FxPro Review 2025 with Rankings By Dumb Little Man

By Peter Vanderbuild

January 5, 2025 • Fact checked by Dumb Little Man

| Evaluation Criteria |

|---|

Before making any impression of the brokerage firms, our expert panel on the Dumb Little Man platform does a complete analysis of the firm. This panel includes retail traders, financial advisors, and trading experts to ensure an accurate evaluation takes place without any personal biases. Moreover, the evaluation process is also comprised of an algorithm that distinguishes each broker from others based on standardized criteria. This criterion consists of the following factors:

Furthermore, the final step of the evaluation consists of the user's opinion and feedback. To provide a complete picture of the broker, we combine expert opinion and customer reviews before coming to any conclusion. The reviews of the existing customers provide a clear and objective image of the firm to potential clients as their are no personal bias involved.

|

FxPro Review

FxPro, a prominent player in the contracts for difference (CFD) and spread betting market in the UK, has built a strong reputation as a reliable Forex broker since its establishment in 2006. With its headquarters in London, the organization has accumulated vast experience in the sector by carrying out more than 445 million orders. FxPro was recognized by Global Brands Magazine in 2017 as the most dependable and superior forex brand in the United Kingdom.

Operating in more than 170 countries, FxPro has accumulated a substantial client base with over 2,188,000 client accounts. This demonstrates the broker's ability to attract and retain traders from around the globe. Moreover, the company's solid financial foundation is reflected in its impressive €100 million of tier 1 capital, emphasizing its stability and commitment to providing a secure trading environment for its clients.

The fact that FxPro is regulated by a number of well-known financial authorities adds credence to its image as a reliable broker. The Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), the Financial Sector Conduct Authority (FSCA) in South Africa, and the Securities Commission of The Bahamas (SCB) all have oversight and regulations that apply to the broker. These oversight organizations make sure that FxPro operates under stringent rules and upholds high standards, protecting the interests of its clients.

The purpose of this comprehensive FxPro review is to provide a thorough examination of the company, presenting both its advantages and disadvantages. Reading our FxPro review will equip you with all the essential information about this broker, ranging from different account types to the procedures for deposits and withdrawals, as well as details on commissions and more. By offering a balanced perspective that includes expert analysis and feedback from actual traders, we aim to empower you to make an informed decision before choosing to invest with this firm.

What is FxPro?

FxPro is a reputable brokerage company that obtained official registration in Cyprus in July 2006. It is a global company with clients in more than 170 nations, serving both institutional and retail traders.

The broker's dedication to excellence is demonstrated by the numerous awards it has won—more than 85 in all. These honors, which include prestigious titles like “Best Forex Trading Platform” and “Best Trading Platform,” demonstrate FxPro's commitment to offering traders the best trading tools, trading platforms, and resources. They also offer a free demo account to those who will sign up for them.

More than 70 currency pairs, as well as futures and stocks from well-known companies like Twitter, Apple, and Google, are among the many tradable assets that are available through FxPro. The broker also offers access to energy resources, precious metals, and stock indices, enabling a variety of trading opportunities.

FxPro places a big emphasis on security and transparency when it comes to the security of client funds. The broker makes sure that client funds are kept separate from its own equity in reputable international banks. This additional layer of security helps to protect clients' investments through the segregation of funds. Further enhancing the safety and peace of mind of its clients, FxPro also takes extra precautions by insuring the funds.

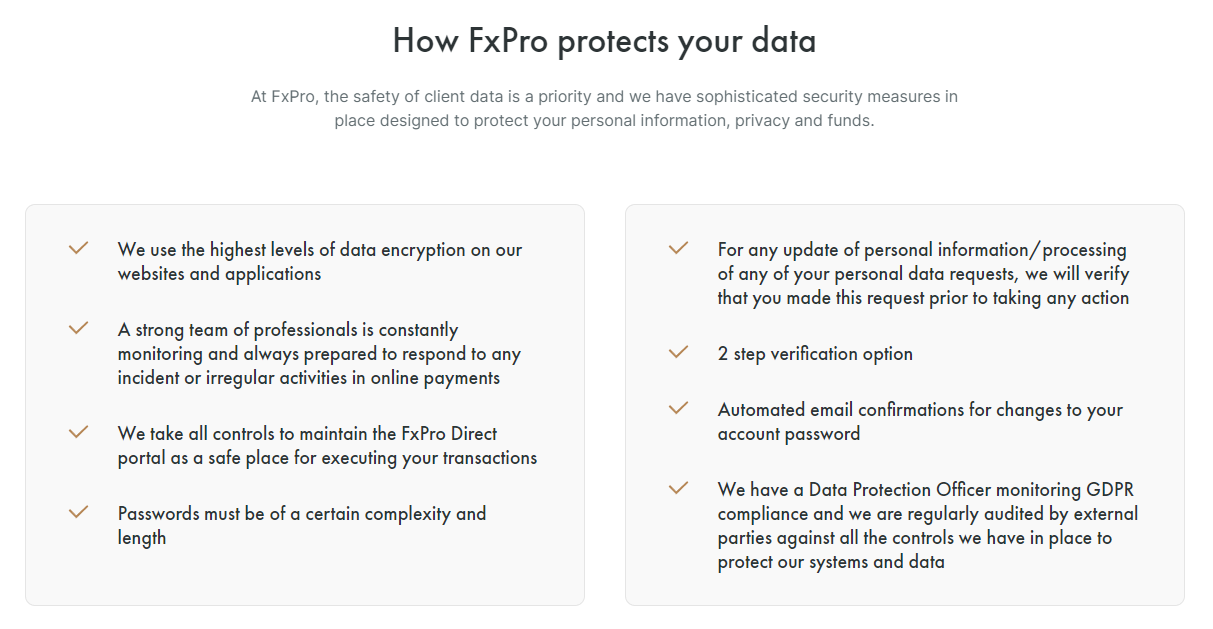

Safety and Security of FxPro?

When it comes to safety and security, FxPro prioritizes the protection of its client's funds and maintains a robust framework to ensure the highest level of financial security just like other trading platforms.

First and foremost, FxPro's regulation by reputable financial authorities is a testament to its commitment to maintaining strict standards and complying with industry regulations. The Financial Conduct Authority (FCA) in the United Kingdom, the Cyprus Securities and Exchange Commission (CySEC) in Cyprus, the Financial Sector Conduct Authority (FSCA) in South Africa, and the Securities Commission of The Bahamas (SCB) oversee and regulate FxPro's operations. These regulatory bodies set guidelines and enforce rules that brokers must adhere to, ensuring transparency, fair practices, and client protection.

One crucial aspect of client fund security is the way FxPro handles these funds. The broker takes great care to ensure that client funds are fully segregated from its own funds. This means that client funds are held in separate accounts and are not mixed with the company's operational funds.

By segregating client funds, FxPro creates a clear separation between clients' invested capital and the broker's own financial obligations. This practice helps protect client funds in the event of any financial difficulties or insolvency faced by the broker, as clients' funds remain intact and unaffected.

Additionally, FxPro employs advanced encryption technology and secure online systems to safeguard clients' personal and financial information, ensuring confidentiality and data protection, similar to the majority of Forex trading platforms. With a strong regulatory framework and a commitment to client fund security, FxPro offers a safe and secure trading environment for its clients.

Sign-Up Bonus of FxPro

FxPro does not provide any sign-up bonuses or promotional incentives for new or novice traders. The broker's approach is focused on offering transparent trading conditions without the allure of bonuses, rewards, or competition. Traders should be aware that bonuses often come with specific terms and conditions, such as trading volume obligations or limitations on withdrawals.

While sign-up bonuses can be enticing, it is equally important to evaluate other critical factors when selecting a forex broker, including the broker's reputation, regulatory compliance, trading conditions, and customer support. By considering these aspects alongside the absence of sign-up bonuses, traders can make a well-informed decision when choosing their preferred forex broker.

Minimum Deposit of FxPro

At FxPro, the minimum deposit requirement is set at $100. This means that in order to begin trading, traders are required to deposit at least $100 into their trading account.

Once traders have successfully completed the registration process and fulfilled the necessary verification requirements, they can proceed to fund their trading account. The minimum deposit serves as the initial capital that traders allocate to their accounts, providing them with the necessary funds to engage in trading activities.

By setting a minimum deposit requirement, FxPro financial services ensure that traders have sufficient capital to participate in the markets. This requirement helps establish a baseline for account funding, promoting responsible trading and providing traders with the necessary resources to engage in various trading strategies.

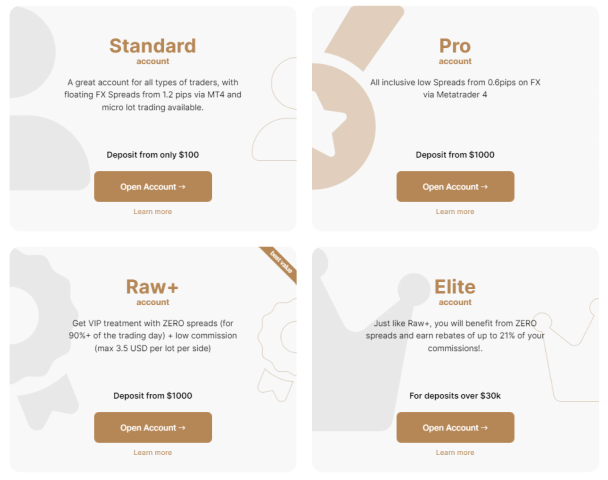

FxPro Account Types

FxPro presents a variety of trading accounts that accommodate the unique requirements and inclinations of traders. Every account type is meticulously crafted to offer distinct trading conditions and features that align with various trading styles and account sizes. Additionally, when signing up with FxPro, a trader also has access to a complimentary demo account, allowing them to explore and practice their trading strategies without any financial risk.

Standard Account

Standard trading accounts are suitable for all types of traders. It offers floating FX spreads starting from 1.2 pips via the popular MetaTrader 4 (MT4) platform. Traders can engage in micro-lot trading, allowing for more precise position sizing. The minimum deposit requirement for a Standard Account is only $100, making it accessible to traders with smaller capital.

Pro Account

Pro trading accounts are designed for experienced traders who seek competitive trading conditions. It provides low spreads starting from 0.6 pips on major currency pairs through the MetaTrader 4 platform. The Pro Account requires a higher minimum deposit of $1000, reflecting its more advanced trading features and tighter spreads.

Raw+ Account

Traders looking for VIP treatment and the potential for reduced trading costs may opt for Raw+ trading accounts. With this account type, traders can benefit from zero spreads for over 90% of the trading day, resulting in highly competitive pricing. Additionally, the Raw+ Account features low commissions, capped at a maximum of $3.5 per lot per side. The Raw+ Account requires a minimum deposit of $1000.

Elite Account

The Elite Account is designed for high-volume traders or those with substantial capital. With this account, traders enjoy the advantages of zero spreads and have the opportunity to earn rebates of up to 21% on their commissions. The Elite Account is available for deposits exceeding $30,000, offering exclusive benefits for traders who operate at a larger scale.

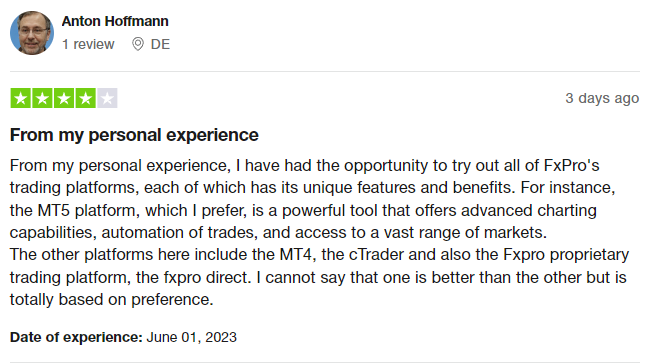

FxPro Customer Reviews

|

|

|

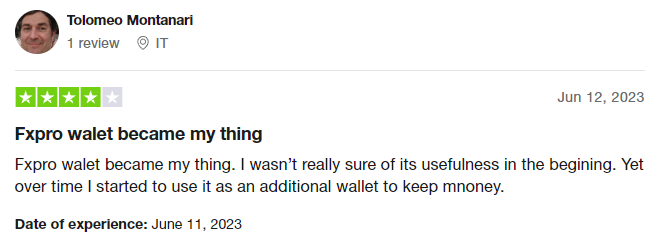

Customer reviews of FxPro generally reflect positive experiences and satisfaction with the broker's services. Traders appreciate the variety of trading platforms available, such as the MT5, MT4, cTrader, and FxPro Edge, each offering unique features and catering to different trading preferences. The stability and speed of order execution are highlighted as important factors contributing to a seamless trading experience.

Customers also praise FxPro financial services for its wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. This diversity allows traders to diversify their portfolios and explore various markets, providing them with the flexibility and freedom to pursue different trading opportunities.

The overall professionalism and high level of service provided by FxPro are acknowledged in customer reviews. Traders report receiving prompt and knowledgeable responses to their queries, demonstrating the broker's commitment to customer support and satisfaction.

Based on these positive customer experiences, FxPro is recommended as a reliable and stable broker for traders seeking success in the financial markets.

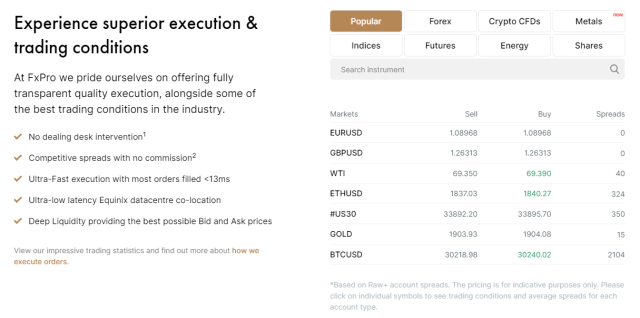

FxPro Spreads, Fees, and Commissions

When it comes to trading with FxPro financial services, novice and professional traders can expect a diverse range of fees and spreads that vary depending on the chosen account type. The broker offers a transparent fee structure, ensuring that traders have clear visibility into the costs associated with their trading activities.

Spreads from 0.6 Pips

FxPro offers competitive spreads that can be as low as 0.6 pips. Spreads represent the difference between the buying and selling prices of a financial instrument, and lower spreads can potentially enhance trading profitability.

Fees from $3.50 USD

The fees charged by FxPro can start from as low as $3.50 USD. It's important to note that the exact fee amount may vary depending on factors such as the account type, trading instrument, and trading volume.

Commissions

Commissions on FxPro vary across different account types. For the MT4 Raw Spread account, there are low spreads on FX & Metals with no markup, but a commission of $3.50 per lot is charged both when opening and closing positions.

On cTrader accounts, the commission fee for trading FX & Metals is $35 for every 1 million USD traded when opening and closing positions, with lower spreads compared to other account types. However, all other instruments on these accounts have floating spreads and zero commission.

For all other FxPro MT4 & MT5 accounts, as well as Spread betting accounts for UK clients, no commission is charged on any instruments. Instead, traders are only charged the spread, which includes a small markup, along with any applicable swap charges.

Deposit and Withdrawal

FxPro provides traders with a diverse range of payment methods, including PayPal, Skrill, FxPro Wallet, Credit Cards, Bank Wire Transfer, and Neteller. These options ensure accessibility for users trading in different currency pairs.

When it you withdraw money, FxPro prioritizes efficiency and convenience. Withdrawals are processed promptly, within a maximum of one business day, allowing traders to access their funds quickly. Notably, FxPro does not charge any fees for withdrawals, enabling traders to maximize their profits without currency pair limitations.

While withdrawals are processed swiftly, it's essential to consider that the actual timeframe for receiving funds may vary. Depending on the chosen payment method and the recipient's bank or payment service provider, the withdrawal process can take up to five business days. Traders should keep this in mind when managing their financial activities involving different currency pairs.

To ensure security and compliance, FxPro has established withdrawal limits. For bank wire transfers, traders enjoy flexibility with a maximum withdrawal limit of $1 million, allowing for larger transactions in various currency pairs. Conversely, the minimum withdrawal limit for bank wire transfers is set at $100.

When utilizing payment wallets like Skrill, traders benefit from the absence of a minimum withdrawal limit, giving them the freedom to withdraw any desired amount in their preferred currency pairs. For wallet withdrawals, FxPro has set a maximum limit of $25,000, providing a reasonable cap for withdrawals using this method.

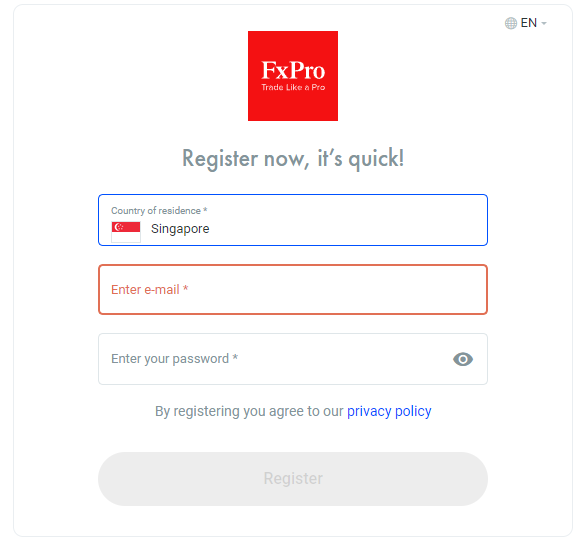

How to Open an FxPro Account

To open an account with FxPro, follow these steps:

- Click the ‘Register' button on the FxPro website and create a new FxPro Direct account.

- Fill out the registration form with your name, country of residence, and email, and set a password. Provide your nationality, date of birth, mobile number, and address.

- Specify your occupation, education level, financial status, and investment plans.

- Complete a test to assess your knowledge of the Forex market and other financial markets.

- Set the default trading account settings, knowing that you can open additional real and demo accounts later with different preferences.

- Undergo identity verification by uploading the necessary digital copies of required documents.

- Check your email inbox for an email from the FxPro Team containing your account credentials. Keep this information safe.

- Once your account is verified, you can fund it and start trading with FxPro.

By following these steps, you can efficiently open an account with FxPro and begin your trading journey with the broker.

FxPro Partnership Programs

FxPro offers three distinct Partnership Programs to cater to different business needs:

Affiliate Program

The Affiliate Program is a popular choice among partners. It follows a standard structure but with a unique revenue-sharing approach. With a Referral Trader's Deposit (FTD) between 100 and 499 USD, EUR, or GBP, partners can earn a generous CPA (Cost Per Acquisition) of $1,100. Notably, becoming an Affiliate is free, and partners can receive their activation code within three days, allowing for a swift start to their partnership journey.

Introducer Program

The Introducer Program serves as a starter plan for aspiring partners. It offers an impressive revenue-sharing arrangement with a CPA of up to 62.5%. The FTD range is between 100 and 499 in either USD, EUR, or GBP, depending on the partner's country of residence. However, there is a minimal cost involved in joining the program, which will be disclosed by FXPro after a thorough evaluation of the partner's business. The activation code is typically provided within three days, ensuring a prompt commencement of the partnership.

White Label Partnership

The White Label Partnership program involves collaboration towards a common goal, where the FXPro brand takes precedence. However, partners can still earn substantial profits through this program. While there is a minimal upfront fee, once the partner receives the activation code (usually within 2-4 days), they can enjoy a lucrative CPA of up to 70%. This program offers various features that foster long-term partnerships and mutual success.

By providing these diverse Partnership Programs, FXPro accommodates different business models and offers attractive revenue-sharing opportunities to its partners. Whether choosing the Affiliate, Introducer, or White Label program, partners can find a suitable option to collaborate with FXPro and benefit from their partnership.

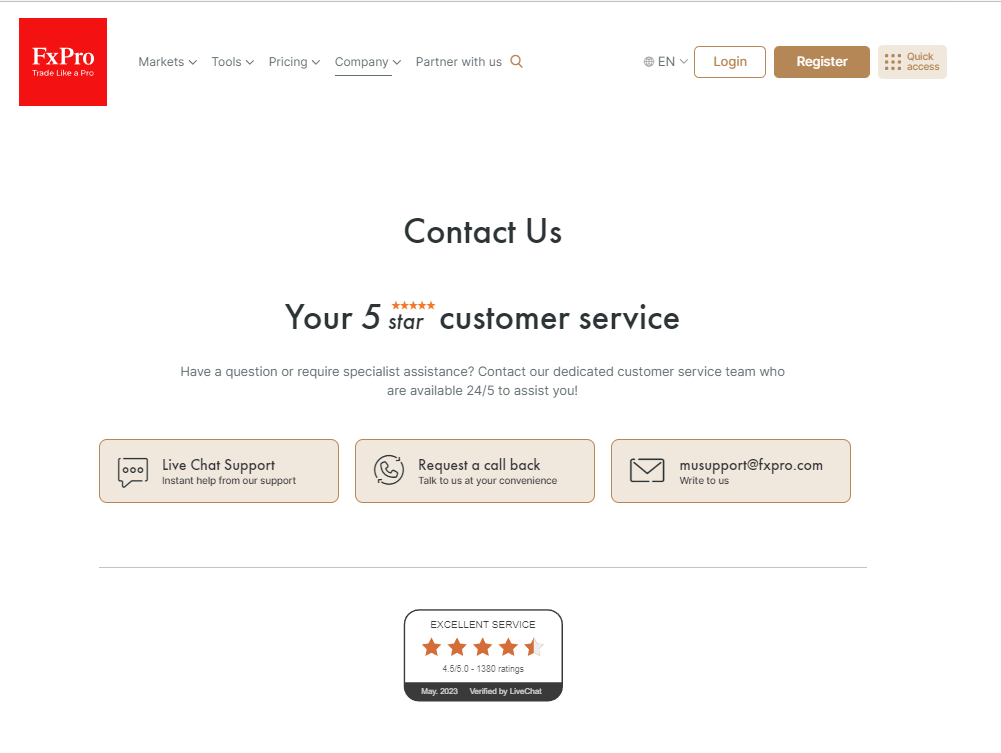

FxPro Customer Support

FxPro takes pride in its customer support services, ensuring that clients receive assistance whenever needed. The customer support team is available 24/5, excluding weekends.

Known for their exceptional service, the FxPro support team can be reached through multiple channels, including Live Chat, email, and phone. Clients can rely on the expertise and responsiveness of the team to address their inquiries promptly and efficiently.

In recognition of their outstanding commitment to customer satisfaction, FxPro's support team has been honored with the esteemed “Best Customer Service 2021” award by FxScouts Forex Awards. This accolade serves as a testament to the team's unwavering dedication, responsible approach to business, and personalized attention given to each trader.

To get in touch with the FxPro support team, clients have various options:

- Live Chat: Connect with a support representative directly on the FxPro website.

- Phone: Call the dedicated support line at +44 (0) 203 151 5550.

- Email: Send inquiries to [email protected], and expect a timely response from the team.

With FxPro's customer support team available round-the-clock and its esteemed reputation for service excellence, clients can rest assured that they will receive the assistance they need at any time.

Advantages and Disadvantages of FXPro Customer Support

| Advantages | Disadvantages |

|---|---|

|

|

FxPro Vs Other Brokers

#1. FxPro vs. AvaTrade

FxPro and AvaTrade are both well-established brokers in the forex and CFD trading industry. Here's a brief comparison of the two:

- Regulation and Trust: Both brokers are regulated by reputable financial authorities. FxPro is regulated by FCA, CySEC, FSCA, and SCB, while AvaTrade is regulated by ASIC, Central Bank of Ireland, FSA, and FSC. In terms of regulation, both brokers have strong credentials.

- Trading Platforms: FxPro offers a range of platforms, including MT4, MT5, cTrader, and FxPro Direct, while AvaTrade primarily uses its proprietary platform, AvaTradeGO, along with MT4. The choice of trading platforms may depend on individual preferences.

- Range of Instruments: Both brokers provide access to a wide range of instruments, including forex, commodities, indices, stocks, and cryptocurrencies. Traders can diversify their portfolios with both brokers.

- Spreads and Fees: FxPro is known for its competitive spreads and reasonable fees. AvaTrade also offers competitive spreads, but fees may vary depending on the account type and instrument.

- Customer Support: FxPro has a 24/7 customer support team that has received recognition for their service. AvaTrade also offers customer support, although response times may vary.

Verdict: Both FxPro and AvaTrade are reputable brokers with their own strengths. The choice between the two ultimately depends on individual preferences and specific trading needs. FxPro may be preferred for its wider range of platforms and strong customer support, while AvaTrade may appeal to traders who prefer its proprietary platform and regulatory oversight.

#2. FxPro vs. RoboForex

FxPro and RoboForex are both popular brokers in the forex and CFD trading industry. Here's a brief comparison of the two:

- Regulation and Trust: FxPro is regulated by FCA, CySEC, FSCA, and SCB, while RoboForex is regulated by IFSC and CySEC. FxPro has a longer track record and is considered more established in terms of regulation and trust.

- Trading Platforms: FxPro offers a range of platforms, including MT4, MT5, cTrader, and FxPro Direct, providing options for different trading preferences. RoboForex primarily offers MT4 and MT5 platforms, which are widely used and popular among traders.

- Range of Instruments: Both brokers offer a wide range of trading instruments, including forex, commodities, indices, stocks, and cryptocurrencies. Traders can access various markets with both brokers.

- Spreads and Fees: FxPro is known for its competitive spreads and reasonable fees. RoboForex also offers competitive spreads and has different account types with varying spreads and commission structures.

- Customer Support: FxPro has a 24/7 customer support team that has received recognition for their service. RoboForex also provides customer support, although their response times may vary.

Verdict: While both brokers have their strengths, FxPro may have an edge in terms of regulation, platform options, and customer support. FxPro's long-standing reputation and extensive range of platforms make it a favorable choice for traders. However, individual preferences, trading strategies, and specific requirements may influence the decision.

#3. FxPro vs. FXChoice

FxPro and FXChoice are two well-known brokers in the forex and CFD trading industry. Here's a brief comparison of the two:

- Regulation and Trust: FxPro is regulated by FCA, CySEC, FSCA, and SCB, while FXChoice is regulated by IFSC. FxPro has a stronger regulatory framework with multiple reputable authorities overseeing its operations.

- Trading Platforms: FxPro offers a variety of platforms, including MT4, MT5, cTrader, and FxPro Direct, providing flexibility and options for different trading styles. FXChoice primarily focuses on MT4 as its main trading platform.

- Range of Instruments: Both brokers offer a wide range of trading instruments, including forex, commodities, indices, and cryptocurrencies. However, FXChoice also provides access to trading precious metals such as gold and silver, which may be of interest to some traders.

- Spreads and Fees: FxPro is known for competitive spreads and offers both fixed and floating spread options depending on the account type. FXChoice also offers competitive spreads, particularly on its ECN account, which provides tight spreads with a commission per trade.

- Customer Support: FxPro has a 24/7 customer support team that has received positive feedback for its service. FXChoice also offers customer support, although their availability and responsiveness may vary.

Verdict: Both FxPro and FXChoice have their strengths, but FxPro tends to stand out due to its strong regulation, a diverse range of platforms, and reliable customer support. FxPro's reputation and commitment to providing a comprehensive trading experience make it a preferred choice for many traders.

Choose Asia Forex Mentor for Your Forex Trading Success

If you have a keen interest in establishing a successful career in forex trading and aspire to achieve substantial financial gains, Asia Forex Mentor stands as the optimal choice for the best forex, stock, and crypto trading course. Ezekiel Chew, renowned as the visionary behind trading institutions and banks, is the driving force behind Asia Forex Mentor. On a personal note, Ezekiel consistently achieves seven-figure trades, a distinction that truly sets him apart from other educators in the field. Here are the compelling reasons that underpin our recommendation:

Comprehensive Curriculum: Asia Forex Mentor offers an all-encompassing educational program that covers stock, crypto, and forex trading. This well-structured curriculum equips aspiring traders with the knowledge and skills necessary to excel in these diverse markets.

Proven Track Record: The credibility of Asia Forex Mentor is firmly established through its impressive track record of producing consistently profitable traders across various market sectors. This achievement serves as a testament to the effectiveness of their training methodologies and mentorship.

Expert Mentors: At Asia Forex Mentor, students benefit from the guidance and insights of experienced mentors who have demonstrated remarkable success in stock, crypto, and forex trading. These mentors provide personalized support, enabling students to navigate the intricacies of each market with confidence.

Supportive Community: Joining Asia Forex Mentor brings access to a supportive community of like-minded traders pursuing success in the stock, crypto, and forex markets. This community fosters collaboration, idea-sharing, and peer learning, enhancing the overall learning experience.

Emphasis on Discipline and Psychology: Success in trading necessitates a strong mindset and disciplined approach. Asia Forex Mentor provides crucial psychological training to help traders manage emotions, handle stress, and make rational decisions during trading.

Constant Updates and Resources: The financial markets are dynamic, and Asia Forex Mentor ensures that students remain up-to-date with the latest trends, strategies, and market insights. Continuous access to valuable resources keeps traders ahead of the curve.

Success Stories: Asia Forex Mentor takes pride in a multitude of success stories where students have transformed their trading careers and achieved financial independence through their comprehensive forex, stock, and crypto trading education.

In summary, Asia Forex Mentor emerges as the premier choice for those seeking the best forex, stock, and crypto trading course to carve a rewarding career and achieve financial prosperity. Through its comprehensive curriculum, experienced mentors, practical approach, and supportive community, Asia Forex Mentor provides the necessary tools and guidance to mold aspiring traders into accomplished professionals across diverse financial markets.

RECOMMENDED TRADING COURSE | REVIEW | VISIT |

#1 Forex, Crypto and Stocks trading course. Ranked most comprehensive by Investopedia and Best by Benzinga. Free to Try! |

Conclusion: FxPro Review

In conclusion, FxPro is a reputable and well-established broker in the CFD and forex market. With its headquarters in London and regulation from multiple financial authorities, including FCA, CySEC, FSCA, and SCB, FxPro has gained trust and recognition in the industry.

While FxPro has many advantages, it's important to consider individual trading needs and preferences when choosing a broker. Conducting thorough research, comparing offerings, and evaluating personal requirements will help make an informed decision. Overall, FxPro's strong regulation, diverse platforms, extensive trading instruments, competitive pricing, and reliable customer support make it a reputable choice for traders looking for a trustworthy and comprehensive trading experience.

FxPro Review FAQs

Can I trade cryptocurrencies on FxPro's platform?

Yes, FxPro offers trading in cryptocurrencies such as Bitcoin, Ethereum, and Litecoin. Traders can take advantage of the volatility and potential profits of the crypto market through FxPro's platform.

What educational resources does FxPro provide for traders?

FxPro understands the importance of knowledge and offers a range of educational resources for traders. These include webinars, video tutorials, trading guides, and technical analysis to help traders enhance their understanding of the financial markets, trading tools, trading platforms, and improve their trading strategies.

Can I use automated trading systems or Expert Advisors (EAs) on FxPro's platforms?

Yes, FxPro supports automated trading systems, such as trading robots, and allows the use of Expert Advisors (EAs) on their platforms. Traders can utilize algorithmic trading strategies and take advantage of the automated execution capabilities offered by FxPro, enhancing their trading efficiency.

Dumb Little Man Recommends - Top 3 Best Forex Brokers in 2023 | ||

Peter Vanderbuild

Trevor Fields is a tech-savvy content strategist and freelance reviewer with a passion for everything digital—from smart gadgets to productivity hacks. He has a background in UX design and digital marketing, which makes him especially tuned in to what users really care about. Trevor writes in a conversational, friendly style that makes even the most complicated tech feel manageable. He believes technology should enhance our lives, not complicate them, and he’s always on the hunt for tools that simplify work and amplify creativity. Trevor contributes to various online tech platforms and co-hosts a casual podcast for solopreneurs navigating digital life. Off-duty, you’ll find him cycling, tinkering with app builds, or traveling with a minimalist backpack. His favorite writing challenge? Making complicated stuff stupid simple.