Squared Financial Review 2024 with Rankings By Dumb Little Man

By John V

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before forming an opinion about brokerage firms, the expert team at Dumb Little Man conducts comprehensive reviews. This team is made up of retail traders, financial consultants, and trading specialists to ensure unbiased and precise assessments. Additionally, a specialized algorithm is used to compare each broker based on uniform criteria, which include: The final layer of evaluation includes user reviews and feedback. To offer a well-rounded view of the broker, we blend expert analysis with customer testimonials. This approach minimizes personal biases and provides a clear, objective portrait of the brokerage for prospective clients. After assessing Squared Financial using the above criteria, we found that Squared Financial serves as a dependable option for traders and investors seeking a reputable financial broker. However, there are also various drawbacks, which will be outlined in the article, that potential users should carefully weigh. |

Squared Financial Review

In the world of online trading, Forex brokers play a crucial role. They act as intermediaries between retail traders and the foreign exchange market. One such broker that has evolved is Squared Financial. Known initially as ProbusFX, then rebranded to SquaredDirect, the company now operates under its current name. Based in Cyprus, Squared Financial specializes in foreign exchange (FX) and Contracts for Difference (CFDs). The platform offers more than just forex; it also provides access to precious metals and CFDs on Energies and Indices.

This article is a comprehensive review of Squared Financial, designed to give you an in-depth look at what the broker offers. We aim to highlight both the strengths and weaknesses of the platform. The review is a blend of insights from trading experts at Dumb Little Man and actual customer experiences. By combining these perspectives, we offer a balanced view that covers essential aspects like account options, deposit and withdrawal processes, and commission structures. This information is geared to help you decide if Squared Financial should be your go-to broker for trading.

What is Squared Financial?

Squared Financial is a notable player in the fintech industry, offering investment and wealth management services. Established in 2005, it has grown to become a reliable brokerage service. The broker operates out of offices in Cyprus and the Republic of Seychelles and is a Squared Financial (CY) Limited subsidiary. It falls under the regulatory supervision of well-known entities like the Cyprus Securities and Exchange Commission (CySEC) and the Seychelles Financial Services Authority (FSA SC).

In 2020, the Global Awards recognized the broker for its transparency, significantly enhancing its trustworthiness among traders. Squared Financial appeals to a wide audience, from novice traders to seasoned professionals. It offers versatile, technology-driven solutions that suit various investment objectives. The platform’s comprehensive suite of products and services makes it an ideal choice for active trading or long-term investment strategies.

Safety and Security of Squared Financial

When it comes to safety and security, Squared Financial takes multiple measures to protect its clients. The broker is a part of Squared Financial (CY) Limited, registered in Cyprus. It comprises two entities: Squared Financial (Cyprus) Limited, regulated by CySEC (Cyprus Securities and Exchange Commission), and Squared Financial (Seychelles) Ltd, regulated by FSA SC (Seychelles Financial Services Authority). These regulatory bodies monitor the broker’s financial activities and ensure compliance with international standards.

Our analysis at Dumb Little Man reveals additional layers of security. All client funds are insured by Lloyd’s of London, which guarantees a $1,000,000 net loss return per client if the company faces bankruptcy or closure. This offers a substantial safety net for investors.

Client accounts are kept separate from the company’s corporate funds. This segregation of accounts ensures that client money is not used for the broker’s operational expenses. All trading activities are conducted as per the terms outlined in the Client Agreement, providing an additional layer of legal security.

Squared Financial also maintains an insurance policy to cover any losses related to the broker’s insolvency. This extra layer of financial insurance offers clients peace of mind when trading or investing through the platform.

Sign-Up Bonus of Squared Financial

As of this review, when considering broker incentives like Sign-Up Bonuses, it’s essential to know that Squared Financial only provides such incentives to new traders. The absence of a sign-up bonus is worth noting for those who factor promotional offers into their decision-making when choosing a broker.

Minimum Deposit of Squared Financial

When starting with Squared Financial, the minimum deposit varies depending on your account type. For a SquaredPro account, the minimum deposit required is 250 EUR. On the other hand, if you opt for a SquaredElite account, be prepared to deposit at least 5,000 EUR. This information is crucial for traders when weighing the financial commitments associated with different account options.

Squared Financial Account Types

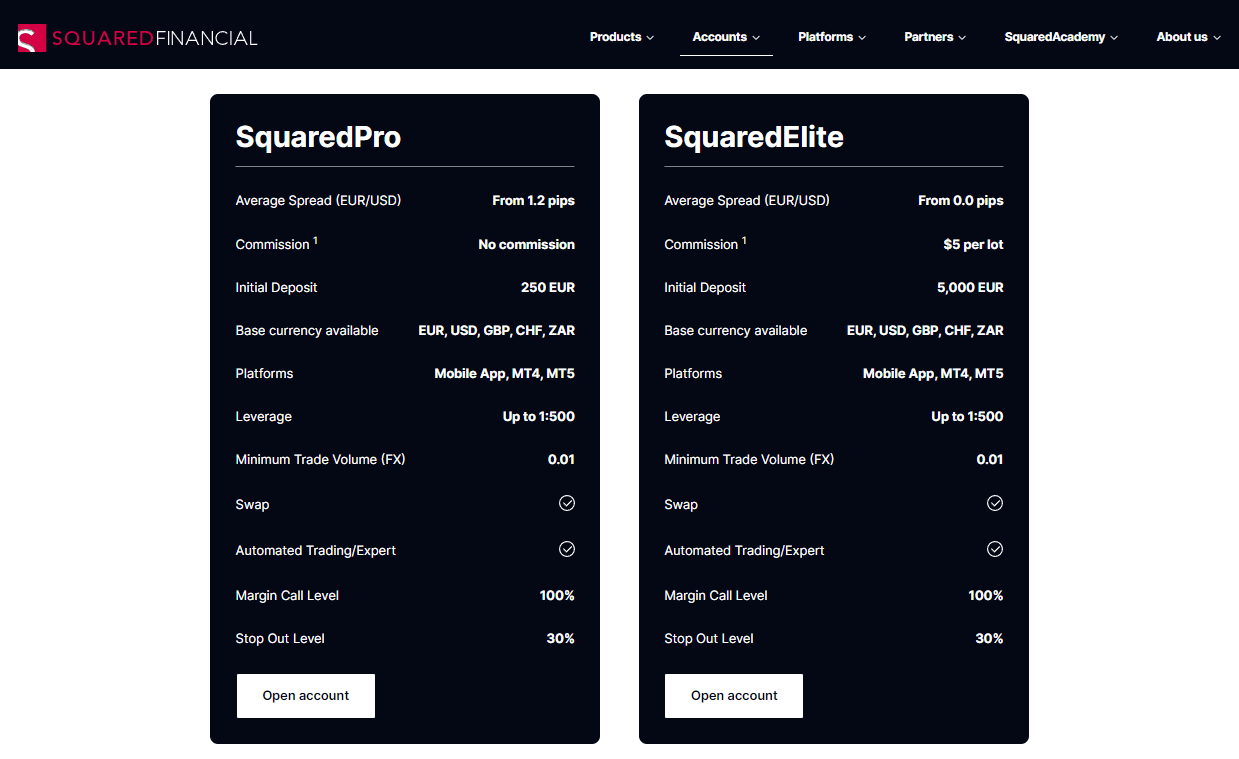

Our team of experts at Dumb Little Man conducted thorough research and tested the account types offered by Squared Financial. They also provide a demo account. Here’s a straightforward list of the Squared Financial Account Types and their respective features:

SquaredPro

- Average Spread (EUR/USD): From 1.2 pips

- Commission 1: No commission

- Initial Deposit: 250 EUR

- Base Currency Available: EUR, USD, GBP, CHF, ZAR

- Platforms: Mobile App, MT4, MT5

SquaredElite

- Average Spread (EUR/USD): From 0.0 pips

- Commission 1: $5 per lot

- Initial Deposit: 5,000 EUR

- Base Currency Available: EUR, USD, GBP, CHF, ZAR

- Platforms: Mobile App, MT4, MT5

Squared Financial Customer Reviews

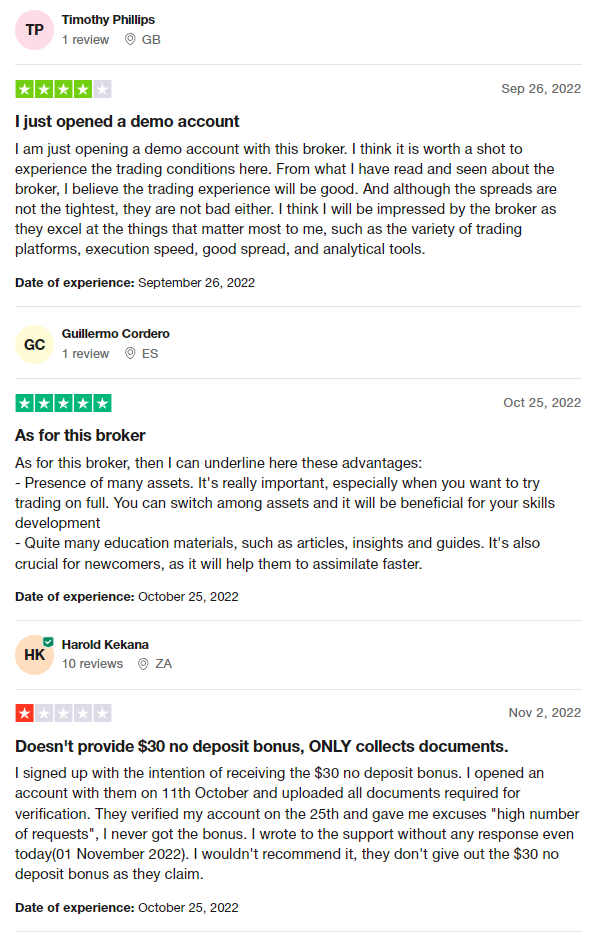

Customer feedback for Squared Financial presents a mixed picture. On the positive side, users highlight the broker’s variety of trading platforms, execution speed, and educational resources. They also appreciate the range of assets available for trading, which benefits both new and experienced traders.

However, there are complaints regarding promotional offers, specifically a $30 no-deposit bonus that should have been granted as advertised. These reviews suggest that while the broker excels in many areas critical to traders, there are also areas needing improvement.

Squared Financial Fees, Spreads, and Commissions

Squared Financial maintains a competitive and transparent fee structure designed to provide traders with an unambiguous understanding of trading costs. Fees vary based on the account type: The SquaredPro account offers trading without commissions but comes with standard spreads on forex pairs. In contrast, the SquaredElite account offers spreads starting from 0 pip but charges a $5 commission per trade.

It’s worth noting that Squared Financial does not charge deposit or withdrawal fees, aiding in efficient fund management. However, traders should know rollover fees for positions held overnight and inactivity fees for dormant accounts.

An additional fee to consider is the overnight funding or swap fee, applicable to long positions. For example, a long position on the EUR/USD pair would entail costs of -12.5 for buying and 5.5 for selling. Understanding these various fees is essential for traders to manage their expenses effectively.

Deposit and Withdrawal

After thorough testing by a trading professional at Dumb Little Man, it’s confirmed that Squared Financial offers secure and straightforward withdrawals. The platform is accessed through the client area and provides multiple depositing options such as credit cards, bank wire, and e-payments.

An additional benefit is that Squared Financial does not charge commissions or fees on withdrawals. This feature mainly benefits traders prioritizing cost-efficiency when managing their trading funds.

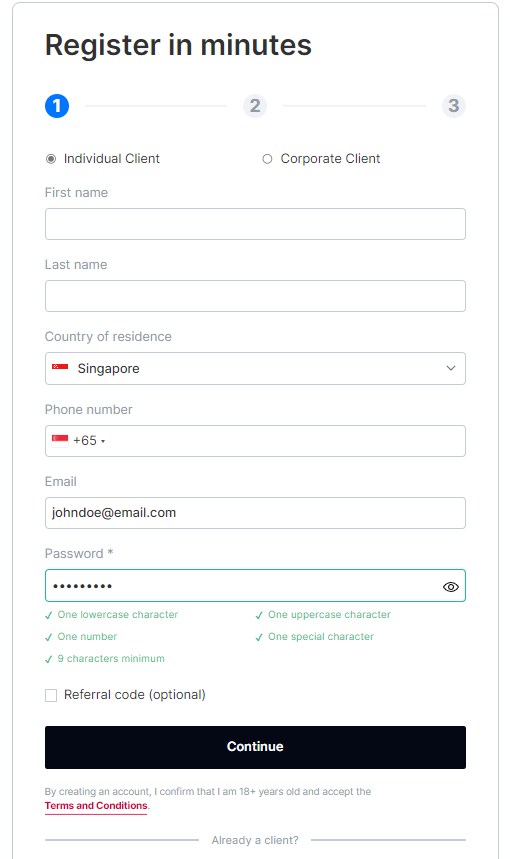

How to Open a Squared Financial Account

- Visit the Squared Financial website.

- Choose the option to open an account.

- Fill out the registration form with personal details like name, contact, and financial information.

- Submit the form.

- Check your email for a verification message.

- Click the link in the verification email.

- Complete the account verification process.

- Log into your newly verified account.

- Start trading on the platform.

Squared Financial Affiliate Program

The Squared Financial Affiliate Program offers a way to earn commissions by referring qualifying clients. The program utilizes a CPA compensation structure, offering up to $800 CPA for successful referrals.

Affiliates benefit from fast and easy CPA withdrawals, making the process streamlined and efficient. Additionally, the program provides access to higher conversion landing pages and banners, optimizing the chance of successful client acquisition.

Squared Financial offers multilingual customer support to assist affiliates globally, broadening its accessibility and user-friendliness. This program is advantageous for those seeking to generate income through client referrals.

Squared Financial Customer Support

Based on the experience of Dumb Little Man, Squared Financial offers robust customer care. The broker features a 24/5 live chat service available in multiple languages, some of which are less commonly found, ensuring a broad client reach.

The platform also provides a Secure Client Area, a one-stop shop for complete account management. Within this area, traders can access real-time news feeds, educational resources, and market commentary, enhancing their trading experience and making account management more convenient.

Advantages and Disadvantages of Squared Financial Customer Support

| Advantages | Disadvantages |

|---|---|

Squared Financial vs Other Brokers

#1. Squared Financial vs AvaTrade

Squared Financial and AvaTrade differ in their account offerings and regulations. AvaTrade, with its robust law, operates in multiple global jurisdictions and offers a wide array of financial instruments. Squared Financial focuses on a more simplified account structure and is regulated by CySEC and FSA SC.

Verdict: AvaTrade is better for those who value strong regulation and a wide range of trading options. Squared Financial suits traders who prefer simplified account structures and targeted financial instruments.

#2. Squared Financial vs RoboForex

RoboForex offers a broad range of trading platforms and is known for its cutting-edge technology. It also provides numerous trading options across eight asset classes. Squared Financial, on the other hand, offers two main account types and emphasizes transparent fee structures.

Verdict: RoboForex is better for traders looking for various sophisticated trading platforms. Squared Financial is more geared toward traders who appreciate fee transparency and a more straightforward account structure.

#3. Squared Financial vs FXChoice

FXChoice caters mainly to experienced traders, offering professional ECN accounts and high trading volumes. Squared Financial has a broader appeal with its SquaredPro and SquaredElite accounts, serving novice and experienced traders.

Verdict: FXChoice is better for professional traders with high trading volumes. Squared Financial is more accommodating to a broader range of traders, from beginners to professionals.

Choose Asia Forex Mentor for Your Forex Trading Success

Looking to master forex trading? Asia Forex Mentor is your go-to platform for top-notch forex, stock, and crypto education. Recommended by trading experts at Dumb Little Man, this platform sets you on the path to financial success.

Comprehensive Curriculum: It offers a full range of courses that cover stock, crypto, and forex trading. You learn all you need to excel in these markets.

Proven Track Record: With a history of creating profitable traders, Asia Forex Mentor is a trusted name in the trading education sector.

Expert Mentor: Led by Ezekiel Chew, a seven-figure trader, the platform provides personalized guidance to help you understand complex market dynamics.

Supportive Community: Being a part of Asia Forex Mentor gives you access to a community of traders. This enhances your learning and keeps you motivated.

Focus on Discipline and Psychology: It’s not just about market knowledge; the platform also trains you in discipline and emotional control, critical for trading success.

Constant Updates and Resources: Stay ahead with the latest market trends and strategies, thanks to their continuous provision of updated resources.

Success Stories: Numerous testimonials confirm that traders have achieved financial independence through this education.

In summary, Asia Forex Mentor is the best choice for comprehensive trading education. With its experienced mentorship and diverse curriculum, it equips you with the skills you need to succeed in forex, stock, and crypto trading.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Squared Financial Review

After a thorough analysis by trading experts at Dumb Little Man, Squared Financial stands out as a competitive option for traders. One of its strong suits is its Transparent and Competitive Fee Structure. Whether you opt for the SquaredPro account with standard spreads or the SquaredElite account with tighter spreads and a commission, you know what you’re getting into.

Another advantage is Efficient Fund Management. With no fees on deposits or withdrawals, you have more control over your money. It also has a Diverse Range of Trading Instruments, offering a broad spectrum of opportunities for novice and experienced traders.

However, being cautious about Potential Rollover Fees for overnight positions and Inactivity Fees for dormant accounts is crucial. These can sneak up on you if you need to be more vigilant about your trading habits and account management.

Squared Financial Review FAQs

What are the account types offered by Squared Financial?

Squared Financial offers two main account types: SquaredPro and SquaredElite. SquaredPro has no commissions but standard spreads, while SquaredElite offers spreads starting from 0 pip but charges a $5 commission per trade.

Does Squared Financial charge fees for deposits and withdrawals?

Squared Financial does not charge any fees for deposits or withdrawals, making it more efficient for traders to manage their funds.

Are there any hidden costs to be aware of?

While the fee structure is transparent, traders should be cautious about potential rollover fees for positions held overnight and inactivity fees for accounts not used for an extended period.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.