HFM Review 2025 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors: Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved. |

HFM Review

HotForex Markets, widely recognized by its abbreviation HFM, is a brokerage firm that holds an eminent position in the global financial markets. As part of the HF Markets Group, HFM offers an extensive array of account types that cater to various trader needs, making it a suitable platform for diverse trading profiles. It boasts an extensive selection of trading assets, supported by top-notch software, which stands as a testament to its strong commitment to providing high-quality trading services.

In this comprehensive review, our objective is to dissect the various aspects of HFM, focusing on its unique selling propositions, as well as potential drawbacks. We intend to explore various account options, deposit and withdrawal processes, commission structures, and other relevant details that will give you a clear picture of what HFM offers. By combining expert analysis with actual trader experiences, we aim to provide you with a well-rounded perspective of HFM, assisting you in making an informed decision about choosing it as your preferred broker.

>> Also Read: 5 Best Forex Trading Software in 2025: A Guide to Stop Losing Money

What is HFM?

HotForex Markets, or HFM, is a globally recognized multi-asset Forex broker. It has etched its mark in the industry by offering Forex and Commodities trading, having previously been known as HotForex. HFM provides a choice of seven account types and trading platforms, with tight spreads averaging 0.1 EUR USD. This brokerage firm also operates unrestricted liquidity, an aspect that allows traders of any size or profile to choose between different spreads and liquidity providers.

HFM ensures flexibility in trading through automated trading platforms, permitting traders to perform various strategies, including news trading. Founded in 2010 with its headquarters in Cyprus, HFM has grown its presence globally, with offices in Dubai, South Africa, and offshore entities in St Vincent and the Grenadines.

A unique aspect of HFM is its strategic focus on the African, Asian, and MENA regions. These regions offer lucrative opportunities to global residents, enhancing HFM's international proposals. Furthermore, HFM demonstrates its commitment to safety and reliability by holding applicable licenses in each region it operates. These licenses are pivotal in regulating the Forex industry and instilling trust in HFM's trading services.

Safety and Security of HFM

Safety and security are paramount in the trading world, and HFM ensures that its clients are well protected from the inherent risks associated with forex or CFD trading. There are several measures in place designed to boost client trust and protect their investments.

Firstly, HFM uses segregated funds/accounts. In essence, the client's money is kept in accounts that are entirely separate from the company's operational funds. This means that the company does not directly utilize the client's funds for its expenses, and in the event of a company default, these funds cannot be used to repay creditors.

Another security measure employed by HFM is negative balance protection. This feature, common among top forex brokers, ensures that the client is not held liable for a negative account balance. This is particularly helpful when measures like stop-outs are unable to prevent losses.

In addition to these, HFM has established a deposit insurance fund. The company runs a Civil Liability Insurance program with coverage of up to 5 million Euros. This coverage protects client funds from risks such as errors, negligence, fraud, and other potential dangers prevalent in financial trading operations. The insurance certificate is readily available on the website for perusal.

Lastly, HFM only uses major international banks for its accounts, which adds another layer of stability. These banks are renowned for their high liquidity and superior security measures, ensuring that client funds are safe.

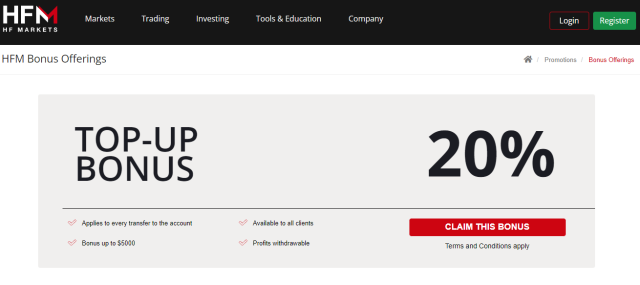

Sign-Up Bonus of HFM

Unlike many forex brokers who dangle enticing sign-up bonuses as a strategy to lure new traders, HFM adopts a different strategy. Instead of a conventional sign-up bonus, HFM offers a top-up bonus, which is calculated at 20% of the deposited amount and can go up to a maximum of $5000.

This means that if you're a trader who makes a deposit, you will receive an additional 20% of your deposit amount as a bonus, enhancing your trading capacity. For example, if you deposit $1000, you will receive an extra $200, giving you a total trading capital of $1200. The maximum limit for this bonus is capped at $5000, meaning even if your deposit exceeds $25000, the bonus amount remains at $5000.

Minimum Deposit of HFM

The minimum deposit to open a live trading account with HFM varies based on the type of account chosen. It ranges between $0 USD and $100 USD. This flexible range is designed to accommodate both novice and experienced traders with varying financial capabilities. It's an appealing feature that makes HFM a preferred choice for many individuals venturing into the forex market, as it doesn't place a hefty initial financial burden on them.

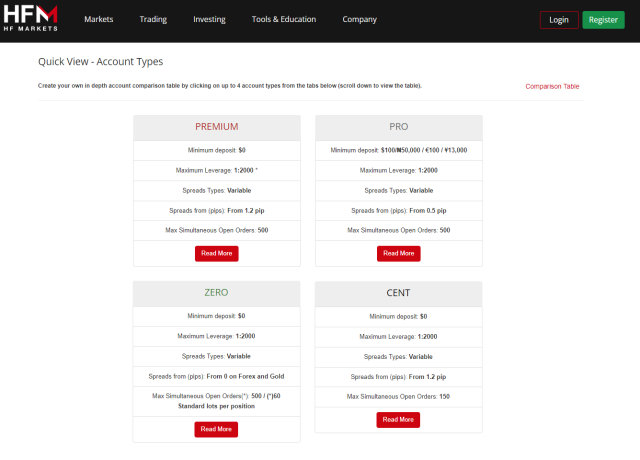

HFM Account Types

HFM is renowned for offering a diverse selection of account types, each designed to suit different trader requirements. Each account type comes with a unique set of features, benefits, and opportunities that can be customized to fit individual trading strategies and preferences. Here are the account types HFM provides:

- Premium Account: With a minimum deposit requirement of $0, this account type provides a maximum leverage of 1:2000. It offers variable spreads starting from 1.2 pips and permits a maximum of 500 open orders simultaneously.

- Pro Account: This account requires a minimum deposit of $100/₦50,000 / €100 / ¥13,000 and also provides a maximum leverage of 1:2000. It offers variable spreads starting from 0.5 pips and permits a maximum of 500 open orders concurrently.

- Zero Account: The ZERO account requires no minimum deposit. It offers variable spreads starting from 0 on Forex and Gold and allows for a maximum of 500 open orders or 60 standard lots per position.

- Cent Account: This account also does not have a minimum deposit requirement and provides a maximum leverage of 1:2000. It offers variable spreads starting from 1.2 pips and allows up to 150 open orders concurrently.

These account types allow traders to choose the one that best suits their trading needs and strategies, providing a tailored and satisfying trading experience.

HFM Customer Reviews

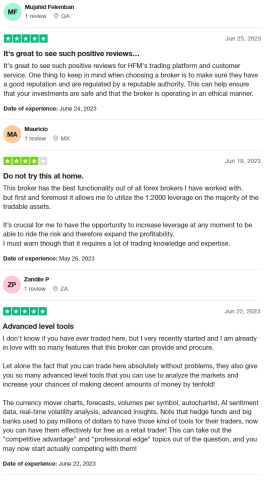

HFM has received positive reviews regarding its trading platform and customer service. Customers emphasize the importance of choosing a regulated and reliable broker to ensure the safety of investments and ethical operations. The functionality of HFM's platform is highly praised, particularly the ability to utilize high leverage ratios for increased profitability. Advanced tools and features provided by the broker, such as currency mover charts, market analysis tools, and AI sentiment data, are appreciated for empowering retail traders to compete with hedge funds and big banks. Customers express their satisfaction with HFM's services and highlight the potential for increased profitability and market analysis capabilities.

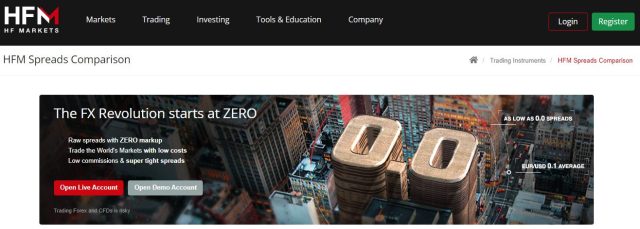

HFM Fees, Spreads, and Commissions

One of the primary appeals of HFM is its competitive cost structure, which offers generally tight spreads, making it an attractive choice for traders. The trading costs center around variable spreads, which are essentially the difference between the bid and ask price. In some instances, spreads can be as low as 0 pips on certain account types.

HFM adopts a transparent fee structure, where the primary cost incurred by traders is the variable spread. There are no additional fees or commissions, streamlining the cost calculation for any trade, irrespective of the trader's experience level.

However, traders should be mindful of certain non-trading charges, such as fees for deposits or withdrawals, when calculating their overall trading costs. Another consideration is the rollover or overnight fees that apply if an open position is held for more than a day. Each instrument has a specific fee, which can be viewed directly from the platform or upon opening the trade. This fee does not apply to swap-free accounts, which are designed for traders following Sharia rules.

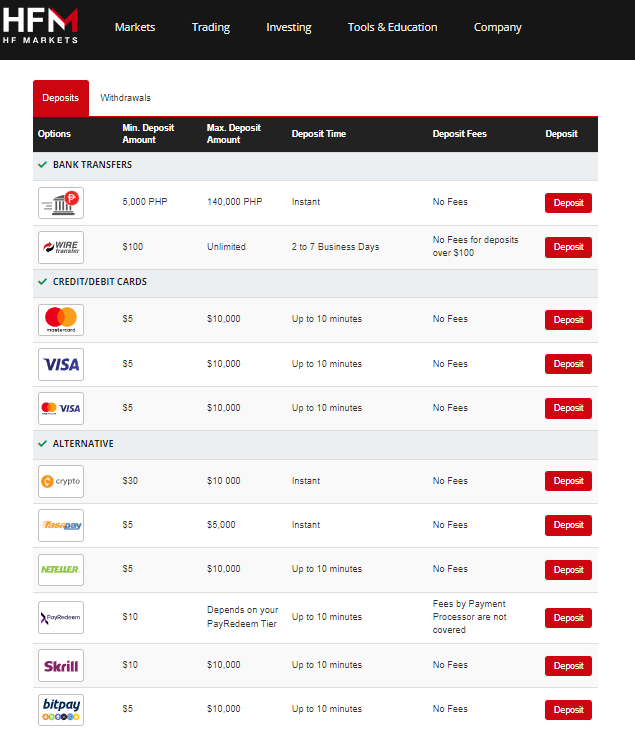

Deposit and Withdrawal

HFM offers multiple convenient methods for account funding. The broker even issues its own HFM MasterCard for direct transactions and secure online payments.

Deposit methods available include major credit and debit cards, wire transfers, domestic transfers (available in certain regions), and a wide array of e-wallets. This includes the option of cryptocurrency deposits, FasaPay, WebMoney, and more.

When it comes to withdrawals, HF Markets supports a range of options including cards, bank transfers (the most popular option), and various e-wallets. One key advantage of HFM is the zero withdrawal fee, which alleviates worries about extra charges. Please note that wire transfers may incur correspondent fees, depending on your bank's international policies.

How to Open an HFM Account

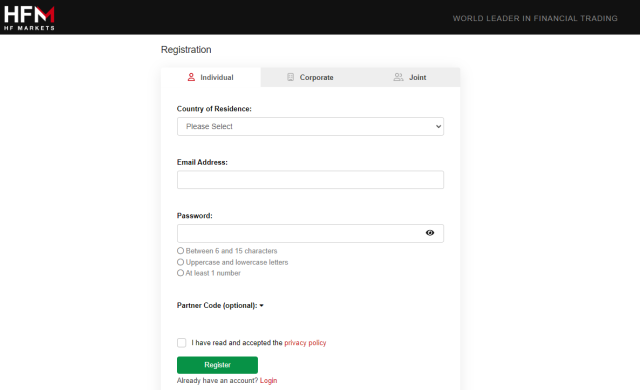

Creating an account with HFM involves a few simple steps.

- Step 1 – Complete Your Personal Information: To start the process, go to the HFM homepage and click “Open Live Account” on the top right. Fill in the required personal information.

- Step 2 – Complete Your HFM Live Account Profile: Traders will be asked to complete additional personal information to further set up the trading account.

- Step 3 – Upload Requested Documents to Verify Your Chosen HFM Markets Live Account: Traders will need to upload specific documentation for verification purposes before they can select a forex trading platform.

- Step 4 – Choose a Trading Platform: After uploading all necessary documents, verification of the HFM live trading account should generally be completed within minutes. Once the trader's account is fully verified, they will receive an email notification confirming their status.

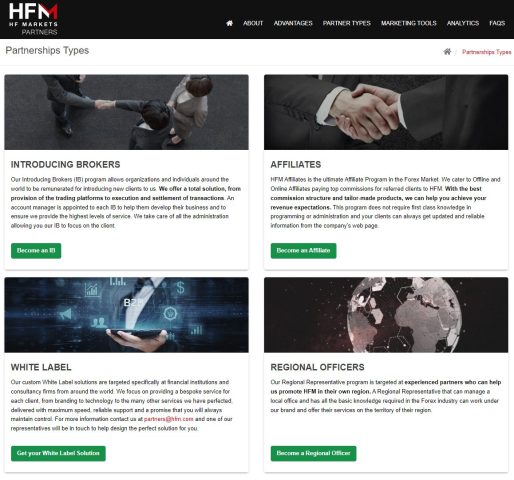

HFM Partnership Programs

The partnership programs at HFM are designed to reward individuals and organizations that help to expand their client base. These programs include an affiliate program, introducing broker (IB) program, and white-label solutions.

- Affiliate Program: This is geared towards social influencers, bloggers, and website owners who can direct traffic to HFM. Affiliates are paid a commission for every trader they refer who opens an account and begins trading.

- Introducing Broker (IB) Program: This is designed for individuals or businesses with a network of potential traders. An IB earns a commission based on the trading volume of the clients they introduce to HFM.

- White-Label Solutions: These are for businesses wanting to establish their own brokerage using HFM's infrastructure and trading platforms. HFM provides the necessary technology and support, while the partner handles branding and client relationships.

HFM Customer Support

Customer support is a critical aspect of any broker, and HFM excels in this area. Their support team is available 24/5, corresponding with the forex trading week, and can be reached through various channels including live chat, email, and telephone.

The representatives are known for their responsiveness and professional manner. They are well-equipped to handle a range of issues, from technical difficulties to queries about trading conditions. HFM also provides an extensive FAQ section on its website that addresses common concerns and questions, which users can access for quick self-service support.

Advantages and Disadvantages of HFM Customer Support

| Advantages | Disadvantages |

|---|---|

| ㅤㅤ ㅤㅤ ㅤㅤ | ㅤㅤ |

Advantages and Disadvantages of HFM Customer Support

HFM vs Other Brokers

#1. HFM vs AvaTrade

HFM and AvaTrade are both reputable brokers in the trading industry, but they have distinct offerings. HFM is a relative newcomer that has attracted clients due to its competitive pricing and flexible platform options. AvaTrade, on the other hand, has been in the industry since 2006 and boasts a broad range of trading instruments and high-level regulatory licenses, making it a trusted name for many traders.

In terms of trading costs, HFM holds an edge with its zero-commission model and low spreads. AvaTrade, while offering zero commissions, generally has higher spreads. The range of tradable assets is broader with AvaTrade, as they offer over 250 financial instruments compared to HFM's more niche offerings.

When it comes to platforms, both brokers support MetaTrader 4 and 5, but AvaTrade also provides its proprietary platform, AvaTradeGO, which offers advanced social trading features.

Verdict: AvaTrade is a better choice for traders looking for a wider range of instruments, an established track record, and a unique platform. HFM would be better suited for those who prioritize lower trading costs.

>> Also Read: AvaTrade Review: Is it the Best Overall Broker?

#2. HFM vs RoboForex

RoboForex is a popular broker with an emphasis on automated trading systems and a wide array of trading assets. HFM, on the other hand, focuses on competitive spreads, transparency, and appeal to both beginners and experienced traders.

HFM‘s fees are generally lower, offering a more cost-effective option. However, RoboForex excels in the range of trading instruments, with thousands of assets, including ETFs and cryptocurrencies.

In terms of platforms, RoboForex provides MetaTrader, cTrader, and a proprietary platform, R Trader. HFM also offers MetaTrader, which is a favored choice among forex traders.

Verdict: RoboForex is a better choice for traders looking for a wider variety of trading assets and those interested in automated trading systems. HFM stands out for traders prioritizing lower trading costs and transparency.

#3. HFM vs FXChoice

FXChoice is a Belize-based forex broker with a good reputation for competitive spreads and customer service. They also offer MetaTrader 4 and 5 and are well-regarded for their VPS services, which is a big plus for algorithmic traders.

HFM has lower spreads on some instruments and a more transparent fee structure. However, FXChoice offers more deposit and withdrawal options and has been recognized for its customer service, which some traders might value highly.

Verdict: HFM is a better choice for traders who value cost-effectiveness and simplicity in their trading environment. FXChoice would be more suitable for traders who prioritize customer service and the flexibility of deposit and withdrawal methods.

> Also Read: 9 BEST Forex Brokers For 2025: Reviewed By Dumb Little Man

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion

In conclusion, HFM has managed to make a name for itself in a relatively short time due to its competitive spreads, transparent fee structure, and robust customer support. The variety of account types, easy sign-up process, and appealing partnership programs make it a solid choice for both beginners and experienced traders.

While it might not offer the extensive range of trading instruments seen with some larger, more established brokers, its commitment to low costs and excellent customer service has positioned it as a reputable choice in the trading market. As always, potential clients should consider their individual trading needs and goals when deciding whether HFM is the right broker for them.

HFM Review FAQs

What platforms does HFM support for trading?

HFM supports the MetaTrader 4 platform, which is one of the most popular and widely used trading platforms in the forex industry. The platform is known for its user-friendly interface, advanced charting capabilities, and extensive automation features. It is available in multiple versions including a web version, a desktop application, and mobile apps for iOS and Android devices.

How can I deposit funds into my HFM account?

Depositing funds into your HFM account is easy. You can do so through a variety of methods including credit/debit cards, bank wire transfers, and popular e-payment solutions. When you log into your account, go to the ‘Deposit' section, select your preferred payment method, and follow the provided instructions.

Are my funds safe with HFM?

Yes, HFM takes the safety and security of client funds very seriously. They adhere to strict regulatory standards and employ advanced security measures. Client funds are held in segregated accounts, separate from the company’s own operational funds, ensuring that your money is not used for the broker's own business activities. Additionally, HFM uses SSL encryption to protect the transmission of transaction information across the Internet, safeguarding your personal and financial details.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.