NFP Forex – A Complete Expert’s Guide 2024

By Jordan Blake

January 10, 2024 • Fact checked by Dumb Little Man

NFP, short for Non-Farm Payrolls, refers to a data release on labor statistics from the USA. NFP Forex traders utilize this information or data to predict the economy's next move, either positive or negative, after the news release.

NFP is one of the employment-related data releases impacting the Forex markets. Jobs (and employment generation) are crucial to a trader's assessment of a country's medium- to long-term economic prospects. Therefore, labor data provide significant insight into a nation's economic health.

We've got Ezekiel Chew, one of the foremost and most renowned forex experts globally, to share his perception of NFP Forex as we read in this article. Therefore, even though the NFP is undoubtedly a crucial indicator of the U.S. economy and is vital for market participants, it is necessary to grasp its shortcomings and advantages. This article will further and in-depth explain the NFP Forex strategy and its relation to the economy.

What is NFP Forex

The non-farm payroll (NFP) is a crucial economic indicator for the economy of the United States. It indicates the number of jobs added, omitting farm workers, government workers, personal household workers, and workers of nonprofit establishments.

NFP data is always used to indicate how many jobs have been established for non-agricultural enterprises every month.

NFP discharges normally induce extensive activity in the forex market. The NFP data is typically made public at 8:30 a.m. on the first Friday of the month. E.T.

How does NFP affect Forex

NFP data is released monthly, which makes it a very promising indicator of the existing state of the economy. The data are made available by the Bureau of Labor Statistics The subsequent discharges can be seen on an economic calendar.

Employment is an essential indicator of the Federal Reserve Bank. When the unemployment rate is high, policymakers tend to adopt an expansionary monetary policy. An expansionary monetary policy aims to increase economic output and employment.

However, if the unemployment rate is higher than expected, the economy is believed to be operating below its capacity, and policymakers will strive to stimulate it. A stimulatory monetary policy includes lower interest rates and reduces the need for the Dollar, which affects Forex.

NFP Trading Strategy

The NFP usually influences all major currency pairs, but one of its favorites among traders is the British pound/U.S. dollar (GBP/USD). Because the forex market is available around the clock, all traders can trade on the news.

Once the market has absorbed the information's importance and primary swings, investors will enter a trade based on the leading momentum and an indication that the market has selected a path. This avoids jumping in too fast and reduces the percentage of being whipsawed out of the market before it has chosen a path.

The following are the rules needed for this strategy to work perfectly;

1. Nothing is done during the first bar after the NFP report.

2. The bar created from 8:30 to 8:45 a.m. will be wide-ranging. Traders wait for an inside bar to transpire after this first bar. In other words, they pause for the most current bar's range to be entirely inside the previous bar's range.

3. This inside bar's high and low rates reveal your potential trade catalysts. When the following bar finishes above or below the inside bar, the market participant assumes a trade in favor of the breakout. They can likewise enter a trade immediately after the bar moves past the high or low without pausing for the bar to close. Stick to whatever method you choose.

4. Place a 30-pip stop on the trade you joined.

5. Do not choose more than two trades. If they are both stopped out, don't reenter. High and low inside bars are utilized likewise for the following trade if required.

6. The target is time. Usually, most trends manifest within four hours of the report's discharge. Hence, traders leave four hours after their entry time. A trailing stop is an option if traders desire to remain in the trade.

The Strategy Pitfalls

Though the strategy mentioned above can be very profitable, it also has some pitfalls and risks that market analysts must be aware of.

The market may push aggressively in one direction and be trying to recede accordingly when an investor obtains an inside bar signal. However, if a powerful motion transpires before the inside bar, it is apparent that a move may annihilate before an indication.

When there is high volatility, rates can overturn rapidly even after pausing for a pattern to form, which is why it is vital to keep a stop in place.

Currency Pairs that are most affected by NFP

The NFP data indicates American employment, so currency pairs that include the U.S. dollar, such as EUR/USD, USD/JPY, GBP/USD, AUD/USD, USD/CHF, and others, are most influenced by the data discharge.

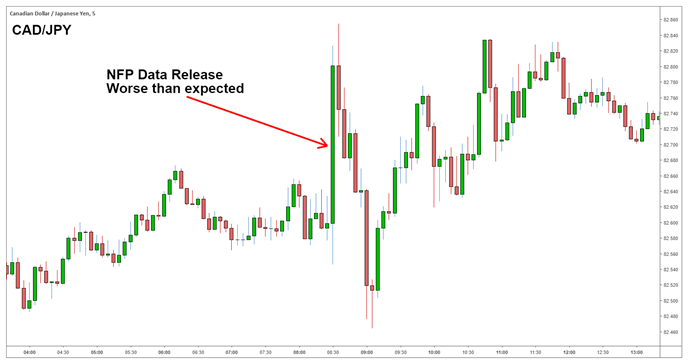

Other currency pairs display a boost in volatility when the NFP discharges, and traders should be aware of this because it may lead to them being stopped.

The boost in volatility may influence a trader's position even though they are not trading a currency pair associated with the U.S. Dollar. Thus, traders must use specialized analysis and comprehensive market outcome data.

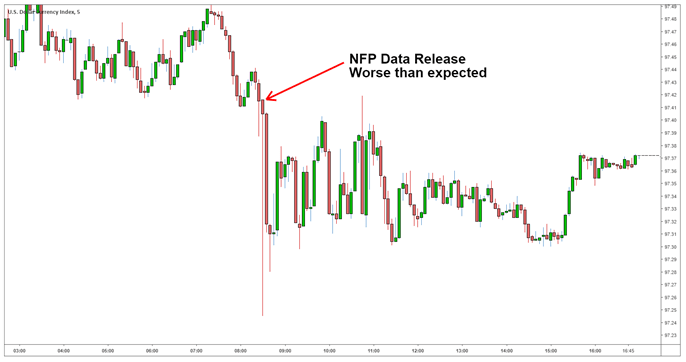

NFP Data and US Dollar Exchange Rate

Positive NFP numbers are perfect for the economy, and investors look to buy the dollar as a result, as they anticipate a better economy in the future.

The US dollar suffers if the NFP data is unfavorable because of a weak labor market results. Low economic growth and less pressure to raise interest rates lead investors to sell their US currency.

How to Trade NFP

NFP trading can be very profitable but also risky if the trader doesn't know exactly what to do or doesn't adhere to a tried-and-true strategy. Understanding NFP is essential for trading.

Things often get very hectic during the NFP release. Any NFP release gets two price reactions.

- You will see an immediate spike in volatility.

- As more and more traders analyze the data, prices reverse, and afterward, they begin to trend in the right direction.

The essential trading tip for the NFP is “Trading with people's reaction and expectations to the NFP release, not the actual number.”

The NFP release comes with three numbers; the previous number for last month's NFP, the forecast made by experts, and the actual number.

Three factors influence the people's or investors' responses;

The dollar likely rises when the actual number exceeds expectations and prior results.

- The dollar likely falls when the actual number is less than expectations and prior results.

- When the actual number exceeds expectations and is lower than the previous (or vice versa), the investors are likely to get confused, leading to no direction.

NFP and the Economy Explained

For every NFP day, there are three segments of a news release

The NFP numbers: This data reveals how many new jobs have been generated and how many have been eliminated.

- The Unemployment Rate: This information shows the unemployment rate in the economy.

- The hourly wages: This displays the typical hourly wages of employees, or how much they make on average.

The NFP provides data on the US job market, the economy's health, and prospects for the future. When the economy is struggling, businesses or companies don't hire as many employees as before, and many sometimes let go of their current workers. As a result, those people lose their jobs and cannot purchase goods, lowering overall revenues, decreasing overall consumer spending, and slowing down the economy even further.

However, the need for businesses to hire more workers to meet demand increases when the economy is doing well. The new employees now have more money available and can use it to buy things stimulating the economy.

Best Forex Trading Course

If you're seeking the best Forex training program, The Asia Forex Mentor Trading Course by Ezekiel Chew is your course of choice. Trading Forex profitably is made easy with Ezekiel Chew's trading strategies, backed up by mathematical probability. He has taught several students worldwide, including DBP, the second-largest state-owned bank in the Philippines with assets of over US$13 billion.

Ezekiel Chew is a prominent and skilled trader. With his years of experience spanning more than a decade, he will teach you how to make six figures in forex trading, from the beginner level to the advanced. In this course, Ezekiel will impart his wisdom and experience to you and show you how to trade foreign exchange like a professional.

The course covers everything you need, from the fundamentals of Forex trading to cutting-edge tactics that can boost your earnings significantly. To help you learn from his successes and errors, Ezekiel will also share his own trading experiences with you.

| RECOMMENDED TRADING COURSE | REVIEW | VISIT |

|---|---|---|

| #1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |  |

4 Best Forex Brokers

| Broker | Best For | More Details |

|---|---|---|

| Advanced Non US Traders Read Review | securely through Avatrade website |

Multi Asset Trading Platform Read Review | securely through Roboforex website | |

Professional Traders | securely through FXchoice website | |

| Copy Traders Read Review | securely through FXTM website |

Conclusion: NFP Forex

NFP trading offers time advantages and the opportunity for immediate or long-term earnings, as you may have noted in this article, and it does so on various instruments available to traders.

It will take a day trader an hour of work per month to trade the non-farm payroll announcement and maybe make significant profits. This gives a chance for the swing trader to confirm his or her optimistic or bearish bias on the instruments of their choice for the upcoming weeks, depending on the state of the US economy.

Remember that you should never trade the actual NFP figures; instead, concentrate on how people will react to or anticipate the NFP numbers.

The ideal NFP technique is to forecast a minor consolidation inside the bar if the report's volatility decreases.

Keep in mind the risks when important economic news is published. It is advised for novice traders to take positions only after the report has been published to reduce risk.

NFP Forex FAQs

How does NFP affect Forex?

The release of NFP data directly relates to job creation and interest rates. The interest rate will climb if the economy is solid and average employment growth is strong. On the other hand, a weak economic climate is brought about by low pay and poor employment.

Significant price changes occurred in the market following the announcement of the NFP report. So the data released provides traders with the currencies they should buy.

What does NFP stand for?

The acronym NFP stands for non-farm payrolls. It is a monthly indicator of the health of the US labor market that helps to determine how many jobs the US economy has gained or lost each month. The Bureau of labor statistics releases it every first Friday of the month at 8:30 am EST.

How do I trade with NFP?

To trade, sign in to a trading platform and adhere to the fundamental NFP trading rule since NFP reports are always released at 8:30 am Eastern Time on the first Friday of each month.

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.