Kimura Trading Review 2025 with Rankings By Dumb Little Man

By Jordan Blake

January 5, 2025 • Fact checked by Dumb Little Man

Overall Rating Overall Ranking Trading Terminals 1.4 132nd

| Evaluation Criteria |

|---|

The Dumb Little Man team, made up of financial specialists, seasoned traders, and personal investors, leverages advanced algorithms for in-depth reviews of brokerage firms. They focus on critical aspects like:

By integrating feedback from actual users, they offer an impartial and thorough assessment. Their comprehensive research identifies Kimura Trading as a dependable choice for those seeking a robust financial ally. Nonetheless, Dumb Little Man advises prospective customers to meticulously examine their detailed analysis to grasp any potential drawbacks linked to the broker. |

Kimura Trading Review

Forex brokers are essential facilitators in the global currency exchange market, providing platforms for trading a variety of financial instruments. Kimura Trading emerges as a notable contender in this space, offering access to currency pairs, ETFs, and CFDs on a diverse array of assets including stocks, indices, commodities, energy sources, and cryptocurrencies.

To cater to both seasoned traders and novices, Kimura Trading provides a free demo account, allowing users to practice trading strategies without financial risk. For those ready to dive into live trading, a minimum deposit of €100 is required to open a user account. This feature positions Kimura as an accessible option for traders at various levels of experience.

In this review, our aim is to deliver a thorough analysis of Kimura Trading, focusing on its unique selling propositions and potential limitations. We will cover account options, deposit and withdrawal processes, and commission structures. By integrating expert opinions with feedback from actual users, this review seeks to provide balanced and informative insights necessary for making an informed decision about using Kimura Trading as your brokerage service provider.

What is Kimura Trading?

Kimura Trading is a brokerage firm that facilitates trading in a wide range of financial instruments, including currency pairs, ETFs, and CFDs on stocks, indices, commodities, energy sources, and cryptocurrencies. The platform is designed to be accessible to both novice and experienced traders, featuring a user-friendly interface.

To support new traders, Kimura Trading offers a free demo account, which allows individuals to experiment with trading strategies without any financial risk. For those looking to engage in real trading activities, the brokerage requires a minimum deposit of €100 to open a standard user account. Additionally, Kimura provides tailored options for more experienced traders through a professional account and for businesses via a corporate account, both of which have specific requirements.

Kimura Trading stands out by offering competitive pricing with floating spreads starting from 0.7 pips on currency pairs, without imposing additional trading fees or withdrawal fees. This cost-effective pricing structure makes it an attractive option for traders looking to maximize their returns. The platform also offers maximum leverage of 1:30, aligning with regulatory standards to balance opportunity with risk management.

Safety and Security of Kimura Trading

Kimura Trading, operated by ELP Finance LTD, is a Maltese broker that has built a reputation for reliability in the forex and CFD trading space. Registered in Malta and regulated by the Malta Financial Services Authority (MFSA), Kimura Trading adheres to strict European financial regulations, ensuring safety and security for its clients.

The brokerage is known for its robust safety measures, including the segregation of client funds from company funds, which are kept in separate bank accounts. This separation is crucial as it protects clients’ investments from being used for any other purpose than the intended trading activities. Moreover, Kimura Trading is part of the Investor Compensation Scheme (ICS), which offers additional security, safeguarding investors against the potential financial failure of the brokerage.

Furthermore, the company's commitment to regulatory compliance and client security is reinforced by its registration with the EUIPO (Office of the European Union for Intellectual Property). This provides a layer of intellectual property protection that aligns with community legislation aimed at combating counterfeiting and maintaining industrial property rights.

Pros and Cons of Kimura Trading

Pros

- Licensed through an affiliate, enhancing its regulatory credibility.

- Uses the efficient cTrader platform, known for its low spreads in demo mode and versatility across devices.

- Provides access to a broad array of financial instruments, including multiple asset classes like cryptocurrencies and ETFs.

Cons

- Operates without a direct license, relying on an affiliate's credentials.

- Trading conditions are poorly detailed online, leading to potential uncertainty about fees and terms.

- Limited payment options, excluding widely-used e-payment systems.

- Lacks features like copy trading and support for other major trading platforms

Sign-Up Bonus of Kimura Trading

As of now, Kimura Trading does not offer a sign-up bonus for new clients. This could be a drawback for potential traders looking for initial trading incentives typically offered by other brokers. Many brokers use sign-up bonuses as a way to attract new users, but Kimura Trading has chosen not to implement this strategy.

Minimum Deposit of Kimura Trading

The minimum deposit required to open an account with Kimura Trading is €100. This amount allows new traders to start engaging in various trading activities without a significant initial investment. Setting the deposit threshold at €100 makes Kimura Trading accessible to a broader range of clients, from beginners to more experienced traders who may prefer to start with a lower risk.

Kimura Trading Account Types

Kimura Trading offers several account types to suit different levels of traders. After extensive testing and research by the experts at Dumb Little Man, here’s a clear breakdown of each available account type:

- Demo Account:

- No deposit required and can be opened without verification.

- Functions similarly to the standard account but uses virtual funds for trading.

- Ideal for beginners or those looking to practice trading strategies without financial risk.

- Standard Account:

- Requires a minimum deposit of €100.

- Offers floating spreads starting from 0.7 pips for currency pairs and 0.17 pips for other assets.

- No transaction fees are charged, making it a cost-effective choice for individual traders starting out.

- Professional Account:

- Available to traders who demonstrate significant experience and understanding of the financial markets.

- Applicants need to have a portfolio worth at least €500,000 (across all accounts, not exclusively with Kimura Trading).

- Features include reduced spreads starting from 0.1 pips and other trading advantages.

- Corporate Account:

- Designed specifically for legal entities.

- Opened upon request and offers the ability to negotiate individual conditions with the broker.

- Includes additional options tailored to the needs of corporate clients.

Each account type is structured to cater to different trading requirements and financial backgrounds, providing flexibility and targeted benefits to enhance the trading experience.

Kimura Trading Customer Reviews

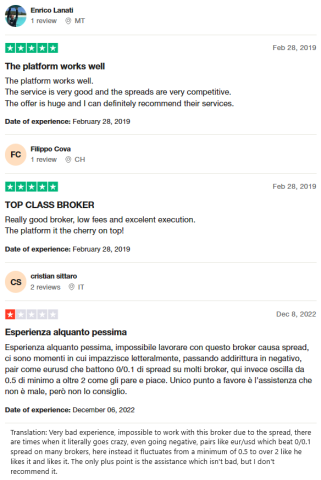

Customer reviews of Kimura Trading present a mixed picture. Many users praise the platform for its efficiency and competitive spreads, highlighting the excellent service and the extensive range of offerings which make it recommendable. Positive feedback often points out the low fees and excellent execution of trades, with the platform itself being described as the “cherry on top.” However, some customers have had negative experiences, particularly with the spreads fluctuating widely, which can be problematic for trading strategies, especially noted with popular pairs like EUR/USD. These users find the spreads occasionally unworkable, despite the good customer service offered by the broker. This range of experiences suggests that while Kimura Trading excels in many areas, potential clients should be mindful of possible spread volatility.

Kimura Trading Fees, Spreads, and Commissions

Kimura Trading adopts a simplified approach to trading fees, focusing primarily on spreads while eliminating transaction and withdrawal fees. The spreads offered by Kimura Trading are typically floating, which means they vary based on market conditions. However, the average spread for most currency pairs lies between 0.7 to 1 pip, aligning with industry standards. By not charging transaction fees, Kimura Trading provides a cost-effective trading environment, which can be particularly advantageous for traders who perform frequent transactions. This straightforward fee structure makes it easier for traders to manage their trading costs and enhances the overall transparency of the trading experience.

Deposit and Withdrawal

Kimura Trading offers a structured approach to deposits and withdrawals, which was thoroughly tested and reported by a trading professional at Dumb Little Man. Initially, traders can practice using a demo account where trading occurs with virtual funds and no real income is generated. Upon upgrading to a real trading account, traders can engage in full-fledged trading and, upon successful trades, withdraw their profits.

The process to withdraw profits is straightforward. Accumulated profits appear on the trader’s account balance and can be withdrawn wholly or partially at any time. Withdrawals are requested through an option available in the user account dashboard. Importantly, this functionality is also accessible via the mobile version of the Kimura Trading platform, adding convenience for traders on the go.

Regarding withdrawal methods, profits can currently be transferred to a bank account or bank card. Kimura Trading does not impose a withdrawal fee, making it economically favorable for traders. However, it’s important to note that fees may still apply from the bank’s end as the third party handling the transaction. Typically, the transferred funds should reflect in the trader’s bank card or account within 1-2 days, facilitating efficient access to withdrawn funds.

How to Open a Kimura Trading Account

- Visit the official Kimura Trading website and select your preferred language from the top right corner under “User Account.”

- Enter your personal details including first and last names, select your country's telephone code, and enter your contact number; create and confirm your password.

- Choose cTrader as your platform in the ‘Platform' section and set your account currency to euros, then click ‘Next’.

- Provide your address and email, choose your preferred method of communication, and proceed by clicking ‘Next’.

- Complete the detailed information form about yourself including date of birth, place of birth, and tax identification number, then click ‘Next’.

- Answer additional questions regarding the terms of cooperation, check the agreement boxes, and click ‘Next’.

- Address a final set of questions about your trading experience, then finalize by clicking ‘Log In'.

- Verify your identity by either using an electronic passport or manually uploading necessary documents under ‘Account Settings' > ‘Upload Documents'.

- To add funds, go to ‘Account Settings', find the ‘Trading Accounts' section, press the ‘Deposit' button, and follow the on-screen instructions; then download and install the trading platform from the ‘Trading Platforms' section to begin trading.

Kimura Trading Affiliate Program

As of the current moment, Kimura Trading does not offer an affiliate program. However, the company has expressed interest in potentially developing such a program in the future. This would provide opportunities for individuals and businesses to earn commissions by referring new clients to the broker. For those interested in partnership opportunities, staying updated with Kimura Trading’s announcements could be beneficial as they consider implementing an affiliate program.

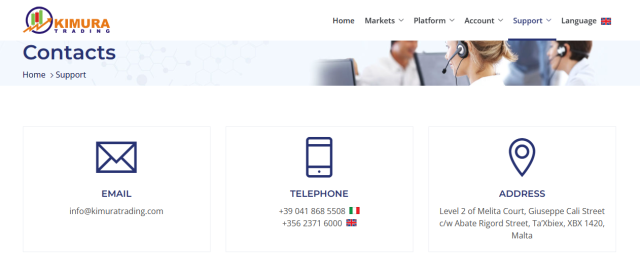

Kimura Trading Customer Support

Kimura Trading offers a robust customer support system that operates 24/5 on weekdays to assist clients with any queries or issues they may encounter. The support services provided by Kimura Trading have been positively rated for both quality and responsiveness based on evaluations conducted by Dumb Little Man.

Clients can reach Kimura Trading's customer support through various channels:

- Phone support allows direct conversations for immediate assistance.

- Email and tickets, available through the broker’s contact page, offer a more formal avenue for queries that may require detailed responses.

- Live chat functions are the quickest option, available both on the website and within the Trader's Room, and have been noted as the most responsive method.

The presence of multiple communication options ensures that traders can select the channel that best suits their needs, enhancing the overall user experience with timely and effective support.

Advantages and Disadvantages of Kimura Trading Customer Support

| Advantages | Disadvantages |

|---|---|

Kimura Trading vs Other Brokers

#1. Kimura Trading vs AvaTrade

Kimura Trading offers a streamlined trading platform focused primarily on forex and CFDs, with a simple fee structure based on spreads, and is known for its strong customer service. AvaTrade provides a broader range of financial instruments, catering to over 300,000 customers globally. It boasts strong regulatory compliance with multiple licenses worldwide and offers an extensive suite of trading platforms tailored to varied trader needs.

Verdict: AvaTrade might be better for traders looking for a more globally recognized broker with a wider range of instruments and platform choices. Its long-standing reputation and commitment to regulatory adherence make it a safer bet for those concerned with compliance and security.

#2. Kimura Trading vs RoboForex

Kimura Trading maintains a focus on user-friendly trading experiences with competitive spreads and no transaction fees. RoboForex excels in technology and variety, offering over 12,000 trading instruments and multiple trading platforms like MetaTrader, cTrader, and RTrader. It’s also notable for its diverse contest offerings on demo accounts, which can appeal to traders looking to test their strategies without risk.

Verdict: RoboForex may be better for traders who value technological sophistication and a vast array of trading instruments. Its provision of different platform options and the ability to engage in trading contests presents a robust environment for both new and experienced traders.

#3. Kimura Trading vs FXChoice

Kimura Trading is straightforward with its trading conditions, providing services predominantly through its web-based platform and focusing on core forex and CFD trading with no additional perks. FXChoice targets experienced traders with offerings like classic and professional ECN accounts, and it supports automated trading extensively. It also provides a loyalty program that is more attractive to high-volume traders.

Verdict: FXChoice would be more suitable for advanced traders who require features like ECN accounts and benefits for high-volume trading. Its focus on providing tools and conditions for experienced traders makes it a strong choice for those who have significant trading activity and seek tighter spreads and more complex trading setups.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

If you're eager to start a successful career in forex trading and aim for significant financial success, choosing Asia Forex Mentor is a wise decision. Led by Ezekiel Chew, a respected figure in the trading world known for his expertise in guiding both trading institutions and banks, and personal achievements in seven-figure trading, Asia Forex Mentor is well-regarded for its effectiveness.

Comprehensive Curriculum: Asia Forex Mentor provides an extensive educational program focusing on forex, stock, and crypto trading, preparing students comprehensively for success in these markets.

Proven Track Record: The institution is celebrated for its consistent success in cultivating profitable traders, highlighting the efficacy of their educational methodologies.

Expert Mentor: Under Ezekiel Chew’s mentorship, students receive personalized guidance, gaining the confidence needed to tackle the complex aspects of various markets.

Supportive Community: Students also gain entry to a vibrant community of traders, which encourages knowledge sharing and collaborative learning, enriching the educational experience.

Emphasis on Discipline and Psychology: Recognizing the importance of psychological strength in trading, the program emphasizes mental discipline and the ability to manage stress and decision-making under pressure.

Constant Updates and Resources: Keeping pace with the dynamic nature of financial markets, Asia Forex Mentor ensures that its students have access to the latest trends and insights, maintaining their competitive edge.

Success Stories: The numerous success stories of students who have achieved financial independence through their training underscore the program’s value.

Overall, Asia Forex Mentor stands out as the top choice for anyone looking to excel in forex, stock, and crypto trading, supported by a robust curriculum, expert guidance, and an active trading community.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: Kimura Trading Review

Concluding this review, Kimura Trading has established itself as a compelling option within the forex and CFD trading landscape, well-suited for traders looking for a straightforward and efficient trading environment. The brokerage’s simple fee structure, characterized by competitive spreads and no transaction fees, stands out as a significant advantage. Additionally, the provision of a user-friendly platform, both on desktop and mobile, enhances trading accessibility and convenience.

However, potential clients should also consider the limitations before choosing Kimura Trading. The absence of a sign-up bonus might be seen as a drawback compared to other brokers that offer initial incentives. Moreover, while customer support is robust during the week, the lack of weekend support could be a limitation for those who prefer trading or resolving issues during those days.

>> Also Read: Admiral Markets Review 2024 with Rankings By Dumb Little Man

Kimura Trading Review FAQs

What types of accounts does Kimura Trading offer?

Kimura Trading provides a variety of account types to cater to different trading needs and experiences. They offer a Demo Account for beginners or those looking to practice strategies without financial risk. The Standard Account requires a minimum deposit of €100 and features competitive floating spreads. For more experienced traders, there is a Professional Account, which offers lower spreads and other benefits. Additionally, a Corporate Account is available for legal entities with customized trading conditions.

Does Kimura Trading charge any fees for deposits and withdrawals?

Kimura Trading prides itself on its straightforward fee structure. The broker does not charge any fees for deposits or withdrawals. However, traders should be aware that while Kimura does not impose fees, there may be charges from their bank or payment processor, particularly for international transfers.

How does Kimura Trading ensure the safety of its clients' funds?

Safety and security are paramount at Kimura Trading. The broker is regulated by the MFSA, ensuring compliance with financial standards and obligations. Additionally, client funds are kept in segregated accounts, separate from the company's operating funds. This separation ensures that client funds are only used for their trading activities and provides an extra layer of protection.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Jordan Blake

Jordan Blake is a cultural commentator and trending news writer with a flair for connecting viral moments to the bigger social picture. With a background in journalism and media studies, Jordan writes timely, thought-provoking content on everything from internet challenges and influencer scandals to viral activism and Gen Z trends. His tone is witty, observant, and sharp—cutting through the noise to bring readers the “why” behind the “what.” Jordan’s stories often go deeper than headlines, drawing links to pop culture, identity, and digital behavior. He’s contributed to online media hubs and social commentary blogs and occasionally moderates online panels on media literacy. When he’s not chasing the next big trend, Jordan is probably making memes or deep-diving into Reddit threads. He believes today’s trends are tomorrow’s cultural history—and loves helping readers make sense of it all.