Range Market Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 112th  |  |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

Range Market Review

Forex brokers play a pivotal role in providing access to the global currency markets. Among these brokers, Range Market stands out as a veteran, having offered its services since 2002. Catering to both active traders and investors, Range Market specializes in facilitating access to Forex and CFD trading. Its appeal largely lies in its support for clients wishing to copy trades from top-performing MT4 signal providers, alongside offering high leverage, a diverse selection of account types, and a broad array of currency pairs.

Our comprehensive review aims to dissect Range Market thoroughly, highlighting its strengths and areas where it might fall short. We delve into the specifics of what Range Market has to offer, including account types, deposit and withdrawal mechanisms, commission fees, and more. By merging expert analysis with feedback from actual users, this evaluation seeks to arm you with critical insights. Whether you're contemplating Range Market for its high-leverage options or the variety of trading instruments it provides our balanced review endeavors to guide you through making a well-informed choice about adopting Range Market as your brokerage ally.

What is Range Market?

Range Market is a broker renowned for its longstanding presence in the Forex and CFD trading industry since 2002. It serves a diverse clientele, including active traders and investors who show a preference for emulating the strategies of the most proficient MT4 signal providers. Range Market is distinguished by its offering of high leverage, an extensive assortment of account options, and a wide variety of currency pairs, catering to the needs of a broad trading audience.

In addition to its core brokerage services, Range Market enriches its offerings with complimentary market analytics, supporting clients in making informed trading decisions. It champions scalping, hedging, and algorithmic trading practices, providing traders with the flexibility to employ various strategies. The broker's legitimacy is underscored by its registration with the Financial Services Authority of Saint Vincent and the Grenadines (SVGFSA), ensuring its operations align with the regulatory frameworks of the state. This blend of regulatory compliance, diverse trading options, and supportive trading conditions underscores Range Market's commitment to facilitating a comprehensive trading environment for its users.

Safety and Security of Range Market

After an in-depth investigation by Dumb Little Man, it's important to clarify the safety and security aspects associated with Range Market. This broker, operating under Range Market Ltd., is registered in St. Vincent and the Grenadines, falling under the purview of the SVGFSA (Financial Services Authority St. Vincent and the Grenadines). However, it's crucial to understand that such registration does not equate to licensing or active regulation of its brokerage activities. The SVGFSA's role is limited to providing registration numbers to companies with financial orientations, not overseeing their operational practices.

This distinction raises significant points about the safety and security framework surrounding Range Market. While registration with SVGFSA establishes a level of formal recognition, prospective traders and investors should be aware that it does not imply comprehensive regulatory oversight. The absence of direct regulation by SVGFSA means that the broker's operations do not undergo the same level of scrutiny or adhere to regulatory standards typically enforced on licensed entities. This information, gathered through thorough research, highlights the importance of conducting personal due diligence when considering Range Market for trading activities.

Pros and Cons of Range Market

Pros

- Enables trading on news, hedging, and use of automation

- Competitive spreads from 0.5 pips

- Allows unlimited advisors and trading bots

- Offers an affiliate program

- High leverage up to 1:500

- Utilizes the MetaTrader 4 platform

- Provides both Cent and Classic account types

Cons

- Restricted range of CFDs

- Limited payment methods

- Lacks a formal brokerage license

Sign-Up Bonus of Range Market

Range Market currently does not offer a sign-up bonus for new clients. This approach aligns with its focus on providing core trading services and features over promotional incentives. While some traders may seek initial bonuses as a boost to start trading, Range Market emphasizes the quality of its trading conditions and the comprehensive suite of tools available through its platform.

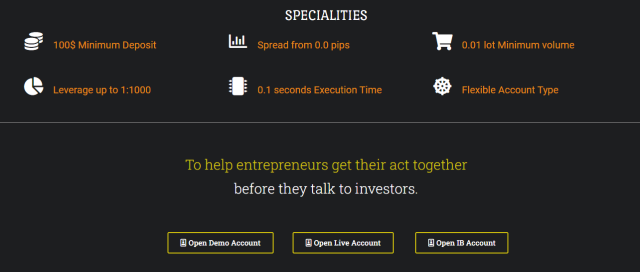

Minimum Deposit of Range Market

Range Market sets a minimum deposit requirement of $100 for new accounts. This amount is designed to make Forex and CFD trading accessible to a wide range of traders, balancing entry-level affordability with a commitment to quality trading conditions. By setting this threshold, Range Market aims to attract both novice and experienced traders, ensuring that starting or maintaining an account is within reach for many individuals interested in the trading market.

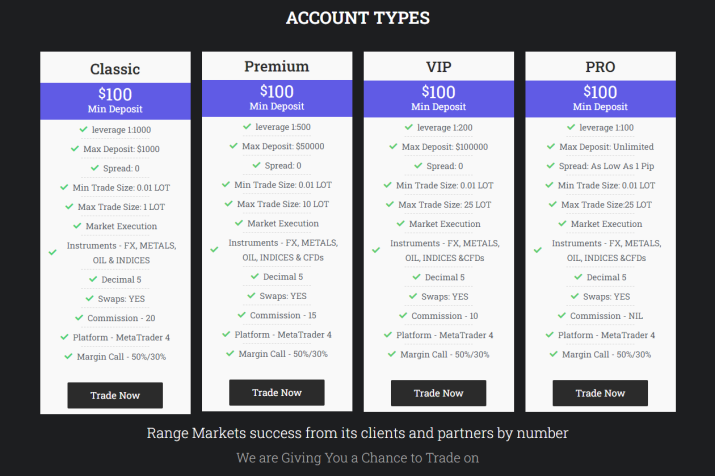

Range Market Account Types

Following thorough research and hands-on testing by our Dumb Little Man expert team, we present a concise and organized list of Range Market account types. Each account has been designed to cater to different trading styles and experience levels, ensuring traders can find an option that best suits their needs.

Classic Account

- Minimum Deposit: $100

- Leverage: 1:1000

- Maximum Deposit: $1,000

- Spread: 0

- Minimum Trade Size: 0.01 LOT

- Maximum Trade Size: 1 LOT

Premium Account

- Minimum Deposit: $100

- Leverage: 1:500

- Maximum Deposit: $50,000

- Spread: 0

- Minimum Trade Size: 0.01 LOT

- Maximum Trade Size: 10 LOT

VIP Account

- Minimum Deposit: $100

- Leverage: 1:200

- Maximum Deposit: $100,000

- Spread: 0

- Minimum Trade Size: 0.01 LOT

- Maximum Trade Size: 25 LOT

PRO Account

- Minimum Deposit: $100

- Leverage: 1:100

- Maximum Deposit: Unlimited

- Spread: As Low As 1 Pip

- Minimum Trade Size: 0.01 LOT

- Maximum Trade Size: 25 LOT

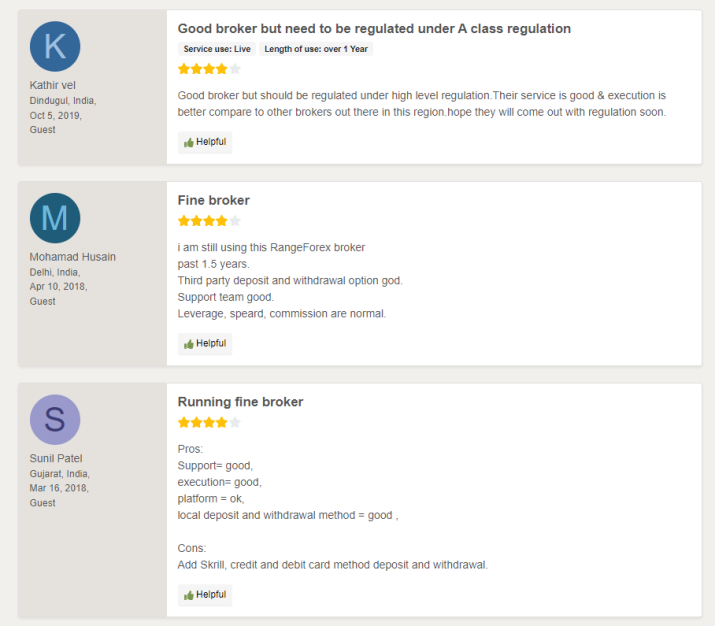

Range Market Customer Reviews

Customer reviews on Range Market highlight a generally positive perception of the broker, with specific commendations on its service quality and execution speed. While praised for being a reliable choice in the region, a common suggestion among users is the need for higher-level regulation to enhance trust and security.

Clients appreciate the support team's responsiveness and flexibility in deposit and withdrawal options, including third-party methods. However, there's a clear call for the addition of more payment methods such as Skrill, credit, and debit cards to accommodate a wider range of financial preferences. Overall, Range Market is regarded as a good broker with room for improvement in regulatory standing and payment versatility, reflecting a balance between satisfaction with current offerings and a desire for broader enhancements.

Range Market Fees, Spreads, and Commissions

At Range Market, the primary cost to traders comes in the form of spreads, which are effectively the broker's only trading commission. The Platinum account boasts the most competitive spreads, starting as low as 0.5 pips. For those opting for the Gold account, spreads begin at 1.4 pips, while Silver and Palladium account holders face spreads starting from 1.6 pips. Notably, the Silver account operates as a micro account, meaning commissions are uniquely calculated in cents, making it an attractive option for traders managing smaller volumes.

Range Market stands out for its no-fee policy on deposits and withdrawals, enhancing its appeal to traders by minimizing overhead costs. Furthermore, the broker absorbs Neteller system fees, alleviating additional charges for its clients. However, transactions via bank transfer incur a $25 fee, a detail important for traders who prefer this method for their financial operations. Additionally, an inactive account fee of $5 per month is applied to accounts that have shown no funds movement or trading activity over a 90-day period, encouraging active participation in the trading platform.

Deposit and Withdrawal

Based on an evaluation conducted by a trading professional at Dumb Little Man, Range Market's deposit and withdrawal processes stand out for their efficiency and user-friendly approach. Withdrawal requests are expediently handled by the company's finance department and typically processed within 24 hours. Clients have the flexibility to withdraw funds directly to a bank account, card, or through the Neteller system, accommodating various preferences.

The timeline for fund transfers to bank accounts varies by country, with the crediting period extending up to 5 business days in some cases. This variation underscores the importance of considering geographical factors when planning withdrawals. Importantly, Range Market is committed to affordability, not imposing fees for withdrawals and absorbing payment system commissions. However, it's critical for traders to note that withdrawal conditions, especially regarding profit withdrawals, are subject to change. Traders are advised to consult the most current information on the broker's website prior to account opening, ensuring clarity on the terms of financial transactions.

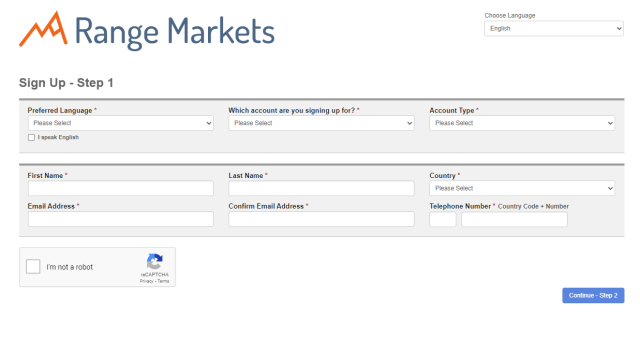

How to Open a Range Market Account

- Navigate to Range Market‘s official website and click on the “Open Live Account” button.

- Fill in your personal details in the form that appears.

- Confirm your email address to proceed.

- Set up a strong password for account security.

- Answer a few basic questions related to Forex trading.

- If you intend to use bank transfer, add your bank account information.

- Set up a “Landing Account” to hold funds before your trading account activation.

- Use the provided email and password to access your user account.

- Complete the registration to start trading with your new Range Market account.

Range Market Affiliate Program

Range Market offers an affiliate program designed for both retail traders and companies interested in becoming Introducing Brokers. This partnership framework enables participants to generate additional income by referring new clients to the platform. The commission plan at Range Market directly correlates with the trading activity of these referred clients, aligning rewards with performance.

Affiliates have the advantage of withdrawing their rewards monthly, specifically on the first business day of the month. This structured payout system ensures that partners receive timely compensation for their contributions to expanding Range Market's client base. Through this program, Range Market incentivizes and rewards the collaborative efforts of its affiliates, fostering a mutually beneficial relationship.

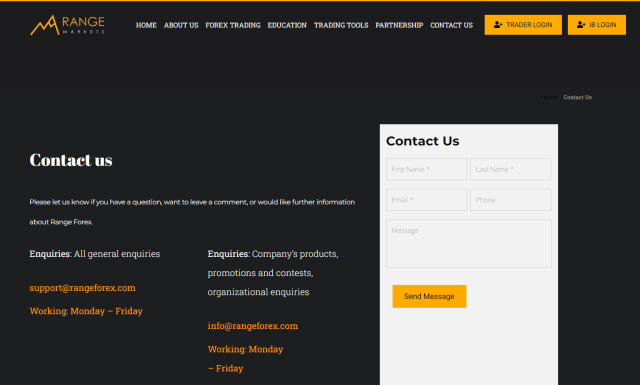

Range Market Customer Support

Based on the experience of Dumb Little Man with Range Market‘s Customer Support, several methods are available for contacting support, including via email and via phone calls. To initiate a phone call, users must first fill out a form requesting a callback, tailoring the support experience to their schedule and needs.

While the Contact Us section of Range Market's website suggests that support can also be requested through online chat, it was noted that an actual button or link to initiate this chat was not visible on the website or within the user account area. This discrepancy may require potential users to rely more heavily on email and callback requests for assistance. Despite this, Range Market's customer support channels aim to provide accessible and responsive service to address client inquiries and issues.

Advantages and Disadvantages of Range Market Customer Support

| Advantages | Disadvantages |

|---|---|

Range Market vs Other Brokers

#1. Range Market vs AvaTrade

Range Market offers a niche approach with high-leverage options and a focus on MT4 signal providers, catering to traders interested in copying trades and leveraging high market access. AvaTrade, on the other hand, has a broader appeal due to its extensive regulatory framework, a wide array of over 1,250 financial instruments, and a strong global presence, including locations in Australia, Ireland, the British Virgin Islands, and Japan. AvaTrade's commitment to regulation and licensing, combined with its vast instrument offering, makes it a more secure and versatile option for traders looking for a comprehensive trading platform.

Verdict: AvaTrade is better for traders prioritizing regulatory security, diverse trading instruments, and global reach. Range Market may appeal to those focused on high leverage and specific trading strategies like signal copying.

#2. Range Market vs RoboForex

Range Market and RoboForex both offer unique trading conditions, but RoboForex stands out with its extensive selection of over 12,000 trading options and eight asset classes. RoboForex's adoption of cutting-edge technologies, variety in trading platforms, including MetaTrader, cTrader, and RTrader, and its ContestFX for demo account contests, provide a rich trading environment suitable for various trading styles and volumes. RoboForex's regulatory standing under FSC and tailored trading conditions make it a compelling choice for traders seeking technological sophistication and flexibility.

Verdict: RoboForex is better for traders looking for technological versatility, a wide range of trading instruments, and customized trading experiences. Range Market may be preferred by those seeking specific features like high leverage and MT4 signal provider access.

#3. Range Market vs FXChoice

Range Market provides accessibility and flexibility with high leverage and a variety of account types, including options for traders interested in signal copying. FXChoice, with its focus on integrity and customer service, offers a more tailored experience for active and passive trading, especially for experienced traders. FXChoice's commitment to expanding its trading instruments and services, along with licensing by the FSC of Belize, positions it as a reliable choice for traders looking for quality brokerage services and professional ECN accounts with tight market spreads.

Verdict: FXChoice is better suited for experienced traders seeking a broker committed to business integrity and offering a professional trading environment. Range Market's appeal lies in its high leverage and signal copying capabilities, catering to a different trader demographic.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you're deeply invested in carving out a prosperous career in forex trading and aiming for significant financial success, Asia Forex Mentor is your go-to for top-notch forex, stock, and crypto trading education. At the helm is Ezekiel Chew, a luminary in the trading world, known for his work with trading institutions and banks. Notably, Ezekiel's track record includes consistently securing seven-figure trades, distinguishing him from his peers in the educational sphere. Here's why we stand by our recommendation:

Comprehensive Curriculum: Asia Forex Mentor presents a thorough educational suite covering the essentials of stock, crypto, and forex trading. Its structured program is designed to arm traders with the skills to thrive across these varied markets.

Proven Track Record: The reputation of Asia Forex Mentor is solidified by its history of nurturing traders who consistently achieve profitability in different market environments. This success underscores the efficacy of their teaching approach and mentorship.

Expert Mentor: Enrollees at Asia Forex Mentor receive mentorship from Ezekiel, a seasoned trader with a proven success rate in stock, crypto, and forex markets. His tailored support helps students confidently tackle the complexities of trading.

Supportive Community: Membership in Asia Forex Mentor includes entry into a collaborative community of traders focused on succeeding in the stock, crypto, and forex arenas. This network encourages sharing and learning together, enriching the educational journey.

Emphasis on Discipline and Psychology: Mastering trading demands mental strength and a disciplined strategy. Asia Forex Mentor emphasizes psychological training, equipping traders to manage their emotions, cope with stress, and make informed decisions.

Constant Updates and Resources: Recognizing the ever-evolving nature of financial markets, Asia Forex Mentor keeps students informed with the latest trends, techniques, and insights. Ongoing access to resources ensures traders stay competitive.

Success Stories: The pride of Asia Forex Mentor lies in its numerous testimonials from students who've drastically improved their trading careers and reached financial autonomy, thanks to their extensive education in forex, stock, and crypto trading.

For those determined to excel in forex, stock, and crypto trading, Asia Forex Mentor stands out as the definitive choice for an educational platform that promises both career success and financial growth. With its all-inclusive curriculum, expert mentoring, practical focus, and supportive network, Asia Forex Mentor equips aspiring traders with the necessary expertise and support to become proficient in the diverse landscape of financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Range Market Review

In conclusion, the team of trading experts at Dumb Little Man has conducted a thorough review of Range Market, revealing a platform with significant strengths but also areas that warrant caution. Range Market shines with its wide array of account types, high-leverage options, and the absence of deposit and withdrawal fees, making it an attractive choice for traders seeking flexibility and cost-efficiency in their trading endeavors.

However, potential users should be aware of the limited regulatory oversight and the narrow range of CFD offerings. The lack of a live chat feature for immediate customer support and inactive social media profiles may also affect the broker's accessibility and responsiveness to trader inquiries and support needs.

Balancing these considerations, Range Market presents itself as a broker worth considering for traders who prioritize high leverage and cost-effective trading conditions. Yet, the importance of due diligence cannot be overstated, particularly regarding regulatory protections and the broker's fit with your trading requirements and strategies.

>> Also Read: M4Markets Review 2024 with Rankings By Dumb Little Man

Range Market Review FAQs

What account types does Range Market offer?

Range Market offers a variety of account types to cater to different trading needs and preferences. These include Classic, Premium, VIP, and PRO accounts. Each account type varies in terms of leverage, minimum deposit, spread, and maximum trade size, allowing traders to choose the one that best suits their trading strategy and experience level.

Is Range Market regulated?

Range Market is registered with the Financial Services Authority of Saint Vincent and the Grenadines (SVGFSA). However, it's important for traders to note that SVGFSA registration does not equate to comprehensive regulatory oversight. This means that while Range Market operates under a recognized financial authority, it does not receive the same level of regulation as brokers licensed by more stringent regulatory bodies.

Can I trade cryptocurrencies with Range Market?

Range Market primarily focuses on Forex and CFD trading. While it offers a wide selection of currency pairs and high leverage, its offerings in terms of cryptocurrencies might be limited compared to brokers that specialize in or have a broader range of crypto assets. Traders interested in cryptocurrency trading should verify the currently available options directly with Range Market or consider brokers with a stronger emphasis on crypto trading.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.