NS Broker Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.5 1.5/5 | 100th  |  |

| Evaluation Criteria |

|---|

Dumb Little Man's team, consisting of financial experts, seasoned traders, and private investors, employs a specialized algorithm to evaluate brokerage services comprehensively. Their review focuses on key elements like:

|

NS Broker Review

Forex brokers play a crucial role in the financial markets, serving as intermediaries between traders and the global currency markets. Their services enable individuals and institutions to buy and sell foreign currencies and other financial instruments. NS Broker, an ECN broker incorporated in Malta, stands out in this competitive industry. The company offers a platform for online trading of CFDs on a variety of instruments including currencies, stocks, indices, cryptocurrencies, energies, and precious metals.

This comprehensive review aims to provide a detailed evaluation of NS Broker. We focus on highlighting its unique features and possible limitations. Our approach is to offer essential information about the broker, covering aspects like account types, deposit and withdrawal processes, commission structures, and more. By blending expert analysis with actual trader feedback, this review is designed to give you a balanced view, aiding in deciding whether NS Broker is the right choice for your trading needs.

What is NS Broker?

NS Broker is a well-established ECN broker, incorporated in Malta and operational since 2011. It operates under the stringent regulations of the Malta Financial Services Authority (MFSA). This broker is a division of NSFX Ltd., a notable investment firm regulated by five European commissions, ensuring a high standard of financial compliance and security.

The company specializes in providing online trading services for Contract for Differences (CFDs). Clients of NS Broker have access to a diverse range of trading instruments, including currencies, stocks, indices, cryptocurrencies, energies, and precious metals. This variety caters to a wide spectrum of trading interests and strategies, making NS Broker a versatile choice for traders.

Safety and Security of NS Broker

NS Broker, managed by NSFX Ltd., ensures safety and security in Forex trading. This information, gathered from a thorough research by Dumb Little Man, highlights key aspects of the broker's regulatory compliance. NS Broker is licensed under No. IS/56519 by the Malta Financial Services Authority (MFSA), a body known for its strict monitoring of broker operations and insistence on transparent financial reporting.

In line with regulatory requirements, trader funds are rigorously separated from the company’s assets. These funds are held in independent bank accounts, ensuring their safety and integrity. This separation is crucial for protecting client investments.

Negative balance protection is another vital feature offered by NS Broker. It shields clients from losing more than their account balance. Additionally, the broker adheres to the Markets in Financial Instruments Directive (MiFID), further solidifying its commitment to regulatory standards.

NS Broker's participation in a compensation fund provides an additional layer of security for traders. This membership offers a safety net in the unlikely event of financial discrepancies. The broker also implements limited leverage for both retail and professional traders, aligning with responsible trading practices.

Pros and Cons of NS Broker

Pros

- ECN network trade execution

- Diverse CFD options

- Regulated by six authorities

- Up to 100 multi-currency accounts

- Quotes from major liquidity providers

- No deposit/withdrawal fees

- Low spreads from 0.3 pips

Cons

- Only ECN accounts

- No investment programs

- Limited to MetaTrader 5

Sign-Up Bonus of NS Broker

As of the current date, NS Broker does not offer a sign-up bonus for new clients. This is a straightforward approach, focusing on the broker's comprehensive trading services and features rather than promotional incentives. It's important for potential traders to note this, as bonuses can often be a significant factor in choosing a broker.

Minimum Deposit of NS Broker

The minimum deposit requirement for NS Broker is set at $250. This amount is relatively standard in the industry, striking a balance between accessibility for new traders and seriousness for more experienced ones. This initial deposit is crucial for traders to start their journey in Forex and CFD trading with NS Broker.

NS Broker Account Types

Based on thorough research by our experts at Dumb Little Man, NS Broker offers a streamlined account structure tailored for MT5 users. Here's a clean and organized list of the account types available:

Real Account

- Type: ECN account for retail and professional trading

- Minimum Deposit: $250

- Currencies: Accounts can be opened in USD, EUR, GBP

- Spreads: Floating, starting from 0.3 pips for EUR/USD

- Commission: $8 per lot (including $4 for opening and $4 for closing positions) for currencies, metals, and energies

- Leverage for Retail Traders:

- Currency pairs: up to 1:30

- Gold, silver, oil, indices: up to 1:20

- Stocks: up to 1:5

- Cryptocurrencies: up to 1:2

- Leverage for Professional Traders:

- Currency pairs: up to 1:100

Demo Account

- Purpose: To test trading conditions without financial risk

- Virtual Funds: $100,000

- Expiry: None

Each client has the flexibility to open up to 100 trading accounts in the three aforementioned currencies. This setup allows for a customized trading experience, catering to both novice and experienced traders. The demo account, with a generous virtual fund, is an excellent way for traders to familiarize themselves with NS Broker's platform and conditions.

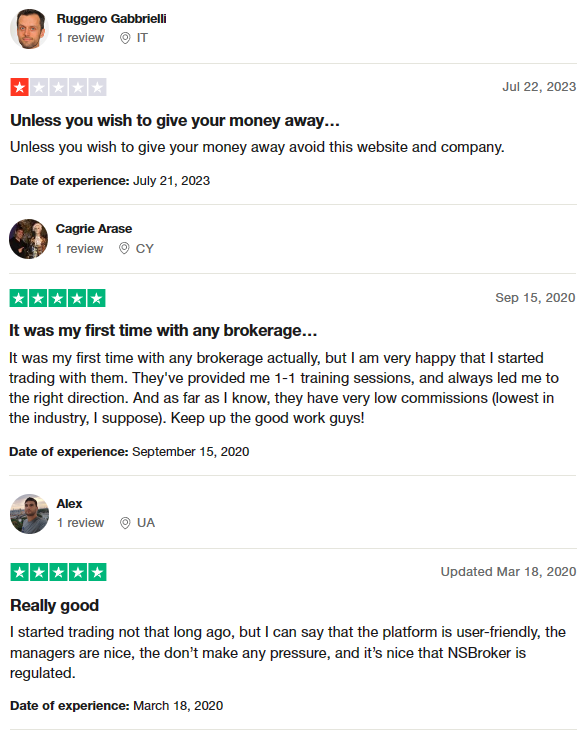

NS Broker Customer Reviews

NS Broker customer reviews offer a diverse range of experiences. Some clients express dissatisfaction, warning against using the service and equating it to losing money. However, others have had a positive first-time experience with the broker, highlighting features like 1-1 training sessions, low commission rates which they believe could be the lowest in the industry, and commendable customer support.

New traders particularly appreciate the user-friendly platform, the approachable and non-pressuring nature of the managers, and the reassurance provided by NS Broker being a regulated entity. This mixed feedback suggests that while NS Broker has areas of strength, particularly for beginners, there may be aspects that need improvement or might not meet the expectations of all traders.

NS Broker Fees, Spreads, and Commissions

NS Broker is notable for its fee structure in the Forex and CFD trading market. Importantly, the broker does not charge any fees for deposits or withdrawals, which is a significant advantage for traders.

The primary trading cost comes from the spreads, which are floating and vary depending on the asset and current market conditions. This means the spread, or the difference between the buying and selling price, can change based on market volatility and liquidity.

In addition to spreads, NS Broker implements specific trading commissions. For trades involving currency pairs, metals, and energies, there is an $8 commission per lot traded. This fee is split between the opening and closing of a position. For index and stock CFDs, traders incur a commission of 0.05% of the trade value. In the case of cryptocurrency trades, the commission is slightly higher at 0.5% of the trade value.

Another fee to consider is the swap fee, which is a commission charged for rolling over a position to the next day. This is common in Forex trading and varies based on the financial instrument and market conditions. These varied fees and commissions are crucial considerations for traders when calculating potential profits and costs associated with trading on NS Broker's platform.

Deposit and Withdrawal

NS Broker, as tested and reported by a trading professional at Dumb Little Man, has streamlined its deposit and withdrawal processes. The financial department at NS Broker is efficient, processing withdrawal requests within one working day. This prompt service is a crucial aspect for traders who prioritize quick access to their funds.

For funding and withdrawing money, traders have multiple options. These include Visa and Mastercard debit/credit cards, bank accounts, and electronic wallets like Neteller and Skrill. The timeframe for crediting funds varies: wire transfers take up to two working days, while transactions via cards and electronic payment systems (EPS) are completed within one working day.

Notably, NS Broker does not charge a withdrawal fee. However, it's important to note that Skrill and Neteller impose a 2.9% fee on transactions. The fees for wire transfers and card withdrawals are determined by the respective financial institutions. Additionally, withdrawals can be made in US dollars, Euro, and British pounds, offering flexibility to traders in managing their funds in different currencies.

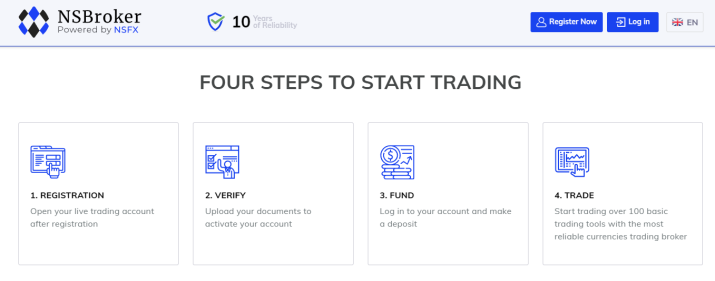

How to Open an NS Broker Account

- Visit NS Broker‘s official website.

- Click Open an Account in the upper right part of the page.

- Fill in the registration form with your personal details and select an account currency.

- Tick the box to accept the official conditions.

- Click on the Register button to complete registration.

- Log into your Personal Account using your email and password.

- In your Personal Account, upload verification documents.

- Open a new trading account within your Personal Account.

- Make a deposit to start trading.

NS Broker Affiliate Program

NS Broker offers an Affiliate Program that operates on a CPA (Cost Per Action) model. In this program, a partner earns compensation based on specific actions taken by clients they have referred. The unique aspect of this program is the payment structure, where the referrer can earn up to 50% of the spread and trading commissions that their referred new clients incur.

NS Broker Customer Support

NS Broker‘s Customer Support is evaluated based on the experience of Dumb Little Man. The broker offers multiple avenues for clients to seek assistance. Clients can call the numbers listed in the Contact Us section for direct verbal communication. This option is ideal for immediate and detailed queries.

For more instantaneous support, users can message the operators through the online chat, available on both the website and within the Personal Account. This feature provides a convenient way to get quick responses to urgent issues. Additionally, clients can ask questions by filling out the feedback form on the website, which is suitable for less urgent inquiries.

Another method of contact is sending an inquiry via email to [email protected]. This channel is best for detailed inquiries that may require thorough explanations or attachments. Overall, NS Broker's customer support system is designed to be accessible and responsive, catering to a wide range of client needs and preferences.

Advantages and Disadvantages of NS Broker Customer Support

| Advantages | Disadvantages |

|---|---|

NS Broker vs Other Brokers

#1. NS Broker vs AvaTrade

NS Broker focuses on ECN trading, limited to MT5, and offers tight spreads. On the other hand, AvaTrade offers a wider range of financial instruments (>1250), operates in multiple global jurisdictions, and is heavily regulated. It also provides services to a large customer base (over 300,000) but excludes US traders.

Verdict: AvaTrade is better for traders seeking a broad range of instruments and those who value heavy regulation. NS Broker is more suitable for traders focusing on ECN trading with MT5.

#2. NS Broker vs RoboForex

NS Broker specializes in ECN accounts with a focus on major trading instruments. Meanwhile, RoboForex offers a vast selection of over 12,000 trading options across eight asset classes and a variety of platforms, including MetaTrader, cTrader, and RTrader. They are also known for their personalized trading conditions and contests for demo account holders.

Verdict: RoboForex stands out for traders seeking diversity in trading options and platforms. NS Broker is more aligned with traders who prefer a focused approach to ECN trading.

#3. NS Broker vs FXChoice

NS Broker is an ECN broker with a straightforward account structure, focusing on major trading instruments. In contrast, FXChoiceis known for a strong commitment to customer service, offering both classic and professional ECN accounts. However, it primarily caters to experienced traders with no cent accounts or zero spreads.

Verdict: FXChoice is preferable for experienced traders seeking a variety of account types and a strong customer focus. NS Broker is more suitable for those looking for a simpler, more direct ECN trading experience.

Choose Asia Forex Mentor for Your Forex Trading Success

For those eager to forge a successful career in forex trading with substantial financial returns, Asia Forex Mentor is the leading choice for comprehensive forex, stock, and crypto trading education. The heart of Asia Forex Mentor is Ezekiel Chew, known for his profound influence on trading institutions and banks. Notably, Ezekiel's track record includes consistent seven-figure trades, distinguishing him significantly from other educators in the sector. The following points underscore why we highly recommend them:

Comprehensive Curriculum: Asia Forex Mentor delivers a thorough educational program spanning stock, crypto, and forex trading. This curriculum is meticulously designed to provide budding traders with essential knowledge and skills for success in various markets.

Proven Track Record: Asia Forex Mentor's reputation is solidified by its history of nurturing consistently profitable traders in diverse markets, showcasing the effectiveness of their educational techniques and mentorship.

Expert Mentor: Students at Asia Forex Mentor receive insights and guidance from Ezekiel, a mentor with proven success in stock, crypto, and forex trading. His personalized mentoring helps students confidently tackle market complexities.

Supportive Community: Being part of Asia Forex Mentor means joining a community of traders focused on stock, crypto, and forex market success. This network encourages collaboration, sharing ideas, and learning from peers, enhancing the learning process.

Emphasis on Discipline and Psychology: Trading success requires a disciplined mindset. Asia Forex Mentor emphasizes psychological training to aid traders in managing emotions, handling stress, and making informed decisions.

Constant Updates and Resources: Recognizing the ever-changing nature of financial markets, Asia Forex Mentor keeps students updated with the latest trends, strategies, and insights, providing ongoing access to critical resources.

Success Stories: Asia Forex Mentor is proud of its numerous success stories, where students have dramatically improved their trading careers and achieved financial independence through their in-depth education in forex, stock, and crypto trading.

Asia Forex Mentor stands out as the foremost option for those seeking an exceptional forex, stock, and crypto trading course, aimed at nurturing a lucrative career and financial success. Its exhaustive curriculum, experienced mentors, practical approach, and strong community support equip aspiring traders with the tools and guidance to evolve into successful professionals in various financial domains.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

>> Also Read: Fullerton Markets Review with Rankings 2025 By Dumb Little Man

Conclusion: NS Broker Review

Based on the analysis by the team of trading experts at Dumb Little Man, NS Broker stands out as a noteworthy player in the Forex and CFD trading arena. The broker's commitment to offering ECN trading and diverse CFD options is commendable, providing traders with access to a range of markets including currencies, stocks, and cryptocurrencies. The fact that NS Broker is regulated by six international authorities further enhances its credibility, offering traders a sense of security and trust.

However, potential traders should be aware of certain limitations. The exclusive offering of ECN accounts means NS Broker may not be the best fit for beginners or those looking for standard or cent accounts. Additionally, the platform's focus is primarily on active traders, which might not align with the interests of those seeking passive investment options. The limited platform choice, restricted to MetaTrader 5, might also be a constraint for some traders.

NS Broker Review FAQs

What types of accounts does NS Broker offer?

NS Broker primarily offers an ECN account suitable for both retail and professional trading. Traders can open up to 100 accounts in three different currencies: USD, EUR, and GBP. Each account type comes with its own set of features, including tight floating spreads and various leverage options. Additionally, for those looking to practice or get a feel of the broker's platform, NS Broker provides a demo account with virtual funds.

Are there any deposit or withdrawal fees charged by NS Broker?

NS Broker is notable for not charging any deposit or withdrawal fees, making it a cost-effective option for traders. However, it's important to note that while NS Broker doesn't impose charges, there may be fees applied by the payment service provider, especially when using services like Skrill or Neteller. Traders should consider these potential external costs when managing their funds.

How does NS Broker ensure the safety and security of its clients' funds?

Safety and security are paramount at NS Broker. The broker adheres to strict regulatory standards, being licensed under the Malta Financial Services Authority (MFSA). Furthermore, client funds are kept separate from the company's assets in independent bank accounts, a practice known as fund segregation. This ensures that the clients' investments are protected. NS Broker also offers negative balance protection, safeguarding traders from losing more than their account balance.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.