Charterprime Review 2024 with Rankings By Dumb Little Man

By John V

January 10, 2024 • Fact checked by Dumb Little Man

Charterprime Review

Forex brokers act as intermediaries between retail traders and the interbank forex market. They offer trading platforms where individuals can buy and sell foreign currencies. Charterprime is a notable player in this sector, specializing in Forex, commodities, and index futures markets. Founded with the mission to deliver top-tier financial services, the company has earned its stripes as an award-winning brokerage. They are acclaimed for offering customized solutions tailored to meet the individual requirements of their clientele.

This article serves as an in-depth review of Charterprime. Our aim is to give you a comprehensive look at what sets this broker apart, as well as any limitations you should be aware of. With a blend of expert insights from Dumb Little Man and customer reviews, we’ll cover key aspects like account types, deposit and withdrawal methods, and commission structures. Our goal is to offer a balanced view that equips you with the vital information you need to decide if Charterprime is the right brokerage service for you.

What is Charterprime?

Charterprime is a global Forex and financial broker that came into existence in 2012. The company is lauded for its customer-centric approach, offering tailored trading conditions within a safe and secure environment. To underline its credibility, Charterprime is regulated by New Zealand authorities and holds registration as a financial provider in Australia. This contributes to its reputation as a trusted platform in the trading community.

Charterprime is not just confined to one geographic location; it has a global presence. Offices are strategically situated in key locations around the world, aimed at providing accessible services to an international clientele. Over the years, the company has been committed to continually enhancing its service offerings to meet evolving trader needs.

An additional note on its operation, CharterPrime Limited, its overseas division, is officially registered in St. Vincent and the Grenadines. This branch functions under the jurisdiction of the Financial Services Authority of St. Vincent and the Grenadines, adding another layer to its regulatory framework.

Safety and Security of Charterprime

When it comes to the safety and security of its clients, Charterprime takes multiple steps to instill confidence. First and foremost, the broker operates under the strict regulation of the FSP (Financial Service Providers). This regulatory oversight offers traders an additional layer of assurance. This information is backed by thorough research conducted by Dumb Little Man.

Another critical safety feature is the segregation of funds. Charterprime practices this to ensure increased security for client deposits. This mechanism keeps the traders’ funds separate from the company’s operational funds, thereby offering added safety.

In addition to FSP regulation, Charterprime is also registered by the ASIC (Australian Securities and Investments Commission). This dual registration adds another notch to its belt, further strengthening its credibility as a secure trading platform.

However, it’s essential to note some limitations. Charterprime is not listed on any Stock Exchange, which could potentially impact its financial transparency. Traders who prioritize transparency may see this as a drawback.

Another point of consideration is the absence of Negative Balance Protection. This means traders could risk losing more than the funds present in their trading account. Such a feature’s absence could pose additional risks that prospective traders should be aware of.

Sign-Up Bonus of Charterprime

For those interested in the perks of a Sign-Up Bonus, it’s important to note that Charterprime currently does not offer a sign-up bonus for newcomers or beginner traders. This absence may affect the initial appeal for those who are looking to start their trading journey with some extra financial cushioning. This information is up-to-date at the time of this review.

[wptb id="129622" not found ]Minimum Deposit of Charterprime

When it comes to starting your trading account, Charterprime keeps the barrier relatively low. The minimum deposit is 100 USD, making it accessible for traders with various budget levels. This low entry point allows novice traders an opportunity to explore the platform without committing a large initial investment.

Charterprime Account Types

Charterprime offers a variety of account options tailored to different trading needs. Each account type comes with its own set of features and fee structures. Dumb Little Man’s team of experts have tested these accounts and can confirm the following based on thorough research:

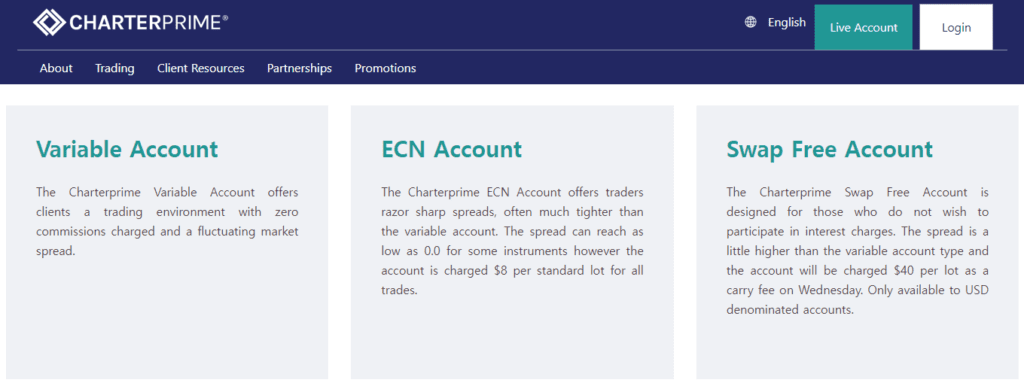

Variable Account

This account provides a no-commission trading environment with a fluctuating market spread. Ideal for traders who prefer not to worry about additional costs per trade.

ECN Account

Known for razor-sharp spreads, this account can go as low as 0.0 for certain trading instruments. However, a fee of $8 per standard lot is charged for all trades, making it suitable for more experienced traders.

Swap Free Account

Swap-free accounts are specifically designed for traders wanting to avoid interest charges. While it has higher spreads, a $40 per lot fee is incurred on Wednesdays. Note that this account type is available only to USD-denominated accounts.

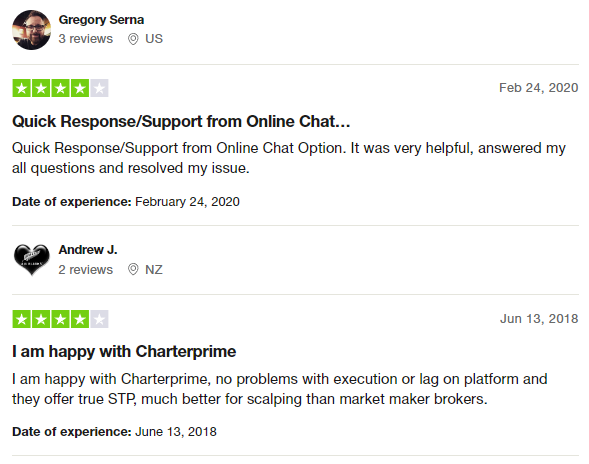

Charterprime Customer Reviews

Based on customer reviews, Charterprime appears to be a reliable platform for trading. Users highlight the quick and effective customer support via online chat as a strong point, which seems to resolve issues promptly. Additionally, traders appreciate the no-lag platform and true STP offering, indicating it’s well-suited for various trading strategies, including scalping. Overall, the feedback suggests that Charterprime provides a smooth and efficient trading experience.

Charterprime Fees, Spreads, and Commissions

Understanding the cost structure is crucial when choosing a broker. In the case of Charterprime, trading fees and spreads vary based on the account type you select. Traders should be aware that fees can start from $8 USD and spreads can go as low as 0.0 pips. Some accounts even offer commission-free trading.

The Variable Account solely relies on spread charges, making it a good option for those who prefer not to pay commissions. On the other hand, the ECN Account operates on raw spreads and imposes an $8 commission per lot. This type of account would be more suitable for experienced traders who are comfortable with paying a commission for tighter spreads.

Last but not least, the Swap-free Account presents variable spreads and takes a different approach by charging a $40 per lot commission each Wednesday. This is important to consider for traders who wish to avoid interest charges but are okay with paying a higher fee once a week.

Deposit and Withdrawal

Charterprime provides a range of deposit and withdrawal options, aimed at facilitating smooth financial transactions for its clients. Some of the popular methods include China UnionPay, Bitcoin, Neteller, Wire transfer, Skrill, and Local Gateway. This flexibility in payment options was confirmed after being tested by a trading professional at Dumb Little Man.

When it comes to fees, Charterprime generally does not charge fees for deposits or withdrawals. This is an attractive feature for traders who wish to maximize their trading capital. However, traders should be aware that some methods might incur additional charges due to international policies.

For example, transactions involving Tether block-chain wallets come with a 5% fee for both deposits and withdrawals. Such fees are not imposed by Charterprime, but by the international payment method itself. Traders using this method should be prepared for the added cost.

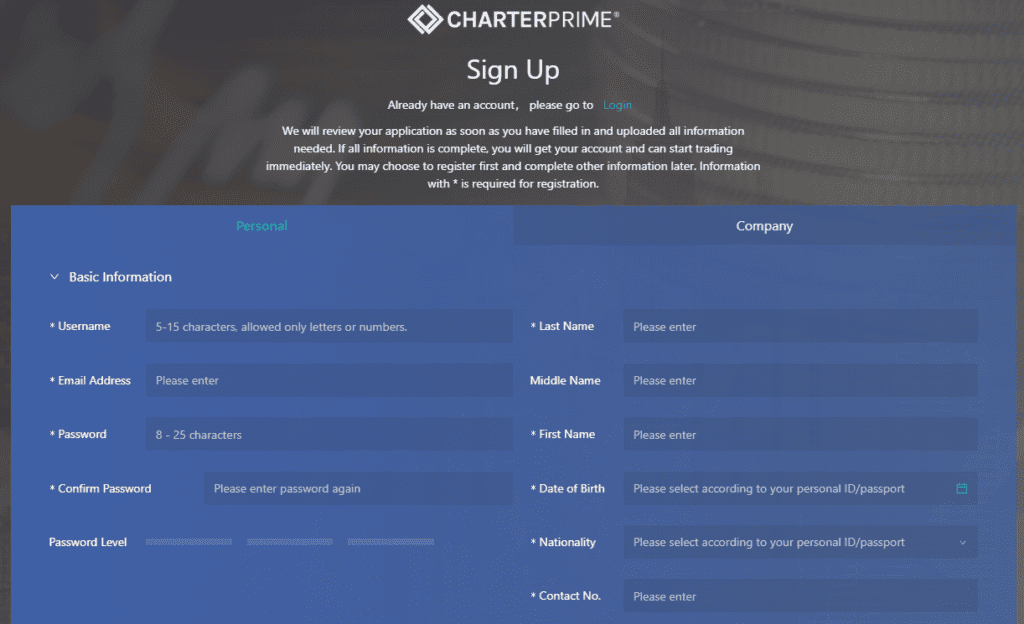

How to Open a Charterprime Account

- Go to the “Live Account” page on the Charterprime website.

- Fill in the personal information fields, including name, email, and phone number.

- Submit necessary documentation for verification, like proof of residence and valid ID.

- Wait for account activation and identity confirmation.

- Once activated, deposit funds into your new account.

- After depositing, you can start trading.

>> Also Read: How To Trade Forex For Beginners – An Important Know How For Traders

Charterprime Affiliate Program

For those interested in becoming affiliates, Charterprime offers a lucrative Introducing Brokers program. What sets this program apart is the unlimited earning potential for brokers who refer new business to Charterprime. This makes it an outstanding opportunity for anyone looking to supplement their income.

Charterprime equips its Introducing Brokers with a unique platform, featuring in-depth analysis of clients and revenue streams. This analytics-driven approach is what makes the program distinctive in the trading industry.

When it comes to the nitty-gritty details, Charterprime has made the program accessible and straightforward. For instance, there is an instant commission payment calculation feature, meaning you don’t have to wait long to see your earnings. Also, there are no minimum starting amount requirements and no minimum client requirements, which reduces barriers to entry for new brokers.

Last but not least, the program offers extensive training and a dedicated account manager, ensuring that you have the support and resources needed to succeed as an Introducing Broker.

Charterprime Customer Support

Excellent customer service is a top priority for Charterprime and is essential to trading success. The team is equipped to deal with a wide range of circumstances because they recognize the value of prompt, dependable, and efficient service. Their objective is to provide prompt, intelligent answers to all questions. This data is derived from Dumb Little Man’s customer service encounters.

Live chat is one of the most effective ways to communicate with the Charterprime support staff. Traders who have urgent questions that need to be answered right away will find this real-time function especially helpful. In general, during their operating hours, responses are prompt.

For matters that are less pressing or require in-depth answers, there’s the option to use email support. Charterprime’s team aims to provide comprehensive responses within a reasonable time frame, making this a reliable channel for complex queries.

Clients can also reach out using the contact form on the website. This method is convenient for general inquiries or feedback, giving traders another avenue to get the support they need.

Advantages and Disadvantages of Charterprime Customer Support

[wptb id="129624" not found ]Charterprime vs Other Brokers

#1. Charterprime vs AvaTrade

Charterprime and AvaTrade differ significantly in their approach to trading. Charterprime focuses on customer-centric bespoke trading conditions, while AvaTrade provides a comprehensive trading experience with a wider range of financial instruments. AvaTrade, regulated in multiple jurisdictions, has a broader global reach and serves more than 300,000 clients worldwide.

Verdict: AvaTrade is better for traders looking for a more extensive array of financial instruments and global accessibility.

#2. Charterprime vs RoboForex

Charterprime and RoboForex both offer diverse trading environments but differ in the range of trading options. RoboForex has over 12,000 trading options across eight asset classes, providing tailored trading conditions ideal for diverse trading styles. Charterprime, on the other hand, emphasizes customer-centric services but doesn’t offer as many trading options.

Verdict: RoboForex is better for traders who prioritize diverse asset classes and customizable trading terms.

#3. Charterprime vs FXChoice

Charterprime and FXChoice target different types of traders. While Charterprime aims to provide bespoke trading conditions for its clientele, FXChoice focuses on serving experienced traders with tighter market spreads and professional ECN accounts. FXChoice does not offer features like cent accounts or zero spreads, making it more suited for seasoned traders.

Verdict: FXChoice is better for professional traders looking for advanced features and tight market spreads.

[wptb id="129625" not found ]Choose Asia Forex Mentor for Your Forex Trading Success

If you’re looking to build a profitable career in forex, stock, or crypto trading, Asia Forex Mentor is your go-to option for top-tier education. Led by Ezekiel Chew, known for his expertise and contributions to trading institutions, this educational platform sets itself apart. Ezekiel himself is a seven-figure trader, setting him above other educators in this sector. Here’s why we recommend them:

In-Depth Curriculum: The course offered by Asia Forex Mentor covers all angles of forex, stock, and crypto trading. This thorough educational pathway prepares you to excel across multiple financial markets.

Solid Reputation: Asia Forex Mentor has an impressive history of creating profitable traders in various markets. Their success rate stands as proof of the effectiveness of their teaching and mentorship.

Seasoned Trader: Students at Asia Forex Mentor enjoy the advantage of learning from a mentor who have achieved significant success in forex, stock, and crypto markets. Ezekiel offers personalized guidance, making it easier for you to succeed in different markets.

Collaborative Environment: Being part of Asia Forex Mentor means you’ll join a supportive community of traders with similar goals. This community encourages collaboration and shared learning, enriching your educational experience.

Focus on Mindset and Discipline: To succeed in trading, you need more than just knowledge; you need the right mindset. Asia Forex Mentor places a strong emphasis on psychological training to help traders manage their emotions and make sound decisions.

Up-to-Date Resources: Financial markets are ever-changing, and Asia Forex Mentor ensures you’re always in the loop with ongoing updates and relevant resources.

Success Narratives: Numerous students have achieved financial independence through Asia Forex Mentor’s comprehensive trading education.

In summary, Asia Forex Mentor stands as the leading choice for anyone seeking an effective trading course. The platform offers a complete package, including expert mentors, an inclusive community, and ongoing resources, aimed at turning aspiring traders into professionals in various financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Charterprime Review

The trading professionals at Dumb Little Man have done a great deal of research, and their findings support the notion that Charterprime is a dependable platform. Traders can select from a range of account types, each having its own set of fees and spreads, such as the Variable Account, ECN Account, and Swap-free Account. The platform receives great marks for customer service as well, offering prompt and informed responses.

But it’s important to recognize some disadvantages. The absence of round-the-clock customer service may provide a challenge for dealers who conduct business in disparate time zones. Additionally, although certain accounts at Charterprime offer commission-free trading, fees might add up based on the account type and trading volume.

>> Also Read: 9 BEST Forex Brokers For 2024: Reviewed By Dumb Little Man

Charterprime Review FAQs

What types of accounts does Charterprime offer?

Charterprime offers a variety of accounts including Variable Account, ECN Account, and Swap-free Account, each with its own set of fees and spreads.

Is Charterprime customer support available 24/7?

No, Charterprime does not offer 24/7 customer support. The availability times are specified on their website.

Are there any hidden fees I should be aware of when trading with Charterprime?

While Charterprime offers commission-free trading in some accounts, it’s crucial to read the terms and conditions for each account type to understand the fees and commissions that may apply.

[wptb id="129626" not found ]Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

John V

John is a digital marketing master's student who enjoys writing articles on business, finance, health, and relationships in his free time. His diverse interests and ability to convey complex ideas in a clear, engaging manner make him a valuable contributor to these fields.