NordFX Review 2024 with Rankings By Dumb Little Man

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before we get to the detailed Nordfx review, it is quite important to first of all discuss the criteria that we used to do this review. These are some of the factors we looked for when ranking the forex trading broker in relation to other firms out there. Check them out below:

|

NordFX Review

Are you interested in trading the financial markets? Do you have the skills and training needed to do forex trading and profit from it? Well, if the answer to these questions is a definite yes, then the only thing you need to make things happen for you is a reliable and high-quality forex trading brokerage company. Here is where NordFX comes in.

The broker is one of the most reliable forex brokers out there and comes with a strong track record of excellence. It offers several trading accounts, a vast range of trading instruments, and some of the most advanced trading platforms out there. NordFX will be the focus of our review today.

We will give you detailed info on what the broker is about, how it works, including minimum deposit requirements and trading platforms, and some of the pros and cons associated with the trading service. We will also talk about Nordfx's regulatory status by the Vanuatu financial services commission and give you some additional practical tips that you can use to profit from the forex market. Keep reading to get all the details.

What is NordFX?

NordFX is an illustrious and notable international forex broker that has been offering trading services to customers around the world for the best part of 15 years. The company was founded back in 2008, and ever since, it has grown to become a big player in the forex broking business. According to info on the website, so far, NordFX has managed to register over 1.7 million customers in over 190 countries around the world. This is a huge customer base!

NordFX has also invested heavily in building some of the best trading platforms. In fact, the trading platforms nordfx offers cut across various options. On the one hand, you will get access to meta trader 4 and a series of mobile trading applications that will allow you to trade on the go. NordFX also offers trading success tools, including automated trading solutions targeting more advanced trading strategies.

This firm is also categorized as a regulated broker. The Vanuatu financial services commission, the Cyprus securities and exchange commission, and others regulate it. You also get relatively better fees, a decent Nordfx trading platform, secure payment method options, and a superb variety of assets to buy and sell.

Safety and Security of NordFX?

Safety is indeed a big part of any brokerage service. In fact, it takes a lot of effort to make sure that trading conditions for retail investor accounts are secure enough for traders to feel confident. The good news is that NordFX has implemented several key measures to ensure its investors' safety and security.

For starters, the broker uses segregated accounts for customer funds. This means that all the money that you send here will be stored in a different account and will not be used for day to day running of NordFx. In addition to this, all the customer funds are stored in some of the leading banks in the world with huge liquidity. In other words, when you start trading forex with this firm, you will be able to get money and withdrawals in no time.

You will also note that NordFX uses some of the most secure and encrypted technology, especially when it comes to making deposits and withdrawals. This ensures that your financial data is not threatened when trading forex or depositing money with a bank transfer. There are also additional security measures that are generally expected with modern forex brokers.

For instance, there are regular security audits to ensure that everything is running safely. The broker also uses some of the most advanced cyber security systems out there so that you don't have to worry when you trade forex pairs with this provider. And finally, NordFX is a regulated broker. This means that it has to adhere to certain rules and standards that protect the customer against any exploitation. Besides, you will also get negative balance protection for retail traders and institutional ones.

Sign Up Bonus of NordFX

Unlike other brokers out there, NordFX does not have any signup bonuses. In fact, we scoured the depths of the internet and could not find any info on this. We even looked at some of the reviews left by customers who have traded currency pairs with this provider and still did not see any info about sign-up bonuses.

But this is not necessarily a bad thing. After all, NordFX allows you to deposit as low as $10 and trade these small amounts using its micro account types. This means you don't need too much capital to get started. The broker also has relatively small fees, including low withdrawal fees as well. You will be able to maximize your profits even if you do not get a signup bonus.

But even with these factors, there is no doubt most experienced traders will tell you that a signup bonus is always welcomed. Remember, the more capital you have to trade, the more flexible you will be in your trading strategy. In that case, you could see this as more of a downside.

Minimum Deposit of NordFX

At the moment, the minimum deposit requirement for people who want to trade with NordFX is $10. But this only applies to the basic starter Fix account. With just $10, you will be able to access the online trading platforms and online payment methods that the firm offers.

Now, typically, most FX brokers will have a very minimal deposit requirement. This is often done to ensure that retail traders can start as small as possible. But the Nordfx regulated trading approach gives you so much flexibility by ensuring you can trade on a micro account. Besides, the $10 minimum deposit requirement is one of the lowest of any FX broker on our list. It is literally close to a no-minimum deposit requirement.

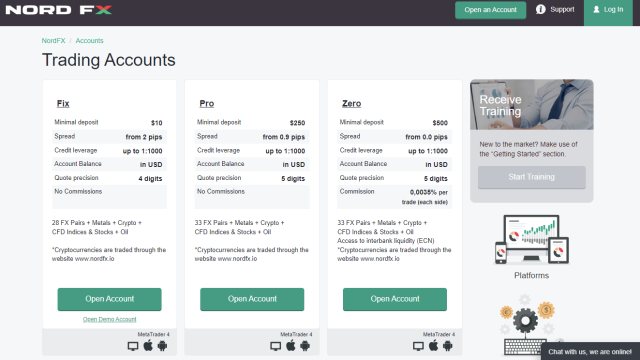

Account Types

One thing that sets NordFX apart is the great variety of account types that it offers. Whether you are looking for managed accounts, a defi savings account, or a simple micro account that suits your budget and trading hours, this online broker will sort you out. So, there are three main accounts to look forward to here and one savings account. Here is the full list:

#1. The Fix Account

This account is the most basic of the three that are on offer at NordFX. It comes with several key features. First, you get more than 30 trading instruments, including currency pairs and other CFDS. The account is only available in USD too. This means that you can only trade in dollars. You will also be able to get a copy trading tool to use if you are a beginner, and if you are experienced enough, you can integrate automated trading tools in the fix account.

#2. The Pro Account

The second account option that you can use here is the Pro Account. This one is quite intermediate and would be ideal for both professional traders and newbies. The account also comes with over 40 tradable assets that cut across currency pairs, metals, CFDs, and so much more. However, please note that the minimum deposit for this account is $250.

In fact, although it is well-agreed that the minimum deposit at this broker is $10, it seems like it depends on the account you are using. Nonetheless, you will be able to get technical support service works and some analytical and mental abilities with added financial analysis with this account. Besides, copy trading and automated trading are also allowed.

#3. Zero Account

If you are looking for more advanced trading accounts, then you should consider the zero account. It comes loaded with an array of impeccable features too. First, you will be able to trade a huge catalog of assets with the account, including some crypto assets and metals too. Max leverage is also offered here, and several payment methods are available for making deposits and withdrawing money. The minimum deposit for this account is around $500, which is high compared to other brokers. You will, however, get algorithmic trading, fast market execution, and copy trading as well.

#4. Savings Account

The savings account is not really a trading account per se. It is simply an option for people who want to earn some interest for their money without dealing with the headwinds of the market. You see, brokers offer leverage to traders. In essence, they basically loan money to traders where they make a slight interest in fees. You can actually contribute to this loan capital by opening a savings account with NordFX. This will allow you to earn a share of the firm's fees when offering leverage to traders.

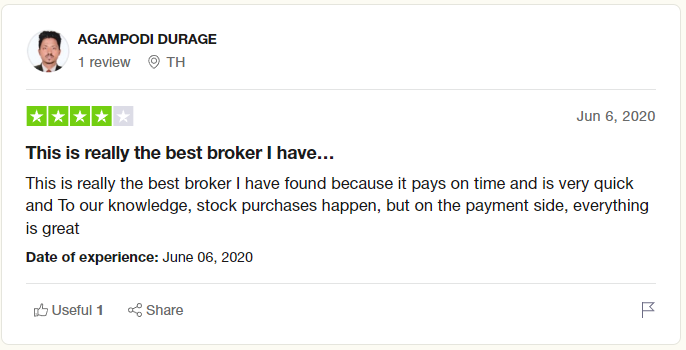

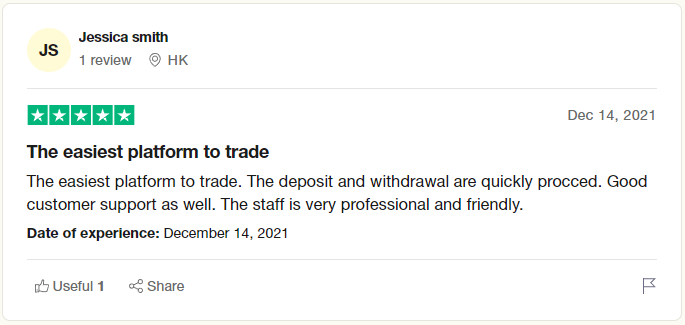

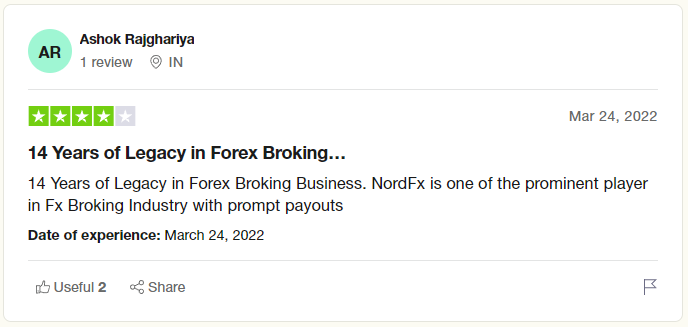

NordFX Customer Reviews

|

|

|

Most of the reviews we have looked at regarding the NordFX broker are quite positive. It seems most users are quite satisfied with the firm, its trading service, and its conduct as well. For starters, there are so many traders who seem pretty happy with the ease of use associated with the firm. Whether it's using the Nordfx platform, opening a trading account, or even executing a trade, the firm has proved to be a reliable broker in the eyes of many of its customers.

Some users also seem to appreciate the legacy and the experience that the firm brings to the table. As noted above, this brokerage company has been offering trading services for 14 years. It has learned so much in that time and worked on fine-tuning its services to meet the highest possible standards.

We have also seen some new and existing clients talk about how quick the trading platform is. And it does not even end there. Some users even say that they are able to make quick withdrawals and deposits while still tracking their trading history with so much ease. Overall, NordFX traders are happy, but there are some areas where the company can improve in the future.

NordFX Spreads, Fees, and Commissions

NordFX bills itself as one of the most reliable and affordable brokers out there. However, although the firm offers an affordable trading environment, the fees are a bit higher than other firms in its category. Now, please keep in mind that there are no standard fees here. How much you pay will often depend on your account type.

For users who are interested in using the basic Fix account, you will pay a fixed spread of 2 pips for currency trading. However, cryptocurrency traders only have to pay a floating spread of about one pip. There is also a minimum deposit requirement of $10, but you don't pay fixed commissions here. All charges are spread-based.

As for the pro account, minimum spreads for all currency pairs start at 0.9 pips. However, you will typically pay 1.2 pips on average based on data provided by NordFX itself. The pro account also requires a minimum deposit of $250, and just like the Fix account, no commissions are charged.

The final trading account is the Zero account. This one is designed for pro traders who often don't need professional portfolio management. According to data from the NordFX website, the account charges a floating spread of 0. However, unlike the other two accounts, where there are no fixed commissions, you will pay 0.0035% for every trade you make here. This is very low compared to other brokers and even some market-maker firms.

Deposit and Withdrawal

The ability to deposit and withdraw money is one of the most important determinants of success for any broker. NordFX has worked quite hard over the years to fine-tune its trading platform to cater to the needs of customers, and one area where the firm is doing really well is withdrawal and deposits.

First of all, you will not be required to pay any deposit fees here. But be aware that you may be required to pay some currency conversion fees if you deposit from a different currency. The withdrawal fees charged will typically depend on the withdrawal method that you are using.

However, we did not see any concrete info on these numbers on the website. From the reviews we can see from other users, it doesn't seem like the withdrawal fees are that much. This allows you to take on the trading journey and enjoy most of your profits.

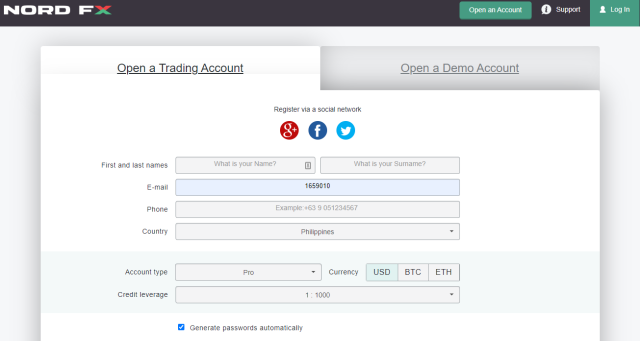

How To Open a NordFX Account – Step-by-Step Guide

If you want to start trading forex with NordFX, or maybe you just want to try out the trading platforms, you can easily open a live account or even a free demo account if you want. Either way, the whole process of opening an account is quite simple and straightforward. Just follow the simple steps below:

- Head over to the main website of NordFX. Keep in mind that there are so many fake websites, so be sure you are on the official site.

- Once you are there, click on the “Open an Account” tab at the top left corner of your screen. It's a large green button, so it should be easy to find it.

- An account application form will now appear on the screen. You must fill in all the required details, including the type of account you want and the max leverage.

- As soon as these details are recorded, NordFX will need you to upload some verification documents to process your account. These ones will take less than 24 hours to be approved.

- The moment your account is approved, you can log into the trading area. Simply use the available NordFX payment methods to fund your account and trade stocks and any other asset that you may deem fit.

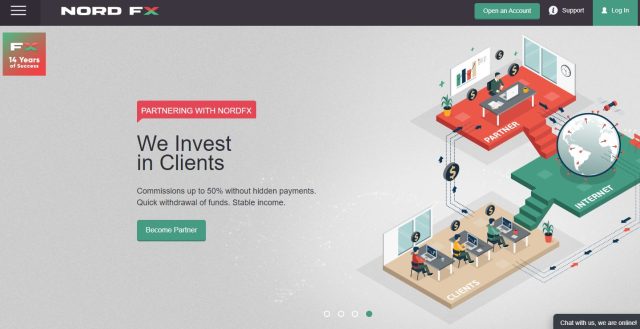

NordFX Affiliate Program

This NordFX review wouldn't be complete if it didn't look at the affiliate program that is offered here. You see, there are many ways to earn and profit from NordFX, and it doesn't have to be on trading alone.

There are also some incredible benefits that you get here. For starters, NordFX pays up to 60% in commissions to its affiliates. This is way higher than anything else out there. In addition to this, you are also going to get instant payouts, fast withdrawal, processing, and so much more.

Besides, NordFX has made it clear that it will work so hard to meet the needs of its clients. The firm has invested heavily in creating an advanced trading apparatus. So, for you as an affiliate, it will be much easier to sell this firm to your audience. So far, NordFX has managed to get nearly 2 million users. It means that the firm is doing something right, so it's an excellent option for affiliates who want to market it.

NordFX Customer Support

Customer support is also a big part of the reasons why so many users have chosen to trade forex with NordFX. Well, the firm has been doing quite well in creating a robust customer support system that ultimately helps enhance the overall user experience. For instance, the firm offers a live chat support feature on its website.

If you have something that needs to be addressed urgently, you can just hit the live chat and get some help. But that is not all. You will also get the option to talk to the support team via phone and seek any assistance you need. Whether you are having issues with opening the account, issues with verification, or maybe the trading platform is not working as you expect, call the support team, and they will be more than happy to help.

There is also email support for folks who may not have urgent issues. However, it takes a bit longer to get a response via email. From the reviews that we have seen, it takes about two days to get a response via email. But despite this, other options exist to reach out and get help.

Advantages and Disadvantages of NordFX Customer Support

The support team and system NordFX has put in place have pros and cons. So, it helps to look at various ways the team does well and some areas that it may need to improve in the future. Here is a breakdown of the pros and cons:

| Advantages | Disadvantages |

|---|---|

|

|

NordFX Vs Other Brokers

NordFX is, of course, a big part of the forex trading business. But it is not the only one. There are still many FX brokers out there that can easily match up to the quality and service offered by NordFX. So, here is a breakdown of how Nordfx compares to other broker firms out there:

#1. NordFX vs. Avatrade

AvaTrade is one of the leading and most popular FX brokers out there. Based in Dublin, Ireland, the firm has been offering trading services for years now. As you can probably guess, the firm is quite similar in so many ways to NordFX. For starters, these are two of the most experienced brokers you can work with.

On the one hand, NordFX has been doing this for 14 years while AvaTrade has been doing it for almost similar time frames. The regulation status is another area where these two firms look pretty similar. Both are regulated in top tier 1 jurisdictions. AvaTrade is regulated in the UK, while NordFX is regulated in Cyprus. These are some of the most strict jurisdictions in the world.

The variety of tradable assets available in both these firms is also similar. The goal for both is to give traders as many options as possible. However, even with these similarities, there are some notable differences. First of all, NordFX uses the MetaTrader 4 as the leading trading platform for its services. It does not have its own proprietary software.

AvaTrade, on the other hand, has its own internal software but still uses the third-party MetaTrader 4 and 5. You will also notice that fees are quite different as well. NordFX is cheaper than AvaTrade, but the difference is not huge. Either way, these are reliable brokers that you can use for your FX trade.

#2. NordFX vs RoboForex

Roboforex is a technologically superior and reliable brokerage that is designed to work with clients all over the world. Although the firm has primarily established a presence in South America, it has managed to expand its wings to reach as many people as possible. The firm also shares some incredible similarities with NordFX.

The first thing is that these are all global players in forex trading. They are open to clients in hundreds of countries. In addition to this, both firms have streamlined their processes to a very great extent. This means that it takes very little effort to open a trading account, deposit, and trade. You will also be happy to know that both these firms use MetaTrader 4 as the main trading platform. These are some of the most advanced platforms in the world.

The areas of difference are also there. In terms of regulation, you could argue that NordFX is better regulated compared to Roboforex. In addition to this, NordFX also appears to have better trading technology, especially for folks who are interested in getting into algorithmic trading.

#3. NordFX vs FXChoice

FXchoice is a US-based forex broker that offers users a vast range of CFDs on several asset classes. However, please note that even though the firm is headquartered in the United States, it is not regulated there. This is a big downside and is one of the key differences between the firm and NordFX.

But that is not all. There are also some other areas where the two firms are very different. For example, regarding fees, NordFX is a bit more expensive than FX choice. But the tech at NordFX is better, and besides, you will get better trading tools. On the other hand, FXchoice has a much more detailed and well-created education program for new traders. You will learn forex and get an intro to the markets that will make you a better trader.

As for how the firms are similar, there are some areas we can look at. For instance, copy trading is seen as a very key aspect of how these two firms operate. As such, you will have access to advanced copy trading solutions that work best for you. In addition, these two firms have done well in creating the best trading conditions for people not in the United States. They allow you to open an account fast and verify your details without having to go through a long process. Despite these similarities and differences, NordFX is a relatively better firm to use.

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: NordFX Review

The success of any trader in the forex market will come down to several key factors. But at the end of the day, your ability to be able to land a decent brokerage will be the most important thing. There are so many brokers out there, each with the features and services you need. But as you know by now, brokers aren't the same, and some, like NordFX, tend actually to stand out.

And it's not by mere coincidence here. The firm has done well to invest in its services. It offers some of the most advanced trading platforms with in-built algo trading features and copy trading as well. The broker has also been able to expand its research and trading tools. Whether you are looking for proper technical analysis, signals, or some advanced portfolio management ideas, there will always be info on the website to help you with this. The fees are also not that bad. Despite these positive points, NordFX is not perfect. There are still so many areas where the firm can do better.

For example, although in general, the support team is good, we have seen several people complain that email support is way too slow. The minimum deposits that are charged by NordFX are also very high. The basic account comes with a minimum deposit requirement of around $10, which is good. But the other two require a deposit of $250 and $500, respectively. This is just too much. But despite these shortcomings, overall the trading experience that is offered at NordFX is quite good. Any trader should be able to enjoy working with the firm.

NordFX Review FAQs

Is NordFX safe or a scam?

No, NordFX is not a scam. This is a highly regulated broker with a track record of success in the market. The firm is regulated in the EU under the Cyprus securities and exchange commission and by the Vanuatu financial services commission. This should give you the confidence you need to trade here.

Does NordFX offer a demo account?

Yes, you can be able to easily open a free demo account with the provider that you can use to hone your trading skills. The account can also be used to test out the trading platform for people new to NordFX.

Can I convert my demo account to a live trading account with NordFX?

No, you cannot do this directly. If you want to trade live, you will need to open a live trading account. The process here is very different in fact, you will be required to present verification documents and add a payment method to the live trading account.

Dumb Little Man Recommends - Top 3 Best Forex Brokers in 2023 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.