OANDA Review 2024 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 10, 2024 • Fact checked by Dumb Little Man

OANDA Review

Forex brokers play a crucial role in the foreign exchange market. They act as intermediaries, helping both novice and experienced traders execute transactions. OANDA stands out in this space, offering innovative features along with competitive commissions and spreads. The broker aims to make Forex trading accessible and user-friendly, appealing to a wide range of traders.

A comprehensive review of OANDA is presented in this article, with a focus on both its benefits and drawbacks. Compiled by Dumb Little Man's trade experts and grounded in actual customer reviews, our objective is to offer a comprehensive assessment. We will discuss account options, deposit and withdrawal processes, and commission arrangements.

What is OANDA?

Reputable FX and CFD trading platform OANDA has been operating for over 25 years. The platform gives traders access to a range of markets, such as currencies, bonds, indices, and commodities. A vast array of instruments can be matched by traders with their investment goals and strategies.

It is formally registered with OANDA Corporation as a Retail Foreign Exchange Dealer and Futures Commission Merchant. It is regulated by the Commodity Futures Trading Commission and a member of the National Futures Association.

With additional regional offices located in significant financial hubs including Singapore, London, and Tokyo, the corporation has its headquarters in New York City. Regardless of experience level, OANDA, which is renowned for its creativity, focuses on giving traders the tools and resources they require. This makes it possible for them to thrive in the very competitive CFD and forex trading sectors.

The primary goal of OANDA is to provide a trustworthy, transparent, and equitable trading environment. The platform is dedicated to meeting the demands of its users and offers competitive trading conditions. These consist of flexible leverage choices, no commission fees, and narrow spreads. OANDA also offers a range of trading platforms and tools aimed at effective strategy development and risk management.

Educational support is another cornerstone of OANDA’s services. The broker offers an extensive knowledge base, a trading academy, and varied customer support options. These educational resources are designed to help traders at all levels succeed in their trading endeavors.

Safety and Security of OANDA

Safety and security are pivotal when selecting a forex broker. OANDA is regulated by the Financial Conduct Authority (FCA), one of the most reputable financial authorities. This regulatory oversight adds a layer of credibility and safety to the platform. The information provided here is backed by thorough research from Dumb Little Man.

OANDA uses SSL encryption to further safeguard traders. The platform's technology guarantees the security of traders' financial and personal information.

Additionally, the broker segregates the funds of traders. As a result, OANDA provides an additional degree of financial security by keeping traders' funds apart from its own operating funds.

It's crucial to remember that OANDA does not provide protection against negative balances. This implies that traders can end up losing a larger amount of money than they first deposited.

Furthermore, OANDA might give outside service providers access to the financial and personal data of traders. The purpose of this sharing is to make it easier to provide services to its clients. This is something to keep in mind for traders who are thinking about using OANDA as their platform.

Sign-Up Bonus of OANDA

In the competitive world of trading CFDs and Forex, brokers often offer incentives to attract new traders. OANDA provides a Sign-Up Bonus to entice newcomers. The process is straightforward: open an account and make an initial deposit to claim the bonus.

Based on the amount placed, the bonus structure is tiered. A US$500 bonus is awarded for a deposit of at least US$1,000, and a US$5,000 bonus is awarded for a deposit of US$50,000. It's important to remember that in order to take full use of the bonus offers, minimum trade volumes must be reached.

With additional funds to explore the platform and maybe increase gains, this bonus option makes OANDA a more appealing broker.

[wptb id="129657" not found ]Minimum Deposit of OANDA

When selecting a forex broker, one of the most important considerations is the Minimum Deposit needed. OANDA distinguishes itself by allowing traders with different levels of capital to use its non-standard accounts with a mere $1 minimum deposit. More people can enter the trading world without being constrained by money because to this flexibility.

Traders can fund their OANDA account with up to US$9,000 (or the equivalent amount in another currency). Those who want to trade with bigger sums have more room thanks to this higher cap. It's a feature that can appeal particularly to traders of all skill levels.

OANDA Account Types

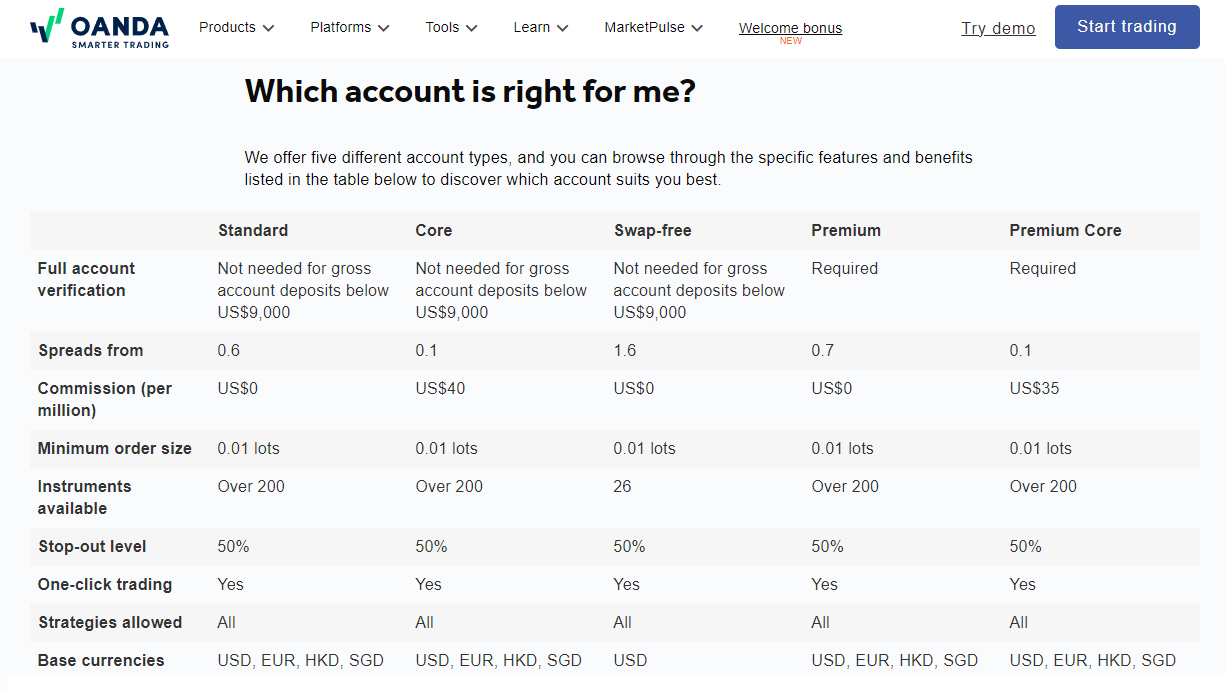

For a profitable trading experience, selecting the appropriate account type is crucial. To accommodate a range of trading requirements and tastes, OANDA provides a variety of account kinds. After thorough research and testing by our team of experts at Dumb Little Man, here are the account types you can choose from:

Standard Account

- Basic account type

- Competitive spreads from 1.1 pips

- No commission fees

- Access to all trading instruments

- Minimum deposit: $1

Core Account

- Focuses on low trading costs

- Ultra-tight spreads from 0.2 pips

- No commission fees

- Minimum deposit: $1

Swap-Free Account

- Complies with Shariah law

- No rollover charges or interest

- Floating spread starts from 1.6 pips

- Minimum deposit: $1

Premium Account

- For traders seeking extra features

- Lower spreads starting at 0.8 pips

- Priority customer support

- Access to premium research and analysis tools

- Minimum deposit: $20,000

Premium Core Account

- Most exclusive type

- Tightest spreads starting at 0.2 pips

- Access to premium research tools

- Priority customer support

- Minimum deposit: $20,000

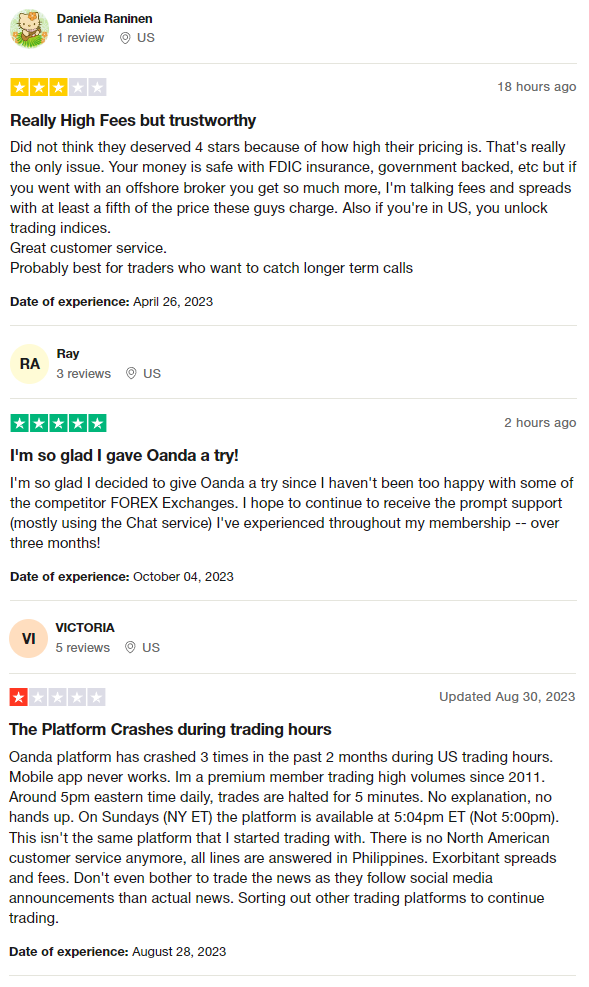

OANDA Customer Reviews

Customer feedback on OANDA presents a mixed picture. On one hand, traders commend the platform's great customer service and prompt support, especially via chat. OANDA is often considered suitable for those interested in long-term trading. On the other hand, there are criticisms about high pricing, including fees and spreads.

Some users have experienced platform crashes and have raised concerns about a lack of North American customer service. Notably, there are comments about the platform's unexplained trade halts and OANDA platform issues. This diverse range of reviews suggests that while OANDA has strong points, potential traders should also be aware of its limitations.

OANDA Fees, Spreads, and Commissions

When it comes to Fees, Spreads, and Commissions, OANDA offers several advantages. Known for its tight spreads, OANDA is a top pick for traders focused on reducing trading costs. The spreads are variable, adjusting to market conditions, but remain competitive. For instance, the average spread on EUR/USD hovers around 0.9 pips, noticeably lower than many competitors.

Another advantage is the absence of commission fees on trades. This cost-saving feature is a big plus for many traders. However, it's important to note that OANDA has a minimum spread value per trade of $11.

OANDA employs a “core pricing” model to ensure traders get the best bid/ask prices. This guarantees that the spreads remain competitive even during volatile market periods. It adds an extra layer of cost-efficiency, helping traders to steer clear of unexpected fees.

Deposit and Withdrawal

OANDA provides a wide variety of alternatives for deposits and withdrawals. A trading expert at Dumb Little Man who evaluated these capabilities claims that you can use PayPal, Skrill, credit or debit cards, and bank wire transfers to deposit and withdraw money. Depending on the method used, different costs and processing periods apply. In general, electronic payment methods such as PayPal and Skrill offer more affordable and faster transactions as compared to bank wire or card methods.

OANDA has a distinctive withdrawal charge schedule. When making the first withdrawal of the month by an electronic mode or a bank wire transfer, the platform does not impose any costs. However, there is a $15 commission fee for any additional withdrawals made within that month. Traders should also be aware of any additional fees that can be assessed by the payment processor or the receiving bank. Depending on the card issuer, a fee of up to 1.5% of the withdrawal amount may be charged for credit or debit card withdrawals.

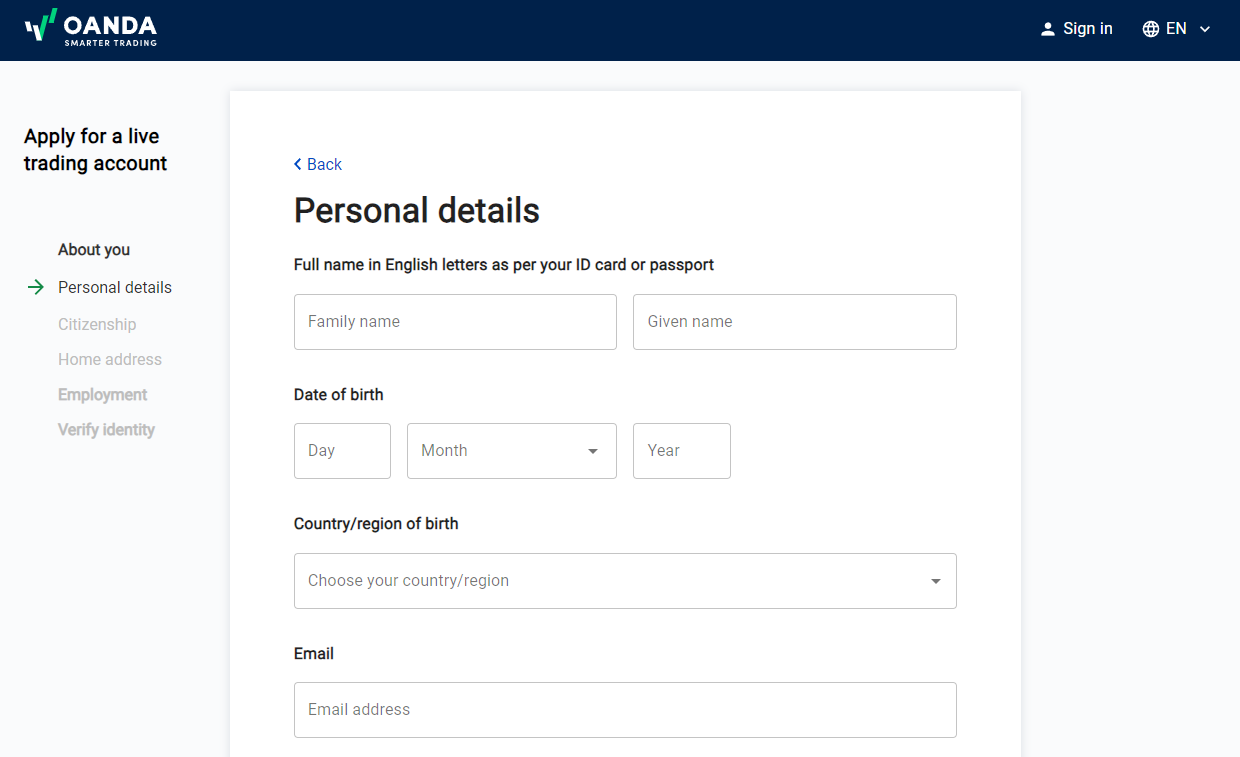

How to Open an OANDA Account

- Visit the OANDA website and decide which account type fits your needs, such as individual, joint, corporate, or trust accounts.

- Fill in the required personal information like name, address, phone number, and email.

- Submit valid identification, which could be a passport or driver's license.

- Choose your preferred trading platform from options like OANDA’s proprietary platform or MetaTrader 4.

- Wait for account approval from OANDA.

- Once approved, fund your account using options like bank transfer, credit/debit card, or PayPal.

- Verify your identity to comply with anti-money laundering laws.

- Submit additional documents like a recent utility bill or bank statement for verification.

- After verification, you are ready to start trading on your chosen platform.

OANDA Affiliate Program

The competitive affiliate program that OANDA provides is intended to reward partners that bring new traders to the site. Up to USD 600 can be earned by partners for each competent trader in emerging markets. With the program's competitive multi-tiered reward system and clear conditions, affiliates can grow their income as they recommend more customers.

The OANDA platform guarantees that affiliates receive sufficient assistance through assigned relationship managers and round-the-clock customer service. Access to OANDA's MARKETPULSE, a resource for Forex market insights, is also provided under the program. For FX goods, the ladder rebate structure is based on progressive volume tiers and begins at US$10/million. As a result, partners can establish a reliable revenue foundation.

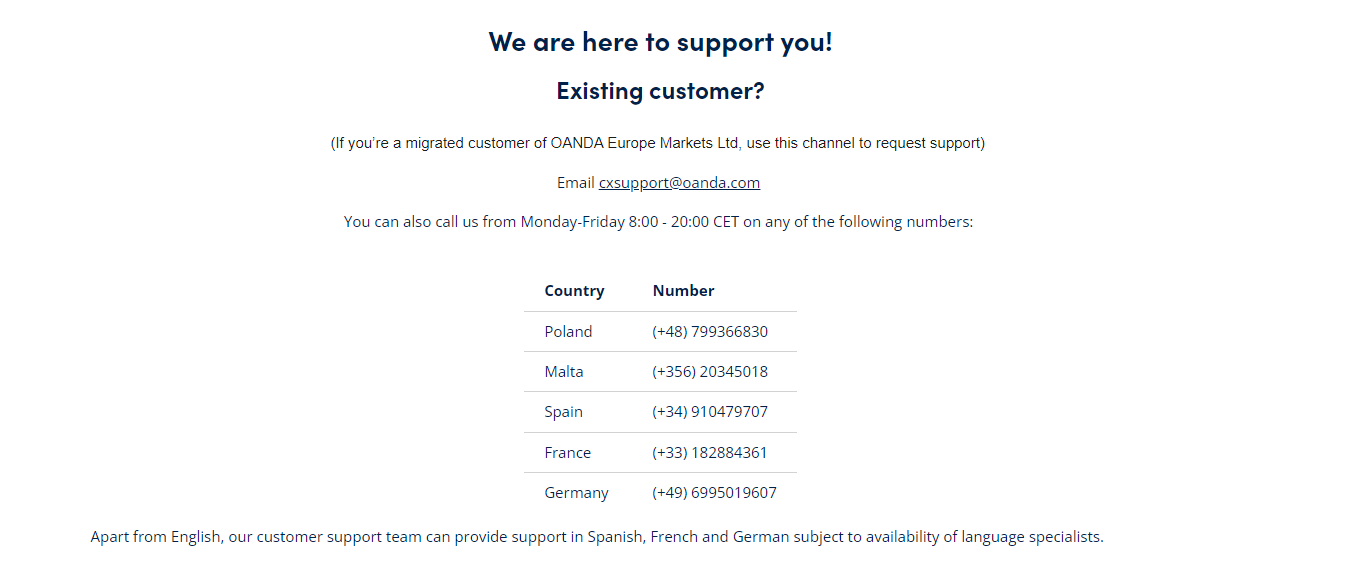

OANDA Customer Support

OANDA offers a variety of customer support channels to guarantee prompt and effective assistance. Drawing from Dumb Little Man's experience, the platform's support staff is reachable by phone and email around-the-clock, providing traders with prompt assistance when needed.

The company also provides a comprehensive online help center with video training, trading guidelines, and FAQs. This is an excellent resource for traders who are eager to learn about the features and trading tools offered on the platform. Outstanding for its commitment to transparency and accountability, OANDA's customer service offers knowledgeable agents that deliver prompt, courteous assistance.

By making public customer service performance metrics such as average wait times and satisfaction ratings, OANDA further builds its credibility. Because of this transparency, traders feel more confident and the platform is held accountable for offering top-notch customer support.

Advantages and Disadvantages of OANDA Customer Support

[wptb id="129659" not found ]OANDA vs Other Brokers

#1. OANDA vs AvaTrade

OANDA is known for its flexible trading options and user-friendly interface. AvaTrade excels in diversity of financial instruments and has a strong global presence but doesn't cater to U.S traders.

Verdict: OANDA is better for U.S-based traders and those who prefer an easy-to-use platform. AvaTrade is better for those seeking diverse trading instruments.

#2. OANDA vs RoboForex

OANDA offers a simplified trading experience, while RoboForex shines in technological innovation and a wide array of asset classes. RoboForex also offers ContestFX, adding a gamification element.

Verdict: OANDA is preferable for traders seeking straightforwardness. RoboForex is the go-to for those who appreciate technological sophistication and variety.

#3. OANDA vs FXChoice

OANDA caters to both novice and experienced traders with its flexible trading conditions. FXChoice focuses more on experienced traders, offering benefits like a loyalty program but has a limited demo account validity.

Verdict: OANDA is better for a broader range of traders, while FXChoice is suited for experienced traders with high trading volumes.

[wptb id="129660" not found ]Choose Asia Forex Mentor for Your Forex Trading Success

For those aiming for a successful career in forex, stock, or crypto trading, Asia Forex Mentor is the prime choice for high-quality education. Helmed by Ezekiel Chew, a seven-figure trader, the platform offers unique advantages over other educational services. Here's what sets them apart:

Comprehensive Course: Asia Forex Mentor offers a detailed curriculum that spans forex, stock, and crypto trading, equipping you to excel in diverse financial markets.

Strong Track Record: With a history of developing profitable traders, Asia Forex Mentor's success rate validates the effectiveness of its education and mentorship.

Expert Mentorship: Learning from Ezekiel provides the benefit of personalized guidance from a trader who has achieved remarkable success in multiple markets.

Supportive Community: Membership at Asia Forex Mentor involves joining a collaborative network of traders, enhancing your learning experience through shared insights.

Emphasis on Psychology: Besides trading skills, the platform focuses on mindset and discipline to help traders manage emotions and make informed decisions.

Current Resources: Asia Forex Mentor keeps you updated with the latest market trends through regular updates and pertinent resources.

Testimonials of Success: Numerous case studies show how students have gained financial freedom through the platform's robust educational offering.

In a nutshell, Asia Forex Mentor is the top recommendation for those looking for a comprehensive trading education. It offers an all-inclusive package: from expert mentors to a collaborative community and ongoing resources, all aimed at molding aspiring traders into industry professionals.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: OANDA Review

OANDA is a cost-effective option for traders due to its cheap spreads and lack of commission fees, according to the analysis provided by the specialists at Dumb Little Man. probable customers should be aware of its restricted customer service alternatives and probable extra costs for services like overnight stays and certain withdrawal methods.

>> Also Read: Valutrades Review By Dumb Little Man

OANDA Review FAQs

Is OANDA hood for beginners?

OANDA is relatively user-friendly with a range of educational resources. However, its fee structure may be more suitable for experienced traders. New traders should weigh these factors before signing up.

Does OANDA offer customer support on weekends?

No, OANDA's customer support is available 24/5, meaning it's closed during the weekends. This could be a limitation if you trade or encounter issues outside standard weekdays.

Are there hidden dees at OANDA?

OANDA is transparent about its fees, which include competitive spreads but no commission fees. Additional charges may apply for overnight positions and multiple withdrawals within a month. Always read the fine print to understand the complete fee structure.

[wptb id="129661" not found ]Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.