent results of using TeleTrade.

TeleTrade Fees, Spreads, and Commissions

TeleTrader provides a range of account kinds with diverse price plans. The commission-free Standard MT4 account has a spread of 1.7 pip from the beginning, or $17 per standard lot on EUR/USD. The commission for the MT4 NDD account is 0.007%, or $16, while the spread is less at 0.9 pip. The spread on the MT5 Real ECN account is as low as 0.2 pip, and there is a $10 or 0.008% commission.

Considering the higher average rates, these expenses may not be the lowest on the market, but they are in accordance with CySEC regulations. The commission for equity CFD traders is 0.10%, and markups are greater. Swap rates are determined by overnight holdings, and account balances are impacted by corporate actions such as dividends.

Payment processors have different fees for third-party withdrawals.

With cheap rates like 0.007% for the NDD Account and spreads as low as 0.2 pips on the ECN account, TeleTrade makes money from commissions and spreads. MT4/MT5 traders can quickly get swap rates by using the Market Watch pane on the platform.

Deposit and Withdrawal

Experts at Dumb Little Man have examined and offered feedback on the TeleTrade deposit and withdrawal procedures, and reported the following:

Deposit and Withdrawal Methods

In general, e-wallets provide quicker withdrawal times than bank wire transfers. On the other hand, higher bank fees might have an impact on trade profitability.

Recall that the withdrawal method must coincide with the deposit method and that third-party deposits and withdrawals are forbidden. It is recommended that traders carefully analyze these factors because they have an effect on the total cost and effectiveness of trading with TeleTrade.

- Bank Wire Transfer

- Credit/Debit Cards

- Neteller

- Skrill

- FasaPay

Withdrawal Fees

- Bank Wire Transfer: SEPA EUR payments incur a fee of €1 plus beneficiary bank commission. Non-SEPA payments have a fee of 0.1% of the amount, with a minimum of $55 and a maximum of $200.

- Credit/Debit Cards: A fee of 2.3% plus €1/$1.30 is charged.

- Neteller: 2%

- Skrill: 1%

- FasaPay: 0.5%

Currency Limitations of Your Trading Account

Only USD and EUR are accepted by TeleTrade, which may restrict traders from using other base currencies and result in extra conversion costs.

Withdrawal Specifics

- Bank Account: A fee of 80–150 euros and a two–three day wait period after approval apply to withdrawals with a minimum of $500.

- Credit/Debit Cards: 2.35% + EUR 1 or USD 1.30 is the cost for withdrawals, which take 1-2 business days.

- E-wallets: 1-2 business days for processing. Withdrawals from Skrill and Neteller are subject to fees of 1% and 2%, respectively, whereas dollar withdrawals via FasaPay are subject to a 0.5% cost.

How to Open a TeleTrade Account

Creating an account with TeleTrade is simple and quick; here's a 9-step tutorial to get you started.

- Start the account opening process by going to the TeleTrade homepage.

- Supply the necessary information being asked.

- Verify your account by checking your email for the verification link.

- Select the account type that you want from the list of options.

- Present identity documents in order to validate the account.

- Wait for an email that says your status has been verified.

- Make your first trading deposit using your chosen payment option.

- Install any trading software or platforms that TeleTrade may offer.

- With your new TeleTrade account, start trading.

TeleTrade Affiliate Program

TeleTrade offers two kinds of commission structure. The first one is the MLM-Network which has five levels, starting from Level 1 with a 45% commission fee up to Level 5 with only 5% commission.

The second one is the CPA-Hybrid is an additional choice that provides up to $500 per active client in addition to up to 10% of commission and spread.

TeleTrade provides a range of supplementary resources, such as link builders, banners, promo posts, and everyday posts, to its affiliates in order to support their success. These tools are intended to support efficient interaction and promotion, enabling affiliates to reach their full earning potential.

TeleTrade Customer Support

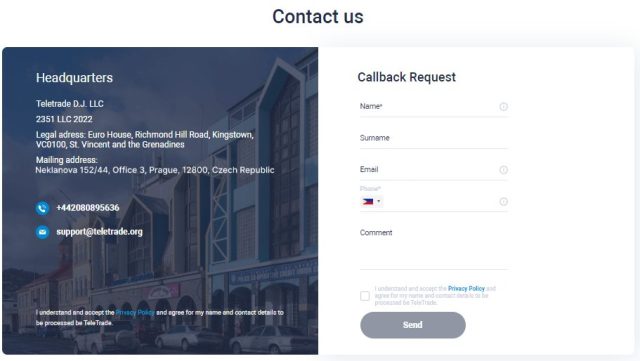

TeleTrade can be reached via multiple platforms like their phone, email address, convenient live chat on their website, and even their physical address, based on thorough research by Dumb Little Man.

Although they do not have FAQs on the website, they provide extra descriptions on the platform itself so traders will not need to ask questions as all of the information they will need are already available as they navigate.

Advantages and Disadvantages of TeleTrade Customer Support

| Advantages | Disadvantages |

|---|---|

TeleTrade vs Other Brokers

#1 TeleTrade vs AvaTrade

With CySEC regulation in place since 1994, TeleTrade provides a large selection of instruments and a reliable service, but it is subject to stringent ESMA leverage limitations. Since 2006, AvaTrade has provided a more extensive range of trading assets, protection against negative balances, and its exclusive AvaProtect feature—all without being restricted by ESMA regulations.

Verdict: Due to its larger range of trading platforms, more extensive asset offers, and cutting-edge trade protection measures, AvaTrade is superior compared to other brokers like TeleTrade.

#2 TeleTrade vs RoboForex

RoboForex has been in business since 2009 and is well-known for offering a variety of trading platforms to suit different trading styles, such as MT5, MT4, cTrader, and R Stock Trader. Because of ESMA's limitations on leverage, TeleTrade, which also provides MetaTrader trading platforms, could not have as much of a competitive advantage. Although RoboForex has a wider selection of trading platforms and greater flexibility than TeleTrade, it may provide a more individualized trading experience.

Verdict: RoboForex outperforms since it offers more trading platforms and personalized trade conditions.

#3 TeleTrade vs FXChoice

With the ability to trade in emerging market currencies like the South African Rand and the Russian Ruble, as well as commodity CFDs like crude oil and precious metals, FXChoice is a broker that serves a worldwide clientele. TeleTrade, on the other hand, might not offer as much diversity in terms of emerging market currencies and commodities, but it does offer a good service within its regulated environment.

Verdict: FXChoice offers a more diversified portfolio than TeleTrade, making it a better option for traders hoping to profit from commodities trading and emerging markets.

Choose Asia Forex Mentor for Your Forex Trading Success

Asia Forex Mentor is the resource you should use if you're committed to achieving financial success and developing a profitable career in Forex trading. It comes highly recommended by the trading experts at Dumb Little Man and is renowned for offering an excellent forex broker program, and stock, and cryptocurrency trading training.

The program's creator, Ezekiel Chew, is praised for his wealth of knowledge and his regular seven-figure deals, which establish his reputation in the trading community.

Extensive Curriculum: Asia Forex Mentor goes much beyond the surface. The curriculum is extensive and covers all the information you require to trade stocks, FX, and cryptocurrencies. It's intended to give you the tools you need to succeed in these diverse marketplaces.

Proven Track Record: Real-world success is what matters here, not theory. Asia Forex Mentor has a strong track record of developing traders who consistently make money in the markets. This record demonstrates the worth and efficacy of the instruction you will get.

Expert Mentor: You can become the best by studying under the greatest. The exceptional chance to receive mentoring from Ezekiel Chew, a mentor with a successful track record in the markets, is provided by Asia Forex Mentor. His individualized assistance gives pupils the confidence to comprehend and maneuver the complexity of the market.

Friendly Community: Trading doesn't always have to be done alone. When you sign up with Asia Forex Mentor, you join a community of traders who help and learn from one another.

Stress on Psychology and Discipline: Having the correct attitude is essential. Asia Forex Mentor places a strong emphasis on psychological training as a means of assisting you in controlling your emotions, handling stress, and making wise trading decisions.

Updates and Resources Every Day: Asia Forex Mentor and the markets are always moving. You'll always be one step ahead because of your constant access to the newest tactics, trends, and market knowledge.

Success Stories: It's feasible and it's proven. With the help of their thorough education, many students at Asia Forex Mentor have successfully transitioned from trading platforms to profitable employment and achieved financial independence.

All things considered, Asia Forex Mentor is the best option available for a comprehensive and successful trading course. With a comprehensive curriculum, professional mentoring, a caring community, and an abundance of tools, it puts you on the right track to becoming an adept trader in the fast-paced financial markets of today.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: TeleTrade Review

After a thorough investigation by the experts at Dumb Little Man, the TeleTrade review received mixed reactions. Despite the region's competitive advantage being diminished since 2018, the company has managed to withstand regulatory changes, including stringent leverage restrictions enforced by the ESMA.

This broker company offers one commission-free account and two commission-based account types unlike other Forex brokers; nevertheless, inconsistent labeling and costs that are higher than average—such as 1.7 pip charges for the commission-free account—indicate potential problems for other traders.

TeleTrade's brokerage services lack a competitive edge and state-of-the-art technology because they rely on outdated MT4/MT5 platforms. The broker's appeal may also be restricted by the lack of educational resources and pricey trading conditions, despite its reputation for providing dependable MetaTrader platforms and a customer-focused approach.

Traders can acquire the advanced strategies and tactics needed to navigate TeleTrade by signing up to programs like Asia Forex Mentor. The extensive training program in AFM can significantly improve traders' chances to succeed in Forex.

>> Also Read: JustMarkets Review 2024 with Rankings By Dumb Little Man

TeleTrade Review FAQs

What types of trading accounts does TeleTrade offer?

Focusing on Forex and CFD trading, and to accommodate varying trading methods and preferences, TeleTrade offers a number of accounts to both novice and seasoned traders. These accounts include a commission-free Standard account and two commission-based accounts, the MT4 NDD and MT5 Real ECN.

Is TeleTrade a regulated broker?

In order to provide a certain level of confidence and security for the investments of its clients, TeleTrade is indeed governed by the CySEC.

Can I trade cryptocurrencies with TeleTrade?

Indeed, TeleTrade allows dealers to diversify their portfolios with digital assets by offering trading in a range of cryptocurrencies.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.