GTCFX Review 2024 with Rankings By Dumb Little Man

By Wilbert S

March 10, 2024 • Fact checked by Dumb Little Man

Overall Rating | Overall Ranking | Trading Terminals |

1.4 2.5/5 | 116th  |   |

| Evaluation Criteria |

|---|

The Dumb Little Man team, consisting of financial experts, experienced traders, and private investors, utilizes a sophisticated algorithm to conduct detailed evaluations of brokerage services. Their analysis centers on crucial aspects such as:

|

GTCFX Review

Forex brokers and their brokerage services play an important role in providing traders with access to the Forex market. They act as intermediaries, enabling both individual and institutional traders to buy and sell foreign currencies. Global Trade Capital (GTCFX) is a prime example of such a broker, known for its robust regulatory framework and comprehensive trading solutions. GTCFX offers its clients a broad selection of trading platforms, including MT4/MT5 & cTrader, along with various account types tailored to meet different trading needs.

This GTCFX review aims to deliver a thorough analysis of the brokerage, highlighting its unique selling propositions as well as its limitations. By focusing on essential aspects like account options, deposit and withdrawal methods, commission structures, and more, we strive to provide you with a well-rounded perspective. The review integrates expert analysis with real user feedback, ensuring you have the relevant information to consider GTCFX as your go-to brokerage service. Our goal is to assist you in making a well-informed decision about whether GTCFX fits your trading preferences and requirements.

What is GTCFX?

Global Trade Capital (GTCFX) is a prominent forex broker that enables its clients to engage in trading a diverse range of financial instruments. These include currency pairs and CFDs on stocks, indices, precious metals, and energies. The broker offers advanced trading platforms such as MetaTrader 4 (MT4), MetaTrader 5 (MT5), and cTrader, catering to the needs of both novice and experienced traders. With GTCFX, traders have the flexibility to choose the platform that best suits their trading style and requirements.

One of the standout features of GTC Global Trade Capital is the provision of a free demo account alongside two standard and three professional account options. This variety ensures that traders of all levels can find an account that matches their risk appetite and trading strategy. The broker boasts floating spreads starting from 0 pips and does not charge trading fees on most accounts, making it an attractive option for cost-conscious traders. Additionally, no fees for depositing and withdrawing funds further enhance its appeal, with multiple payment methods supported including bank transfers, bank cards, e-wallets, and crypto-wallets.

Safety and Security of GTCFX

In the safety and security analysis of GTCFX, information sourced from Dumb Little Man’s thorough research reveals key regulatory insights. GTCFX, also known as GTC Forex, has its registration in Vanuatu, with its brokerage activities subject to oversight by three regulatory authorities: the Vanuatu Financial Services Commission, the Department of Economic Development of Dubai (DED), and the Financial Services Commission. This regulatory framework is indicative of a high level of broker reliability, suggesting that GTCFX adheres to stringent standards for operational integrity and client security.

However, it’s crucial for potential traders to be aware of certain limitations regarding recourse to financial control agencies. GTCFX’s clients are restricted from addressing any financial control agency outside Vanuatu, limiting their options for external regulatory intervention. This means that traders cannot seek assistance or file complaints with international regulators that are not involved in the monitoring of GTCFX’s activities.

Pros and Cons of GTCFX

Pros

- Minimum deposit $30

- Spreads from 0 pips

- Five live account types

- No trading restrictions

- Top-end platforms

Cons

- Only currency pairs and CFDs

- No standard referral program

Sign-Up Bonus of GTCFX

GTCFX is celebrating its 12+ years of dynamic and competent trading experience with an enticing ANNIVERSARY BONUS offer. This exclusive promotion is designed to welcome new traders to join the successful ranks of GTCFX clients. By creating a GTCFX Standard, Standard Cent, Raw Spread, Zero, or Pro Account, new members have the opportunity to significantly boost their trading journey.

From 22nd February to 31st March 2024, GTCFX is offering a sign-up bonus of up to $20,000 on your FIRST DEPOSIT. To be eligible for this offer, traders need to deposit $100 or more into their newly created account. This initial deposit sets the stage for lucrative trading endeavors, enhancing the trading power of participants.

To unlock this bonus, it’s essential to submit the application form. Doing so will instantly amplify your trading potential, giving you an excellent start in the competitive world of trading. Embrace this opportunity to join the league of successful traders with GTCFX and take advantage of the ANNIVERSARY BONUS to elevate your trading experience.

Minimum Deposit of GTCFX

The minimum deposit amount at GTCFX is set at $30. This accessible entry point is designed to make trading available to a wide audience, allowing both novice and seasoned traders to start their trading journey with GTCFX. The low threshold ensures that individuals can explore the financial markets without a significant initial investment, opening the door to the world of trading with a manageable risk level.

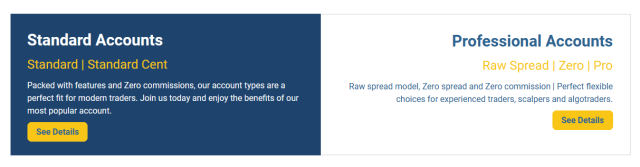

GTCFX Account Types

After thorough research and testing by our team of experts at Dumb Little Man, we have detailed insights into the account types offered by GTCFX. Here’s a clean and organized list of the available account types, designed to meet the diverse needs of traders:

Standard Cent

- Minimum deposit: $30

- Spreads: From 0.3 pips

- No fee

- Micro-lot trading

- Available assets: Only currency pairs and metals

Standard

- Minimum deposit: $30

- Spreads: From 0.3 pips

- No fee

- All assets are available

Raw Spread

- Minimum deposit: $3,000

- Spreads: From 0 pips

- Fee: $3.5 per lot

- Leverage: Up to 1:500

Zero

- Minimum deposit: $3,000

- Spreads: From 0 pips

- Fee: $0.2 per lot

- Leverage: 1:500

- All assets are available

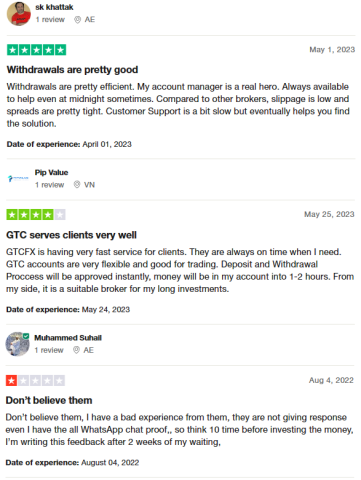

GTCFX Customer Reviews

GTCFX customer reviews offer a mixed perspective on the broker’s services. Many clients praise the efficiency of withdrawals and the availability of account managers, highlighting their dedication and support, even outside conventional hours. Slippage is noted to be low, and spreads tight, positioning GTCFX favorably against competitors. The flexibility of GTC accounts and the speed of deposit and withdrawal processes are also commended, with funds often available within hours, making GTCFX a preferred choice for many traders. However, some feedback points to slower customer support responses, though resolutions are eventually provided. A minority of reviews express dissatisfaction, citing poor communication and advising caution before investing. Overall, while most experiences lean positive, highlighting GTCFX’s strong points, potential clients should consider all aspects to make an informed decision.

GTCFX Fees, Spreads, and Commissions

At GTC Forex, the fees, spreads, and commissions structure is tailored according to the account type chosen by traders. Spreads are floating, ranging from 0-0.3 pips across all account types, offering competitive trading conditions. The Raw Spread account stands out for its particularly low spreads, accompanied by a fee of $3.50 per lot, making it an attractive option for traders looking for tight spreads with a straightforward commission structure.

For those opting for Standard and Pro accounts, the advantage is clear: no trading fees are applied, which can significantly reduce the cost of trading over time. Another notable benefit is the absence of a withdrawal fee, positioning GTC Forex as a cost-effective choice among brokers. This no withdrawal fee policy applies universally, with the sole exception being the withdrawal of bonus funds, which is subject to specific conditions.

However, traders should be aware that while GTC Forex does not charge withdrawal fees, other parties involved in the transaction, such as banks or electronic payment systems, might impose their fees. It is advisable for traders to clarify potential external fees in advance to manage their financial planning effectively.

Deposit and Withdrawal

According to a trading professional at Dumb Little Man, GTCFX offers a seamless process for deposit and withdrawal, enhancing the trading experience for its clients. Successful trading on a live account enables clients to generate income, which can be withdrawn at their convenience. The broker provides a straightforward mechanism for withdrawals through the user accounts on their website, ensuring traders have easy access to their profits.

Withdrawal options are diverse, including bank accounts, bank cards, and e-wallets, catering to the preferences of different traders. A significant advantage is that GTCFX does not impose a withdrawal fee for these transactions, irrespective of the method chosen, the amount, or any other factors. However, it is important to note that withdrawals of profits earned through bonus funds, specifically under the “Welcome Bonus” promotion, are subject to a fee.

The withdrawal process is generally swift, with most channels completing transactions within 24 hours. Nevertheless, some channels may take between 1-5 days to process withdrawals. Traders should also be aware that withdrawal options are currency-specific for certain channels; for instance, only USD and EUR can be withdrawn to Visa and Mastercard. This information, tested and verified by a professional, underscores GTCFX’s commitment to providing flexible and efficient financial transactions for its clients.

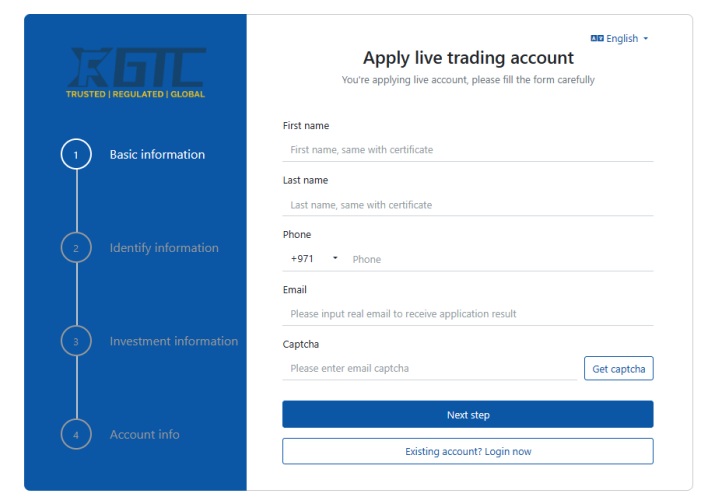

How to Open a GTCFX Account

- Visit the GTCFX website and choose your language in the top right corner, then click on Open Live Account.

- Fill in your name, email, phone number, select your account type and trading platform, choose your country, agree to the terms, and press Next.

- Provide your nationality, date of birth, complete address, occupation details, and hit Next.

- Answer questions about your trading experience to help GTCFX tailor their services to you, then click Next.

- Inform GTCFX about your financial situation by answering all questions in this section, then proceed with Next.

- Complete a few more queries and upload required verification documents, review the documents, and click Confirm.

- Check your email for a confirmation link, click it to activate your account and access your user area.

- In your account, download the trading platform and make a deposit by following the provided instructions.

- With your account set up and funded, you’re ready to start trading with GTCFX.

GTCFX Affiliate Program

The GTCFX affiliate program is tailored towards individuals and legal entities interested in becoming partners through the Introducing Broker (IB) route rather than a standard Refer a Friend program. GTC Forex equips its partners with a variety of promotional materials to help in the attraction of new clients, alongside integrated mechanisms for implementation within existing trading solutions. The potential income for partners can reach up to $1,850, varying by region. Additionally, GTCFX offers a franchising program among other partnership opportunities, broadening the scope for affiliates looking to collaborate with the broker and earn from their referrals.

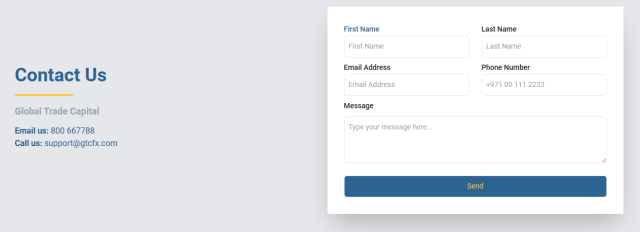

GTCFX Customer Support

GTCFX Customer Support is designed to assist both existing clients and those considering joining. Dumb Little Man’s experience highlights the ease of accessing support for any trade-related queries. The broker offers multiple channels for contacting their technical support team, including a call center, email, tickets on the website, and live chat both on the website and within the user account, ensuring prompt and efficient assistance.

Additionally, GTCFX maintains active profiles on social media platforms such as Facebook, Twitter, YouTube, LinkedIn, and Instagram. Clients and prospective clients can reach out to managers through any of these channels for support. It’s also advisable to subscribe to the company’s social media profiles to stay updated on the latest news and announcements. This multi-channel support system underscores GTCFX’s commitment to providing comprehensive and accessible customer service.

Advantages and Disadvantages of GTCFX Customer Support

| Advantages | Disadvantages |

|---|---|

GTCFX vs Other Brokers

#1. GTCFX vs AvaTrade

GTCFX, known for its customizable account types and competitive spreads, contrasts with AvaTrade, which has built a reputation for being a robust, heavily regulated online Forex and CFD broker since 2006. AvaTrade shines with its expansive global presence, catering to over 300,000 clients with a wide array of financial instruments and rigorous regulatory adherence across several jurisdictions. GTCFX, while offering a broad trading platform selection and no withdrawal fees, might not match AvaTrade’s extensive regulatory framework and global reach.

Verdict: AvaTrade stands out as the better option for traders prioritizing regulatory security and a vast array of financial instruments. Its established reputation and commitment to client confidence make it a preferred choice for traders worldwide.

#2. GTCFX vs RoboForex

GTCFX and RoboForex differ significantly in their approach to trading technology and customer service. RoboForex boasts a strong emphasis on providing superb trading conditions through advanced technologies and a wide selection of trading platforms like MetaTrader, cTrader, and RTrader. With its FSC regulation and a diverse offering of over 12,000 trading options, RoboForex caters to a wide range of traders’ needs. GTCFX, with its flexible account types and trading platforms, also aims to meet the varied demands of traders but might not offer the same breadth of trading options and platforms as RoboForex.

Verdict: RoboForex is better suited for traders seeking a wide array of trading platforms and a vast selection of trading options. Its commitment to cutting-edge technology and personalized trading conditions makes it a superior choice for traders looking for diversity in their trading strategies.

#3. GTCFX vs FXChoice

While GTCFX offers a range of account types and platforms catering to various traders, FXChoice differentiates itself with a focus on serving both active and passive traders, emphasizing business integrity and customer focus. Established in 2010 and licensed by the FSC of Belize, FXChoice is known for its ECN accounts with tight market spreads and a commitment to expanding its trading instruments. However, FXChoice’s trading conditions are primarily tailored to experienced traders, lacking options like cent accounts and zero spreads which could appeal to beginners.

Verdict: FXChoice emerges as the preferable broker for experienced traders due to its professional ECN accounts and stringent regulatory oversight. However, GTCFX’s broader account selection and lower entry barriers may appeal more to novice traders or those seeking more flexible trading conditions.

>> Also Read: AvaTrade Review 2024 By Dumb Little Man: Is It The Best Overall Broker?

Choose Asia Forex Mentor for Your Forex Trading Success

For individuals passionate about forging a lucrative career in forex trading, Asia Forex Mentor is the unrivaled selection for top-tier forex, stock, and crypto trading education. Ezekiel Chew, celebrated for his contributions to trading institutions and banks, spearheads Asia Forex Mentor. Ezekiel’s consistent record of seven-figure trades underscores his unparalleled expertise compared to other trading educators. The following points highlight why we endorse Asia Forex Mentor:

Comprehensive Curriculum: Asia Forex Mentor delivers a thorough educational framework encompassing stock, crypto, and forex trading. This curriculum is designed to arm budding traders with the essential skills and knowledge for success across various markets.

Proven Track Record: The legitimacy of Asia Forex Mentor is solidified by its history of nurturing consistently profitable traders in different market segments. This record affirms the potency of their teaching methods and mentorship.

Expert Mentor: Students at Asia Forex Mentor receive mentoring from Ezekiel, who boasts significant achievements in stock, crypto, and forex trading. His tailored support empowers students to confidently tackle the complexities of each market.

Supportive Community: Membership in Asia Forex Mentor grants access to a community of ambitious traders striving for success in the stock, crypto, and forex realms. This environment promotes mutual support, exchange of ideas, and collective learning, enriching the educational journey.

Emphasis on Discipline and Psychology: Mastery in trading requires a disciplined mindset and psychological resilience. Asia Forex Mentor emphasizes mental training to assist traders in managing emotions, coping with stress, and maintaining objectivity in trading decisions.

Constant Updates and Resources: Given the ever-evolving nature of financial markets, Asia Forex Mentor keeps students informed on the latest trends, strategies, and insights. Ongoing access to these resources ensures traders stay competitive.

Success Stories: Asia Forex Mentor is proud of its numerous success stories, with students achieving remarkable transformations in their trading careers and reaching financial independence through their education in forex, stock, and crypto trading.

Asia Forex Mentor stands as the definitive choice for aspiring traders seeking a comprehensive, high-quality course in forex, stock, and crypto trading. With its in-depth curriculum, seasoned mentors, practical learning approach, and nurturing community, Asia Forex Mentor equips students with the tools and guidance necessary to become proficient traders in diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: GTCFX Review

In conclusion, the team of trading experts at Dumb Little Man has provided a comprehensive review of GTCFX, highlighting its strengths and areas for caution. GTCFX’s low minimum deposit requirement and wide range of account types make it an accessible option for traders at all levels. The broker’s commitment to offering competitive spreads and no withdrawal fees enhances its appeal as a cost-effective trading platform.

However, it’s important for potential clients to weigh the limited asset options and the absence of a standard referral program against their trading goals and preferences. While GTCFX offers strong trading platforms and flexibility in trading strategies, the scope of available financial instruments is narrower than some competitors.

>> Also Read: XBTFX Review 2024 with Rankings By Dumb Little Man

GTCFX Review FAQs

What are the minimum deposit requirements at GTCFX?

The minimum deposit at GTCFX is set at $30, making it accessible for traders who are starting out or prefer to trade with lower capital. This low entry barrier is designed to accommodate a wide range of traders, from beginners to more experienced ones looking for a platform that allows for minimal initial investment.

Does GTCFX charge fees for withdrawals?

GTCFX does not charge a withdrawal fee, offering traders a cost-efficient way to access their funds. This policy applies to all withdrawal methods, enhancing the broker’s appeal for those seeking to maximize their earnings. However, it’s important to note that while GTCFX doesn’t impose withdrawal fees, external charges may be applied by banks or payment systems.

Can traders use different strategies with GTCFX?

Yes, GTCFX imposes no restrictions on trading strategies, allowing traders the freedom to employ various approaches, including scalping, hedging, or using EAs (Expert Advisors). This flexibility ensures that traders can explore different methods to find what works best for their trading style and objectives.

Dumb Little Man Recommends – Top 3 Best Forex Brokers in 2024 | ||

Wilbert S

Wilbert is an avid researcher and is deeply passionate about finance and health. When he's not working, he writes research and review articles by doing a thorough analysis on the products based on personal experience, user reviews and feedbacks from forums, quora, reddit, trustpilot amongst others.