Ment Funding Review with Rankings 2025 By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

The skilled finance and trading team at Dumb Little Man rigorously assesses proprietary trading firms, employing a comprehensive algorithm and strict standards. They concentrate on essential elements such as:

|

Traders can trade financial assets through prop trading firms, which in turn, leverage their cash. One notable player in this field is Ment Funding, which emerged from mentfx.com to fill the need for authentic trading instruction. Not only does it serve as an educational platform, but it also gives them the tools they need to succeed.

Combining analysis from Dumb Little Man's trading specialists with actual user reviews, this article provides a comprehensive evaluation of Ment Funding. Its goal is to provide an objective assessment of Ment Funding's offerings while deftly navigating the trading environment it cultivates.

What is Ment Funding?

When legitimate trading education and opportunities were scarce, Ment Funding stepped in to fill the need. At its inception, mentfx.com set out to address a lack of resources for traders by providing them with in-depth educational content and practical tools.

Ment Funding was born out of a need for a simple, equitable, and transparent approach for skilled traders to access trading capital, free from the shackles of antiquated two-stage funding processes.

The straightforwardness and honesty of Ment Funding set it apart. Traders are free to work at their own speed through its 1-step assessment process. Any competent trader aiming for success can benefit from this methodology, not only students at mentfx.com.

Traders are allowed to trade any way they like because to the firm's extensive ecosystem, which includes education, support, collaboration, and access to more than 300 trading instruments.

Ment Funding is more than just one of the proprietary trading firms out there; it's a community of dedicated traders with a mission to change the game. It promotes trading freedom, removing common restrictions found in other trading environments. Traders have the liberty to shape their trading journey, backed by the support of an award-winning CFD trading broker, ThinkMarkets.

This partnership ensures traders benefit from raw account spreads, starting as low as 0.0 pips on Majors, allowing unrestricted trade execution. Ment Funding is not just about providing capital; it's about fostering a thriving trading community.

Pros and Cons of Ment Funding

Pros

- Generous 75% profit split

- Monthly withdrawal requests

- Up to $2,000,000 funding

- Flexible trading days

- Growth-based scaling

- Robust customer support

Cons

- Evaluation fees $250-$15,000

- Restrictive trading rules

- Manual lot size adjustments

- Strict max drawdown policy

- Platform-dependent support

Safety and Security of Ment Funding

Eightcap is an ASIC-regulated broker situated in Melbourne, Australia, and Ment Funding has partnered with them to ensure the protection of their clients. The supply of reliable technical services, necessary for safe and effective trade activities, is guaranteed by this partnership.

Established in 2009 and regulated in numerous jurisdictions, Eightcap is dedicated to providing exceptional financial services. The company has five offices worldwide. Thanks to this collaboration, clients of Ment Funding can trade with confidence in a wide variety of markets, including commodities, equities, indices, and foreign exchange.

Dumb Little Man's extensive study is the basis for the data shown above, which demonstrates Ment Funding's dedication to maintaining stringent security measures in the trading space.

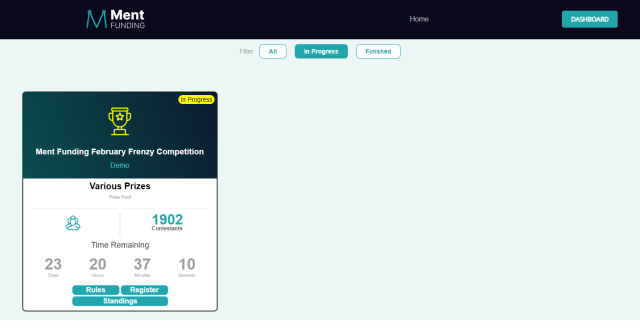

Ment Funding Bonuses and Contests

Every month, Ment Funding hosts tournaments that draw in more than a thousand people. Prizes for the best eight traders in these contests range from 25,000 to 200,000 evaluations, which is a big amount. The criteria for evaluating these contests are unique. Instead of focusing on getting the greatest balance or equity, Ment Funding values consistent and proficient trading.

To encourage strategic and fair trading environment, the rules of the contest have been carefully crafted. Having the highest balance isn't enough to win first place; you have to show that you can trade well in every way imaginable.

Having a good equity curve, a consistent trading style, managing risks well, and an effective trading style are all part of this. Finding traders that can show sustained profitability and discipline in their trading is important to Ment Funding's methodology.

Participants are required to follow the detailed guidelines established by Ment Funding. In order to maintain the honesty of the competition, it is forbidden to adopt trading tactics that are effective in practice but have no place in actual trading.

The professional and disciplined trading atmosphere promoted by Ment Funding encourages participants to trade inside their established systems and follow their particular trading rules.

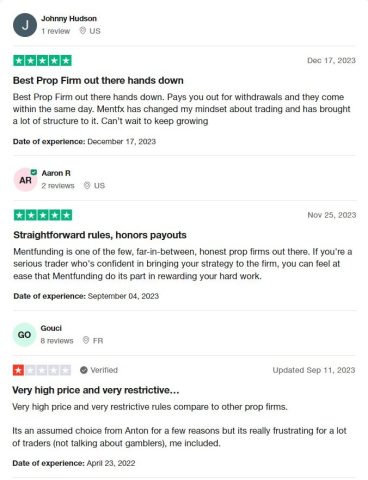

Ment Funding Customer Reviews

There is space for improvement with Ment Funding's 4.8-star rating on Trustpilot, which is the result of mixed user comments. Customers rave about the company, calling it one of the greatest because of the excellent effect it has had on their trading mentality and framework and the speed with which it pays out profits.

A lot of people think it's one of the good prop firms because of how honest it is and how it helps serious traders who have good tactics.

But there are a few people who aren't happy about it. They say the prices are too high and the regulations are too stringent when compared to other prop companies. There seems to be a disconnect between the firm's products and the expectations of some traders, since some consumers find the choices made by the firm annoying.

Ment Funding Commissions and Fees

To keep its traders in the know, Ment Funding takes a no-nonsense approach to fees and commissions, unlike other prop firms. Traders who work with the firm get to keep a large chunk of their trading income because of the 75% profit share. There is a wide range in the evaluation charge, which is the cost of joining the firm's trading program.

Depending on the program and the amount of access, prospective traders might anticipate paying an evaluation charge ranging from $250 to $15,000. Trading opportunities are made available by Ment Funding to traders of all skill levels and financial capacities through this charge structure.

Ment Funding Account Types

To accommodate a wide variety of traders, Ment Funding provides several account options. Our experienced team at Dumb Little Man has done extensive testing and analysis, and the results show that the company gives traders a lot of leeway and potential. In a nutshell, these are the many kinds of accounts:

$25,000

- Target: 1-Step Evaluation = 10%

- Min./Max. Trading Days: None

- Max Daily Loss: $1,250 (5%)

- Max Loss Trailing Drawdown: $1,500 (6%)

- Available Leverage: Trade with up to 1:20 leverage. Upgrades are available once you “Select” a 1-step evaluation below

- Live Account Gains: Keep 75% (90% with upgrade), first withdrawal whenever you want

- One Time Fee: $250

$50,000

- Target: 1-Step Evaluation = 10%

- Min./Max. Trading Days: None

- Max Daily Loss: $2,500 (5%)

- Max Loss Trailing Drawdown: $3,000 (6%)

- Available Leverage: Trade with up to 1:20 leverage. Upgrades are available once you “Select” a 1-step evaluation below

- Live Account Gains: Keep 75% (90% with upgrade), first withdrawal whenever you want

- One Time Fee: $450

$100,000

- Target: 1-Step Evaluation = 10%

- Min./Max. Trading Days: None

- Max Daily Loss: $5,050 (5%)

- Max Loss Trailing Drawdown: $6,000 (6%)

- Available Leverage: Trade with up to 1:20 leverage. Upgrades are available once you “Select” a 1-step evaluation below

- Live Account Gains: Keep 75% (90% with upgrade), first withdrawal whenever you want

- One Time Fee: $750

$200,000

- Target: 1-Step Evaluation = 10%

- Min./Max. Trading Days: None

- Max Daily Loss: $10,050 (5%)

- Max Loss Trailing Drawdown: $12,000 (6%)

- Available Leverage: Trade with up to 1:20 leverage. Upgrades are available once you “Select” a 1-step evaluation below

- Live Account Gains: Keep 75% (90% with upgrade), first withdrawal whenever you want

- One Time Fee: $1,500

$400,000

- Target: 1-Step Evaluation = 10%

- Min./Max. Trading Days: None

- Max Daily Loss: $20,050 (5%)

- Max Loss Trailing Drawdown: $24,000 (6%)

- Available Leverage: Trade with up to 1:20 leverage. Upgrades available once you “Select” a 1-step evaluation below

- Live Account Gains: Keep 75% (90% with upgrade), first withdrawal whenever you want

- One Time Fee: $3,000

$1,000,000

- Target: 1-Step Evaluation = 10%

- Min./Max. Trading Days: None

- Max Daily Loss: $50,000 (5%)

- Max Loss Trailing Drawdown: $60,000 (6%)

- Available Leverage: Trade with up to 1:20 leverage. Upgrades are available once you “Select” a 1-step evaluation below

- Live Account Gains: Keep 75% (90% with upgrade), first withdrawal whenever you want

- One Time Fee: $7,500

$2,000,000

- Target: 1-Step Evaluation = 10%

- Min./Max. Trading Days: None

- Max Daily Loss: $100,000 (5%)

- Max Loss Trailing Drawdown: $120,000 (6%)

- Available Leverage: Trade with up to 1:20 leverage. Upgrades are available once you “Select” a 1-step evaluation below

- Live Account Gains: Keep 75% (90% with upgrade), first withdrawal whenever you want

- One Time Fee: $15,000

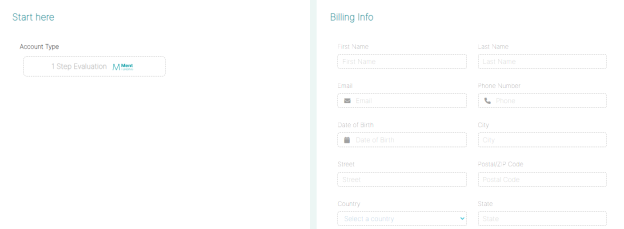

Opening a Ment Funding Account

The account-opening procedure at Ment Funding is simple, intuitive, and quick. To make sure you're prepared to begin your trading journey, here is a straightforward 8-step checklist to assist you in setting up your trading account.

- Go to the website, and click “Get Started”.

- Choose an account type and consider your trading goals, level of expertise, and trading technique.

- To pay for the selected plan, please enter your billing details.

- Fill up the form with your full name, email address, phone number, and birthday.

- To finish your contact information, please enter your address.

- By checking the box, you confirm that you have read and agree to the terms and conditions set out by the company.

- Recognize the conditions of possible returns by agreeing to the refund policy.

- Please confirm that you have read and understand the privacy policy before agreeing to the use and storage of your information.

Ment Funding Customer Support

Customers can reach Ment Funding through a variety of ways because the company values customer service. The experience of the Dumb Little Man team shows that support staff is easily reachable on Discord for any questions or issues.

We recommend that clients start by reading the RULES and FAQ section. It answers a lot of frequent issues and will help you get your typical inquiries answered quickly.

The Ment Funding team, headed by CEO Anton Calmes, is always there to help and willing to lend a hand when you need it. They are quite active on the Ment Funding team's Discord and YouTube community pages. The leadership and support team at Ment Funding are very involved, which shows that they care about their clients and want to make sure they're happy.

Advantages and Disadvantages of Ment Funding Customer Support

| Advantages | Disadvantages |

|---|---|

|

Ment Funding Withdrawal Options

According to testing conducted by a trading expert at Dumb Little Man, Ment Funding offers its traders a systematic withdrawal strategy. You can request a withdrawal from your Funded Accounts at any moment using your trader dashboard, but you are only allowed to do so once every 30 days. There is no time limit on the initial withdrawal, so rookie traders have more leeway to collect their profits when they want to.

Select the amount you wish to withdraw by clicking the “Withdraw Profits” button. Importantly, Ment Funding will be taking its cut of the profits from this deal at the same time. Remember that the maximum drawdown, also known as the maximum permitted loss, is set at the starting amount and does not reset when you withdraw funds.

Thus, the new maximum drawdown limit is defined as the amount remaining after withdrawal less Ment Funding's portion. To illustrate the point, the Funded Account might be forfeited if, for instance, earnings are withdrawn to the point where the account balance is reduced to the initial starting amount, as this would trigger the max drawdown breach rule.

This system highlights Ment Funding's dedication to upholding a level playing field in trading.

Ment Funding Challenges and Difficulties

A unique scaling mechanism is implemented for traders managing real accounts with Ment Funding, which enhances their trading ability. Investors can take advantage of compound interest and increased leverage by increasing the Max Lot Size in proportion to the percentage of their account balance that increases by 5% with Ment Funding. Traders must contact the Ment Funding team for them to manually process adjustments to the Max Lot Size.

Traders must get in touch with Ment Funding whenever their account shows development and they want to increase their trading capacity. You can reach out to us at [email protected] or through the Contact Us link to begin the process. The team calculates the percentage increase from the initial balance and adjusts the Max Lot Size accordingly. As an example, the Max Lot Size would go up from 10 lots to 11.5 lots, reflecting the 15% growth, if a trader were to raise a $100,000 account to $115,000.

The goal of this strategy is to help traders amass and responsibly handle large sums of money. The opportunity to trade with higher Max Lot Sizes is unlocked as the account grows, allowing traders to scale their earning potential and financial growth rate.

How to Pass Ment Funding Evaluation Process

Navigating the evaluation process of Ment Funding can be daunting due to its rigorous standards. To increase your likelihood of success, since they only fund successful traders, it's crucial to arm yourself with the necessary skills and techniques. Engaging in a detailed training program is key, as it prepares you thoroughly to face and successfully pass the evaluation.

This foundational step ensures you're not just meeting the basic requirements, but excelling in the areas Ment Funding assesses during their evaluation.

Asia Forex Mentor – Rated Best Comprehensive Course Offering by Investopedia

Asia Forex Mentor is highly regarded as an optimal platform for those aiming to successfully navigate the Ment Funding evaluation process. The software has helped thousands of traders pass several prop company evaluation procedures, and it comes highly recommended by the trading professionals at Dumb Little Man. Central to it all is Ezekiel Chew, a renowned forex trader with a background of over 20 years, renowned for his high-value trades, and the brains behind the Golden Eye Group.

A demonstration of Ezekiel's mastery is his exclusive One Core Program, which he developed to share his wealth of trading wisdom with others. The modest requests for trading advice from his close friends started him on the path that would eventually lead to the creation of Asia Forex Mentor, his mentoring business. In its time, the platform has grown into an all-encompassing web resource, dedicated to its original goal of helping novice traders become proficient market players.

How Could Asia Forex Mentor Help You Pass Ment Funding Challenge?

Traders who want to win the Ment Funding evaluation procedure will find Asia Forex Mentor to be an invaluable resource. Several notable acknowledgments support its credibility:

The One Core Program from Asia Forex Mentor was listed by Investopedia, a renowned financial resource, as the most thorough course offering. The program's breadth and depth earned it accolades as an excellent instructional resource in FX trading.

Benzinga, an authoritative authority on the stock market and financial matters, named the One Core Program the Best Forex Trading Course for Beginners. This honor recognizes the app's excellence in guiding traders of all skill levels, from novice to expert.

Asia Forex Mentor's 2021 Best Forex Mentor award from BestOnlineForexBroker is evidence of the program's success in generating substantial profits for its students.

In a comprehensive review, expert forex traders and platforms gave Asia Forex Mentor the top rating for its powerful trading strategies and tactics.

These awards show that Asia Forex Mentor is able to help traders succeed in Ment Funding's evaluations and confirm the quality and impact of their solutions. In instance, the One Core Program has dutifully surpassed the expectations of a diverse range of traders, including novices and seasoned pros alike.

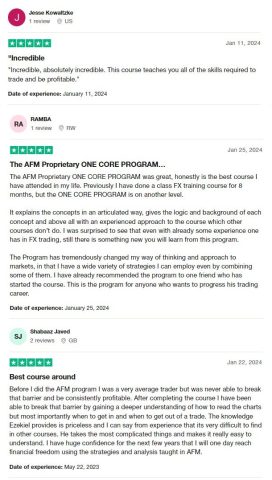

Asia Forex Mentor Members' Testimonials

Customer reviews of the AFM Proprietary One Core Program confirm that it can take average traders and turn them into consistently profitable ones. The curriculum has gotten a lot of good reviews for its clear and comprehensive teaching style, which makes complex concepts easier to understand and produces useful market data.

It is a testament to the program's scope and usefulness that even experienced traders discovered new ideas. If you're serious about making a career change in trading, you need to check out the One Core Program, which comes highly recommended by professionals in the field.

>> Also Read: Asia Forex Mentor Review By Dumb Little Man

Conclusion: Ment Funding Review

In conclusion, trading experts at Dumb Little Man found Ment Funding as a good prop firm for a lot of reasons. Aside from it being highly rated in Trustpilot, and the fact that it offers a 75% profit split, traders can also choose up to $2,000,000 evaluation funding. It caters from small traders to experienced ones.

However, complaints about restrictive trading rules can be a factor, especially for traders who look for flexibility. Evaluation can also be difficult, which is why choosing a program like One Core Program from Asia Forex Mentor can be beneficial.

>> Also Read: SuperFunded Review with Rankings 2024 By Dumb Little Man

Ment Funding Review FAQs

Is ment Funding regulated?

There is no indication that Ment Funding is governed or linked to any particular regulatory body. Nevertheless, it has allied with Eightcap, a broker authorized by ASIC, suggesting that it is subject to some regulatory scrutiny through its broker.

Is Ment Funding suitable for beginners?

With their extensive training and evaluation chances, Ment Funding does indeed accommodate traders of varying levels of experience.

How does Ment Funding's evaluation process work?

Traders can obtain funding from Ment Funding to trade real money with profit-sharing opportunities when they select an evaluation plan, trade with real money, and reach the profit target.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.